Andrew Stotz on Bloomberg: Thai Banks Look Pretty Interesting

Andrew appeared on Bloomberg Markets today discussing the upcoming election in Thailand, the current state of the Thai economy and his thoughts on the Thai equity market. You can see the full interview from Bloomberg and the supporting materials below.

Thailand’s state of the union

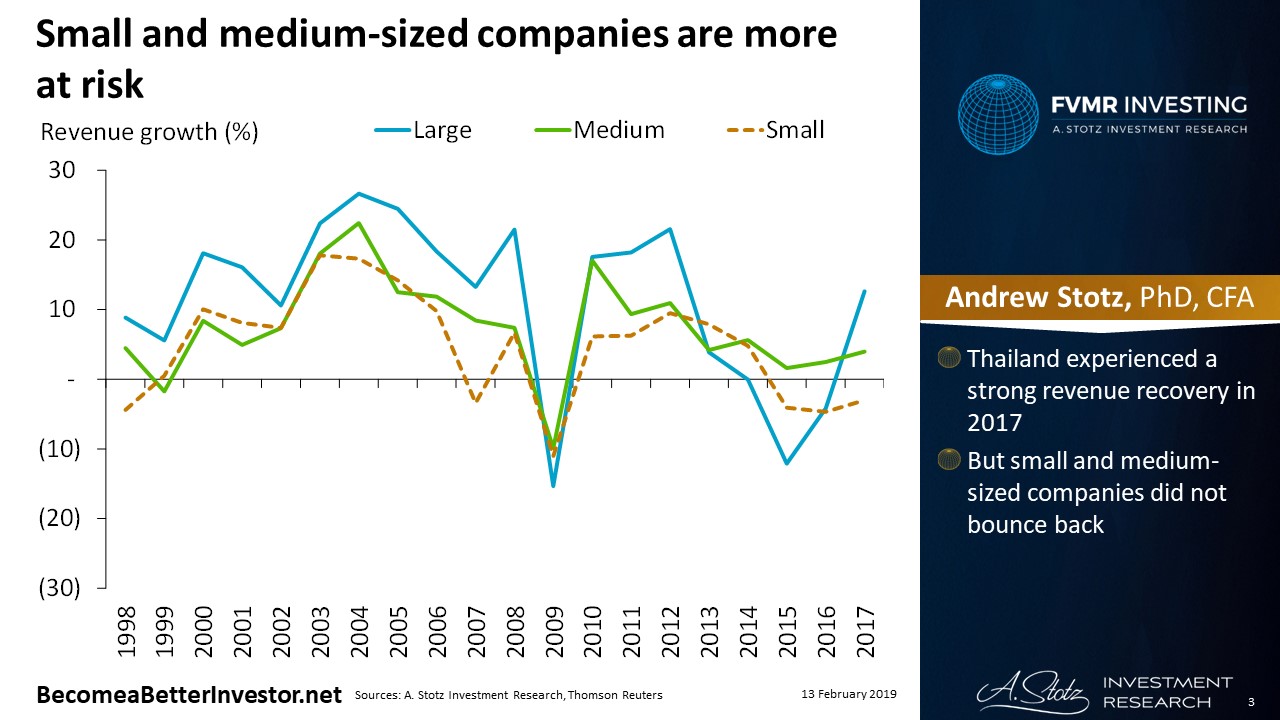

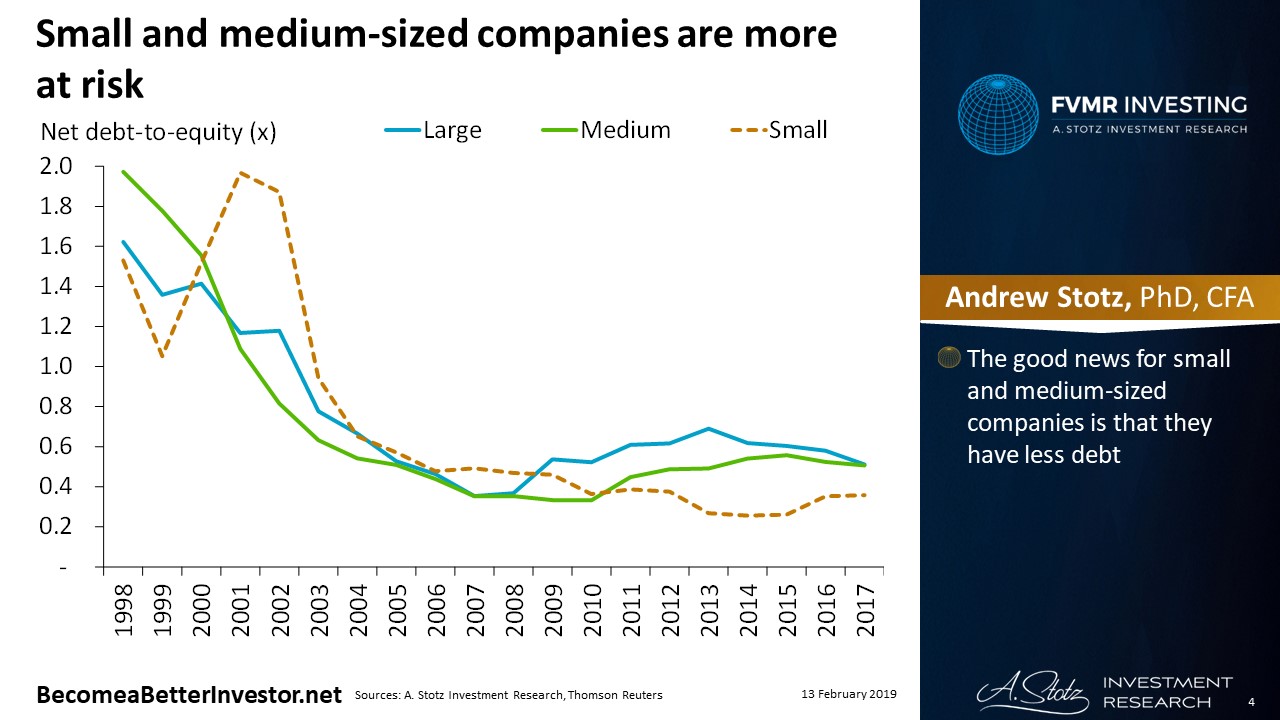

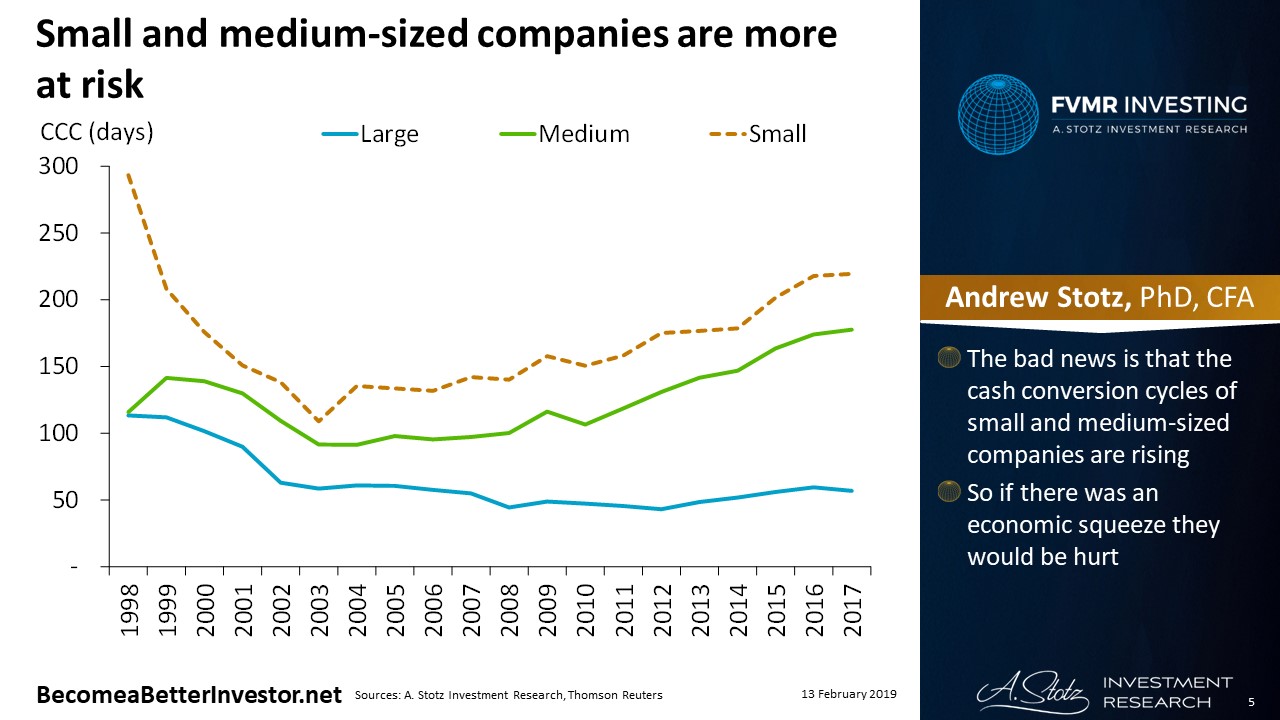

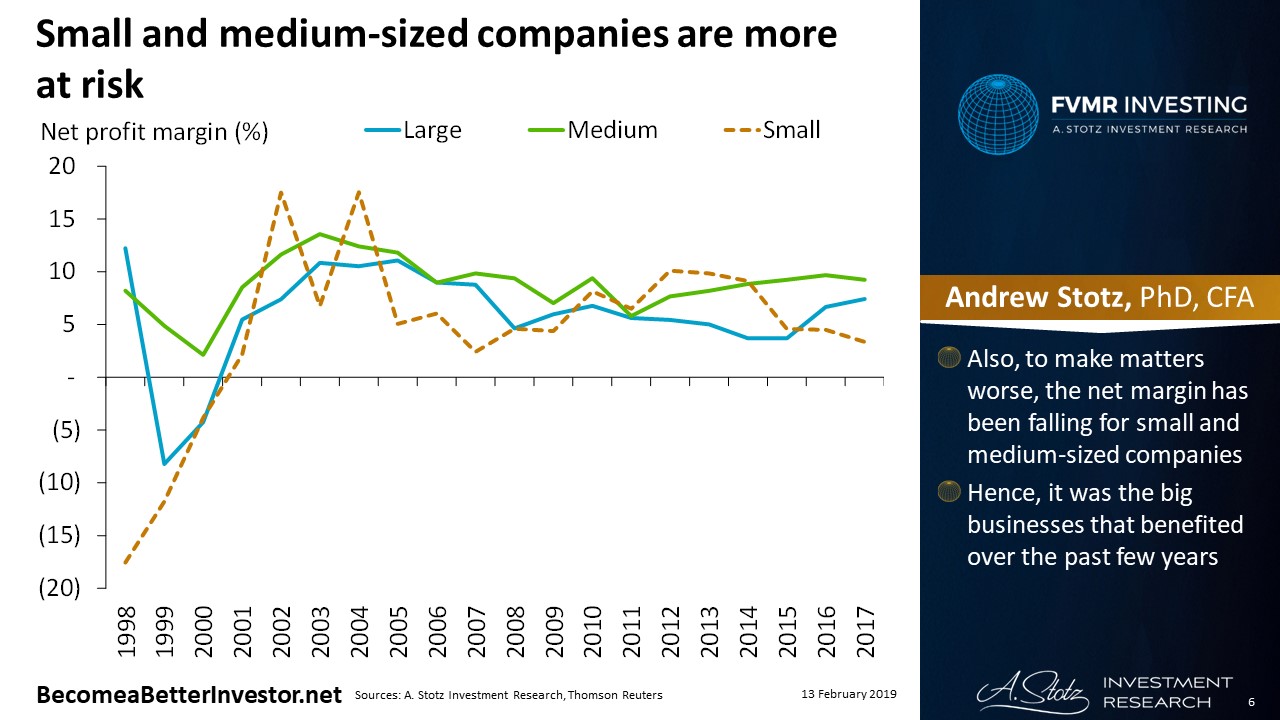

Small and medium-sized companies are more at risk

- Thailand experienced a strong revenue recovery in 2017

- But small and medium-sized companies did not bounce back

- The good news for small and medium-sized companies is that they have less debt

- The bad news is that the cash conversion cycles of small and medium-sized companies are rising

- So if there was an economic squeeze they would be hurt

- Also, to make matters worse, the net margin has been falling for small and medium-sized companies

