Become a Better Investor Newsletter – 6 April 2024

Noteworthy this week

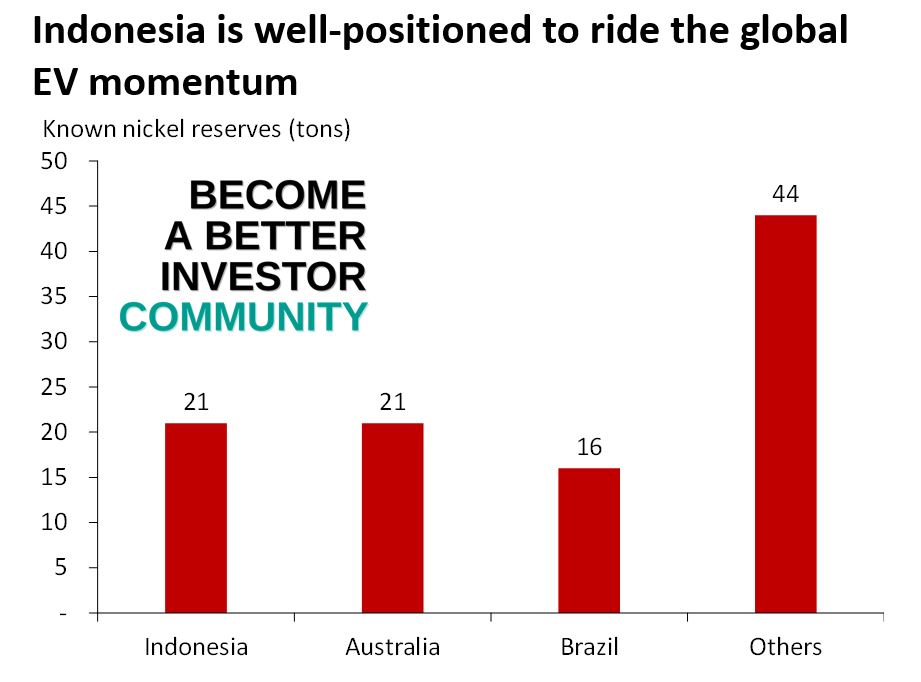

- China is picking up

- New ATHs for gold

- US halts SPR refill

- S&P 493 picking up on Mag 7

- Top talent still moves to the US

China is picking up: The Chinese purchasing managers’ index moved to expansive territory in February due to rising export orders. Is China on the way to recovery?

#China expansion explains world trade pickup pic.twitter.com/I451w8wcd2

— CrossBorder Capital (@crossbordercap) March 31, 2024

New ATHs for gold: The gold price reached new heights during the week, as it traded above US$2,300/oz t for the first time in history.

And we have liftoff! Gold blasting to new all-time highs 🚀 pic.twitter.com/7S0jJQ0uYE

— Barchart (@Barchart) April 1, 2024

US halts SPR refill: The Biden Administration has decided not to refill the Strategic Petroleum Reserve (SPR) due to surging oil prices.

The US government drew down the Strategic Petroleum Reserve to supply the market when prices were high.

But when prices were low, they didn’t refill it much, and today they cancelled their latest buy orders due to rising prices.

Sticking the landing is the hard part. pic.twitter.com/bwaEghPQne

— Lyn Alden (@LynAldenContact) April 3, 2024

S&P 493 picking up on Mag 7: The expectation is that the S&P 500 companies outside the Magnificent 7 are about to catch up in terms of earnings growth. Price performance within the S&P 500 has been broader in 2024YTD compared to 2023.

The Magnificent Seven stocks grew their earnings by 37% over the last year while the remaining 493 companies in the S&P 500 saw a 2% decline. By the 4th quarter of this year, this trend is expected to reverse w/ an 18% YoY increase for the 493 vs. a 15% increase for the Mag 7. pic.twitter.com/YmxOCDbNIJ

— Charlie Bilello (@charliebilello) April 2, 2024

Top talent still moves to the US: An important future growth driver is attracting top talent. The US is still the number one destination by far for top talent from around the world.

