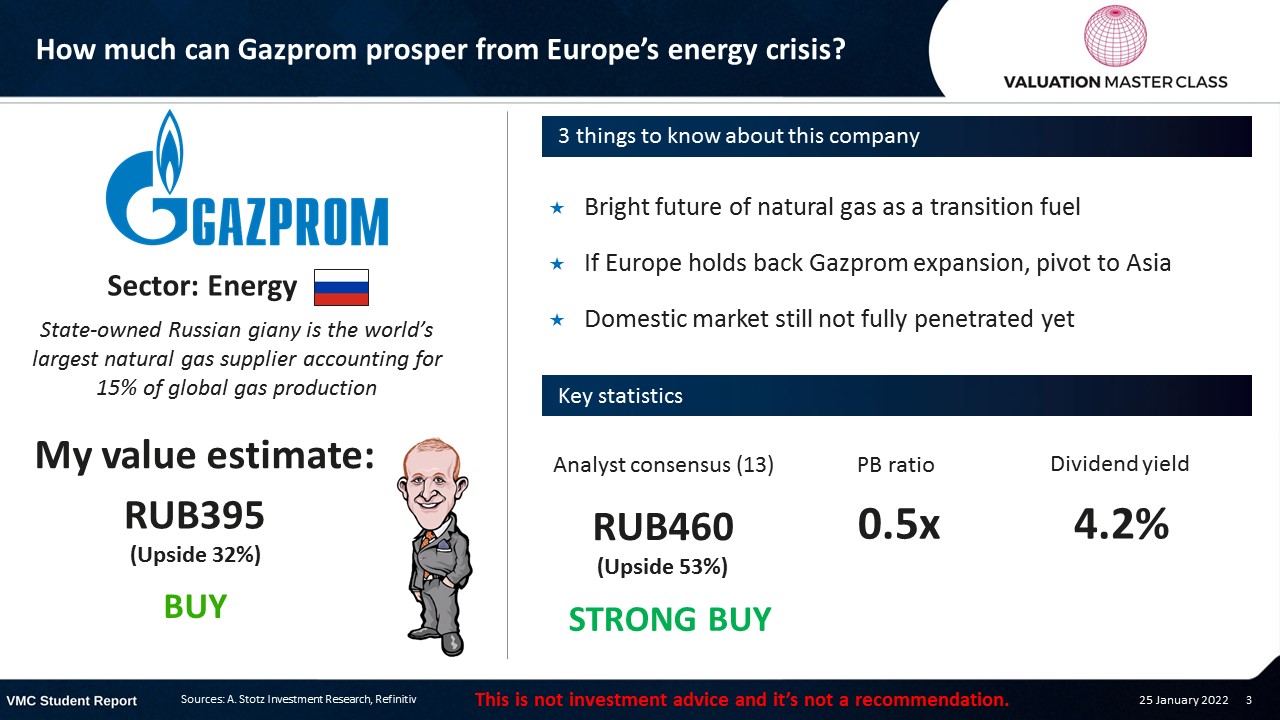

How Much Can Gazprom Prosper From Europe’s Energy Crisis?

The post was originally published here.

Highlights:

