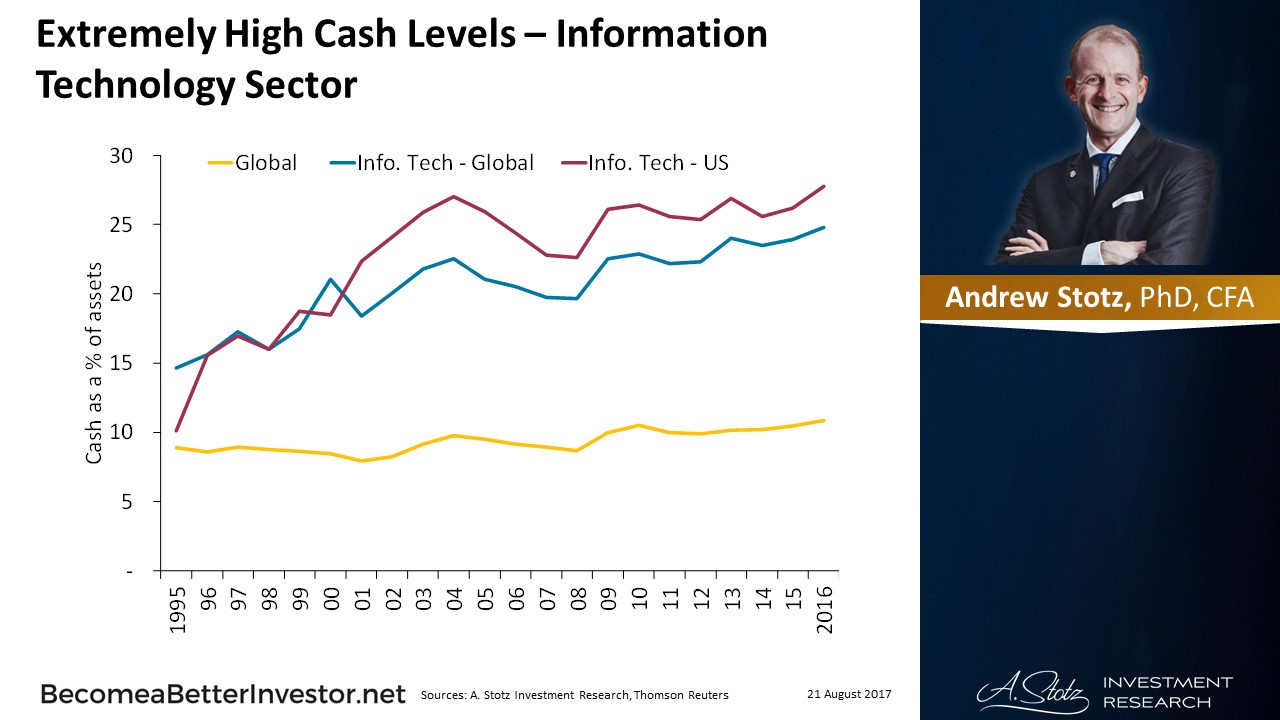

Info Tech Companies Have Massive Amounts of Cash

Watch the video with Andrew Stotz or read a summary of it below.

Over the last few weeks, we have been considering the causes of the rising cash levels at US companies. First, I looked at what academia had to say about it and then realized that the question asked was the wrong one. After that, I looked into how much cash is held at companies in various regions around the world.

Today, I’ll look into how much cash is held at companies in various sectors around the world.

