A. Stotz All Weather Strategy – September 2021

Though down by 1.0% for the month, The All Weather Strategy beat a traditional 60/40 portfolio by 1.6%. Fed/ECB unwillingness to taper could drive equities higher. Commodities driven by energy crisis and supply-chain disruption. Risks: Inflation turns out transitory, new lockdowns, US default, slow growth in Germany.

The A. Stotz All Weather Strategy is Global, Long-term, and Diversified:

- Global – Invests globally, not only Thailand

- Long-term – Gains from long-term equity return, while trying to reduce a portion of losses during equity market downturns

- Diversified – Diversified globally across four asset classes

The All Weather Strategy is available in Thailand through FINNOMENA. Please note that this post is not investment advice and should not be seen as recommendations. Also, remember that backtested or past performance is not a reliable indicator of future performance.

Review

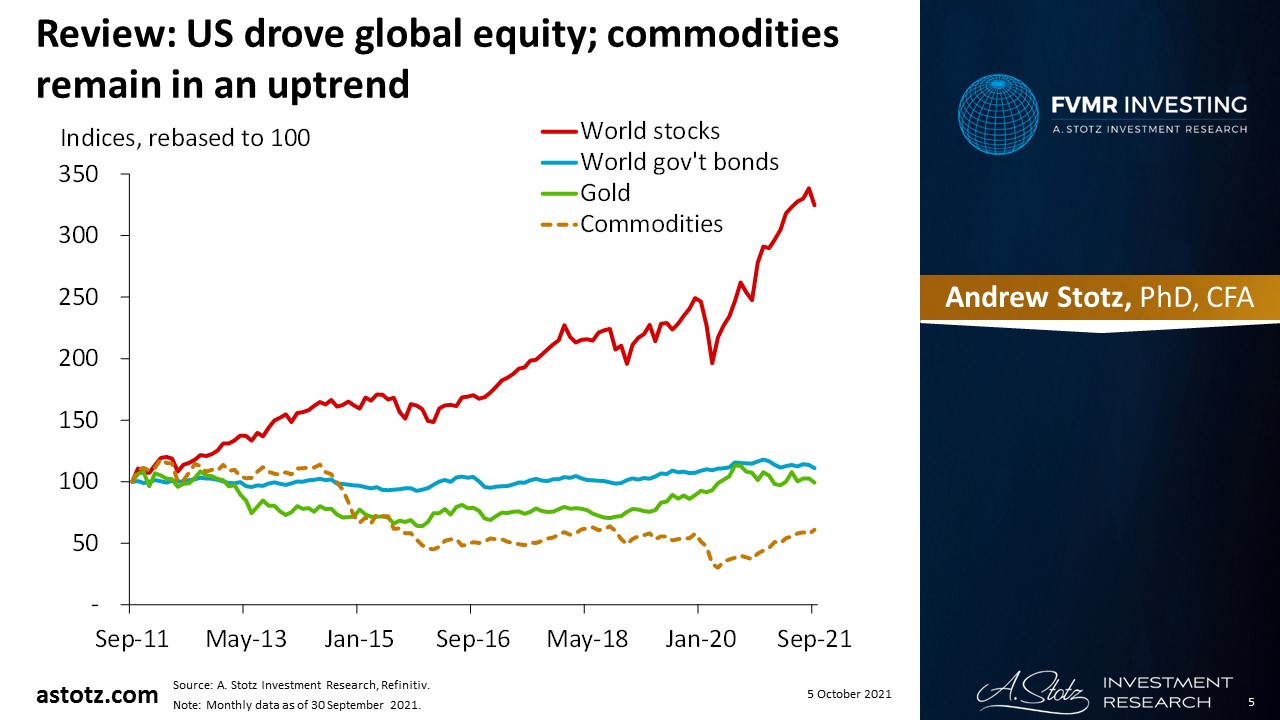

US drove global equity; commodities remain in an uptrend

Stayed in Western Developed markets as the main portion of our equity allocation

- In our June revision, we switched our 25% equity allocations to the US and Developed Europe from Emerging markets and Asia Pacific ex Japan

- We made no change in September revision

US stock market fell the most among all assets in September

- The market reacted to the Fed talking loosely about reducing asset purchases by the end of 2021 and rate hikes in 2022

- Also, the US debt ceiling debate increased uncertainty further

- As a result, the 10-year US Treasury yield rose

- Which was a factor driving the US stock market fall

Developed Europe fell but was still the second-best performing equity

- The European Central Bank (ECB) declared that it would reduce asset buying, but also made clear that its intention wasn’t to reduce purchases down to zero

