A. Stotz All Weather Strategies – April 2025

The All Weather Strategy is available in Thailand through FINNOMENA. If you’re interested in our allocation strategy, you can also join the Become a Better Investor Community. Please note that this post is not investment advice and should not be seen as recommendations. Also, remember that backtested or past performance is not a reliable indicator of future performance.

What happened in world markets in April 2025

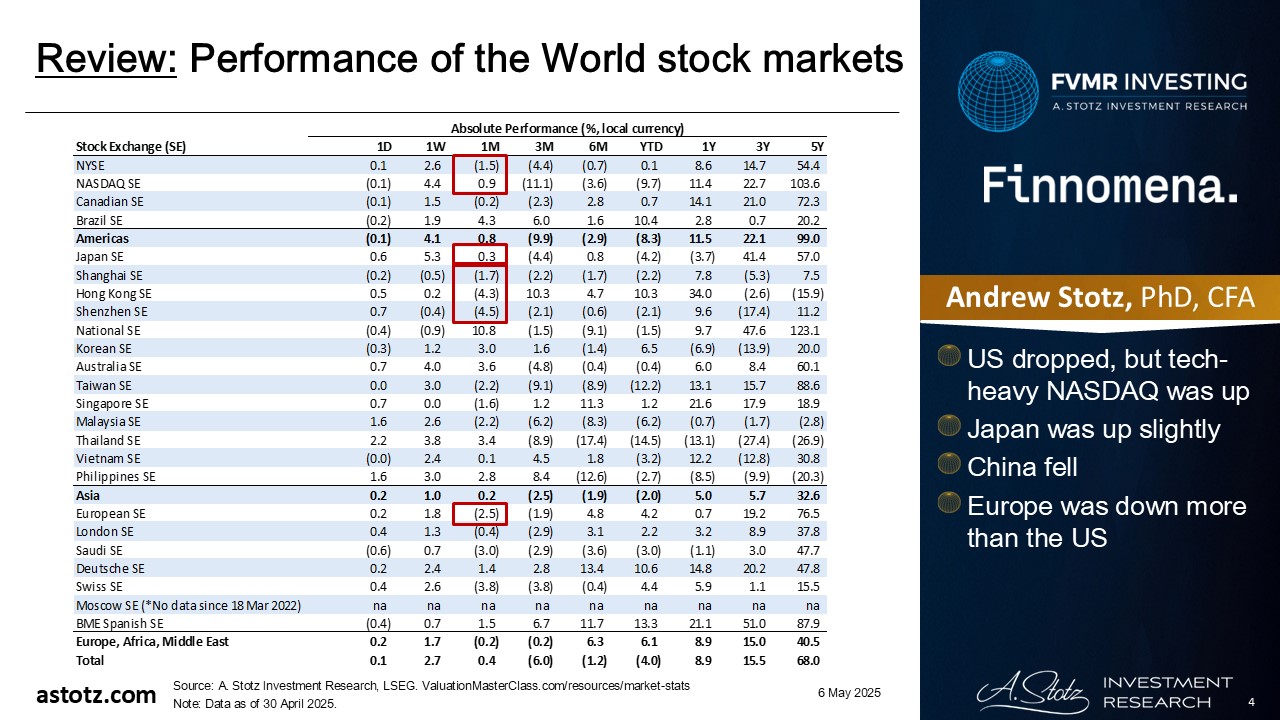

Performance of the World stock markets

- US dropped, but tech-heavy NASDAQ was up

- Japan was up slightly

- China fell

- Europe was down more than the US

Find the updated Performance of the World stock markets here.

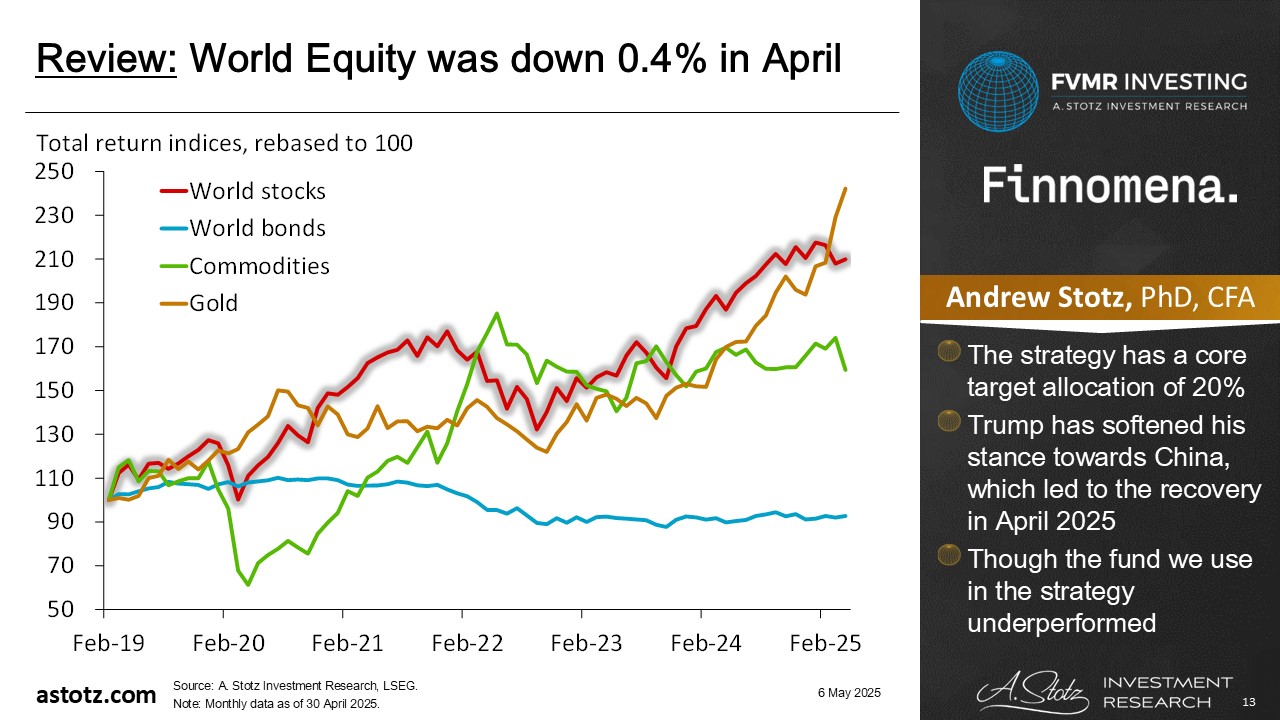

World Equity was down 0.4% in April

- The strategy has a core target allocation of 20%

- Trump has softened his stance towards China, which led to the recovery in April 2025

