A. Stotz All Weather Strategies – October 2023

The All Weather Strategy is available in Thailand through FINNOMENA. If you’re interested in our allocation strategy, you can also join the Become a Better Investor Community. Please note that this post is not investment advice and should not be seen as recommendations. Also, remember that backtested or past performance is not a reliable indicator of future performance.

What happened in world markets in October 2023

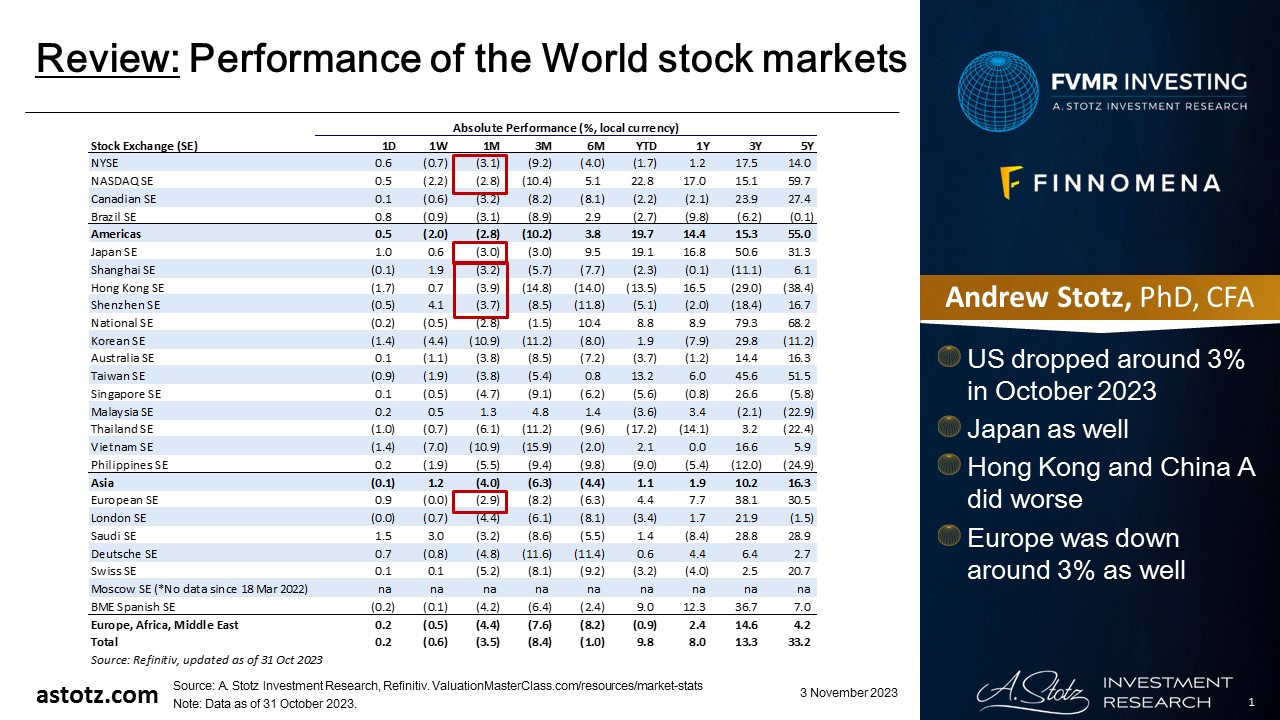

Performance of the World stock markets

- US dropped around 3% in October 2023

- Japan as well

- Hong Kong and China A did worse

- Europe was down around 3% as well

Find the updated Performance of the World stock markets here.

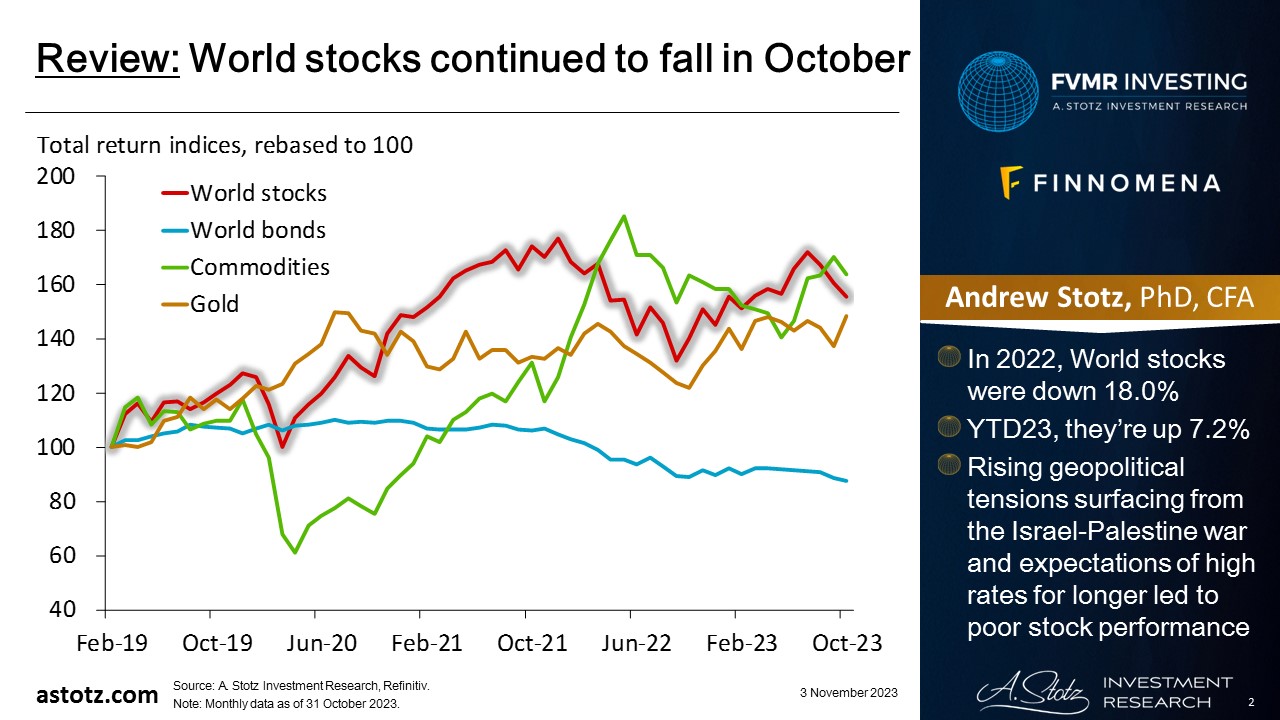

World stocks continued to fall in October

- In 2022, World stocks were down 18.0%

- YTD23, they’re up 7.2%

- Rising geopolitical tensions surfacing from the Israel-Palestine war and expectations of high rates for longer led to poor stock performance