- Hence, it was the big businesses that benefited over the past few years

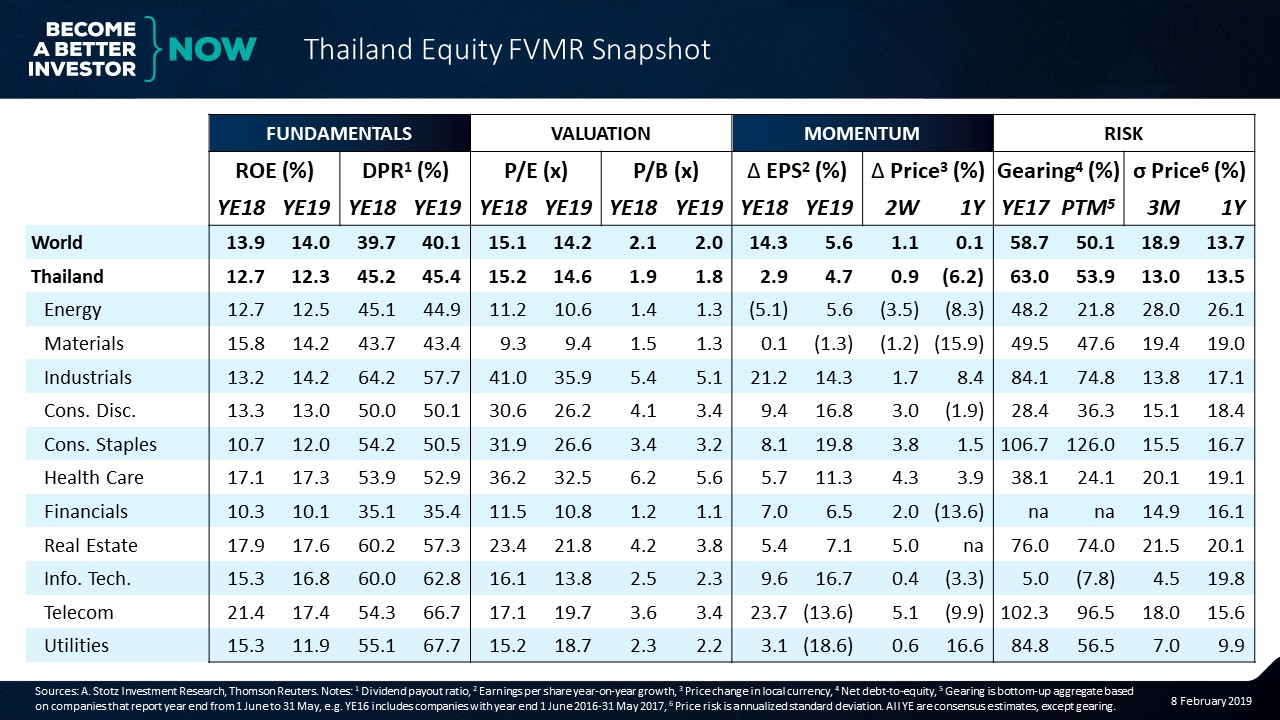

Low risk of a crash but little optimism

- Volatility of the Thai stock market is relatively low, only lower in ASEAN is Malaysia

- PB valuation is about average relative to the past at 1.8x, about fairly valued; less risk of a shock election result severely damaging the market

- Little optimism, earnings expectations have been falling for the past few months

- Analysts have been consistently downgrading their earnings forecasts to now almost no growth from 10% EPS a few months ago

- This is the second lowest expectations in ASEAN (Malaysia is the lowest)