- Though the fund we use in the strategy underperformed

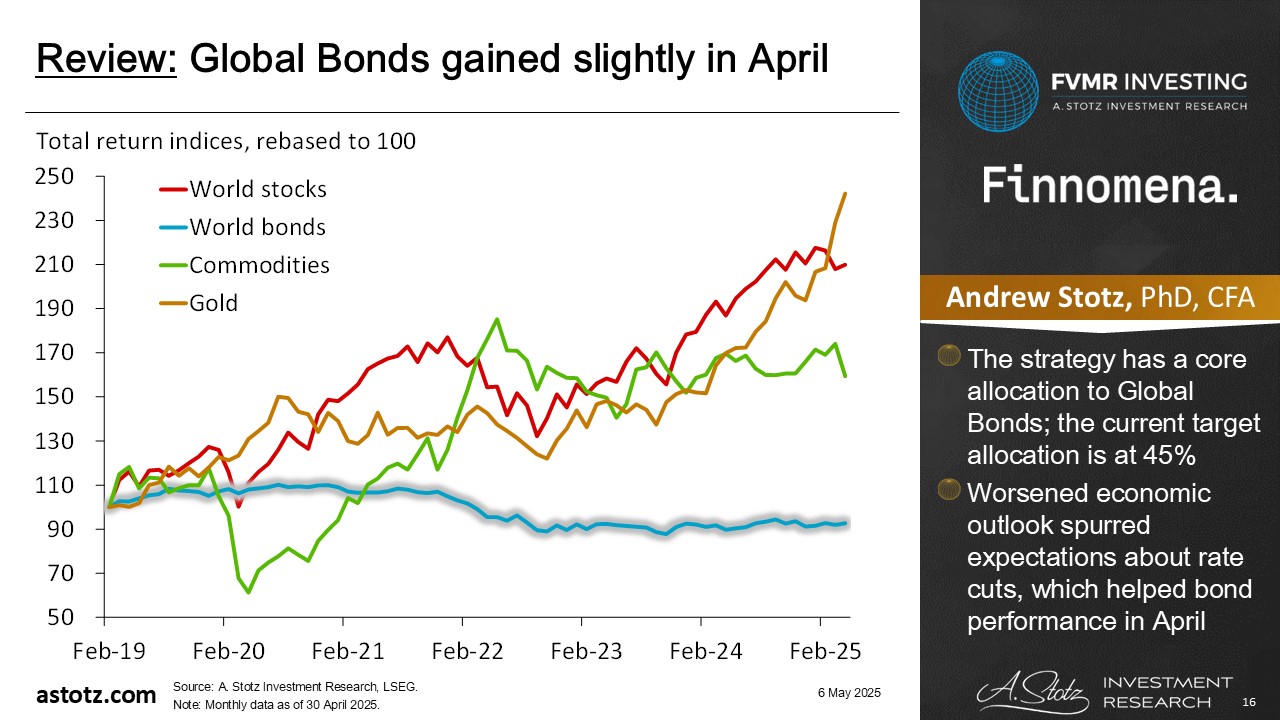

Global Bonds gained slightly in April

- The strategy has a core allocation to Global Bonds; the current target allocation is at 45%

- Worsened economic outlook spurred expectations about rate cuts, which helped bond performance in April

