Is a Hand-Made Hermès Bag a Better Long-Term Investment than Its Stock?

The post was originally published here.

What’s interesting about Hermès is that it is still owned by the family (now in 6th generation)

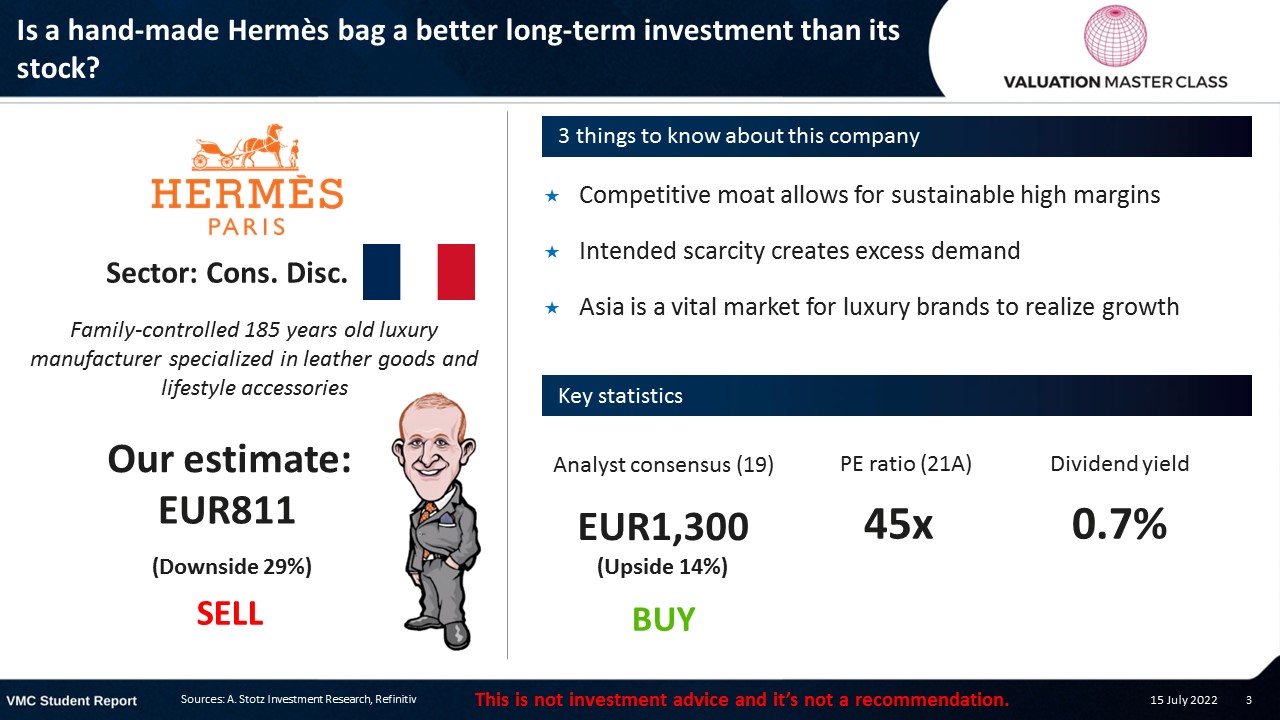

Highlights:

- Competitive moat allows for sustainable high margins

- Intended scarcity creates excess demand

- Asia is a vital market for luxury brands to realize growth

Download the full report as a PDF

Revenue breakdown 2021

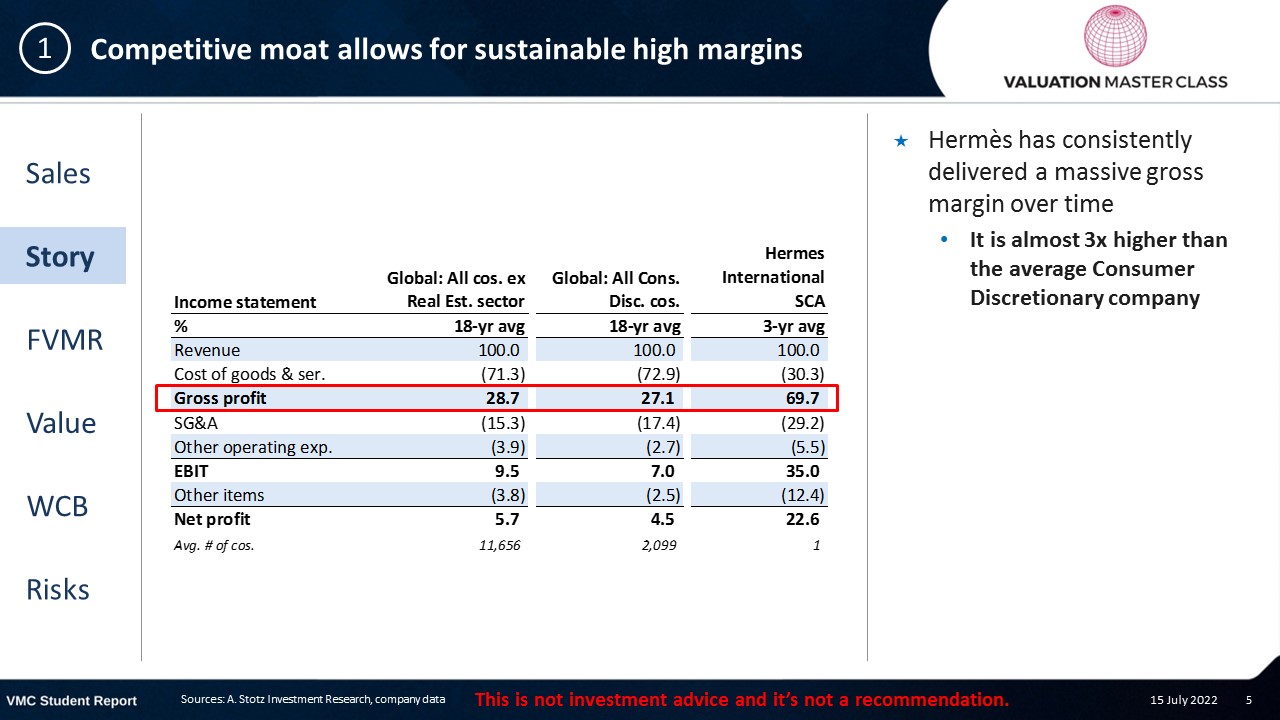

Competitive moat allows for sustainable high margins

- Hermès has consistently delivered a massive gross margin over time

- It is almost 3x higher than the average Consumer Discretionary company

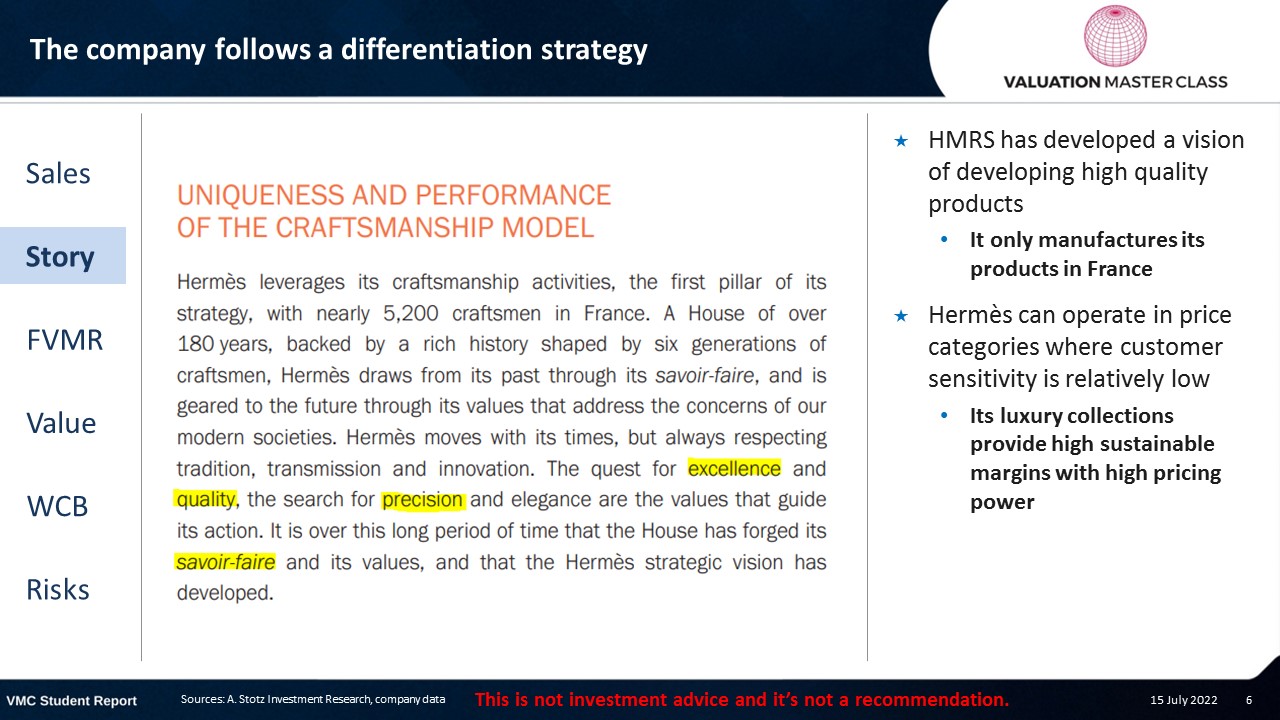

The company follows a differentiation strategy

- HMRS has developed a vision of developing high quality products

- It only manufactures its products in France

- Hermès can operate in price categories where customer sensitivity is relatively low

- Its luxury collections provide high sustainable margins with high pricing power

