A. Stotz All Weather Strategies – December 2022

Executive summary

- Central bankers appear to be raising rates into a recession to stifle inflation; stagflation would be the worst outcome

- Demand for necessities (food and energy), inflation, and supply-chain disruptions can drive commodities higher

- We see opportunities to allocate to specific sectors and markets within equity

- Bonds and gold to protect capital

- Risks: Global recession, collapsing energy prices, weak China

The All Weather Strategy is available in Thailand through FINNOMENA. If you’re interested in our allocation strategy, you can also join the Become a Better Investor Community. Please note that this post is not investment advice and should not be seen as recommendations. Also, remember that backtested or past performance is not a reliable indicator of future performance.

What happened in world markets in December 2022

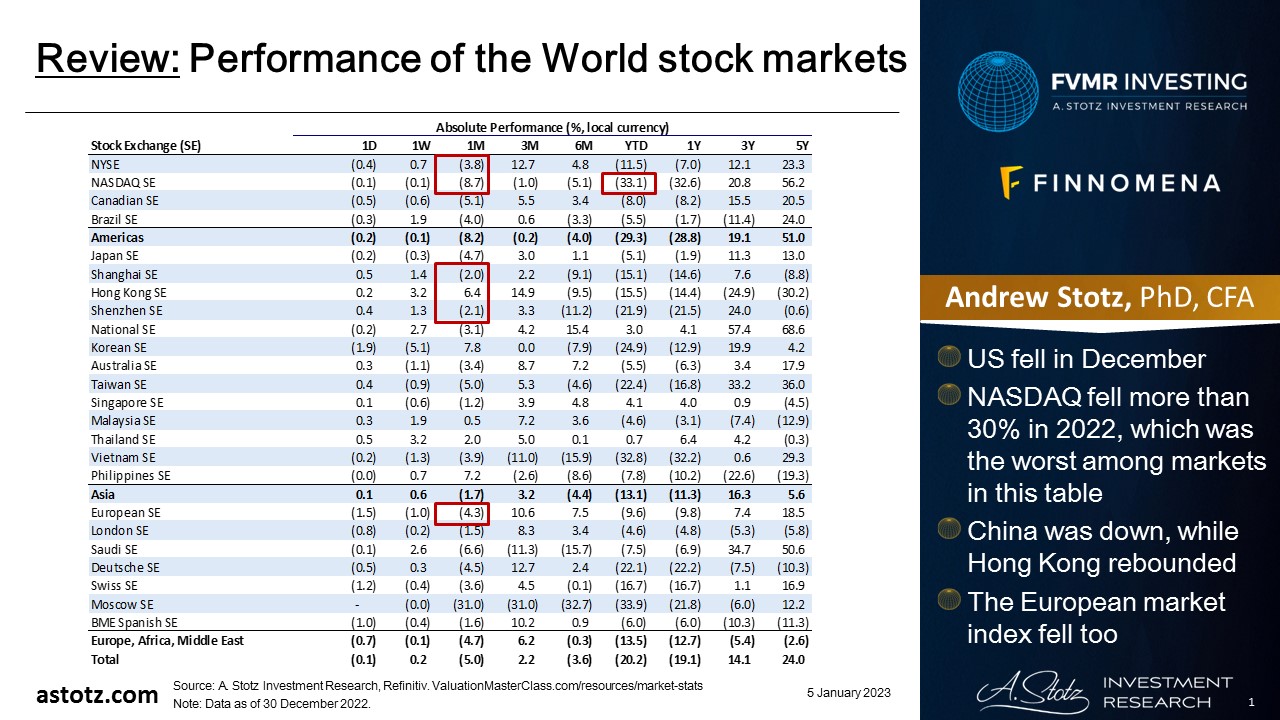

Performance of the World stock markets

- US fell in December

- NASDAQ fell more than 30% in 2022, which was the worst among markets in this table

- China was down, while Hong Kong rebounded

- The European market index fell too

Find the updated Performance of the World stock markets here.

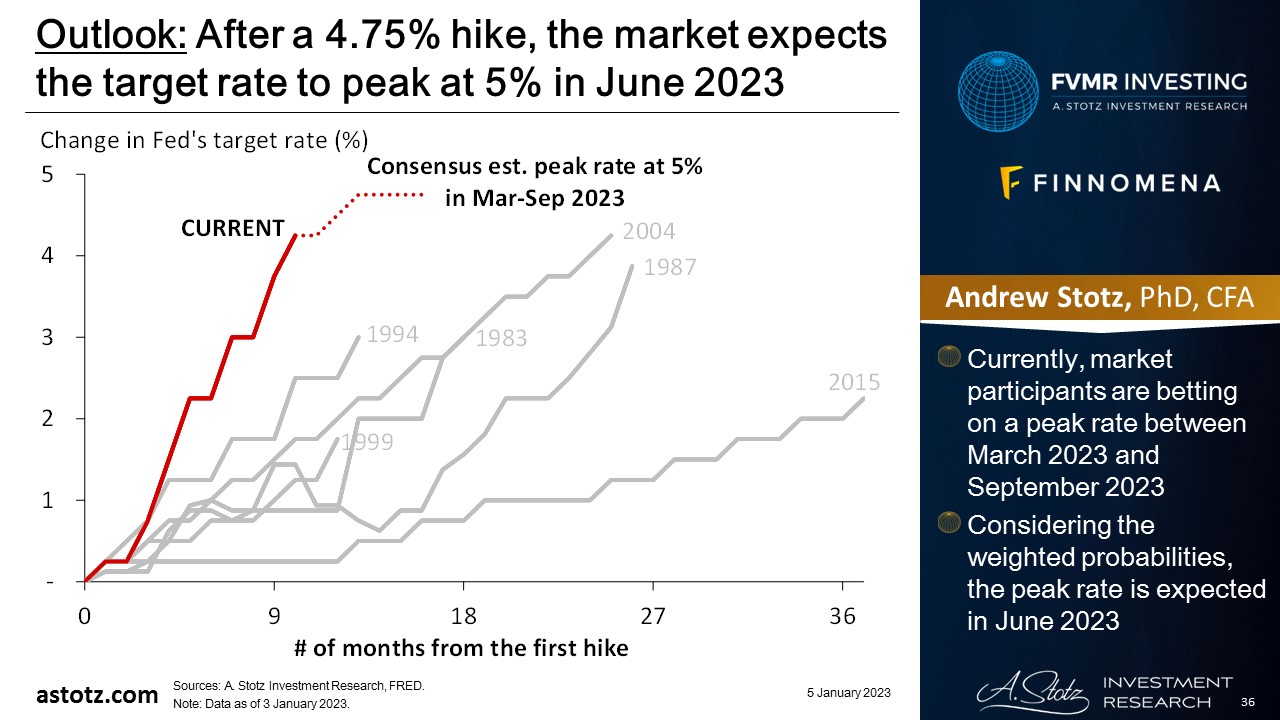

In 2022, World stocks were down 18.0%

- Recession fears and uncertainty about the consequences of the Chinese covid outbreak pushed down stocks in December 2022

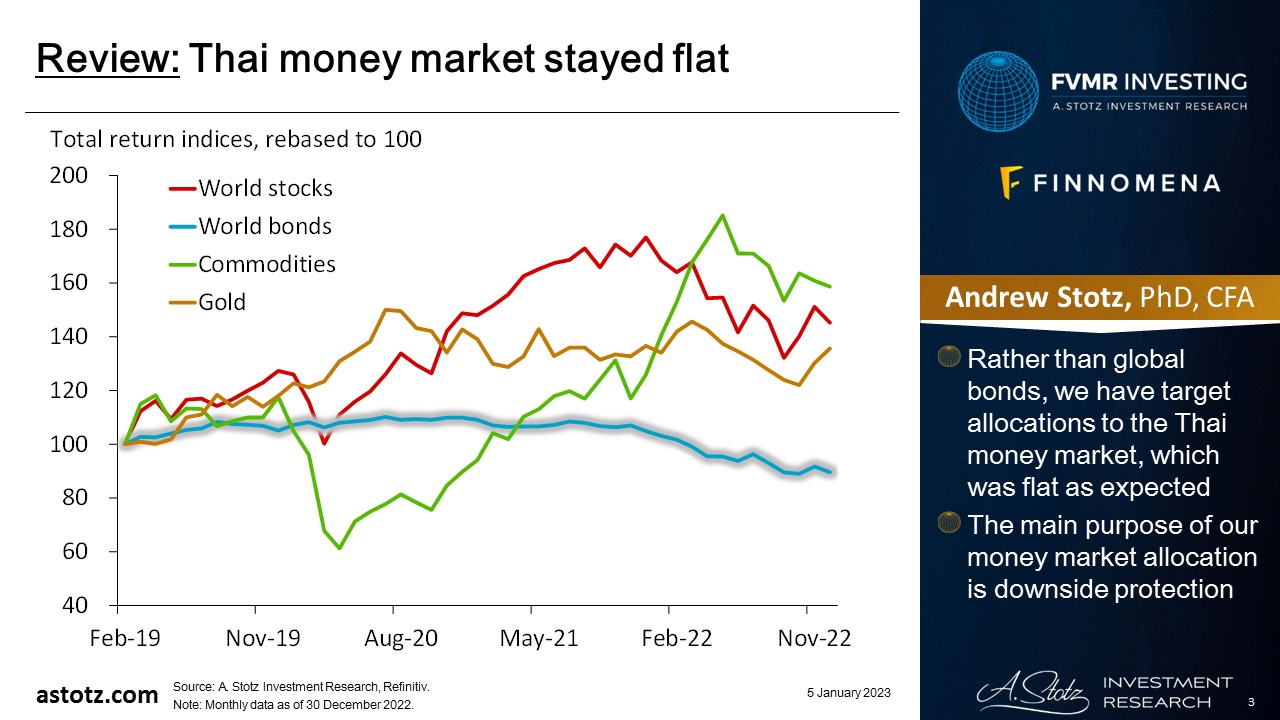

Thai money market stayed flat

- Rather than global bonds, we have target allocations to the Thai money market, which was flat as expected

