High Profitability in Vietnamese Consumer Sectors

We recently released our Vietnam Equity FVMR Snapshot. If you’d like to get it for free to your inbox every Monday you can subscribe to the Vietnam Equity FVMR Snapshot and our other FVMR snapshots here.

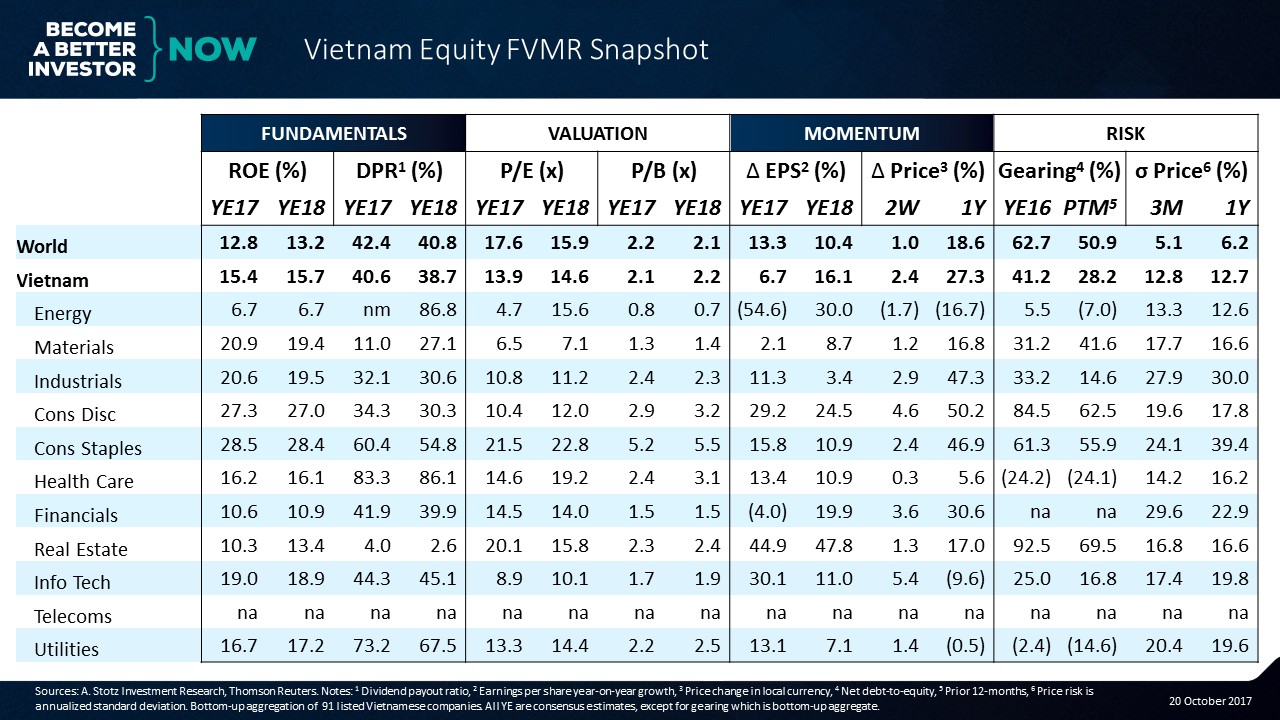

Vietnam Equity FVMR Snapshot

Remember that FVMR stands for Fundamentals, Valuation, Momentum, and Risk. Those are the factors that we look at to get an understanding of the market. The Vietnam Equity FVMR Snapshot is a bottom-up aggregate of 91 Vietnamese companies and all forecasted figures are consensus estimates.

Fundamentals: High ROE in Vietnam

The return on equity (ROE) in Vietnam is above 15% compared to the global average at about 13%. This is also higher than Emerging Asia, which is just below the global average. The two consumer sectors have the highest ROE in Vietnam at 27-28%, while the Energy sector has the lowest.

Looking at the dividend payout ratio (DPR), Vietnam is just slightly lower than the Global average. Health Care and Utilities pay out the largest share of profit as dividend. The lowest DPR is in the Real Estate sector, expected at only 4% in 2017 and less than 3% in 2018. Globally, the Real Estate sector’s DPR is at 78%.

Valuation: The consumer sectors have similar ROE but very different PB

Vietnam trades below the World on price-to-earnings (PE) but in line with the World on price-to-book (PB). Energy and Materials trade at the lowest PE multiples and Consumer Staples trades at the highest, 21.5x for 2017. Taking growth into account and looking at the PEG ratio (PE divided by EPS growth), Information Technology, Consumer Discretionary, and Real Estate all trade at PEG ratios below 0.5. A rule of thumb is that a PEG ratio below 1 is cheap.

Looking at PB, Energy trades below book value which might be reasonable considering the low ROE and falling earnings in 2017. The price performance of the Energy sector has also been poor in the past one year, down 16.7%. When considering the PB valuation it should be compared to how much ROE you get for the price (PB) you pay. The Materials sector offers the highest ROE/PB you get 15.9% ROE for each unit of PB you pay.

Information Technology has the second highest ROE/PB of 11.2% for 2017, followed by Consumer Discretionary at 9.5%. Note that Consumer Staples just offers a slightly higher ROE compared to Consumer Discretionary but trades at a much higher PB.

Momentum: Real Estate has the highest earnings growth

Energy is expected to see a big fall in earnings in 2017, and earnings in the Financials sector is expected to fall by 4%. For the overall Vietnamese market, it’s expected to see earnings grow slower than the global average, dragged down by Energy, Financials, and Materials. Real Estate is expected to see an EPS growth of 44.9% and Information Technology and Consumer Discretionary are expected to see earnings grow about 30% in 2017.

In terms of price performance, Vietnam has beaten the World in the past one year, returning 27.3% versus the World at 18.6%. Three sectors have seen a price performance of about 50%: Consumer Discretionary, Industrials, and Consumer Staples. Energy and Information Technology have seen the price fall in the past one year.

Risk: Lower gearing but higher volatility

Gearing in Vietnam, measured as net debt-to-equity, is well below the global average. In the past 12 months, Health Care, Utilities, and Energy had a net-cash position. Especially notable is that the Utilities sector is net cash as it is the most heavily geared sector globally.

The volatility of the Vietnamese market has been more volatile than the World. Industrials, Consumer Staples, and Financials have been the most volatile sectors while Energy and Health Care have neem the least volatile.

Get our Equity FVMR Snapshots for free to your inbox every Monday!

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.