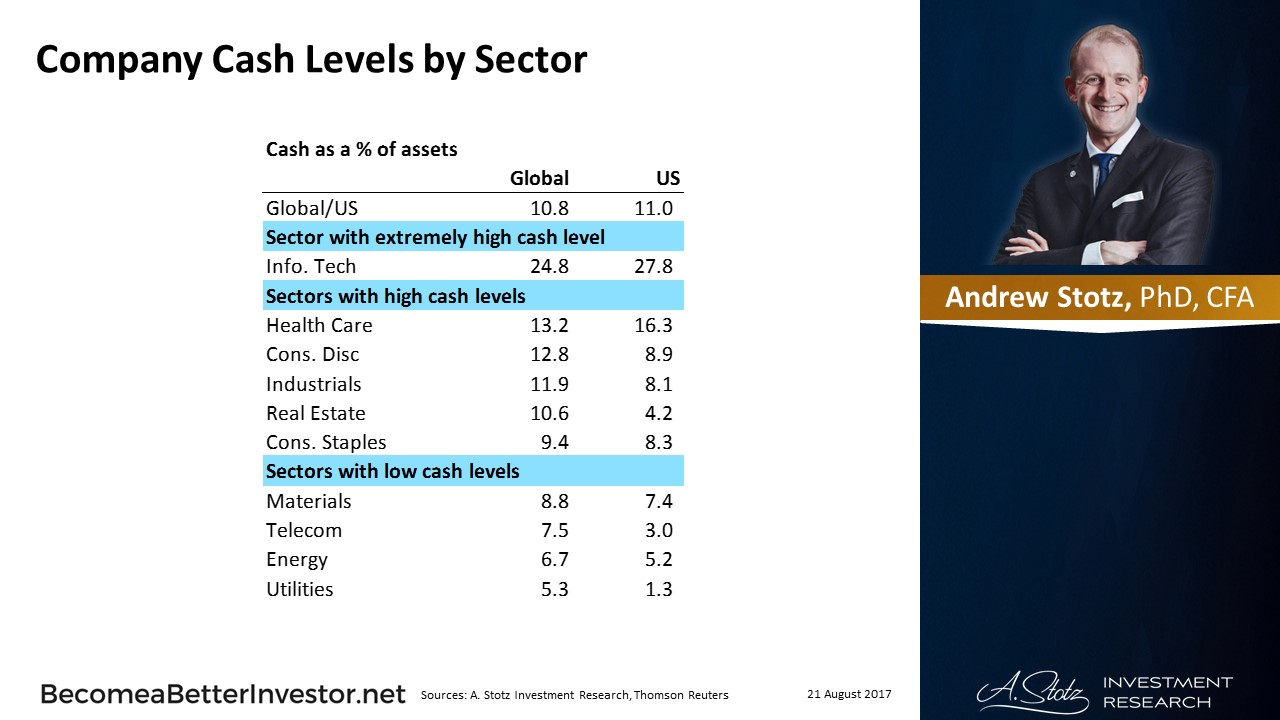

Company Cash Levels by Sector

Changes in Cash Levels by Global Sectors

Consider sectors across the world from the late 90s (average from 1995 to 2001) to the last seven years (average from 2009 to 2016).