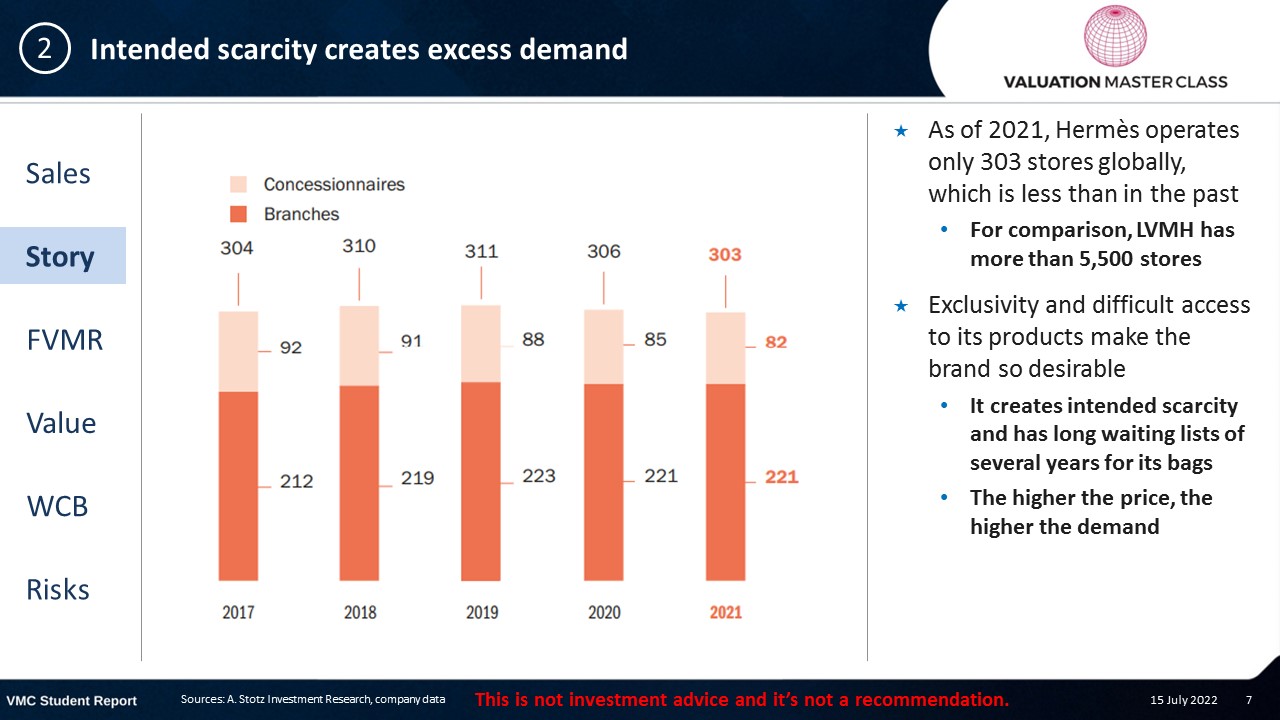

Intended scarcity creates excess demand

- As of 2021, Hermès operates only 303 stores globally, which is less than in the past

- For comparison, LVMH has more than 5,500 stores

- Exclusivity and difficult access to its products make the brand so desirable

- It creates intended scarcity and has long waiting lists of several years for its bags

- The higher the price, the higher the demand

Increasing price to increase demand sounds very odd

- For the majority of goods, we observe that overall demand decreases when price increases