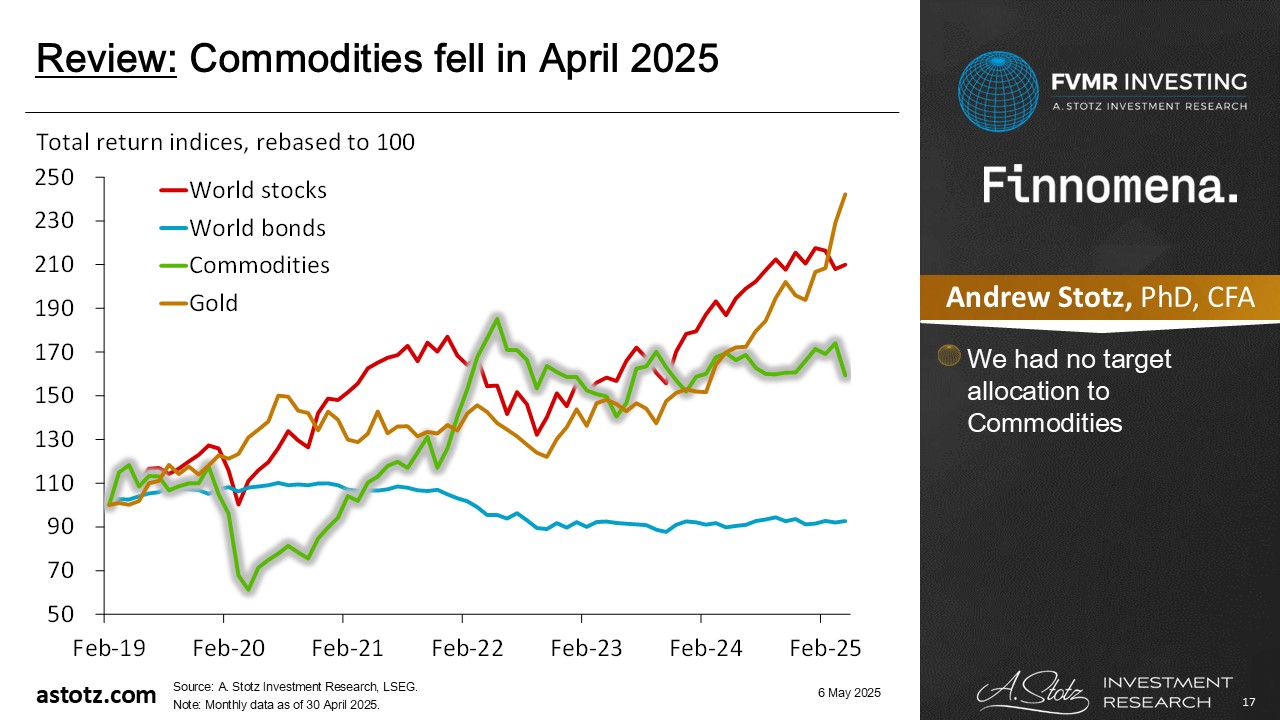

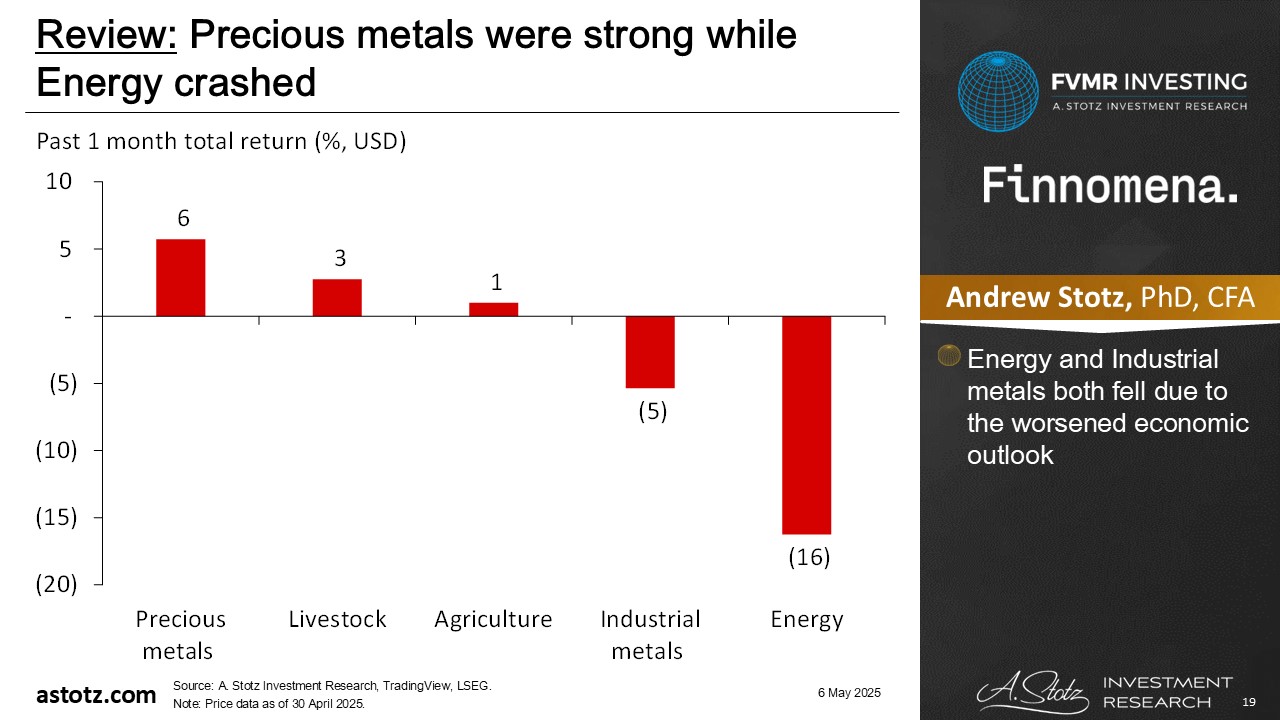

Commodities fell in April 2025

- We had no allocation to Commodities

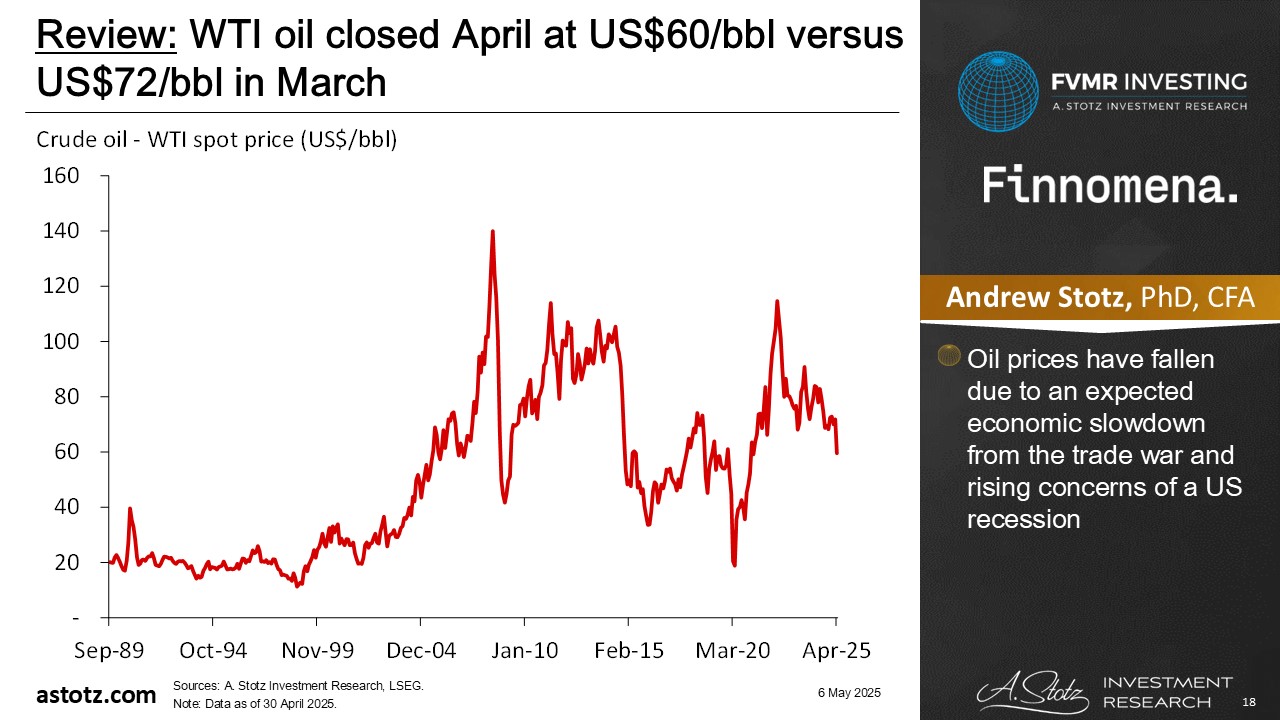

WTI oil closed April at US$60/bbl versus US$72/bbl in March

- Oil prices have fallen due to an expected economic slowdown from the trade war and rising concerns of a US recession

