Learning Valuation: Zhongsheng Group Holdings

Disclaimer:

This example was created on January 16, 2017. This is NOT a valuation, forecast, rating, or recommendation; rather, it is a teaching example. What follows is NOT investment advice; rather, it is a teaching example. It is intended only as academic information to those who want to learn about valuation. It should not be construed as the basis for any valuation or investment. The information in this presentation came from various sources which we believe are reliable, though we do not guarantee the accuracy, adequacy or completeness of such information. We hope you enjoy learning about valuation as much as we do!

Background

Zhongsheng Group Holdings Limited is a leading automobile retailer in China. The group distributes luxury and mid-tier automobiles from popular brands.

The company has more than 200 dealerships in 70 cities across 20 provinces. It was the first to have dealership rights for Toyota and one of the first dealerships for Lexus and Audi in China.

Mercedes-Benz’s launch of the new E class is expected to increase margins due to its high retail price.

Business plan for stores to standardize operations and reduce average inventory days (-32% YoY in the first half of 2016) start to show results, as finance costs fell 20% YoY in 1H16.

First, let’s look at the revenue breakdown of the company.

We can see that luxury sales account for over 59% and mid-tier sales bring in 29%. After-sales servicing then bring in the remaining 12%.

Forecast

As I always say, valuation is about 90% forecast and 10% valuation.

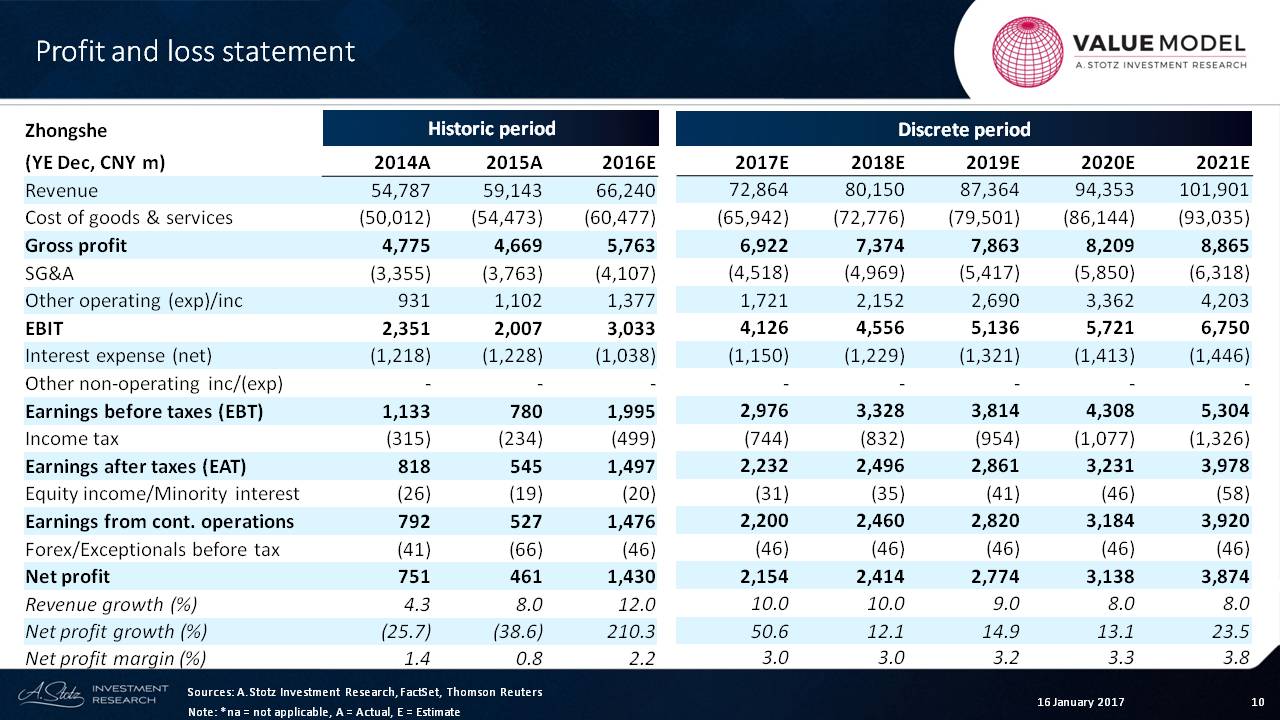

Below, we can see preliminary results from the company. I am going to highlight a few things right here.

The first thing is that we can see revenue continuing to grow, although it’s not particularly fast. But if we look back, we see that the company’s revenue growth has been accelerating.

But will that trend continue?

