A. Stotz All Weather Strategies – March 2024

The All Weather Strategy is available in Thailand through FINNOMENA. If you’re interested in our allocation strategy, you can also join the Become a Better Investor Community. Please note that this post is not investment advice and should not be seen as recommendations. Also, remember that backtested or past performance is not a reliable indicator of future performance.

What happened in world markets in March 2024

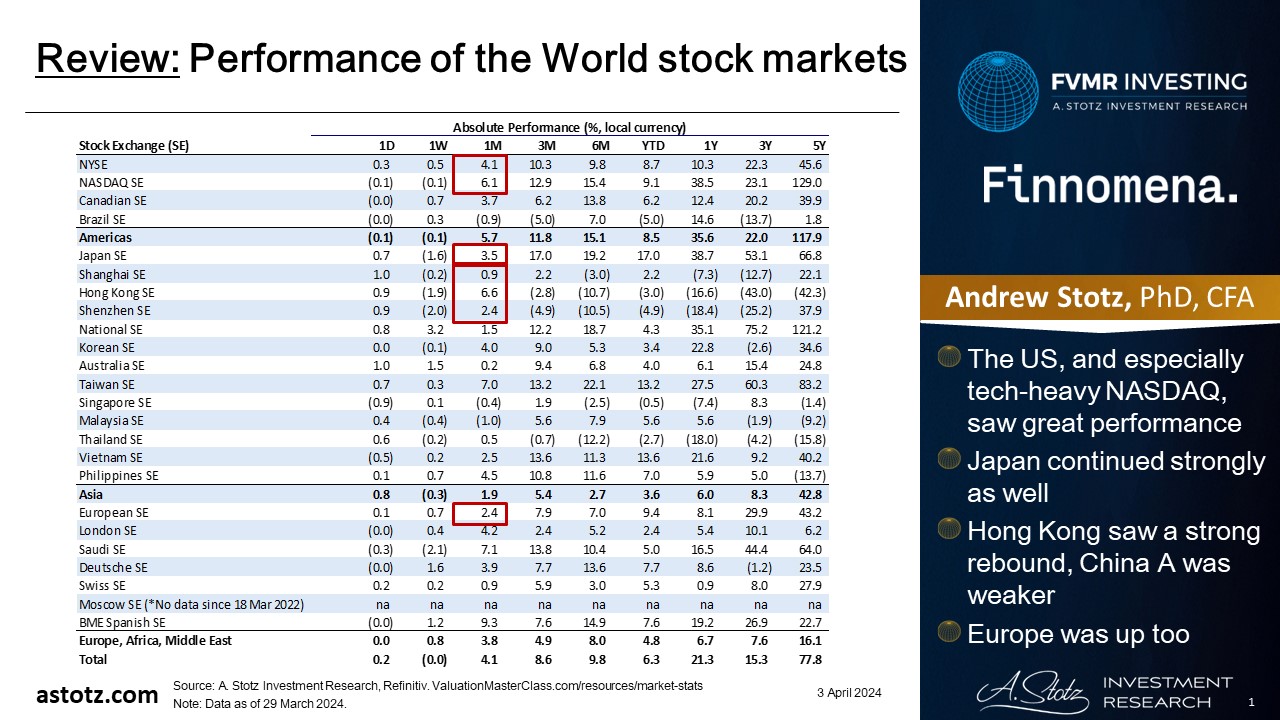

Performance of the World stock markets

- The US, and especially tech-heavy NASDAQ saw great performance

- Japan continued strongly as well

- Hong Kong saw a strong rebound, China A was weaker

- Europe was up too

Find the updated Performance of the World stock markets here.

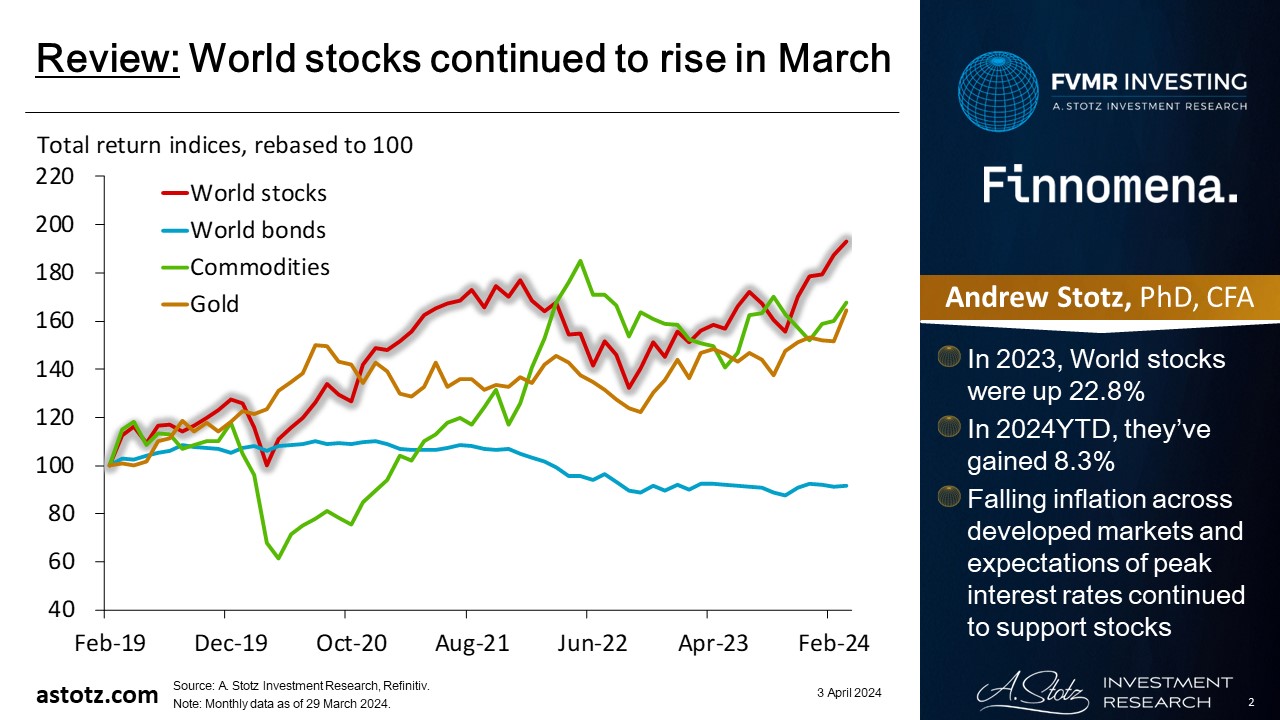

World stocks continued to rise in March

- In 2023, World stocks were up 22.8%

- In 2024YTD, they’ve gained 8.3%

- Falling inflation across developed markets and expectations of peak interest rates continued to support stocks