Precious metals were strong while Energy crashed

- Energy and Industrial metals both fell due to the worsened economic outlook

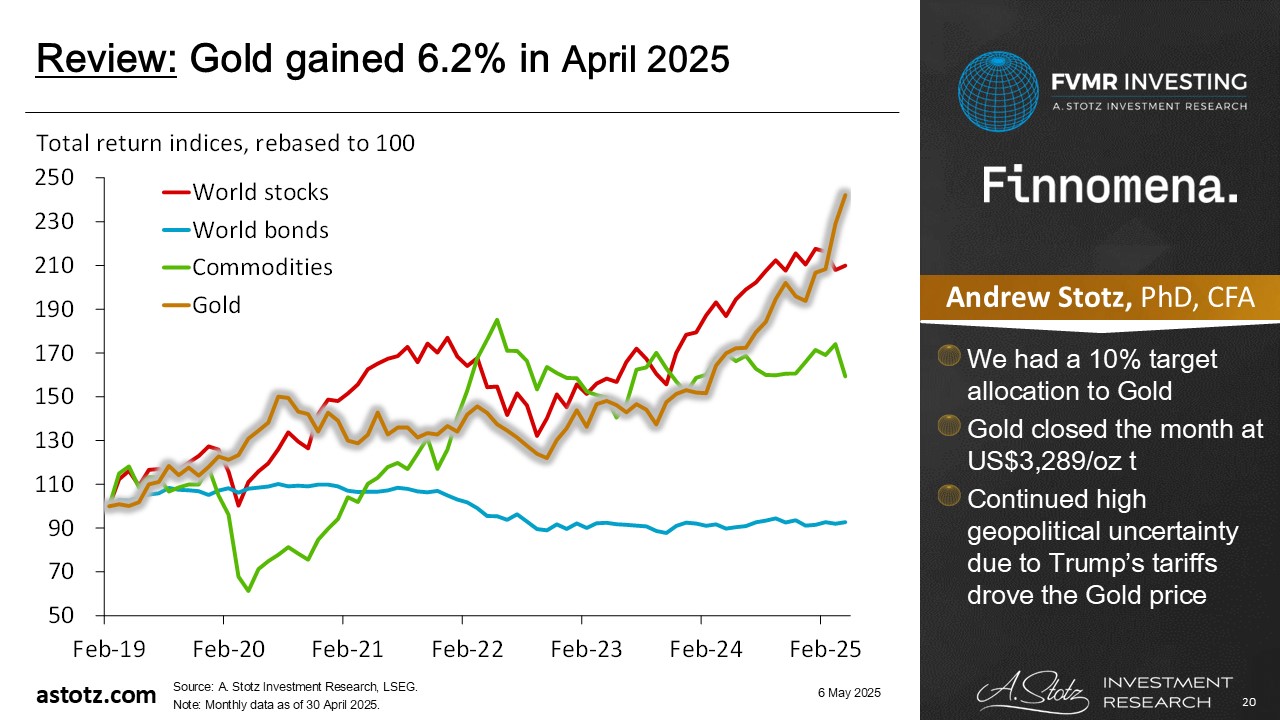

Gold gained 6.2% in April 2025

- We had a 10% target allocation to Gold

- Gold closed the month at US$3,289/oz t

- Continued high geopolitical uncertainty due to Trump’s tariffs drove the Gold price

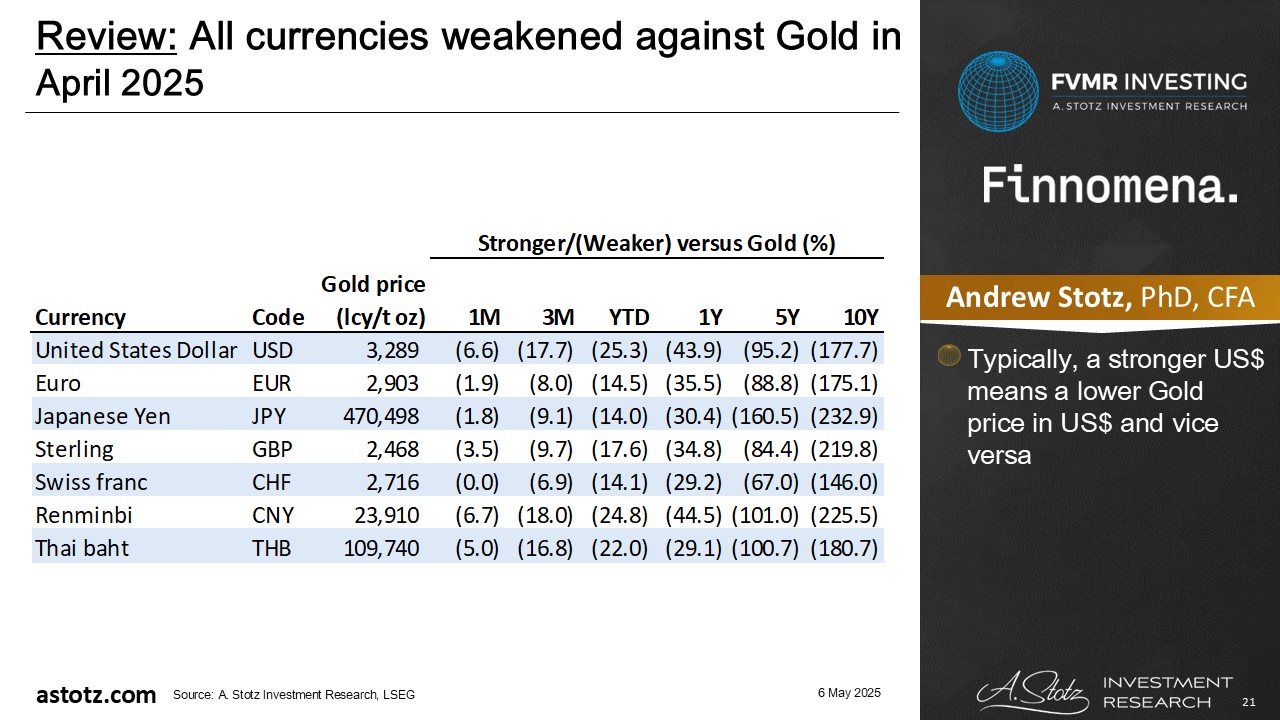

All currencies weakened against Gold in April 2025

- Typically, a stronger US$ means a lower Gold price in US$ and vice versa

The US Treasury is having a hard time getting lower bond yields

Reality check: Bessent has to refinance trillions of dollars in government debt this year. He needs lower yields.

Hence he had one job today:

Restore confidence & thereby get yields to move lower. Take the edge off so to speak.

But no, let’s randomly put out a 2-3 year time… pic.twitter.com/4prPFq2s2C— Sven Henrich (@NorthmanTrader) April 23, 2025

Almost 50% of fund managers expect a US hard landing

Buckle up for a hard landing pic.twitter.com/l7VFSgppwr

— Michael A. Arouet (@MichaelAArouet) April 20, 2025

Private equity wants to sell

Private Equity waiting to sell…

The amount of money firms have on hand, or “dry powder,” relative to the amount they have locked up in unsold companies is at a record low, according to Moody’s. pic.twitter.com/lEWCJ4gHsS

— Samantha LaDuc (@SamanthaLaDuc) April 18, 2025

Lower US oil production could signal economic slowdown

US crude oil production over 12 weeks.

This is not the trend you want to see if you are calling for more growth. pic.twitter.com/7YccLpJPLB