- Amidst rising inflation readings, ECB President Lagarde proclaimed it’s transitory

Emerging markets and Asia Pacific ex Japan continued to fall

- Many countries have continued with restricted economic activities due to lockdowns

- Chinese government intervention in the Tech and education industries have led to uncertainty

- The Evergrande debacle has shaken investor trust in China further, and it dragged on Emerging Markets and Asia Pacific ex Japan

Low bond target allocation at 5%

- We have a bond target allocation of 5% as they appeared less attractive relative to equity

- The strategy is to hold only Thai government bonds, rather than a mix of global government and corporate bonds

- Besides commodities and Japan equity, other assets fell in September; hence, the flattish return of bonds was attractive

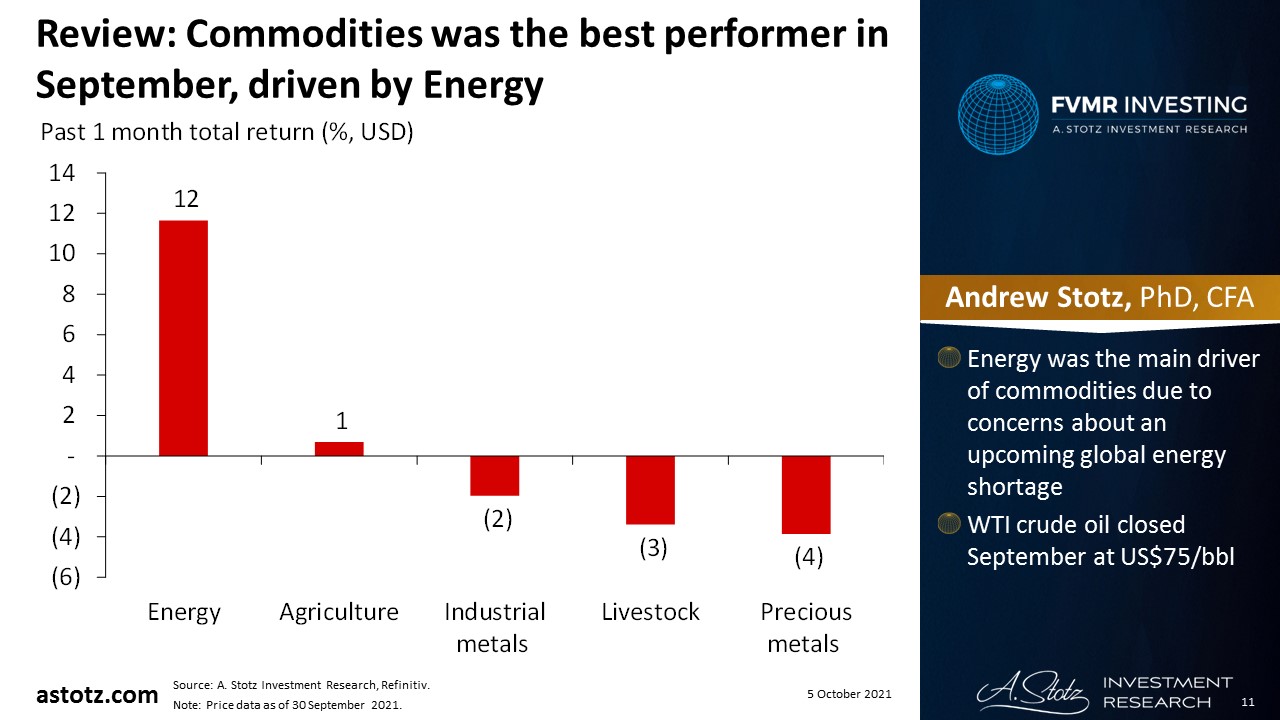

Commodities was the best performer in September, driven by Energy

Gold fell hard in September

- We have a minimum 5% allocation to gold

- Fed’s talk about less support of the economy, and expected rate hikes next year made Treasury yield rise, which is bad for gold

- Investor looking for safety has turned to the US dollar rather than gold, which also is negative for the gold price

- Gold closed the month at US$1,757/oz t

September 2021: AWS was down but outperformed a 60/40 portfolio by 1.6%

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- Commodities: Best performer

- Dev. Europe: Second-best performing equity

- US: Worst performer

Since inception: AWS now beats a traditional 60/40 portfolio

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- The All Weather Strategy has mostly had a 45-65% equity target weight and a 25% gold allocation

