Tianneng Power International Limited is a leading manufacturer of batteries and possesses the largest market share of lead-acid battery sales in China. Profitable Growth has shown a positive trend and climbed up the ranks in 2016.

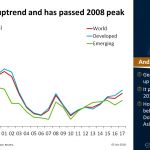

Read MoreChart of the Day: Global gearing has been trending up since 2010. It passed the 2008 peak in 2017. However, gearing is still below peaks before the Dotcom bubble and the Asian financial crisis.

Read MoreStudents of the Valuation Master Class Live events build their practical skills in valuation and advance their analytical skills in forecasting… using Astotz Investment Research’s very own ValueModel.

Read MoreWhen it comes to choosing CFA or MBA, it’s important to check out what will be required of you to attain it in terms of time and study, and what competitive edge each qualification will give your career. Here is how each type of certification will help you advance your skills, so that you can decide which one is right for you.

Read MoreChart of the Day: More than 17,000 companies worldwide have shown a strong revenue uptrend. We are now two years into this revenue uptrend and may be getting closer to a peak. Companies have been slow to expand their assets, unlike in prior stock market boom times.

Read MoreIn our Top 5 this week, we examine the nature of long-tails in investment and business, study certainty, and ask if volatility is risk. All this and more…

Read MoreKorea Gas Corporation was incorporated by the Korean government in 1983 and is the world’s largest liquefied natural gas (LNG) importer. Profitable Growth had sunk to the bottom in 2015 and stayed there until a slight improvement in the past 12 months.

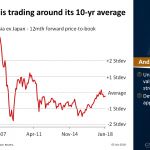

Read MoreChart of the Day: Global markets are expensive, not bubble yet. US 10-year bull run hitting its peak. Unlike the US, Asia valuations are not stretched. Developed Asia ex Japan appears cheap.

Read MoreWhen it comes to choosing CFA or MBA, it’s important to check out what will be required of you to attain it in terms of time and study, and what competitive edge each qualification will give your career. Here is how each type of certification will help you advance your skills, so that you can decide which one is right for you.

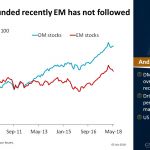

Read MoreChart of the Day: Developed markets have outperformed Emerging markets over the past decade and recently. Outperformance has been driven by the strong performance of the US market. US could be at risk, though.

Read More