A. Stotz All Weather Strategies – August 2023

The All Weather Strategy is available in Thailand through FINNOMENA. If you’re interested in our allocation strategy, you can also join the Become a Better Investor Community. Please note that this post is not investment advice and should not be seen as recommendations. Also, remember that backtested or past performance is not a reliable indicator of future performance.

What happened in world markets in August 2023

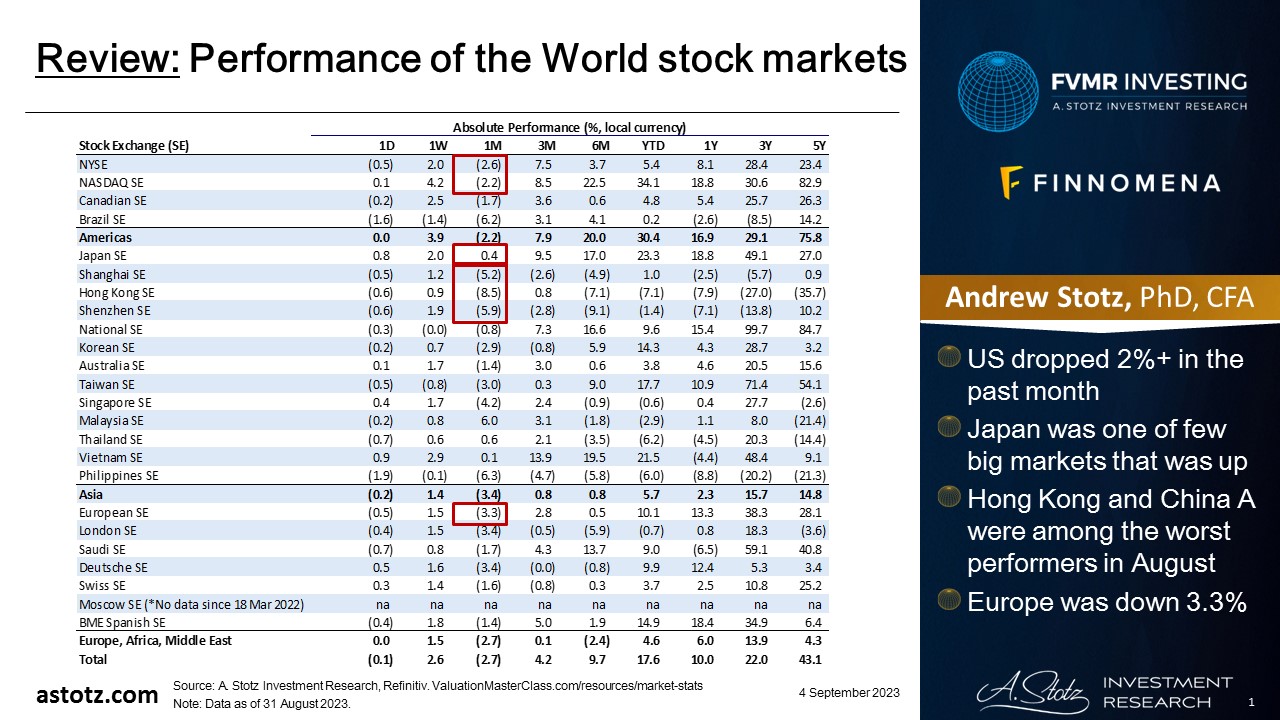

Performance of the World stock markets

- US dropped 2%+ in the past month

- Japan was one of few big markets that was up

- Hong Kong and China A were among the worst performers in August

- Europe was down 3.3%

Find the updated Performance of the World stock markets here.

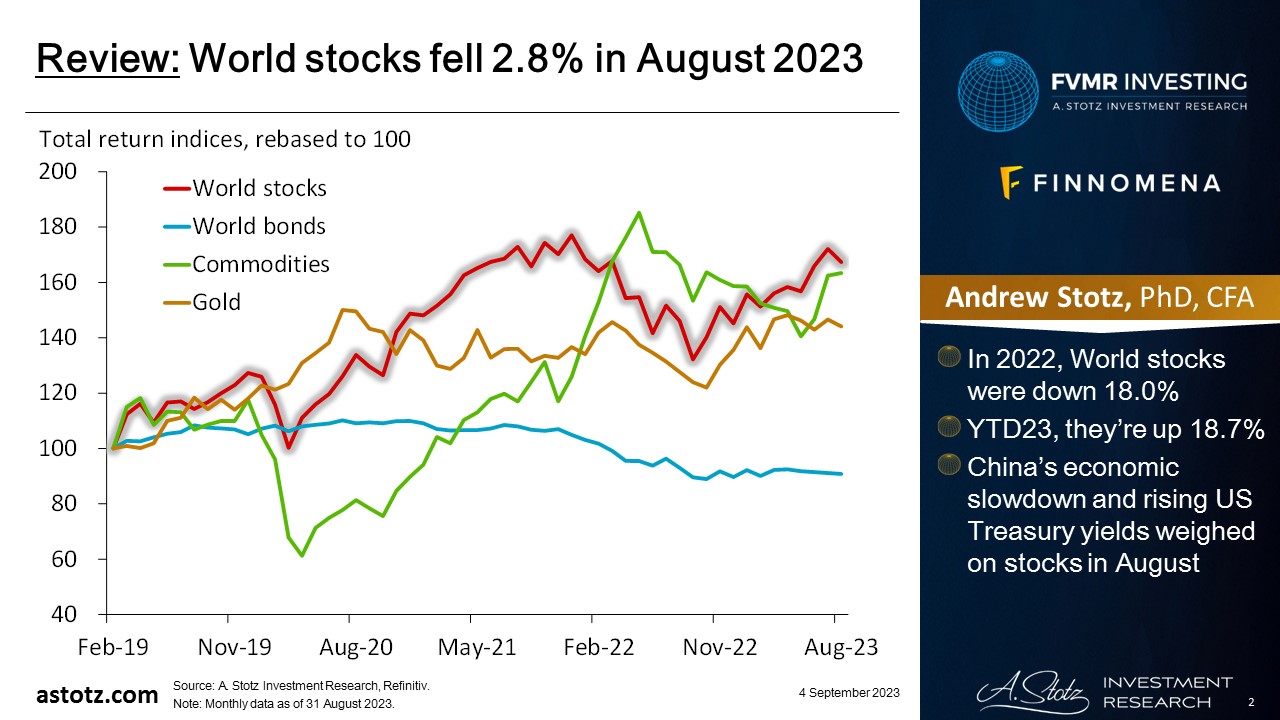

World stocks fell 2.8% in August 2023

- In 2022, World stocks were down 18.0%

- YTD23, they’re up 18.7%

- China’s economic slowdown and rising US Treasury yields weighed on stocks in August