- Bright future of natural gas as a transition fuel

- If Europe holds back Gazprom expansion, pivot to Asia

- Domestic market still not fully penetrated yet

Download the full report as a PDF

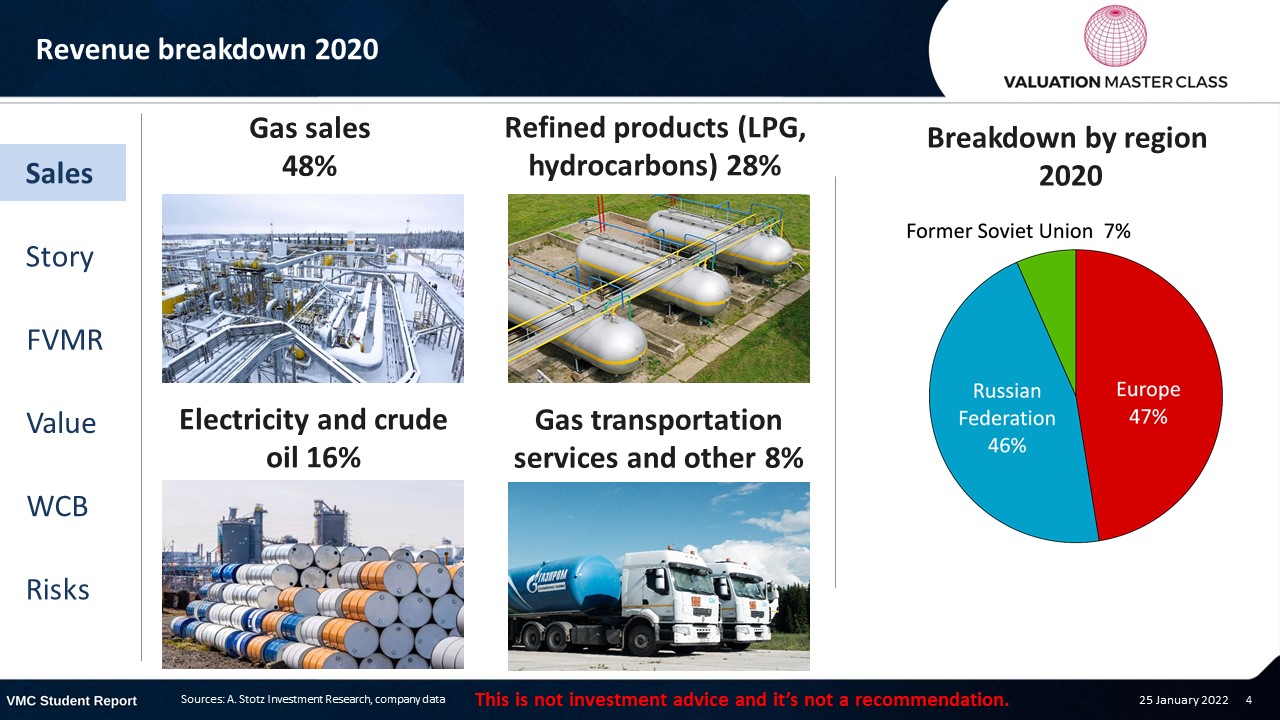

Gazprom’s revenue breakdown 2020

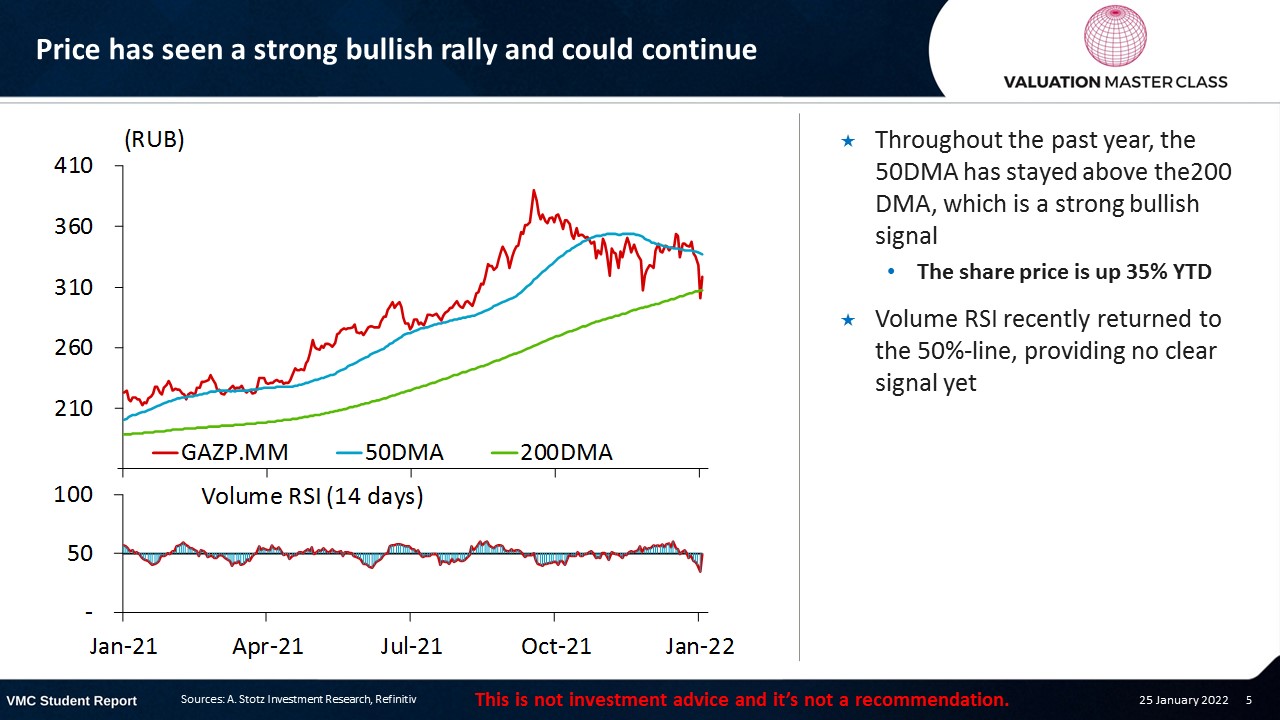

Price has seen a strong bullish rally and could continue