It’s hard to tell at this point. But that brings us to the next feature, which is the net profit growth. So far it has been pretty volatile and large. And we can see the negative period of time that stems from a tough time in the domestic Chinese market.

And then, what I’m going to forecast is that net margin recovers to between 3% and 3.8%.

It’s not overly optimistic, but it is sanguine about things getting better for the company.

Assets

Now, let’s take a look at the assets of the company and understand a little bit about what’s going on.

First of all, I’m expecting that they’ll slightly tighten their receivables collections. The company is trying to reduce the number of days that it takes for them to convert the inventory to sales.

They’ve already brought it from 54.5 down to 43.7, so I’m going to be a little bit pessimistic and say that it’s going to rise slightly.

We can also see the growth in total assets, which starts at about 10% and then trails down to about 7% or so.

I like to look at my growth and my revenue relative to the growth of my assets.

The company generally has more revenue per assets in place, and I expect it to basically stay flat from where it is right now.

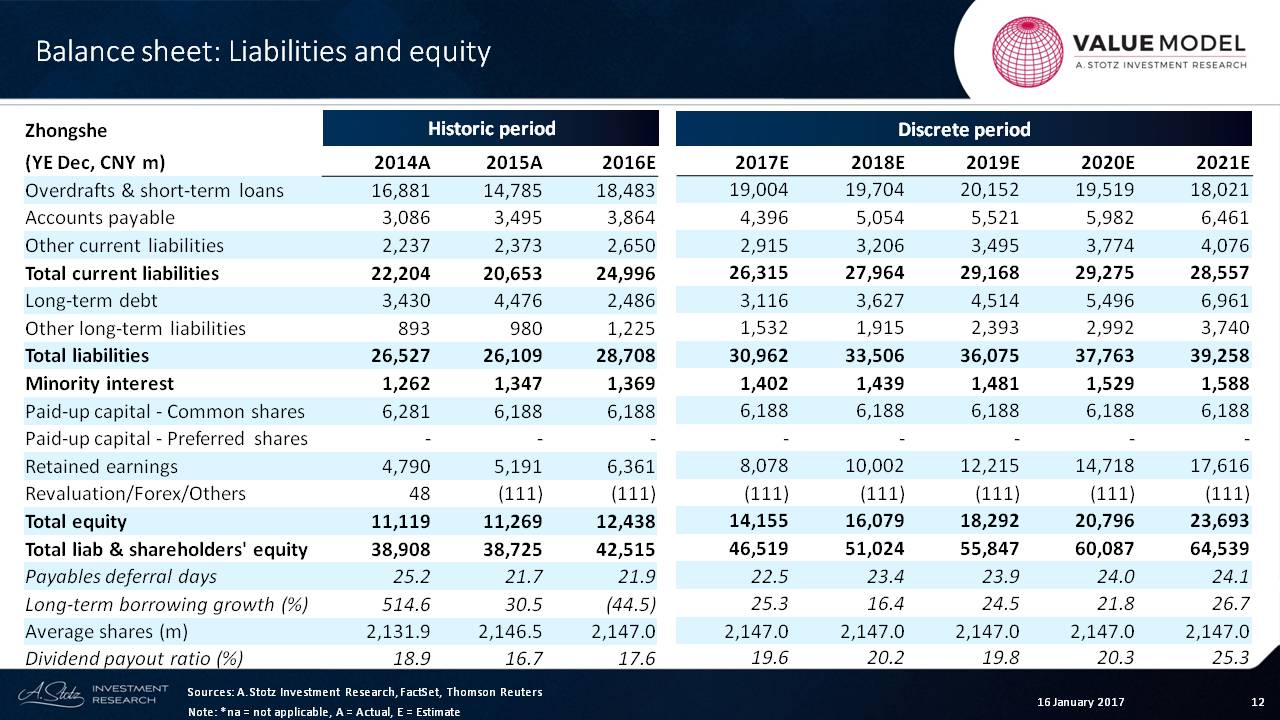

Liabilities and Equity

One of the things we can see on the liability side is that they do have a lot of short-term borrowing, and I think that’s going to remain the case. In fact, the company doesn’t do a lot of long-term borrowing, and that may be something that changes over time, depending on what’s happening with interest rates at that time.

What we can also see is that the company’s dividend payout ratio has been between 15% t0 20% up until now, and I’m going to bring it up to 25% by that period of time.

