Continued Challenging Environment for Chinese Telecoms

China Equity FVMR Snapshot

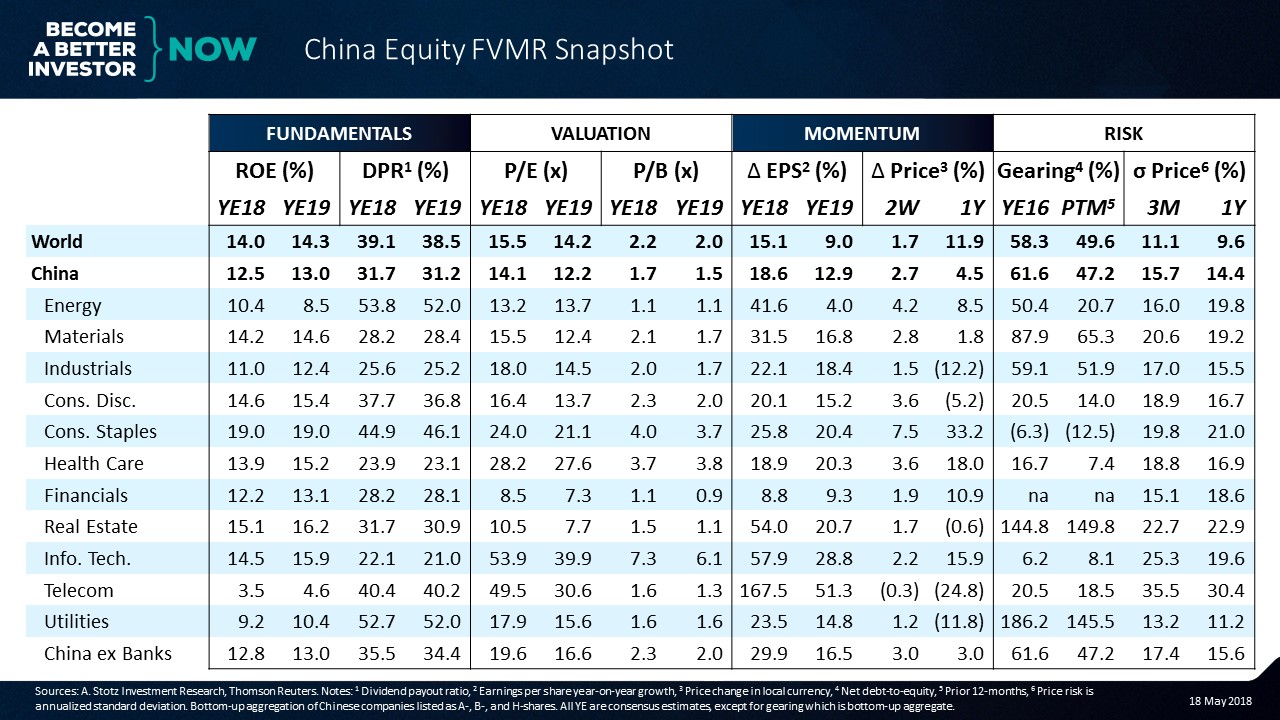

Remember that FVMR stands for Fundamentals, Valuation, Momentum, and Risk. Those are the factors that we look at to get an understanding of the market. This China Equity FVMR Snapshot is an aggregation of Chinese companies listed as China A-, B-, and H-shares.

Fundamentals: Chinese Telecom companies are expected to continue being challenged

The return on equity (ROE) of China is 13% versus the World at about 14%. Chinese Telecom companies are expected to continue being challenged and deliver low profitability. Consumer Staples offers the highest ROE at 19%, followed by Real Estate at 15%.

Overall, the Chinese market has a lower dividend payout ratio (DPR) versus the world. Energy and Utilities are the two sectors that pay out the largest share of earnings as dividends.

Valuation: The Chinese market trades below the World due to banks

The overall Chinese market trades below the World on 2018CE* price-to-earnings (PE) and price-to-book (PB). However, excluding banks, the Chinese market trades above the World. Info Tech and Telecom trade at 2018CE* PE around 50x while Financials trade at 8.5x. China no longer appears cheap when we exclude banks.

Momentum: China is expected to grow earnings faster than the World

China is expected to grow earnings per share (EPS) faster than the World. Telecom is expected to have the fastest EPS growth at 167.5%, however, this is due to a low base. Info Tech and Real Estate are expected to see EPS grow by more than 50% in 2018CE*. Only Financials has EPS growth expectations that are in the single digits.

China has underperformed the world by 7.4% in the past one year in terms of price performance. Consumer Staples has been the best performing sector at 33.2% while Telecom has been the worst at -24.8%.

Risk: Highest gearing in Utilities and Real Estate

Highest gearing, measured as net debt-to-equity, in Utilities and Real Estate while Consumer Staples is net cash.

The Chinese market has been more volatile than the world. In the past one year, Utilities has been the least volatile sector and Telecom was the most volatile.

Get our Equity FVMR Snapshots for free to your inbox every Monday!

* Consensus Estimates

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.