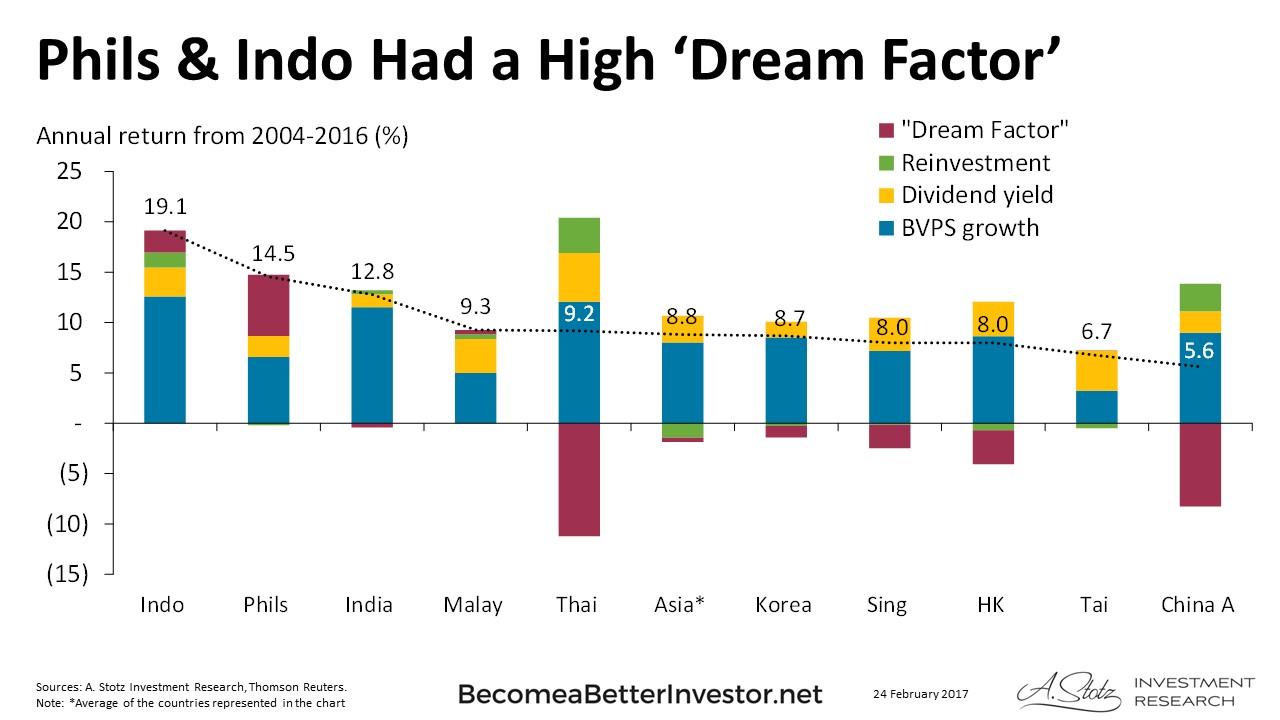

Philippines & Indonesia Had a High ‘Dream Factor’

- We consider five components of stock market return: Inflation, dividend yield, real book-value growth, share dilution and the “Dream Factor”

- The “Dream Factor” could be thought of as the residual, the part of the market return that can’t be explained by the other four fundamental factors

- “Dream Factor” is the portion of return driven only by re-rating of multiples

- During bull markets, the “Dream Factor” is generally high but usually negative in bull markets and market crashes

- Overall in Asia, on average during 2004-2016 (including the global financial crisis in 2008-2009) the “Dream Factor” did not contribute to return

- In the two highest returning markets Indonesia and the Philippines, the “Dream Factor” contribution was also the highest

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.