In our Top 5 this week, we discuss the significance of asset allocation, when to make a move on cryptocurrencies, and what to expect from 2018. All this and more…

Read MoreChart of the Day: All regions have shown earnings recovery for the past 12 months. Seeing strong growth in all Emerging regions. Only Developed Americas showed single-digit growth at 7%, unlike other regions.

Read MoreLive Event: On Saturday, January 27, Andrew Stotz will have four events in Bangkok. All events are free to attend and the venue is the CoffeeWORKS Experience Center.

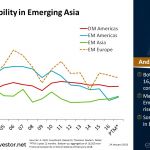

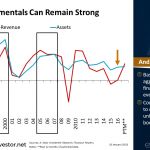

Read MoreChart of the Day: Bottom-up aggregation of 16,200 non-financial companies in the World. Margin recovery in Emerging Asia could still rise further. Some risk of falling margins in Emerging Europe.

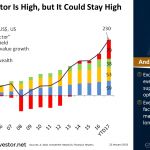

Read MoreChart of the Day: Excluding a major negative event, the fundamentals support a relatively optimistic market. Even though the Dream factor is high, the US market could stay high for longer.

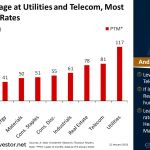

Read MoreChart of the Day: Leverage is always high in Telecom and Utilities. If interest rise, these and Real Estate sector would be hurt the most. Least impacted by interest rate rise are Info Tech, Health Care, Energy, Materials.

Read MoreIn our Top 5 this week, we discover 2018’s investing theme, examine how stock valuations are at their highest since 2000, and see if it really is Bitcoin’s era or not. All this and more…

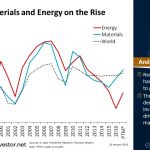

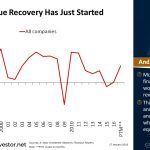

Read MoreChart of the Day: Revenue recovery could have at least another year to go. This should increase demand for goods, this increased demand should drive up price of oil and materials.

Read MoreChart of the Day: More than 16,000 non-financial companies worldwide show a strong revenue uptrend. This trend could continue, which would be positive for equity in 2018.

Read MoreChart of the Day: Based on our bottom-up aggregation of 16,200 non-financial companies across every market in the World. Companies have been slow to expand their assets, unlike in prior stock market boom times.

Read More