Analysts Remain Neutral on India

Watch the video with Andrew Stotz or read Watching the Street: India below.

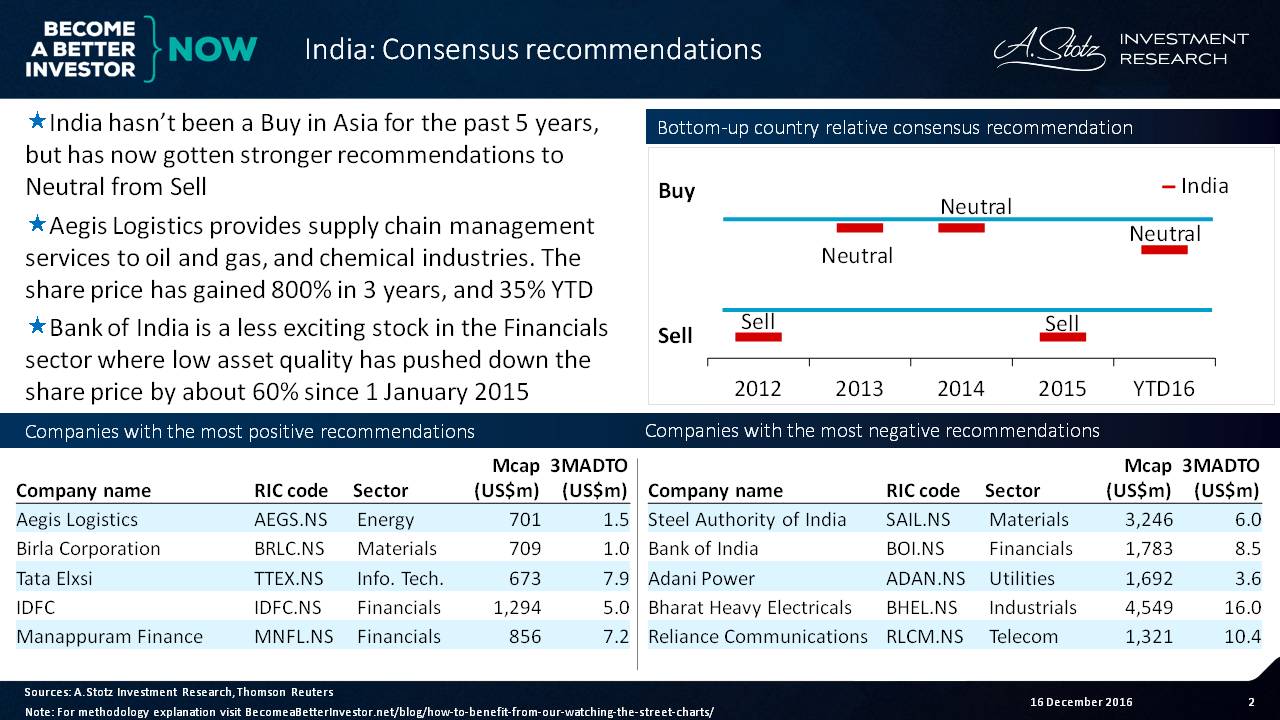

Consensus Recommendations: India

India hasn’t been a “buy” in Asia for the past 5 years. But recently, analysts have moved it from “sell” to “neutral”.

Learn more: How to Benefit from Our Watching the Street Charts

Aegis Logistics provides supply chain management services to the oil, gas and chemical industries. The share price has increased a whopping 800% in 3 years and 35% YTD.

Bank of India is a less exciting stock in the financial sector, where low asset quality has pushed down the share price by about 60% since the start of 2015.

