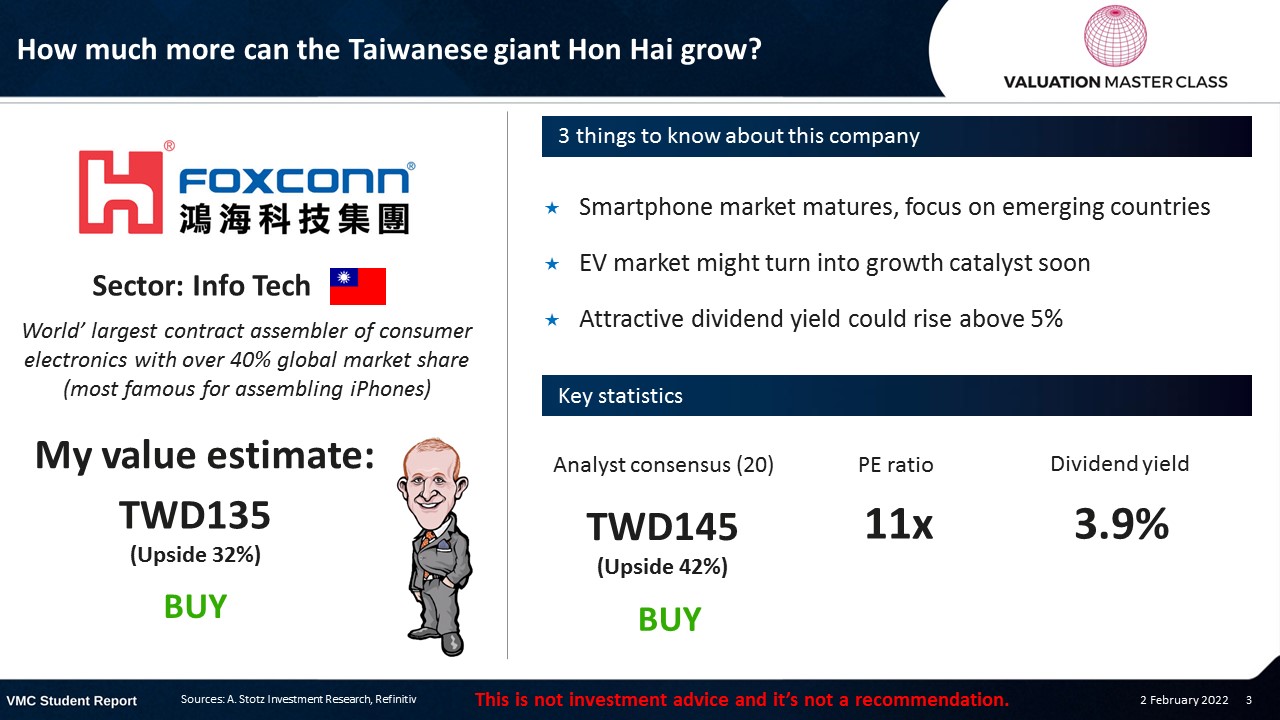

How Much More Can the Taiwanese Giant Hon Hai Grow?

The post was originally published here.

Highlights:

