Become a Better Investor Newsletter – 24 June 2023

Noteworthy this week

- The market doesn’t appear efficient

- It’s a liquidity-driven market

- Cardboard box recession

- BlackRock files for Bitcoin ETF

- Crypto investors push up BTC in anticipation of ETF

The market doesn’t appear efficient: Risk and return go hand in hand in financial theory. But right now, the same return, no matter if you pick low, medium, or high risk. Remarkable!

This would make efficient market maximalists want to quit their profession. https://t.co/AxjQneNDHC

— BowTiedBull – Read Pinned Tweet or NGMI (@BowTiedBull) June 22, 2023

It’s a liquidity-driven market: It may not be news to you, but it’s a good reminder of central banks’ impact on the markets. One starts to think about how long it can last.

Seriously, what’s the point of listening to all the stocks analysts if the only thing that counts is liquidity? (Apollo) pic.twitter.com/Z3ZKSR5Ojw

— Michael A. Arouet (@MichaelAArouet) June 18, 2023

Cardboard box recession: Paperboard production is another recession indicator, as most of our goods are delivered in cardboard boxes. Looking at the production, a recession appears to be on the way.

Recession indicator.

When you see paperboard production decline, watch out. How does everything arrive at your home? In a cardboard box. How does a crew take a shipment on the receiving dock? In many cases, in cardboard boxes. Capacity utilization drops next, 2024.

1/2 pic.twitter.com/Q5w1NEUIr3

— Jeff Weniger (@JeffWeniger) June 21, 2023

BlackRock files for Bitcoin ETF: BlackRock’s track record is 575-1 for getting ETF approvals, which makes this noteworthy. Still, ETF experts are cautious. Filings from other large asset managers followed BlackRock’s filing.

From what I read we’re the most optimistic among ETF experts (just as we were re ProShares futures ETF). Why not higher odds tho? Bc 10 years of denials is no joke. So even tho BlackRock is 575-1 in getting ETFs through the SEC, the SEC is 33-0 in denying spot filings. https://t.co/9GIl488IBj

— Eric Balchunas (@EricBalchunas) June 21, 2023

Crypto investors push up BTC in anticipation of ETF: Following the filings of Bitcoin (BTC) spot ETFs, the BTC price saw a big jump.

Bitcoin is up ~18% since BlackRock’s spot ETF filing pic.twitter.com/It23iJbWJr

— Katie Greifeld (@kgreifeld) June 21, 2023

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

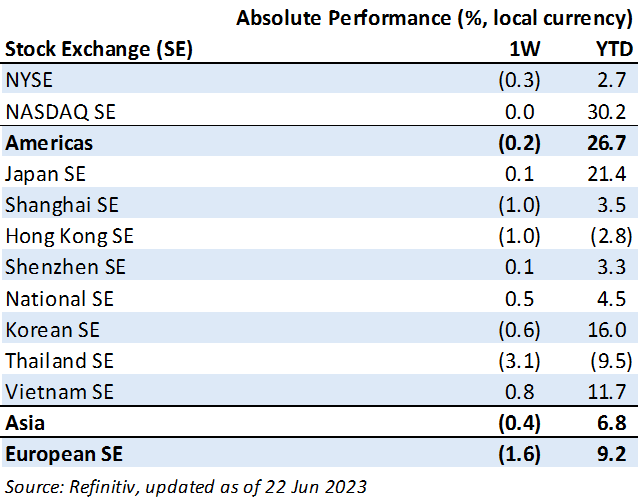

Weekly market performance

Click here to see more markets and periods.

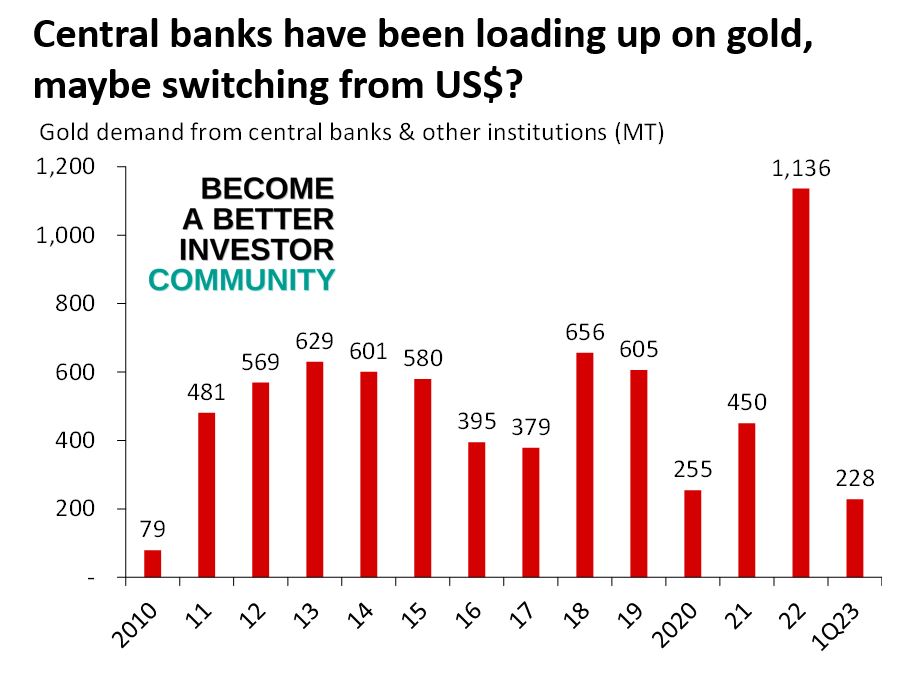

Chart of the week

Discussed in the Become a Better Investor Community this week

“By year-end 2023, US inflation at 3%, Fed Fund rate at 2.25% to try to counteract the US deflationary recession.