— HFI Research (@HFI_Research) April 16, 2025

Gold hit US$3,500/oz t

Can’t sleep…

Watching Gold break above $3,500. pic.twitter.com/FcWbenYfQu

— Geiger Capital (@Geiger_Capital) April 22, 2025

Performance review: All Weather Inflation Guard

All Weather Inflation Guard gained 0.4%

Since inception, the strategy was up 10.3% and 9.3% above a 40/60 portfolio

- The strategy has also experienced less volatility

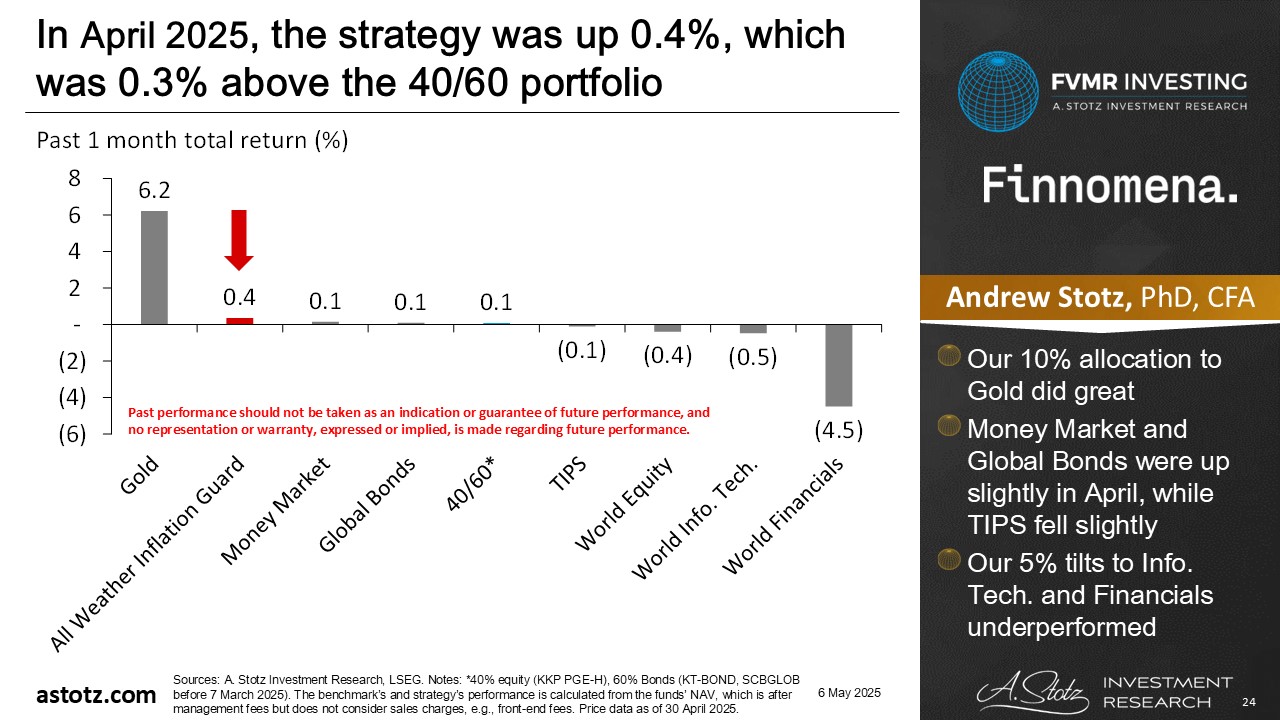

In April 2025, the strategy was up 0.4%, which was 0.3% above the 40/60 portfolio

- Our 10% allocation to Gold did great

- Money Market and Global Bonds were up slightly in April, while TIPS fell slightly

