Become a Better Investor Newsletter – 5 October 2024

Noteworthy this week

- The Chinese stimulus rally

- Money supply on the rise again

- S&P 500’s dividend yield at 1.3%

- Gold trades at extremes

- Germans keep money in the bank

The Chinese stimulus rally: Over the past two decades, China has had five big equity rallies, three fueled by stimulus. We could be at the beginning of a fourth stimulus rally.

Over the last two decades, China has had five big equity rallies, three of which were fueled by stimulus. We could be at the beginning of a fourth stimulus rally which raises expectations of 50-100% gains. pic.twitter.com/XqUklCOYRl

— Gavekal (@Gavekal) September 30, 2024

Money supply on the rise again: Global money supply has risen by US$7.3 trillion over the past year.

Global money supply is rising once again, having increased by $7.3 trillion over the past year.

That is the highest growth rate in two years. pic.twitter.com/TGTxWECdul

— Otavio (Tavi) Costa (@TaviCosta) September 29, 2024

S&P 500’s dividend yield at 1.3%: Only around the peak of the dotcom bubble the S&P 500’s dividend yield was lower.

The S&P 500’s Dividend Yield has moved down to 1.27%, tied with Q4 2021 for the lowest yield since 2000.https://t.co/rQuXrxVpWs pic.twitter.com/7Ja4UIESr7

— Charlie Bilello (@charliebilello) October 2, 2024

Gold trades at extremes: Gold is about 15% above its 200-day moving average or 2 standard deviations, the widest gap since 2020. Can gold keep pushing higher?

Gold is trading at 40-year extremes:

Gold prices have seen a truly historic rally this year and are up 29%.

As a result, gold is now ~15% above its 200-day moving average or 2 standard deviations, the widest gap since 2020.

Over the last 40 years, such a significant divergence… pic.twitter.com/LJAsYzvduy

— The Kobeissi Letter (@KobeissiLetter) September 27, 2024

Germans keep money in the bank: German total retail bank deposits have reached a record high of close to €2.9 trillion. I guess they don’t worry about inflation.

Good Morning from #Germany where citizens are increasingly saving money, w/total retail bank deposits now reaching a record high of almost €2.9tn. pic.twitter.com/EmxriRwF68

— Holger Zschaepitz (@Schuldensuehner) September 29, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

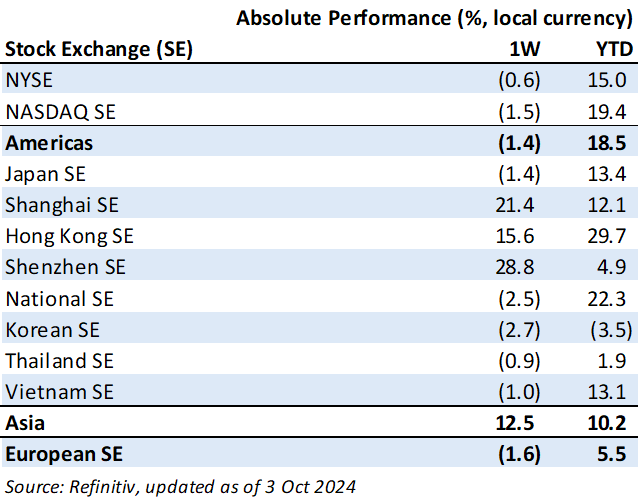

Weekly market performance

Click here to see more markets and periods.