- The main purpose of our money market allocation is downside protection

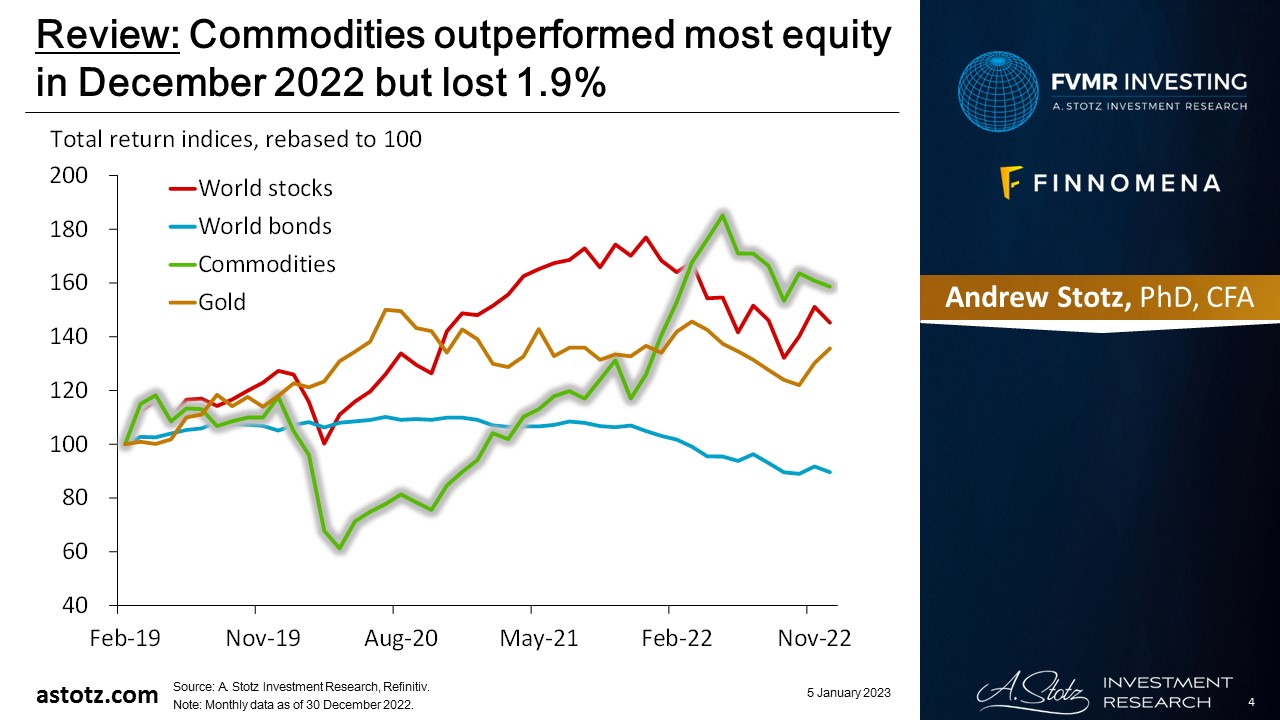

Commodities outperformed most equity in December 2022 but lost 1.9%

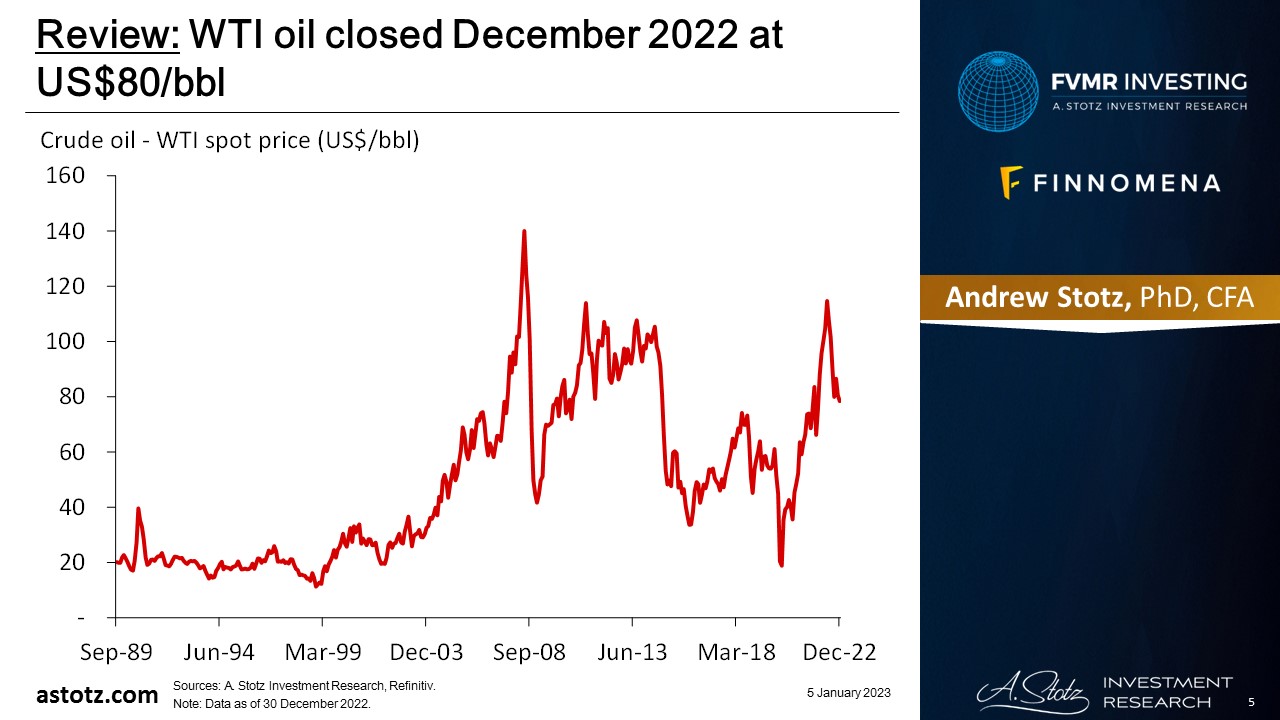

WTI oil closed December 2022 at US$80/bbl

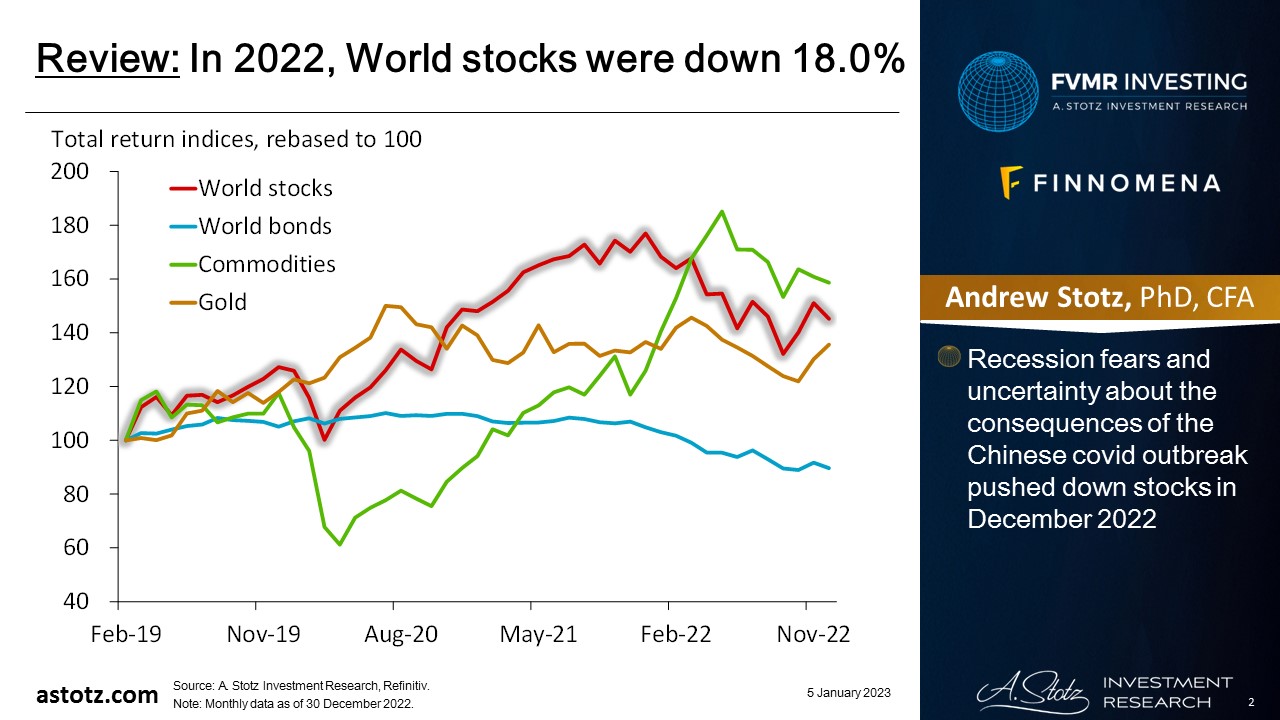

Precious metals did best, while Energy retreated

- Precious metals gained on uncertainty regarding China’s covid outbreak

- A weaker US$ pushed up commodity prices slightly in December

- The so far mild winter in Europe led to drops in natural gas prices, and oil dropped as well

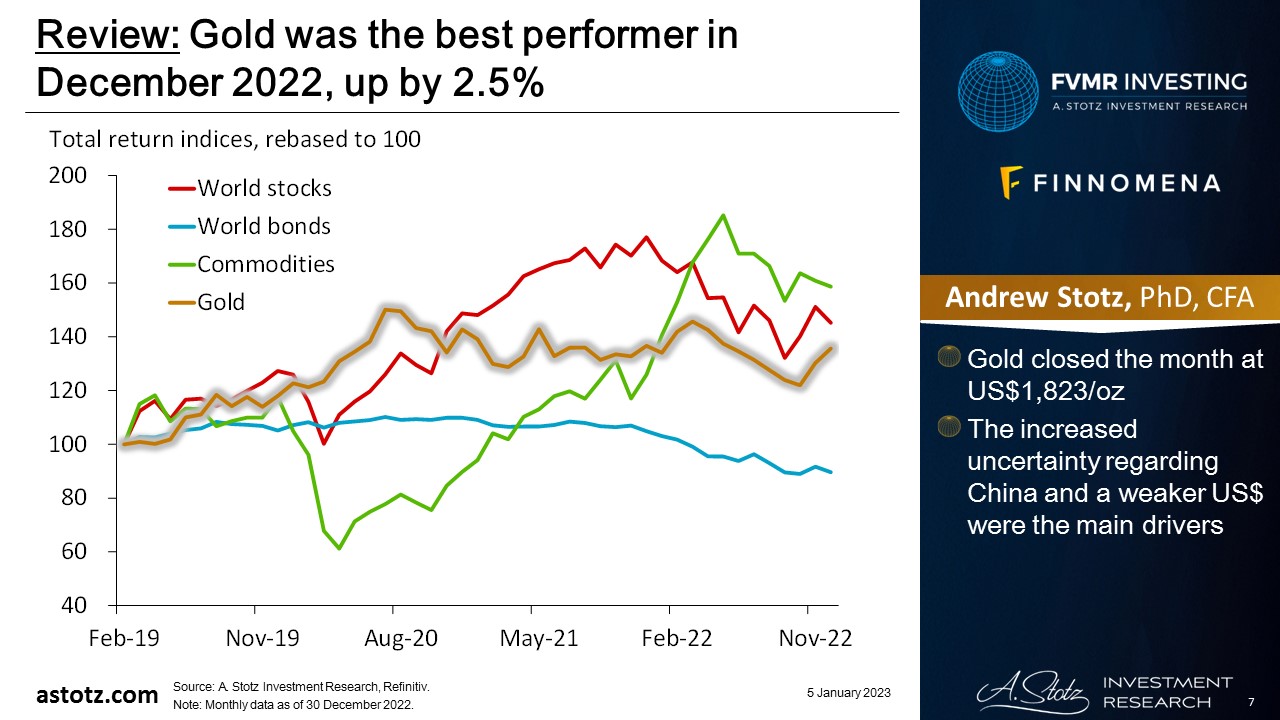

Gold was the best performer in December 2022, up by 2.5%

- Gold closed the month at US$1,823/oz

- The increased uncertainty regarding China and a weaker US$ were the main drivers