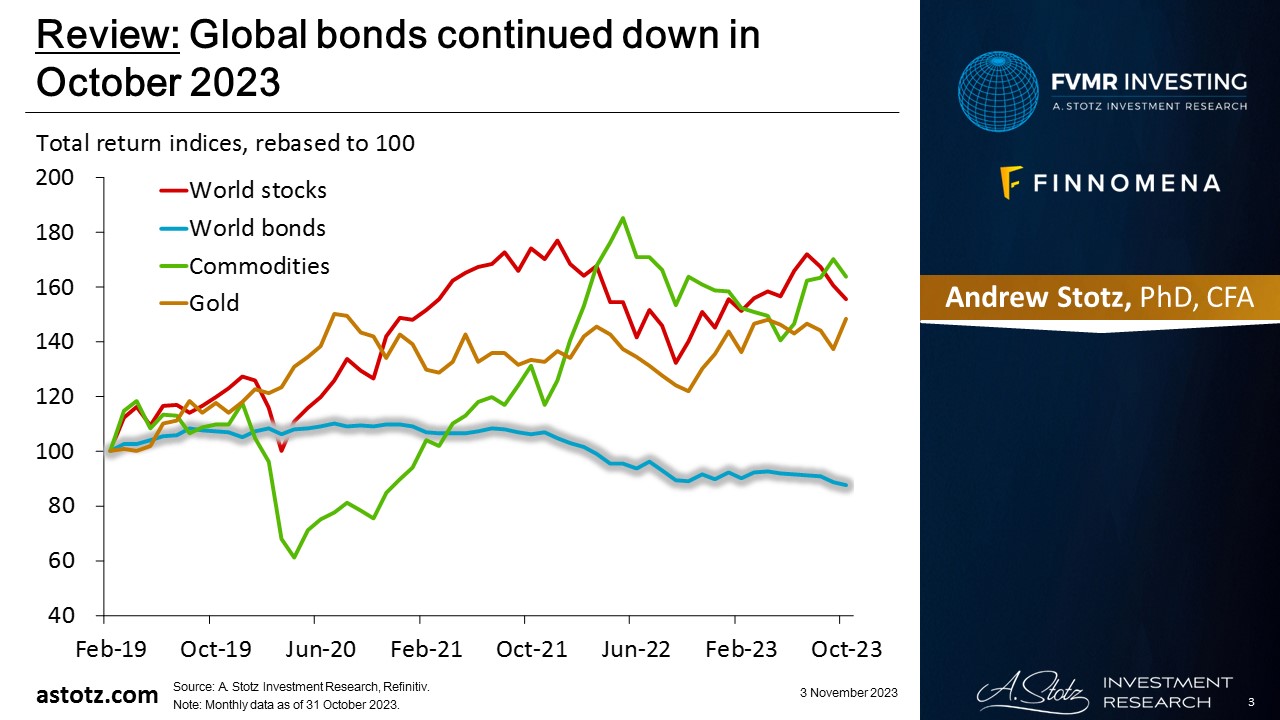

Global bonds continued down in October 2023

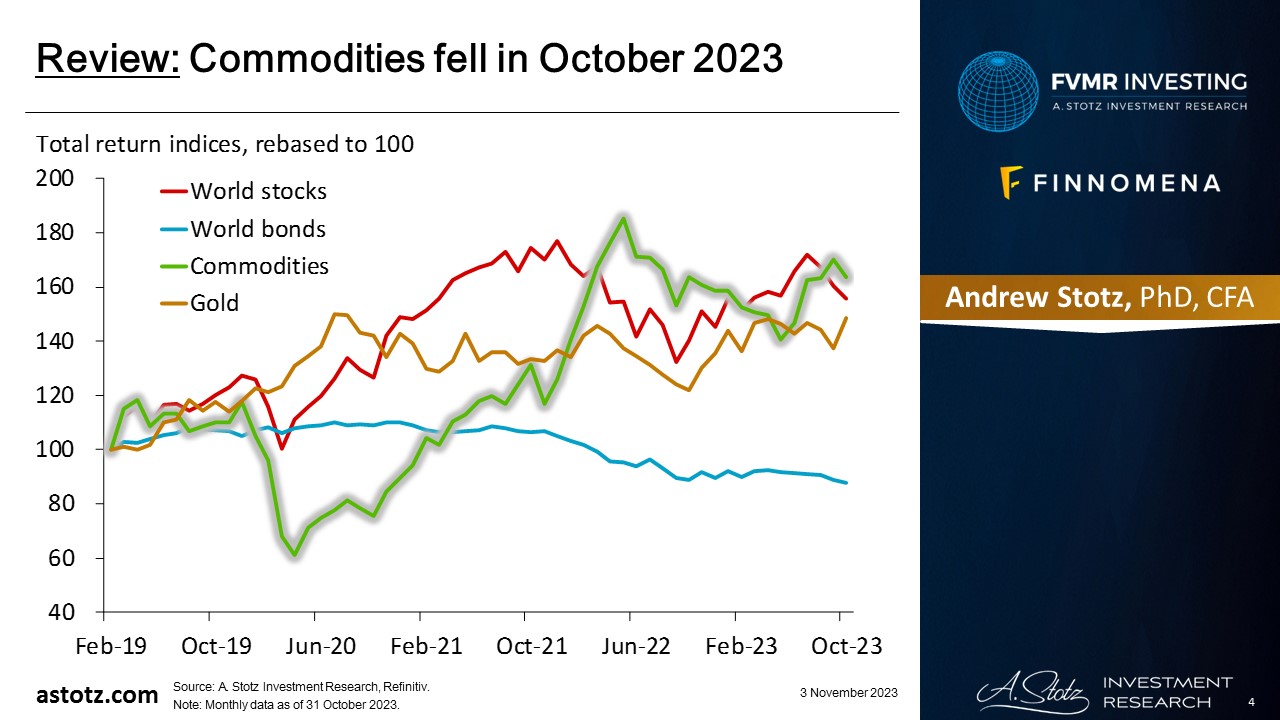

Commodities fell in October 2023

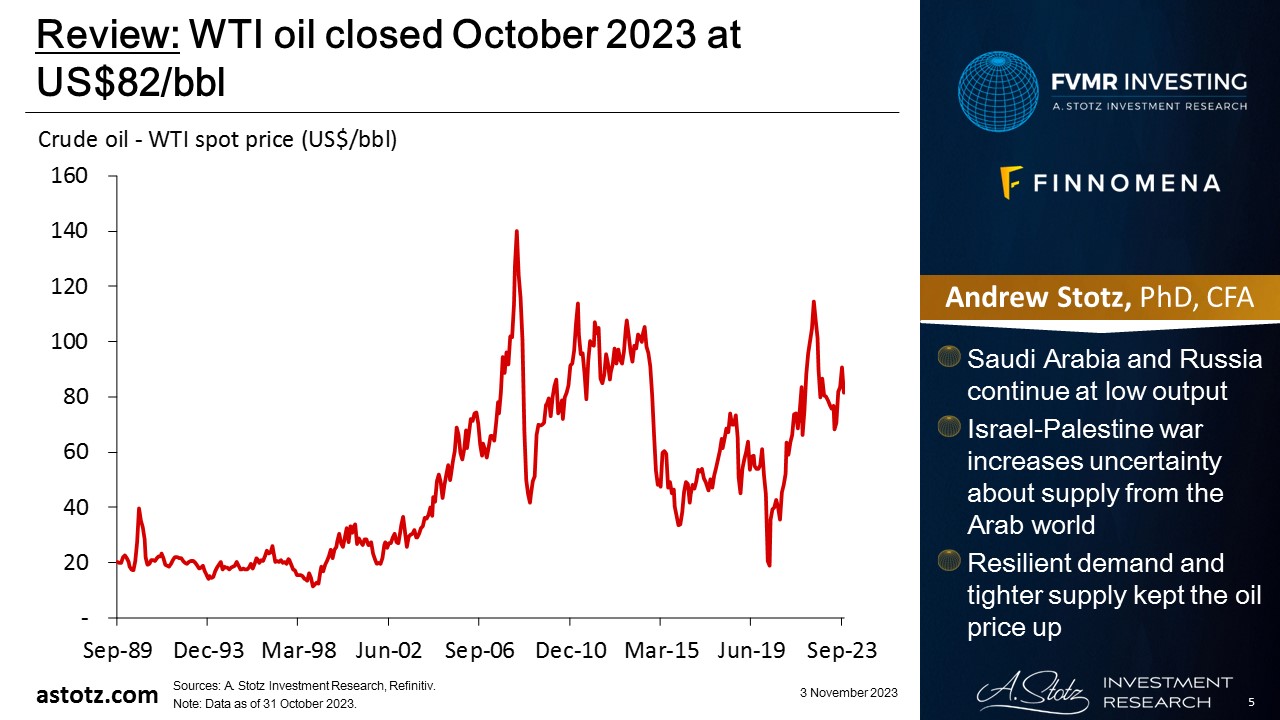

WTI oil closed October 2023 at US$82/bbl

- Saudi Arabia and Russia continue at low output

- Israel-Palestine war increases uncertainty about supply from the Arab world

- Resilient demand and tighter supply kept the oil price up

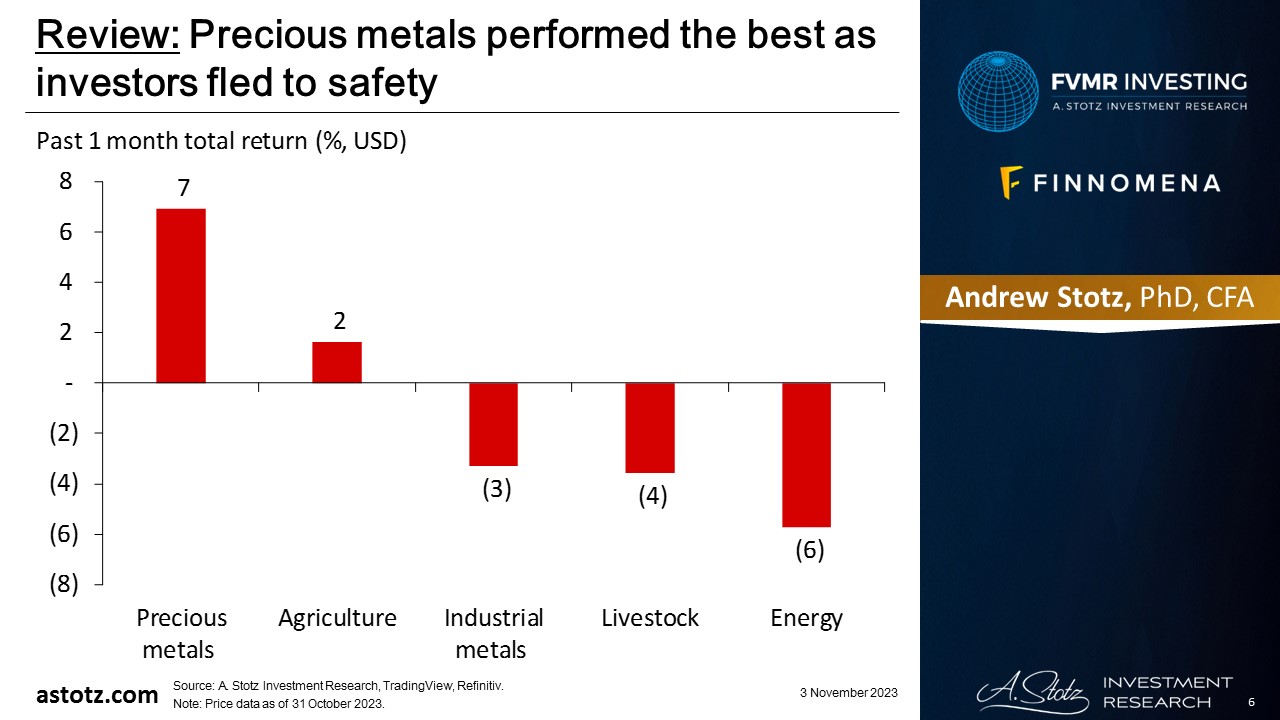

Precious metals performed the best as investors fled to safety

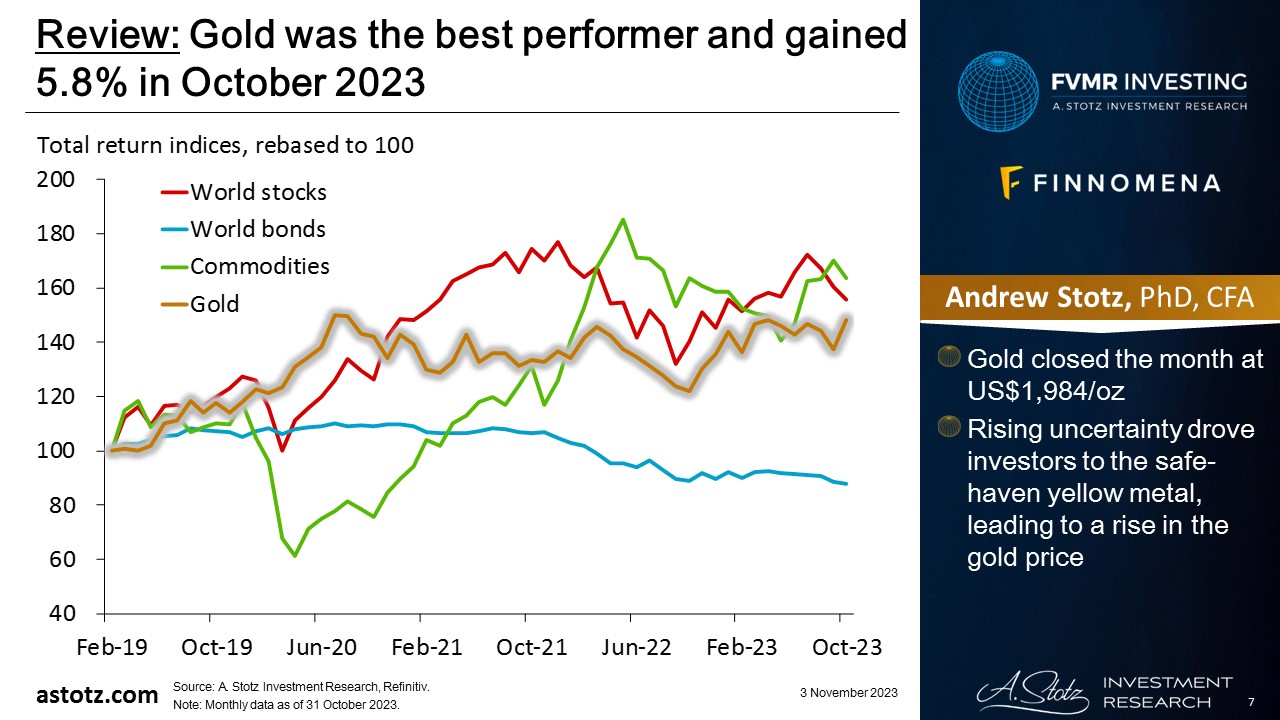

Gold was the best performer and gained 5.8% in October 2023

- Gold closed the month at US$1,984/oz

- Rising uncertainty drove investors to the safe-haven yellow metal, leading to a rise in the gold price

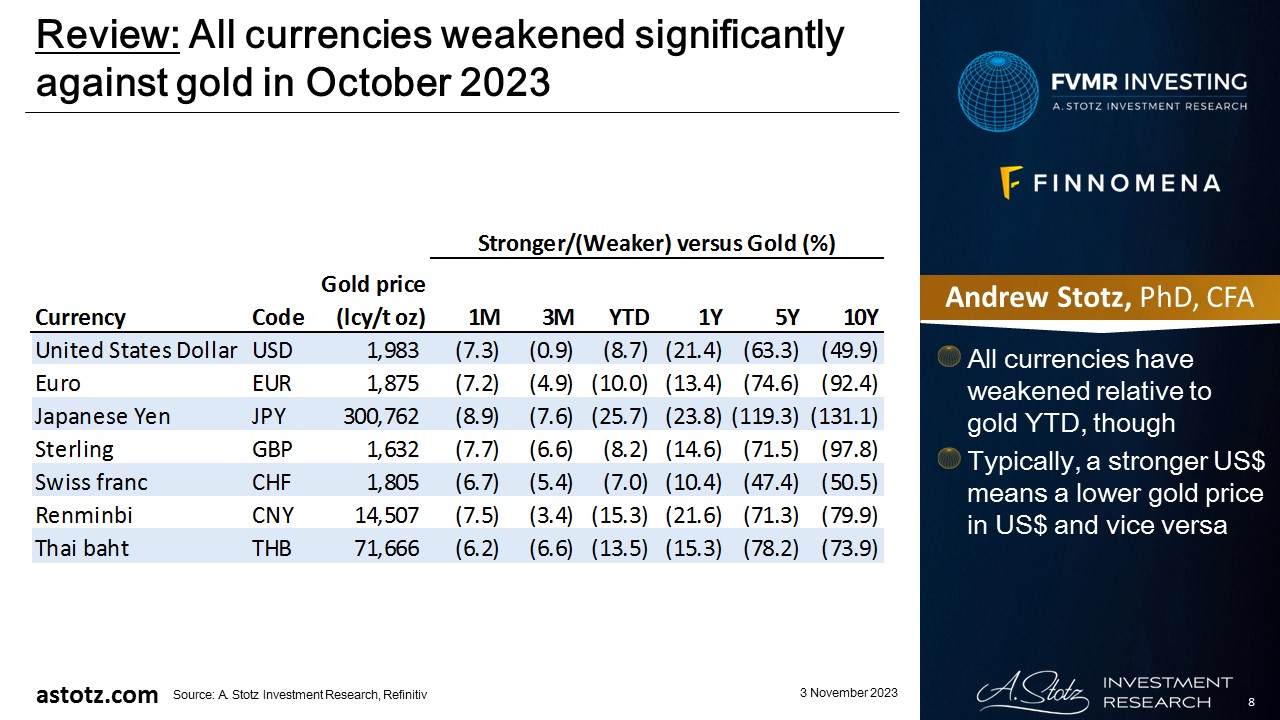

All currencies weakened significantly against gold in October 2023

- All currencies have weakened relative to gold YTD, though

- Typically, a stronger US$ means a lower gold price in US$ and vice versa

A 10% drawdown happens every 1.6 years

The S&P 500 is now down over 10% from its high in late July, the largest drawdown thus far in 2023.

Is such a decline unusual?

Not at all.

A 10% intra-year drawdown has happened every 1.6 years on average. pic.twitter.com/I7Tuy6kbW6

— Charlie Bilello (@charliebilello) October 26, 2023

The second largest US Treasuries issuance in history (only 2020 was higher)

The US has already issued $1.76 trillion in net Treasury securities through September. Will be well over $2 trillion by year-end, trailing only 2020 for the largest net debt issuance of any year in history. pic.twitter.com/B7fqb49Lb6