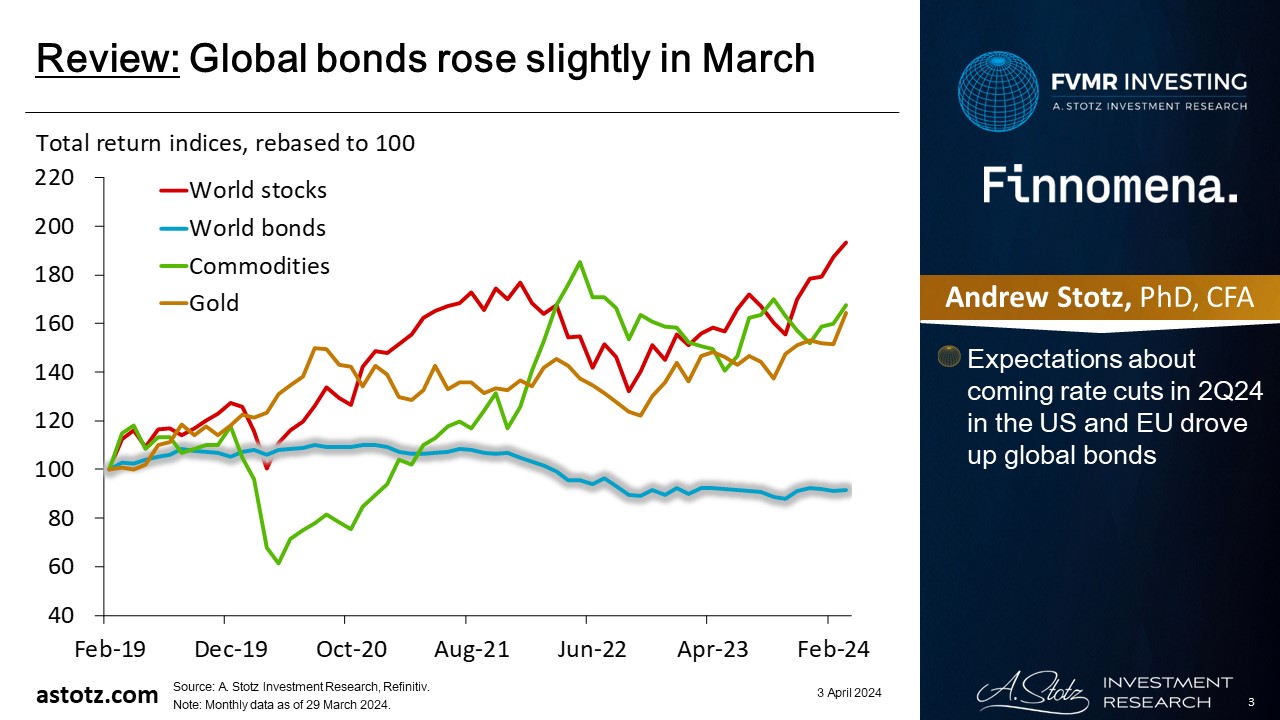

Global bonds rose slightly in March

- Expectations about coming rate cuts in 2Q24 in the US and EU drove up global bonds