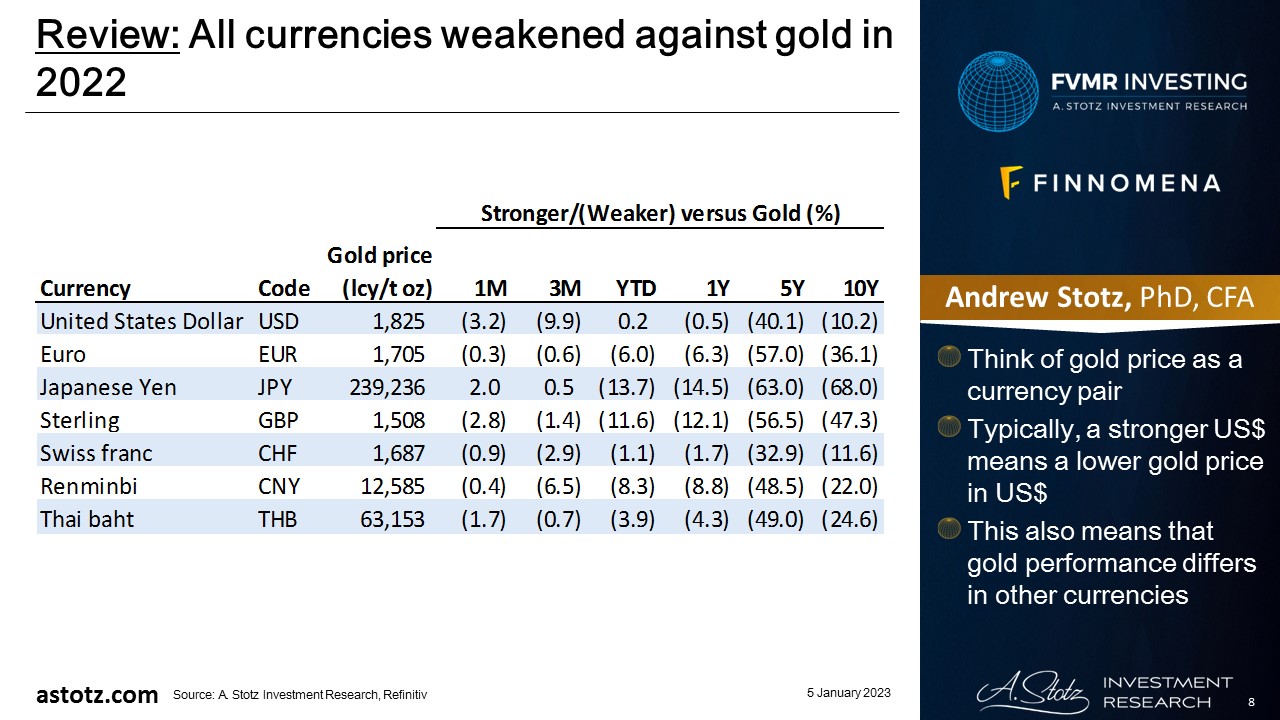

All currencies weakened against gold in 2022

- Think of gold price as a currency pair

- Typically, a stronger US$ means a lower gold price in US$

- This also means that gold performance differs in other currencies

2022 was exceptionally bad for global bonds

2/5

The Bloomberg Global Aggregate Index suffered more than the US Domestic Aggregate index above.

Blame the strong dollar for hitting 46% of the non-dollar bonds in this Global Aggregate Index more than the 54%-dollar bonds (and 100%-dollar bonds in the US Aggregate Index). pic.twitter.com/o0yyamQ0Mc

— Jim Bianco biancoresearch.eth (@biancoresearch) December 31, 2022

US inflation slowed down and came in below consensus expectations

US #inflation undershot St consensus for Nov, w/headline +7.1% YoY (down from +7.7% in prior month & below St’s +7.3% forecast) and core +6% (down from +6.3% in the prior month and below the St’s +6.1% forecast). Stocks & bonds rally w/US 10y yields down 14bps, 2y ylds down 15bps pic.twitter.com/pV2gvfbEci

— Holger Zschaepitz (@Schuldensuehner) December 13, 2022

EU inflation remains high, and the ECB follows the Fed but with a lag

Lagarde wants markets to price 4% terminal rates, and to keep them there for long.

Similar to what Powell was trying to engineer few months ago – the ECB is literally following the Fed with a 4-6 months delay.

European rates not even close to pricing that!

— Alf (@MacroAlf) December 15, 2022

The Japanese Yen has rebounded

#Japan‘s Yen strengthens to highest since June against Dollar. Yen has climbed 16% from its Oct nadir amid govt intervention, hopes for slowing US rate hikes & speculation over possibility of policy shift from BoJ this year after surprise Dec decision to tweak yield curve control pic.twitter.com/O994XlGQdk

— Holger Zschaepitz (@Schuldensuehner) January 3, 2023

US mortgage rates are at a level not seen for a long time

Average 30-Year Mortgage Rate in the US…

1970s: 8.9%

1980s: 12.7%

1990s: 8.1%

2000s: 6.3%

2010s: 4.1%

2020s: 3.8%

—

Today’s Rate: 6.4% pic.twitter.com/y7HaR7V0Eh— Charlie Bilello (@charliebilello) December 30, 2022

The higher rates have impacted the attractiveness of REITs

Investors are frantically pulling money out of real estate.

Nontraded REITs saw $3.7 billion in redemptions in Q3.

This is a 12x increase over last year. pic.twitter.com/Upu60h7ZRP

— Genevieve Roch-Decter, CFA (@GRDecter) December 6, 2022

That real estate gets hit matters a lot, it’s the largest asset class by far

A gentle reminder that the biggest asset class in the world is not bonds or equities.

It’s real estate.

And by far.

Watch it closely, guys. pic.twitter.com/lm2hyyb45Y

— Alf (@MacroAlf) December 12, 2022

Luckily, the winter has been mild so far in Europe

Good Morning from #Germany which may have experienced hottest year on record in 2022. Acc to German Weather Service, avg temperature for the year was at least 10.5 degrees Celsius. 10.5 was the previous record, which was set in 2018. A record was set in terms of sunshine hours. pic.twitter.com/YAoYVwC2sE

— Holger Zschaepitz (@Schuldensuehner) December 30, 2022

Europe is highly dependent on gas, which accounts for 39% of heating

Europe: Energy used for residential heating by source. pic.twitter.com/mdhdaO2awS

— Tracy (𝒞𝒽𝒾 ) (@chigrl) December 29, 2022

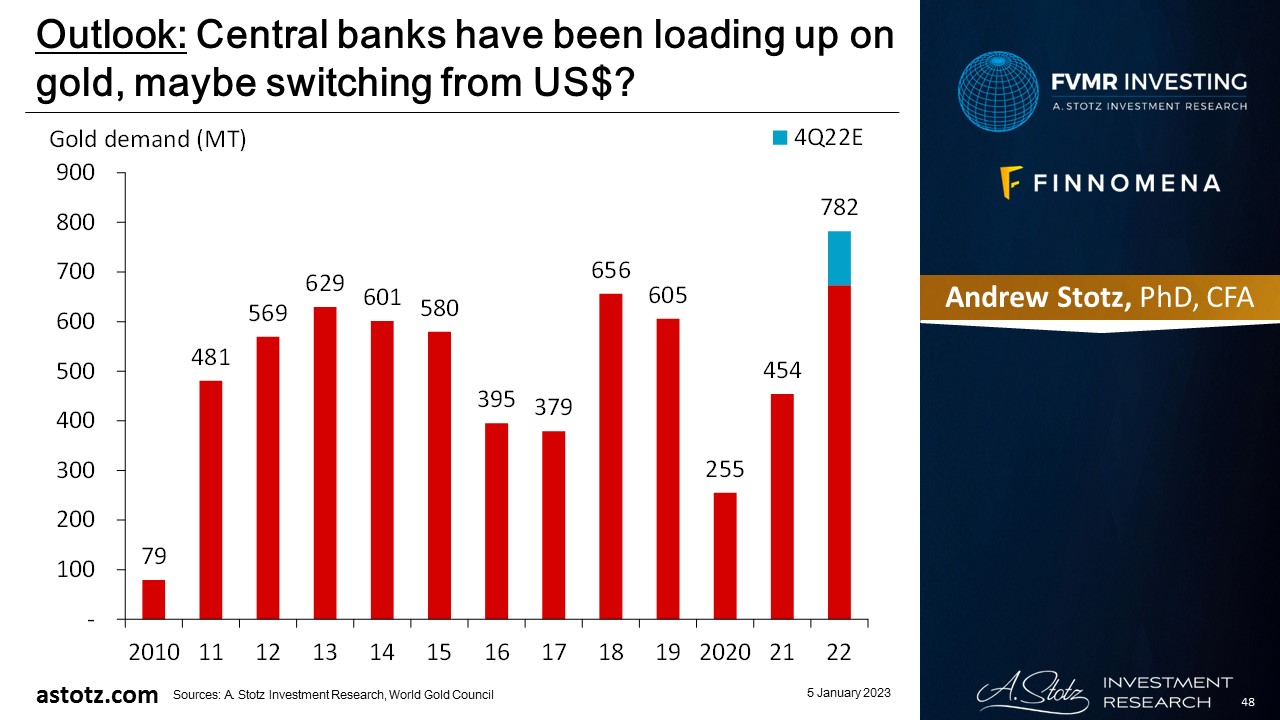

Gold is again in fashion among central banks

Central Banks Buy 31 Tonnes of GOLD in October.

Global Gold Reserves Rise To Highest Level Since 1974, if you believe they are reporting real numbers. There is a lot of doubt about some countries, such as the USA, which refuses to prove their gold reserve data is accurate.🚨 pic.twitter.com/VT0cjUmkqL

