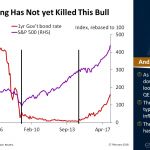

Chart of the Day: As the one-year rate was pushed down by the Fed’s loosening policy through QE following the GFC. The S&P 500 soared, typical “asset price inflation”. The tightening since 2015 has not yet killed this bull.

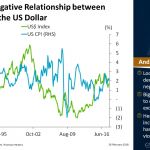

Read MoreChart of the Day: Looking over almost three decades, we can see a negative correlation of 45%. Big moves in inflation lead to opposite moves in the exchange rate. Hence, when inflation increases, the US Dollar has mainly depreciated and vice versa.

Read MoreLive Event: During the week of February 26, Andrew Stotz will have three events in Bangkok. All events are free to attend and we invite you to join us!

Read MoreIn our Top 5 this week, we examine how to find the right balance as a factor investor, the rule for beating buy and hold investing, and the science behind incentives. All this and more…

Read MoreGlobal Equity FVMR Snapshot: Global markets have a return on equity of 14% and a 40% dividend payout ratio. Overall, Asia has seen great price performance in the past year and Europe has been the least volatile market in the past 3 months.

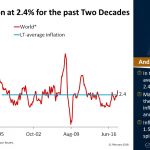

Read MoreChart of the Day: In the past two decades, an average inflation rate of 2.4% in the world. Many central banks around the world are today inflation targeting, e.g. Fed and ECB target 2%.

Read MoreThe Bangkok Podcast: Andrew is interviewed by Greg for the 71st episode of The Bangkok Podcast. They chat about investing in Thailand at the lay-person level, since many of us aren’t the most well-versed in financial options.

Read MoreBrewed in Bangkok (Podcast): Andrew is interviewed by Karsten and Siddhant for the 28th episode of Brewed in Bangkok. They talk about stock markets, coffee, investment and business advice and why you should or shouldn’t come to Thailand.

Read MoreAndrew Stotz interprets the CFA Ethics and Standards of Professional Conduct. Separate fact from opinion to clarify the value you add. Separate fact from opinion, so readers understand that the future is uncertain. Avoid this problem by replacing certainty verbs like “will” and “must”; with “would,” “could,” “should.”

Read MoreI have had the unique pleasure of serving as judge, juror, and, occasionally, as executioner for many business case competitions. During my tenure in these roles, I’ve noticed over the years a couple of mistakes that MBA students consistently make. I wanted to highlight the top 7 here and provide some methods for avoiding them.

Read More