- Throughout the past year, the 50DMA has stayed above the200 DMA, which is a strong bullish signal

- The share price is up 35% YTD

- Volume RSI recently returned to the 50%-line, providing no clear signal yet

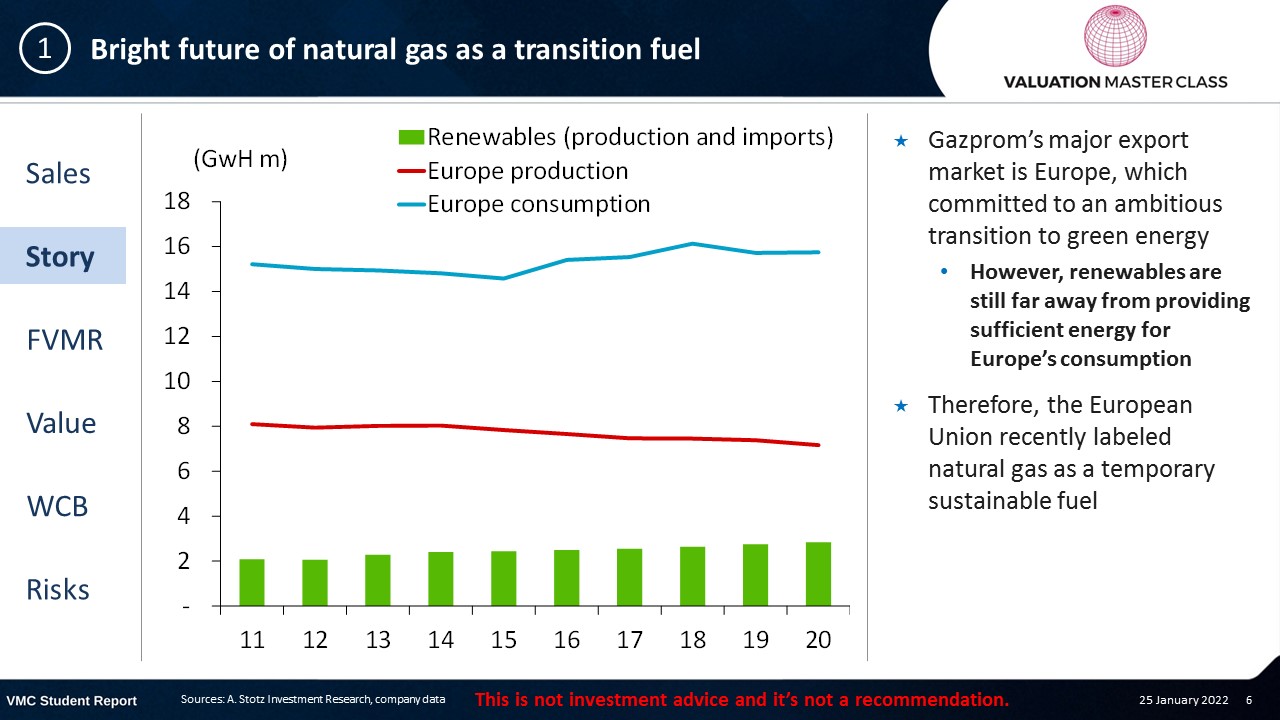

Bright future of natural gas as a transition fuel

- Gazprom’s major export market is Europe, which committed to an ambitious transition to green energy