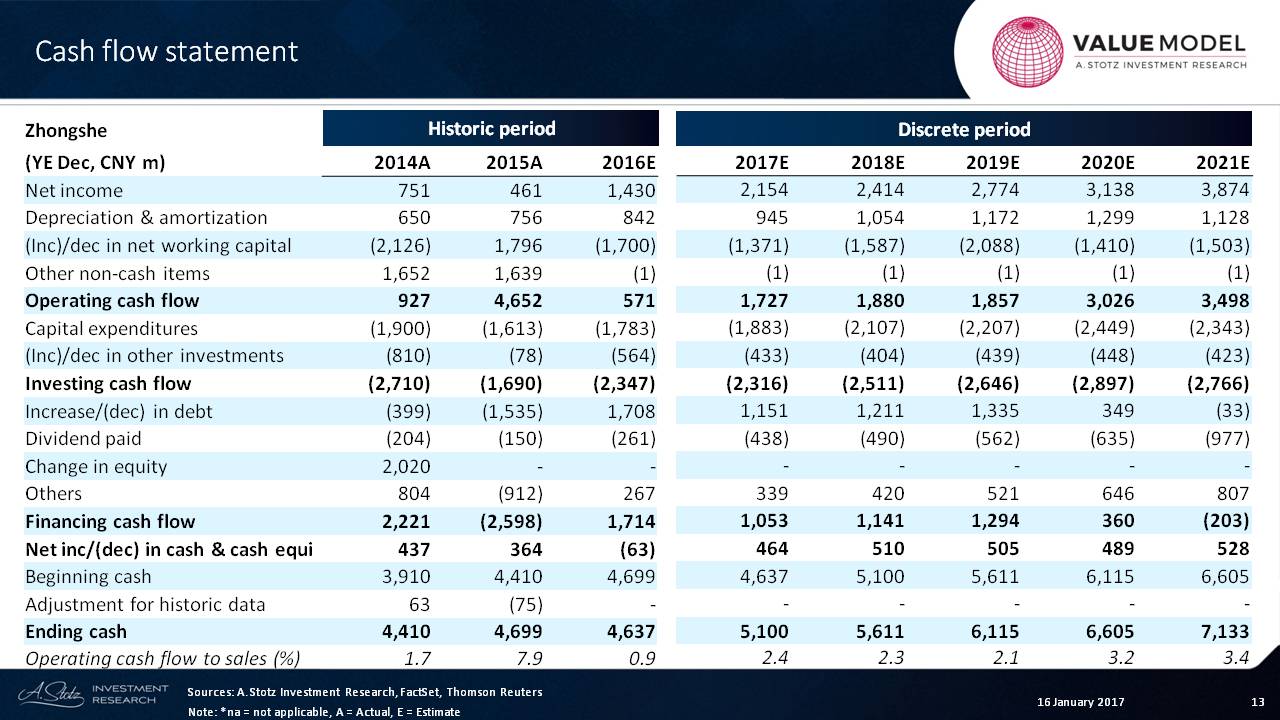

Cash Flow

The thing that I look at very carefully in cash flow is what’s happening with the net working capital. And when you’re forecasting for any company, net working capital is really an outcome of your forecast. Sometimes, it can be a bit strange, so you want to make sure that it’s usually negative. The point is that this is an investment for growth.

And then, you’ve got CAPEX, which you can see increasing steadily over time.

