Malaysia: A Market with Lower Volatility

Malaysia Equity FVMR Snapshot

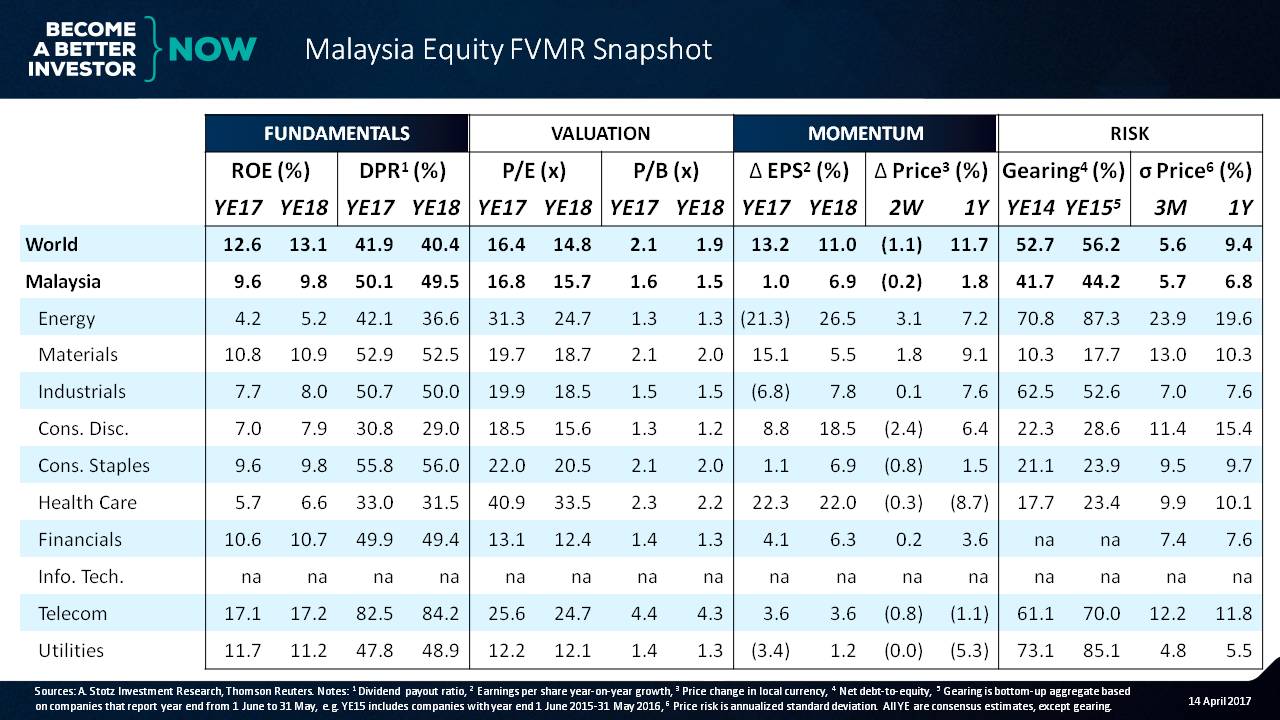

Fundamentals: Lower profitability

The first thing we can see is that the ROE of Malaysia is about 10% versus about 12% to 13% for the world. So the overall profitability of Malaysian companies is slightly lower.

Concerning EPS growth expectations, we can see that it’s very low in 2017 with only 1% expected growth compared to about 13% for the rest of the world. And then, it goes up to about 7% versus about 11% for the rest of the world.

So, basically, we’ve got a low ROE situation and a low growth expectation situation.

Valuation: Slightly more expensive than the world

Now, let’s move on to the PE. We can see that the PE of the market is about 16x or 17x. We can see that it’s just slightly more expensive than the world. So you get lower ROE and a lower earnings growth for about the same price.

Hence, the market hasn’t been that attractive recently.

On a price-to-book value basis, it’s looking even cheaper, which could be due to its correlation with the ROE; whereas, the PE is a little bit more about earnings growth.

Momentum: Stalled out share prices

Let’s take a look at what’s been happening in share price.

We can see that the Malaysian market has risen about 2%, while the world market has gone up about 12%. It’s also been underperforming both in earnings and in price.

Risk: Low leverage, lower volatility

If we look at the volatility, it tends to be very low in this market. We can also see that the leverage of Malaysian companies is pretty low.

I would say that this is a market with weak fundamentals and momentum that’s still a little bit expensive with low risk to boot.

It’s not all that attractive at this point and time.

Malaysia by sector

The energy sector is producing an ROE of about 4%, and we can see that earnings per share have been falling quite dramatically. So we may be forgiven for expecting a slight recovery. And here on the EPS side, we can see large growth.

It’s a cyclical business. Oil prices have been rising, so they’re getting some benefit from that.

The highest ROE sector right now is the telecom sector, but it’s also expensive. It’s trading at about 26 times earnings.

What I find interesting is the health care sector with almost PE of 40x, while the ROE is low and earnings growth is strong. That’s where you can see the correlation between PE and earnings growth versus the ROE and price-to-book, although this is a low ROE and not a particularly expensive price-to-book.

It’s a little bit expensive but it’s got growth, and that’s part of the attraction for that sector.

Most of the other sectors are pretty darn expensive. Look at energy, cyclical; materials, cyclical; industrial, a bit cyclical. Those are all a little bit expensive as they start to see some recovery.

Overall, if we look at the price performance, we can see that the biggest hit has actually been the health care sector.

There does seem to be some recovery going on in the materials sector though.

And if we look at gearing, it’s nice to see very low gearing for most of these sectors, so we can rest assure that they’re not overleveraged.

Finally, what sectors are most volatile?

The energy sector is number one in volatility followed by the consumer discretionary sector.

The lowest volatility sector is utilities ─ as it should be ─ which has a reasonable ROE, a reasonable valuation, steady growth and, therefore, a very low volatility.

There you go. Malaysia tends to be a bit expensive for low profitability and low growth, but the risk is also low. In fact, the risk is probably lowest in Malaysian utility companies. Maybe that’s a defensive strategy right there.

Do you want to see the FVMR snapshot for your country?

Just leave a comment below, and I’ll see what I can do.

Get our Equity FVMR Snapshots for free to your inbox every Monday!

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.