Posts by Andrew Stotz

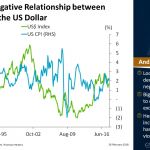

Long-Term Negative Relationship between Inflation and the US Dollar

Chart of the Day: Looking over almost three decades, we can see a negative correlation of 45%. Big moves in inflation lead to opposite moves in the exchange rate. Hence, when inflation increases, the US Dollar has mainly depreciated and vice versa.

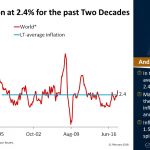

Read MoreWorld Inflation at 2.4% for the past Two Decades

Chart of the Day: In the past two decades, an average inflation rate of 2.4% in the world. Many central banks around the world are today inflation targeting, e.g. Fed and ECB target 2%.

Read More“Woulda, Coulda, Shoulda” — Learn to Separate Fact from Opinion

Andrew Stotz interprets the CFA Ethics and Standards of Professional Conduct. Separate fact from opinion to clarify the value you add. Separate fact from opinion, so readers understand that the future is uncertain. Avoid this problem by replacing certainty verbs like “will” and “must”; with “would,” “could,” “should.”

Read More7 Fatal Mistakes MBA Students Make in Startup Business Case Presentations

I have had the unique pleasure of serving as judge, juror, and, occasionally, as executioner for many business case competitions. During my tenure in these roles, I’ve noticed over the years a couple of mistakes that MBA students consistently make. I wanted to highlight the top 7 here and provide some methods for avoiding them.

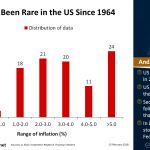

Read MoreDeflation Has Been Rare in the US Since 1964

Chart of the Day: US has only had deflation in 2% of months since 1964. First, following the Global Financial Crisis and the second period of deflation followed the oil price drop that began in late 2014.

Read MoreJapan Shows That Long-Term Deflation Is Bad for the Stock Market

Chart of the Day: Japan’s economy recovered and boomed after WWII until the early 1990s. It was during part of this boom that the country experienced its high-inflation periods. Japan shows that long-term deflation is bad for stock market returns.

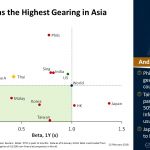

Read MorePhilippines Has the Highest Gearing in Asia

Chart of the Day: Philippines had the highest gearing and the only country above 100%. Taiwan’s low gearing is partly explained by about 50% of total market cap is Info Tech companies, which usually have much cash.

Read MoreChina Trades Below the World on PB but Offers Same ROE

Chart of the Day: Indonesia is most expensive on PB in Asia, followed by India. They also have the highest ROE. China A trades below the World but offers ROE that is in line.

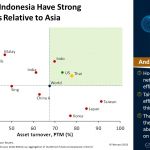

Read MoreThailand and Indonesia Have Strong Fundamentals Relative to Asia

Chart of the Day: Hong Kong has the highest net margin, but lowest efficiency. Taiwan has the highest efficiency, but thin net margin. Thailand and Indonesia are strong on both.

Read MoreCare for Clients as You Would Your Mother

Are we really putting investors first? Through the story of my family, you’ll learn the 10 parts of the CFA Institute Statement of Investor Rights. Care for clients as you would your mother.

Read More