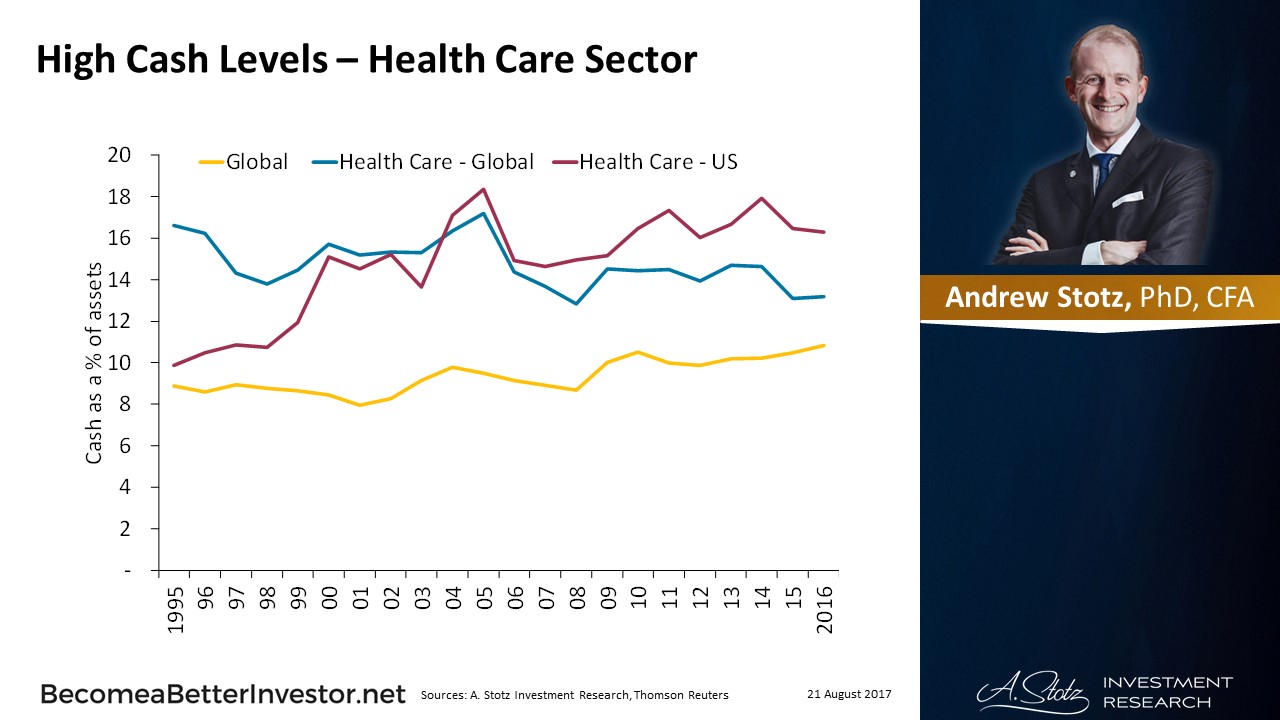

Sectors with small changes

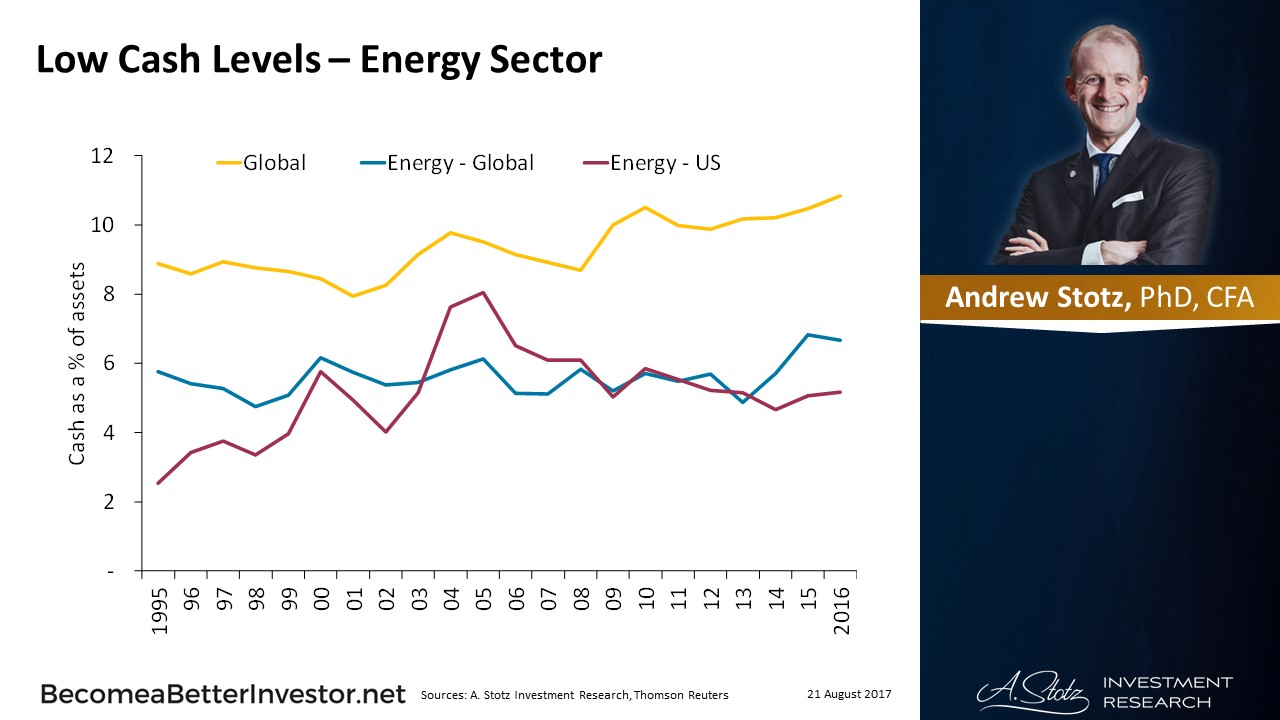

- Energy moved only from 5.4% to 5.8%

- Health Care from 15.2% to 14.1%

