Become a Better Investor Newsletter – 14 December 2024

Noteworthy this week

- China dominates in cars

- China is about to go loose

- Fartcoin surpasses US$500m

- Bitcoin may enter Nasdaq 100

- Central banks buying gold

China dominates in cars: Europe produced almost 30% of cars 15 years ago, now less than 20%. Meanwhile, China has gone from a bit over 20% to over 30%.

Cars are good illustration of the tectonic shift in global manufacturing capacity. It relates to most products. China can produce them faster, cheaper and in many cases in better quality. It will have massive consequences for countries like South Korea, Germany or Sweden. pic.twitter.com/y4akhwbuQz

— Michael A. Arouet (@MichaelAArouet) December 9, 2024

China is about to go loose: The Politburo announced that China will implement a moderately loose monetary policy next year. The last time it happened was the GFC.

Obviously the last time the Politburo embraced a moderately loose monetary policy was in Nov-2008 and a big package came shortly thereafter.

So this might be big news.. pic.twitter.com/O7Z6I8aAhM

— Andreas Steno Larsen (@AndreasSteno) December 9, 2024

Fartcoin surpasses US$500m: Fartcoin’s market cap surpassed HALF A BILLION DOLLARS. I guess we are living in a simulation, after all.

Fartcoin blasting its way to a $550 million market cap, giving it a higher valuation than Eastman Kodak, 1-800 Flowers, and Groupon pic.twitter.com/m6PgUwazvn

— Barchart (@Barchart) December 12, 2024

Bitcoin may enter Nasdaq 100: MicroStrategy may join the Nasdaq 100, forcing ETFs to buy at least US$2bn of its shares.

Bloomberg reports MicroStrategy may join the Nasdaq 100, forcing ETFs to buy at least $2.1 billion worth of its shares.

Not bad for a company that has lost money for the last two decades plus… pic.twitter.com/Qnv7Fxl3sM— Michael Lebowitz, CFA (@michaellebowitz) December 10, 2024