- Smartphone market matures, focus on emerging countries

- EV market might turn into growth catalyst soon

- Attractive dividend yield could rise above 5%

Download the full report as a PDF

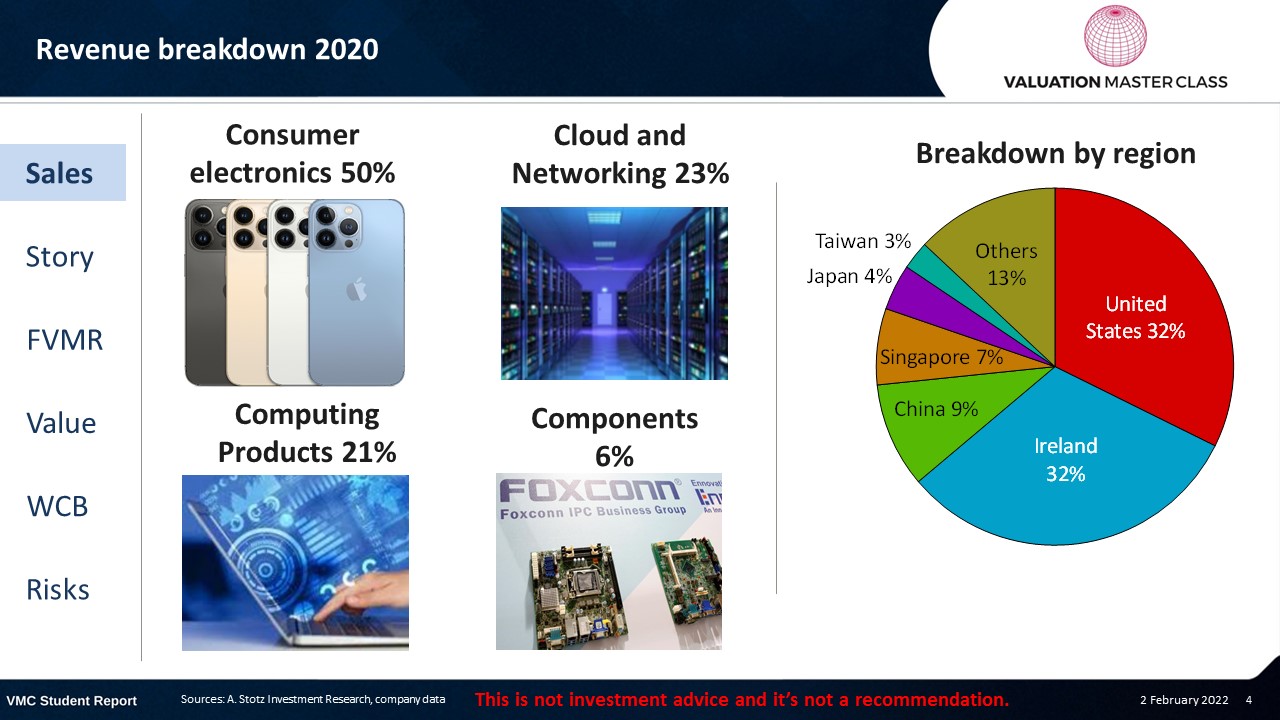

Hon Hai’s revenue breakdown 2020

If you have one of the following products, you are supporting Hon Hai’s revenue…

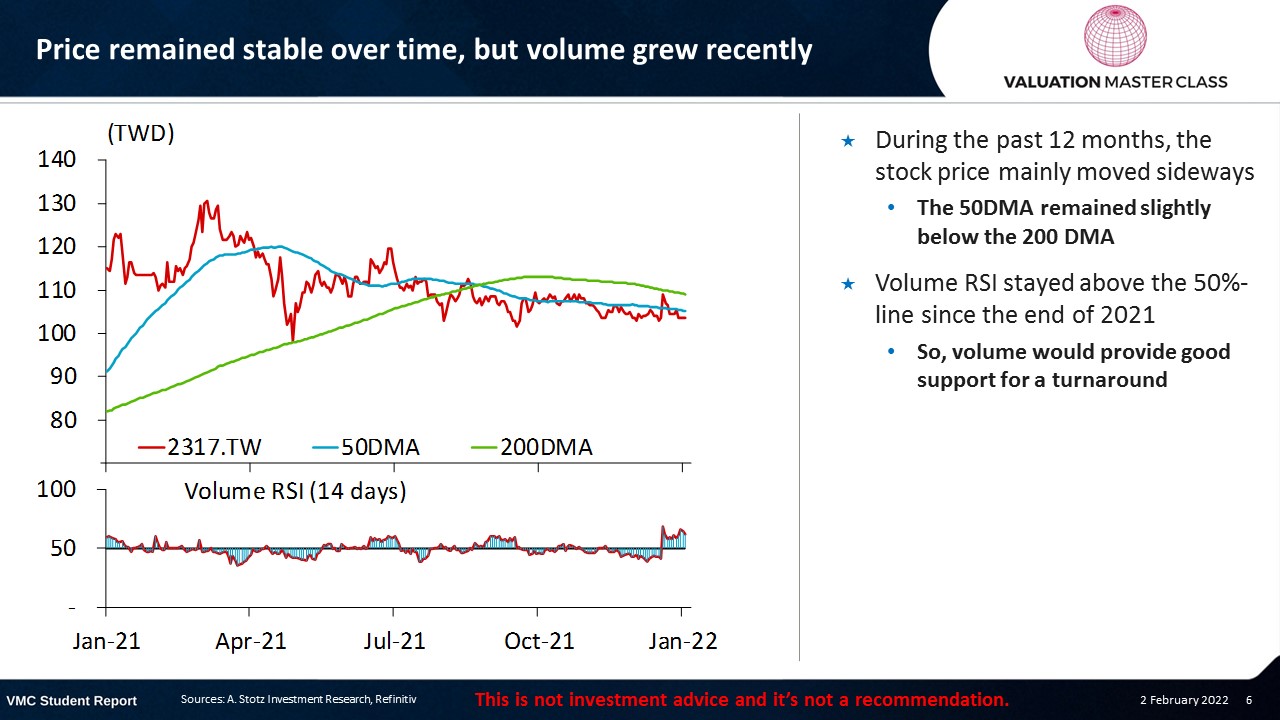

Price remained stable over time, but volume grew recently

- During the past 12 months, the stock price mainly moved sideways

- The 50DMA remained slightly below the 200 DMA