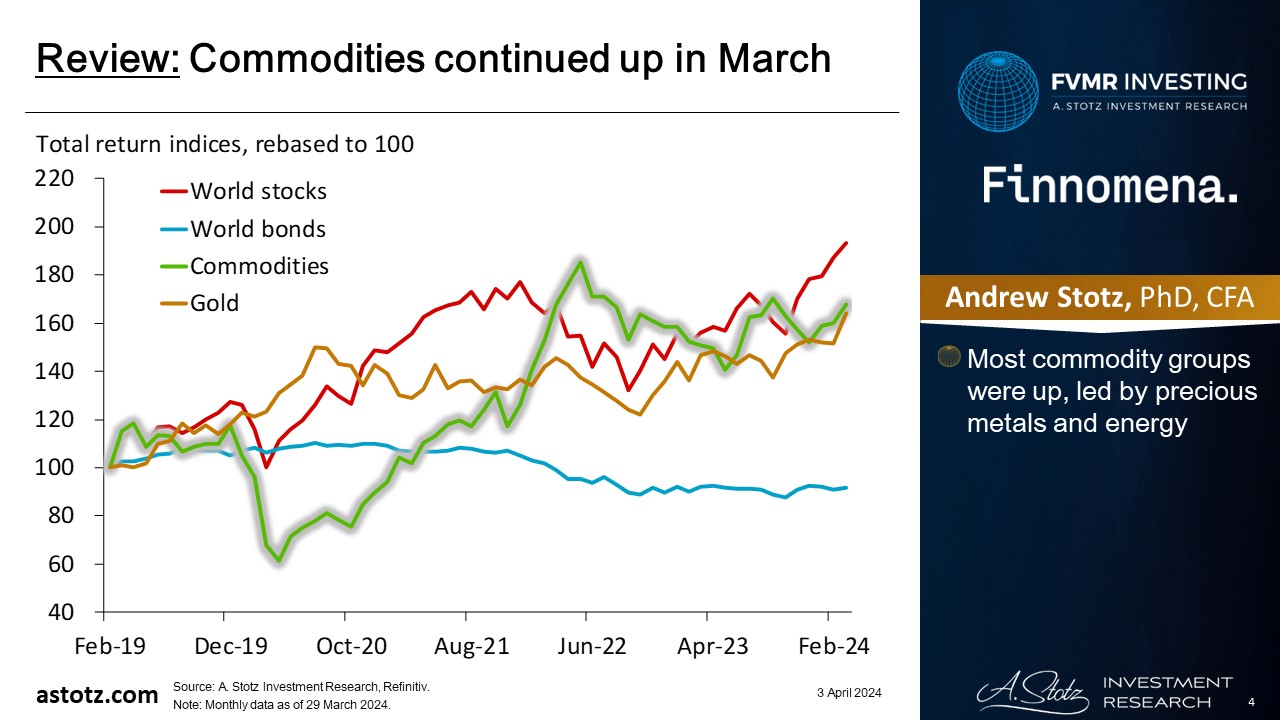

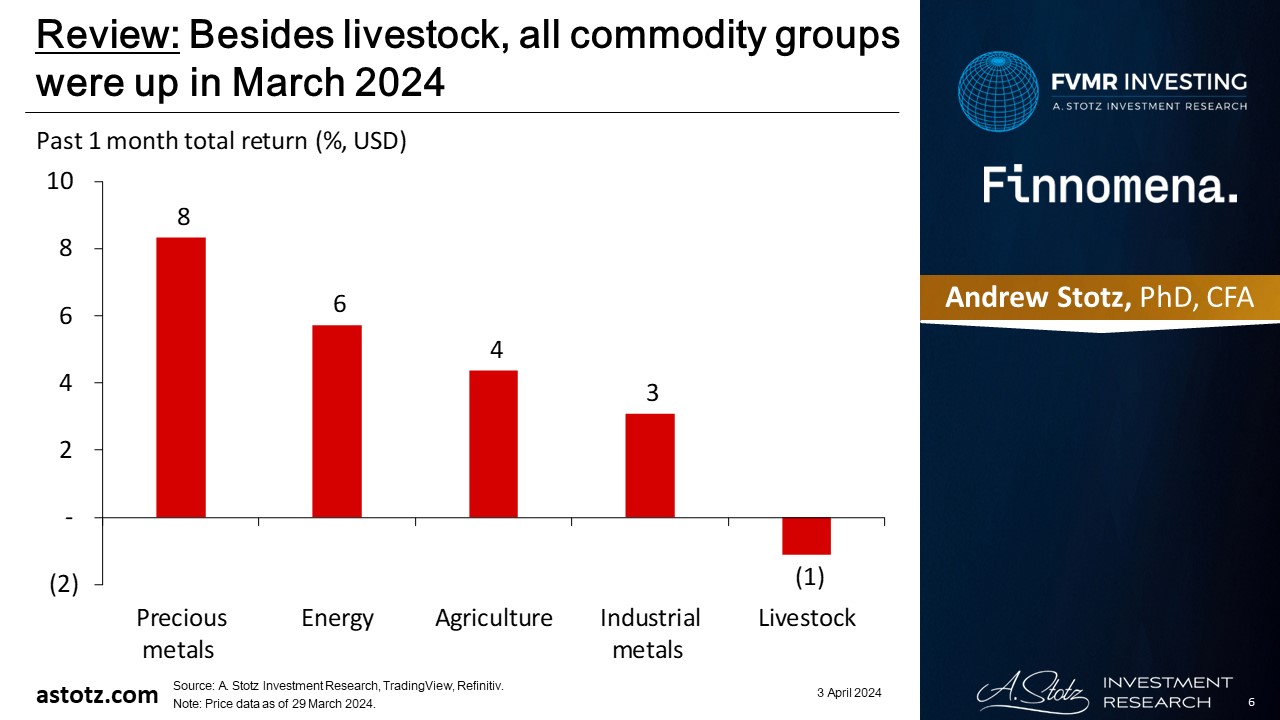

Commodities continued up in March

- Most commodity groups were up, led by precious metals and energy

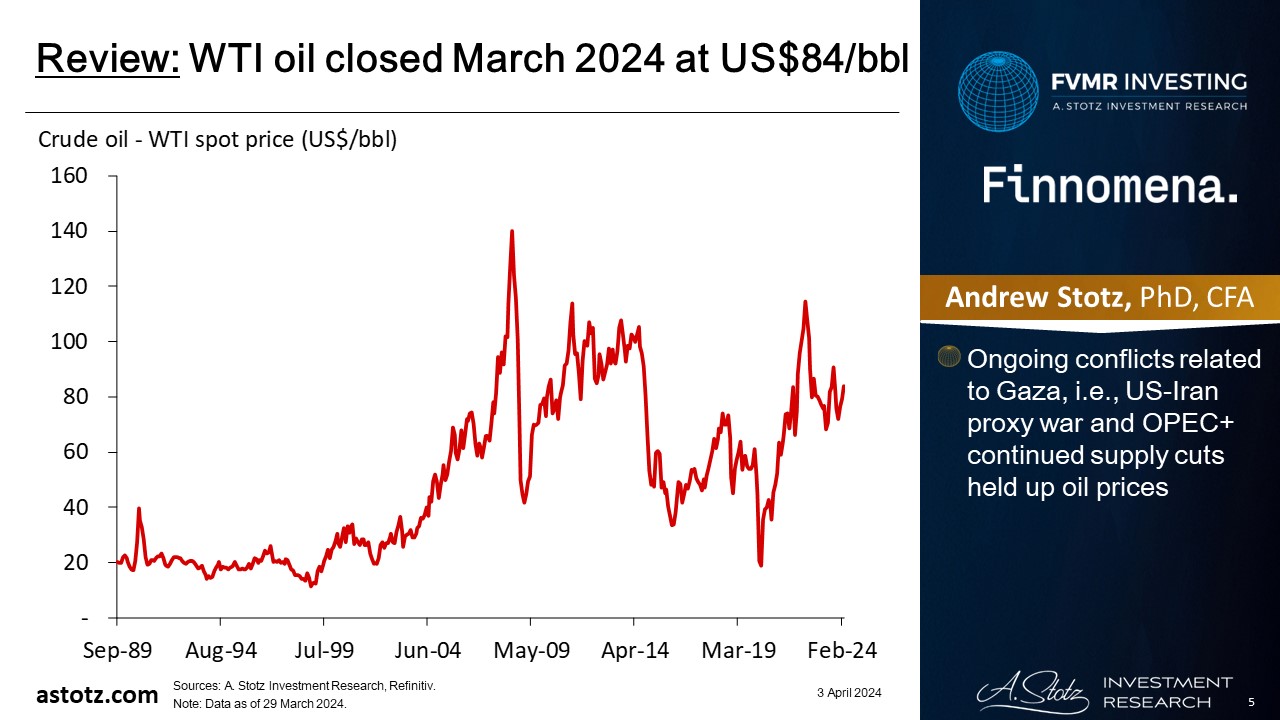

WTI oil closed March 2024 at US$84/bbl

- Ongoing conflicts related to Gaza, i.e., US-Iran proxy war and OPEC+ continued supply cuts held up oil prices