- Our 5% tilts to Info. Tech. and Financials underperformed

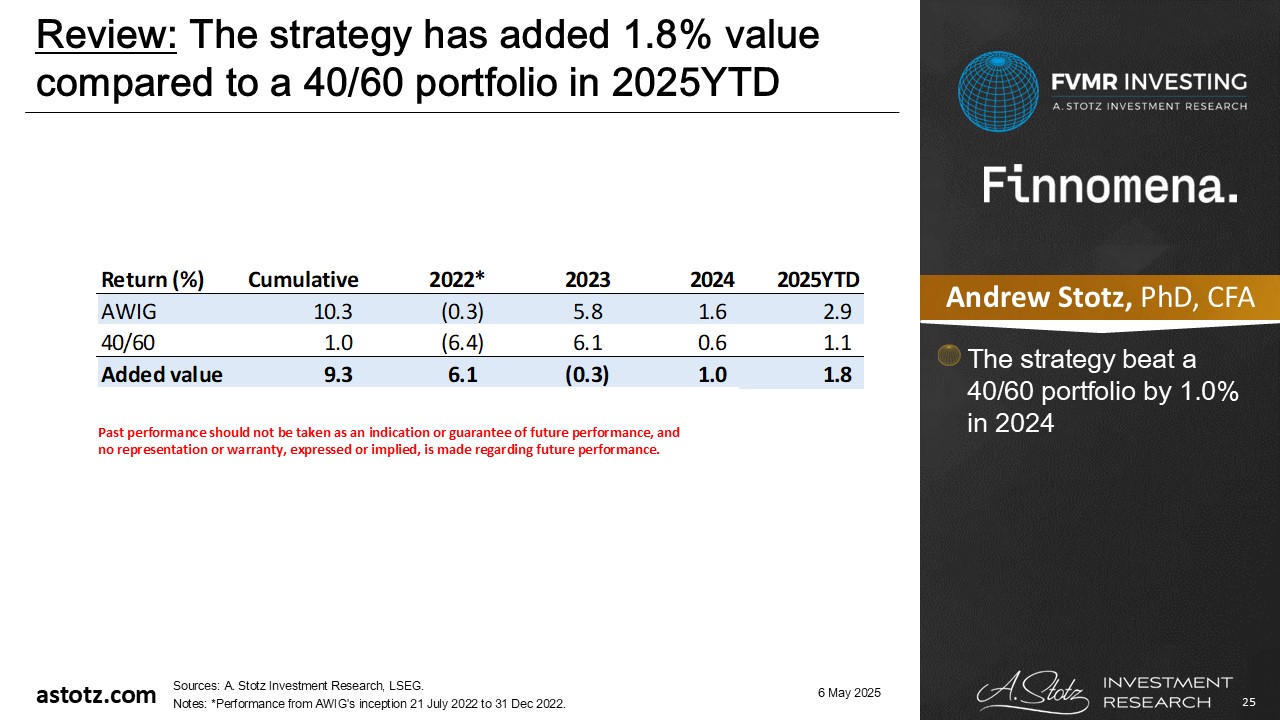

The strategy has added 1.8% value compared to a 40/60 portfolio in 2025YTD

- The strategy beat a 40/60 portfolio by 1.0% in 2024

Performance review: All Weather Strategy

All Weather Strategy lost 0.6%

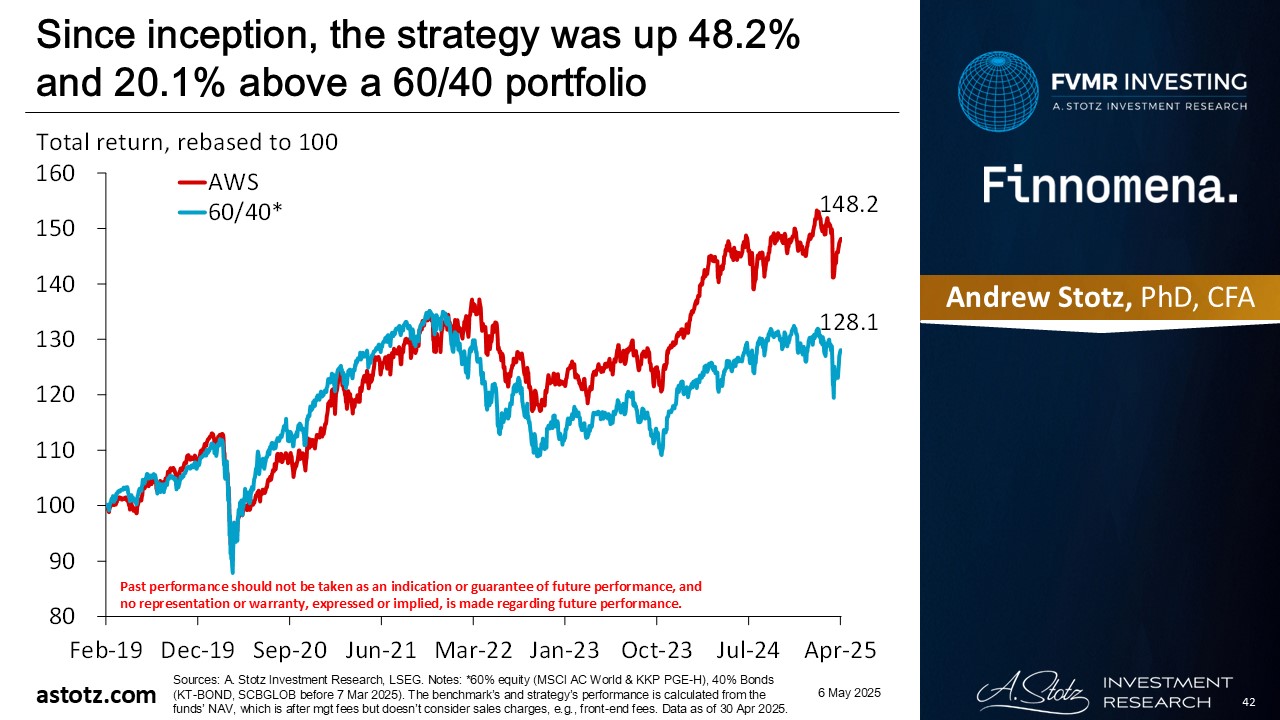

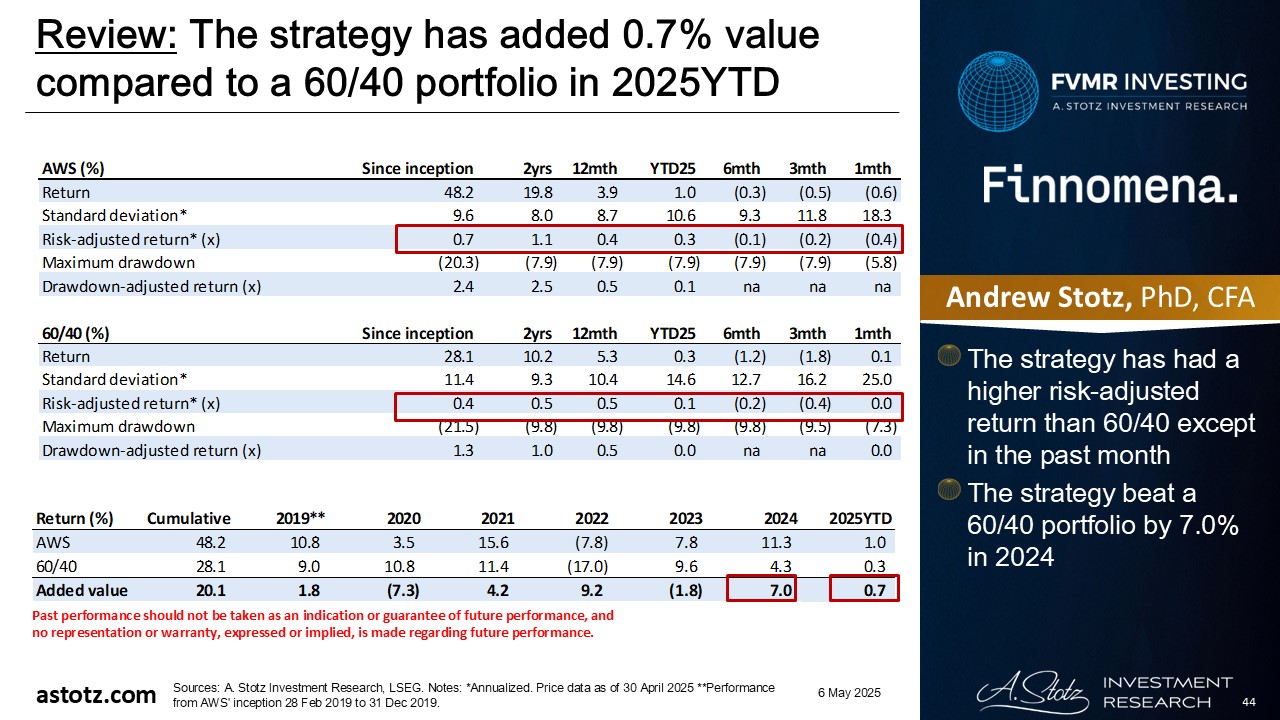

Since inception, the strategy was up 48.2% and 20.1% above a 60/40 portfolio

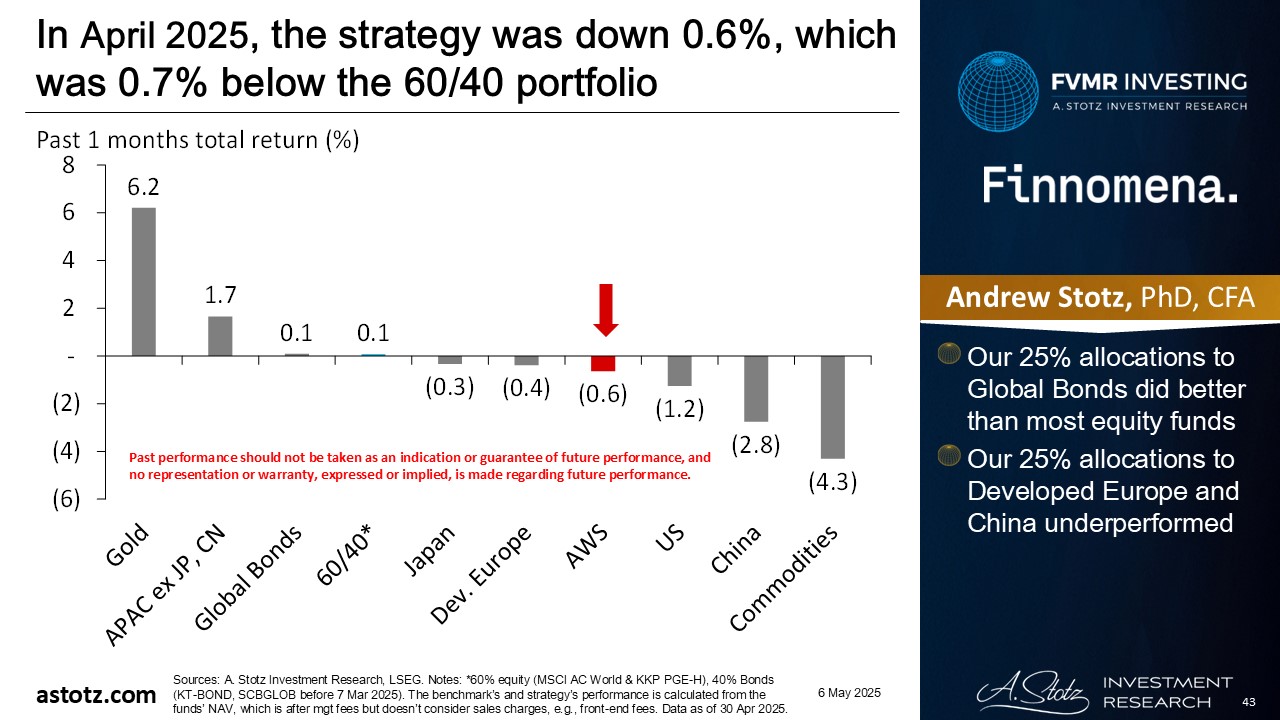

In April 2025, the strategy was down 0.6%, which was 0.7% below the 60/40 portfolio