- Volume RSI stayed above the 50%-line since the end of 2021

- So, volume would provide good support for a turnaround

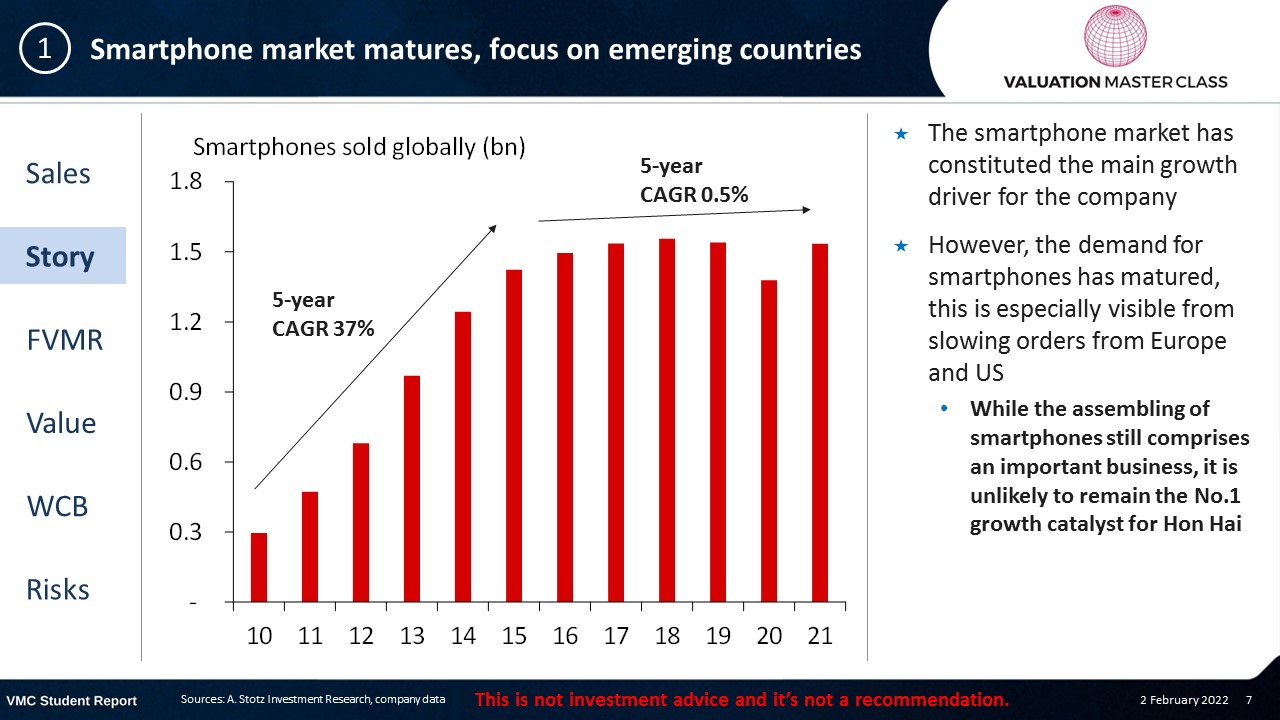

Smartphone market matures, focus on emerging countries

- The smartphone market has constituted the main growth driver for the company

- However, the demand for smartphones has matured, this is especially visible from slowing orders from Europe and US

- While the assembling of smartphones still comprises an important business, it is unlikely to remain the No.1 growth catalyst for Hon Hai