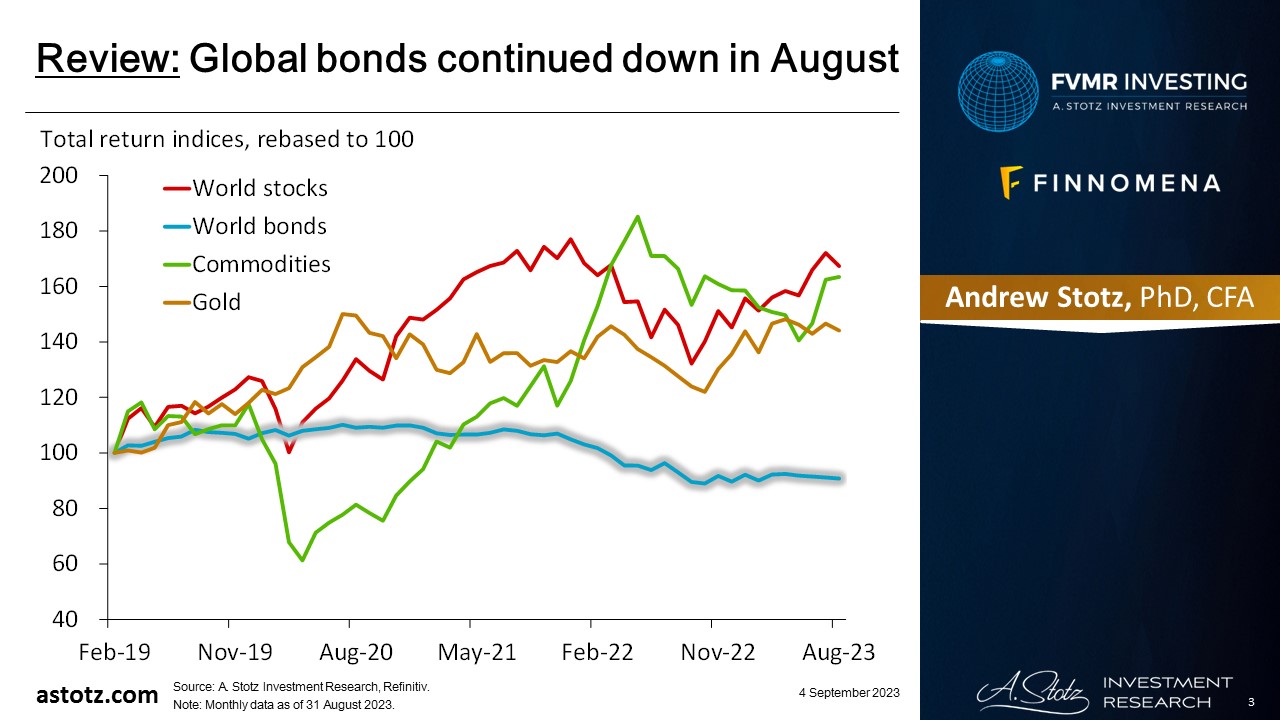

Global bonds continued down in August

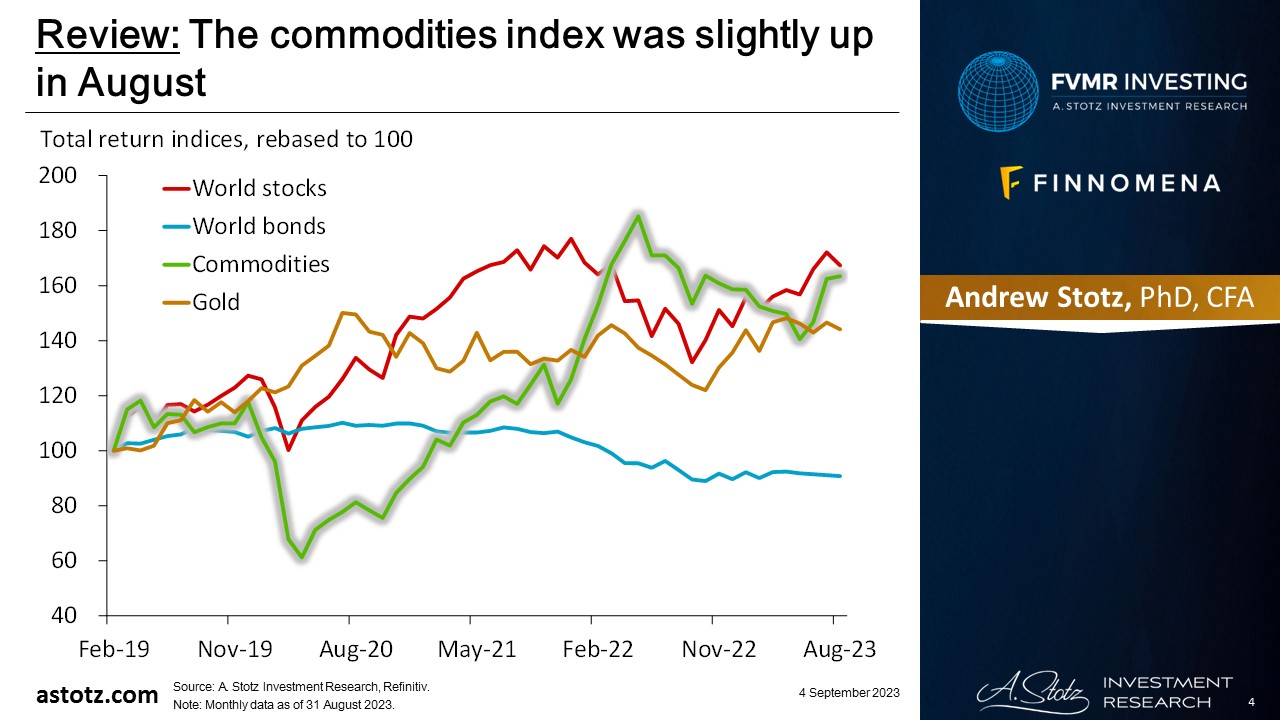

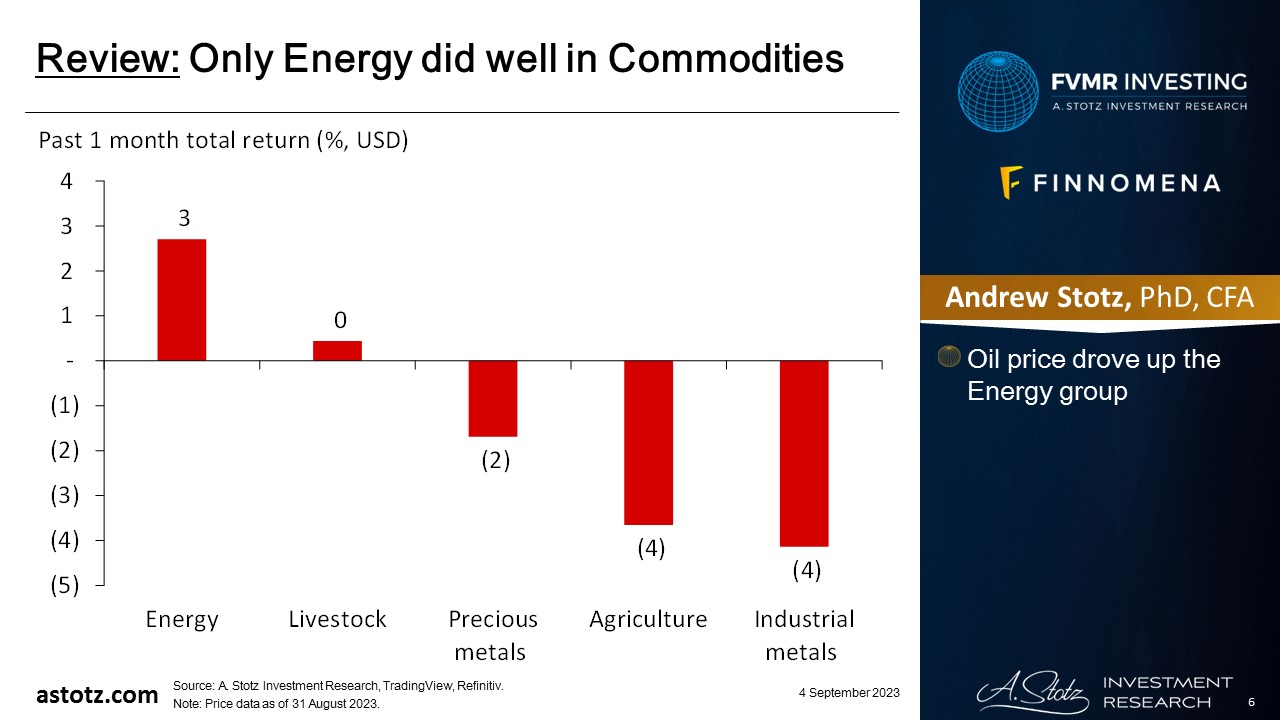

The commodities index was slightly up in August

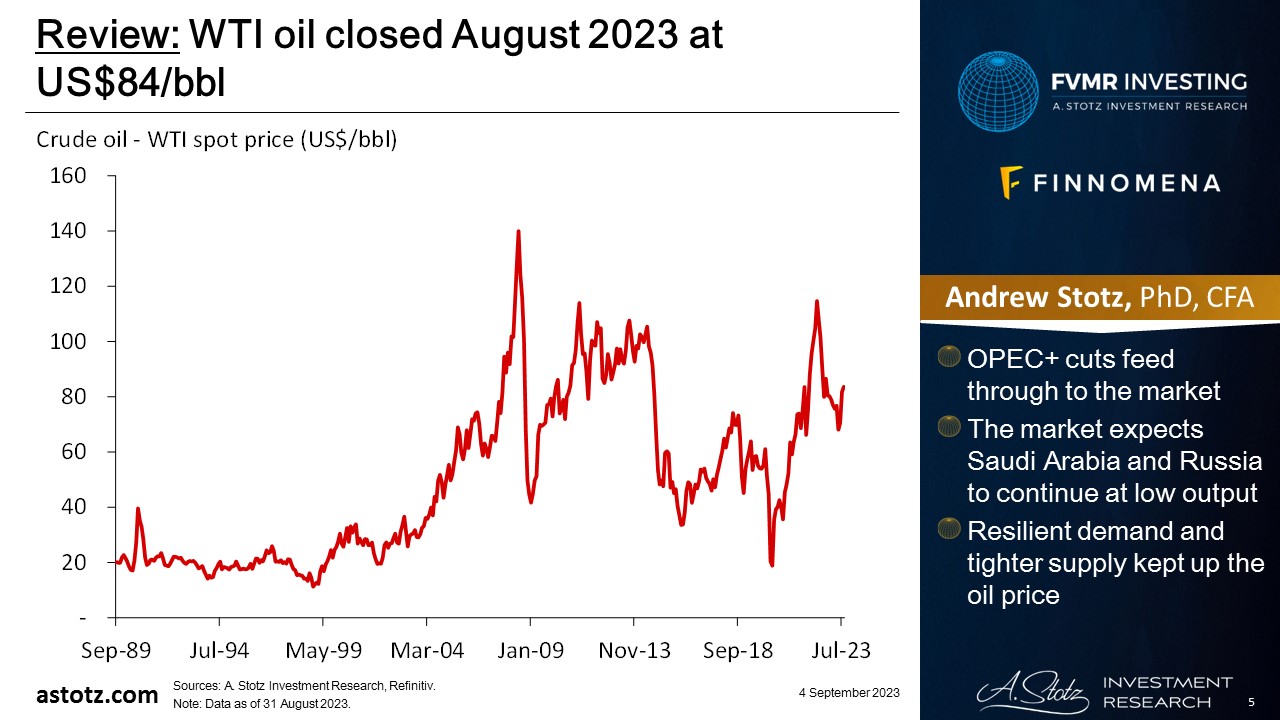

WTI oil closed August 2023 at US$84/bbl

- OPEC+ cuts feed through to the market

- The market expects Saudi Arabia and Russia to continue at low output

- Resilient demand and tighter supply drove up the oil price

Only Energy did well in Commodities

- Oil price drove up the Energy group

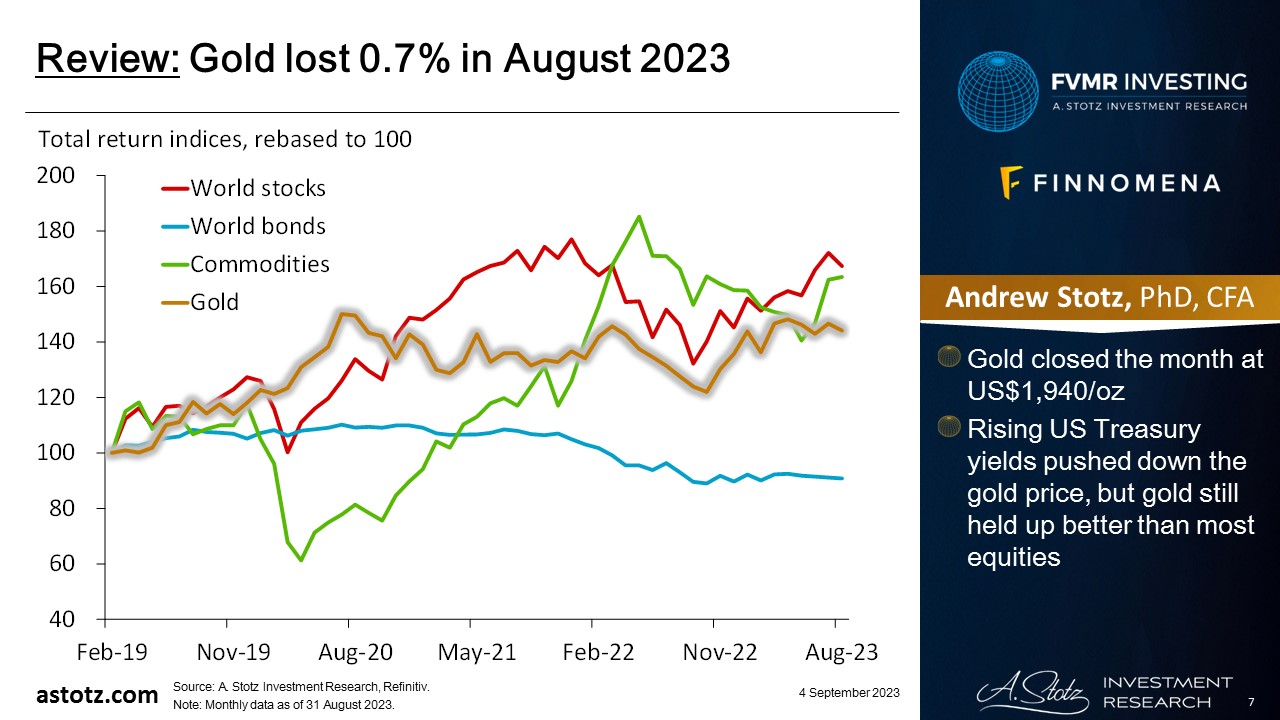

Gold lost 0.7% in August 2023

- Gold closed the month at US$1,940/oz

- Rising US Treasury yields pushed down the gold price, but gold still held up better than most equities