— Charlie Bilello (@charliebilello) October 9, 2023

US$ is stronger, and gold even thought the US money printer has been running hot

Over the last 3 years, the US Money Supply (M2) has increased by 14%, US inflation (CPI) has increased by 18%, and National Debt has grown by 24%.

And over that time the US Dollar Index ETF has gained 19% while the Gold ETF has lost 5%.

Just like everyone predicted. pic.twitter.com/iVOTHPCTCk

— Charlie Bilello (@charliebilello) October 5, 2023

Wall Street no longer sees a recession

For the first time in over a year, the Wall Street consensus no longer expects a recession over the next 12 months. pic.twitter.com/CsijVGWtik

— Robin Wigglesworth (@RobinWigg) October 18, 2023

We’ve heard about soft landings before

Soft landing narrative is not new, it preceded two last hard landings pic.twitter.com/RynAAWlu8L

— Michael A. Arouet (@MichaelAArouet) October 2, 2023

- News about soft landings has peaked before previous recessions

- It may not be a leading indicator but rather a reflection of the hope of a better outcome when recession is on the horizon

As rates have risen, company borrowing has slowed

US firms have raised just under $70 billion from sales of bonds and leveraged loans so far this month, the quietest month this year and the weakest pace of borrowing in any October since 2011. https://t.co/YYopJ4rAlf pic.twitter.com/BvdbI7AptX

— Lisa Abramowicz (@lisaabramowicz1) October 27, 2023

ECB kept rates unchanged and indicated it might be the peak

Today we kept our key interest rates unchanged.

Our past interest rate hikes are already helping push inflation down.

Our future decisions will depend on how we see the economy and inflation developing.