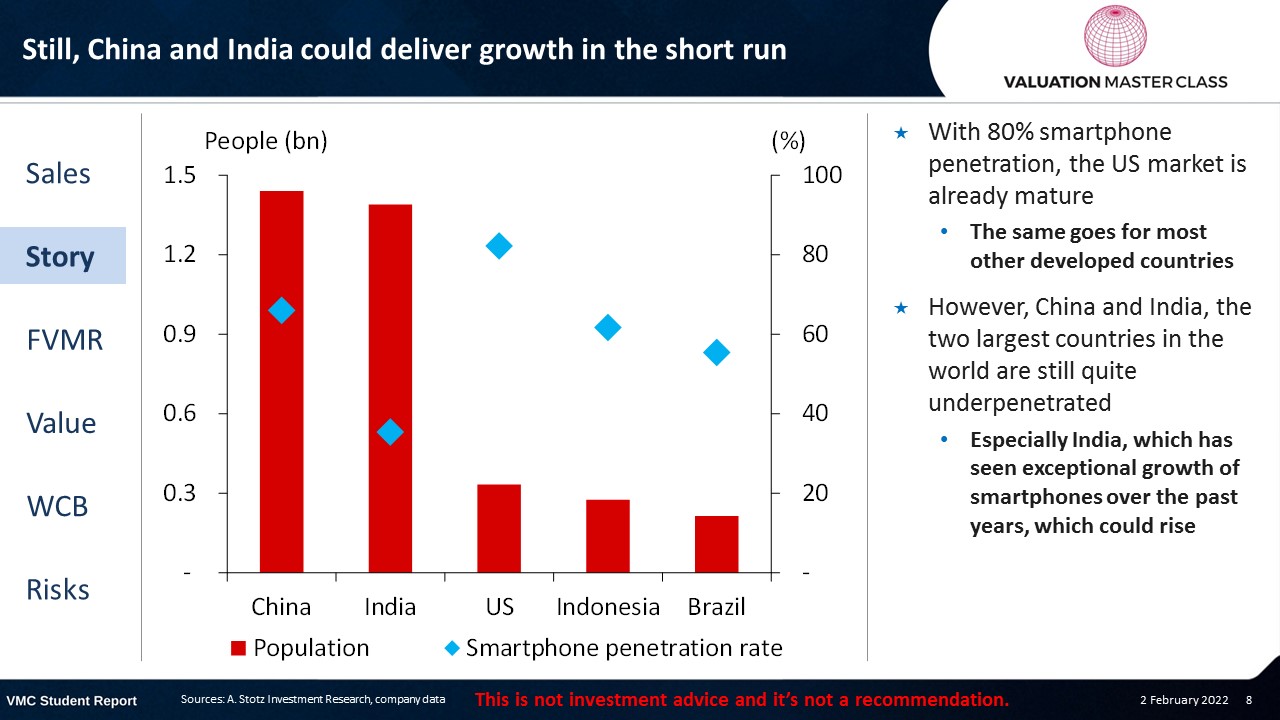

Still, China and India could deliver growth in the short run

- With 80% smartphone penetration, the US market is already mature

- The same goes for most other developed countries

- However, China and India, the two largest countries in the world are still quite underpenetrated

- Especially India, which has seen exceptional growth of smartphones over the past years, which could rise

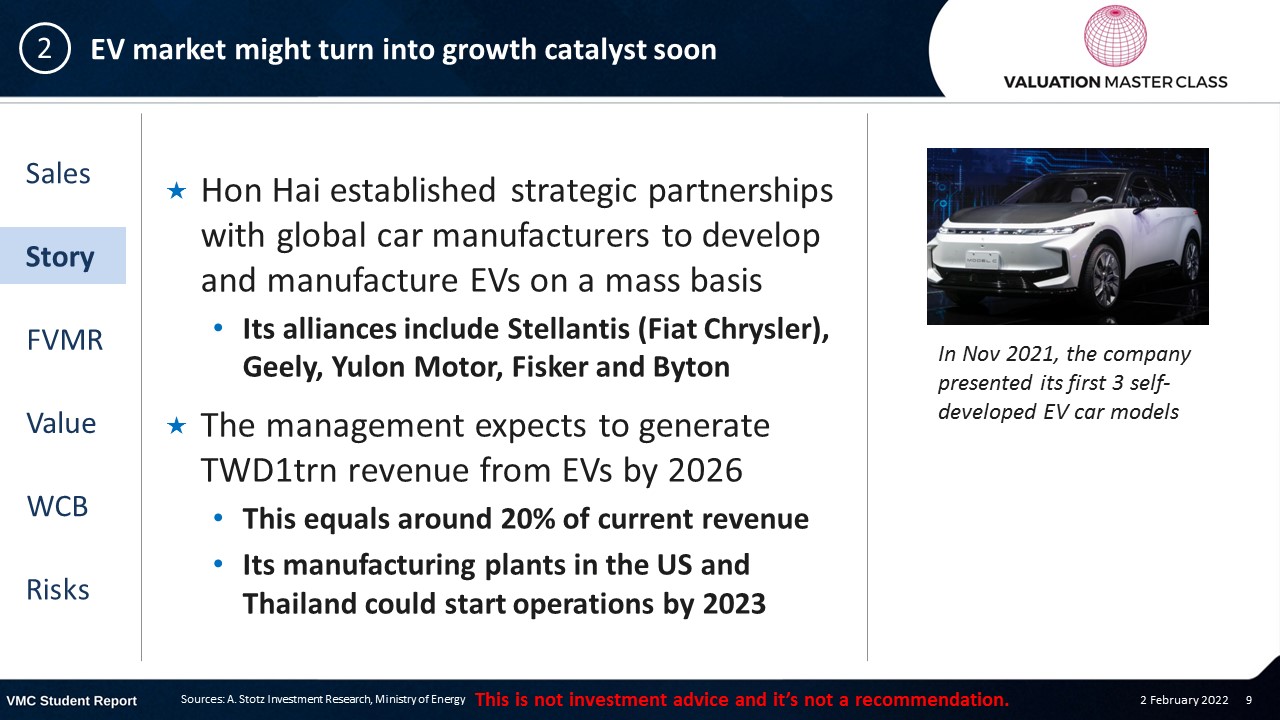

EV market might turn into growth catalyst soon

- Hon Hai established strategic partnerships with global car manufacturers to develop and manufacture EVs on a mass basis

- Its alliances include Stellantis (Fiat Chrysler), Geely, Yulon Motor, Fisker and Byton

