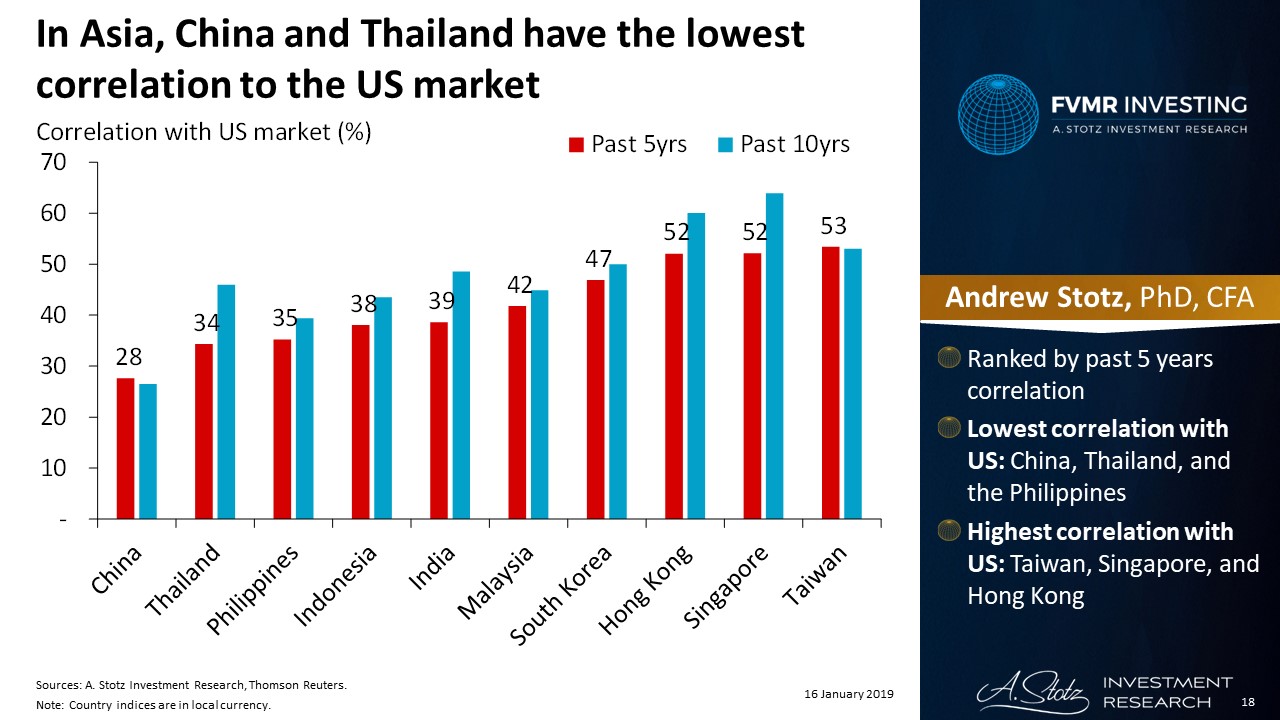

In Asia, China Is Least Correlated to the US Market

In Asia, China and Thailand have the lowest correlation to the US market

- Ranked by past 5 years correlation

- Lowest correlation with US: China, Thailand, and the Philippines

- Highest correlation with US: Taiwan, Singapore, and Hong Kong

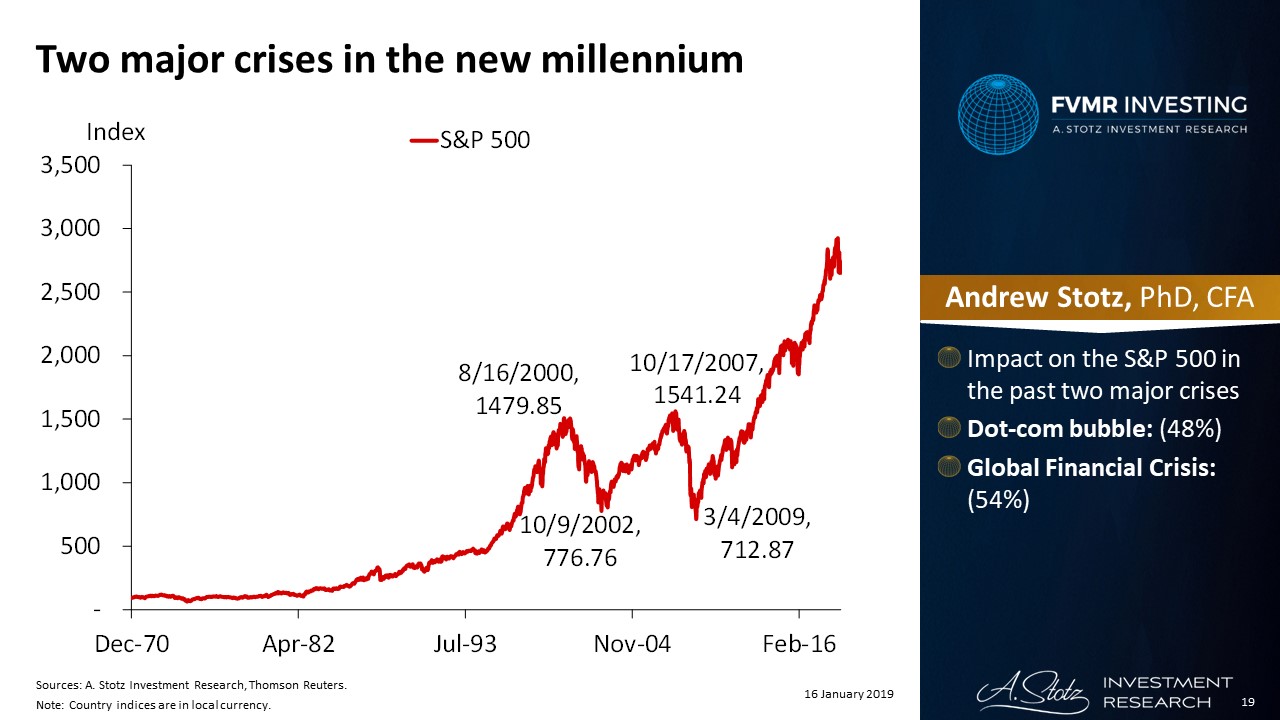

Two major crises in the new millennium

- Impact on the S&P 500 in the past two major crises