Read more https://t.co/JWogBYZDnY pic.twitter.com/5HypP3xw4m

— European Central Bank (@ecb) October 26, 2023

Japan is attractive for stock pickers

46% of #stocks in Japan’s TOPIX index have zero analyst coverage, while a further 22% have only 1-2 analysts covering them. Where do you think you are more likely to find mispriced stocks? In Japan, or in the US where nearly all the stocks in the S&P have 10 or more analysts… pic.twitter.com/K5ABfffuvd

— Jamie Halse🇳🇿🇦🇺🇯🇵🌎🌍🌏 (@JamieHalse) October 12, 2023

- Almost half of the stocks in TOPIX have no analyst coverage, and another 20% have only up to 2 analysts covering them

- Low coverage can often lead to mispricing, which opens opportunities for stock pickers

Key takeaways

- The second largest US Treasuries issuance in history

- Wall Street no longer sees a recession

- We’ve heard about soft landings before

- ECB kept rates unchanged and indicated it might be the peak

- Japan is attractive for stock pickers

Performance review: All Weather Inflation Guard

All Weather Inflation Guard was down 1.5%

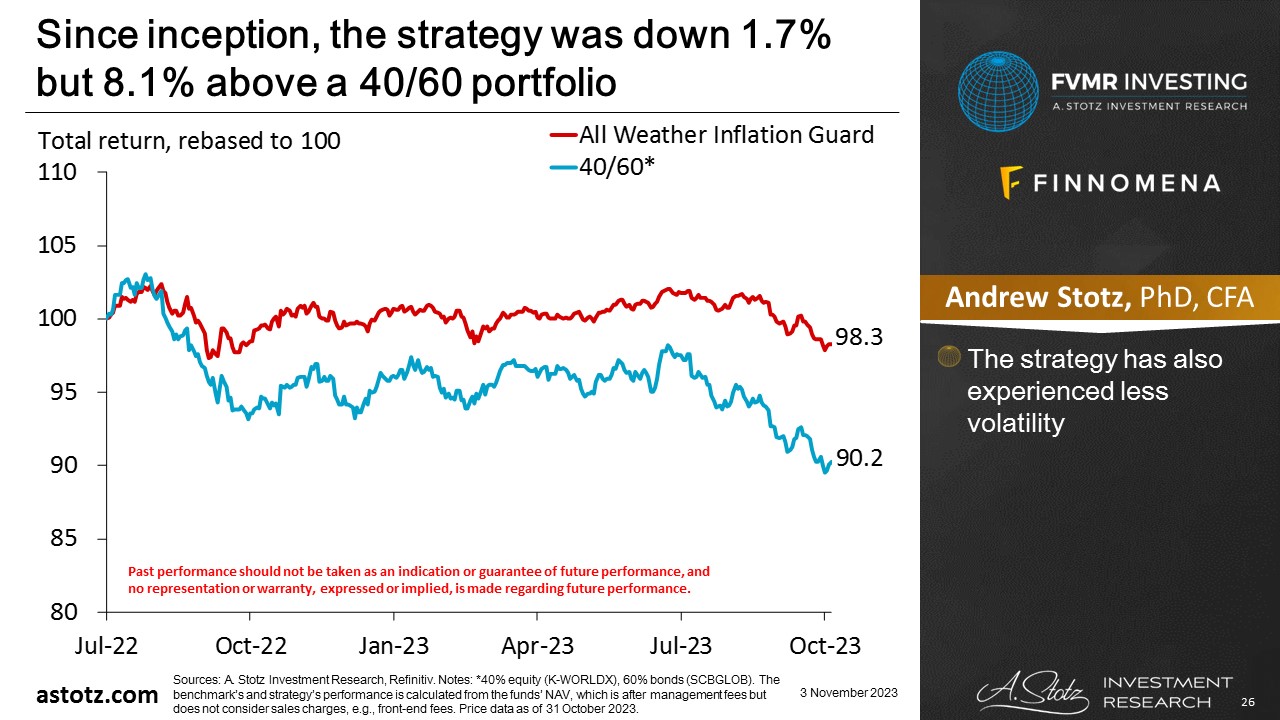

Since inception, the strategy was down 1.7% but 8.1% above a 40/60 portfolio

- The strategy has experienced less volatility though

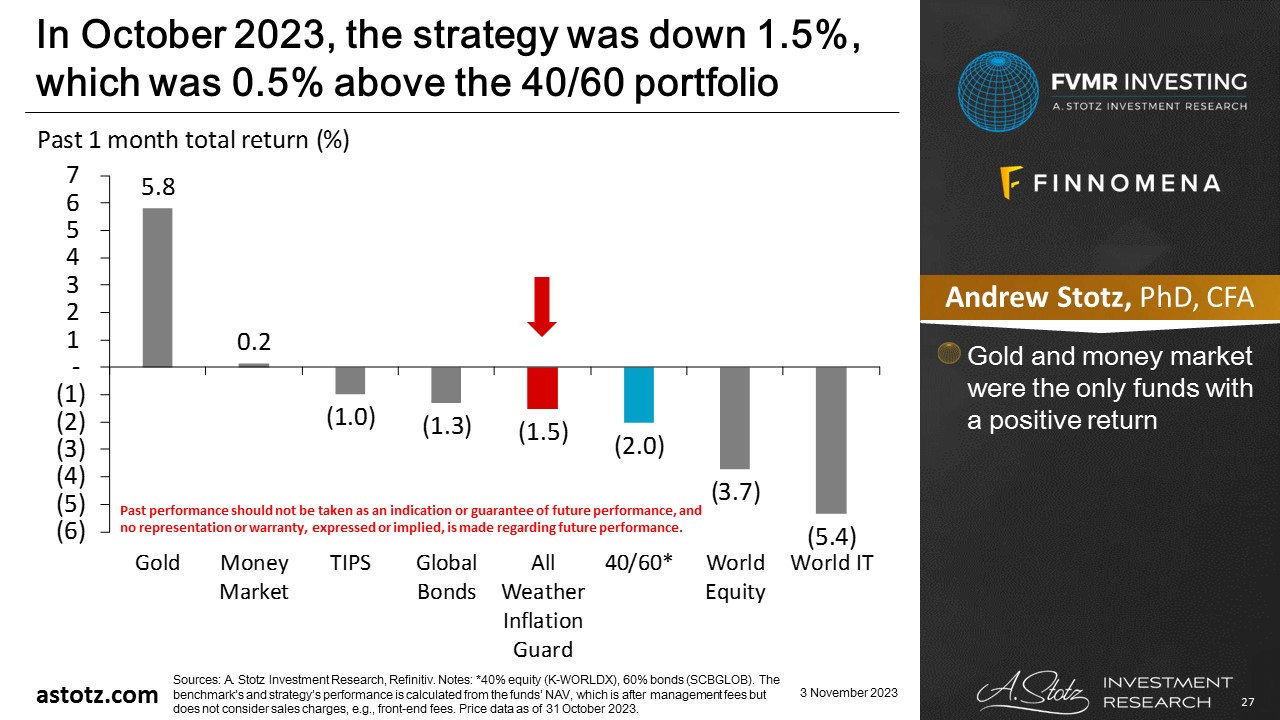

In October 2023, the strategy was down 1.5%, which was 0.5% above the 40/60 portfolio