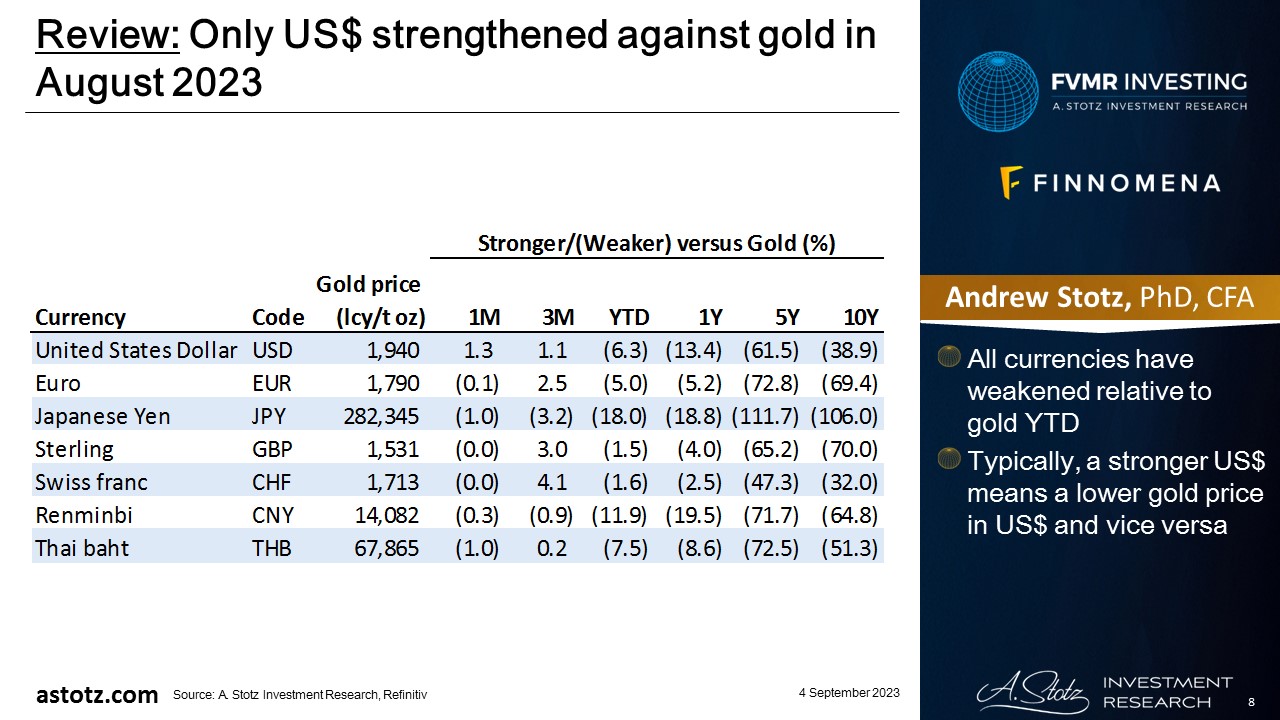

Only US$ strengthened against gold in August 2023

- All currencies have weakened relative to gold YTD

- Typically, a stronger US$ means a lower gold price in US$ and vice versa

Fitch downgrades US gov’t debt

Fitch just downgraded US govt debt for 1st time since August 2011. Following the downgrade then, 10-yr yields declined (!) and the dollar (after brief and short decline) moved sharply higher (!!). HOWEVER, credit spreads widened and gold spurted from $1660 to $1900 in one month.

— steph pomboy (@spomboy) August 1, 2023

- Some fascinating historical accounts in this tweet

- However, Fitch’s downgrade is likely to have a limited impact on markets

Factory-building boosts US GDP growth

Impressive. The recent factory-building boom has contributed the most to US GDP growth since 1981!

The positive fiscal impulse is having a pronounced economic impact, particularly within manufacturing construction.

This spending has also helped to offset Fed tightening impacts. pic.twitter.com/RDCZjA94EG

— Markets & Mayhem 🤖 (@Mayhem4Markets) August 6, 2023

US money supply continues to fall

The US Money Supply fell 3.7% over the last year, the 8th consecutive month with a YoY decline. pic.twitter.com/UlV0IrYVrF

— Charlie Bilello (@charliebilello) August 23, 2023

US corporate bankruptcies double

In the first 7 months of 2023, the U.S. has seen an alarming 402 corporate bankruptcies.

This is more than the entire 2022 total of 373.

In the first 7 months of 2022, the U.S. saw just 205 bankruptcies.

In other words, bankruptcies this year are up 96% compared to 2022.

Can… pic.twitter.com/rXWi5VAiJU

— The Kobeissi Letter (@KobeissiLetter) August 15, 2023

Consensus is now “no recession” in US

The recession is called off (by consensus)!

This may be the exact reason why you should start fearing the recession again.

Link -> https://t.co/7McUCvFxi4 pic.twitter.com/i7aXPWQr49

— AndreasStenoLarsen (@AndreasSteno) August 27, 2023

Chinese export prices see a massive drop

Coming to theatre near you pic.twitter.com/aPj6KON2ET

— Michael A. Arouet (@MichaelAArouet) August 8, 2023

- It’s the biggest drop in a decade for the China Export Price Index, which creates deflationary pressures on the Chinese economy

People’s Bank of China (PBOC) cuts rates

*PBOC CUTS RATE ON 1-YEAR MLF LOANS TO 2.5% FROM 2.65%

*PBOC INJECTS NET 1B YUAN VIA MLF

*PBOC CUTS 7-DAY REVERSE REPO RATE TO 1.8% FROM 1.9%— 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐭 𝐌𝐚𝐫𝐤𝐞𝐭 𝐇𝐲𝐩𝐞 (@EffMktHype) August 15, 2023