Free Cash Flow

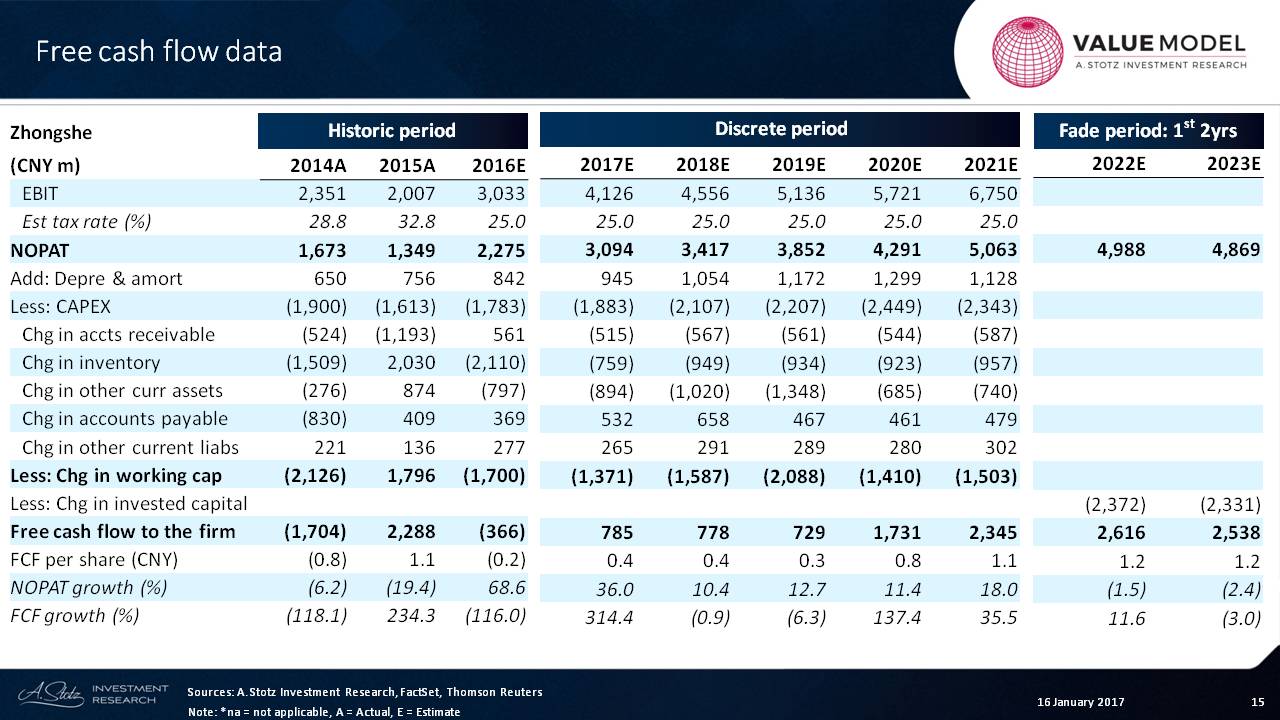

So we want to take those forecasts and then produce a free cash flow output.

With free cash flow, the things that I look at are the CAPEX and the change in the working capital.

The result of those two items, plus NOPAT, in adding back the depreciation, gives us free cash flow to the firm.

And then in my model, I’m always looking at a fade period of about five to ten years ─ and this is just showing the first two years of that fade period ─ so we can understand what’s happening with the free cash flow over that timeline.

Invested Capital

The company has seen a recovery in the return on invested capital, and I think that that’s going to continue. That’s what we’re forecasting here.

We can see the amount of invested capital that’s in the company.

Per Share Data

The earnings per share is going to grow at, let’s say, 49%, 11%, and 15%. Because dividend payout ratio is going to rise slightly in 2021, the amount of growth in dividend per share is very high.

We always want to be careful when we’re increasing our dividend payout ratio. It must be done gradually. Otherwise, you get these massive jumps that may or may not really make sense.

My gosh, who really knows anything about what’s going to happen in 2021, anyways!