- Gold and money market were the only funds with a positive return

Performance review: All Weather Strategy

All Weather Strategy was down 2.4%

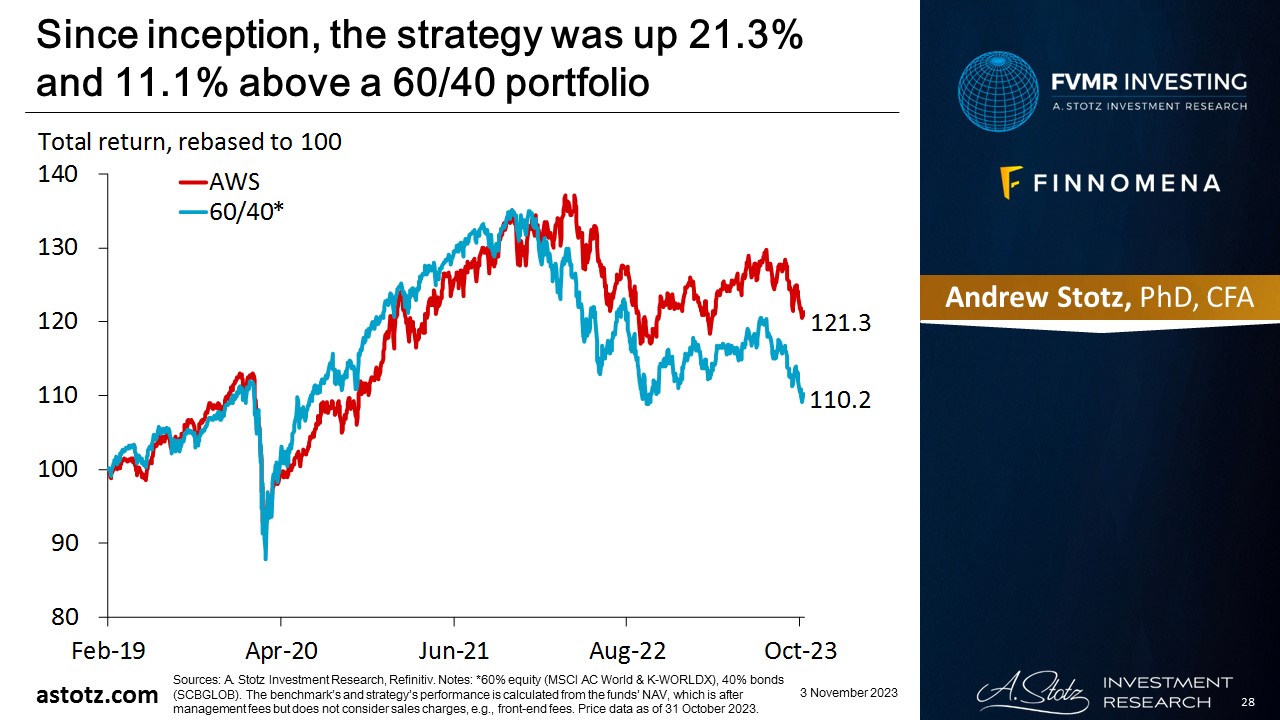

Since inception, the strategy was up 21.3% and 11.1% above a 60/40 portfolio

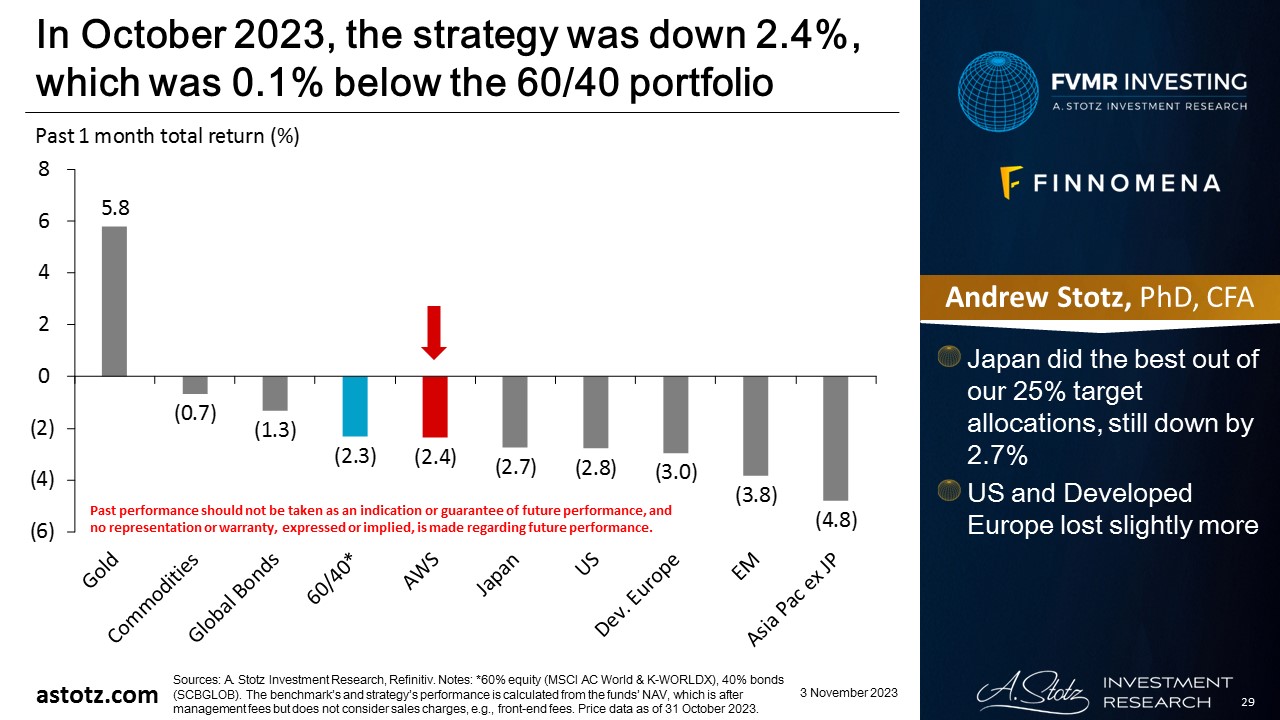

In October 2023, the strategy was down 2.4%, which was 0.1% below the 60/40 portfolio