— Wall Street Silver (@WallStreetSilv) December 2, 2022

Key takeaways

- 2022 was exceptionally bad for global bonds

- Higher rates hit real estate, the largest asset class in the world by far

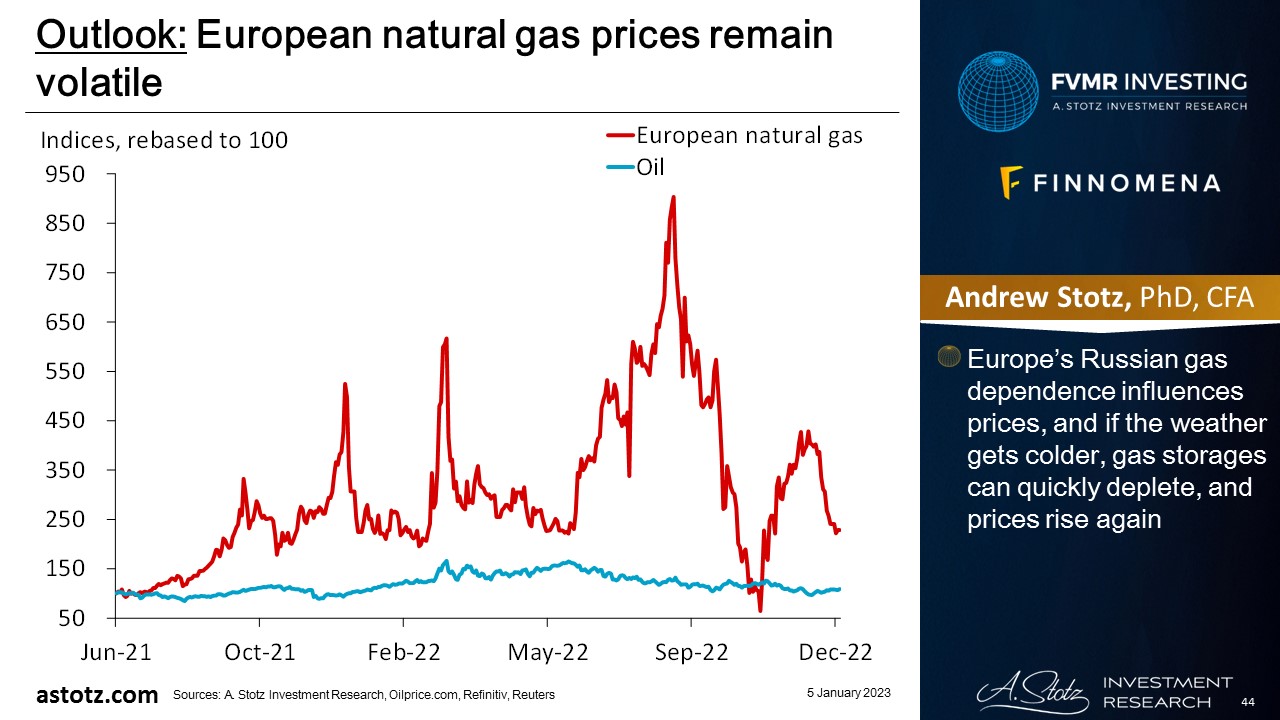

- The mild winter in Europe kept natural gas prices at bay in December

- Central banks have loaded up on gold

Performance review: All Weather Inflation Guard

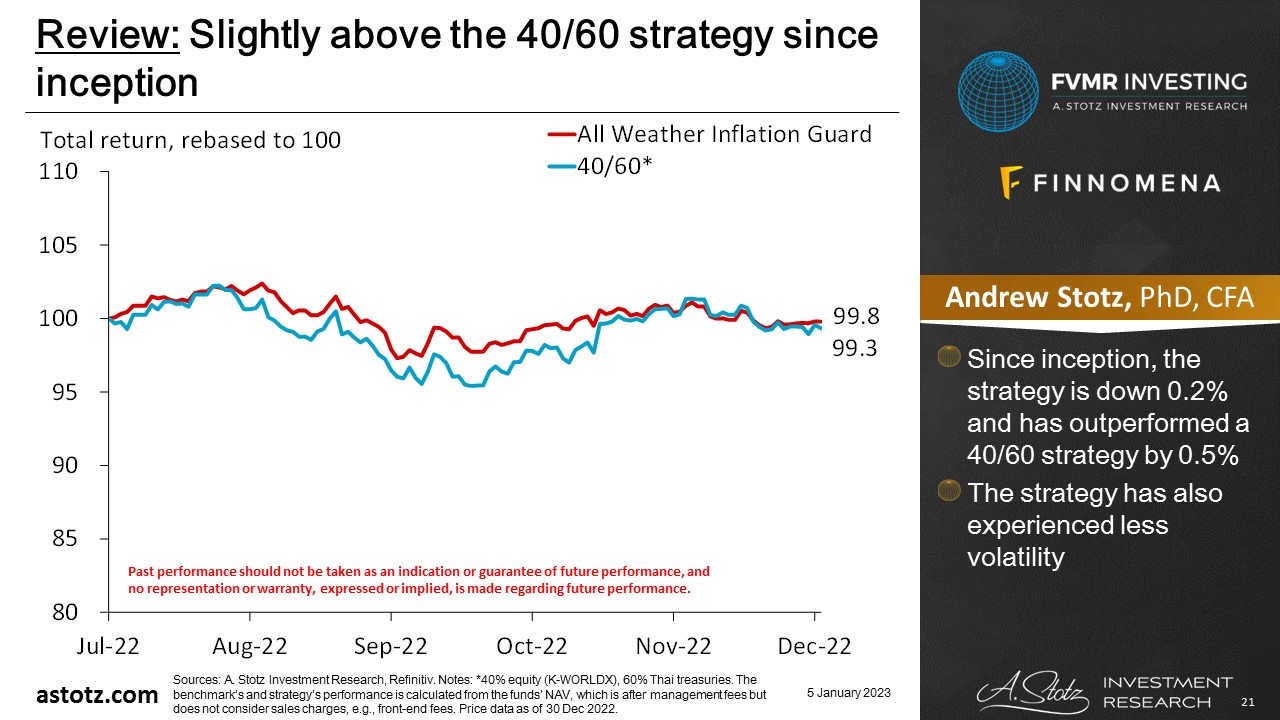

All Weather Inflation Guard fell by 1.1%

- Since inception, the strategy is down 0.2% and has outperformed a 40/60 strategy by 0.5%

- The strategy has also experienced less volatility

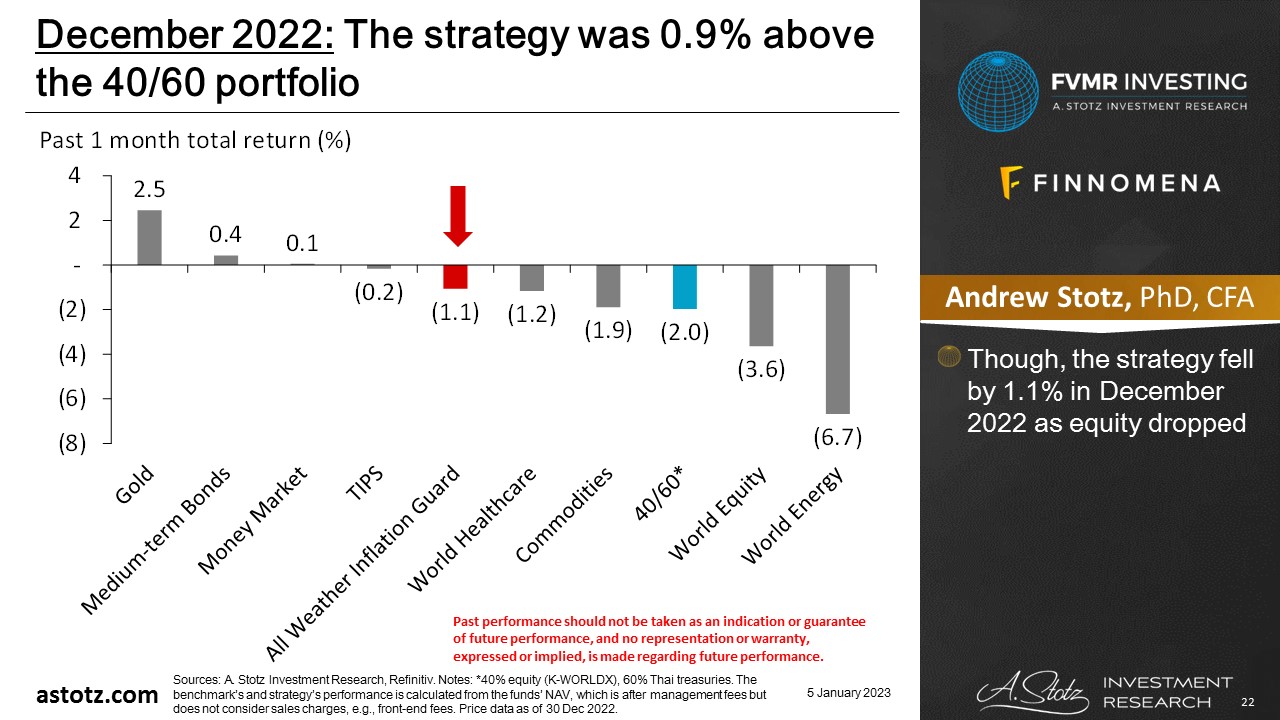

The strategy was 0.9% above the 40/60 portfolio

- Though, the strategy fell by 1.1% in December 2022 as equity dropped

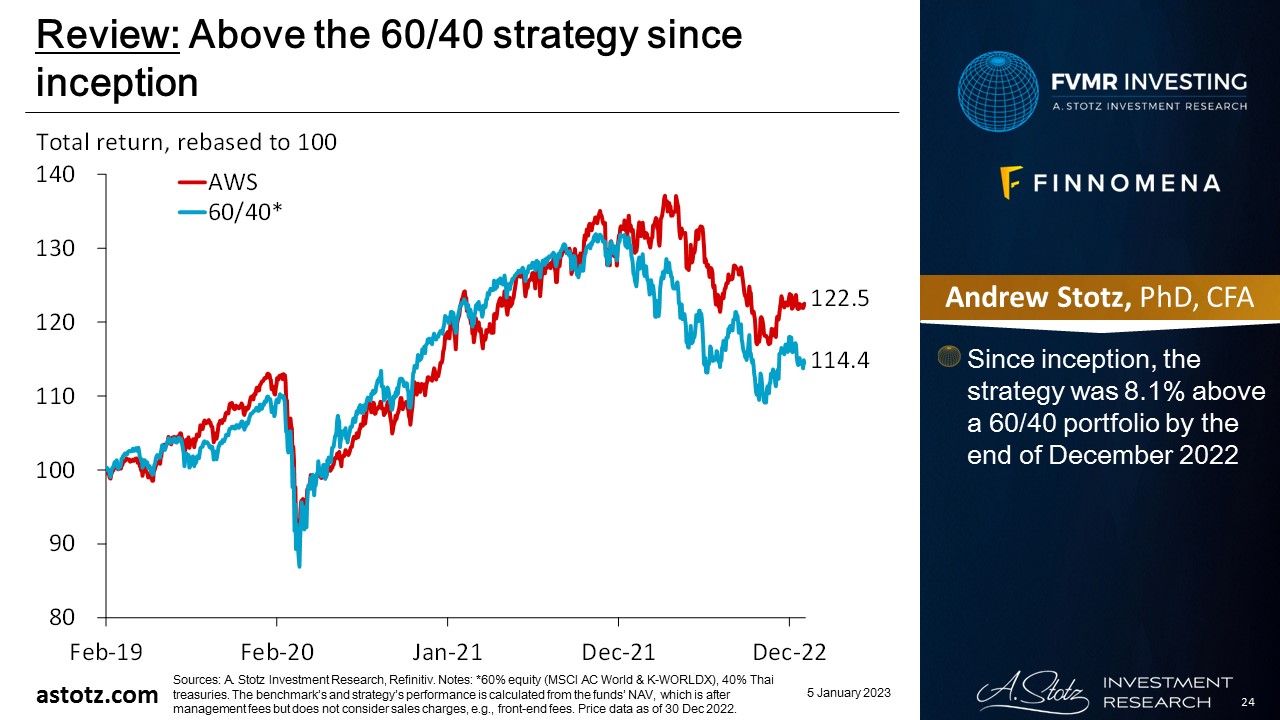

Performance review: All Weather Strategy

All Weather Strategy fell by 0.7%

- Since inception, the strategy was 8.1% above a 60/40 portfolio by the end of December 2022