Sectors with large changes

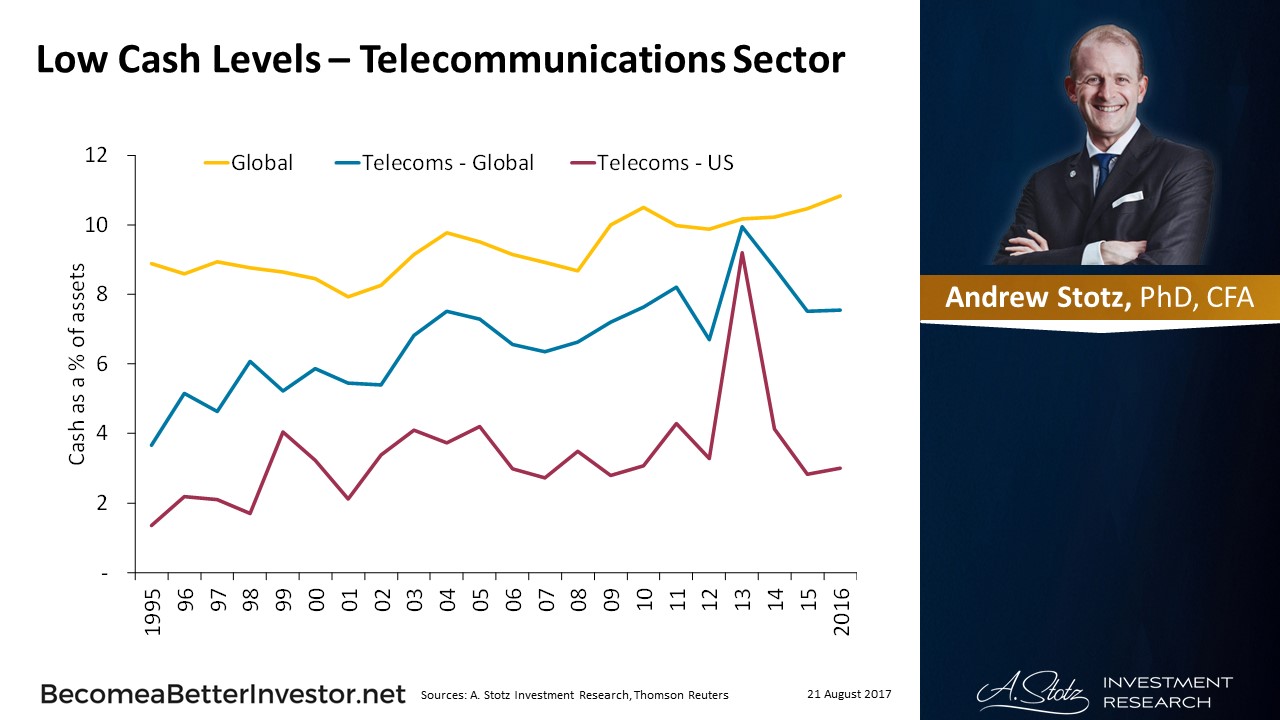

- Telecommunication Services from 5.1% to 7.9%

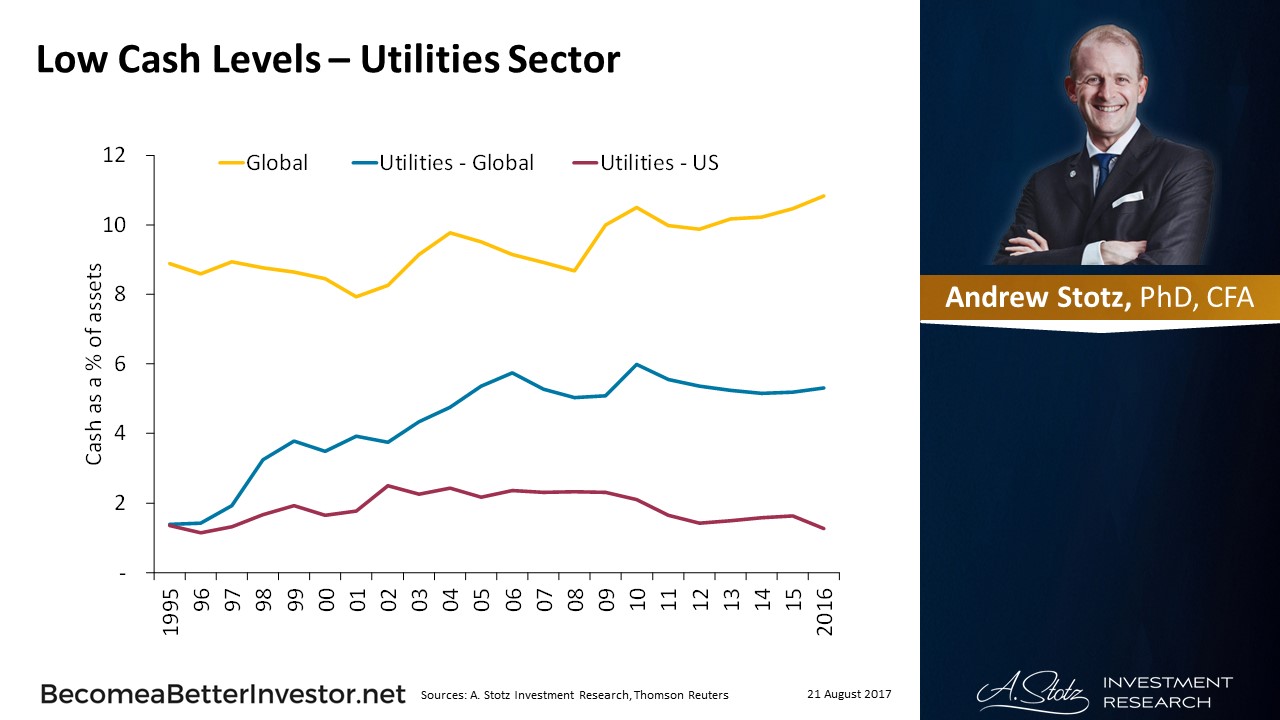

- Utilities from 2.7% to 5.4%

Changes in Cash Levels by US Sectors

Consider sectors across the world from the late 90s (average from 1995 to 2001) to the last seven years (average from 2009 to 2016).