- Since March 2nd: Equity 65%, Bonds 5%, Gold 5%, Commodities 25%

- Reduced downside compared to an equity-only strategy

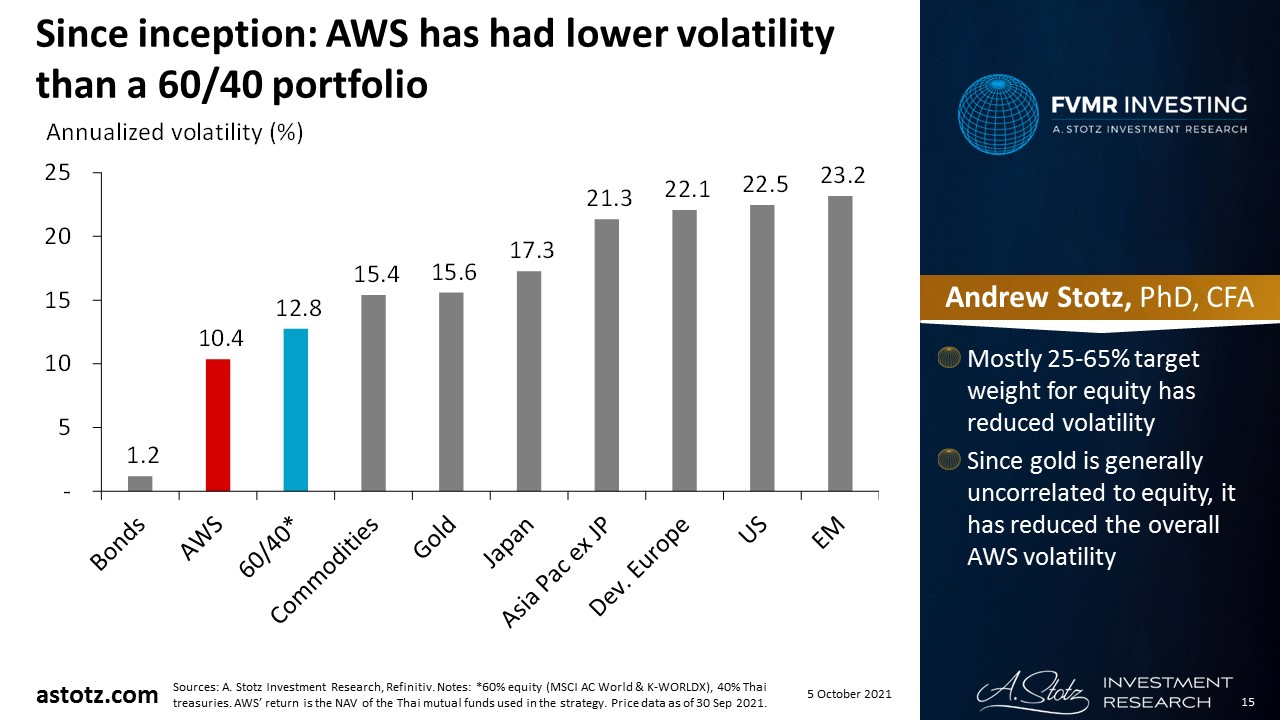

Since inception: AWS has had lower volatility than a 60/40 portfolio

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- Mostly 25-65% target weight for equity has reduced volatility

- Since gold is generally uncorrelated to equity, it has reduced the overall AWS volatility

Since inception: Lost less than 60/40 on 8 out of the 10 worst-returning days of world equity

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- A key feature of AWS is that it aims to lose less when equity markets fall

- On the 10 worst days of Global equity since the inception of AWS, the strategy has lost less than 60/40 on 80% of days