Reasons a US recession is coming:

- Inverted yield curve is screaming recession

- Extremely low unemployment signals a recession

- Slowing US Bank lending

- No end in sight to US real estate damage caused by Fed’s extreme rate rise

What is your opinion?”

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

The Joe Rogan Experience | #1999 Robert Kennedy, Jr.

“Robert F. Kennedy, Jr. is an attorney, founder of the Waterkeeper Alliance and Children’s Health Defense, author, and 2024 candidate for the office of the President of the United States of America.”

Listen to/watch the episode on Spotify

Readings this week

The Spectrum of Financial Dependence and Independence

“I did not intend to get rich. I just wanted to get independent.” – Munger

Book recommendation

Freezing Order: A True Story of Russian Money Laundering, Murder,and Surviving Vladimir Putin’s Wrath by Bill Browder

“When Bill Browder’s young Russian lawyer, Sergei Magnitsky, was beaten to death in a Moscow jail, Browder made it his life’s mission to go after his killers and make sure they faced justice. The first step of that mission was to uncover who was behind the $230 million tax refund scheme that Magnitsky was killed over. As Browder and his team tracked the money as it flowed out of Russia through the Baltics and Cyprus and on to Western Europe and the Americas, they were shocked to discovere that Vladimir Putin himself was a beneficiary of the crime.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

Good morning…

h/t @philbak1 pic.twitter.com/5vi6Gg511w

— Nate Geraci (@NateGeraci) June 18, 2023

weekends are for memes pic.twitter.com/csovtV6djK

— Phil Bak 🎩 (@philbak1) May 28, 2023

New My Worst Investment Ever episodes

Ep702: Spencer Jakab – Don’t Take Investment Tips from People

BIO: Spencer Jakab is the global editor of the Wall Street Journal’s financial and economic analysis column, Heard on the Street. Prior to becoming a financial journalist 20 years ago, he was a top-rated emerging market stock analyst.

STORY: Spencer took investment advice without doing due diligence and ended up losing his entire investment.

LEARNING: Don’t take investment tips from people; do your due diligence. Diversify your portfolio. Don’t invest more than you can lose.

Access the episode’s show notes and resources

Ep701: Charles Rotblut – Realize When You’re Lucky and Walk Away

BIO: Charles Rotblut, CFA, is a vice president and financial analyst at the American Association of Individual Investors (AAII).

STORY: Charles bought a Dotcom stock in 1998. A week later, the stock had tripled. His dad advised him to take the profits, but he insisted the stock would keep going up. Three days later, the stock lost almost all its value. Charles sold the stock and made very little profit.

LEARNING: Don’t confuse luck with skill. Utilize a rolling stop loss to manage risk. Always have a diversified portfolio.

Access the episode’s show notes and resources

Ep700: Arjun Murti – You’ve Got to Get Out of the Battle At Some Point

BIO: Arjun Murti has over 30 years of experience as an equity research analyst, senior advisor, and board member, with global expertise covering traditional oil & gas and new energy technologies.

STORY: Arjun made a call that oil prices would quintuple from $20 a barrel in the 90s to $105 in the 2000s and stay there for at least five years. The price averaged $100 a barrel from 2000 to 2014, entirely consistent with Arjun’s call. However, after the 2008 financial crisis, the return on capital in the energy sector started falling. Arjun made excuses and continued to ride the wave all the way down.

LEARNING: Let go of your ego and get out of the battle at some point. Frameworks need to grow, evolve and adjust to circumstances. Understand and inculcate reversion to the mean into your thinking.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

In this episode (part 4 of the series), John and Andrew continue their discussion from part 3. They talk about how to use data charting in combination with the Plan-Do-Study-Act cycle to gain the knowledge managers need to lead effectively.

Listen to Building Knowledge Through Predictions: Deming in Schools Case Study with John Dues (Part 4)

In this episode of Investment Strategy Made Simple (ISMS), Andrew and Larry discuss two chapters of Larry’s book Investment Mistakes Even Smart Investors Make and How to Avoid Them. In this sixth episode, they talk about mistake number 9: Do you avoid admitting your investment mistakes? And mistake number 10: Do you pay attention to the experts?

Read ISMS 25: Larry Swedroe – Admit Your Mistakes and Don’t Listen to Fake Experts

Jet2 PLC (JET2 LN): Profitable Growth rank of 4 was up compared to the prior period’s 10th rank. This is above average performance compared to 1,440 large Industrials companies worldwide.

Read Jet2 – World Class Benchmarking

United Integrated Services Company Limited (2404 TT): Profitable Growth rank of 1 was same compared to the prior period’s 1st rank. This is World Class performance compared to 1,440 large Industrials companies worldwide.

Read United Integrated Services – World Class Benchmarking

Goldcard Smart Group Company Limited (300349 SZ): Profitable Growth rank of 5 was up compared to the prior period’s 6th rank. This is average performance compared to 820 medium Info Tech companies worldwide.

Read Goldcard Smart Group – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.