Sectors with small changes

- Real Estate from 5.4% to 5.7%

- Utilities from 1.5% to 1.7%

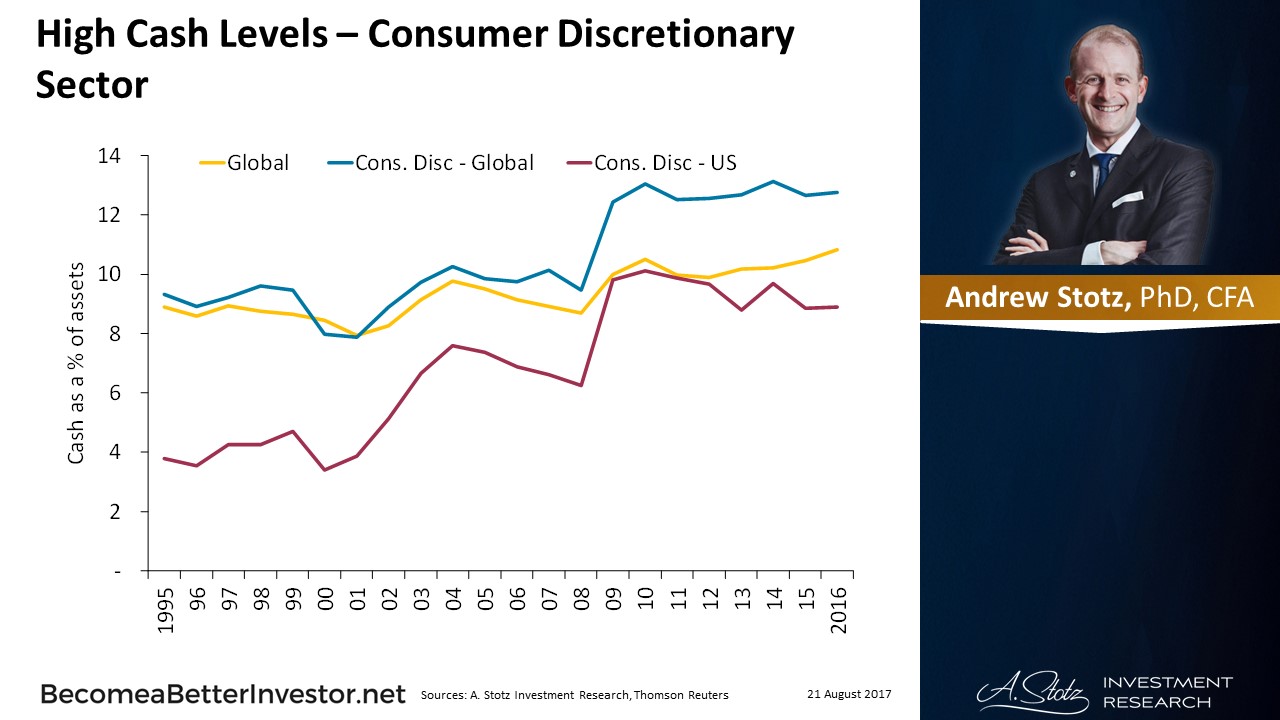

Sectors with large changes