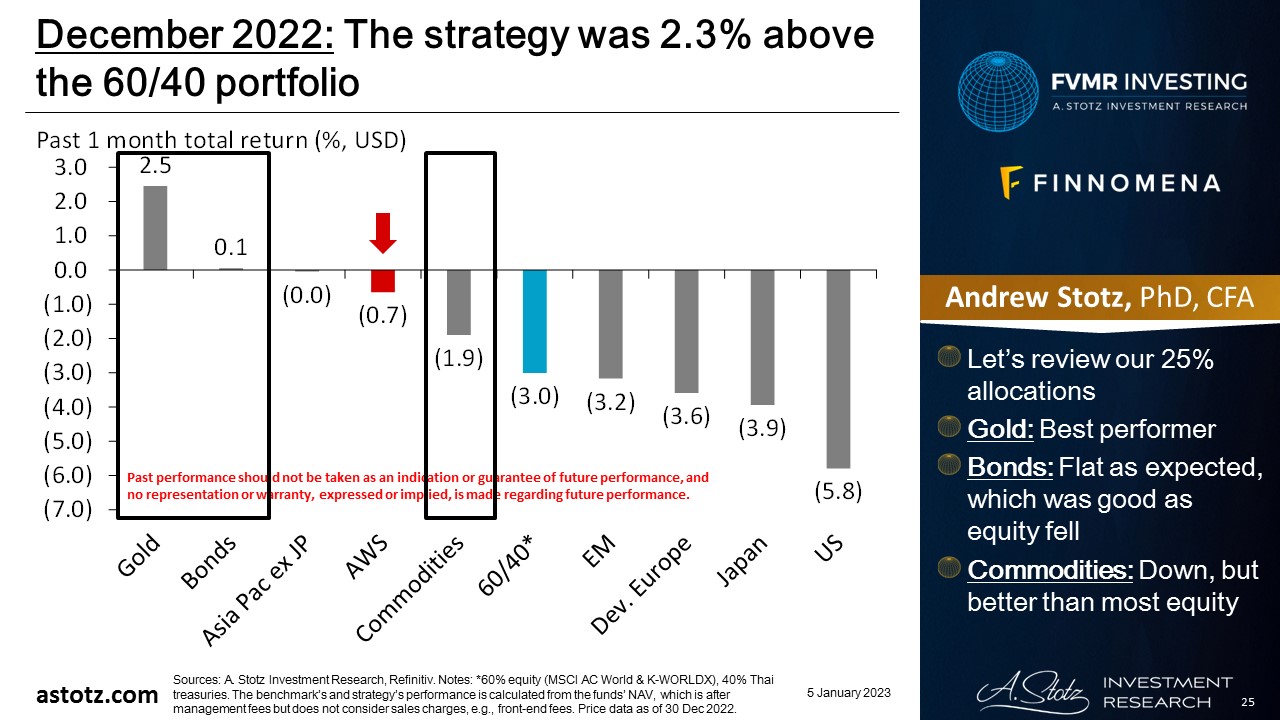

The strategy was 2.3% above the 60/40 portfolio

- Let’s review our 25% allocations

- Gold: Best performer

- Bonds: Flat as expected, which was good as equity fell

- Commodities: Down, but better than most equity

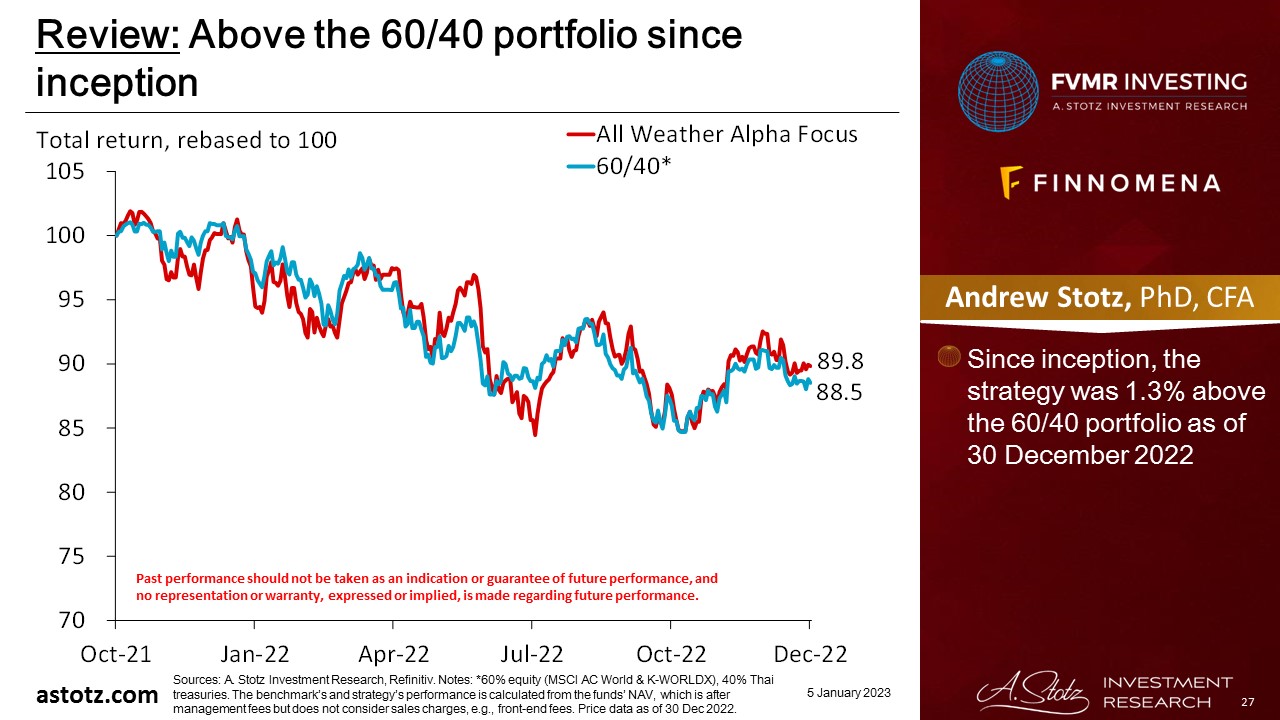

Performance review: All Weather Alpha Focus

All Weather Alpha Focus fell by 2.2%

- Since inception, the strategy was 1.3% above the 60/40 portfolio as of 30 December 2022

The strategy has also done better than World equity since inception

- Since inception, the strategy was 9.2% above World equity as of 30 December 2022

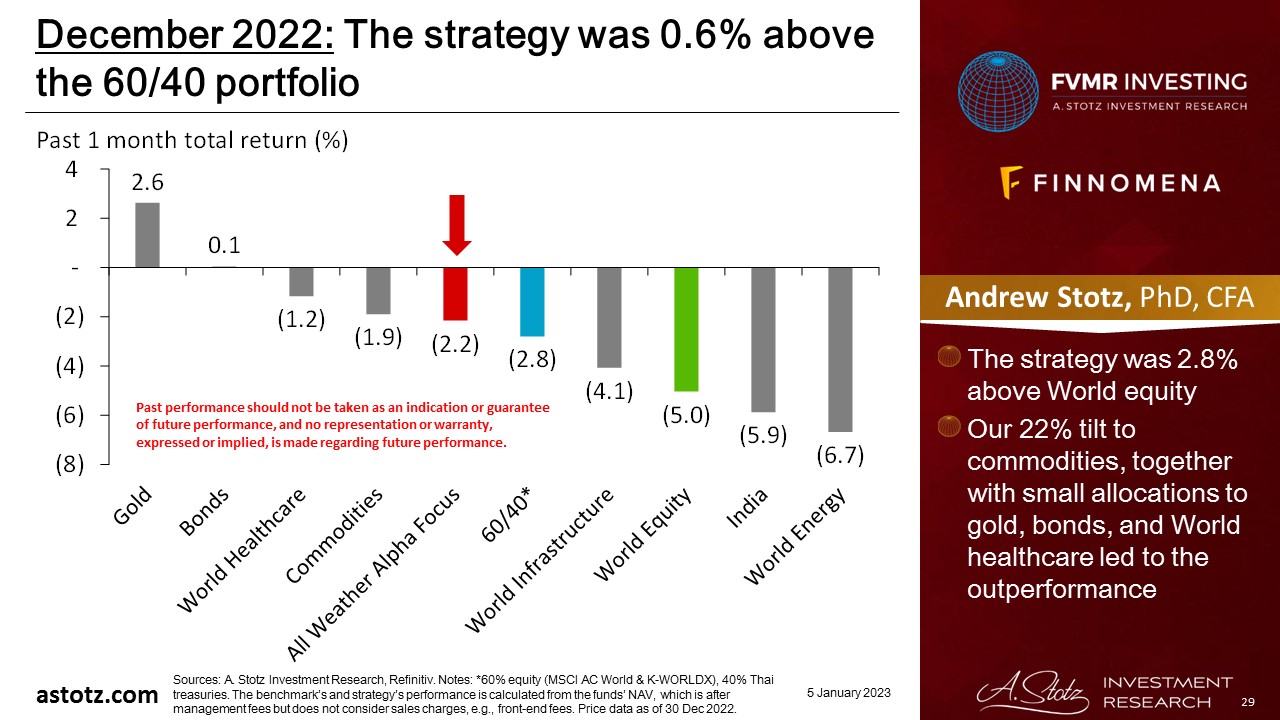

The strategy was 0.6% above the 60/40 portfolio

- The strategy was 2.8% above World equity

- Our 22% tilt to commodities, together with small allocations to gold, bonds, and World healthcare led to the outperformance

Global outlook that guides our asset allocation

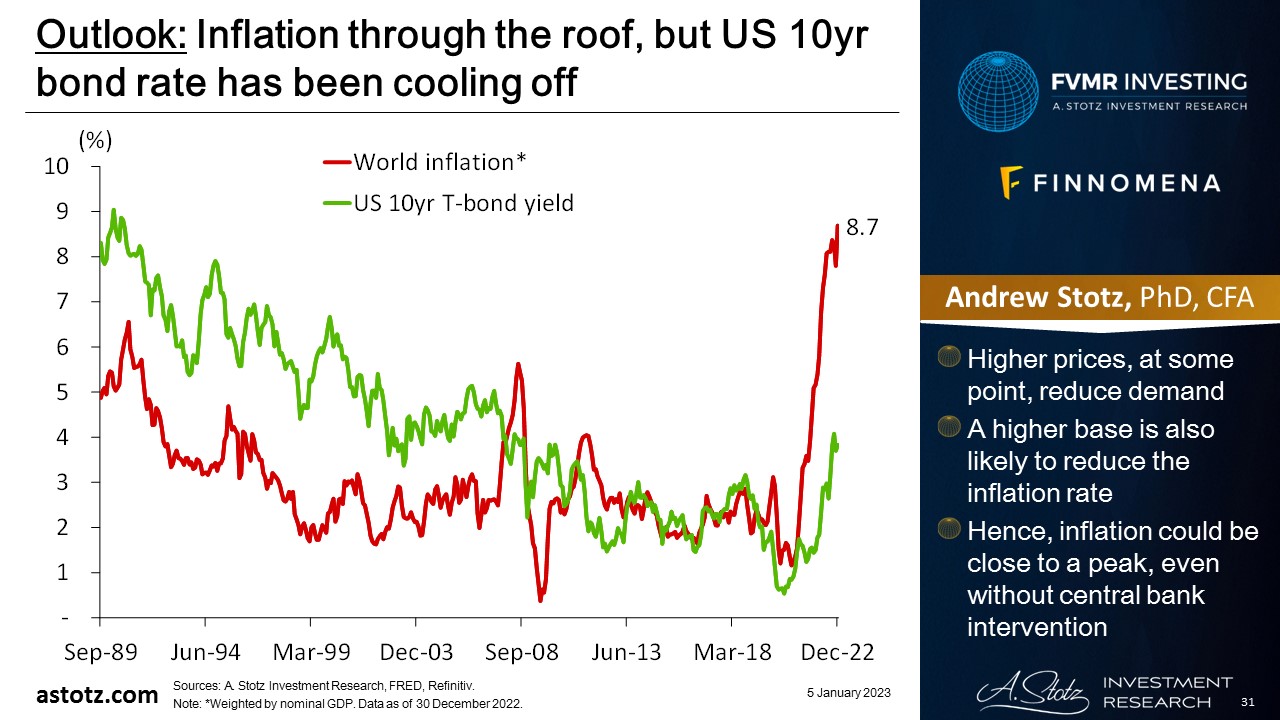

Inflation through the roof, but US 10yr bond rate has been cooling off

- Higher prices, at some point, reduce demand

- A higher base is also likely to reduce the inflation rate

- Hence, inflation could be close to a peak, even without central bank intervention