Besides livestock, all commodity groups were up in March 2024

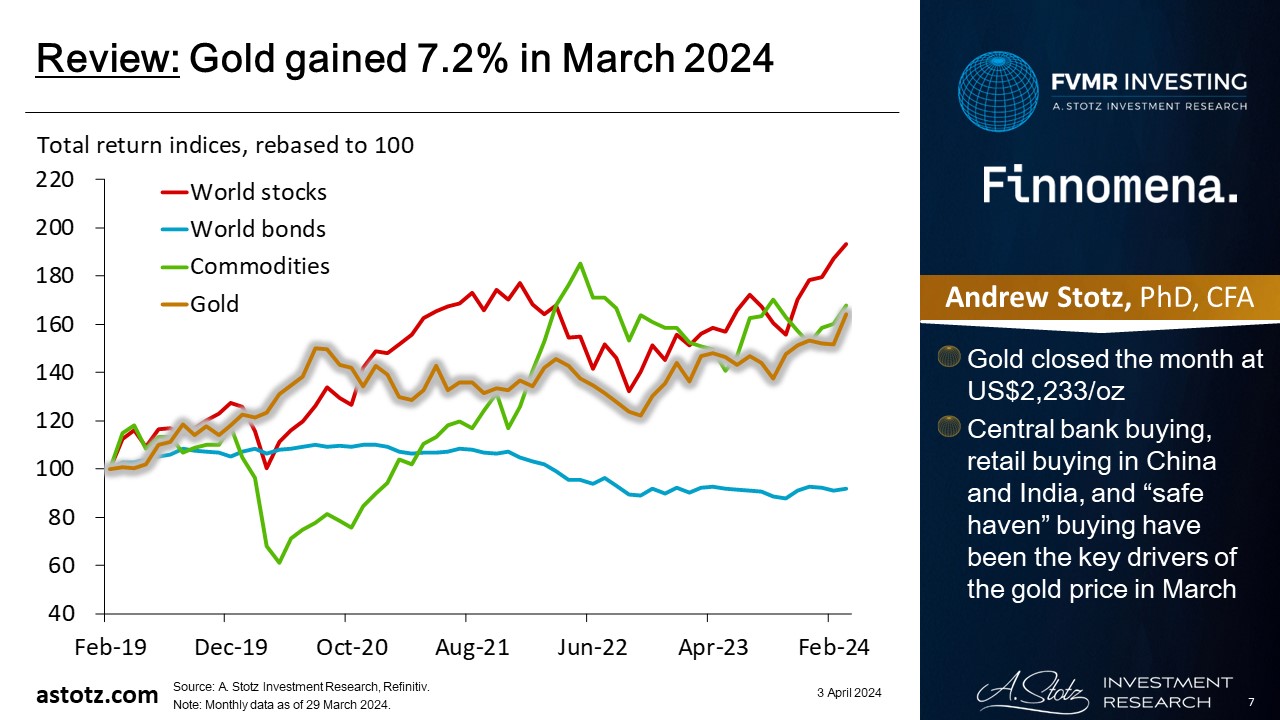

Gold gained 7.2% in March 2024

- Gold closed the month at US$2,233/oz

- Central bank buying, retail buying in China and India, and “safe haven” buying have been the key drivers of the gold price in March