Cost of Capital

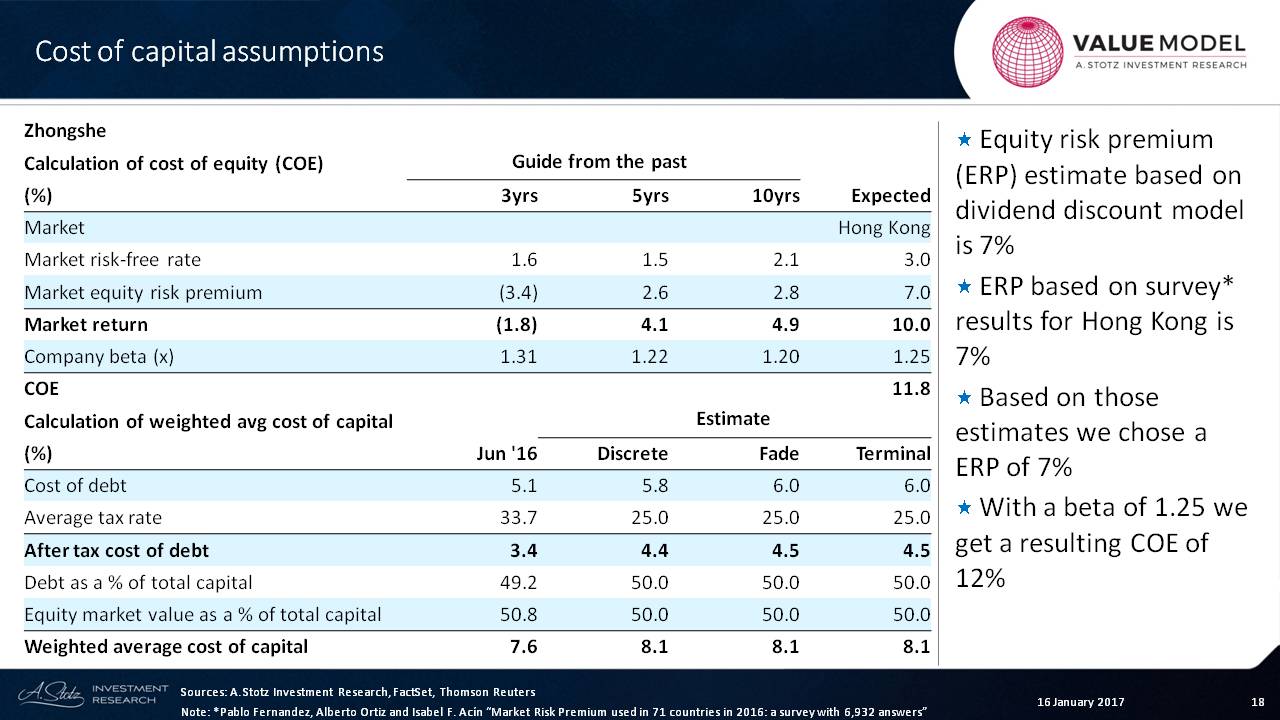

Let’s move on to the cost of capital assumptions. Here I’m going to use the Hong Kong market return, because that’s where the company is listed. And what we can see is that the market risk-free rate has been about 1.5% to 2%, but I think that’s going to go up, since it’s been in an unusually low interest rate environment during this decade.

I’m going to use 3%, remembering that everything that we put into this column is to infinity.

First of all, the equity risk-premium estimate, based upon a dividend discount model, is about 7%. And the ERP, based on survey results from a research paper that we’ve looked at, is also about 7%.

Based on that data, I’m going to keep it simple and stick to 7%. And as I always say, the most important thing is to check your result. Yes, it was a negative market return, followed by returns of 4 and 4.9.

Should we say that it’s going to be the average of that?

Well, I don’t think that that necessarily make sense. What I’m looking at is the actual discount rate that we want to discount from now until infinity, and I’m going to choose 10%.

The company’s beta is somewhat high, so I’m going to choose 1.25. That gives me a cost of equity of 11.8.

Since it is the case that they have a tax rate that’s reasonably high ─ about 25% ─ and about 50% of their financing comes from debt, this means that the weighted average cost of capital of about 8.1 is much lower than the 11.8 that we see there.

Terminal Factors

Now, the next thing we have to do is choose a fade period, and I’ve chosen a fade period of five years.

The return on invested capital was about 11%. But we’re going to show that the return on invested capital at the fade period means 8.1. Remember, that was the weighted average cost of capital (WACC).

The ROC is not going to fade down to a premium. There is no premium or discount. It’s going to fade down to the WACC at about 8.1.

Finally, we have the growth of the cash flows at the terminal period.

Remember, this growth item depends on what cash flow we’re talking about. It could be dividends, or it could be the growth in the free cash flow.

As a result, we’re going to get multiples that we’re going to use for that terminal value of about 19.5 and about 11.4.

If we look at that, we can now see the fading that we’re doing with NOPAT, as we fade down the return on invested capital.