- The China recovery won’t come easy

- While the West is raising rates, China is cutting to stimulate the economy

Chinese gov’t stimulates stock trading

CHINA REDUCES TAX ON STOCK TRADING BY 50% TO BOOST MARKET

— *Walter Bloomberg (@DeItaone) August 27, 2023

Key takeaways

- Fitch downgrades US gov’t debt

- Factory-building boosts US GDP growth

- US money supply continues to fall

- Consensus is now “no recession” in US

- Chinese export prices see a massive drop

- People’s Bank of China (PBOC) cuts rates

- Chinese gov’t stimulates stock trading

Performance review: All Weather Inflation Guard

All Weather Inflation Guard was down 0.2%

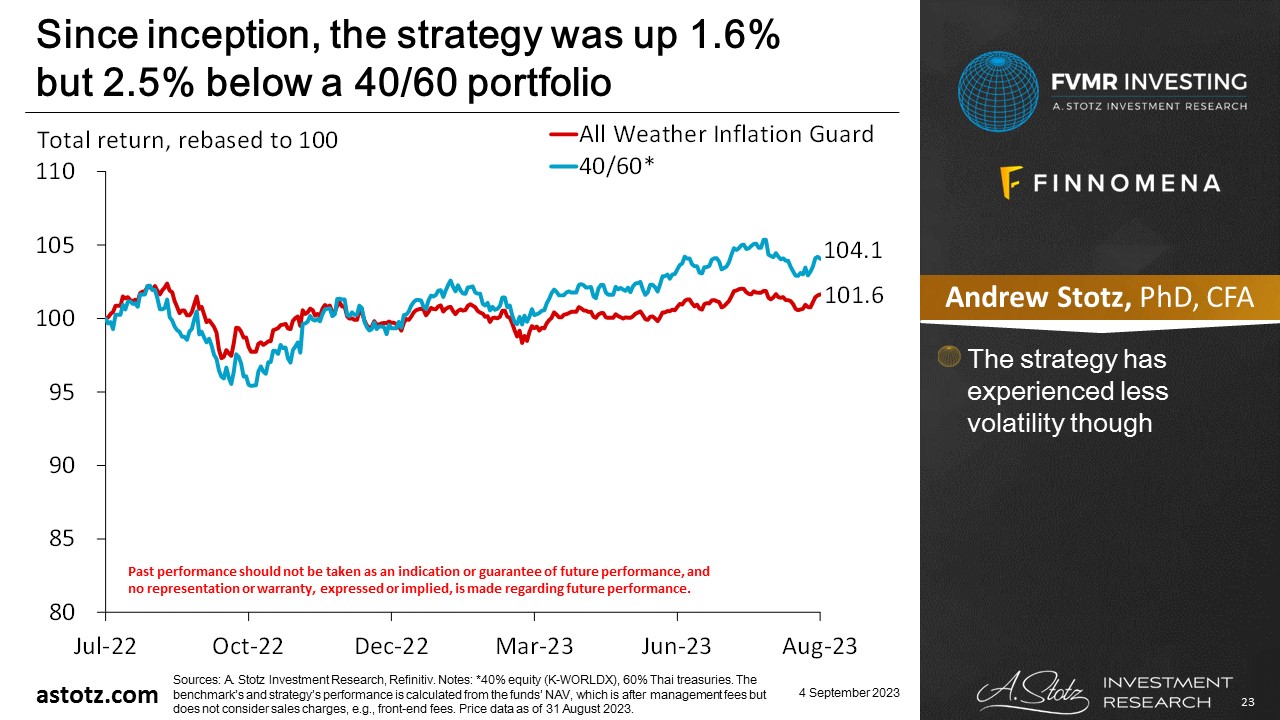

Since inception, the strategy was up 1.6% but 2.5% below a 40/60 portfolio

- The strategy has experienced less volatility though

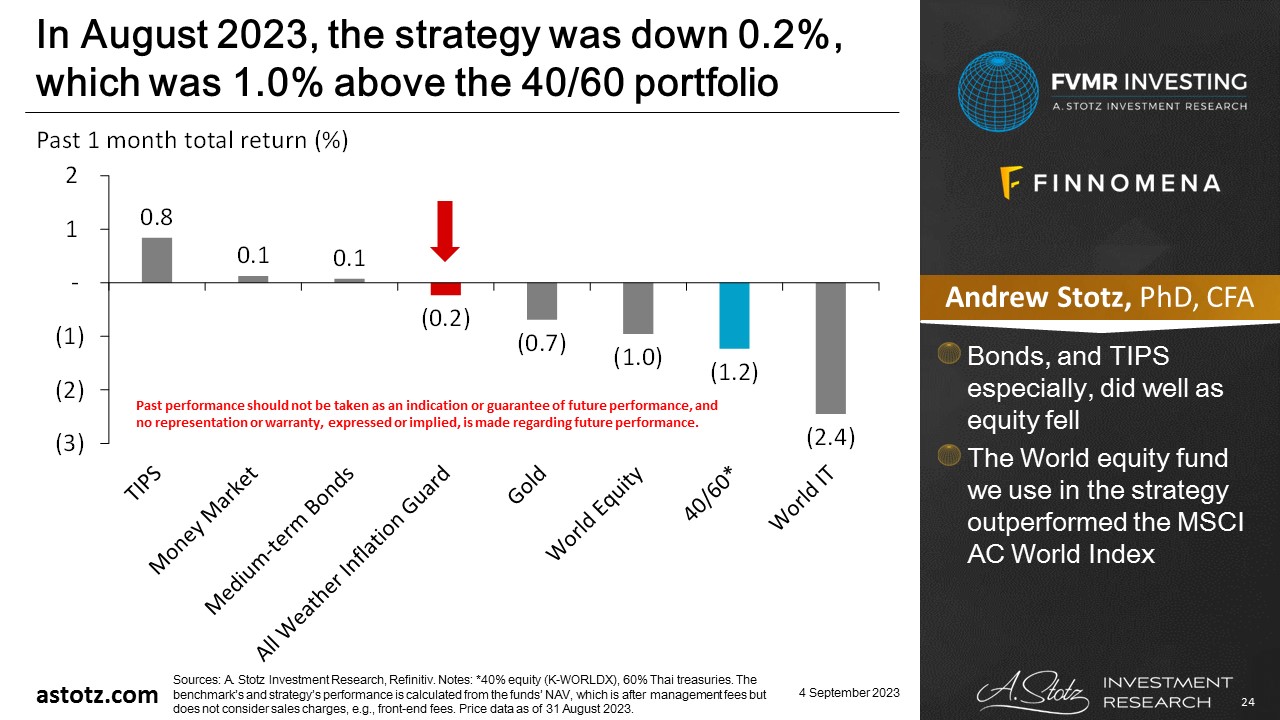

In August 2023, the strategy was down 0.2%, which was 1.0% above the 40/60 portfolio

- Bonds, and TIPS especially, did well as equity fell

- The World equity fund we use in the strategy underperformed the MSCI AC World Index

Performance review: All Weather Strategy

All Weather Strategy was down 1.8%

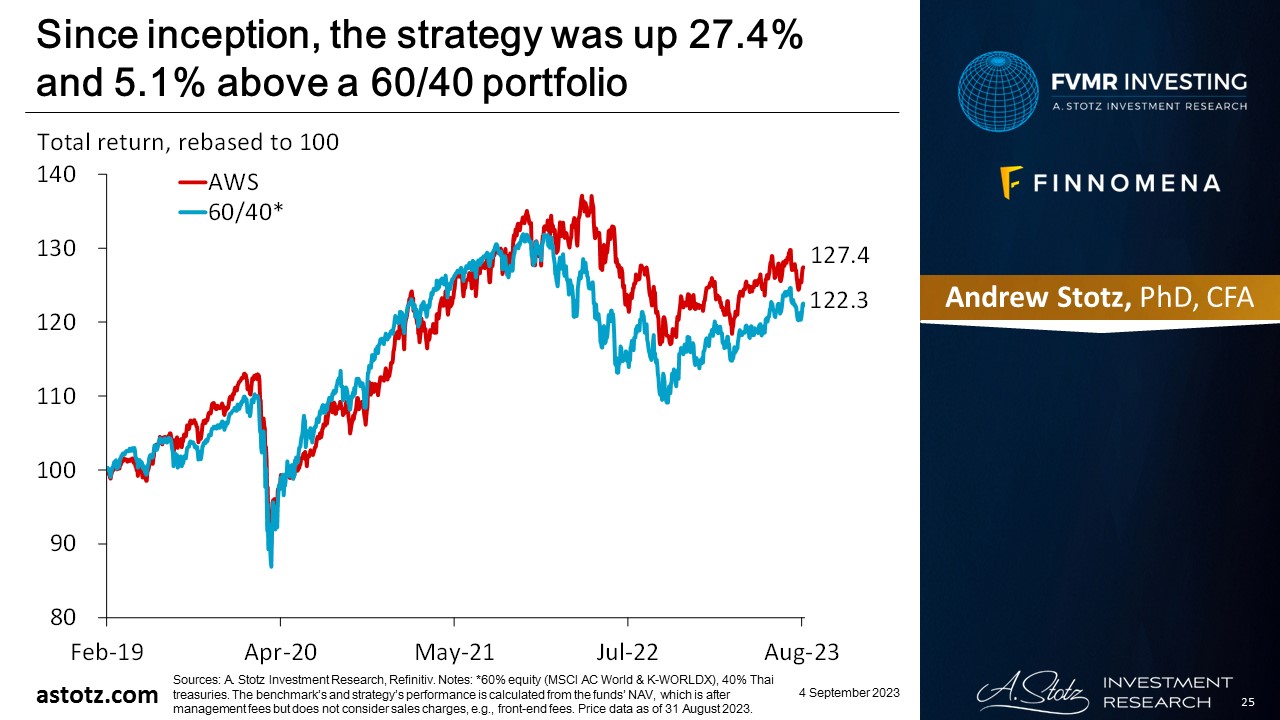

Since inception, the strategy was up 27.4% and 5.1% above a 60/40 portfolio

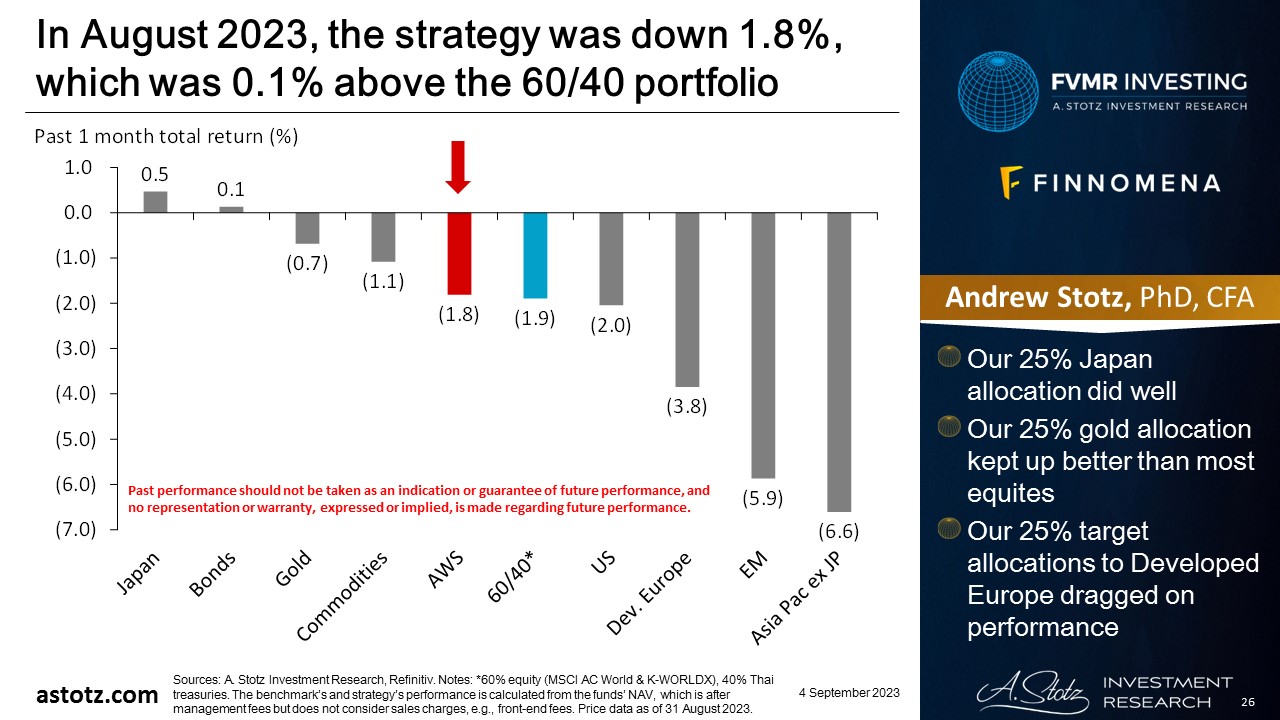

In August 2023, the strategy was down 1.8%, which was 0.1% above the 60/40 portfolio