- Our 25% allocations to Global Bonds did better than most equity funds

- Our 25% allocations to Developed Europe and China underperformed

The strategy has added 0.7% value compared to a 60/40 portfolio in 2025YTD

- The strategy has had a higher risk-adjusted return than 60/40 except in the past month

- The strategy beat a 60/40 portfolio by 7.0% in 2024

Performance review: All Weather Alpha Focus

All Weather Alpha Focus gained 1.0%

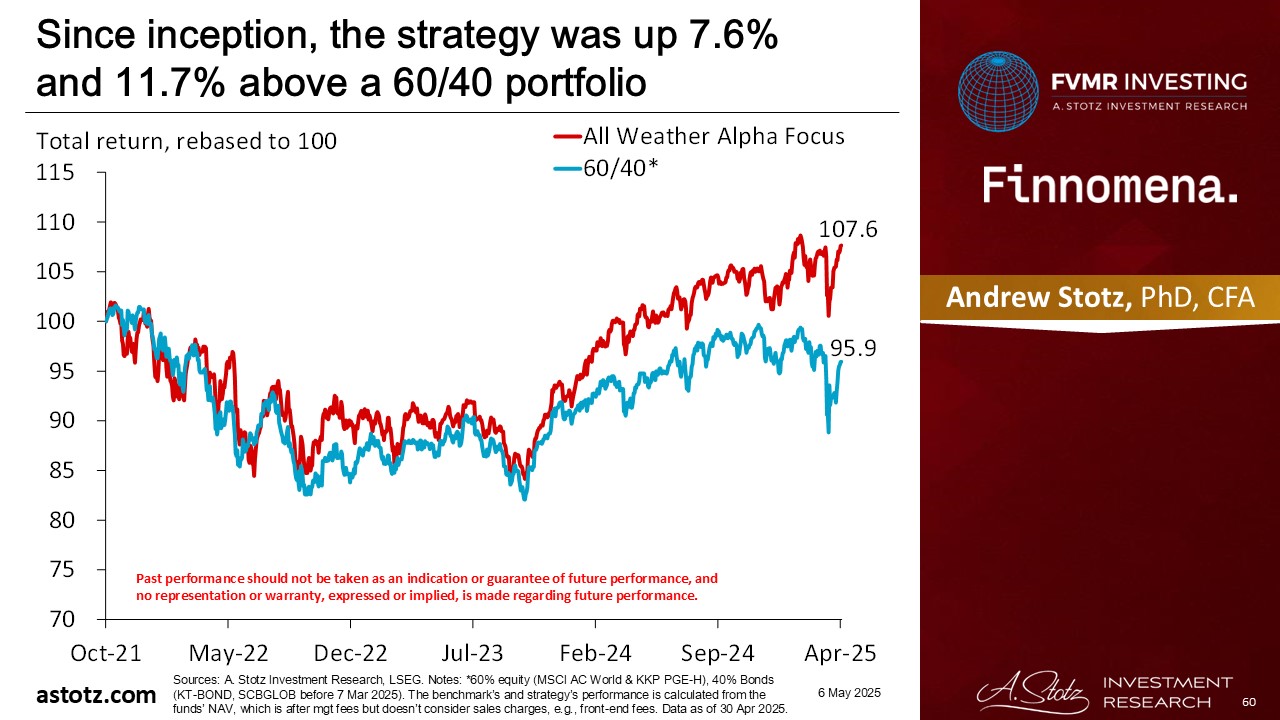

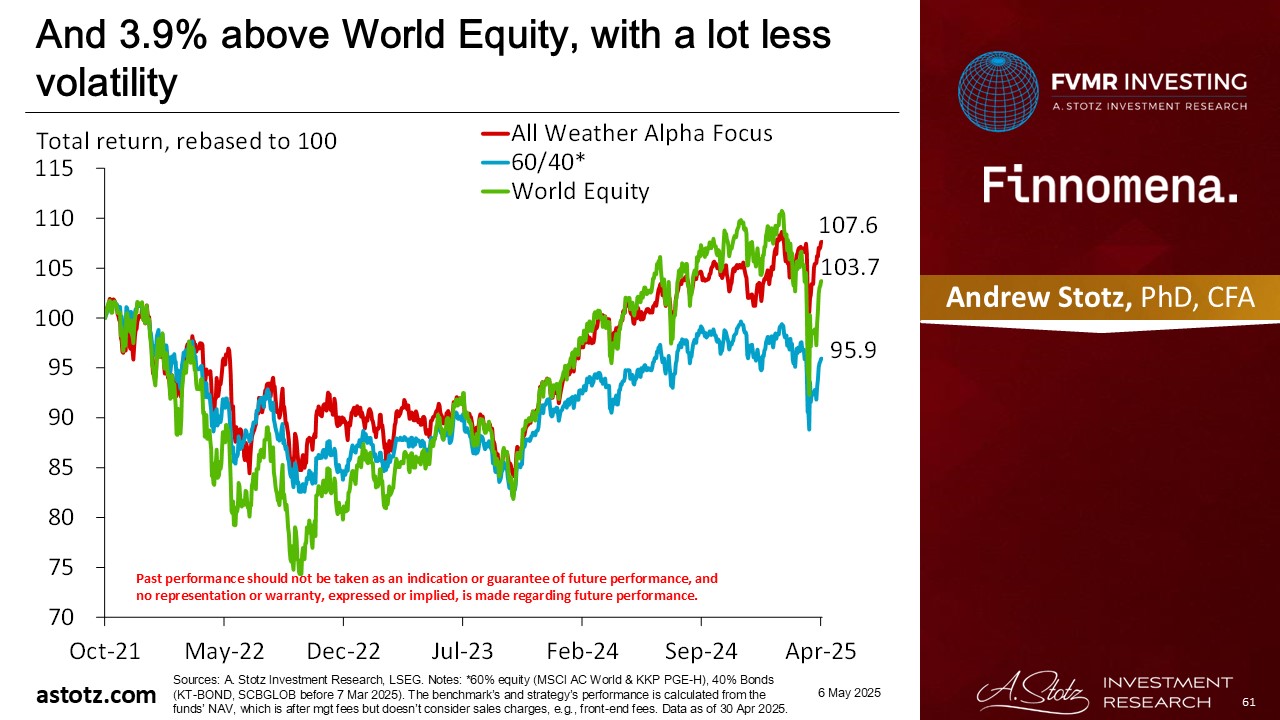

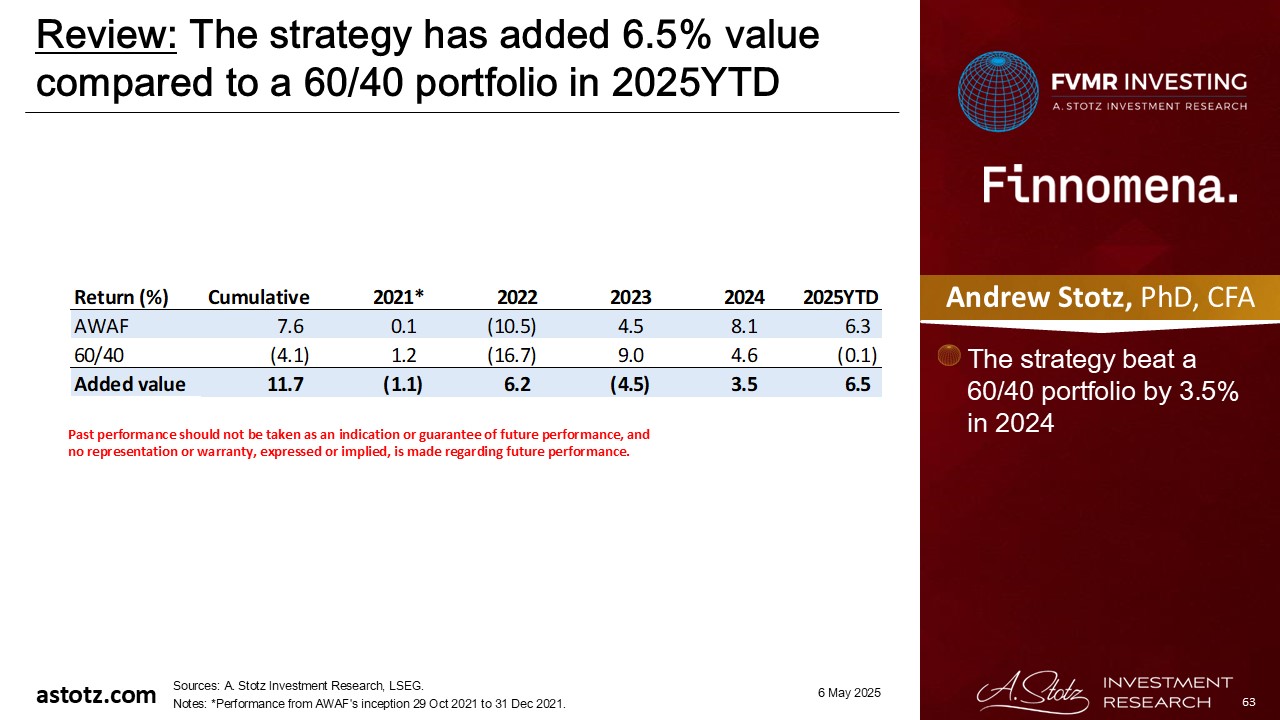