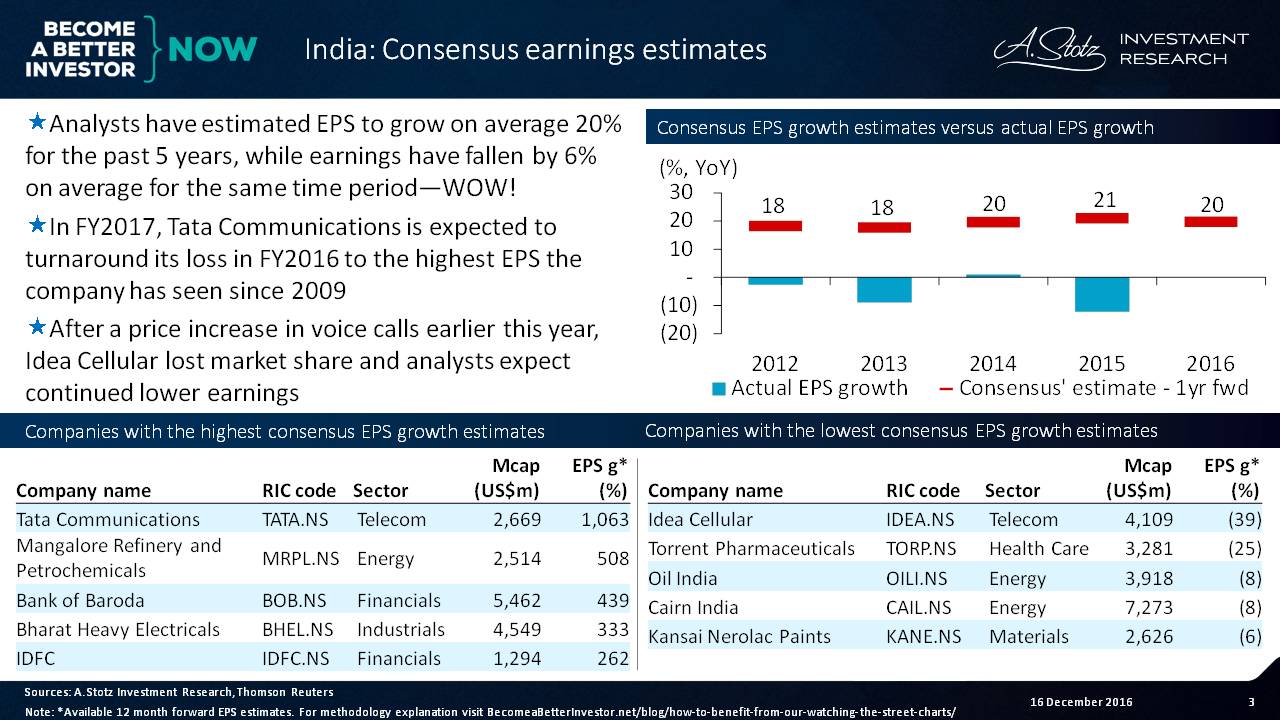

Consensus Earnings Estimates: India

Analysts have estimated EPS to grow an average of 20% for the past 5 years, while earnings have fallen by 6% on average over the same time period—quite a divergence.

In FY2017, Tata Communications is expected to turn its loss in the previous year into the highest EPS the company has seen since 2009.

After a price increase in voice calls earlier this year, Idea Cellular lost market share and analysts expect continued lower earnings.

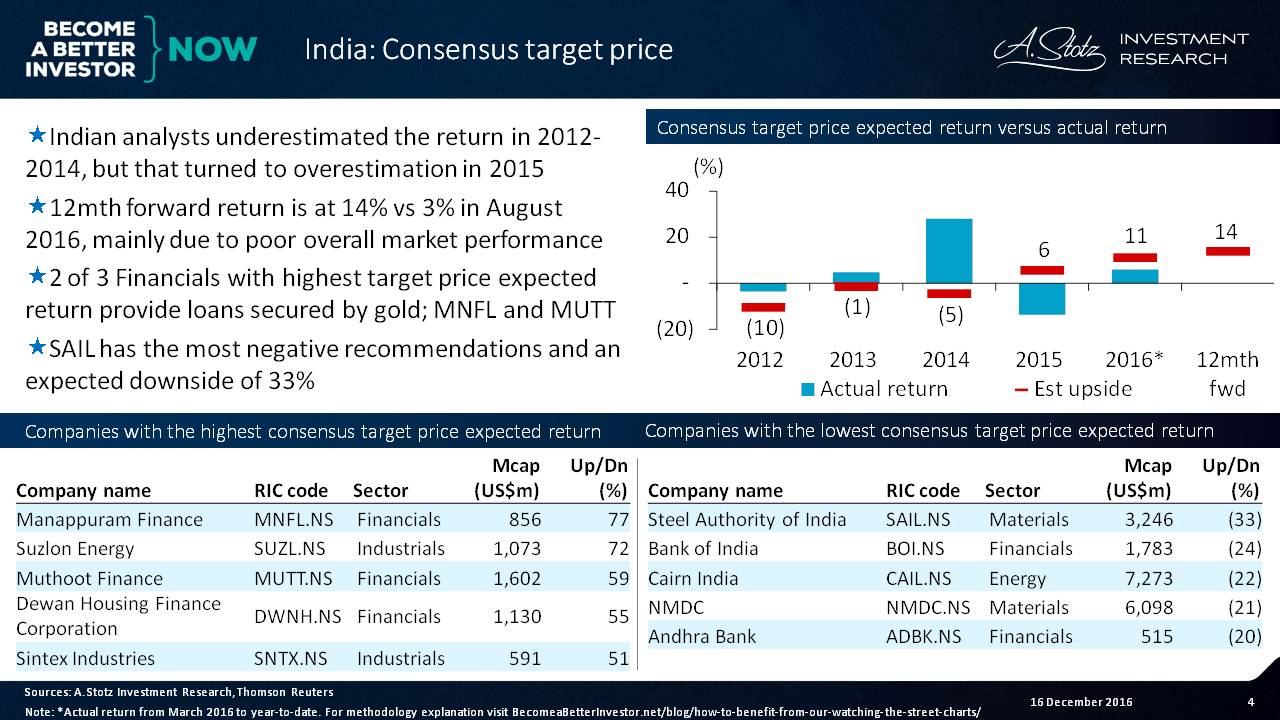

Consensus Target Prices: India

Indian analysts underestimated the returns during the 2012-2014 period, but that turned to overestimation in 2015.

The 12-month consensus forward return sits at 14% vs 3% in August 2016, mainly due to poor overall market performance.

Two of the three financials with the highest target price expected return provide loans secured by gold: Manappuram Finance and Muthoot Finance.

Steel Authority of India has the most negative recommendations on our list and has an expected downside of 33%.

Do YOU use any kind of analyst estimate when considering an investment?

Let us know in a comment below.

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.