- However, renewables are still far away from providing sufficient energy for Europe’s consumption

- Therefore, the European Union recently labeled natural gas as a temporary sustainable fuel

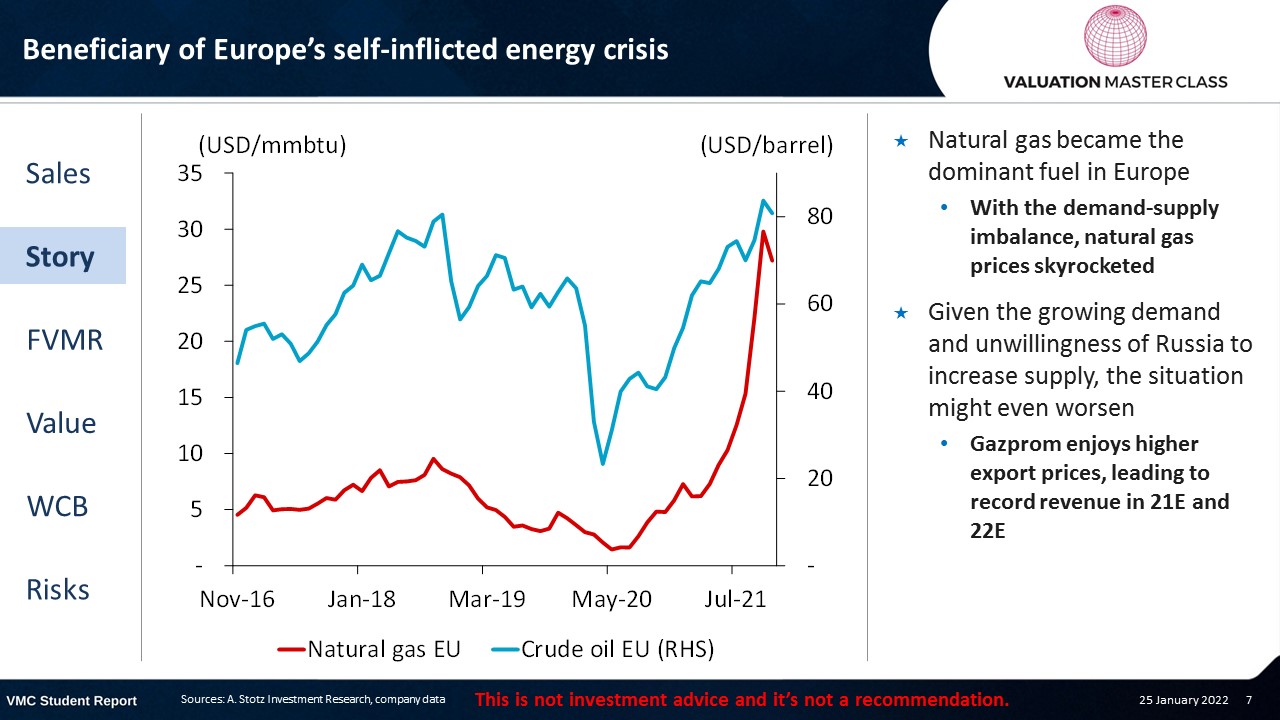

Beneficiary of Europe’s self-inflicted energy crisis

- Natural gas became the dominant fuel in Europe

- With the demand-supply imbalance, natural gas prices skyrocketed

- Given the growing demand and unwillingness of Russia to increase supply, the situation might even worsen

