Become a Better Investor Newsletter – 22 June 2024

Noteworthy this week

- US retail sales are weak

- Foreigners hold less US debt

- A house might not be the investment it once was

- India to add a lot of coal power

- Asia is big in important metals

US retail sales are weak: US Retail Sales increased 2% over the last year, but after adjusting for higher prices, they were down 1.2%. The US consumer appears to be pulling back.

US Retail Sales increased 2% over the last year but after adjusting for higher prices they were down 1.2%.

Both of these numbers came in well below the historical averages of +4.6% nominal and +2.0% real.

The US consumer appears to be pulling back.https://t.co/l5IYmkeySJ pic.twitter.com/A1mKnaDJP3

— Charlie Bilello (@charliebilello) June 18, 2024

Foreigners hold less US debt: The share of US Treasuries owned by foreigners has massively declined. Given the amount of new debt the US issues, this will likely become an issue.

RE: The Goldman report, here’s another way to look at foreign share of UST holdings. Green lines = foreign share of T-Bills (top panel) & USTs (bottom panel.)

Bills foreign share from 50% to 18% since 2015.

UST foreign share from 62% to 33% since 2009. pic.twitter.com/CyaZz0R8Yz

— Luke Gromen (@LukeGromen) June 19, 2024

A house might not be the investment it once was: Buying a house or an apartment has been a great investment in many Asian and European countries. However, with collapsing demographics, one should probably not extrapolate this trend.

With collapsing demographics in major countries in Asia and Europe one should probably not extrapolate this trend pic.twitter.com/CwLdPmtsbn

— Michael A. Arouet (@MichaelAArouet) June 19, 2024

India to add a lot of coal power: India has 28.5 GW of coal power currently being built, and more than 50 GW is planned to be awarded for construction over the next three years. This is not exactly following “the green transition.”

“The country has 28.5 gigawatts of coal power currently being built and more than 50 GW that are planned to be awarded for construction over the next three years, according to the people.”https://t.co/6X8O2xiuUm#energy #EnergyTransition #ClimateActionNow #renewables #NetZero… pic.twitter.com/QkSeW5tjYz

— Art Berman (@aeberman12) June 19, 2024

Asia is big in important metals: China and Asia continue to dominate in important metals like rare earths, graphite, and nickel.

The largest producers of selected metals, China and Asia, continue to dominate this market. ⛏️👇#china #copper #lithium #nickel #commodities pic.twitter.com/X4CTWL1mfM

— Oliver Groß (@minenergybiz) June 16, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

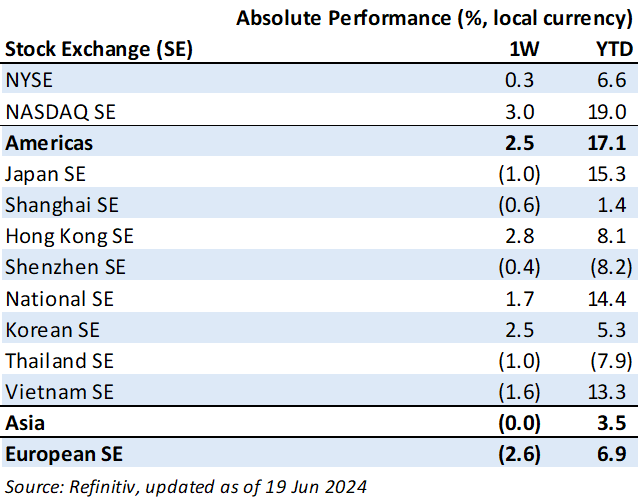

Weekly market performance

Click here to see more markets and periods.