- Consumer Discretionary from 4.0% to 9.5%

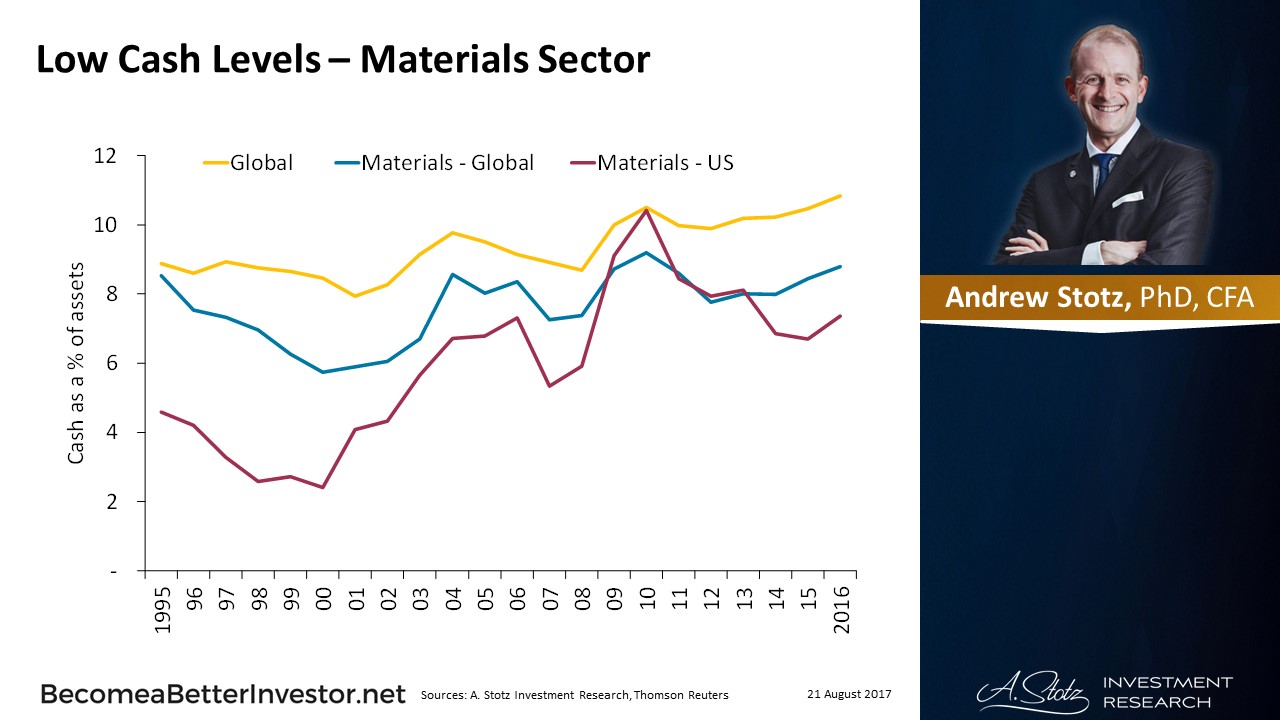

- Materials from 3.4% to 8.1%

Extremely High Cash Levels

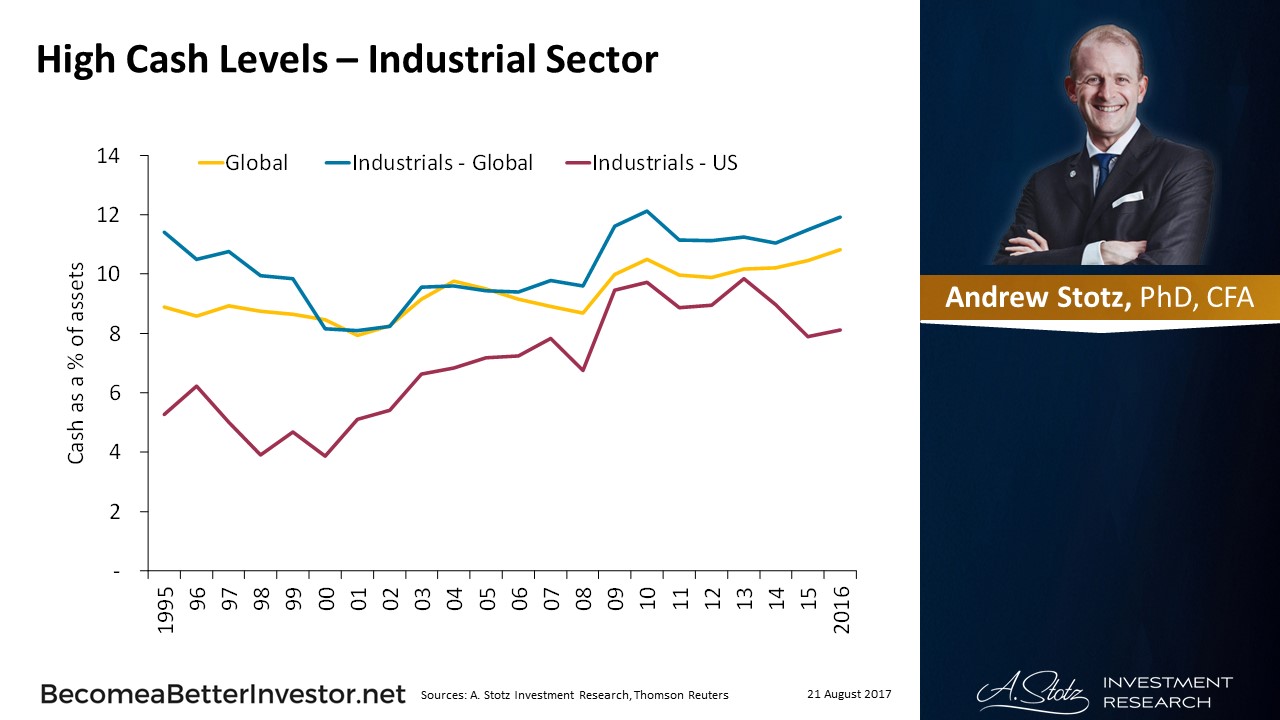

