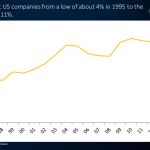

We have been considering the causes of the rising cash levels at US companies. Surprisingly, we realized that the question asked was the wrong one.

Read MoreIn our Top 5 this week, we ask if robots are taking over, question our perspective on the current bull market, and uncover why indexing isn’t quitting. All this and more…

Read MoreThaifoods Group Public Company Limited is engaged in the integrated food processing business that is based in Thailand. The company mainly produces chicken and live pigs. Profitable Growth has improved to World Class from being ranked the worst in 2015.

Read MoreHome Product Center Public Company Limited is a Thailand-based retailer of building materials and home improvement products under the name “HomePro”. Profitable Growth has remained #3 since 2013.

Read MoreHugel Incorporated, founded in 2001, operates as a pharmaceutical company in South Korea. It offers Botulinum Toxin, Hyaluronic Acid Filler and medical equipment. Profitable Growth at Hugel returned to World Class after a dip in 2015.

Read MorePT PP (Persero) Tbk, established in 1961, is an Indonesian state-owned enterprise mainly operating in five segments: Construction; EPC; Property; Precast and Equipment. In the past 12 months, Profitable Growth returned to the average rank.

Read MoreOver the last few weeks, we have been considering the causes of the rising cash levels at US companies from a low of about 4% in 1995, to the currently very high 11%. Let’s have a look at what academia say about it.

Read MoreIn our Top 5 this week, we learn how not to invest, explore the curious world of micro caps, and find the ‘active’ in low-cost passive investing. All this and more…

Read MoreS P Setia’s core business, property development carries out residential projects such as Setia Sky Residences and commercial projects such as SetiaWalk. Profitable Growth saw a great improvement to #2 in 2015 but has fallen back to #4 in the past 12 months.

Read MoreInternational Container Terminal Services, Inc. (ICT), is an international operator of common user container terminals and serves the global container shipping industry. Profitable Growth for ICT has dropped to the average rank from #3 in 2013.

Read More