- Japan did the best out of our 25% target allocations, still down by 2.7%

- US and Developed Europe lost slightly more

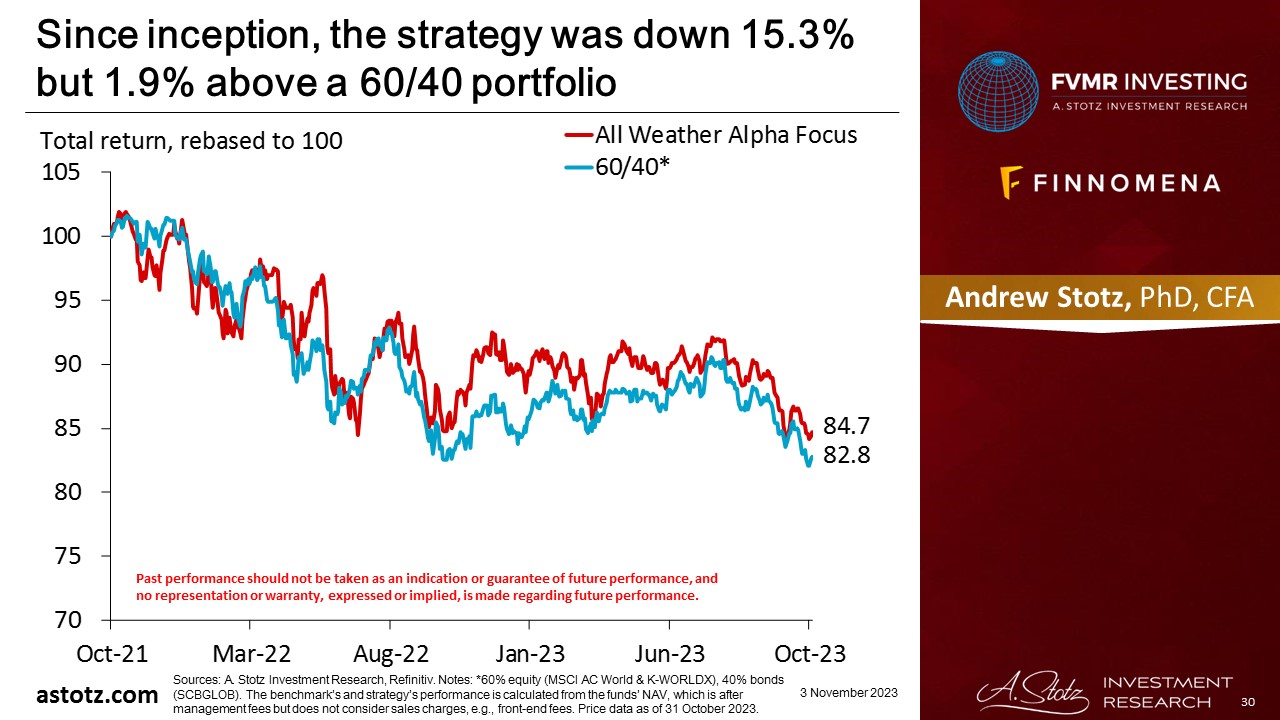

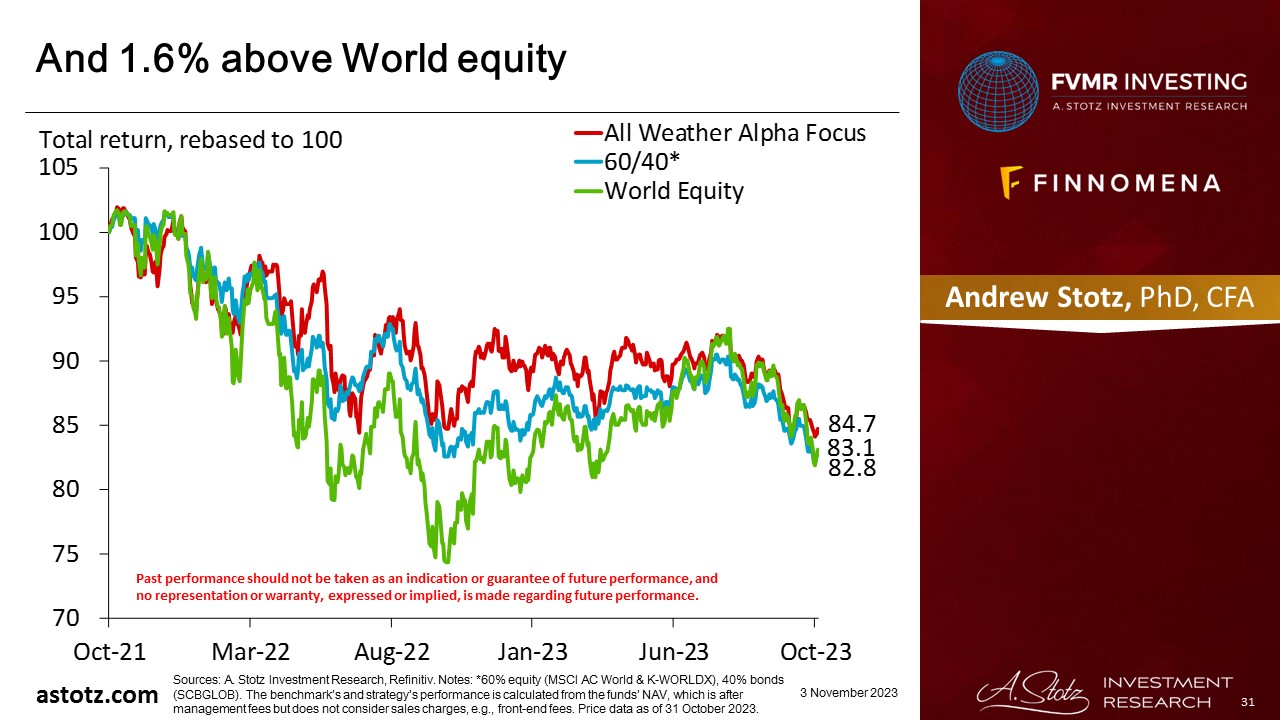

Performance review: All Weather Alpha Focus

All Weather Alpha Focus was down 1.9%

Since inception, the strategy was down 15.3% but 1.9% above a 60/40 portfolio

And 1.6% above World equity

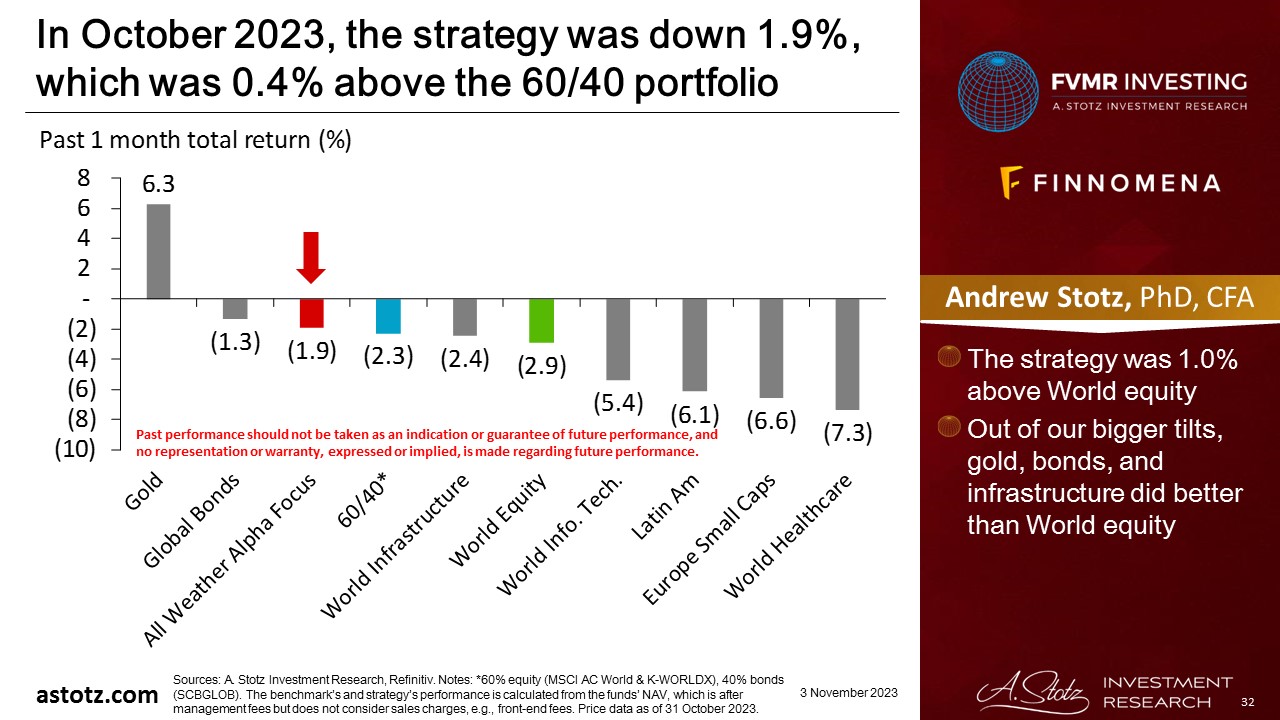

In October 2023, the strategy was down 1.9%, which was 0.4% above the 60/40 portfolio

- The strategy was 1.0% above World Equity

- Out of our bigger tilts, gold, bonds, and infrastructure did better than World equity

Global outlook that guides our asset allocation

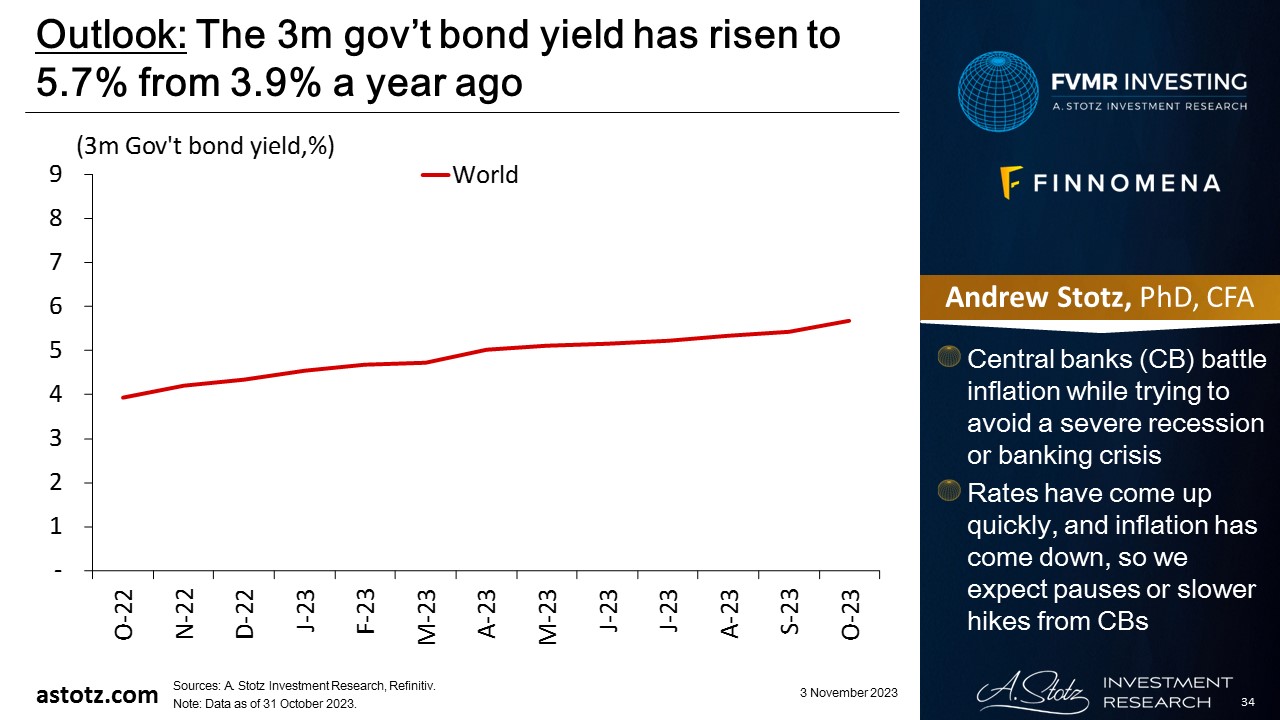

The 3m gov’t bond yield has risen to 5.7% from 3.9% a year ago

- Central banks (CB) battle inflation while trying to avoid a severe recession or banking crisis

- Rates have come up quickly, and inflation has come down, so we expect pauses or slower hikes from CBs

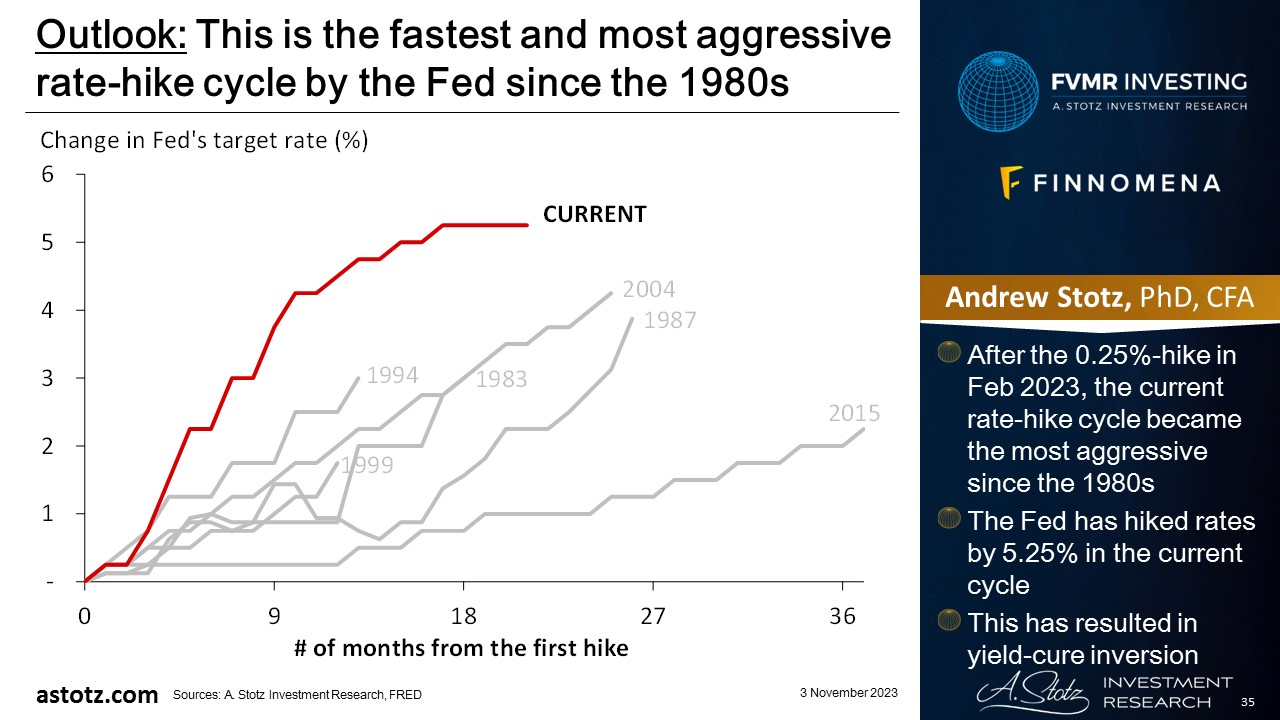

This is the fastest and most aggressive rate-hike cycle by the Fed since the 1980s

- After the 0.25%-hike in Feb 2023, the current rate-hike cycle became the most aggressive since the 1980s