- The management expects to generate TWD1trn revenue from EVs by 2026

-

- This equals around 20% of current revenue

- Its manufacturing plants in the US and Thailand could start operations by 2023

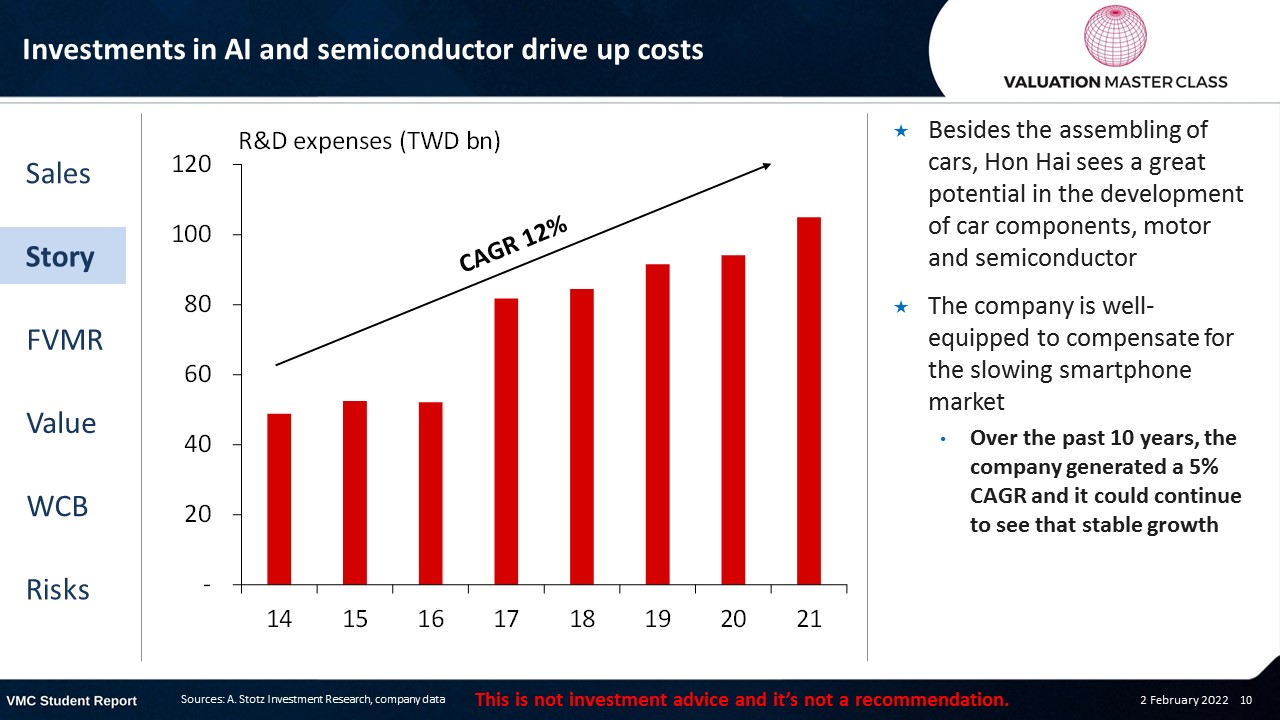

Investments in AI and semiconductor drive up costs

- Besides the assembling of cars, Hon Hai sees a great potential in the development of car components, motor and semiconductor

- The company is well-equipped to compensate for the slowing smartphone market

- Over the past 10 years, the company generated a 5% CAGR and it could continue to see that stable growth