- Our 25% Japan allocation did well

- Our 25% gold allocation kept up better than most equites

- Our 25% target allocations to Developed Europe dragged on performance

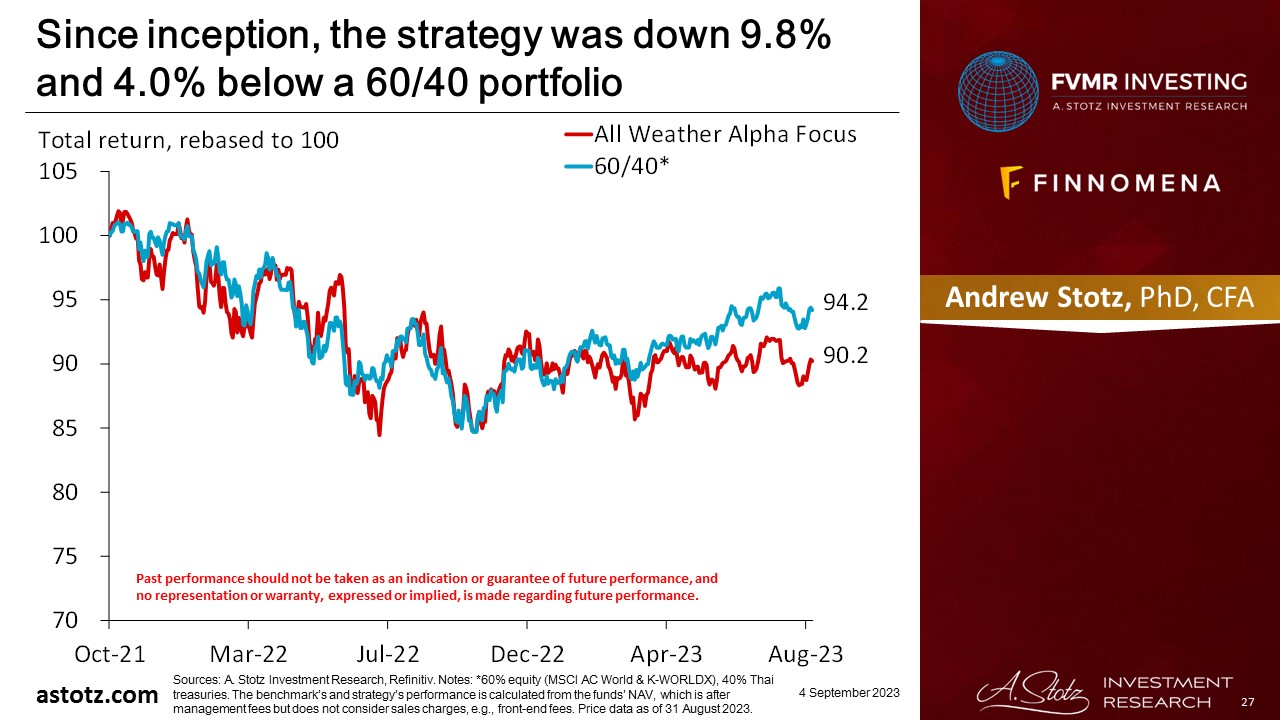

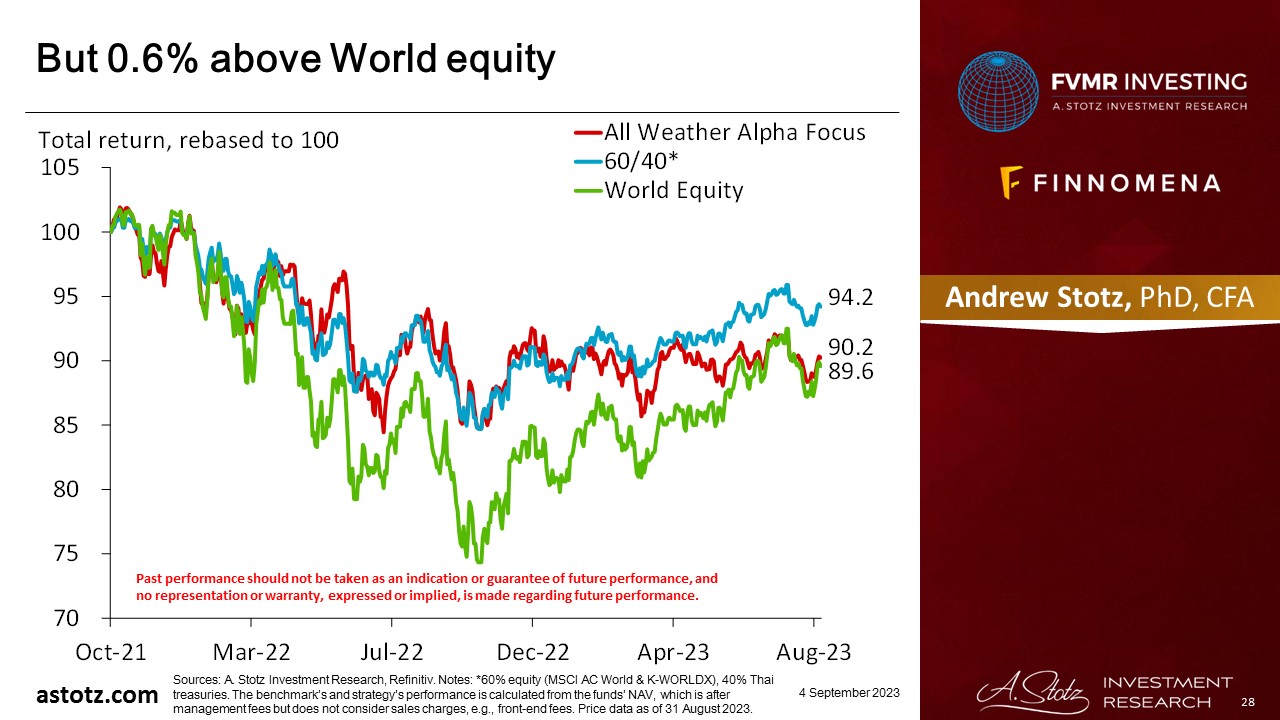

Performance review: All Weather Alpha Focus

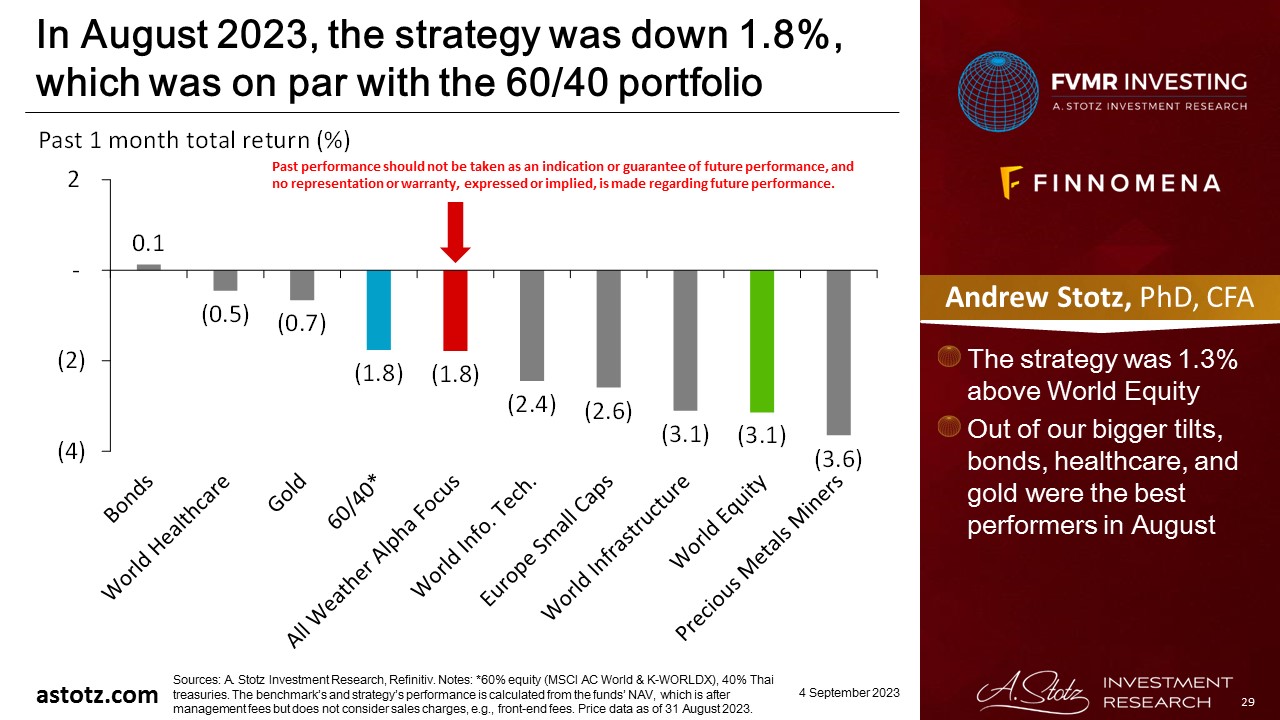

All Weather Alpha Focus was down 1.8%

Since inception, the strategy was down 9.8% and 4.0% below a 60/40 portfolio

But 0.6% above World equity

In August 2023, the strategy was down 1.8%, which was on par with the 60/40 portfolio

- The strategy was 1.3% above World Equity

- Out of our bigger tilts, bonds, healthcare, and gold were the best performers in August