Absolute Valuation

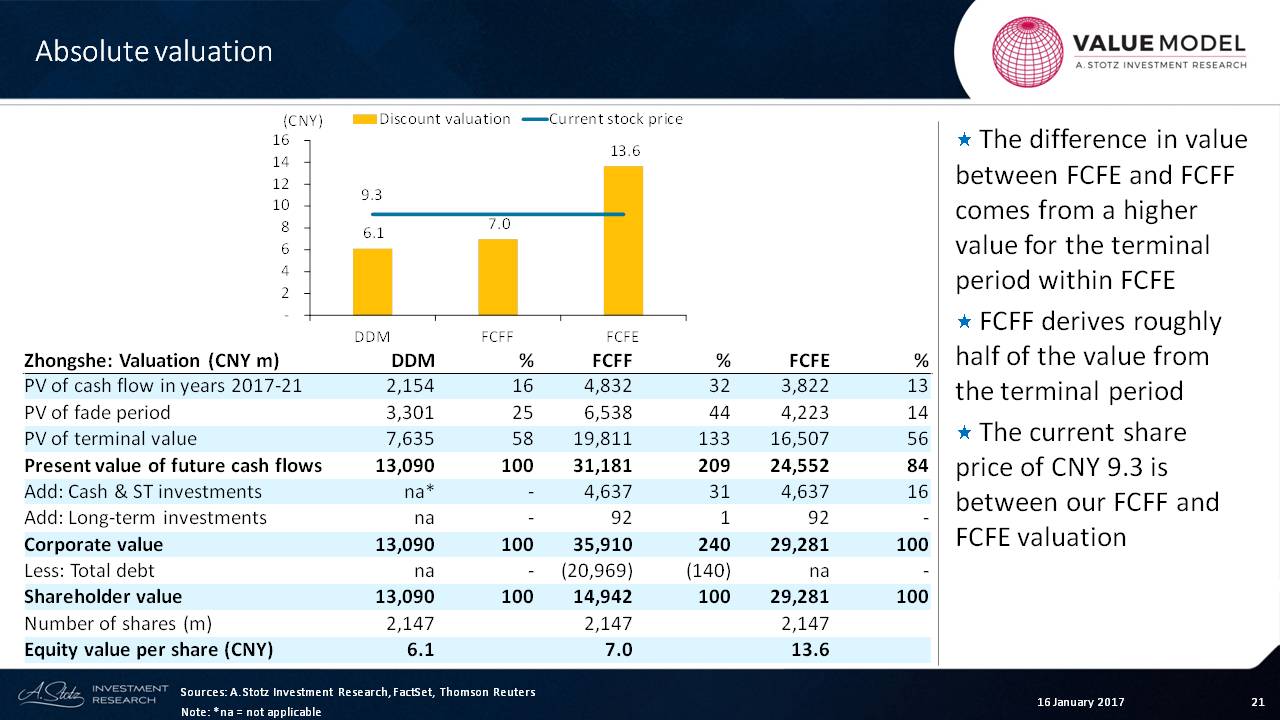

So what output does this produce from an absolute valuation perspective?

You can see in the chart that the price is currently about CNY 9.3 per share. The DDM gives a CNY 6.1 valuation, and DDM tends to be understated a bit compared to the other methods.

Free cash flow to the firm values the company at about CNY 7 per share, and free cash flow to equity values it at about CNY 13.6 per share.

Now, there are a few items that are still open to debate.

The first one is that 58% of the value in the DDM comes from the terminal period. Remember, I said that the multiple was a little bit high, so maybe we should adjust that.

The other thing is we can see that the company does have a lot of debt. We’re going to reduce the corporate value by the amount of debt to get the shareholder value. That means that the present value of the terminal value is about 133% of the total value that we came up with of about 7.

Finally, without the skewed nature of that debt, we can see the free cash flow to equity at 29,281, which gives a value of about 13.6.

That’s quite a range from 6 to almost 14.

Relative Valuation

How about relative valuation? Does that provide us any guidance?

So it’s 6 to 14.

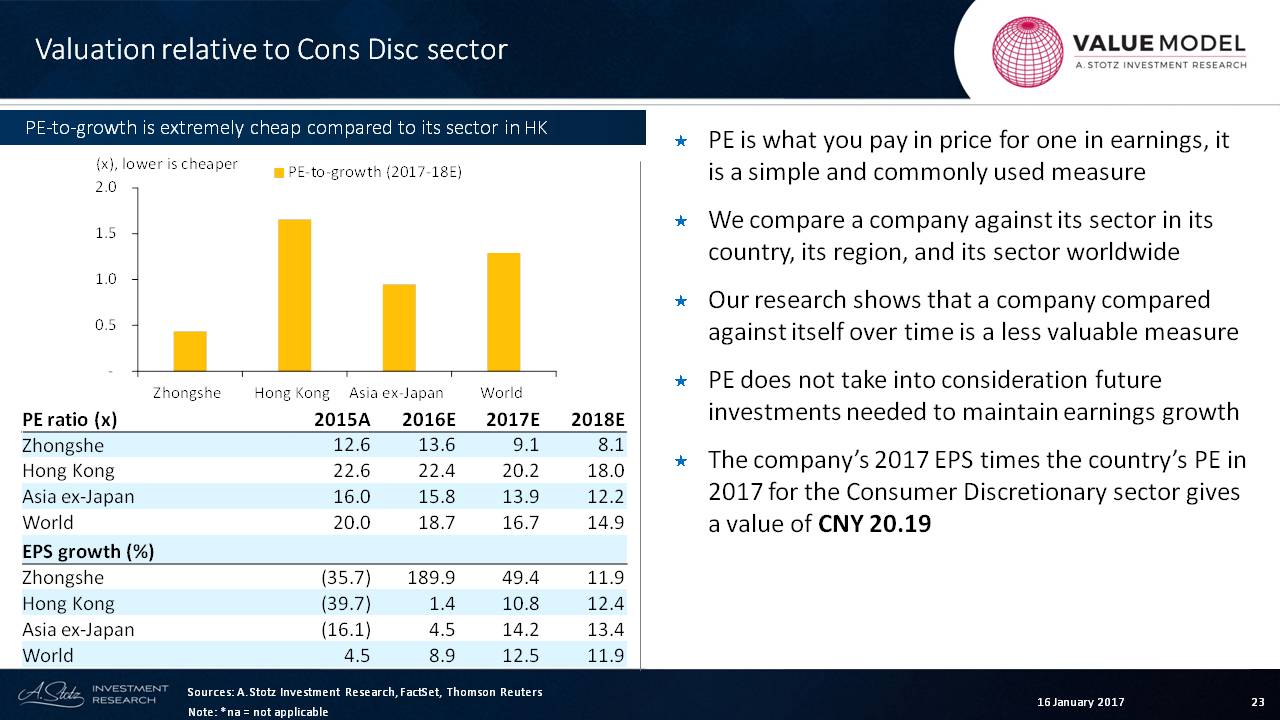

Let’s first look at PE-to-growth. Remember, PE is what you pay in price for one in earnings and it is a simple and commonly used measure.