While the US and UK remain highly attractive for young top talent Germany is laser focused on remaining a magnet for immigration into its generous social system. pic.twitter.com/DljqsRraSo

— Michael A. Arouet (@MichaelAArouet) April 3, 2024

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

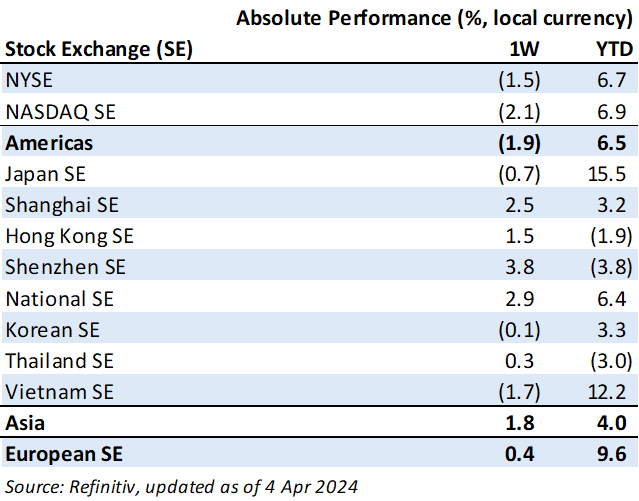

Weekly market performance

Click here to see more markets and periods.

Chart of the week

Discussed in the Become a Better Investor Community this week

“We just uploaded the performance review of our Global Asset Allocation Strategy.”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

RWH041: IGNORE THE CROWD W/ SUPER-INVESTOR BRUCE BERKOWITZ

“In this episode, William Green chats with famed investor Bruce Berkowitz, whose Fairholme Fund has beaten the S&P 500 by 529 percentage points over 23 years. Bruce, who was named Morningstar’s Domestic Stock-Fund Manager of the Decade in 2009, talks here about the ups & downs of his volatile career, how he changed his investment strategy after three costly losses, why he likes cash as a kind of “financial valium,” & why 80% of his fund is riding on one stock.”

Readings this week

Has the Rise of Passive Funds Really Broken Markets?

“Recent data from Morningstar showed that at the close of 2023, assets in passive funds had overtaken those in their active counterparts. This was a moment of celebration for advocates of passive investing, but also came against a backdrop of active investors – most notably hedge fund manager David Einhorn – claiming that this shift had broken markets. So, is the continued growth of passive funds simply validation for a better way of investing, or terrible news for the efficient functioning of capital markets?”

Book recommendation

Prisoners of Geography: Ten Maps That Explain Everything About the World by Tim Marshall

“Maps have a mysterious hold over us. Whether ancient, crumbling parchments or generated by Google, maps tell us things we want to know, not only about our current location or where we are going but about the world in general. And yet, when it comes to geo-politics, much of what we are told is generated by analysts and other experts who have neglected to refer to a map of the place in question..”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

How to become a millionaire:

– get elected to congress

– insider trade

– profit— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA) April 3, 2024

— Stewart Alsop 🇬🇾- Host of Crazy Wisdom Podcast (@StewartalsopIII) April 3, 2024

Published on Become a Better Investor this week

Did Dr. Deming forbid setting goals? Dive into this discussion about healthy goal setting, learn why your process matters, and the four things you need to understand before you start on goals. This episode is the first in a 4-part series about goal setting.

Listen to Goal Setting Is Often An Act of Desperation: Part 1

Jiangsu Guoxin Corporation Limited (002608 SZ): Profitable Growth rank of 8 was up compared to the prior period’s 10th rank. This is below average performance compared to 1,460 large Industrials companies worldwide.

Read Jiangsu Guoxin Corp – World Class Benchmarking

PTT Public Company Limited (PTT TB): Profitable Growth rank of 9 was down compared to the prior period’s 8th rank. This is poor performance compared to 320 large Energy companies worldwide.

Read PTT – World Class Benchmarking

Asian markets were up in 1Q24 except for China, Thailand and Hong Kong in local currencies. Taiwan was the strongest performer in USD and local terms.

Read Taiwan Was the Best Performer in Asia in 1Q24

In March 2024, we published 7 new episodes of the My Worst Investment Ever podcast. Listen to all of them here.

Listen to My Worst Investment Ever March 2024

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.