Global outlook that guides our asset allocation

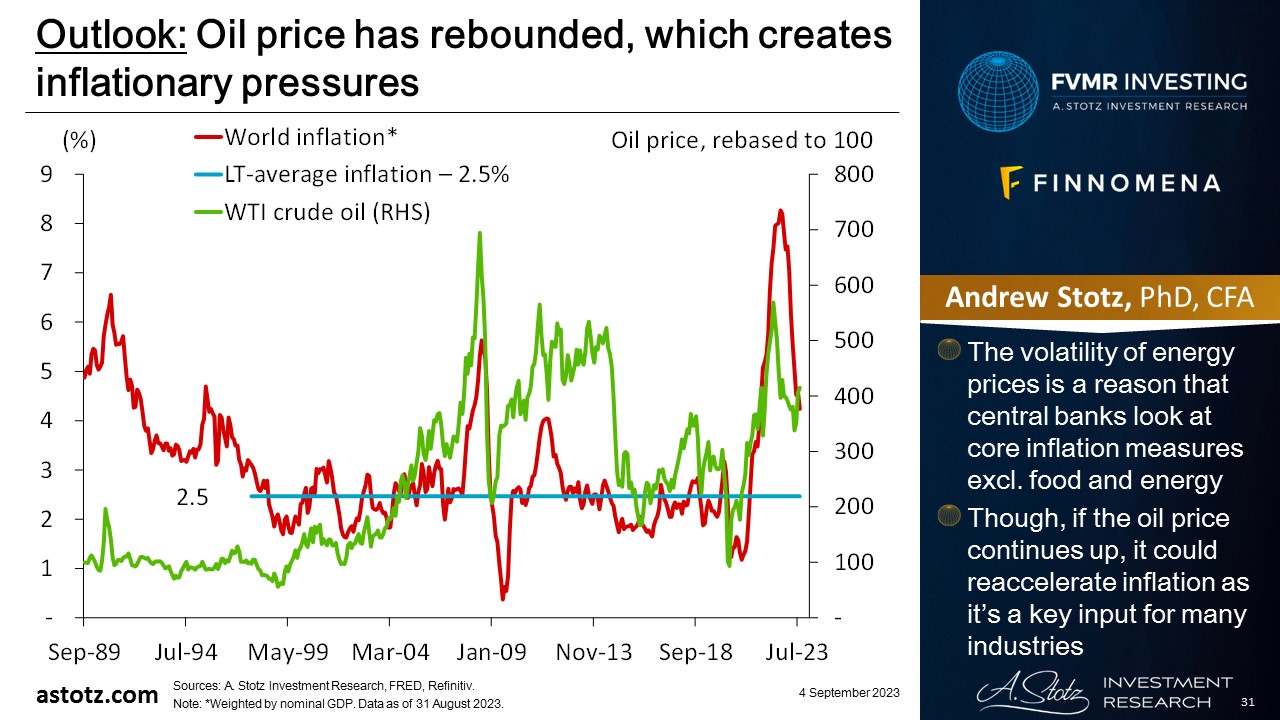

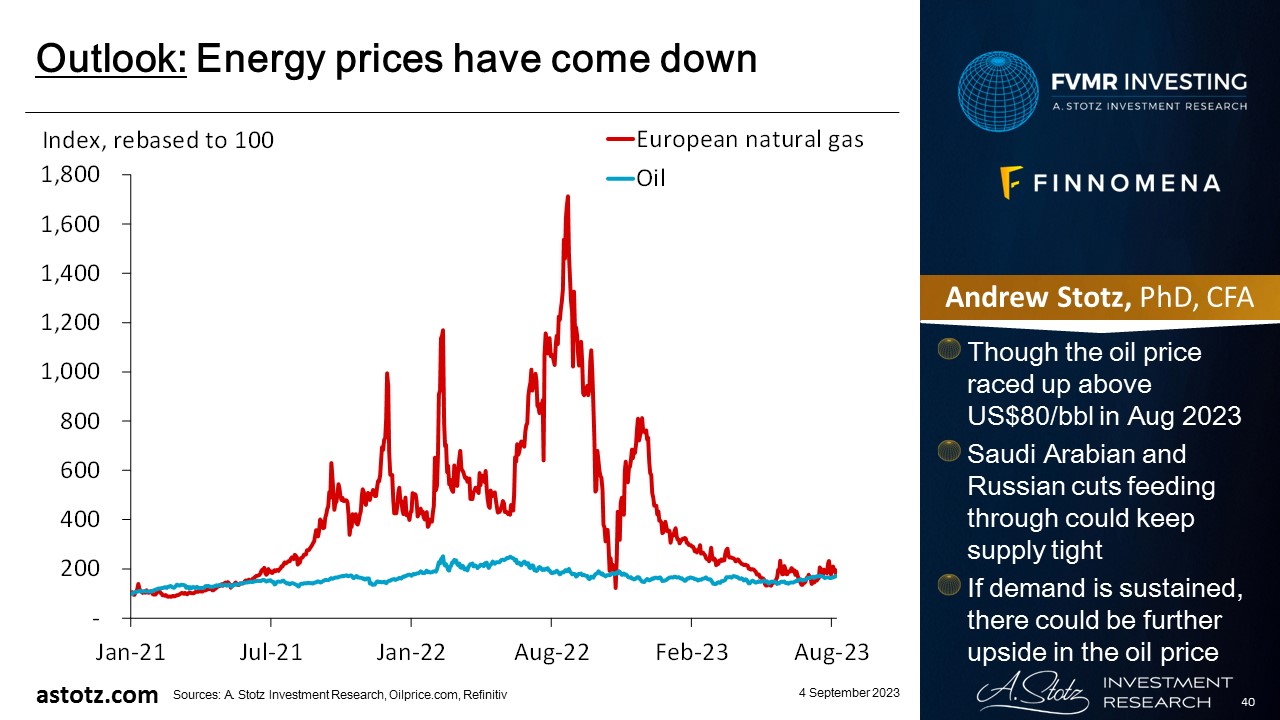

Oil price has rebounded, which creates inflationary pressures

- The volatility of energy prices is a reason that central banks look at core inflation measures excl. food and energy

- Though, if the oil price continues up, it could reaccelerate inflation as it’s a key input for many industries

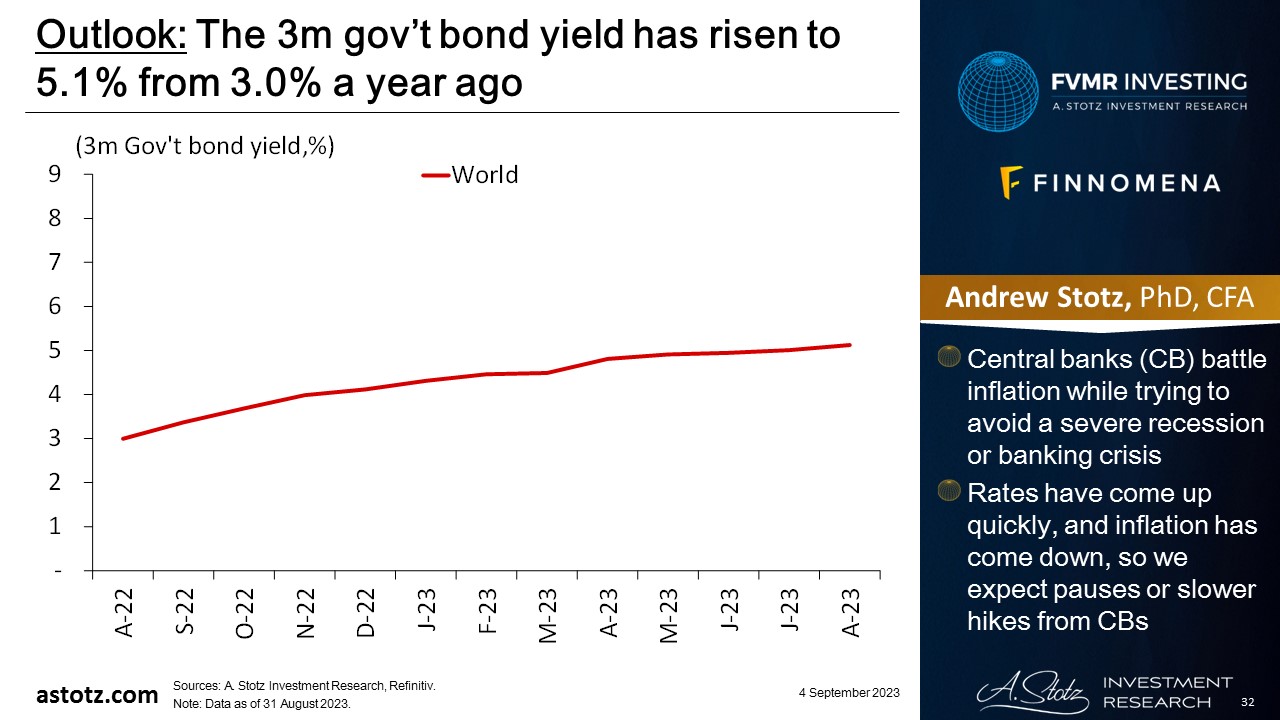

The 3m gov’t bond yield has risen to 5.1% from 3.0% a year ago

- Central banks (CB) battle inflation while trying to avoid a severe recession or banking crisis

- Rates have come up quickly, and inflation has come down, so we expect pauses or slower hikes from CBs

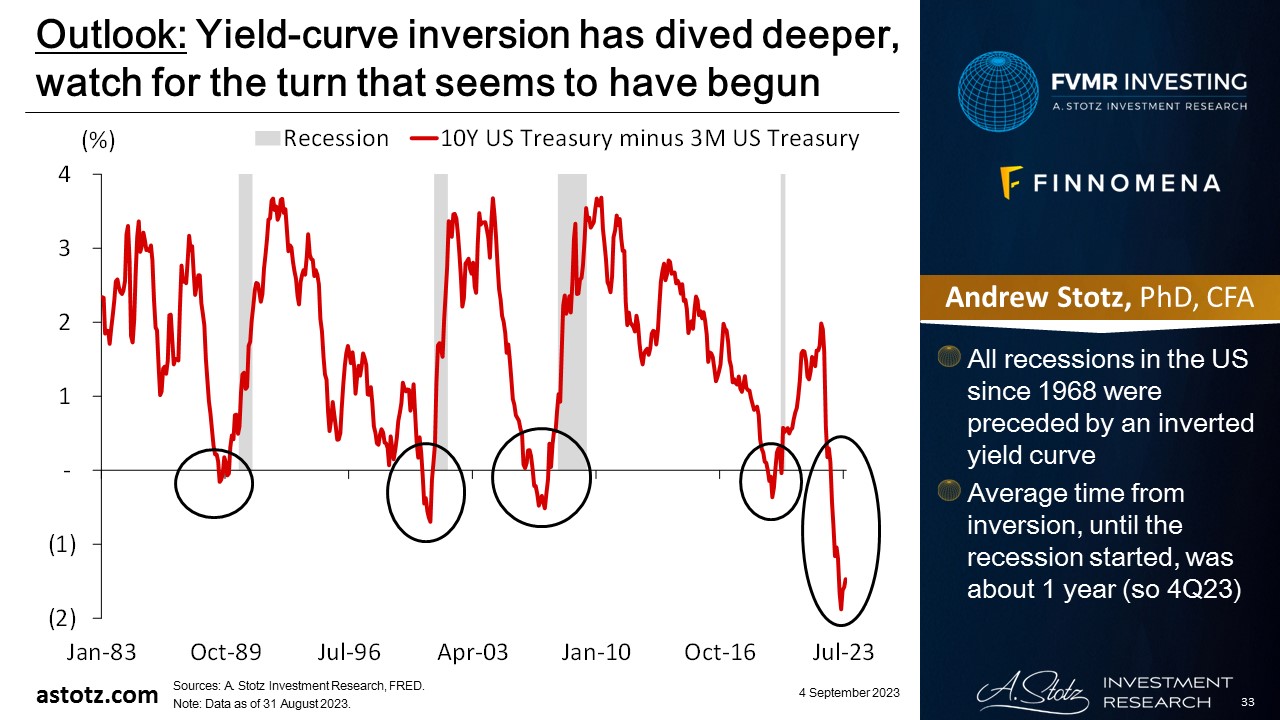

Yield-curve inversion has dived deeper, watch for the turn that seems to have begun