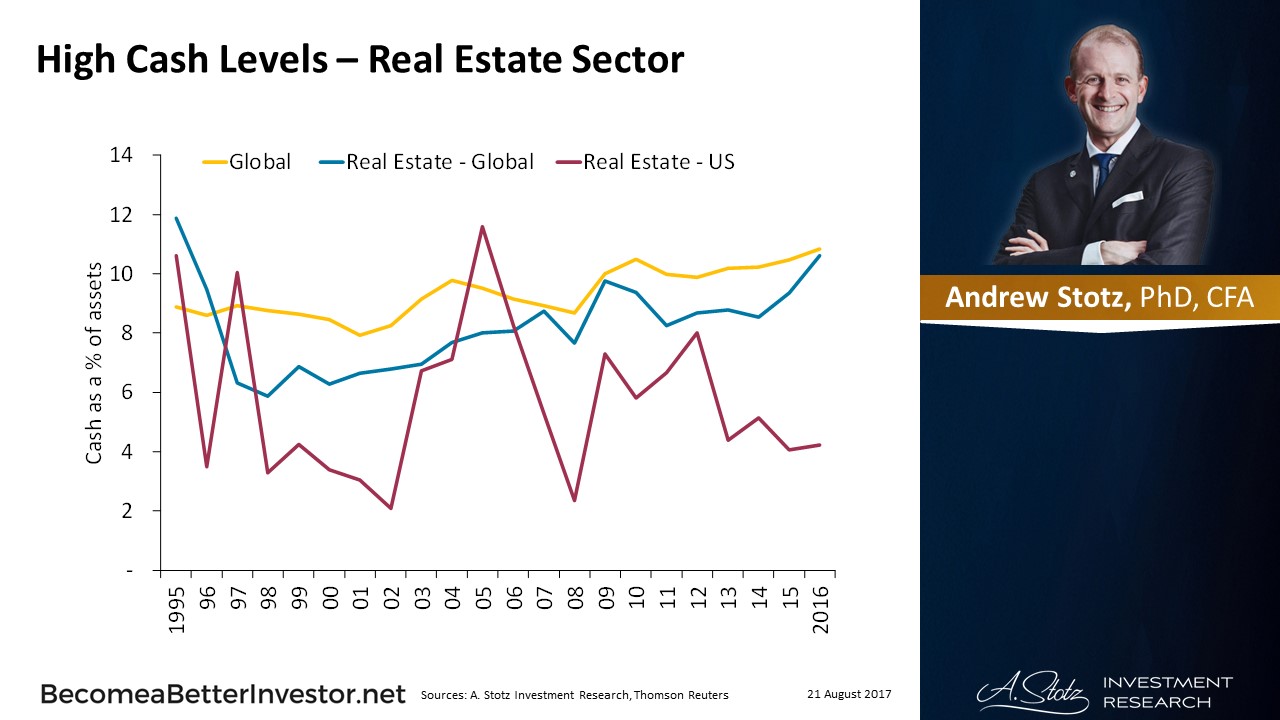

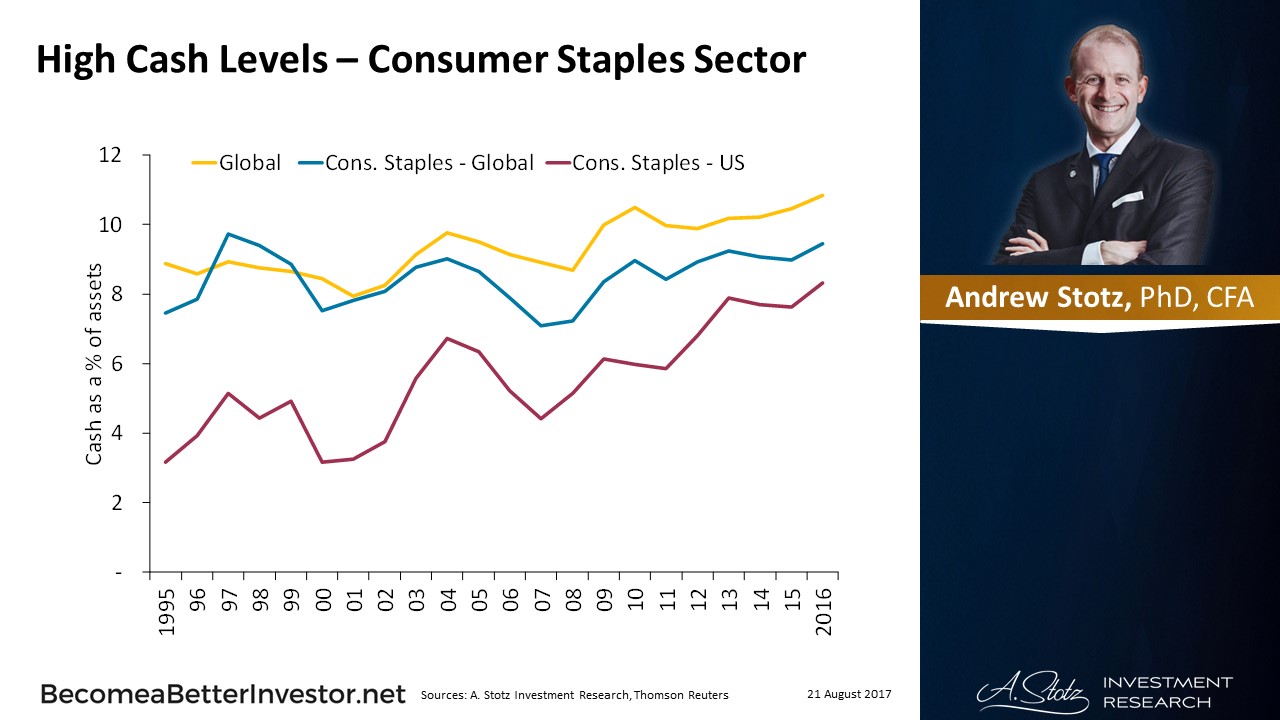

High Cash Levels

Low Cash Levels

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.