- People tend to switch to cheaper variants or look for substitute products

- However, there are a few products where the law of demand does not hold

- Economists call them “Veblen goods”

- If luxury products become cheap, they lose the premium status as more people can afford it

- Raising the price helps to keep exclusivity

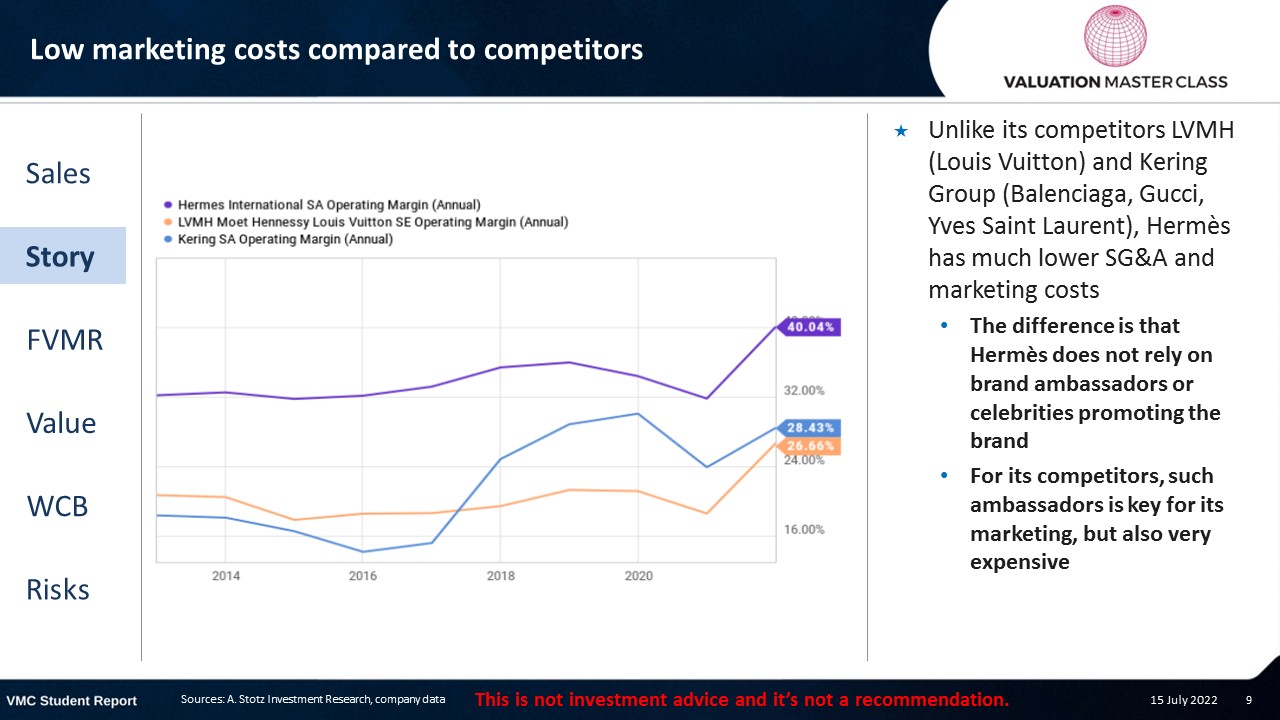

Low marketing costs compared to competitors

- Unlike its competitors LVMH (Louis Vuitton) and Kering Group (Balenciaga, Gucci, Yves Saint Laurent), Hermès has much lower SG&A and marketing costs