- All recessions in the US since 1968 were preceded by an inverted yield curve

- Average time from inversion, until the recession started, was about 1 year (so 4Q23)

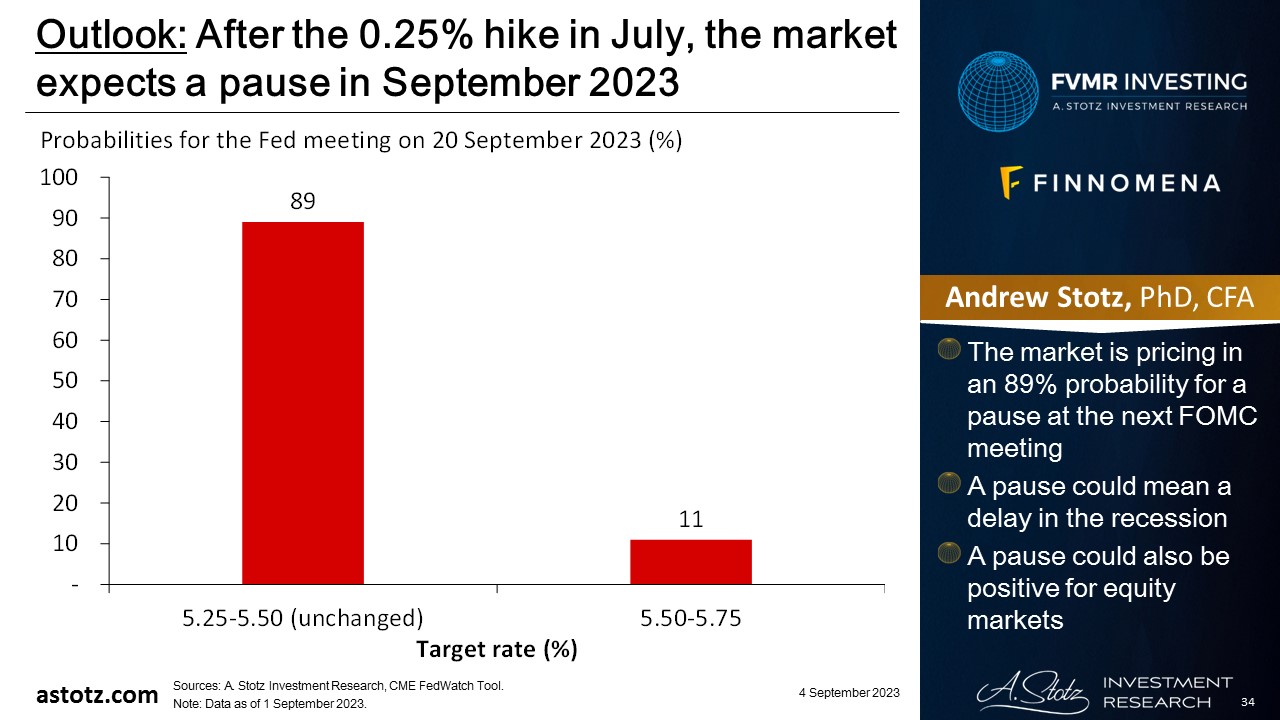

After the 0.25% hike in July, the market expects a pause in September 2023

- The market is pricing in an 89% probability for a pause at the next FOMC meeting

- A pause could mean a delay in the recession

- A pause could also be positive for equity markets

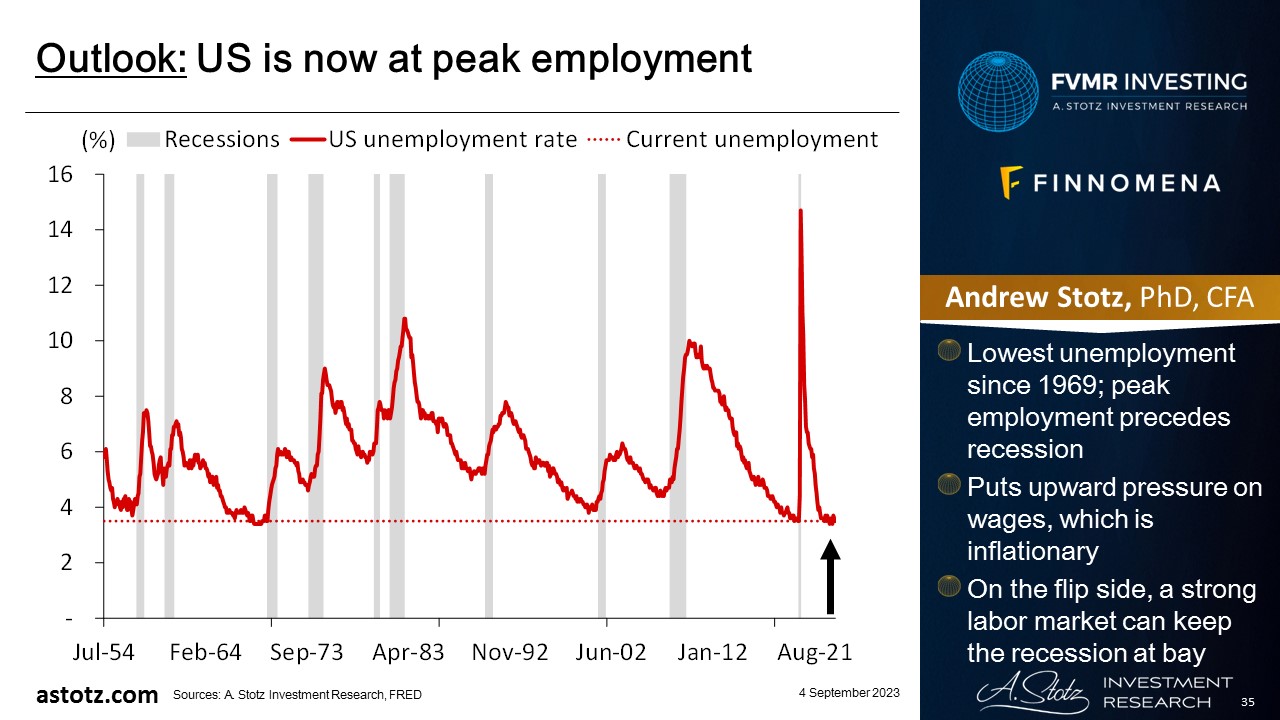

US is now at peak employment

- Lowest unemployment since 1969; peak employment precedes recession

- Puts upward pressure on wages, which is inflationary

- On the flip side, a strong labor market can keep the recession at bay

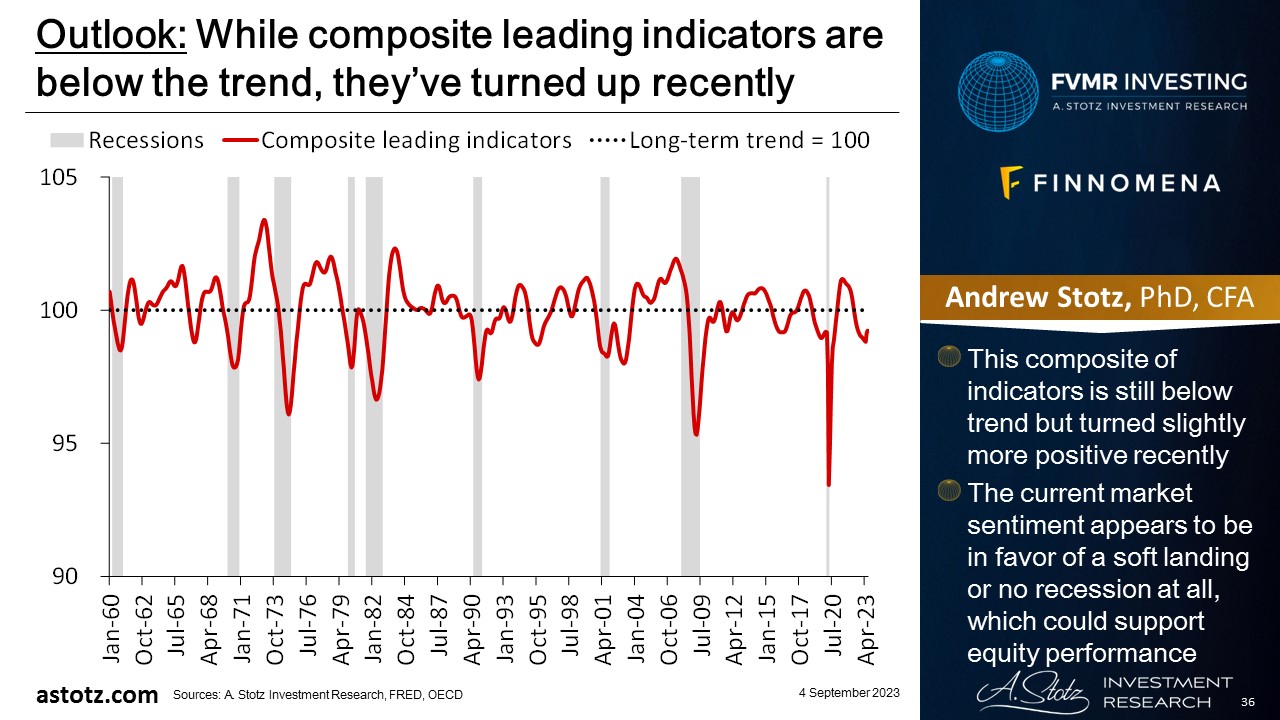

While composite leading indicators are below the trend, they’ve turned up recently

- This composite of indicators is still below trend but turned slightly more positive recently

- The current market sentiment appears to be in favor of a soft landing or no recession at all, which could support equity performance

Valuations have risen, as price has rebounded YTD but still below +1 Stdev

- World stocks’ valuation is now above its long-term average

- The consensus net margin has come down a bit, but analysts have revised it up recently