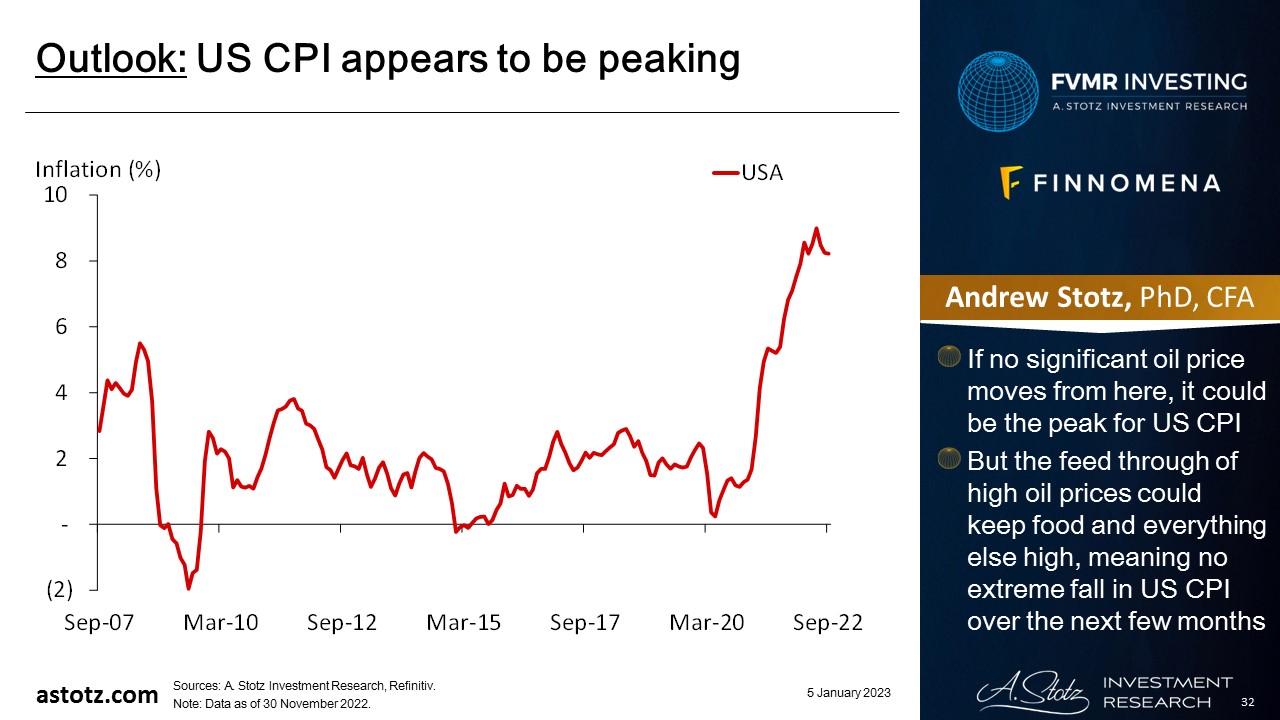

US CPI appears to be peaking

- If no significant oil price moves from here, it could be the peak for US CPI

- But the feed through of high oil prices could keep food and everything else high, meaning no extreme fall in US CPI over the next few months

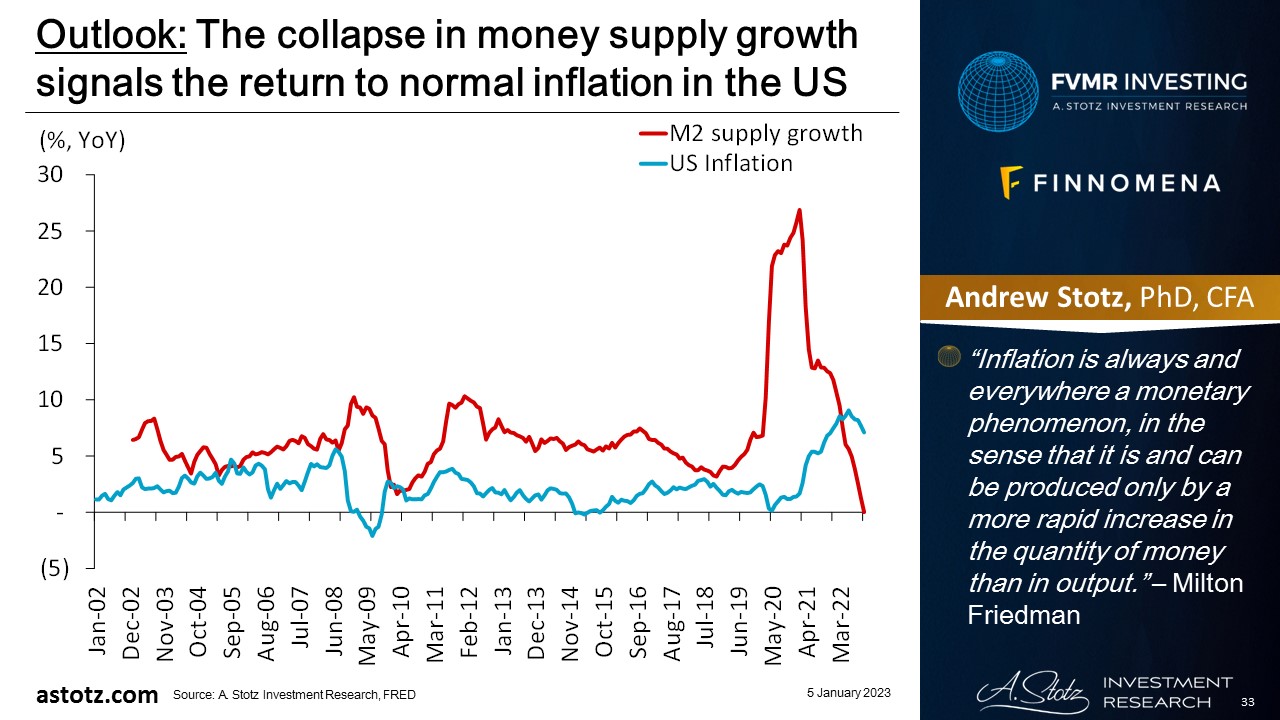

The collapse in money supply growth signals the return to normal inflation in the US

- “Inflation is always and everywhere a monetary phenomenon, in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.” – Milton Friedman

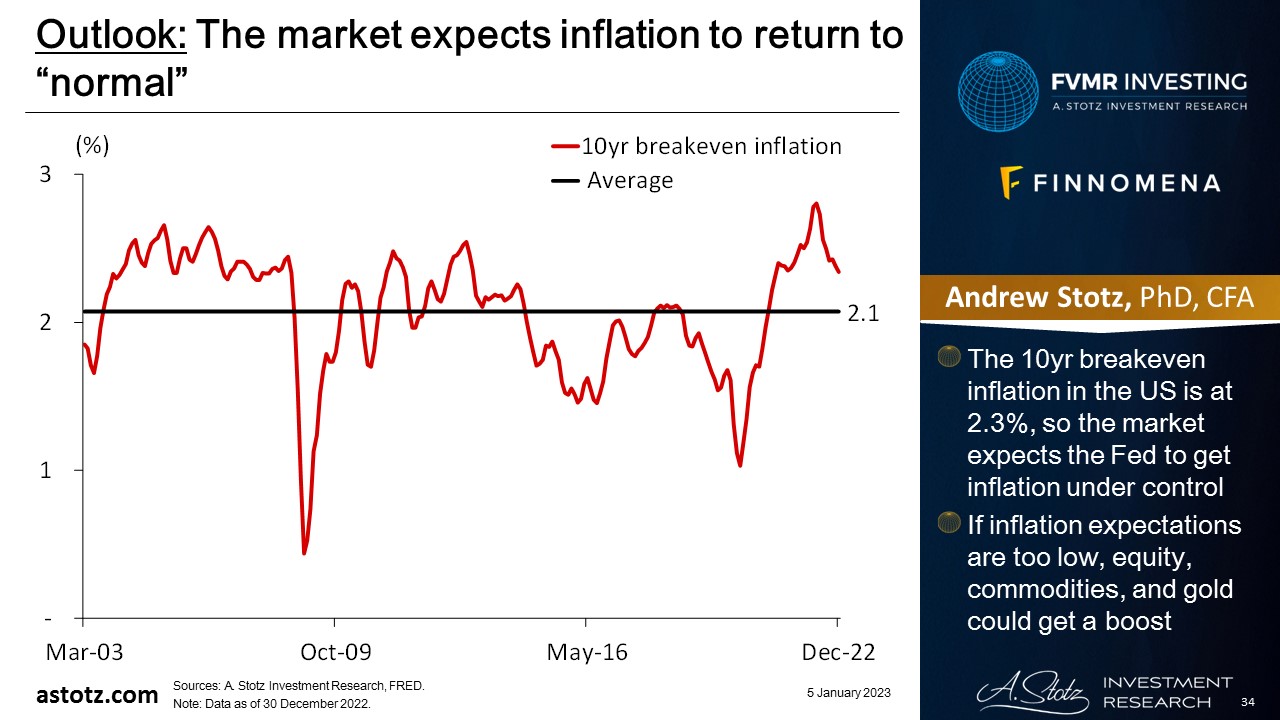

The market expects inflation to return to “normal”

- The 10yr breakeven inflation in the US is at 2.3%, so the market expects the Fed to get inflation under control

- If inflation expectations are too low, equity, commodities, and gold could get a boost

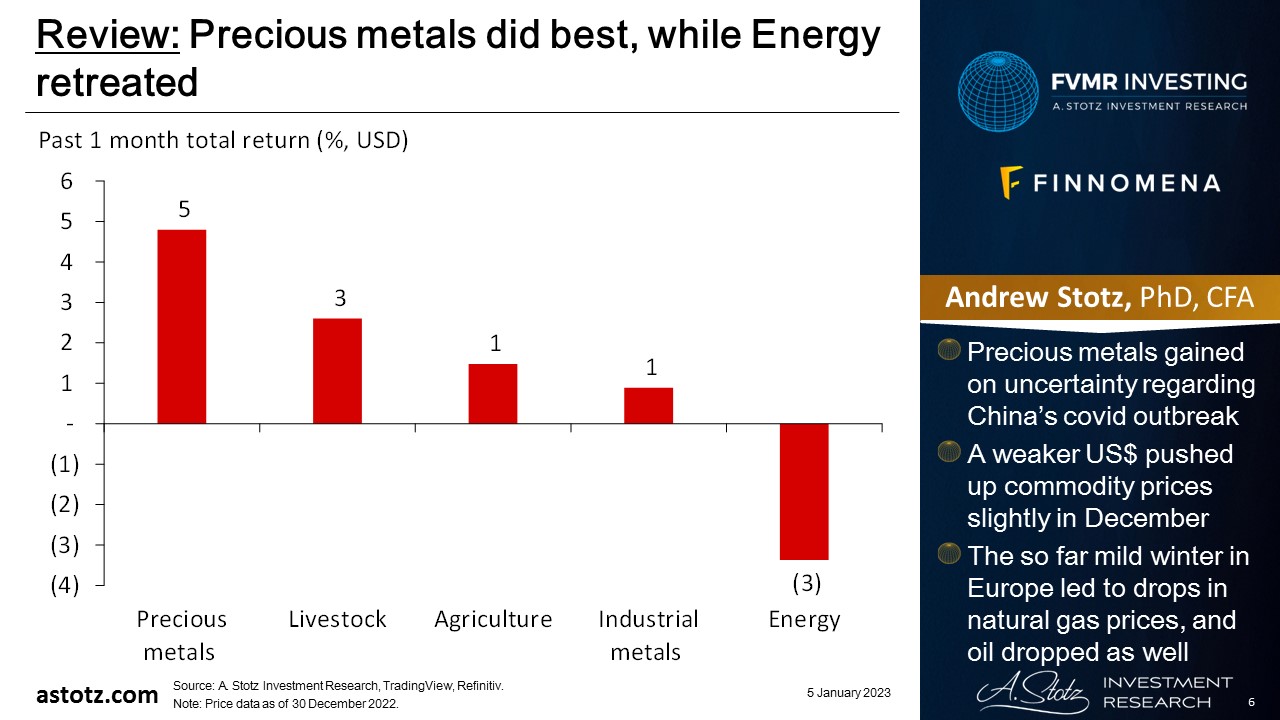

History tells us that inflation can be very persistent

- Once 2% is breached, it has taken a decade or more to come back down to 2%

- If history is any indicator of the future, we should expect >2% US inflation for years to come

