Property and Palm Farms Grow Profitability at Malaysian Conglomerate

Watch the video with Andrew Stotz or read a summary of the World Class Benchmarking on Hap Seng Consolidated Berhad.

Background

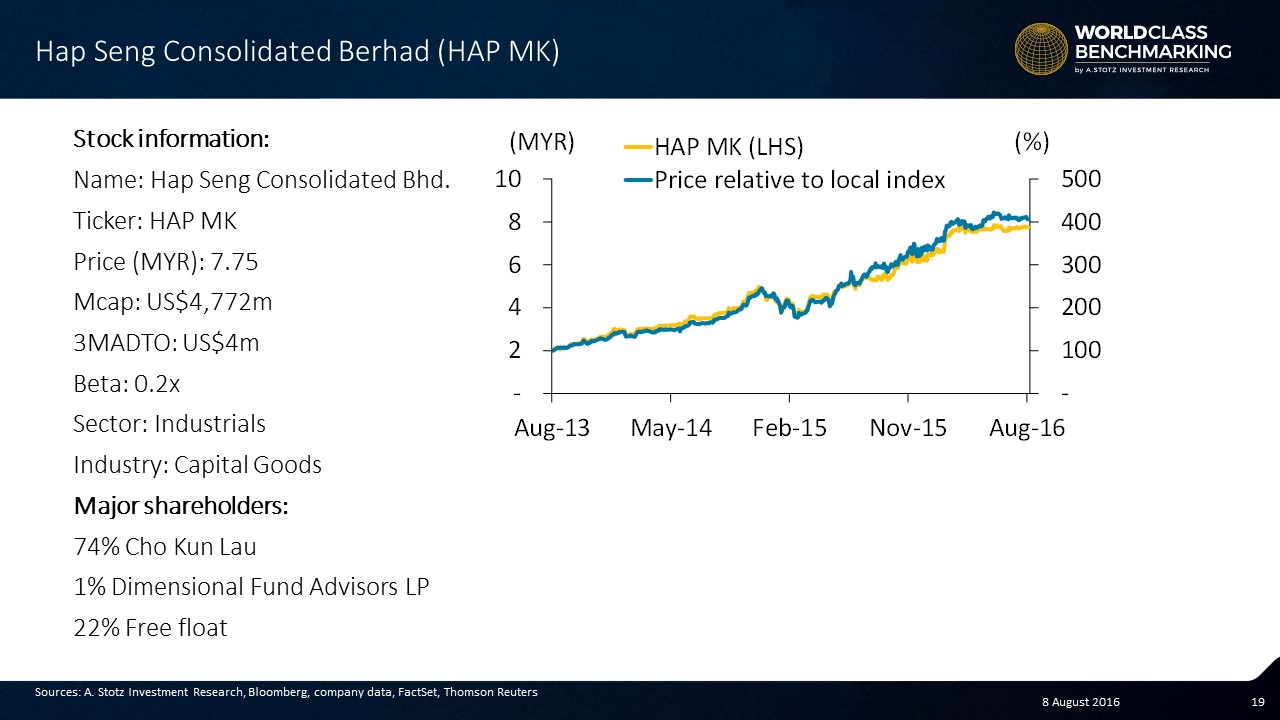

Hap Seng Consolidated Berhad (HAP) is a major Malaysian conglomerate, which was established by the Lau family, its largest shareholders.

Historically, its core business had been palm-oil plantations, but in recent years, property has become its main source of profits. Malaysia constitutes 96% of its business, the rest mainly in Indonesia.

