Become a Better Investor Newsletter – 24 January 2026

Noteworthy this week

- Greenland is strategically important

- Danish pension fund exits UST

- Gold makes new highs

- The yellow metal is overvalued

- The Woke Economic Forum does a 180

Greenland is strategically important: It’s the best place to deploy anti-missile defenses to intercept missiles from Russia/China, and a good place to deploy offensive missile capabilities to threaten Russia/China.

One reason Greenland is strategically important to the US is in fact twofold:

1. It’s the best place to set up anti-missile defenses to intercept ICBMs coming from Russia / China

2. It’s a very good place to set up offensive missile capabilities to threaten Russia / China

The… pic.twitter.com/Vrp0Uw8A4d

— Cassandra Unchained (@michaeljburry) January 20, 2026

Danish pension fund exits UST: A Danish U$25bn public pension fund is planning to exit US Treasuriesas a result of Trump’s actions.

$25 billion public pension fund exiting US Treasury holdings. pic.twitter.com/tLL0mHtT7S

— Ben Hunt (@EpsilonTheory) January 20, 2026

Gold makes new highs: Gold futures surpassed U$4,850/oz t.

BREAKING: Gold extends gains to a record $4,850/oz, now up +$260 in 48 hours.

We are all witnessing history right now. pic.twitter.com/wMkRFkEqrU

— The Kobeissi Letter (@KobeissiLetter) January 21, 2026

The yellow metal is overvalued: At least if you ask the fund managers surveyed by Bank of America.

Gold is overvalued, and so are tech stocks. pic.twitter.com/8UgW2kr7xX

— Callum Thomas (@Callum_Thomas) January 20, 2026

The Woke Economic Forum does a 180: Larry Fink admitted that the power required for data centers can’t be derived solely from intermittent solar and wind. They changed the wording from “stakeholders” back to “shareholders.” They exchanged “climate change” with “weather change.”

Davos Day 1

So far the divergence from past meetings is fascinating

1. Larry Fink admitted that the amount of power needed for data centers can’t be derived from intermittent solar and wind and they need steady baseload power because they can’t be turned on and off (LOL …I…

— Tracy Shuchart (𝒞𝒽𝒾 ) (@chigrl) January 19, 2026

Join the world’s toughest valuation training

Become a Valuation Expert. Valuation Master Class Boot Camp graduates can confidently value any company in the world and possess in-demand industry skills.

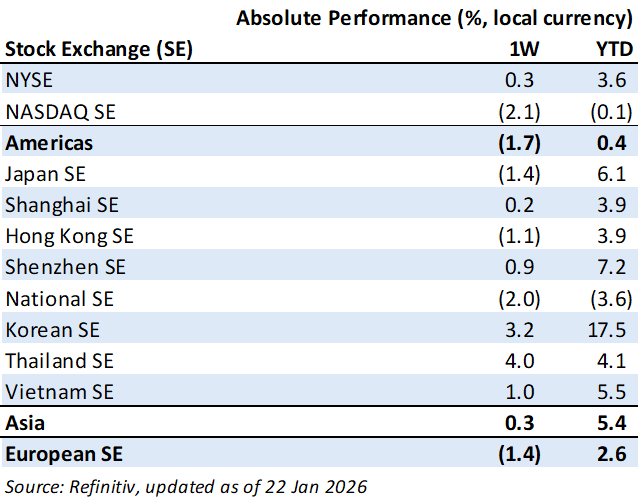

Weekly market performance

Click here to see more markets and periods.