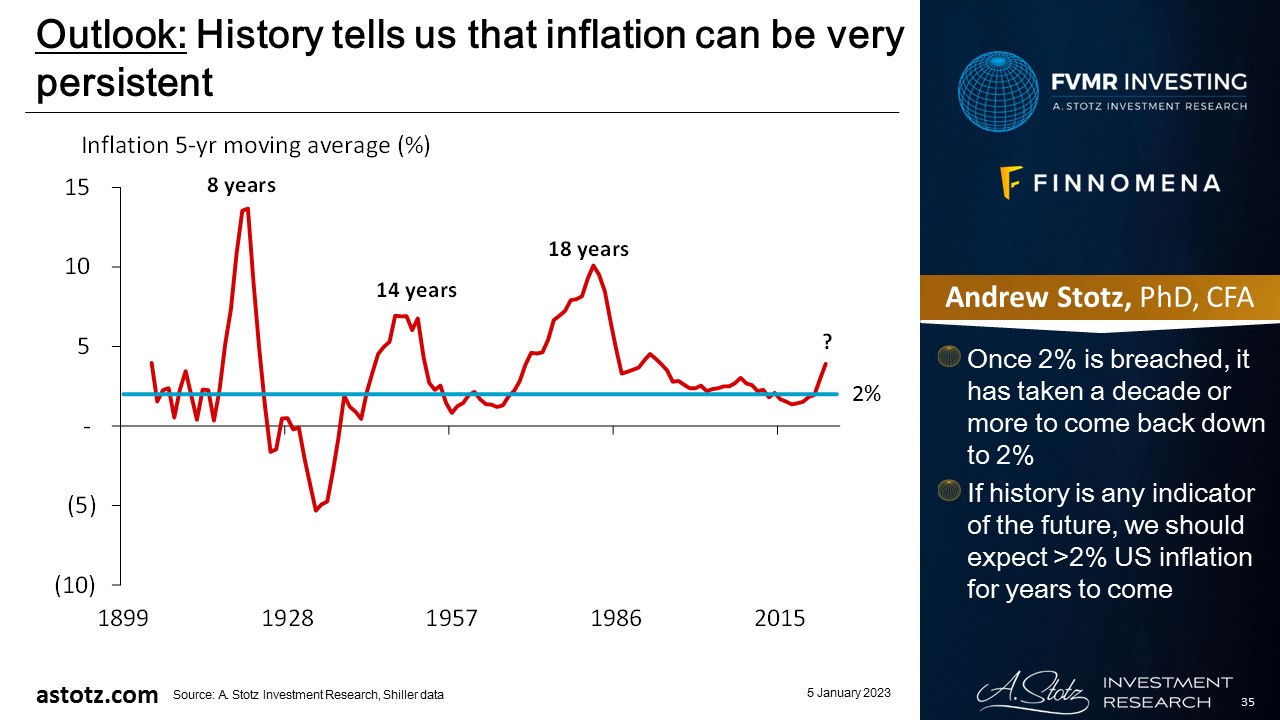

After a 4.75% hike, the market expects the target rate to peak at 5% in June 2023

- Currently, market participants are betting on a peak rate between March 2023 and September 2023

- Considering the weighted probabilities, the peak rate is expected in June 2023

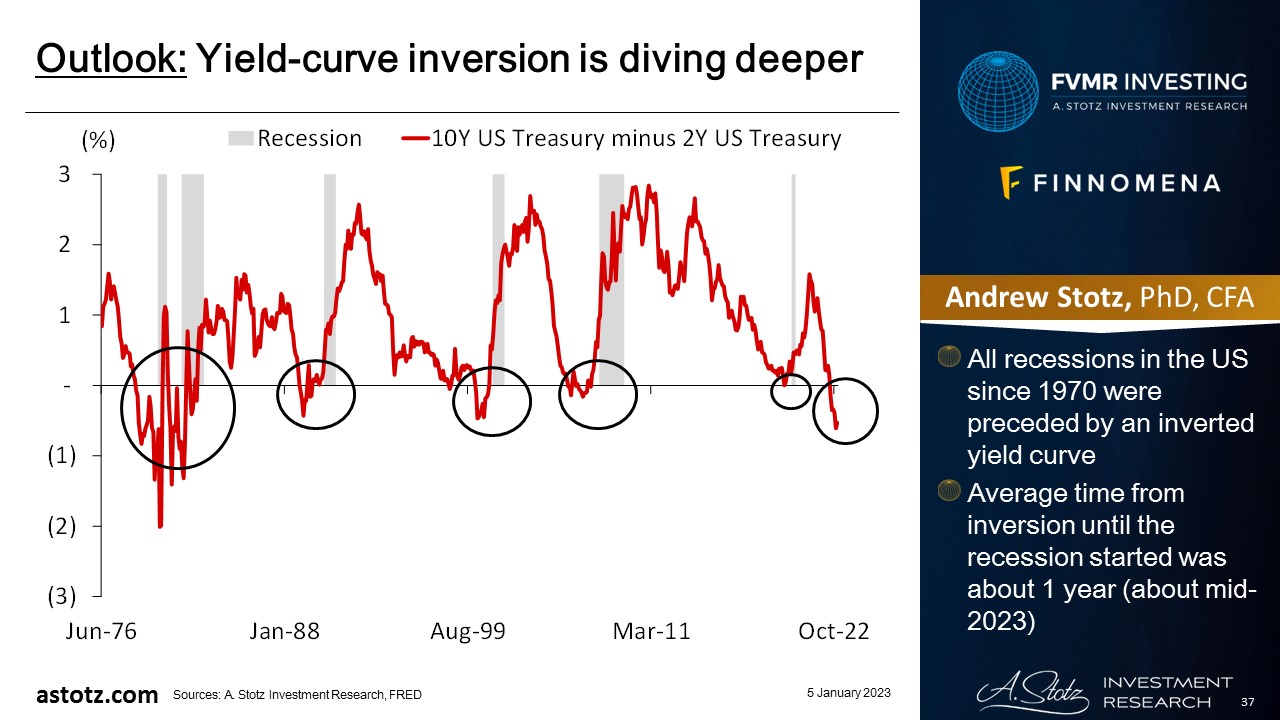

Yield-curve inversion is diving deeper

- All recessions in the US since 1970 were preceded by an inverted yield curve

- Average time from inversion until the recession started was about 1 year (about mid-2023)

Valuations have come down, primarily due to price fall

- World stocks’ valuation is now slightly below its long-term average

- While the consensus net margin has come down a bit, there has been no significant downward revision

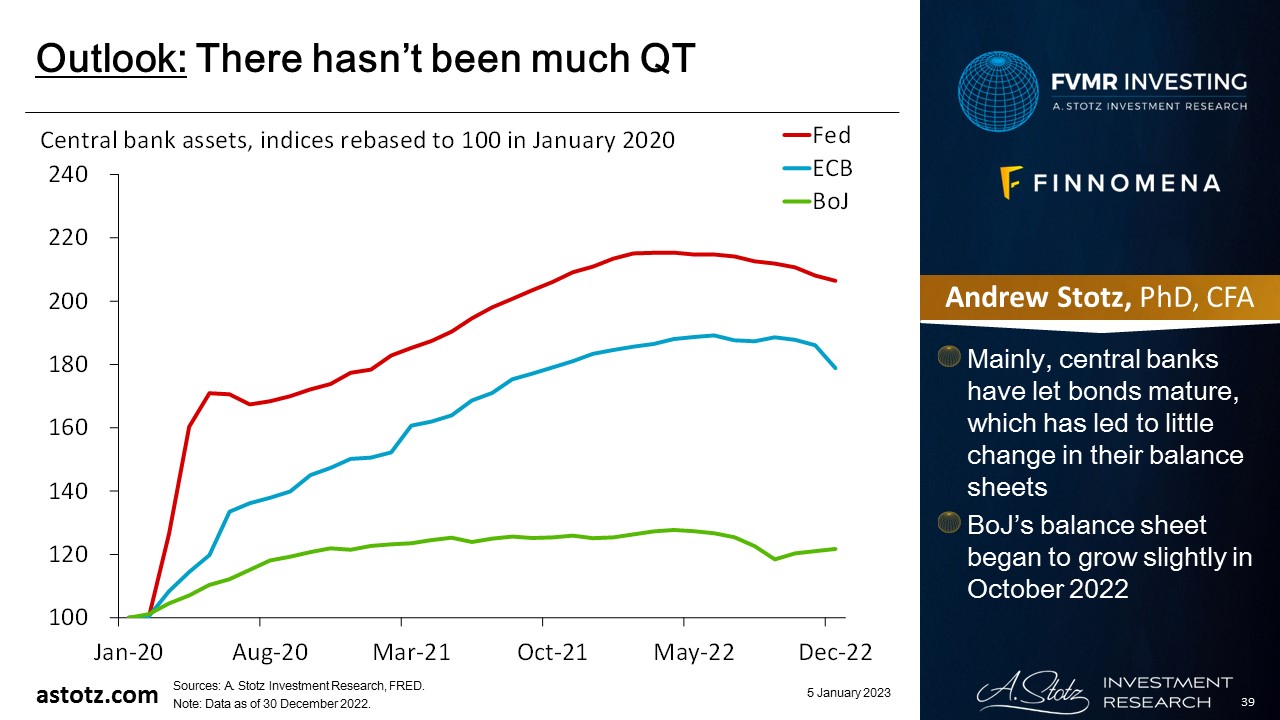

There hasn’t been much QT

- Mainly, central banks have let bonds mature, which has led to little change in their balance sheets