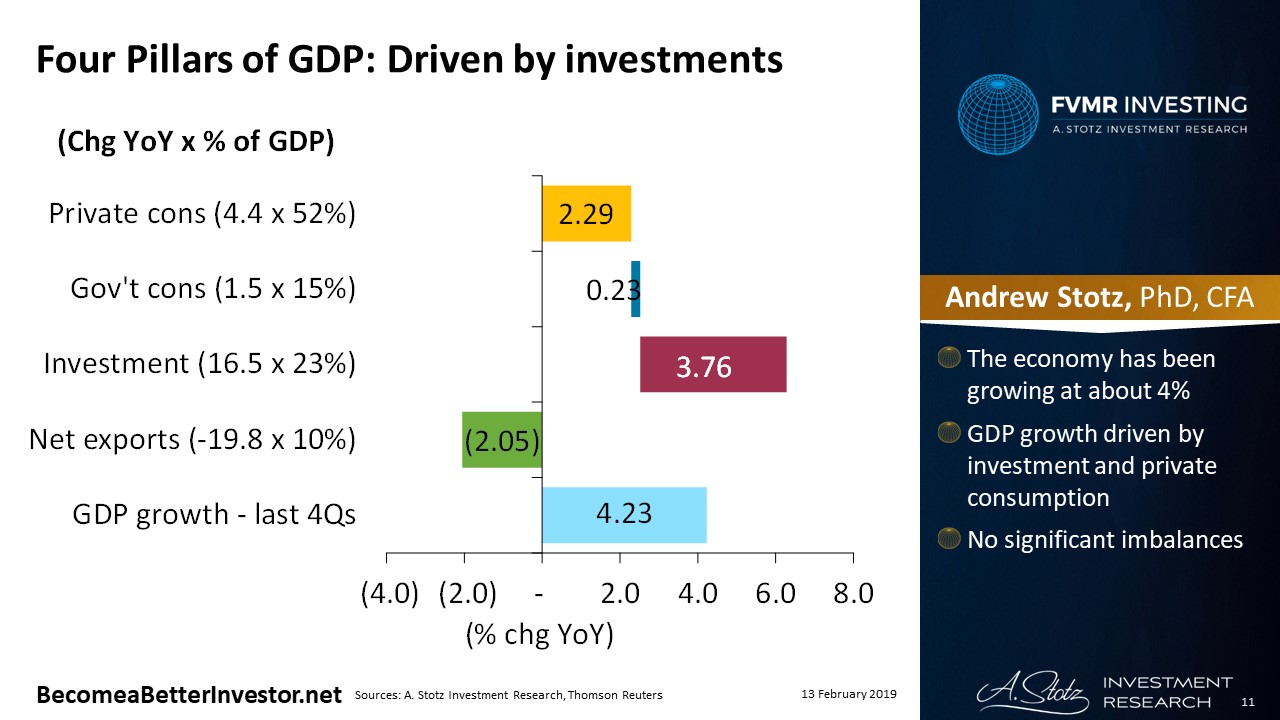

Steady 4% GDP growth

- The economy has been growing at about 4%

- GDP growth driven by investment and private consumption

- No significant imbalances

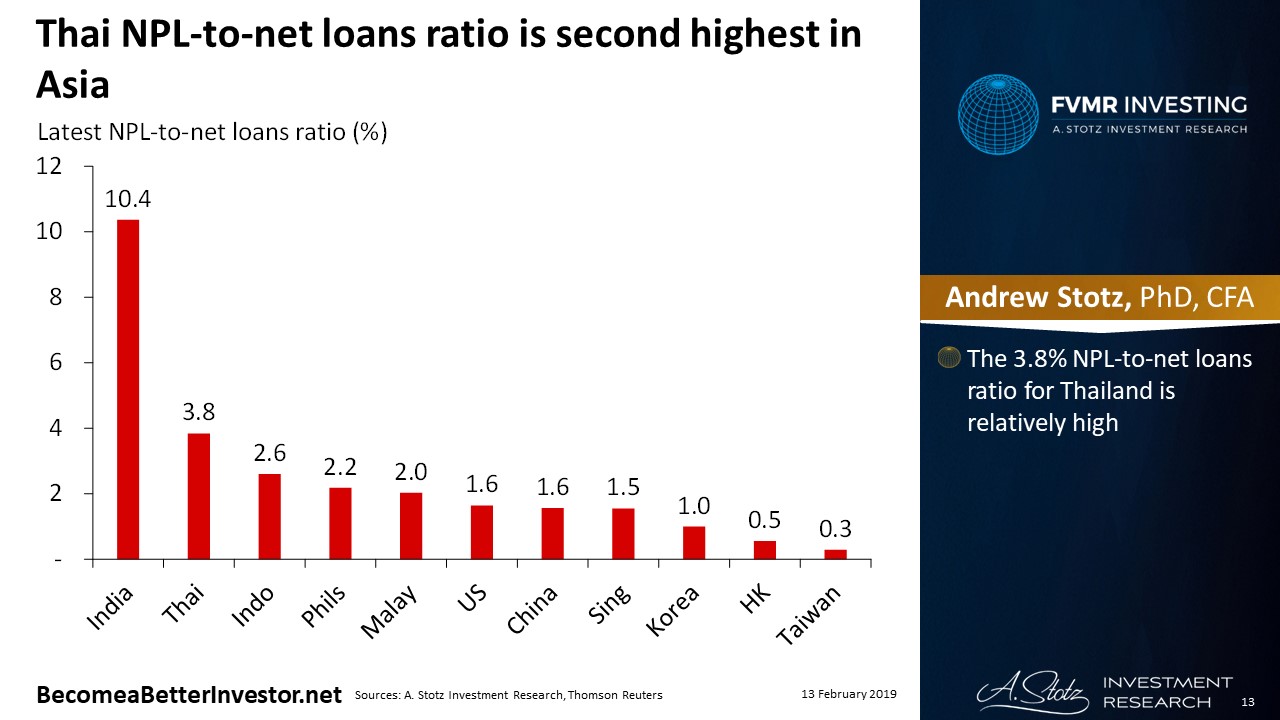

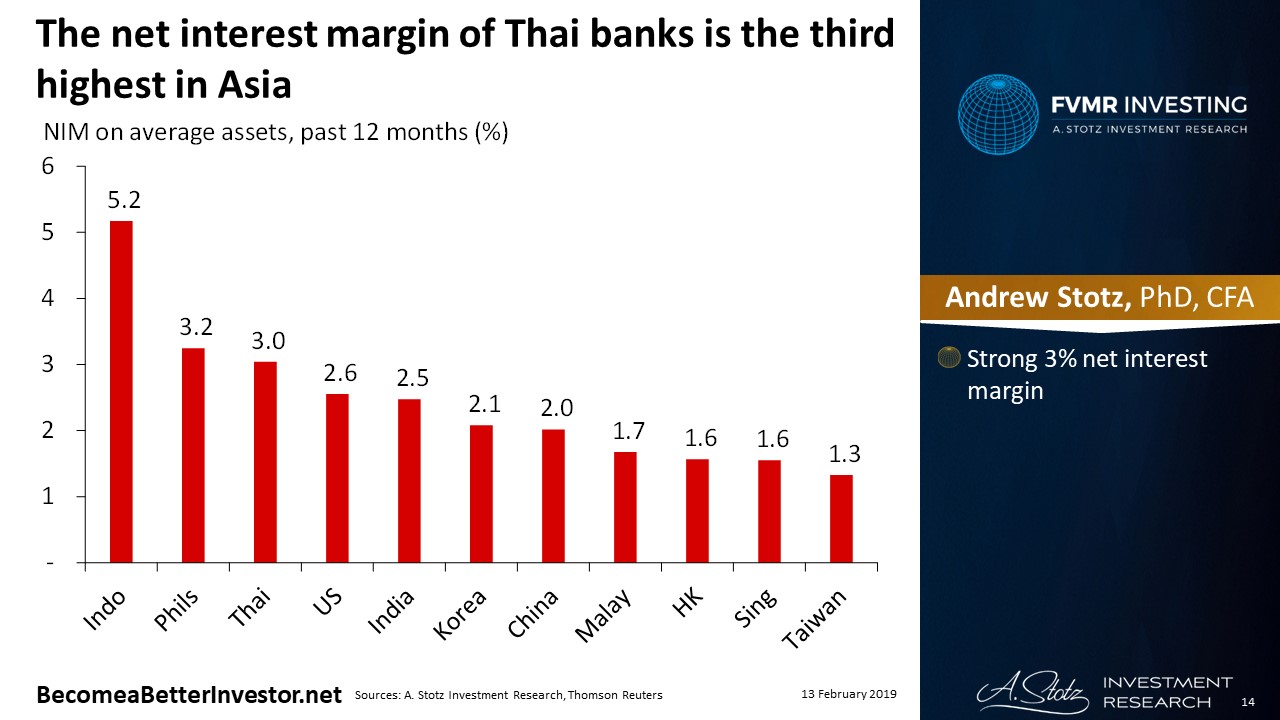

Thai Banks have good profitability, risk is worth the price

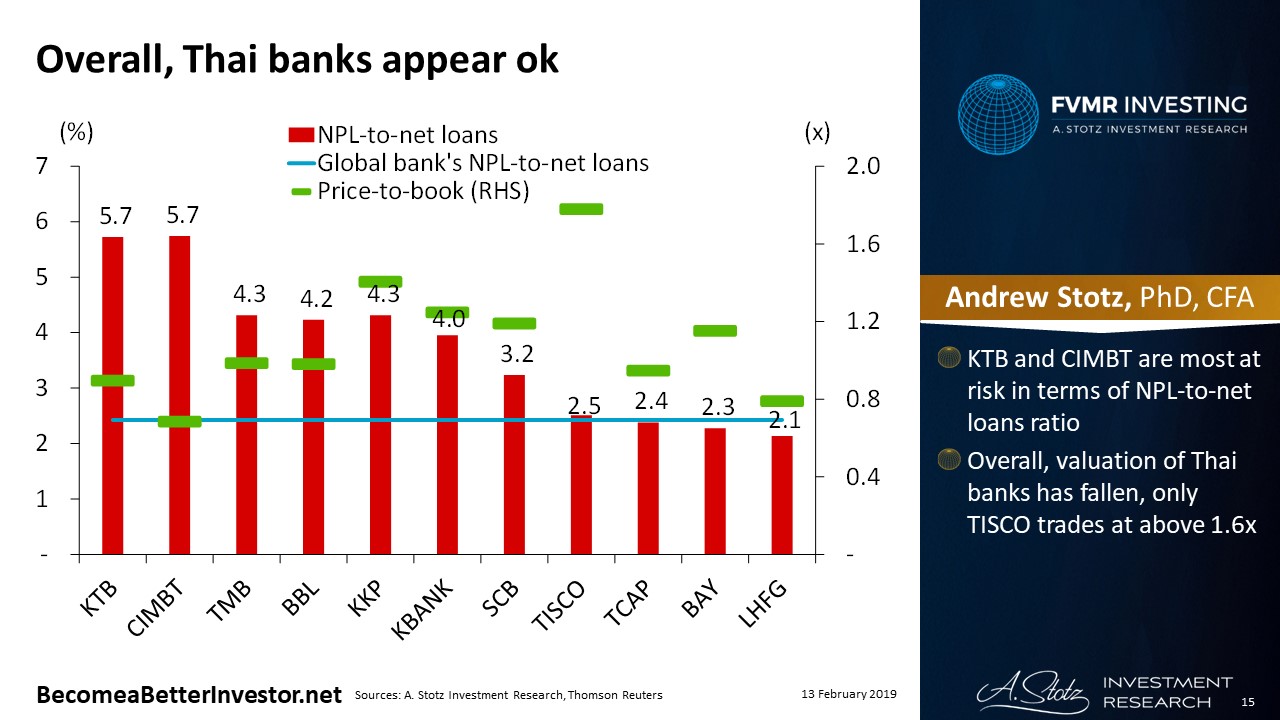

- The 3.8% NPL-to-net loans ratio for Thailand is relatively high

- Strong 3% net interest margin

- KTB and CIMBT are most at risk in terms of NPL-to-net loans ratio

- Overall, valuation of Thai banks has fallen, only TISCO trades at above 1.6x

Either the military will win or the military will win

On Sunday, March 24th voters will be casting one vote for both constituency and party-list seats for the 500 members of the House of Representatives. 375 directly elected through single constituency elections, while the other 125 are elected through party-list proportional representation.

What happens in the House Election doesn’t matter much as all 250 members of the Senate will be appointed by the military-dominated NCPO, hence they can select the next prime minister.

With the assumption that all 250 senators will support Prayut, pro-Prayut parties would only need to win 126 seats for him to be selected as prime minister. Phalang Pracharat and other pro-junta parties are unlikely to win a combined 126 seats, so some speculate that the Democrat Party will join the coalition.

In the most recent polls, Puea Thai and Phalang Pracharat parties have been neck and neck, followed by Democrat and Future Forward parties. Prayut was polling as the leading PM candidate, while the head of the Puea Thai party, Sudarat is second. Abhisit and Thanathorn are in third and fourth.

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.