- The Fed has hiked rates by 5.25% in the current cycle

- This has resulted in yield-cure inversion

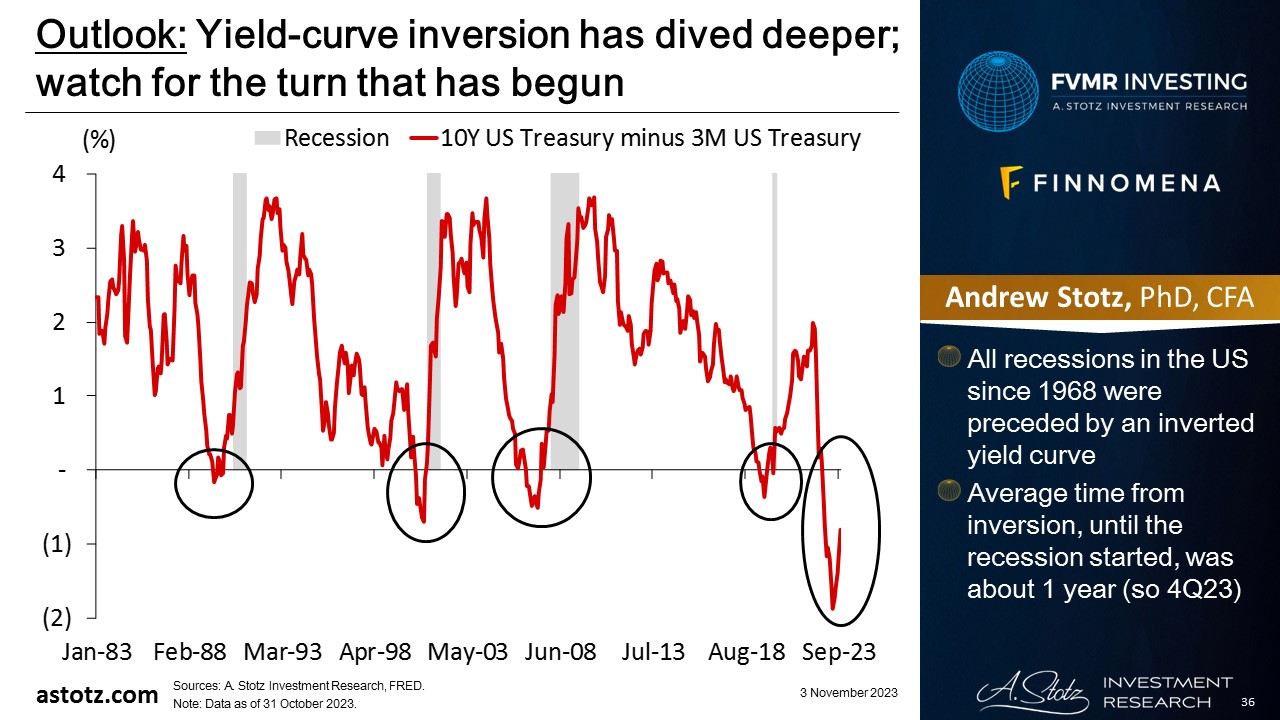

Yield-curve inversion has dived deeper; watch for the turn that has begun

- All recessions in the US since 1968 were preceded by an inverted yield curve

- Average time from inversion, until the recession started, was about 1 year (so 4Q23)

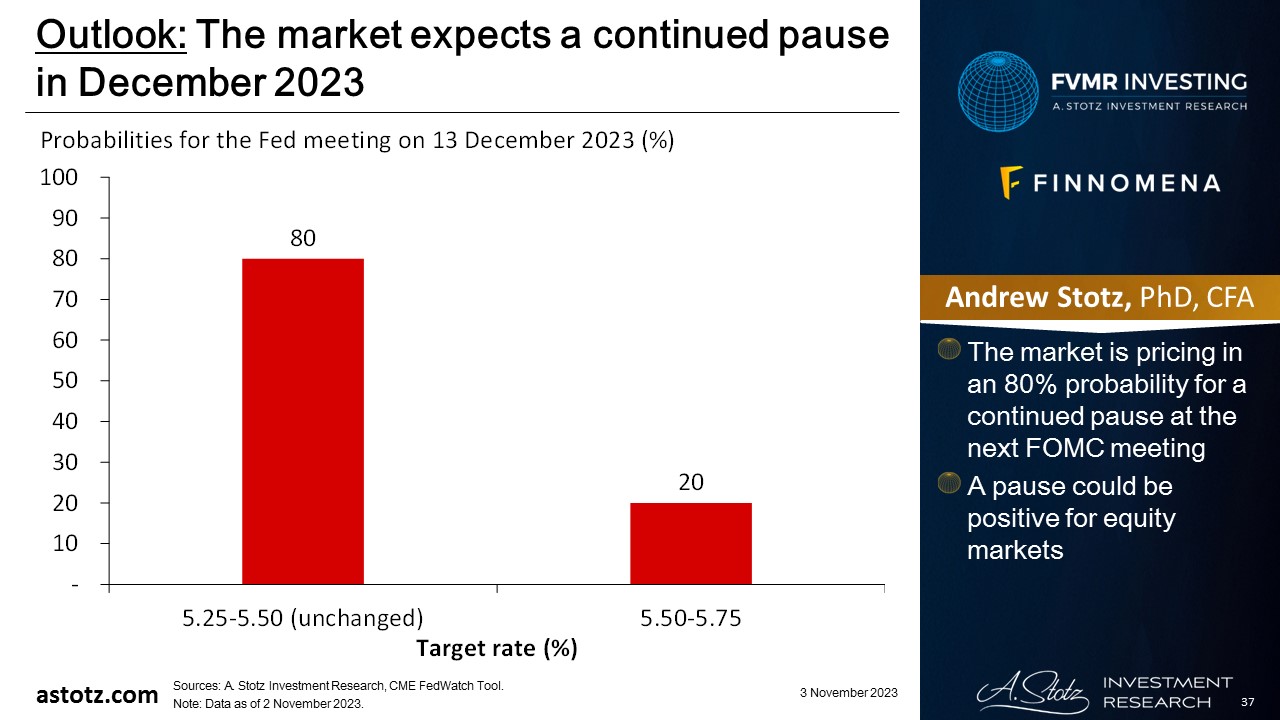

The market expects a continued pause in December 2023

- The market is pricing in an 80% probability for a continued pause at the next FOMC meeting