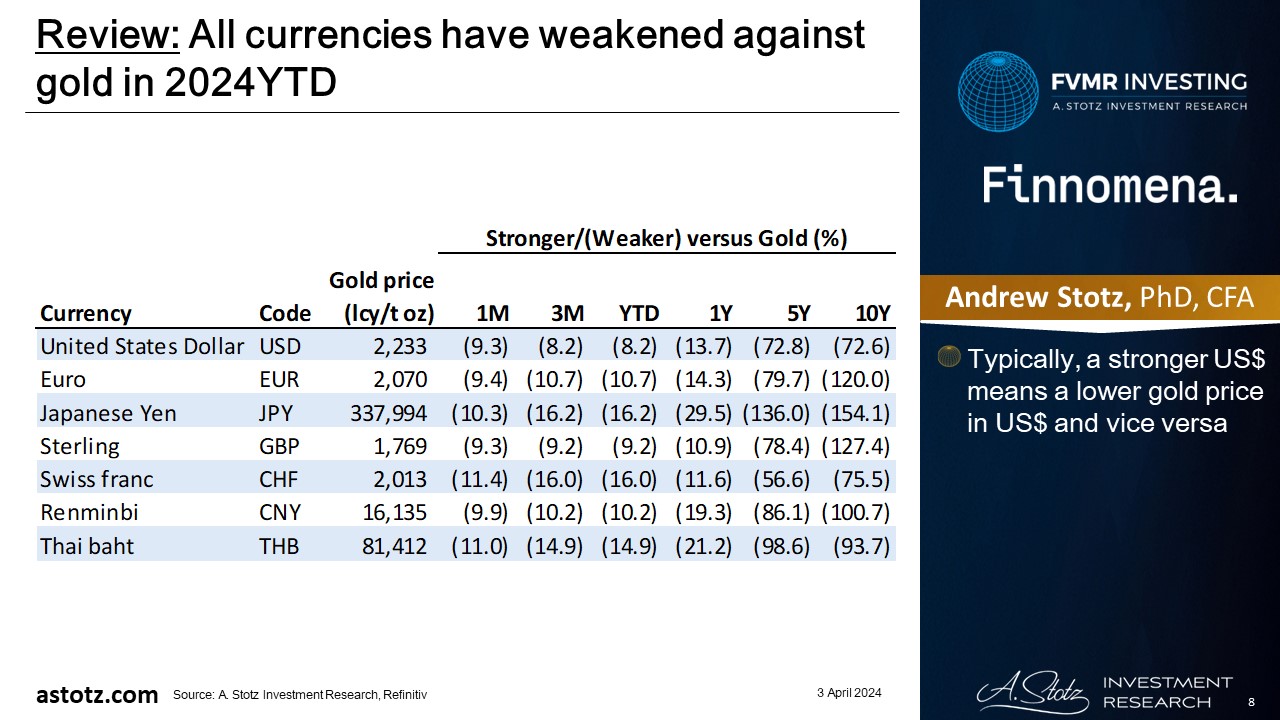

All currencies have weakened against gold in 2024YTD

- Typically, a stronger US$ means a lower gold price in US$ and vice versa

The US CPI inflation rate was 3.2% in February 2024, above expectations of 3.1%

BREAKING: February CPI inflation rate RISES to 3.2%, above expectations of 3.1%.

Core CPI inflation fell to 3.8%, ABOVE expectations of 3.7%.

This is the 35th consecutive month with inflation above 3% and second straight increase.

A Fed pivot is becoming less likely.

— The Kobeissi Letter (@KobeissiLetter) March 12, 2024

- Core CPI inflation fell to 3.8%, above expectations of 3.7%

The US stock market has continued to set new all-time highs

The S&P 500 ended the month at another all-time high, its 22nd of the year. Over the last 12 years, the S&P 500 has hit 369 all-time highs, which is more than any 12-year period in history. $SPX

Video: https://t.co/NwpmKkw1uB pic.twitter.com/I8WLksMYc4

— Charlie Bilello (@charliebilello) March 29, 2024

The Bank of Japan raised interest rates for the first time in 17 years

The Bank of Japan just raised interest rates for the first time in 17 years.

Here are the implications for global markets.

— Alf (@MacroAlf) March 19, 2024

China is buying gold

Is this the most important chart in finance…?? pic.twitter.com/CLWKyWLGhT

— Kuppy (@hkuppy) March 25, 2024

Key takeaways

- The US CPI inflation rate was 3.2% in February 2024, above expectations of 3.1%