Since inception, the strategy was up 7.6% and 11.7% above a 60/40 portfolio

And 3.9% above World Equity, with a lot less volatility

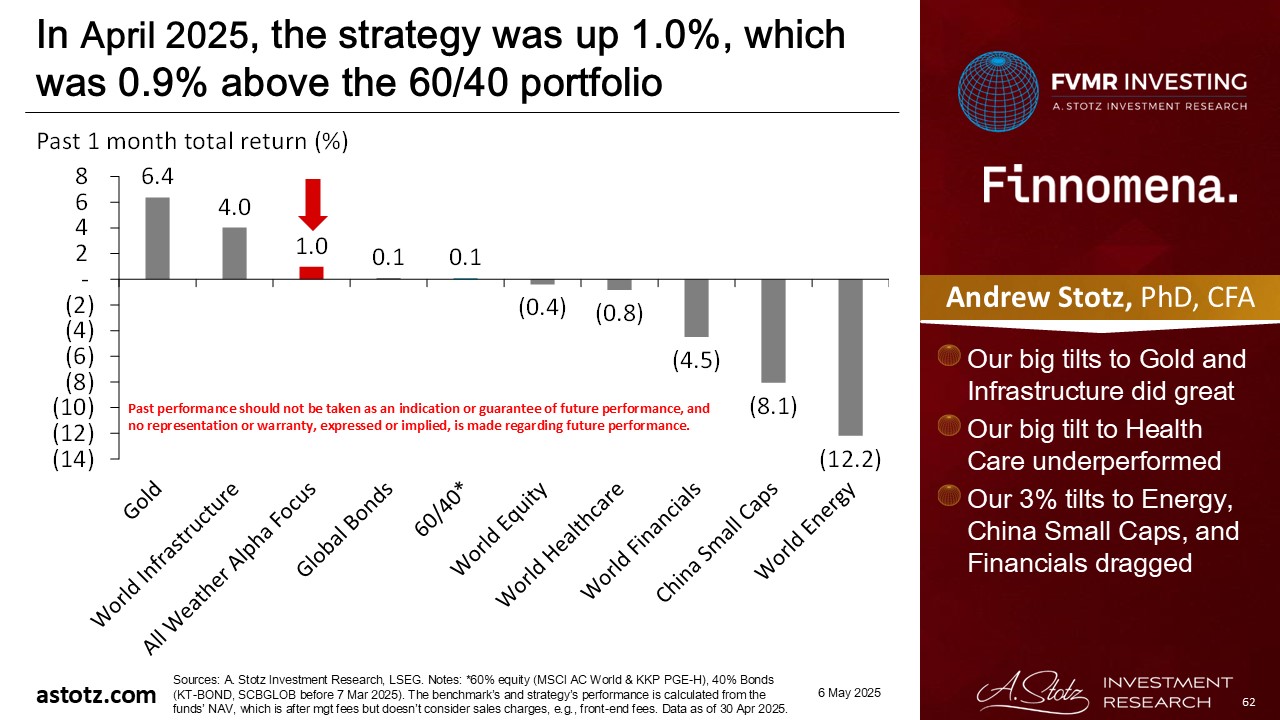

In April 2025, the strategy was up 1.0%, which was 0.9% above the 60/40 portfolio

- Our big tilts to Gold and Infrastructure did great

- Our big tilt to Health Care underperformed

- Our 3% tilts to Energy, China Small Caps, and Financials dragged

The strategy has added 6.5% value compared to a 60/40 portfolio in 2025YTD

- The strategy beat a 60/40 portfolio by 3.5% in 2024

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.