- BoJ’s balance sheet began to grow slightly in October 2022

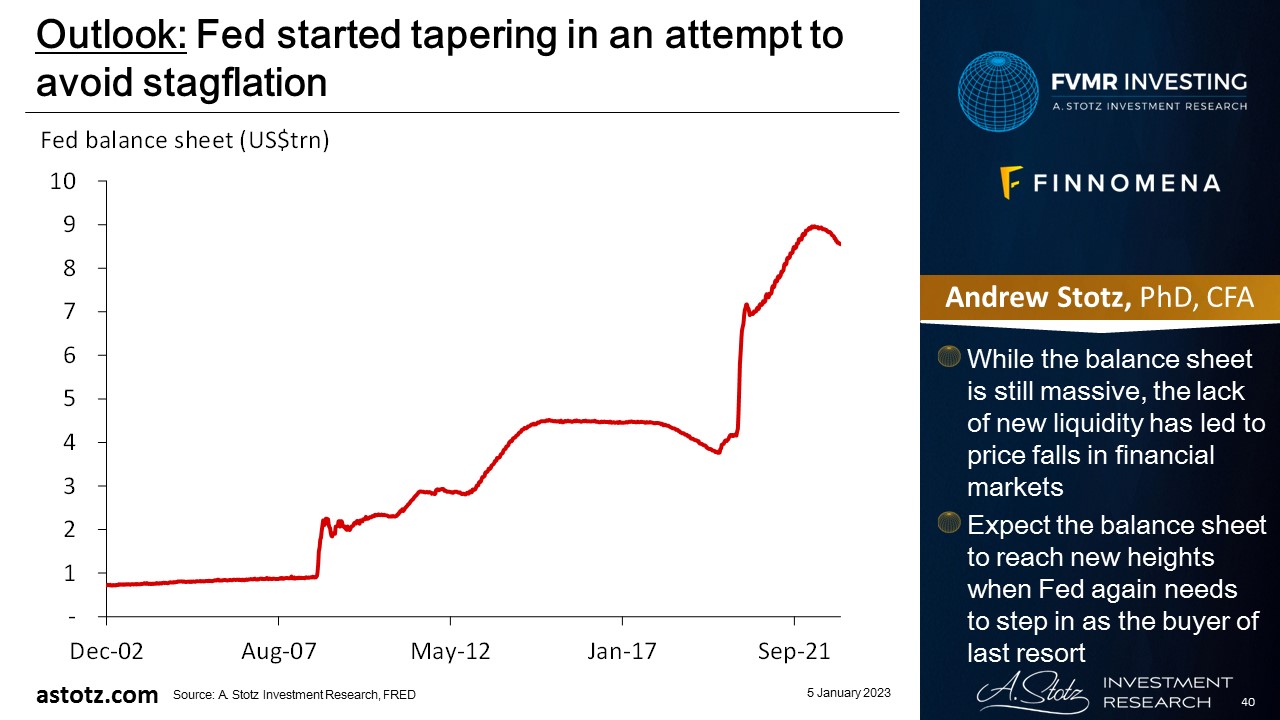

Fed started tapering in an attempt to avoid stagflation

- While the balance sheet is still massive, the lack of new liquidity has led to price falls in financial markets

- Expect the balance sheet to reach new heights when Fed again needs to step in as the buyer of last resort

For the past year, we’ve said that we think the course will eventually be reversed

- We still think central bankers and politicians will change course and return to accommodative policies as soon as something “breaks”

- And we do think central bankers are going to break things

Central banks may kill growth but not inflation, and we’ll get stagflation

- Stagflation is typically bad for both stocks and bonds

- Commodities have typically done well during inflationary times and have been resilient during stagflation

- Gold has historically fared well during stagflation

- We see opportunities to allocate to specific sectors and markets within equity; e.g., Energy and India

Bonds are typically a safe place to be, even though 2022 was exceptionally bad

- In recessions, safer assets like government bonds are typically performing well

- Though with high inflation, low yields could still lead to negative real returns

- We typically don’t allocate to bonds to speculate on the upside but rather use it as a way to protect capital over time

European natural gas prices remain volatile

- Europe’s Russian gas dependence influences prices, and if the weather gets colder, gas storages can quickly deplete, and prices rise again

Fundamental support for energy prices

- OPEC+ keeps missing its output targets, and the cartel has announced to cut production and support oil price

- Ukraine war could lead to further supply shocks

- Energy prices can also remain high due to past underinvestment in new projects

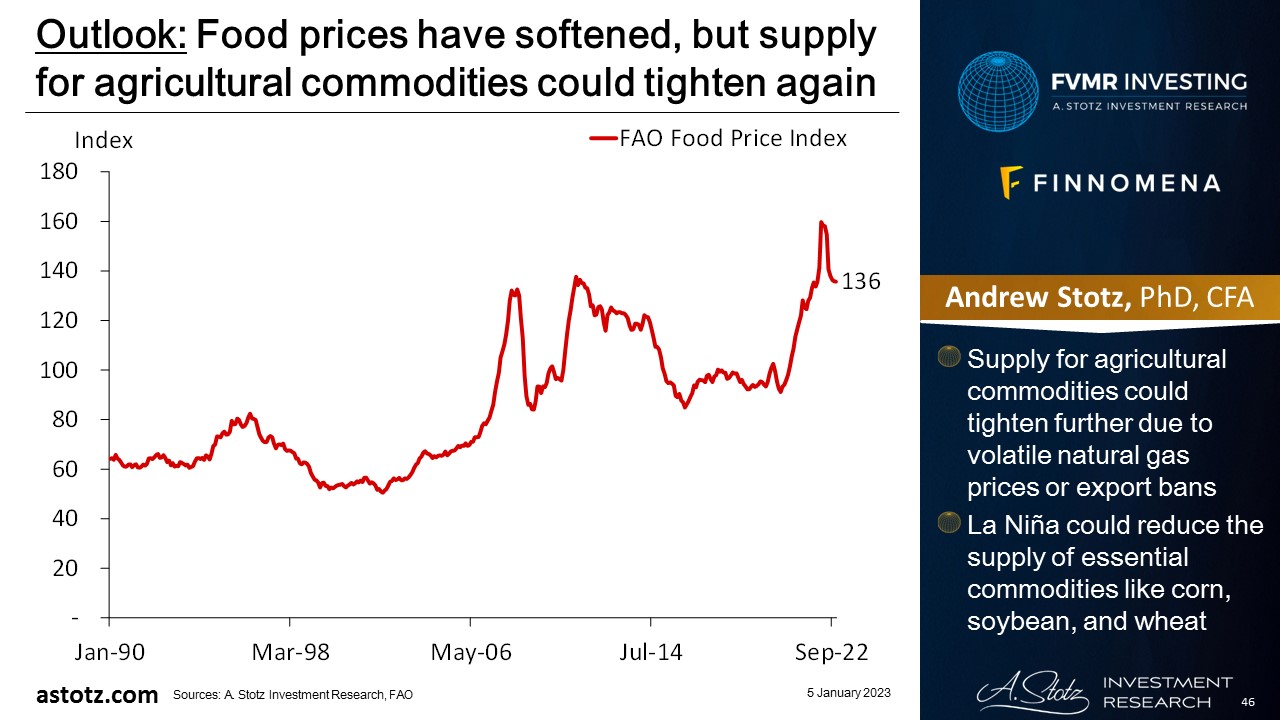

Food prices have softened, but supply for agricultural commodities could tighten again

- Supply for agricultural commodities could tighten further due to volatile natural gas prices or export bans

- La Niña could reduce the supply of essential commodities like corn, soybean, and wheat

Commodities have fundamental support

- Demand for necessities (food and energy), inflation, and supply-chain disruptions related and unrelated to the war in Ukraine are going to keep commodities prices high

- A re-opening of China could lead to increased demand for commodities

- Also, if we were to go into a stagflationary period, commodities could show resilient

Central banks have been loading up on gold, maybe switching from US$?

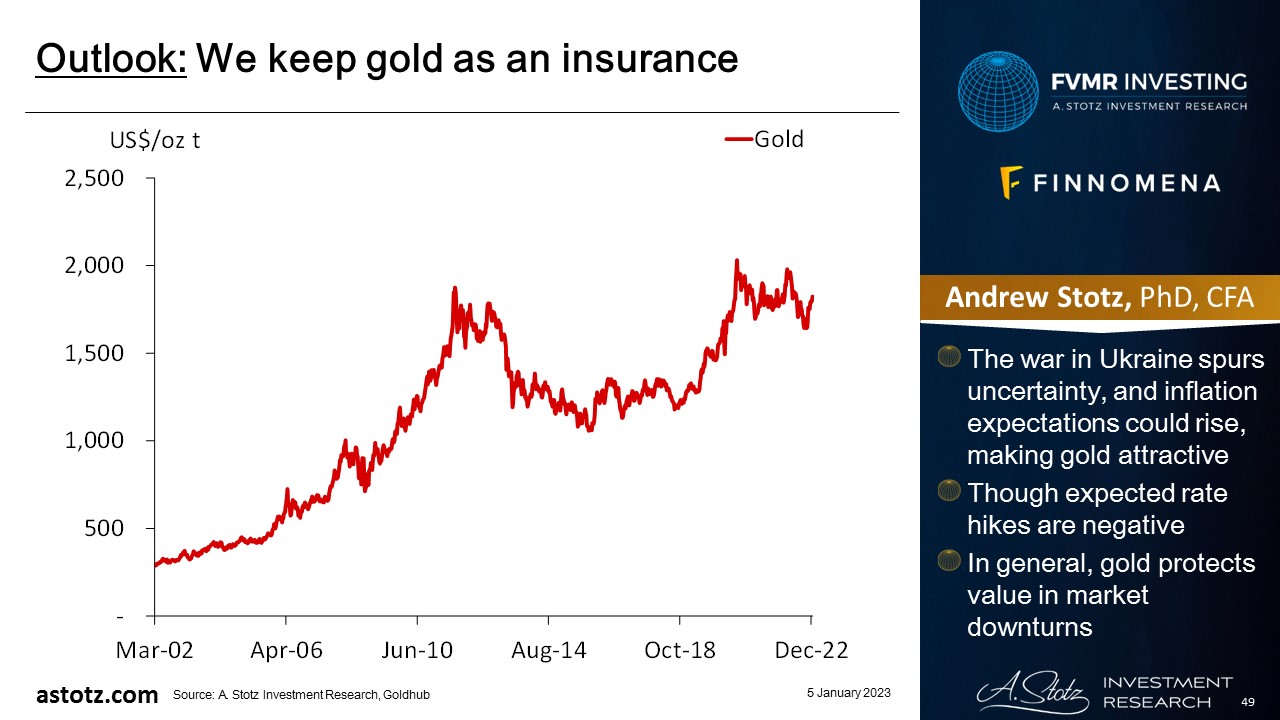

We keep gold as an insurance

- The war in Ukraine spurs uncertainty, and inflation expectations could rise, making gold attractive

- Though expected rate hikes are negative

- In general, gold protects value in market downturns

Risk: Inflation quickly gets under control

- Central banks’ aggressive rate hikes and QT crash the stock markets

- We’re underweight equity, so if central banks pivot and stocks go up, we’d miss the upside

- We are mainly exposed to Thai bonds; hence, BOT’s actions impact the most

- Weak Chinese economy could reduce commodities demand; hence, lower prices

- Other commodities could fall with energy prices, too, as it’s part of the production cost

Key takeaways

- Central bankers appear to be raising rates into a recession to stifle inflation; stagflation would be the worst outcome

- Demand for necessities (food and energy), inflation, and supply-chain disruptions can drive commodities higher

- We see opportunities to allocate to specific sectors and markets within equity

- Bonds and gold to protect capital

- Risks: Global recession, collapsing energy prices, weak China

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.