Dirt Cheap Stocks Are Too Risky

At A. Stotz Investment Research we look at investing through our FVMR framework: Fundamentals, Valuation, Momentum, and Risk. To come up with investment strategies for portfolios that should generate above-benchmark return we do a lot of backtesting. Below you can see a few factors that we consider when we look at the valuation of a company.

We previously tested a Fundamentals factor, return on assets in Investing Is Not Just Buying Highly Profitable Companies. In this post, we will put price-to-book to test.

Hypothesis

Investing in cheap companies with low price-to-book (PB) generates outperformance.

Universe

When backtesting, you should use original statements (and not re-stated) to avoid hindsight bias. When you backtest you also need to know and adjust for when a company closes its books. A company may close its books in December but that data is only available some months after on the announcement date. Focus on the announcement date when you backtest.

This was our process to come up with a global universe to test our hypothesis:

- Started with all companies listed anywhere in the world with a market capitalization of more than or equal to US$40m, which left us with 26,564 companies

- Applied a US$50m minimum market capitalization screen, which left us with 25,039 companies

- Filtered out illiquid stocks with a three-month average daily turnover of less than US$250,000 and was left with 16,270 stocks

- Excluded stocks of financial companies

- Excluded companies that did not close their books in December

- We removed 6,439 stocks (40%), leaving 9,831

Methodology

- On the last day of March of each year we ranked all stocks from lowest PB to highest

- Divided that list up into deciles

- Measured the share price performance of each decile over the coming 12 months

- Re-ranked after 12 months and reallocated the money of each decile into the new stocks included in each decile

- Repeated for 10 years

Results

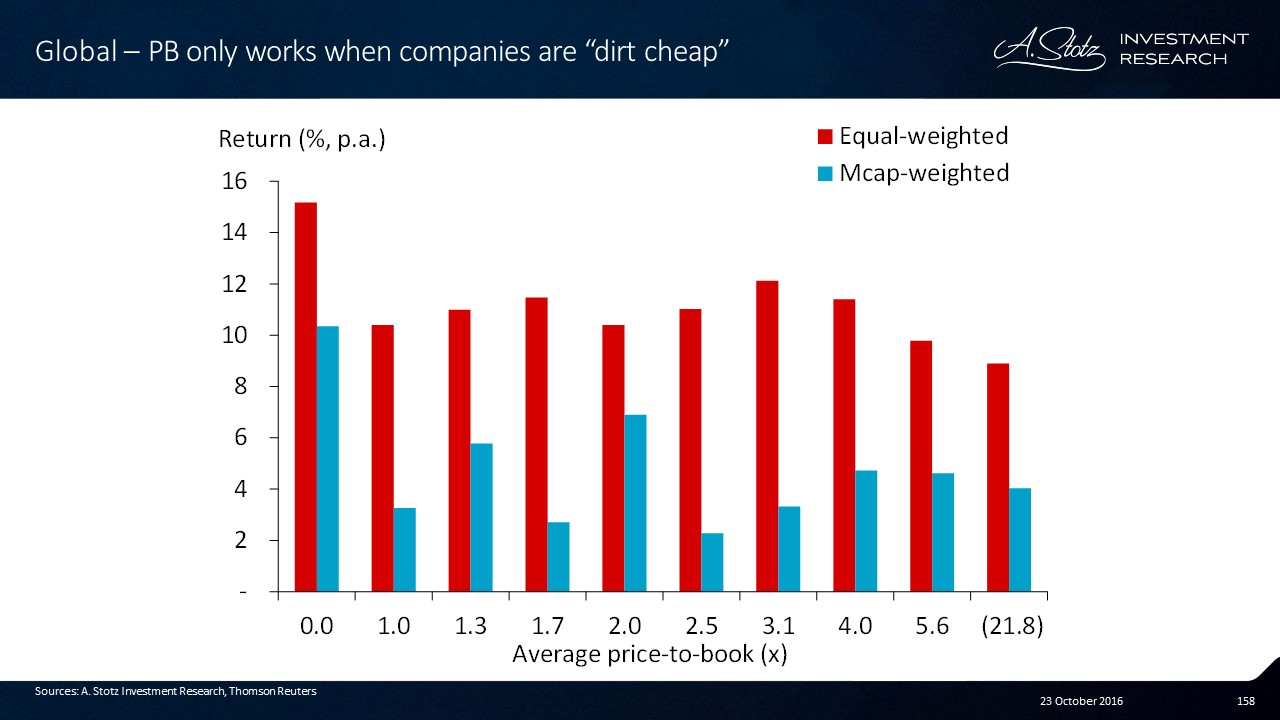

Investing in cheap stocks with low price-to-book only seems to work when they’re dirt cheap. The return of the decile with the lowest PB stocks had the highest return both for equal-weighted and market cap-weighted. With exception for this decile there is no clear relationship.