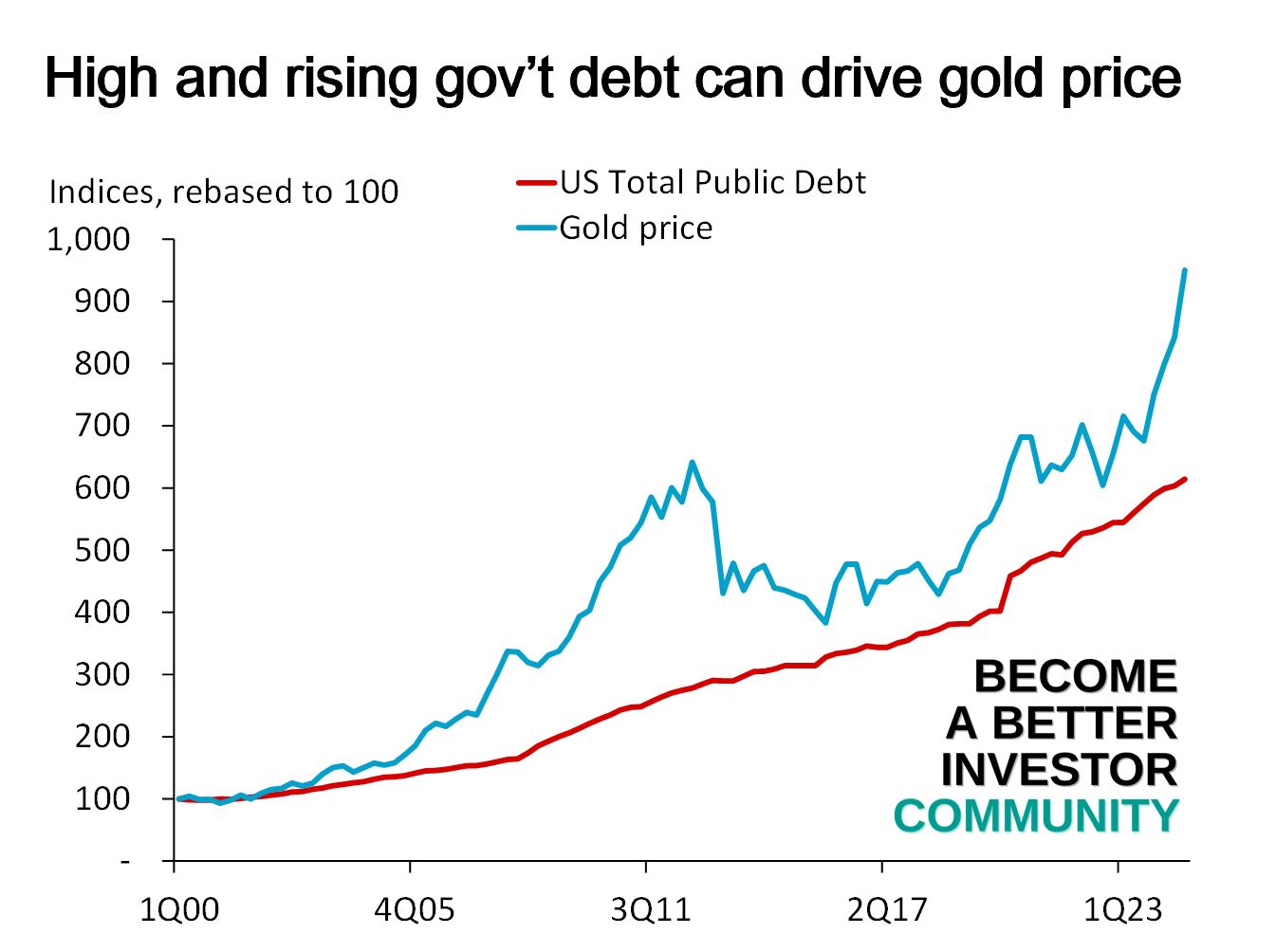

Central banks buying gold: Central banks bought 60 tons of gold in October and 694 tons YTD24. Why are central banks buying so much gold and not Fartcoin?

BREAKING: Central banks bought 60 tonnes of gold in October, the largest monthly net purchase so far in 2024.

Meanwhile, China resumed gold purchases in November after a 6-month pause.

This year alone, India and Turkey have purchased 77 and 72 tonnes of gold.

Central banks… pic.twitter.com/L8wJB6EHSi

— The Kobeissi Letter (@KobeissiLetter) December 10, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

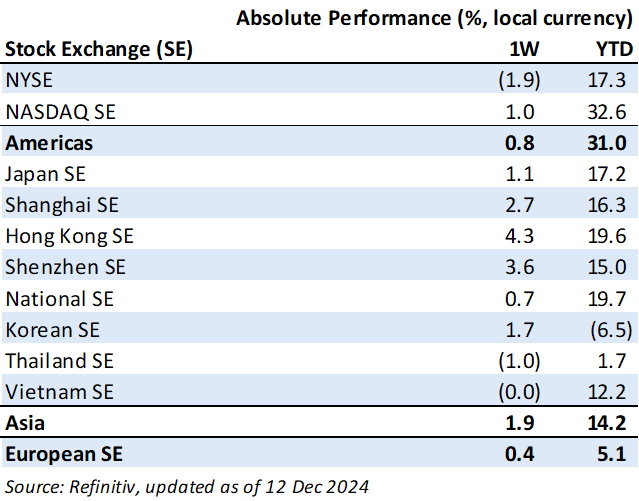

Weekly market performance

Click here to see more markets and periods.

Chart of the week

Discussed in the Become a Better Investor Community this week

“Chinese stocks are surging right after the AWS call—interesting timing!”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

EP. 127: Dr. Daniel Crosby: The Soul of Wealth: 50 reflections on money and meaning – Talking Billions

“In this conversation, Dr. Daniel Crosby, a psychologist and behavioral finance expert, discusses his latest book, ‘The Soul of Wealth,’ which explores the deeper meanings of money and wealth. He emphasizes that true wealth transcends mere financial accumulation and is intertwined with personal values, relationships, and purpose.”

Readings this week

Frog in the Pan Momentum: International Evidence

“This article analyzes various reasons why momentum strategies might work outside US borders. While the US story is firmly rooted in behavioral biases, is the same true on an international scale? That seems logical and likely.”

Book recommendation

Iconic Advantage®: Don’t Chase the New, Innovate the Old by Soon Yu and Dave Birss

“Modern business gurus all cry for the need to innovate, to disrupt, and to act like a startup. It’s hard to argue with that kind of thinking. It’s sexy and exciting. But it’s wrong.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

Best meme of the day pic.twitter.com/jnTkeBR1mQ

— Andreas Steno Larsen (@AndreasSteno) December 10, 2024

— Rothmus 🏴 (@Rothmus) December 8, 2024

New My Worst Investment Ever episodes

Enrich Your Future 21: Think You Can Beat the Market? Think Again

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 21: You Can’t Handle the Truth.

LEARNING: Overconfidence leads to poor investment decisions. Measure your returns against benchmarks.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

John Dues and Andrew Stotz are diving deeper into the improvement model that John is building with his team. In this episode, learn the three ways to think about an improvement frame for your big challenge.

Listen to Frame the Challenge: Path for Improvement (Part 3)

Kobe Bussan Company Limited (3038 JP): Profitable Growth rank of 2 was same compared to the prior period’s 2nd rank. This is World Class performance compared to 540 large Cons. Staples companies worldwide.

Read Kobe Bussan – World Class Benchmarking

Sino-American Silicon Products Incorporated (5483 TT): Profitable Growth rank of 6 was down compared to the prior period’s 5th rank. This is below average performance compared to 630 large Info Tech companies worldwide.

Read Sino-American Silicon Products – World Class Benchmarking

China Resources Sanjiu Medical & Pharmaceutical Company Limited (000999 SZ): Profitable Growth rank of 3 was same compared to the prior period’s 3rd rank. This is above average performance compared to 360 large Health Care companies worldwide.

Read China Resources Sanjiu Medical & Pharmaceutical – World Class Benchmarking

Strong rebound in stocks and fall in gold. Performance review of our strategies in November 2024 – All Weather Inflation Guard gained 1.9%, All Weather Strategy gained 0.4%, All Weather Alpha Focus gained 1.0%.

Read A. Stotz All Weather Strategies – November 2024

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.