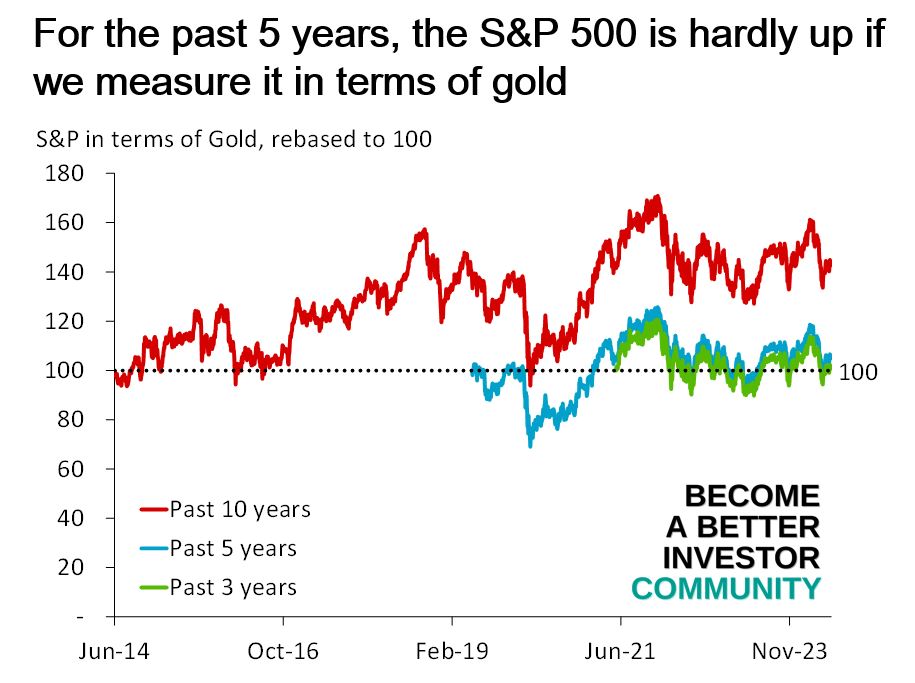

Chart of the week

Discussed in the Become a Better Investor Community this week

“We have updated our FVMR Global strategy!”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

The Morgan Housel Podcast – Quiet Compounding

“’Nature is not in a hurry, yet everything is accomplished,’ said Chinese philosopher Lao Tzu. Giant sequoias, advanced organisms, towering mountains – it builds the most jaw-dropping features of the universe. And it does so silently, where growth is almost never visible right now but staggering over long periods of time. It’s quiet compounding, and it’s a wonder to see. I like the idea of quietly compounding your money. Just like in nature, it’s where you’ll find the most impressive results.”

Readings this week

Experts vs. Imitators

“If you want the highest quality information, you have to speak to the best people. The problem is many people claim to be experts, who really aren’t.”

Book recommendation

Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism by Jeff Gramm

“A sharp and illuminating history of one of capitalism’s longest running tensions—the conflicts of interest among public company directors, managers, and shareholders—told through entertaining case studies and original letters from some of our most legendary and controversial investors and activists.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

— Not Jerome Powell (@alifarhat79) June 13, 2024

My 3 daily non negotiables:

1) Workout

2) Get one task done

3) Reminding myself that u/DeepFuckingValue made over a hundred million dollars gambling on a dying gaming retailer and all my career ambitions are worthlessWhat about you?

— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA) June 19, 2024

New My Worst Investment Ever episodes

Enrich Your Future 02: How Markets Set Prices

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 02: How Markets Set Prices.

LEARNING: Invest in passively managed funds and adopt a simple buy, hold, and rebalance strategy. While gamblers make bets, investors let the markets work for them, not against them.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode, John Dues and Andrew Stotz apply lessons five through seven of the 10 Key Lessons for implementing Deming in classrooms. They continue using Jessica’s fourth-grade science class as an example to illustrate the concepts in action.

Listen to Goal Setting Is Often An Act of Desperation: Part 5

Manila Water Company Incorporated (MWC PM): Profitable Growth rank of 5 was same compared to the prior period’s 5th rank. This is average performance compared to 120 medium Utilities companies worldwide.

Read Manila Water Company – World Class Benchmarking

Genting Singapore Limited (GENS SP): Profitable Growth rank of 4 was up compared to the prior period’s 5th rank. This is above average performance compared to 920 large Cons. Disc. companies worldwide.

Read Genting Singapore – World Class Benchmarking

MOL Magyar Olajes Gazipari Nyrt (MOL BU): Profitable Growth rank of 5 was same compared to the prior period’s 5th rank. This is average performance compared to 300 large Energy companies worldwide.

Read MOL Magyar Olajes Gazipari Nyrt – World Class Benchmarking

COFCO Sugar Holding Company Limited (600737 SH): Profitable Growth rank of 3 was up compared to the prior period’s 6th rank. This is above average performance compared to 540 large Cons. Staples companies worldwide.

Read COFCO Sugar Holding – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.