- Gazprom enjoys higher export prices, leading to record revenue in 21E and 22E

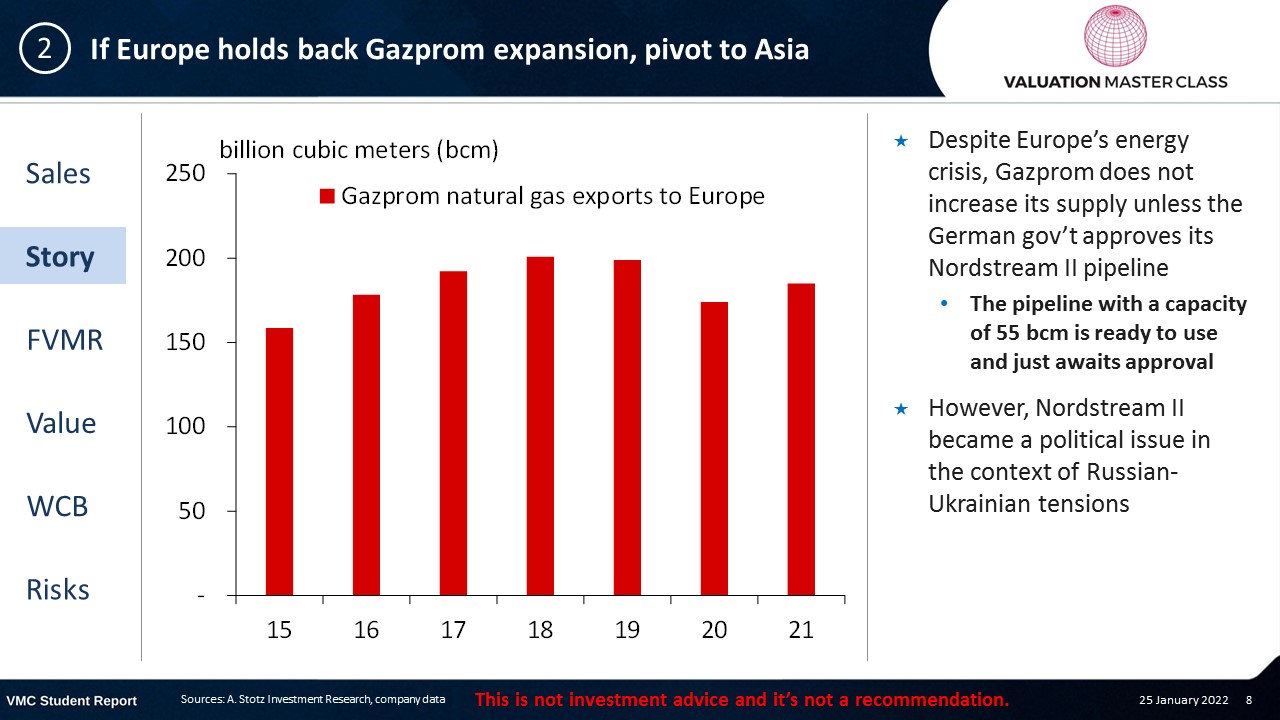

If Europe holds back Gazprom expansion, pivot to Asia

- Despite Europe’s energy crisis, Gazprom does not increase its supply unless the German gov’t approves its Nordstream II pipeline

- The pipeline with a capacity of 55 bcm is ready to use and just awaits approval

- However, Nordstream II became a political issue in the context of Russian-Ukrainian tensions