Business Description

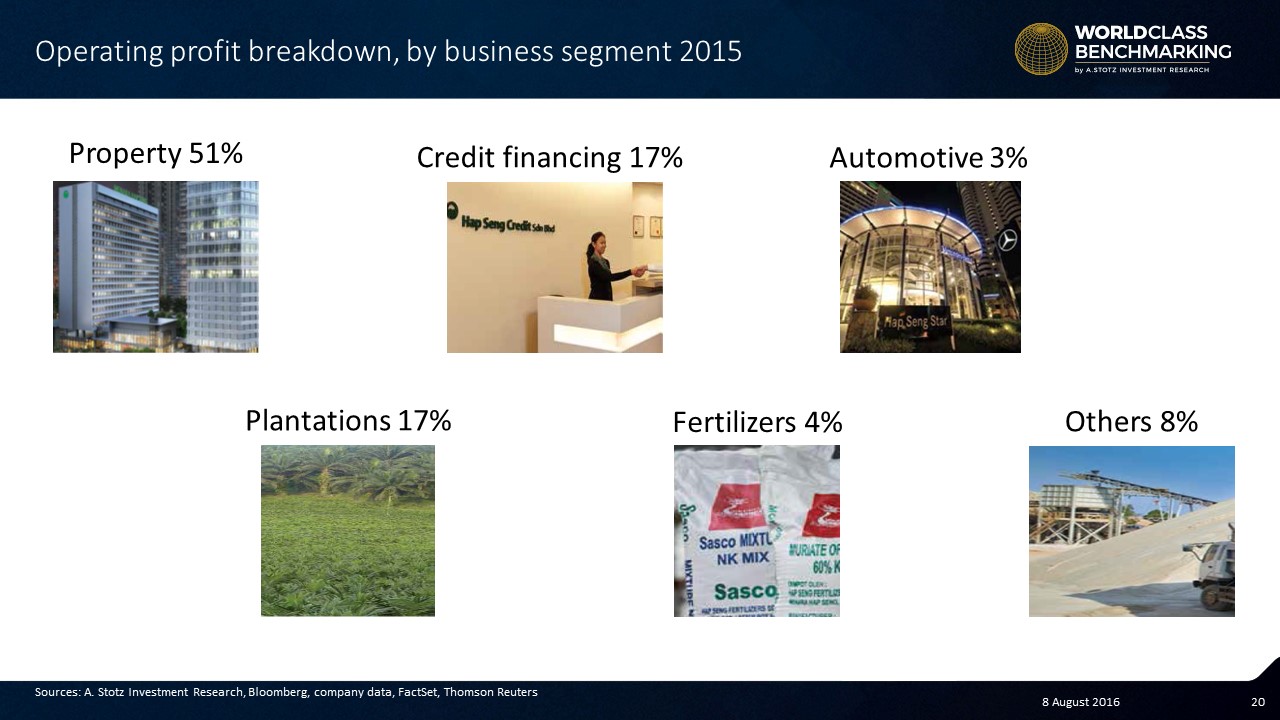

HAP operates in several businesses such as property, plantations, credit financing, fertilizers, automotive, and others such as quarries and trading.

The company’s Property division is involved in the development of residential and commercial properties in Sabah and West Malaysia. HAP’s commercial properties achieve high occupancy rates of over 90% and provide around 1,000,000 square feet of rentable area.

Its Plantations division is engaged in production and distribution of crude palm oil (CPO) with total area of palm plantation accounting for 40,000 hectares, which is in Sabah. HAP produced 160k tons of CPO in 2015.

The Credit financing division operates under Hap Seng Credit Sdn Bhd with the network comprising 10 branches nationwide providing term loans and industrial hire purchase financing to small and medium companies.

HAP’s Fertilizers trading business is operated through eight warehousing facilities in Malaysia and five in Indonesia, offering several types of fertilizers used on plantations. HAP has 35% of the fertilizer market share in East Malaysia and around 17% in Peninsular Malaysia.

Leadership

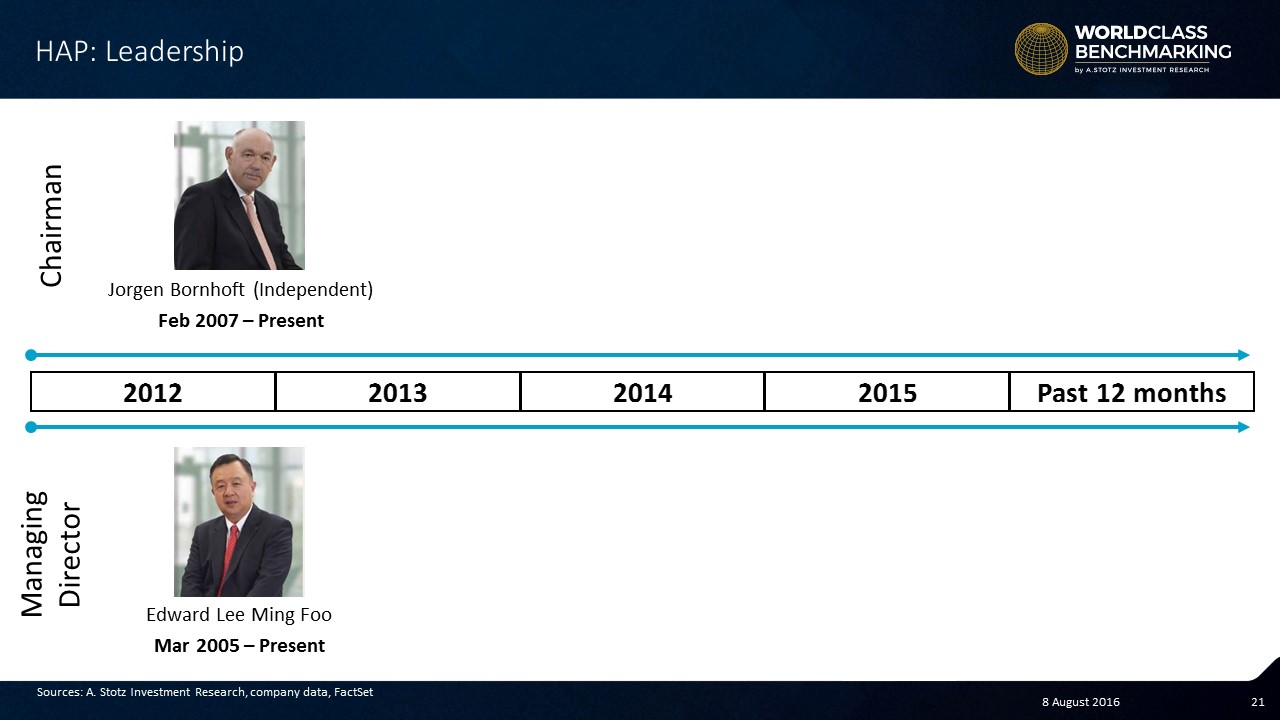

The Chairman of the Board is Jorgen Bornhoft who is an independent director and has held this position since 1 February 2007. He is a Danish national who first joined the board as an independent non-executive director in January 2005.