- The US stock market has continued to set new all-time highs

- The Bank of Japan raised interest rates for the first time in 17 years

- China is buying gold

Performance review: All Weather Inflation Guard

All Weather Inflation Guard gained 1.8%

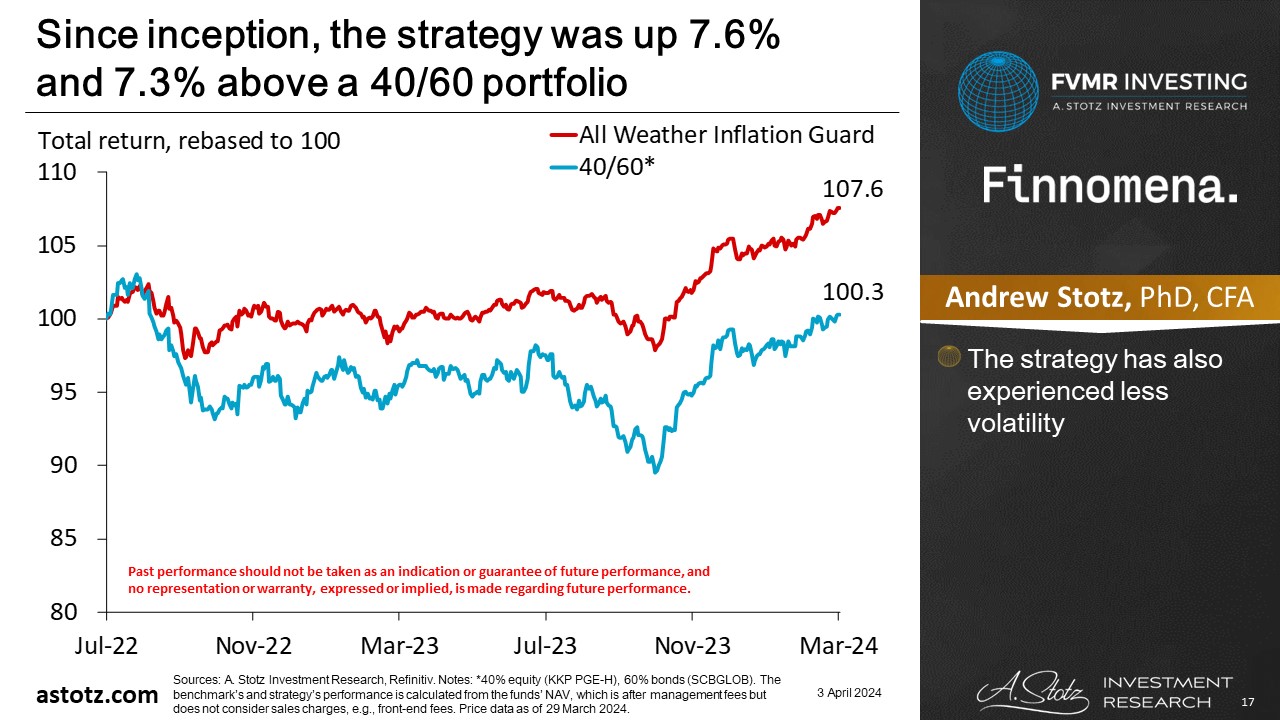

Since inception, the strategy was up 7.6% and 7.3% above a 40/60 portfolio

- The strategy has also experienced less volatility

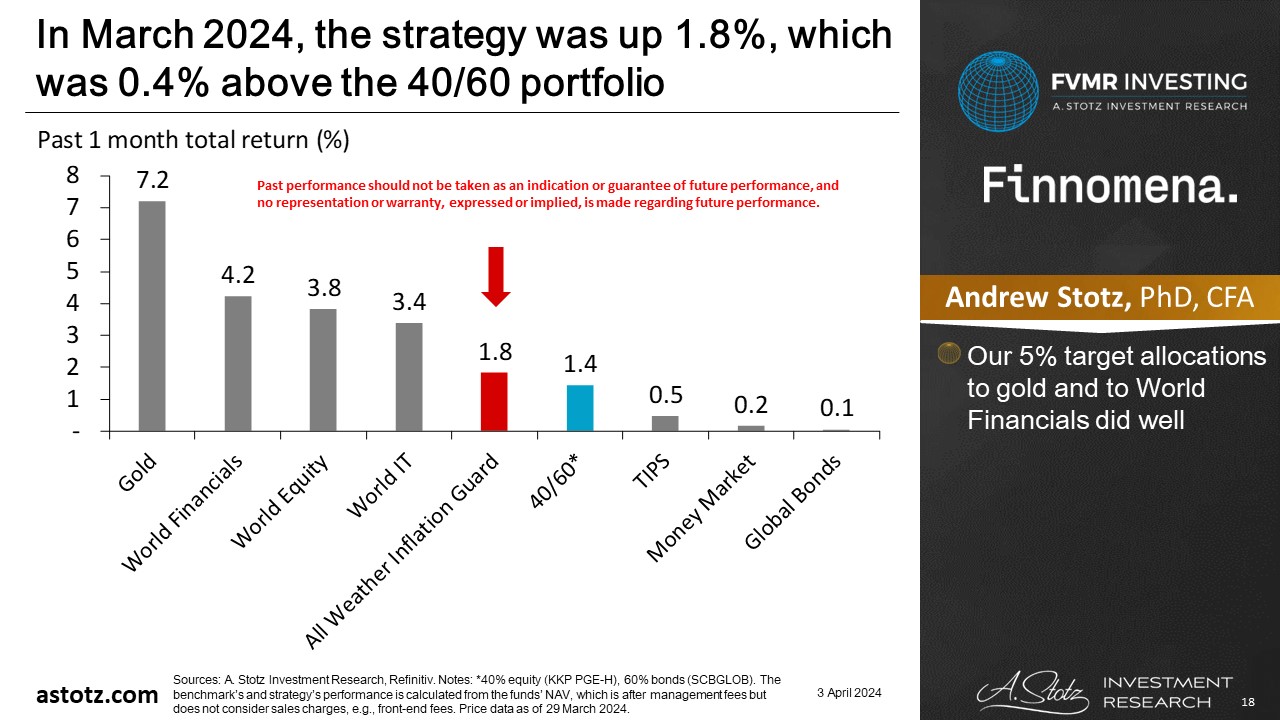

In March 2024, the strategy was up 1.8%, which was 0.4% above the 40/60 portfolio