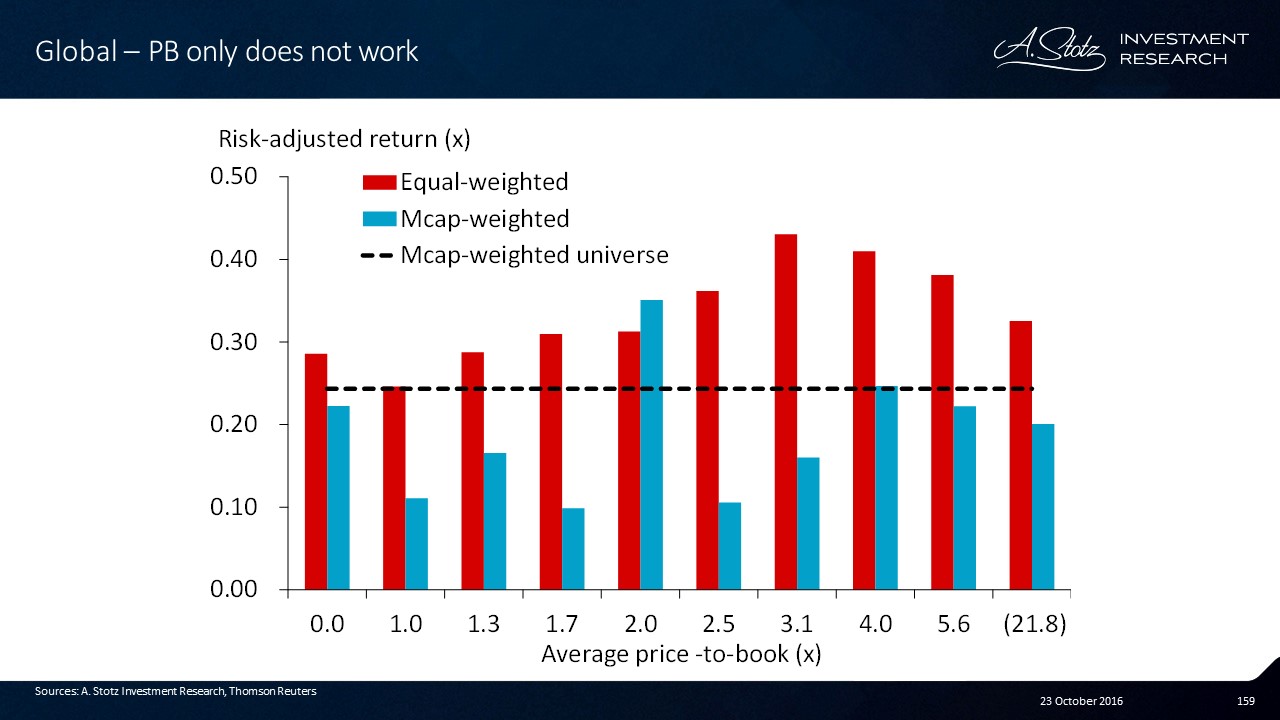

Investing in low PB only doesn’t work. When we have adjusted for risk, it no longer works, not even for the dirt cheap stocks.

For market cap-weighted there is no clear relationship and for equal-weighted it actually looks like expensive stocks with high PB generates higher risk-adjusted return.

Conclusion

Our hypothesis turned out to be wrong, we can’t support that investing in low PB stocks generates higher future returns. Investing based on PB alone doesn’t seem to work.

It’s not uncommon when backtesting that you find that a factor doesn’t work. However, you shouldn’t give up. Some factors only work in certain markets and many times you neeed to find a combination of factors that work.

Going forward we’ll test Momentum and Risk factors, stay tuned.

Is this the results you expected from price-to-book?

Let us know your thoughts in a comment below.

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.