Become a Better Investor Newsletter – 21 June 2025

Noteworthy this week

- The world is invested in the US

- Is it time for EM?

- JPM expects US stocks to underperform

- Gold is 20% of CB reserves

- China buys Iran’s oil

The world is invested in the US: The world owns US$26trn more US assets than Americans own abroad. The so-called US net international investment position has 2x in 5 years.

🚨This is absolutely MIND-BLOWING:

The world owns $26 TRILLION more US assets than Americans own abroad.

The so-called US net international investment position has DOUBLED in 5 years.

The potential partial unwind of this is underappreciated by investors and analysts. pic.twitter.com/X3YEJzaBHr

— Global Markets Investor (@GlobalMktObserv) June 15, 2025

Is it time for EM?: Emerging Markets stocks are underperforming US stocks by the largest margin in more than 50 years. Is it time for EM to outperform?

Emerging Markets stocks are underperforming U.S. stocks by the largest margin in more than 50 years 🚨🚨 pic.twitter.com/Up75hFEki2

— Barchart (@Barchart) June 16, 2025

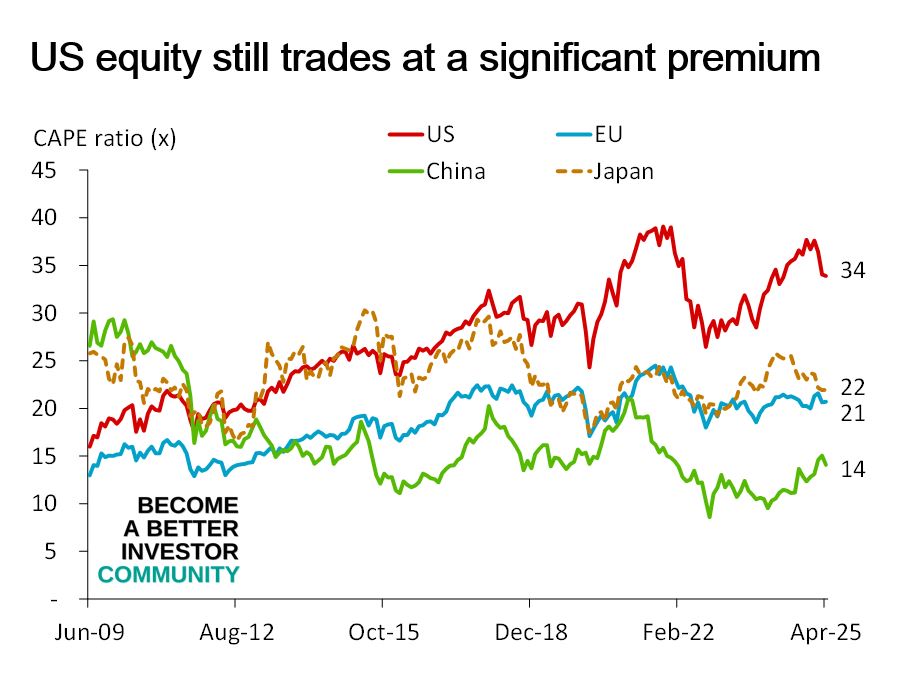

JPM expects US stocks to underperform: JP Morgan expects Japan, EU, and China to outperform the US in the next 10-15 years.

JPM expects Japan, EU, and China to outperform the US in the next 10-15 years

Good start. pic.twitter.com/V7GZEKo50E

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi) June 15, 2025

Gold is 20% of CB reserves: Central banks have reduced their fiat reserves, and gold now constitutes 20% of reserves – the second largest part of reserves. Still, 80% of reserves are fiat currencies, and the US$ is 46% of total reserves.