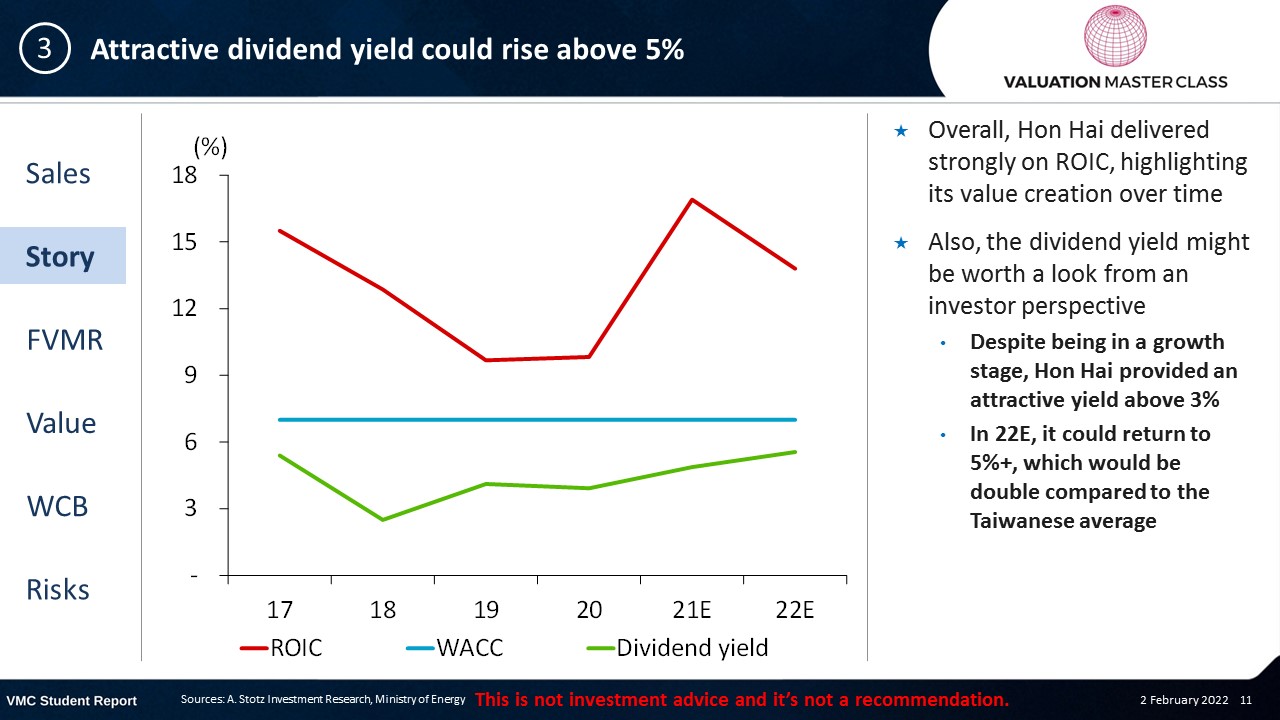

Attractive dividend yield could rise above 5%

- Overall, Hon Hai delivered strongly on ROIC, highlighting its value creation over time

- Also, the dividend yield might be worth a look from an investor perspective

- Despite being in a growth stage, Hon Hai provided an attractive yield above 3%

- In 22E, it could return to 5%+, which would be double compared to the Taiwanese average

Good on financial side, bad on ethics

- The company has been involved in several scandals over the years

- Between 2010 and 2013, more than 20 workers committed suicide in its factories where iPhones were assembled

- Several cases of students working overtime and illegal child labor

- Bribery and fraud scandals of executives

- In Dec 2021, 250 workers got food poisoning, leading to a closure of the factory for more a 1 week

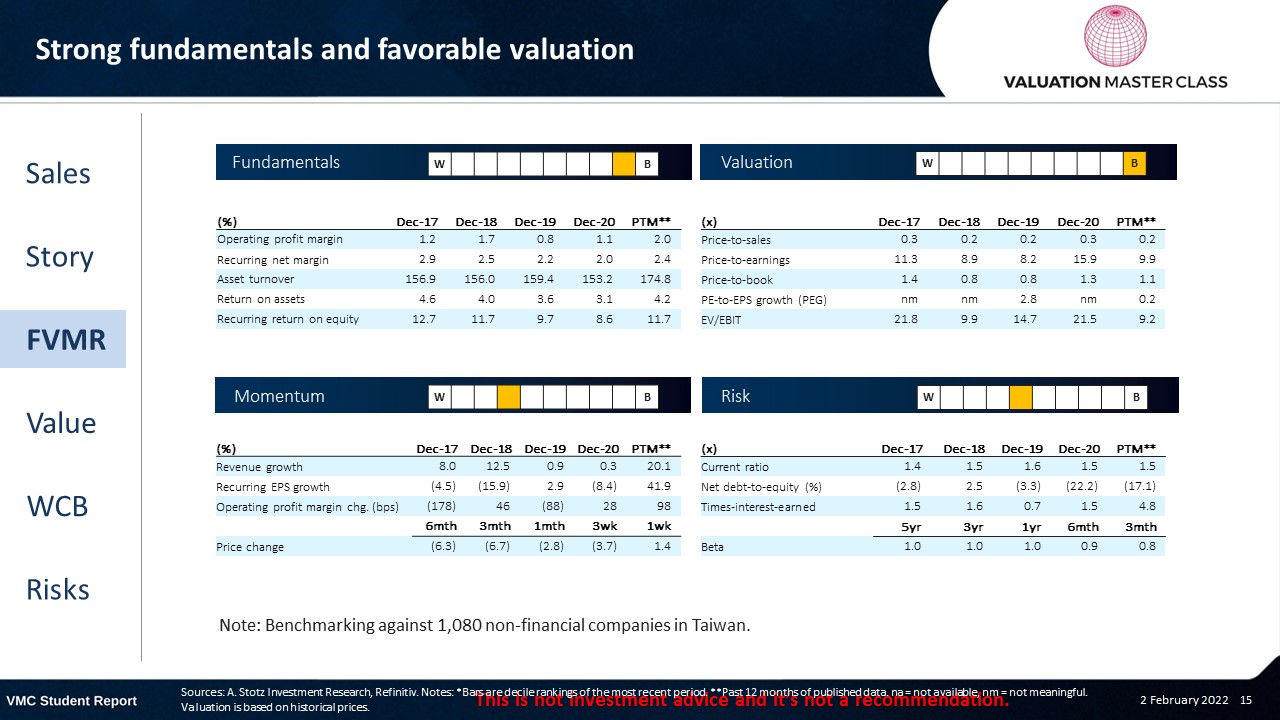

FVMR Scorecard – Hon Hai

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Analysts see a right time to buy

- Most analysts have a BUY recommendation, while 6 analysts recommend HOLD

- Consensus expects robust revenue growth over the next few years

- Also, they believe that the company can expand its margin significantly

Get financial statements and assumptions in the full report

P&L – Hon Hai

- The company is likely to benefit from the consumer demand rebound in 2021

- Most of its products could continue to ride the demand wave providing short-term strength

Balance sheet – Hon Hai

- A core part of Hon Hai’s strategy is to develop strategic partnerships for the joint development and manufacturing of products

- Alliances with the EV car industry are likely to lead to a rise in LT-investments