- Our 5% target allocations to gold and to World Financials did well

Performance review: All Weather Strategy

All Weather Strategy gained 3.6%

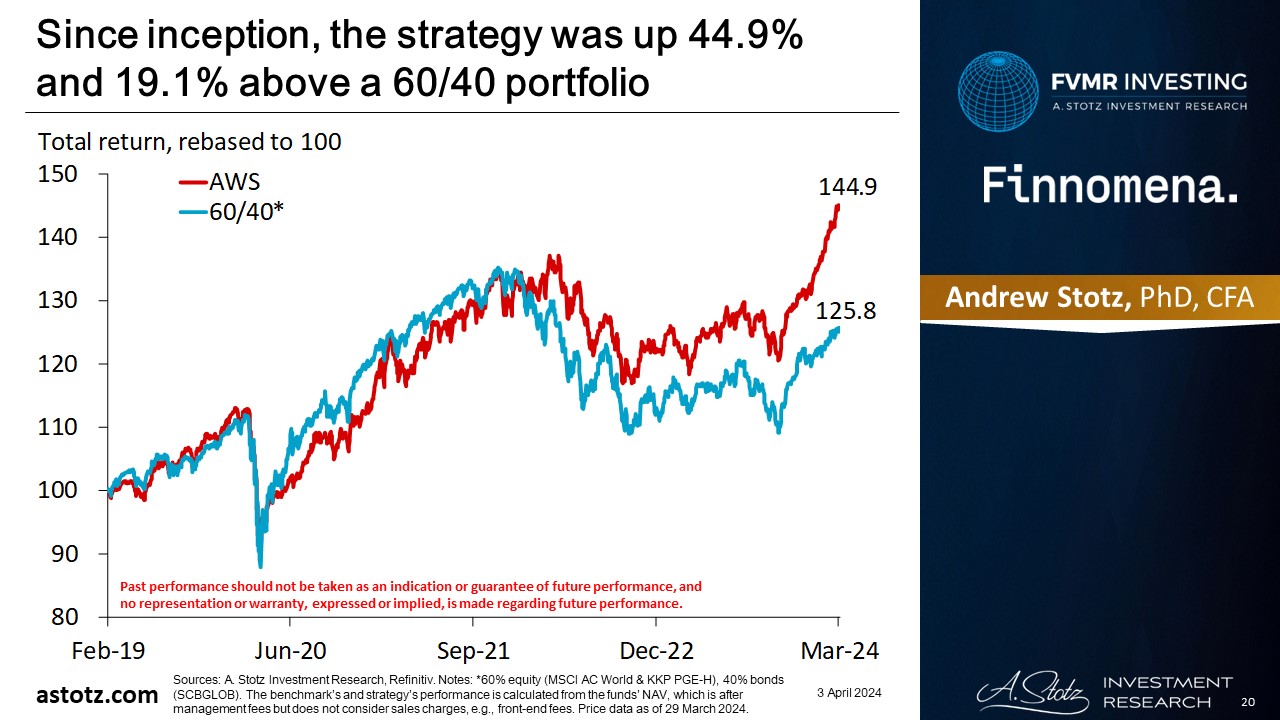

Since inception, the strategy was up 44.9% and 19.1% above a 60/40 portfolio

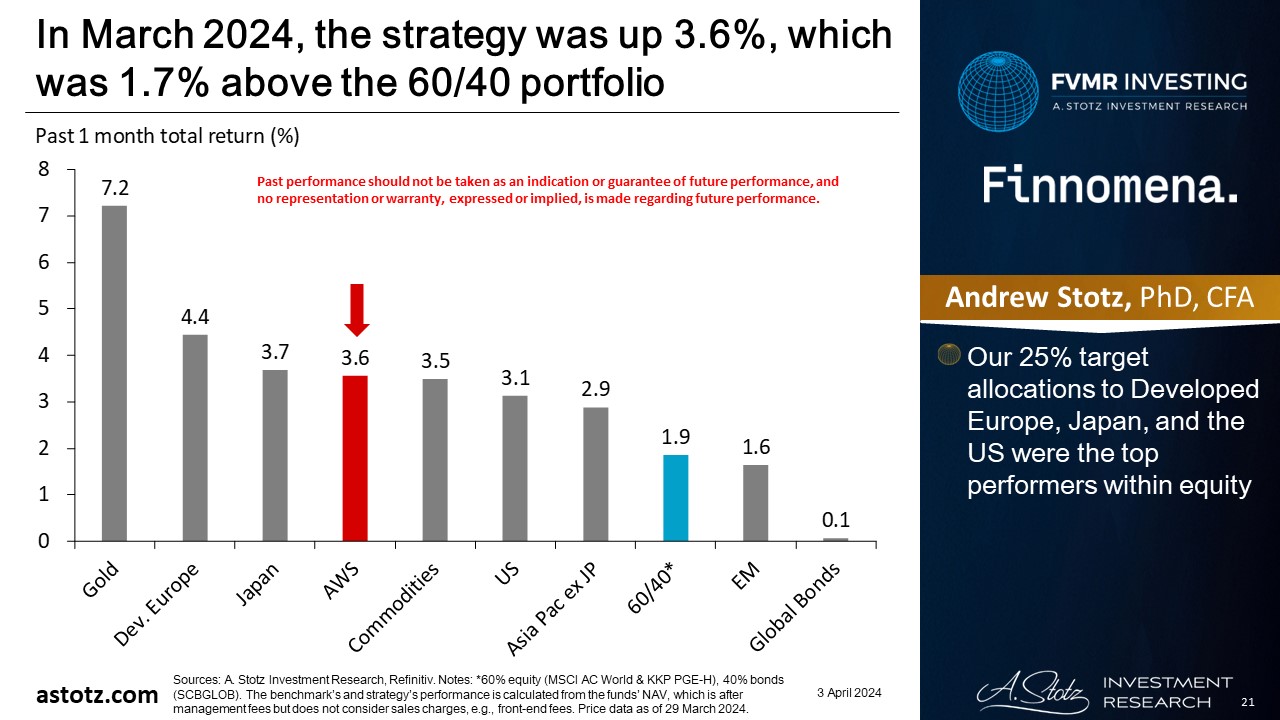

In March 2024, the strategy was up 3.6%, which was 1.7% above the 60/40 portfolio

- Our 25% target allocations to Developed Europe, Japan, and the US were the top performers within equity