Gold Passes Euro as Second Reserve Asset as Central Banks Buy pic.twitter.com/gJjv2G5tmt

— Tracy Shuchart (𝒞𝒽𝒾 ) (@chigrl) June 12, 2025

China buys Iran’s oil: Virtually all of Iran’s oil exports go to China.

virtually all of Iran’s oil exports go to China pic.twitter.com/JgXHxxSdpr

— zerohedge (@zerohedge) June 13, 2025

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

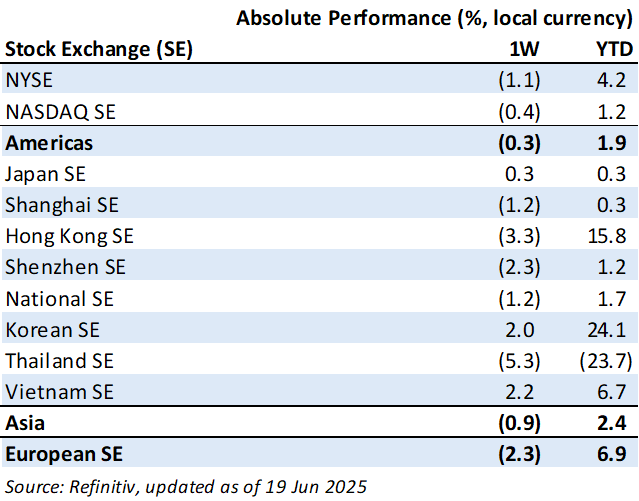

Weekly market performance

Click here to see more markets and periods.

Chart of the week

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

#390 Rare Steve Jobs Interview – Founders

“Steve explains the upcoming technological revolution, why the personal computer is the greatest tool humans have ever invented, how the computer compares to past inventions, why software needs to be simplified, why the future is always exciting and unpredictable, why it’s dangerous to have layers of middle management between the people running the company and the people doing the work, the importance of hiring troublemakers…”

Readings this week

Factoring in the Low-Volatility Factor

“A low-volatility factor substantially improves performance of factor models once accounting for these dimensions in various in-sample and out-of-sample exercises, across different low-risk measures and across methodological choices.”

Book recommendation

The Fish that Ate the Whale: The Life and Times of America’s Banana King by Rich Cohen

“Whether you know him as El Amigo, the Banana Man, the Gringo, or simply Z – whether you even know him at all – Sam Zemurray lived one of the greatest untold American stories of the last hundred years.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

— Not Jerome Powell (@alifarhat79) June 18, 2025

STOP IT 🤣 pic.twitter.com/LKGaP8Ebl8

— Not Jerome Powell (@alifarhat79) June 20, 2025

New My Worst Investment Ever episodes

Ep807: Mike Koenigs – A Founder’s Character Is Bigger Than Their Charisma

BIO: Mike Koenigs is a serial entrepreneur with five successful exits, a 19-time bestselling author, and a top strategist for founders post-exit.

STORY: Mike invested big in a SaaS startup set up for success, but infighting brought it to its knees.

LEARNING: Character is bigger than charisma.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 34: Bear Markets: A Necessary Evil.

Listen to Enrich Your Future 34: Embrace the Bear: Why Market Crashes Are Your Silent Ally

Beijing Enterprises Holdings Limited (392 HK): Profitable Growth rank of 7 was up compared to the prior period’s 8th rank. This is below average performance compared to 300 large Utilities companies worldwide.

Read Beijing Enterprises Holdings – World Class Benchmarking

Adani Power Limited (ADANI IN): Profitable Growth rank of 1 was same compared to the prior period’s 1st rank. This is World Class performance compared to 290 large Utilities companies worldwide.

Read Adani Power – World Class Benchmarking

PT Mitra Keluarga Karyasehat Tbk (MIKA IJ): Profitable Growth rank of 2 was same compared to the prior period’s 2nd rank. This is World Class performance compared to 350 medium Health Care companies worldwide.

Read Mitra Keluarga Karyasehat – World Class Benchmarking

Hyundai Mobis Company Limited (012330 KS): Profitable Growth rank of 3 was up compared to the prior period’s 4th rank. This is above average performance compared to 910 large Cons. Disc. companies worldwide.

Read Hyundai Mobis – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.