- Despite having TWD800bn in debt, Hon Hai is net cash

- The company holds 1/3 of its assets in cash

Ratios – Hon Hai

- The company is characterized by a remarkable efficiency

- This could lead revenue to grow faster than fixed assets over time

- With the increased focus on producing higher-margin complex components such as semiconductor, I expect an expansion of gross margin over time

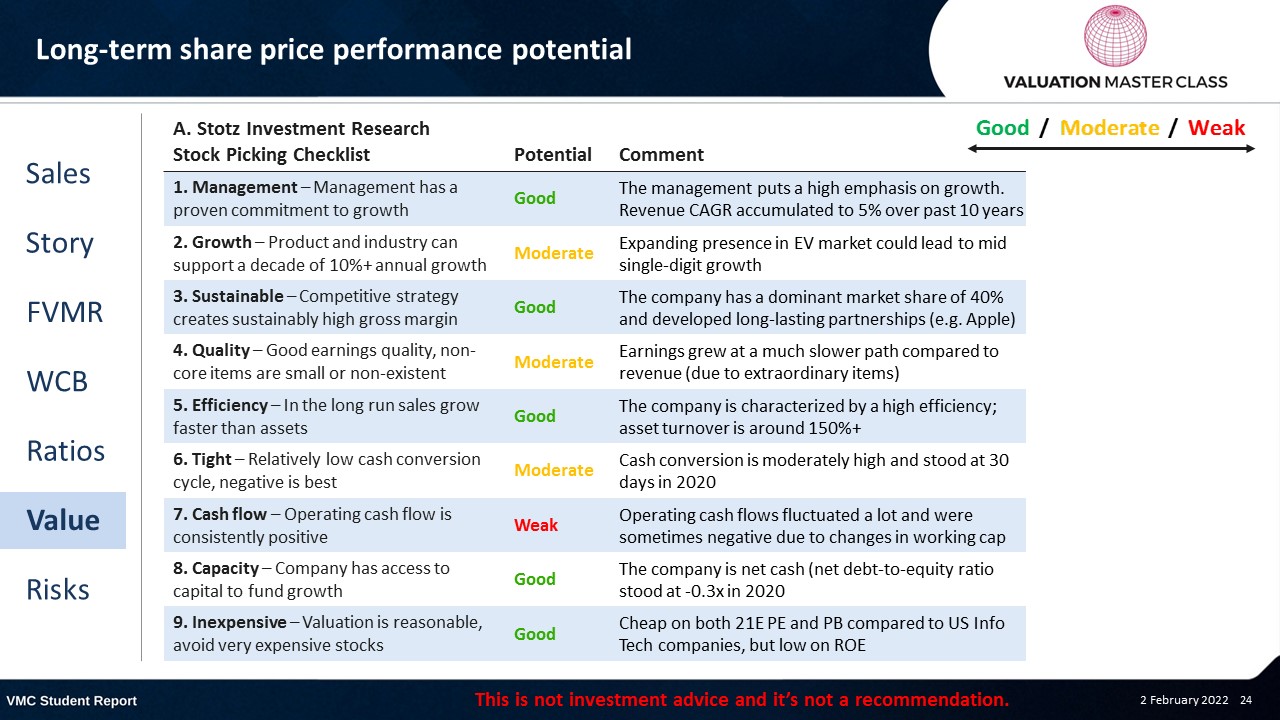

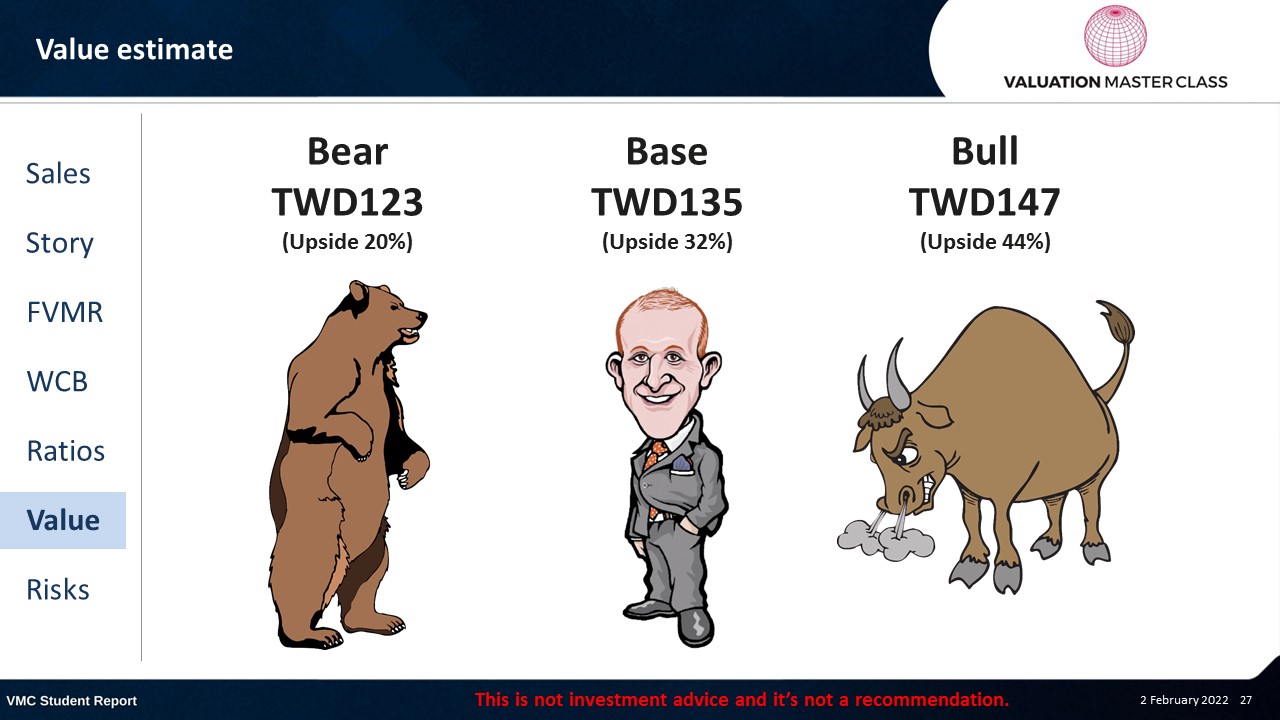

Long-term share price performance potential

Free cash flow – Hon Hai

- FCFF might turn negative in 21E due to significant changes in working cap

- However, 22E onward, Hon Hai should be able to deliver consistent positive FCFF

Value estimate – Hon Hai

- I expect a similar revenue growth and margin expansion compared to the consensus