- Dot-com bubble: (48%)

- Global Financial Crisis: (54%)

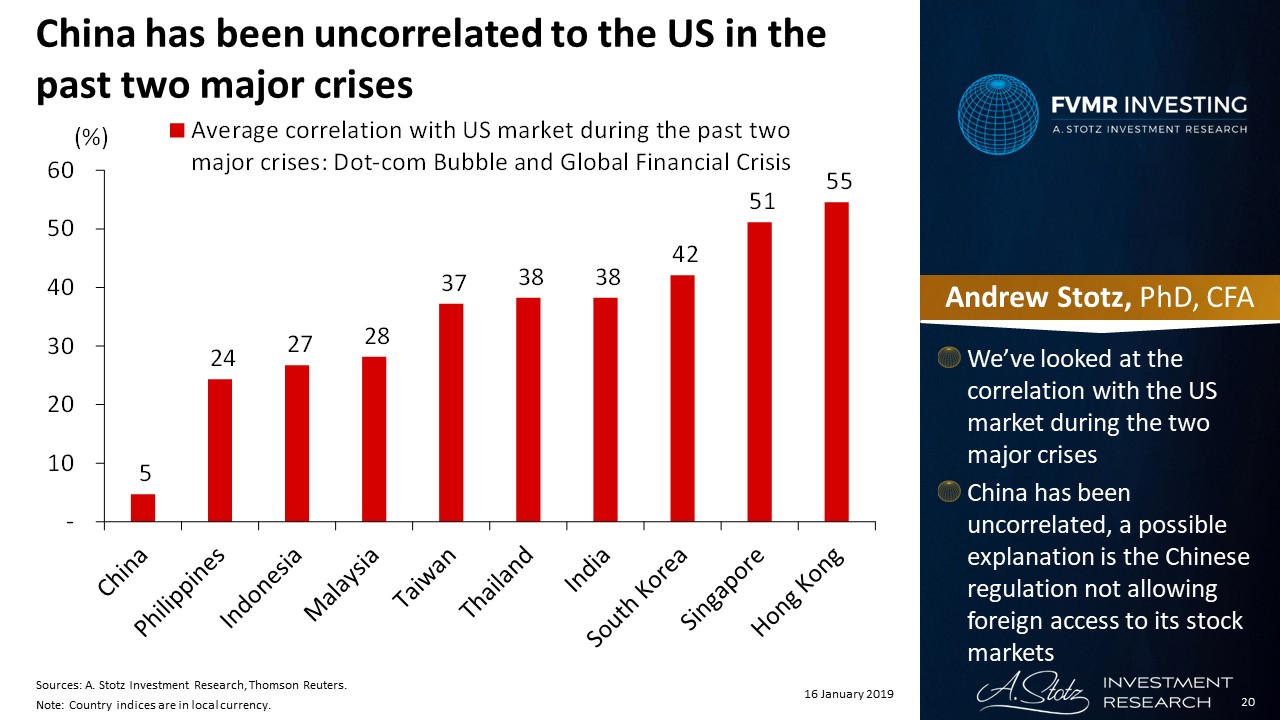

China has been uncorrelated to the US in the past two major crises

- We’ve looked at the correlation with the US market during the two major crises

- China has been uncorrelated, a possible explanation is the Chinese regulation not allowing foreign access to its stock markets

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.