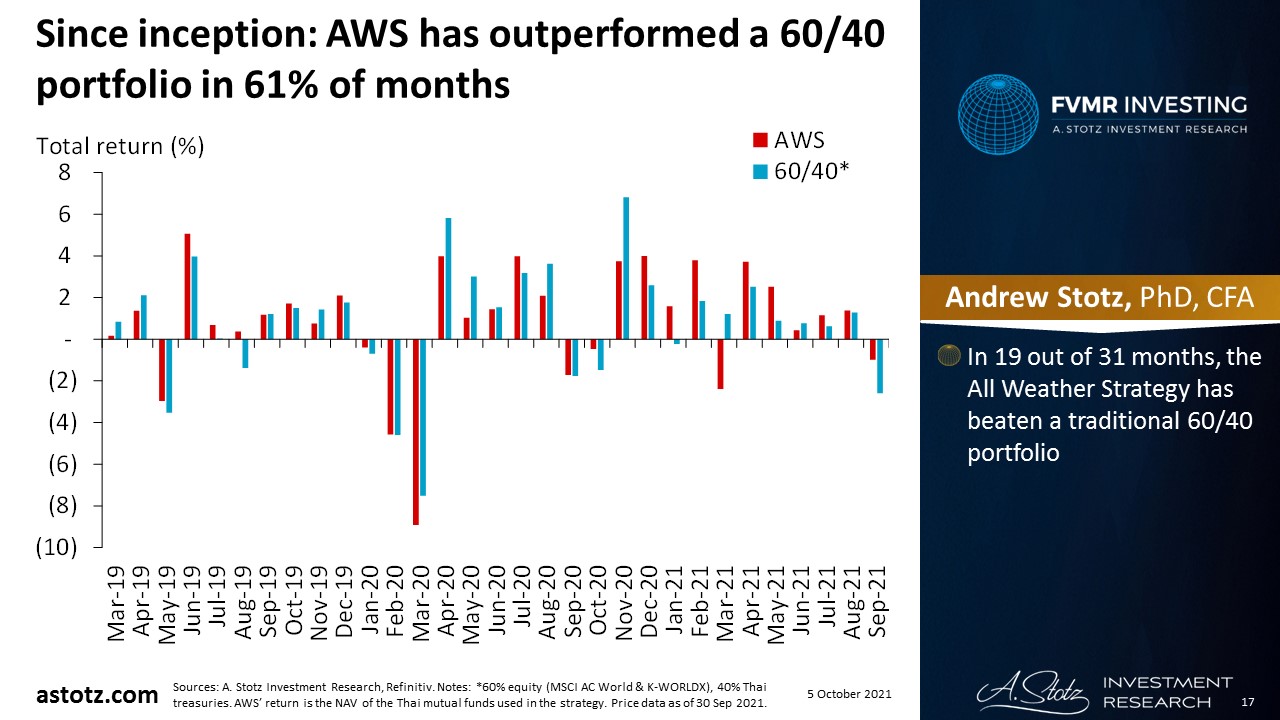

Since inception: AWS has outperformed a 60/40 portfolio in 61% of months

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- In 19 out of 31 months, the All Weather Strategy has beaten a traditional 60/40 portfolio

Outlook

Fed won’t taper in the near term

- Even though Fed signaled to reduce its asset purchasing this year, we think the central bank won’t want to bring on rising interest rates that will come when they start tapering

US Congress is likely to avoid default

- US Treasury Chair Yellen estimated that the Treasury won’t be able to meet its obligations by October 18th if Congress doesn’t raise or abolish the debt ceiling

- We expect Congress to raise the debt ceiling

Fed rate hikes appear to be unlikely before 2H22

- Gov’ts high debt load is also likely to keep Fed from raising rates too fast or by too much

- The Fed is likely to bear higher, and longer-running inflation

- While Fed has talked about rate hikes in 2022, the market still prices in a 50/50 chance that rates remain unchanged in the September 2022 FOMC meeting

Fed is going to continue giving candy (support) to the spoiled brat (US investors)

- Based on our Spoiled Brat Theory, we don’t think the Fed is going to announce further constraining measures any time soon

- Also, when the debt ceiling issue is resolved, we think US equity will bounce back

ECB tapering appears unlikely as well

- Eurozone inflation has stayed high

- ECB President Lagarde, like Fed Chair Powell, echoes the “inflation is transitory” narrative

- Even so, she has also made it clear to continue ECB asset purchasing

- Continued ECB support, removed COVID restrictions, and inflation should be positive for Developed Europe equity

China drags on Emerging markets and Asia Pacific ex Japan

- China’s “common prosperity” policy could lead to further crackdowns on Chinese businesses; negative for Chinese stocks

- If the Evergrande issue isn’t handled well by the Chinese gov’t, sentiment turns worse

- Continued uncertainty is negative for China equity, and its heavy weight in the Emerging markets and Asia Pacific ex Japan indices is likely to drag performance

Bonds to remain weak

- As we’re expecting rising inflation, we expect bonds to underperform

- This is reflected in our 5% target allocation

Energy crisis is on everybody’s lips

- News about an imminent global energy crisis is making it to the first pages, and the supply-demand imbalance could drive energy prices further

- Poor weather conditions limiting the supply of key agricultural commodities could lead to even higher prices

Global supply-chain disruption leads to higher commodity prices

- Expect continued economic recovery in the West and China to support commodities