We compare a company against its sector in its country, its region, as well as its sector worldwide.

Our research shows that a company compared against itself over time is a less valuable measure than comparing it against, for instance, other companies.

The PE does not take into consideration future investments needed to maintain earnings growth. That’s what free cash flow does.

So the company’s 2017 EPS multiplied by the country’s PE in 2017 sits at a multiple of 20 versus the company’s at 9, which would give a value of CNY 20.19.

Remember, we were at a range of 6 to 14 and, all of a sudden, we’re at 20.9.

However, we may have a reason to say, “Well, it shouldn’t rank at such a high multiple.” There are many different debatable reasons, though we can’t say, “Well, the EPS of the growth is going to be pretty strong.” But someone may say, “Well, that was just kind of a one-off. Now, it’s going to be at about industry average.”

It could also be that in Hong Kong there are a lot of domestic companies that are listed, and so the PE multiple is higher for them than it is for Chinese companies.

There are lots of questions that could be raised, but based on the basic research it appears to be cheaper on a PE-to-growth basis, and part of that is because of this large growth.

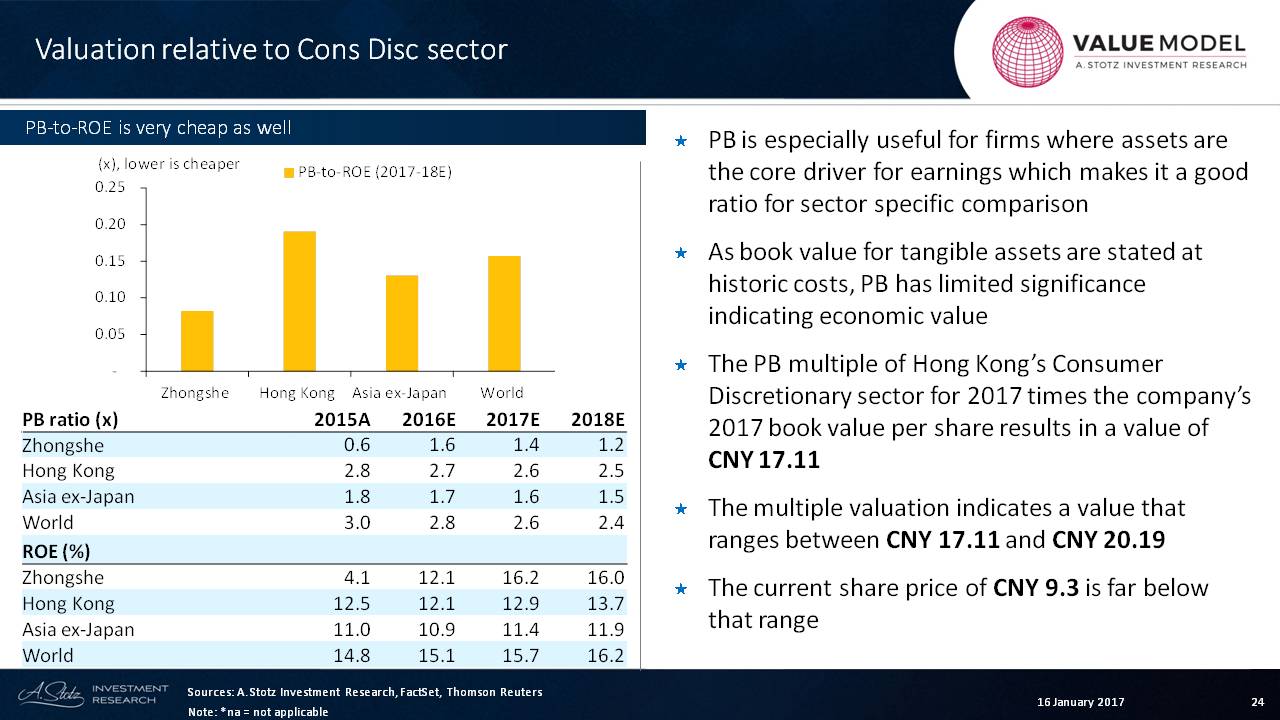

Now, we can see that price-to-book is especially useful for firms where assets are the core driver of earnings. This makes it a good ratio for sector specific comparison.