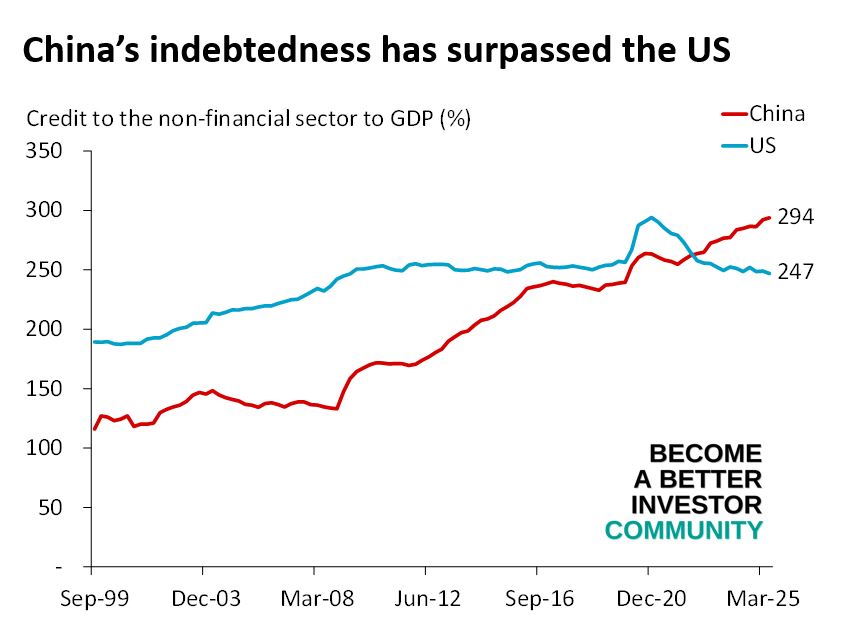

Chart of the week

Try 1 month of the Become a Better Investor Community for FREE today!

You can cancel at any time. Click here to learn more.

Podcasts we listened to this week

The Hundred Year Pivot Ep. 11 – Brian Winter

“We discuss the finer details of Venezuelan politics, what likely happens next, other key potential flashpoints in Latin America as well as the surprising resurgence of right-wing politics across a continent with a history of tending very consistently towards the other extreme of the political spectrum.”

Readings this week

The World in Which We Live Now

“I have seven points. Why seven? Because I’ve been reading too much Babylonian history recently.”

Book recommendation

The Primate Myth: Why the Latest Science Leads Us to a New Theory of Human Nature by Jonathan Leaf

“Challenging everything we thought we knew, this book takes a revolutionary look at how humans are far less like other primates than we’ve been led to believe—and uncovers what truly sets us apart.”

Get the book on Audible or Kindle.

Audible is great; have you tried it? If not, click here to get 2 books for free.

Memes of the week

World’s elites arrive to Davos to fix climate change. pic.twitter.com/WF3oF2CpOD

— Not Jerome Powell (@alifarhat79) January 19, 2026

Wtf pic.twitter.com/xpjN54dJPr

— Not Jerome Powell (@alifarhat79) January 20, 2026

New My Worst Investment Ever episode

Ep817: Jon Ostenson – Top 10 Franchise Opportunities for 2026

BIO: Jon is the Founder and CEO of FranBridge Consulting, a 2-time Inc. 5000 company, and a leading franchise consultant.

STORY: Jon believes franchising remains one of the most effective ways to build durable income, especially when investors focus on operational discipline and unit economics. He shares his top franchise categories for 2026.

LEARNING: Look for businesses with repeat customers, operational discipline, proven unit economics, and leadership teams that have already made their mistakes.

Access the episode’s show notes and resources

Published on Become a Better Investor this week

Sen X Public Company Limited (SENX TB): Profitable Growth rank of 4 was same compared to the prior period’s 4th rank. This is above average performance compared to 410 small Real Estate companies worldwide.

Read Sen X – World Class Benchmarking

MFEC Public Company Limited (MFEC TB): Profitable Growth rank of 6 was down compared to the prior period’s 5th rank. This is below average performance compared to 750 medium Info Tech companies worldwide.

Read MFEC – World Class Benchmarking

MBK Public Company Limited (MBK TB): Profitable Growth rank of 2 was up compared to the prior period’s 3rd rank. This is World Class performance compared to 340 medium Real Estate companies worldwide.

Read MBK – World Class Benchmarking

Vintcom Technology Public Company Limited (VCOM TB): Profitable Growth rank of 3 was same compared to the prior period’s 3rd rank. This is above average performance compared to 740 small Info Tech companies worldwide.

Read Vintcom Technology – World Class Benchmarking

Samart Telcoms Public Company Limited (SAMTEL TB): Profitable Growth rank of 4 was up compared to the prior period’s 7th rank. This is above average performance compared to 210 medium Comm. Serv. companies worldwide.

Read Samart Telcoms – World Class Benchmarking

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.