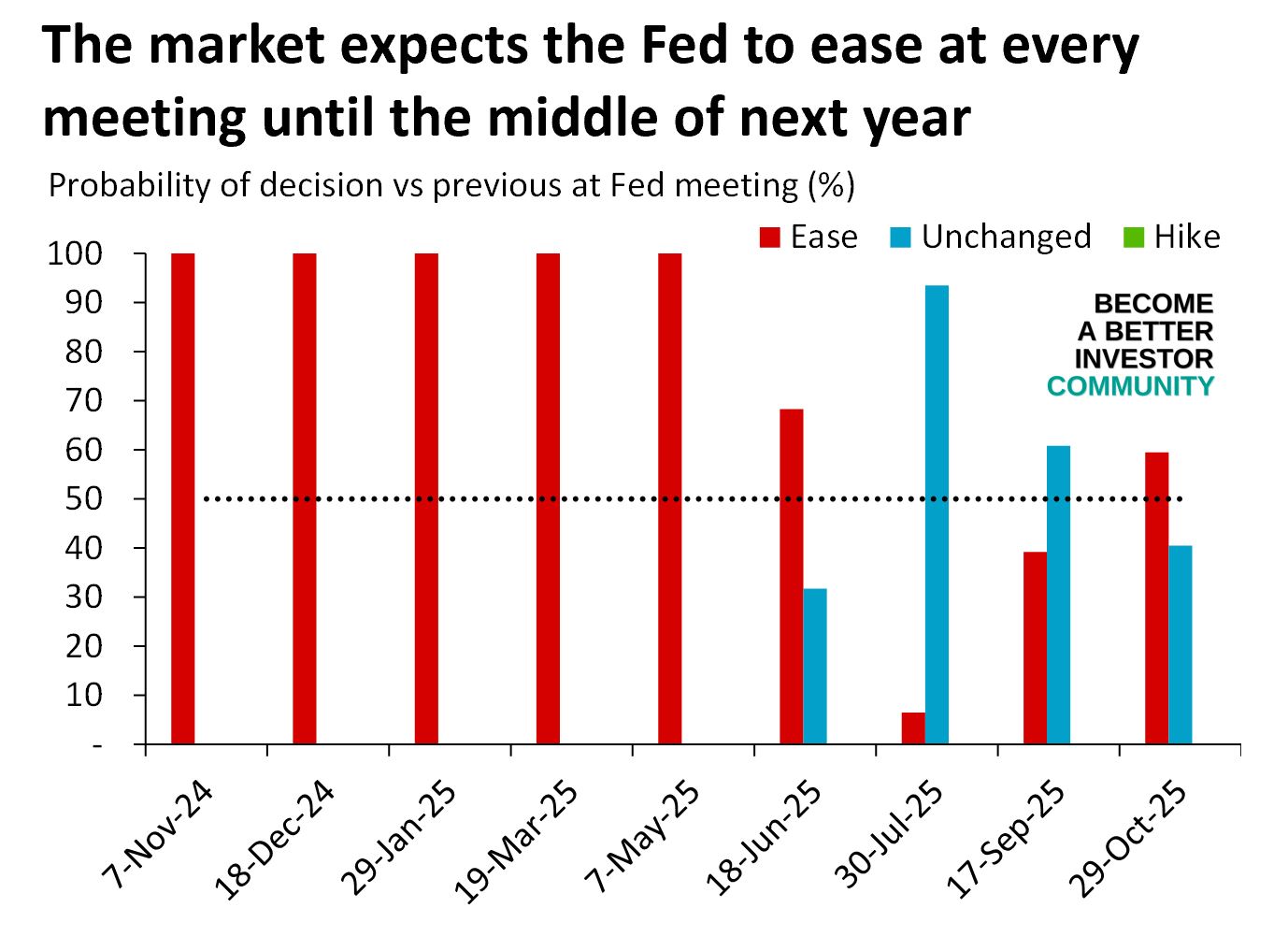

Chart of the week

Discussed in the Become a Better Investor Community this week

“We have some great events today in which some of our Valuation Master Class Professional students will present their final valuations and we would love to see you there and indeed see your questions that will challenge their assumptions.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

#2206 – Chamath Palihapitiya – The Joe Rogan Experience

“Chamath Palihapitiya is a venture capitalist, engineer, and CEO of Social Capital.’”

Readings this week

The Optimism Trap: How We Misjudge Risk and Rewards

“There is a quirk in human nature that is as old as time itself. Yet, it is as relevant today as it was when our ancestors first started trading seashells.

I am talking about the tendency to see the world through rose-coloured glasses when it comes to potential gains, while simultaneously downplaying the very real risks that lurk in the shadows.”

Book recommendation

Supercommunicators: How to Unlock the Secret Language of Connection by Charles Duhigg

“Come inside a jury room as one juror leads a starkly divided room to consensus. Join a young CIA officer as he recruits a reluctant foreign agent. And sit with an accomplished surgeon as he tries, and fails, to convince yet another cancer patient to opt for the less risky course of treatment. In Supercommunicators, Charles Duhigg blends deep research and his trademark storytelling skills to show how we can all learn to identify and leverage the hidden layers that lurk beneath every conversation.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

When you hear that Cramer just recommended a stock that you’re holding pic.twitter.com/WnwQ2uS19g

— Not Jerome Powell (@alifarhat79) October 2, 2024

I will not accept Moo Deng slander in my DM’s pic.twitter.com/pJnoItIqyK

— greg (@greg16676935420) October 2, 2024

Published on Become a Better Investor this week

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 15: Individual Stocks Are Riskier Than Investors Believe.

Listen to Enrich Your Future 15: Individual Stocks Are Riskier Than You Believe

Continuing their discussion from part 3 of this series, Bill Bellows and Andrew Stotz talk more about acceptability versus desirability. In this episode, the discussion focuses on how you might choose between the two.

Listen to Pay Attention to the Choices: Misunderstanding Quality (Part 4)

Asian markets were up in 9M24 except for Indonesia and Korea. Taiwan was the strongest performer in USD and local terms.

Read Taiwan Was the Best Performer in Asia in 9M24

In September 2024, we published 6 new episodes of the My Worst Investment Ever podcast. Listen to all of them here.

Listen to My Worst Investment Ever September 2024

Matrix Concepts Holdings Berhad (MCH MK): Profitable Growth rank of 2 was down compared to the prior period’s 1st rank. This is World Class performance compared to 290 medium Real Estate companies worldwide.

Read Matrix Concepts Holdings – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.