As book value for tangible assets are stated at historic costs, price-to-book has limited significance for indicating what the economic value of the company is.

The price-to-book multiple of Hong Kong’s consumer sector for 2017 multiplied by the company’s 2017 book value per share results in a value of ─ my gosh, look at that! ─ CNY 17.

Could it really be 17? That gives us a range of CNY 17 to CNY 20. Remember, in the absolute valuation, we had a range of 6 to 14.

So which is it?

Well, that depends. And we can see that the current share price is about CNY 7 right now.

It is hard to say that this company is really cheap compared to the overall market. There are more questions that this raises.

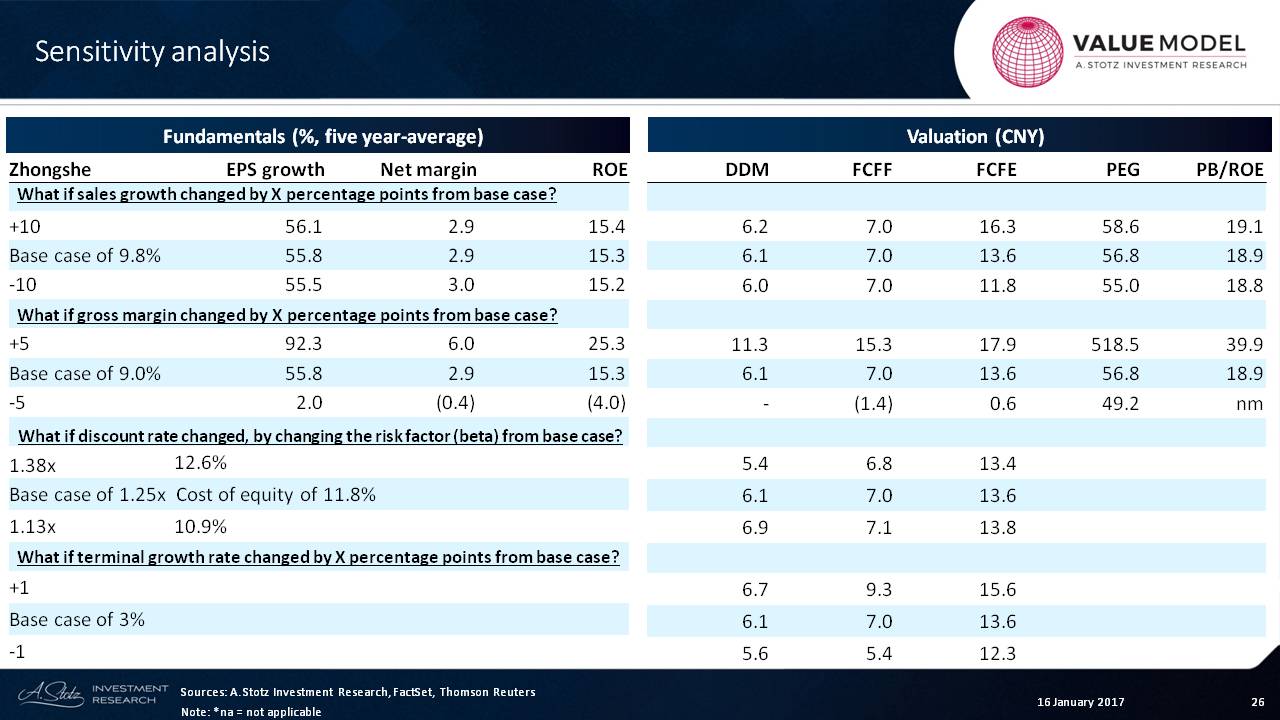

Sensitivity Analysis

I look at sensitivity related to growth, sales and margins, the discount rate and the terminal growth rate.

The key thing on this chart is just to show that the gross margin of this company is very low. So a 5 percentage point change is pretty significant, and that can pretty easily push the company into a negative net margin or a negative ROE.

So we have to be careful in our forecasting on that gross margin.

We can also see that from a free cash flow to equity perspective, for instance, it can be a massive swing from almost no value to about 18.

The PEG ratio is almost always super volatile, and we can see that continues here. So it’s a hard one to just apply randomly.

So there you go! That’s the value of the company as I see it. I hope that you learned from this.

Check out the World Class Benchmarking of Zhongsheng Group Holdings

If you have any questions or comments or experiences with valuation or Zhongsheng Group, leave them below… we want to talk to YOU.