- The difference is that Hermès does not rely on brand ambassadors or celebrities promoting the brand

- For its competitors, such ambassadors is key for its marketing, but also very expensive

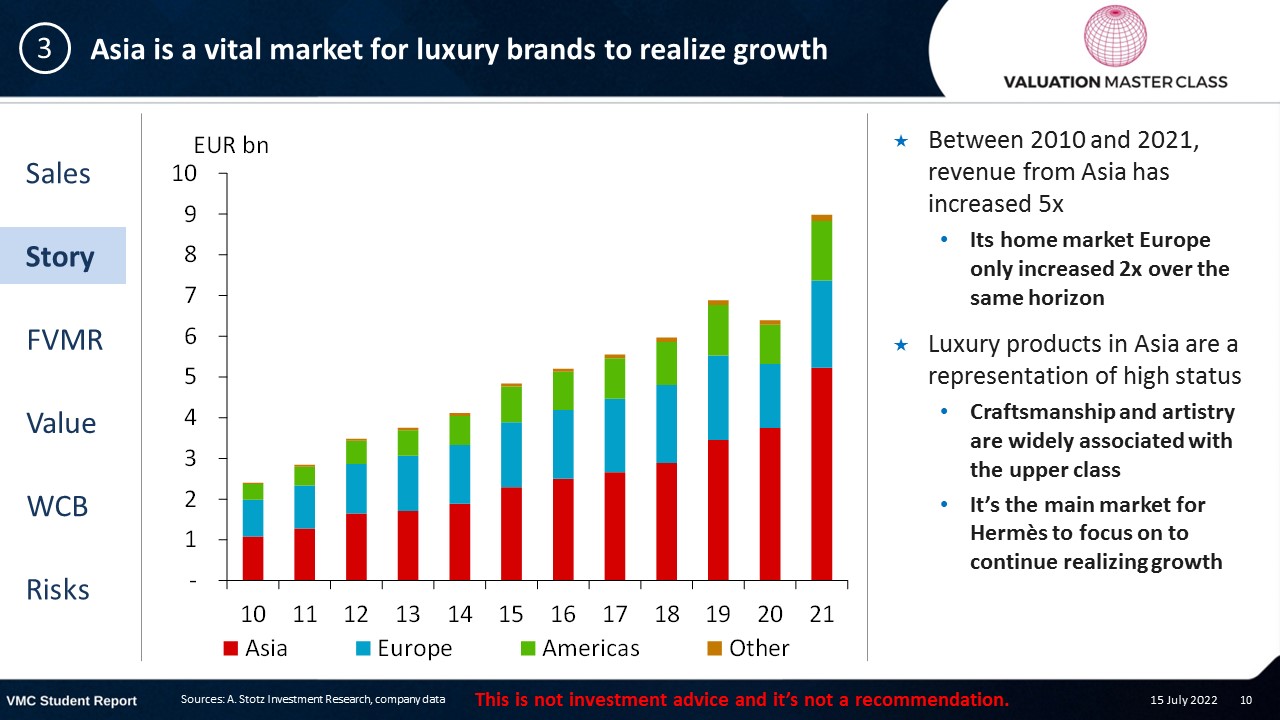

Asia is a vital market for luxury brands to realize growth

- Between 2010 and 2021, revenue from Asia has increased 5x

- Its home market Europe only increased 2x over the same horizon

- Luxury products in Asia are a representation of high status

- Craftsmanship and artistry are widely associated with the upper class

- It’s the main market for Hermès to focus on to continue realizing growth

Consensus is divided

- The majority of analysts stays on HOLD, as current share price might be too high

