Enrich Your Future 12: When Confronted With a Loser’s Game Do Not Play

The post was originally published here.

Listen on

Apple | Listen Notes | Spotify | YouTube | Other

Quick take

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. In this series, they discuss Chapter 12: Outfoxing the Box.

LEARNING: You don’t have to engage in active investing; instead, accept market returns by investing passively.

“You don’t have to play the game of active investing. You don’t have to try to overcome abysmal odds—odds that make the crap tables at Las Vegas seem appealing. Instead, you can outfox the box and accept market returns by investing passively.”

Larry Swedroe

In this episode of Enrich Your Future, Andrew and Larry Swedroe discuss Larry’s new book, Enrich Your Future: The Keys to Successful Investing. The book is a collection of stories that Larry has developed over 30 years as the head of financial and economic research at Buckingham Wealth Partners to help investors. You can learn more about Larry’s Worst Investment Ever story on Ep645: Beware of Idiosyncratic Risks.

Larry deeply understands the world of academic research and investing, especially risk. Today, Andrew and Larry discuss Chapter 12: Outfoxing the Box.

Chapter 12: Outfoxing the Box

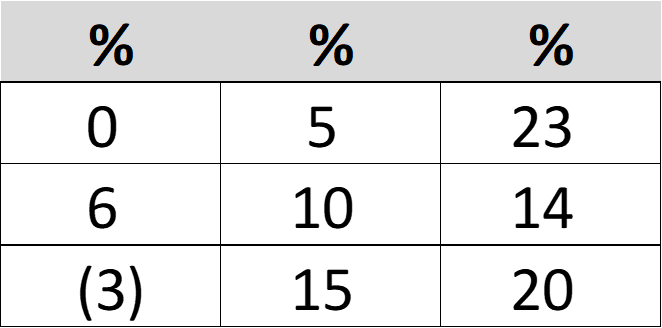

In this chapter, Larry aims to guide investors toward a winning investment strategy: accepting market returns. He uses Bill Schultheis’s “Outfoxing the Box.” This is a simple game that you can choose to either play or not play. The box contains nine percentages, each representing a rate of return your financial assets are guaranteed to earn for the rest of your life.

As an investor, you have the following choice: Accept the 10 percent rate of return in the center box or be asked to leave the room. The boxes will be shuffled around, and you will have to choose a box, not knowing what return each box holds. You quickly calculate that the average return of the other eight boxes is 10 percent.

Thus, if thousands of people played the game and each chose a box, the expected average return would be the same as if they all decided not to play. Of course, some would earn a return of negative 3 percent per annum, while others would earn 23 percent. This is like the world of investing: if you choose an actively managed fund and the market returns 10 percent, you might be lucky and earn as much as 23 percent per annum, or you might be unlucky and lose 3 percent per annum. A rational risk-averse investor should logically decide to “outfox the box” and accept the average (market) return of 10 percent.

In all the years Larry has been an investment advisor, whenever he presents this game to an investor, not once has an investor chosen to play. Everyone decides to accept par or 10 percent. While they might be willing to spend a dollar on a lottery ticket, they become more prudent in their choice when it comes to investing their life’s savings.

Active investing is a loser’s game

Active investing is a game with low odds of success that many would consider a losing battle. It’s a game that, when compared to the ‘outfoxing the box’ game, seems like a futile endeavor. Larry’s advice is to avoid this game altogether.

In the “outfoxing the box” game, the average return of all choices was the same 10 percent as the 10 percent that would have been earned by choosing not to play. And 50 percent of those choosing to play would be expected to earn an above-average return and 50 percent a below-average return.

In his book The Incredible Shrinking Alpha, Larry shows that the odds are far worse than 50 percent. Today, only about 2 percent of actively managed funds generate statistically significant alphas on a pretax basis. If you would choose not to play a game when you have a 50 percent chance of success, what logic is there in choosing to play a game where the most sophisticated investors have a much higher failure rate? Yet, that is precisely the choice those playing the game of active management are making.

Larry adds that research has shown that even the big institutional investors, with all their resources, fail to outperform appropriate risk-adjusted benchmarks such as the S&P 500. In addition to their other advantages, institutional investors have one other significant advantage over individual investors—their returns are not taxable. However, if your equity investments are in a taxable account, the returns you earn are subject to taxes. The incremental tax cost of active funds further reduces your odds of success.

You don’t have to play the game of active investing

Larry’s advice to investors is to avoid trying to overcome abysmal odds—odds that make the crap tables at Las Vegas seem appealing. Instead, he suggests outfoxing the box and accepting market returns by investing passively. Larry quotes Charles Ellis, author of Investment Policy: How to Win the Loser’s Game:

“In investment management, the real opportunity to achieve superior results is not in scrambling to outperform the market, but in establishing and adhering to appropriate investment policies over the long term—policies that position the portfolio to benefit from riding with the main long-term forces in the market.”

Further reading

- Robert D. Arnott, Andrew L. Berkin, and Jia Ye, “How Well Have Taxable Investors Been Served in the 1980s and 1990s?” Journal of Portfolio Management (Summer 2000).

- Charles Ellis, Investment Policy: How to Win the Loser’s Game (Irwin, 1993) p. 24.

Did you miss out on the previous chapters? Check them out:

Part I: How Markets Work: How Security Prices are Determined and Why It’s So Difficult to Outperform

- Enrich Your Future 01: The Determinants of the Risk and Return of Stocks and Bonds

- Enrich Your Future 02: How Markets Set Prices

- Enrich Your Future 03: Persistence of Performance: Athletes Versus Investment Managers

- Enrich Your Future 04: Why Is Persistent Outperformance So Hard to Find?

- Enrich Your Future 05: Great Companies Do Not Make High-Return Investments

- Enrich Your Future 06: Market Efficiency and the Case of Pete Rose

- Enrich Your Future 07: The Value of Security Analysis

- Enrich Your Future 08: High Economic Growth Doesn’t Always Mean High Stock Market Return

- Enrich Your Future 09: The Fed Model and the Money Illusion

Part II: Strategic Portfolio Decisions

- Enrich Your Future 10: You Won’t Beat the Market Even the Best Funds Don’t

- Enrich Your Future 11: Long-Term Outperformance Is Not Always Evidence of Skill

About Larry Swedroe

Larry Swedroe was head of financial and economic research at Buckingham Wealth Partners. Since joining the firm in 1996, Larry has spent his time, talent, and energy educating investors on the benefits of evidence-based investing with an enthusiasm few can match.

Larry was among the first authors to publish a book that explained the science of investing in layman’s terms, “The Only Guide to a Winning Investment Strategy You’ll Ever Need.” He has authored or co-authored 18 books.

Larry’s dedication to helping others has made him a sought-after national speaker. He has made appearances on national television on various outlets.

Larry is a prolific writer, regularly contributing to multiple outlets, including AlphaArchitect, Advisor Perspectives, and Wealth Management.