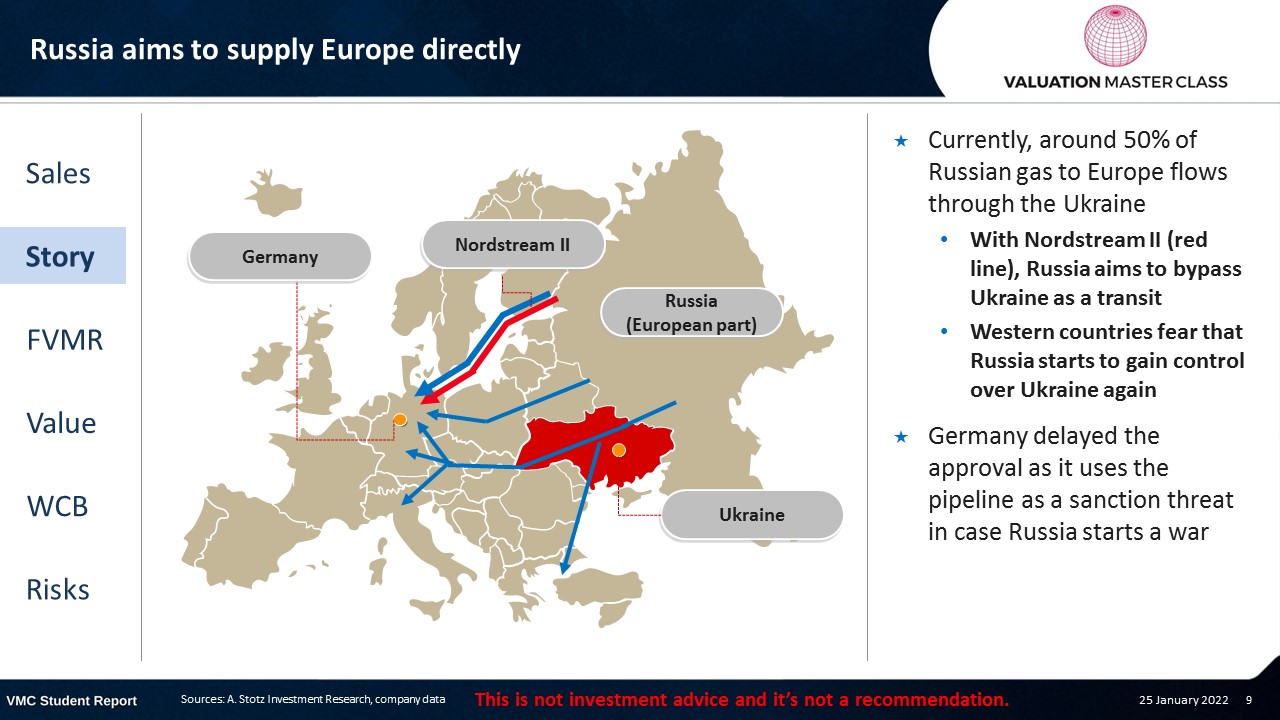

Russia aims to supply Europe directly

- Currently, around 50% of Russian gas to Europe flows through the Ukraine

- With Nordstream II (red line), Russia aims to bypass Ukraine as a transit

- Western countries fear that Russia starts to gain control over Ukraine again

- Germany delayed the approval as it uses the pipeline as a sanction threat in case Russia starts a war

Russia is in a much better negotiation position

- I believe that the approval of the pipeline is inevitable to secure Europe’s smooth transition to green energy