- However, my terminal growth rate of 2% is rather conservative

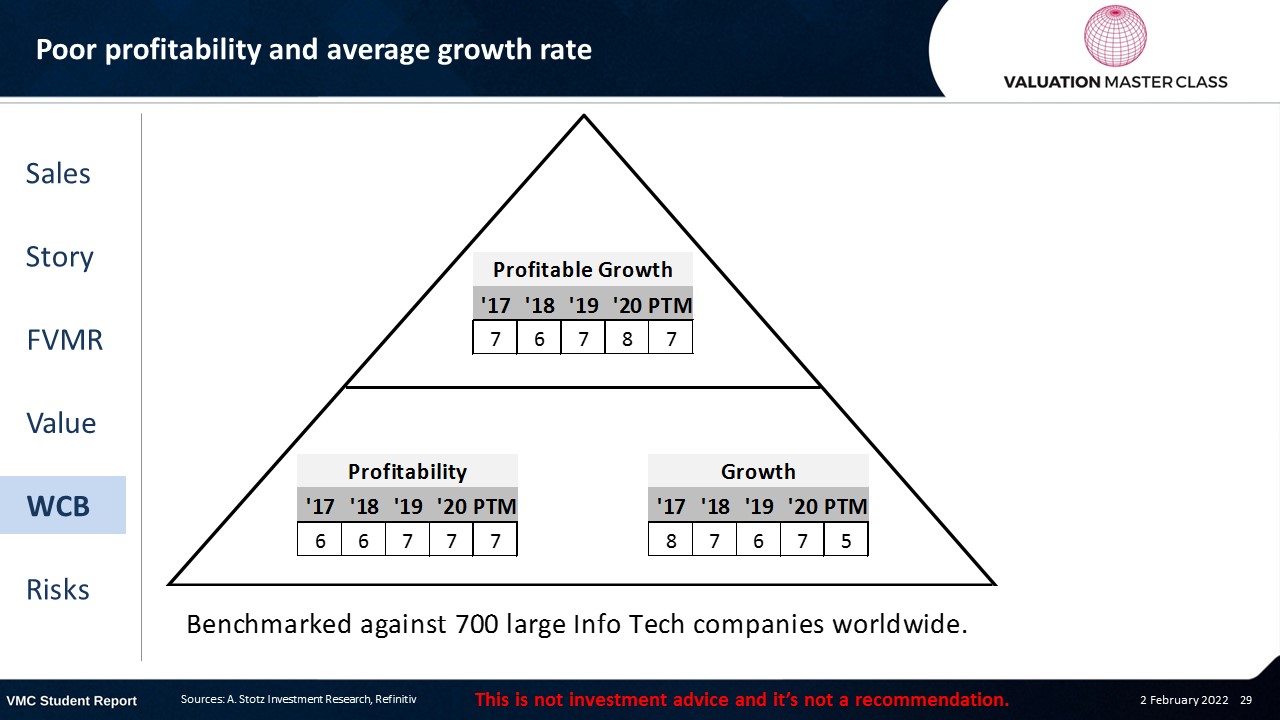

World Class Benchmarking Scorecard – Hon Hai

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is failure to keep up with technological trends

- Underestimating competition in the global EV market

- Lagging technological developments

- Reputation damage (e.g., child labor, working conditions, suicides in its factories already got media attention in the past)

Conclusions

- Management has a proven commitment to growth

- Expansion in EV market offers attractive opportunities to scale

- Valuation is attractive; dividend yield adds some good return on top of upside

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.