For the past year, we’ve said that we think the course will eventually be reversed

- We still expect central banks will reverse course and return to accommodative policies as soon as something “breaks”

- The massive rise in rates will eventually break something

- When the news turns negative and markets and economies start weaking we expect the Fed will reverse course and bring rates back to near zero

- This reversal could support the US market

Bonds are typically a safe place to be

- In recessions, safer assets like government bonds typically have performed well

- Though with high inflation, low yields could still lead to negative real returns

- We generally don’t allocate to bonds to speculate on the upside but rather use it to protect capital over time

Energy prices have come down

- Though the oil price raced up above US$80/bbl in Aug 2023

- Saudi Arabian and Russian cuts feeding through could keep supply tight

- If demand is sustained, there could be further upside in the oil price

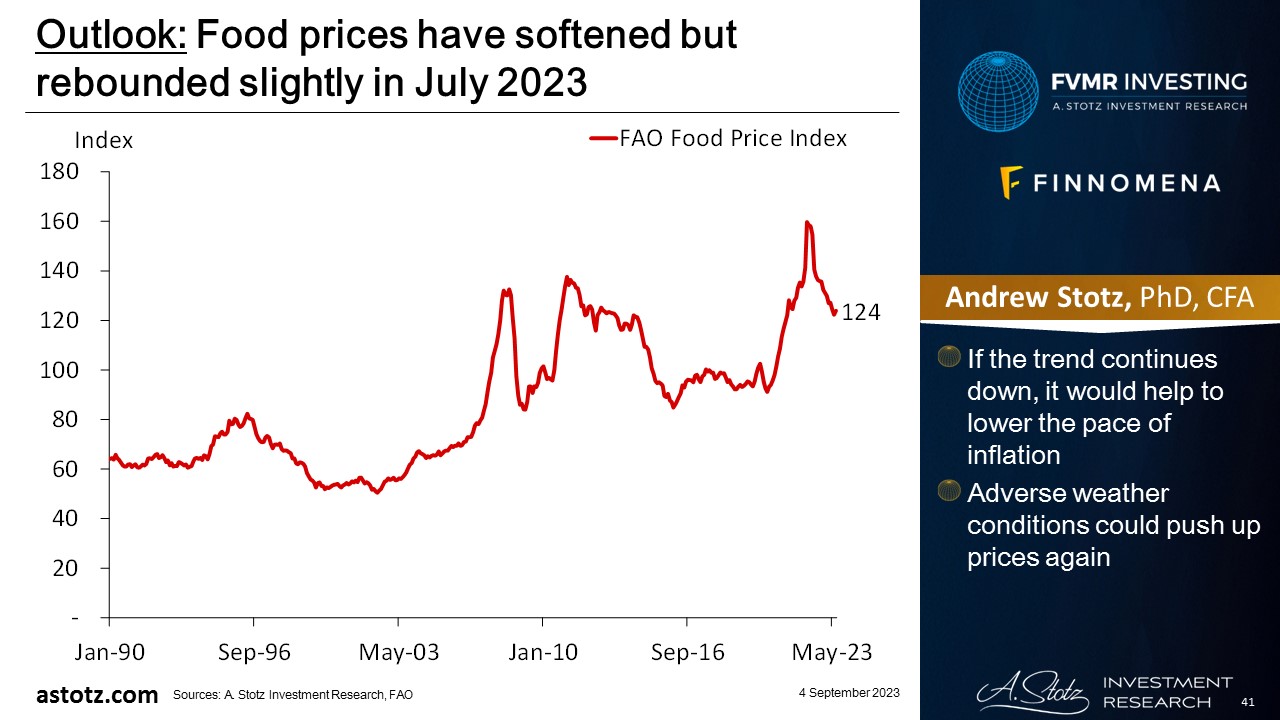

Food prices have softened but rebounded slightly in July 2023

- If the trend continues down, it would help to lower the pace of inflation

- Adverse weather conditions could push up prices again

Commodities have rebounded, but too early to call the turn

- The global economic growth outlook remains uncertain

- The main upside in commodities would come from a supply shock, adverse weather conditions, or significantly higher demand due to an improved growth outlook

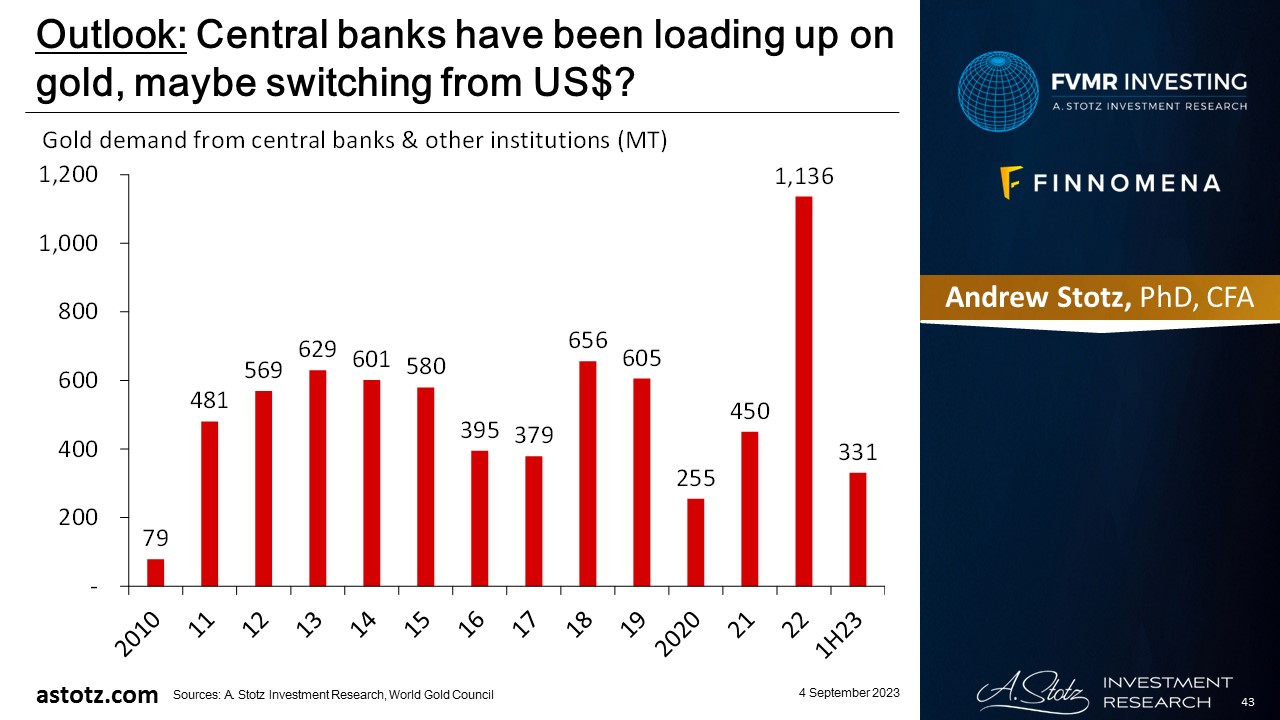

Central banks have been loading up on gold, maybe switching from US$?

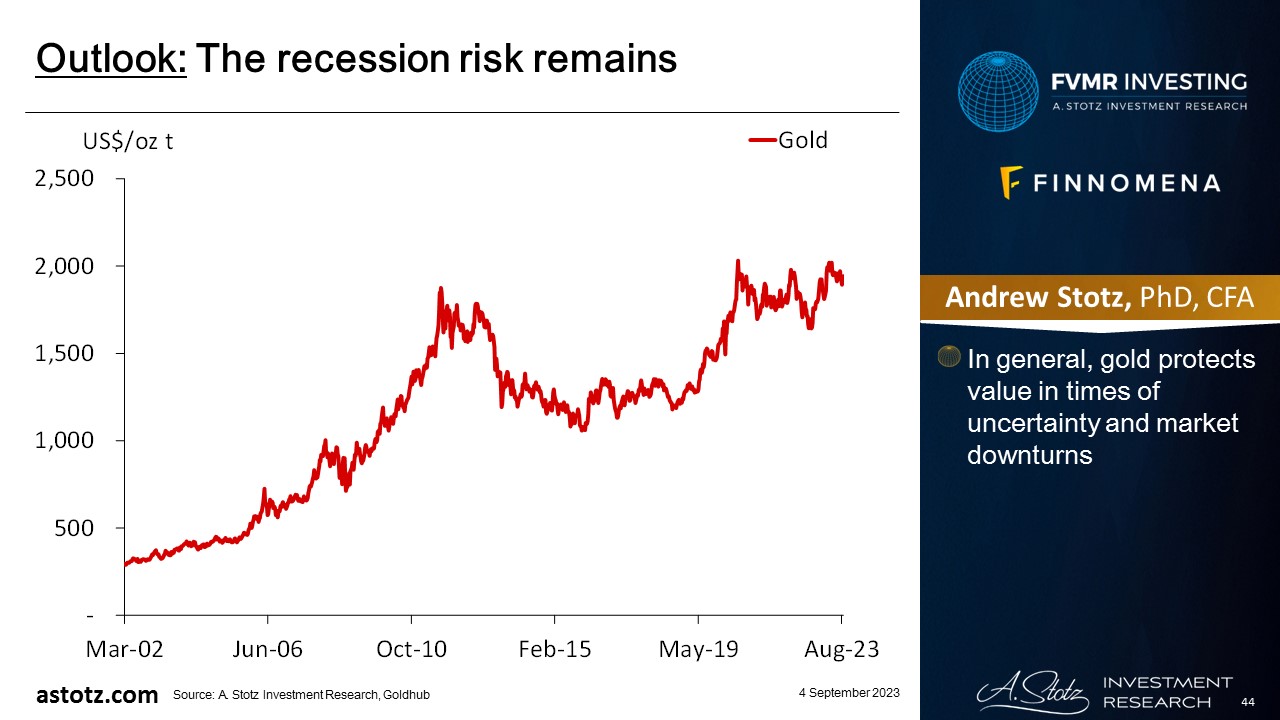

The recession risk remains

- In general, gold protects value in times of uncertainty and market downturns

Risk: Inflation reaccelerates

- Central banks’ aggressive rate hikes and QT crash the stock markets

- If inflation reaccelerates, we could miss out on rising commodities prices

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.