Performance review: All Weather Alpha Focus

All Weather Alpha Focus gained 3.1%

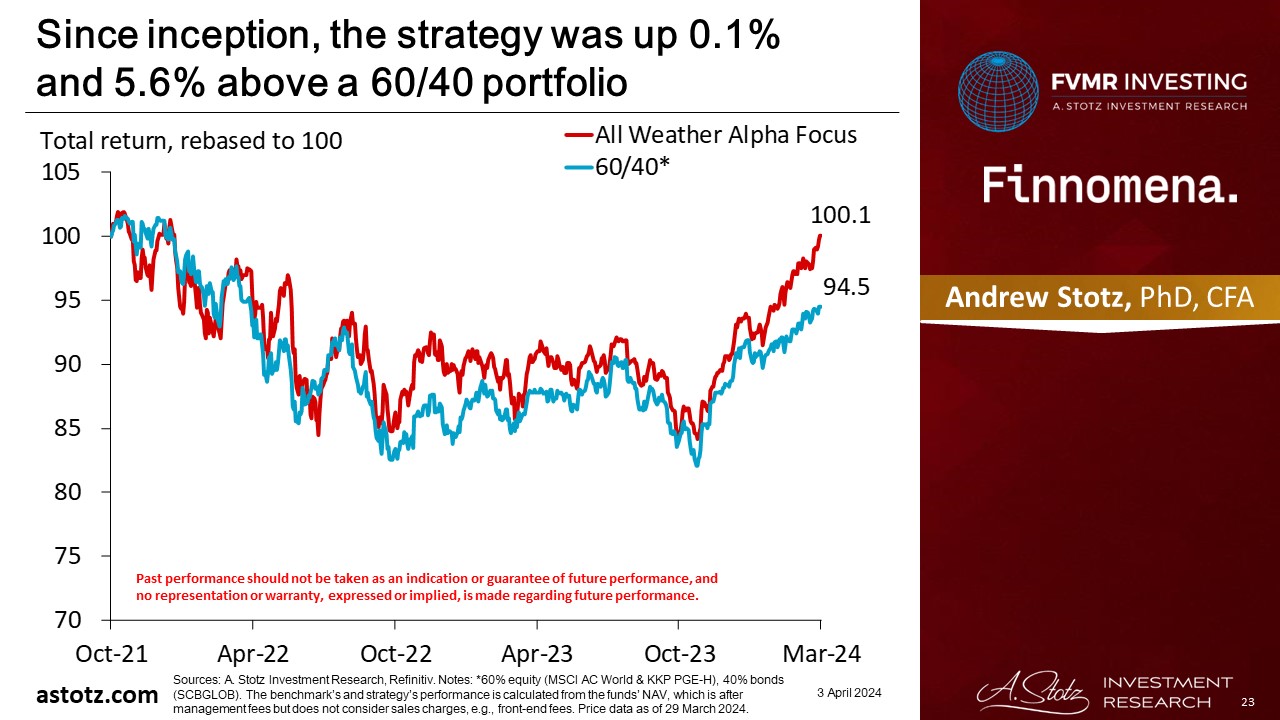

Since inception, the strategy was up 0.1% and 5.6% above a 60/40 portfolio

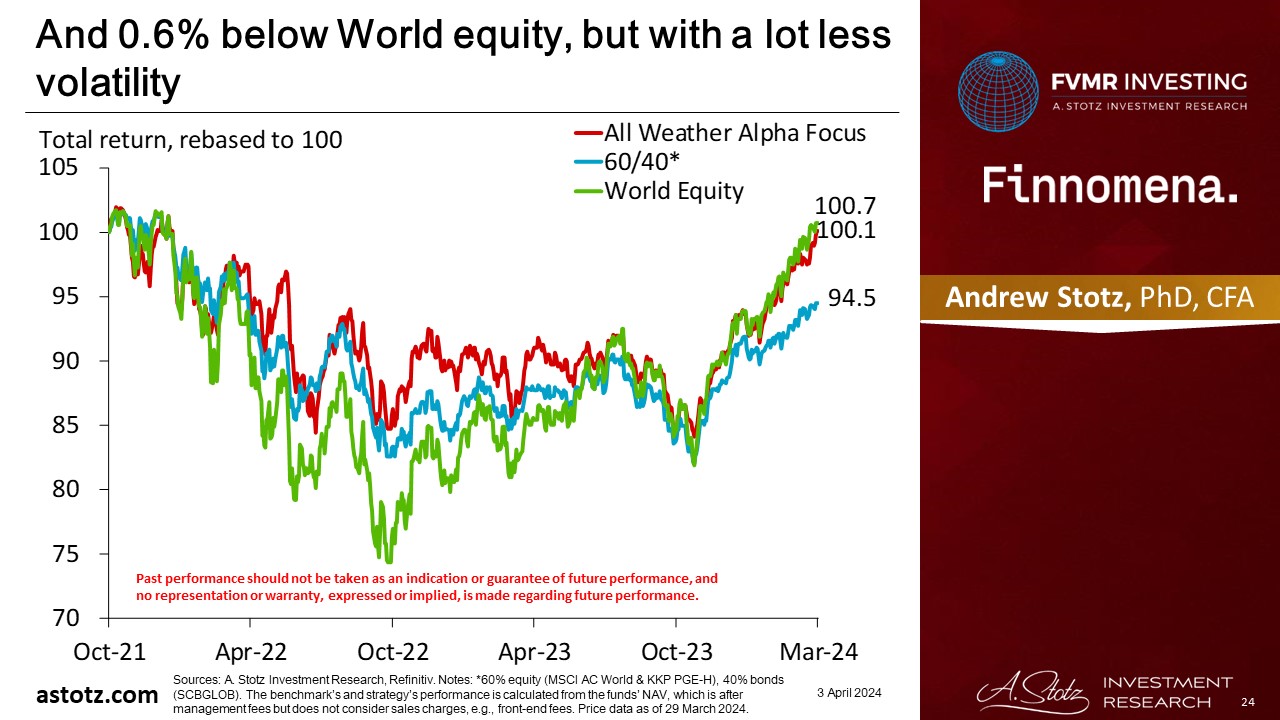

And 0.6% below World equity, but with a lot less volatility

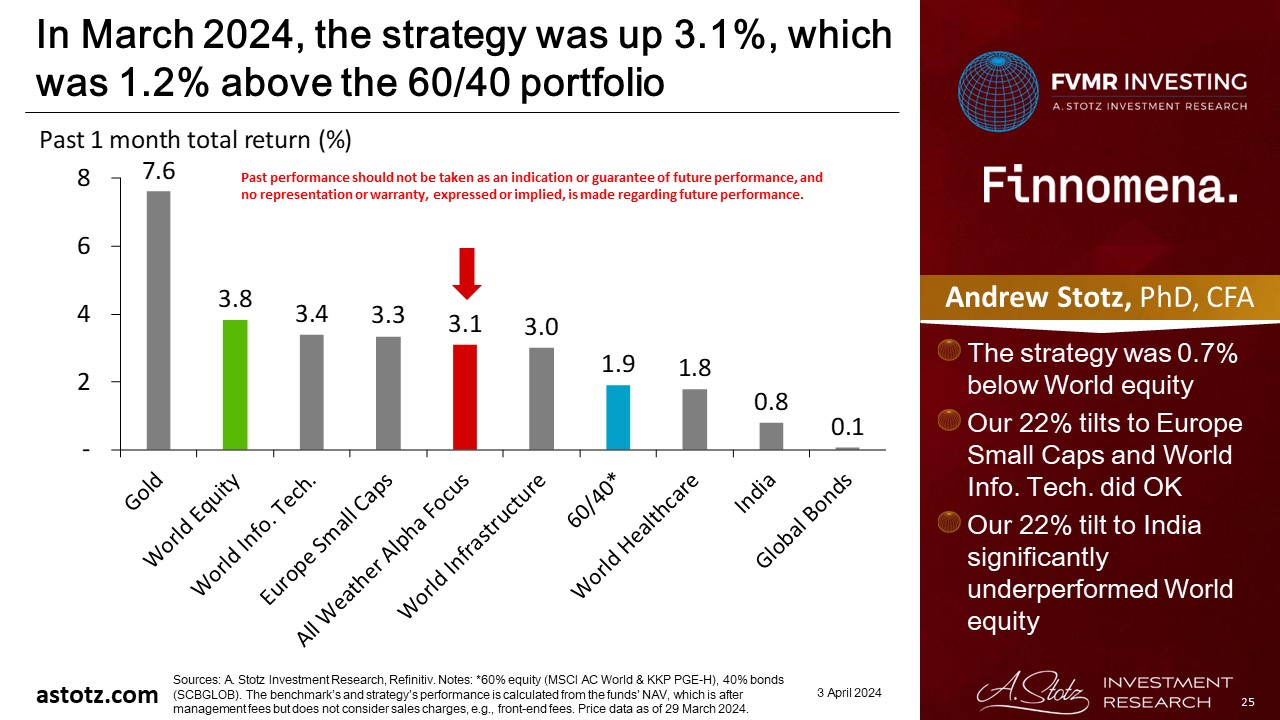

In March 2024, the strategy was up 3.1%, which was 1.2% above the 60/40 portfolio

- The strategy was 0.7% below World equity

- Our 22% tilts to Europe Small Caps and World Info. Tech. did OK

- Our 22% tilt to India significantly underperformed World equity

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.