- Analysts predict strong margins to continue as Hermès has a high pricing power

Get financial statements and assumptions in the full report

P&L – Hermès

- Net profit could stay on heightened levels as it record strong demand growth for its products

Balance sheet – Hermès

- Hermès has a strong cash position as it generates huge cash flows on an annual basis

- Hermès has low leverage with a liabilities-to-assets of 30%

Ratios – Hermès

- Strong bottom line ensures consistent high profitability measured by ROE

- Cash conversion cycle is very long but is not a risk given the strong cash position and cash flow generation ability

Free cash flow – Hermès

- CAPEX requirements are relatively low as it does not expand aggressively in physical stores

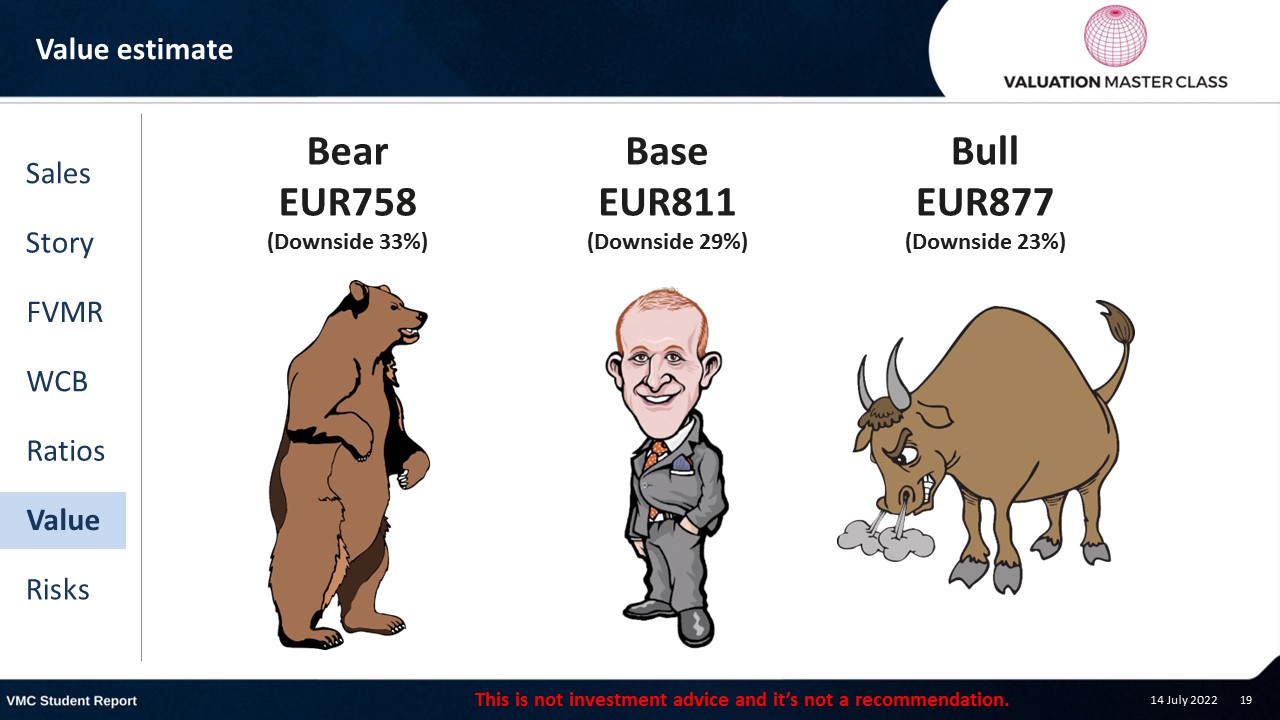

Value estimate – Hermès

- I am a bit more cautious about the revenue growth prospects are China’s demand might be lower than expected

- I value the company by using FCFF and a terminal growth rate of 4%

Key risk is brand damage

- Failure to adopt to changing consumer demands

- Mean reversion of temporary heightened margins

- Failure to comply with growing ESG standards could lead to reputational damage

Conclusions

- Competitive moat delivers best-in-class margin

- Asia continues to provide ample growth opportunities

- Lucrative company but at an expensive price

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.