- Right now, there are few alternatives to substitute Russian imports

- In the case Europe hesitates, Gazprom eyes to build a pipeline to Asia

- Especially China and India have a large appetite for gas

- In either case, Gazprom gains massively

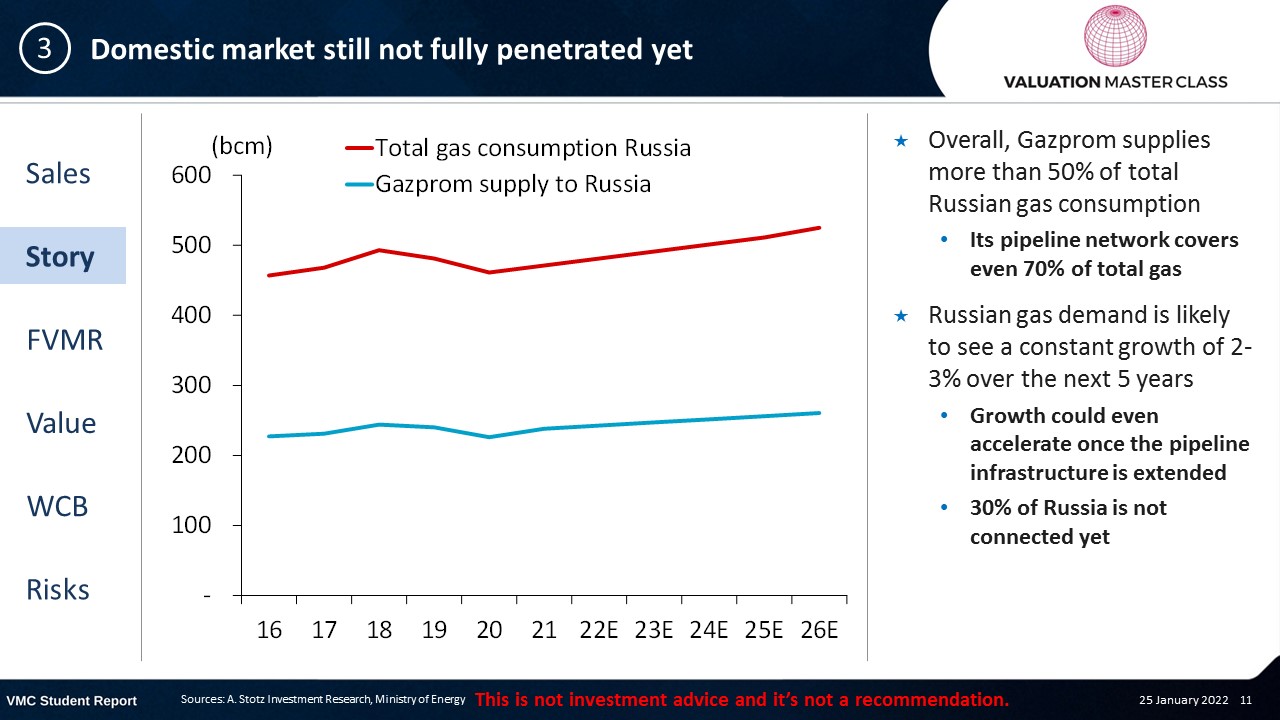

Domestic market still not fully penetrated yet

- Overall, Gazprom supplies more than 50% of total Russian gas consumption

- Its pipeline network covers even 70% of total gas

- Russian gas demand is likely to see a constant growth of 2-3% over the next 5 years

- Growth could even accelerate once the pipeline infrastructure is extended

- 30% of Russia is not connected yet

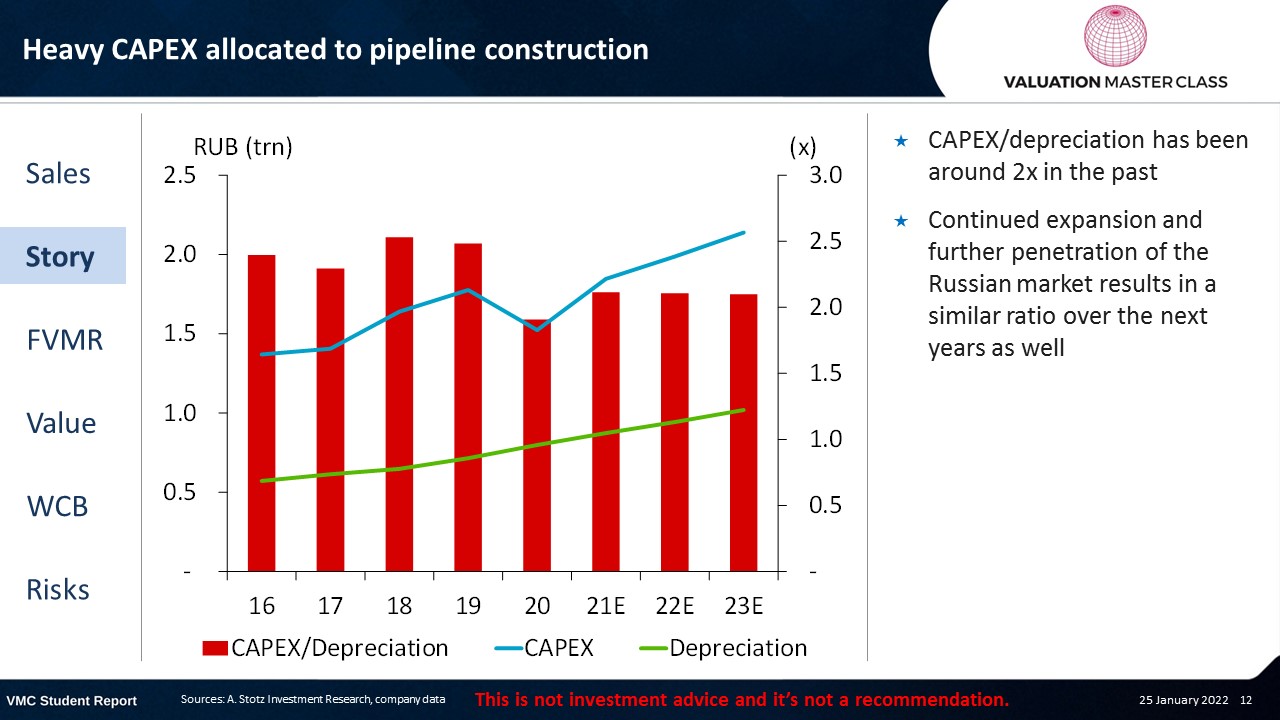

Heavy CAPEX allocated to pipeline construction

- CAPEX/depreciation has been around 2x in the past

- Continued expansion and further penetration of the Russian market results in a similar ratio over the next years as well