Jorgen Bornhoft is also a director of Fraser & Neave Holdings Bhd and the vice-chairman of International Beverage Holdings Limited. Behind him, he has a more than 15-year long career at top positions within Carlsberg in Denmark and Asia.

Edward Lee Ming Foo became the Managing Director of Hap Seng Consolidated on 31 March 2005. He joined the Board on 1 November 2000 as a non-independent non-executive director, and became an executive director in March 2002.

Edward Lee is also the Managing Director of Gek Poh (Holdings) Sdn Bhd and Hap Seng Plantations Holdings Bhd. Hap Seng Consolidated is the majority shareholder of Hap Seng Plantations, and Gek Poh is the holding company of Hap Seng Consolidated.

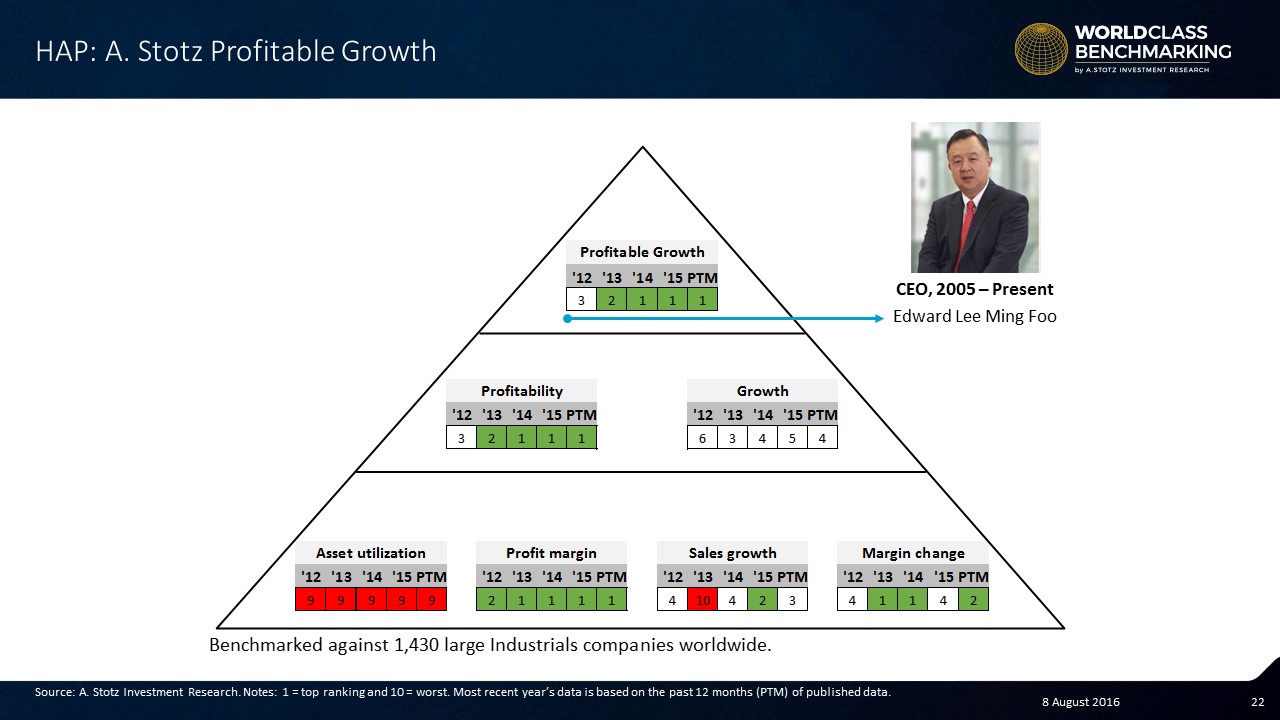

When you look at the Profitable Growth rank in the chart below you’ll see that Edward Lee Ming Foo has been running HAP with great success for the past five years, taking the company from a #3 rank on Profitable Growth in 2012 to the #1 rank it has maintained since 2014.

World Class Benchmarking

Profitable Growth has maintained its #1 rank since 2014. This means HAP ranks better than 1,287 of 1,430 large Industrials companies globally.

Profitability maintained its #1 rank and is the main driver for HAP’s Profitable Growth rank. HAP ranks among the best 143 large Industrials companies globally on ROA. The Growth rank returned to its #4 rank from #5 in 2015.

Asset utilization has been ranked #9 since 2012, while the Profit margin has been stable at the top. Sales growth fell to #3 from #2.

Margin change improved to #2 from #4. It was an improved margin rather than more sales that drove the Growth rank.

Do YOU invest in conglomerates? Why / Why not?

If you like our research, please share with your friends.

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.