- Global supply-chain disruption due to government-mandated economic shutdowns could turn out more permanent

Gold continues to look unexciting in the near term

- In the longer term, as the inflation narrative spreads, it could lead to expectations of negative real rates

- Supportive of the gold price

- Amidst US debt ceiling issues, investors have turned to the dollar for safety

- A stronger dollar means a weaker gold price

- We don’t see Fed or ECB communication pushing gold in either direction

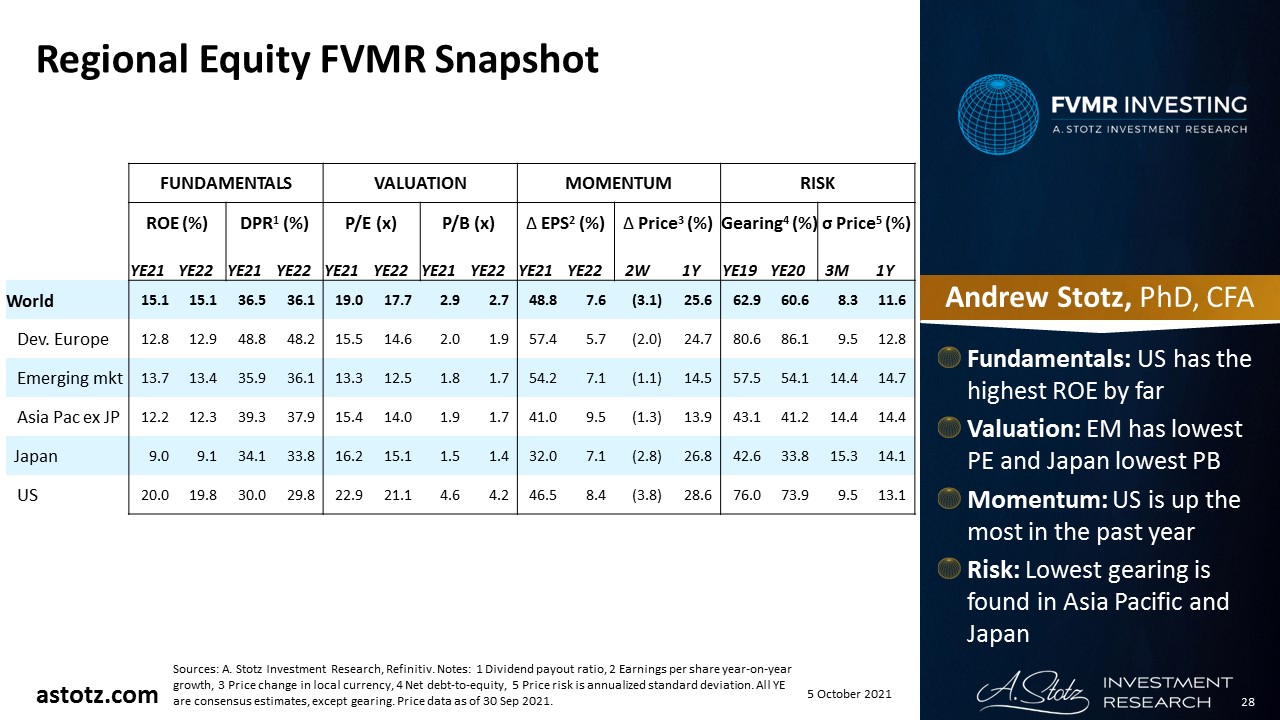

Regional Equity FVMR Snapshot

- Fundamentals: US has the highest ROE by far

- Valuation: EM has lowest PE and Japan lowest PB

- Momentum: US is up the most in the past year

- Risk: Lowest gearing is found in Asia Pacific and Japan

Risks

Inflation turns out transitory

- The All Weather Strategy is positioned to benefit from rising inflation

- There’s a risk that inflation is transitory, which could hurt our performance

- Besides, return expectations in inflationary environments are based upon corresponding rising interest rates

- But the Fed and ECB are expected to keep rates low at least until late 2022

New variants of the coronavirus lead to new lockdowns

- If governments in countries with high vaccination rates return to lockdowns to battle new mutations of the virus, it would be negative for those equity markets

US default

- If the American Congress fails to resolve the debt-ceiling issue and the US defaults, this could have serious negative consequences for US equity, and possible global equities too

German elections may cause a gridlock

- The election results are unlikely to give any influence to the radical left and radical right

- It may take some time for a government to form, and a fragile majority may lead to slower growth in the European economic locomotive

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.