- A pause could be positive for equity markets

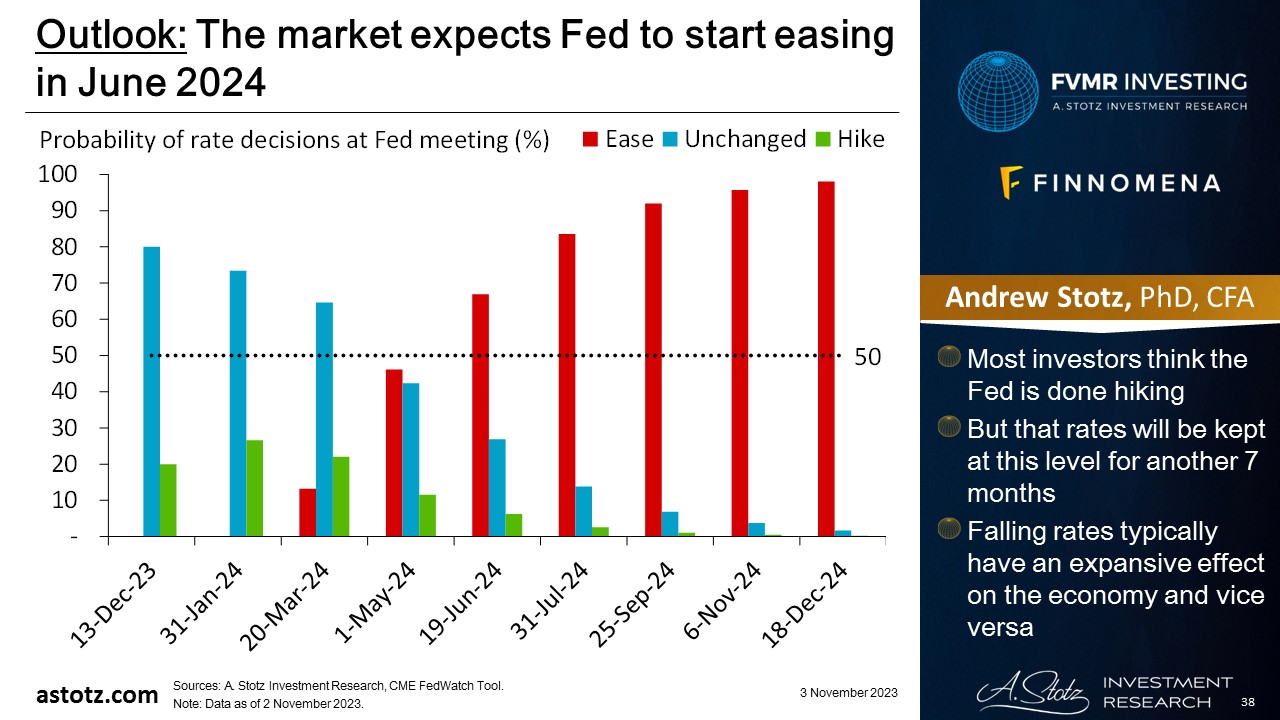

The market expects Fed to start easing in June 2024

- Most investors think the Fed is done hiking

- But that rates will be kept at this level for another 7 months

- Falling rates typically have an expansive effect on the economy and vice versa

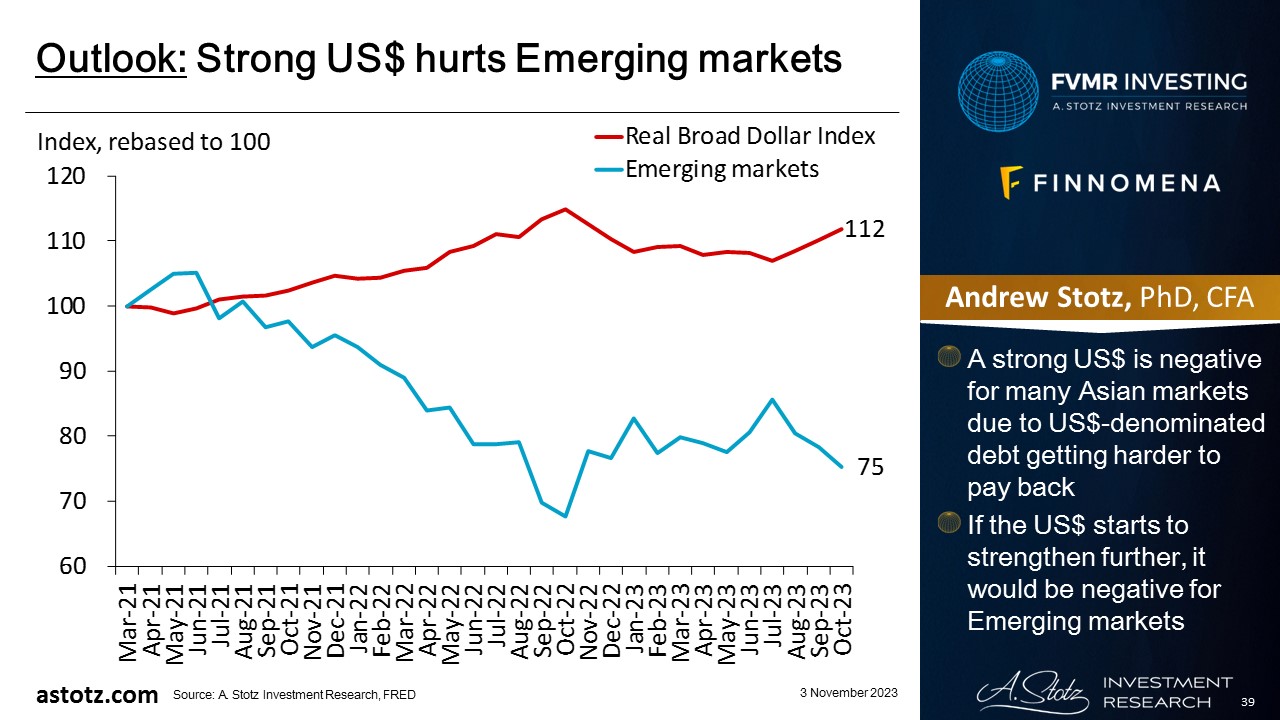

Strong US$ hurts Emerging markets

- A strong US$ is negative for many Asian markets due to US$-denominated debt getting harder to pay back

- If the US$ starts to strengthen further, it would be negative for Emerging markets

Bonds are typically a safe place to be

- In recessions, safer assets like government bonds typically have performed well

- Though with high inflation, low yields could still lead to negative real returns

- We generally don’t allocate to bonds to speculate on the upside but rather use it to protect capital over time

Oil price has strong technical support

- While losing some momentum, oil price still has technical support

- Saudi Arabian and Russian cuts could keep supply tight

- If demand is sustained, there could be further upside in the oil price

Commodities have rebounded due to oil, but too early to call the turn for the group

- The global economic growth outlook remains uncertain

- The main upside in commodities would come from a supply shock, adverse weather conditions, or significantly higher demand due to an improved growth outlook

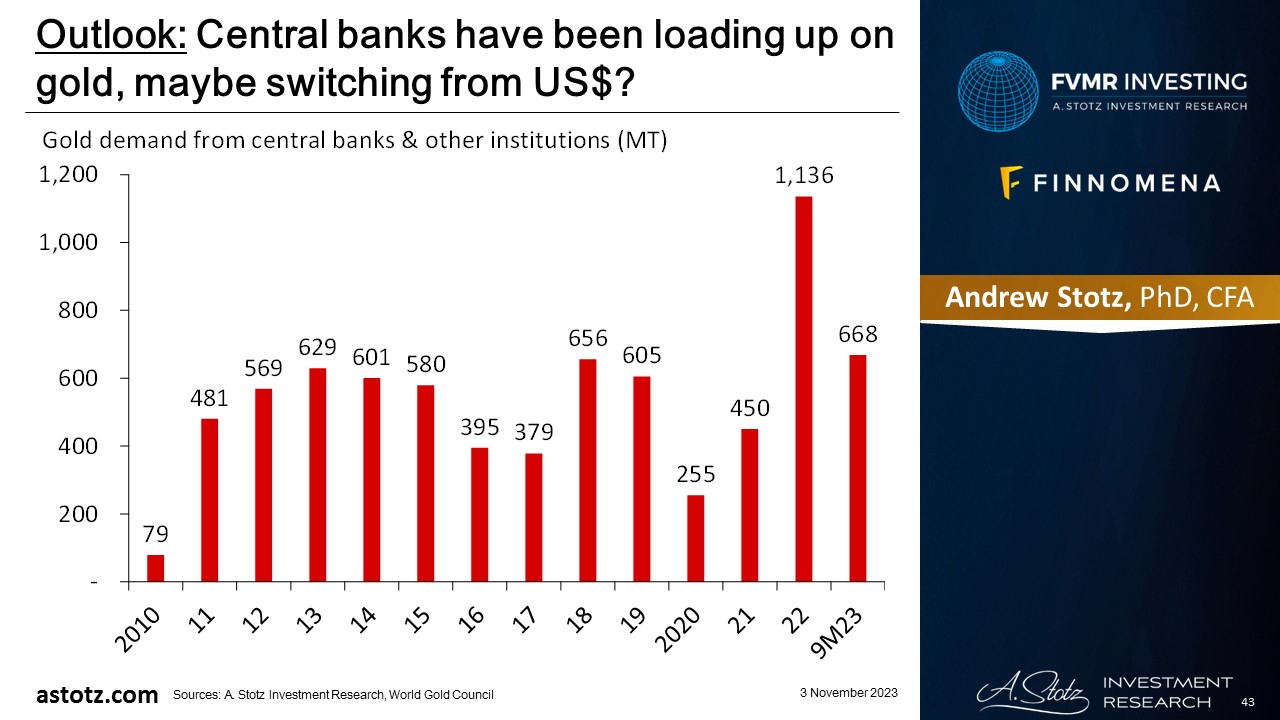

Central banks have been loading up on gold, maybe switching from US$?

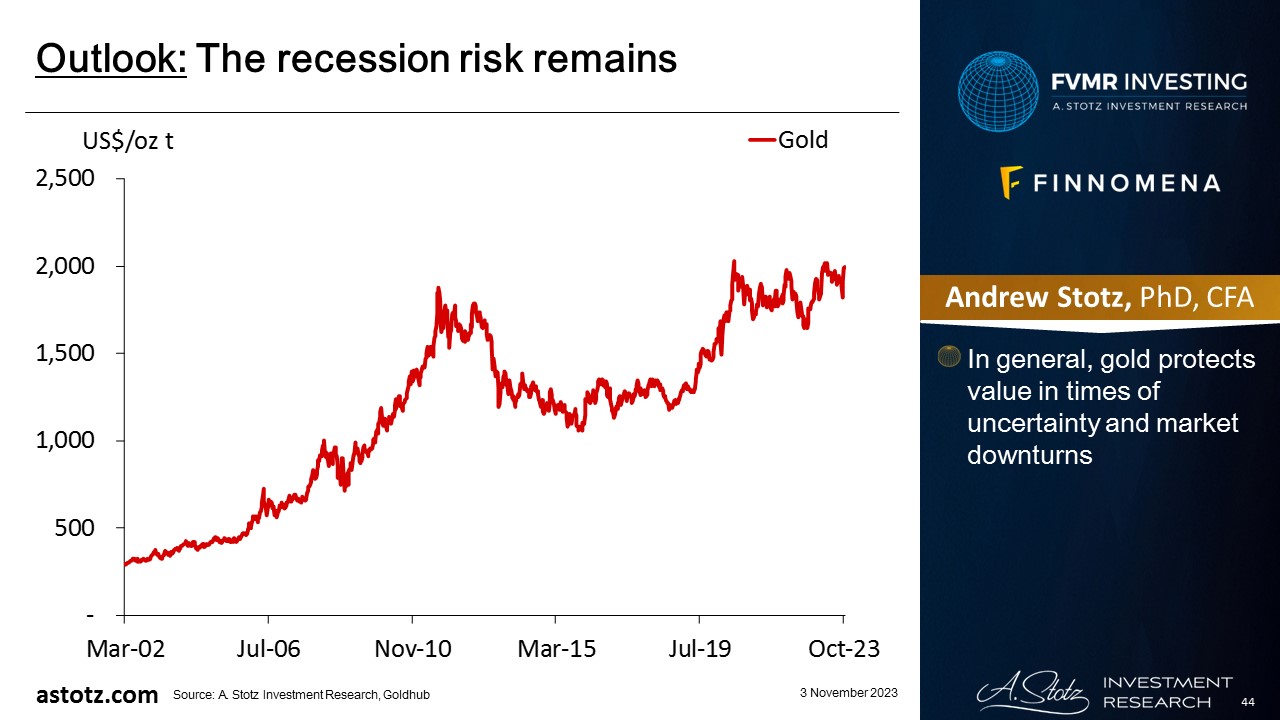

The recession risk remains

- In general, gold protects value in times of uncertainty and market downturns

Risk: Inflation reaccelerates

- Central banks’ aggressive rate hikes and QT crash the stock markets

- Continued rate hikes globally could lower bond yields (as higher rates mean lower bond prices)

- If inflation reaccelerates, we could miss out on rising commodities prices

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.