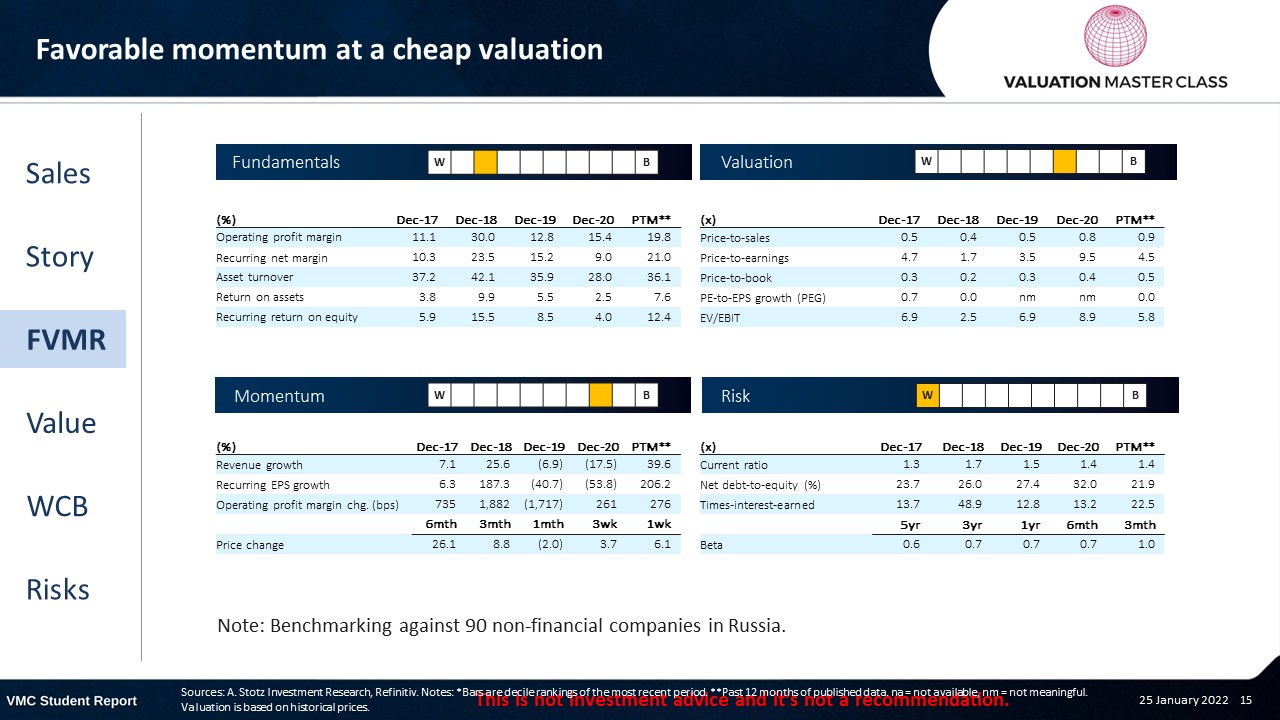

FVMR Scorecard – Gazprom

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Analysts are optimistic about the Russian giant

- Analysts’ consensus sees a massive upside for Gazprom

- Only 2 analysts are still on HOLD

- Consensus expects strong revenue prospects in 21E and 22E

- Revenue might drop in 23E as natural gas prices could normalize

- Also, operating margin could reach a record over the next two years

Get financial statements and assumptions in the full report

P&L – Gazprom

- Strong bottom-line mainly driven by inflated gas prices in Europe

Balance sheet – Gazprom

- Gazprom is a capital-intensive business, with more than 70% of total assets being net fixed assets

- Expansion of pipeline structure requires high CAPEX in the future

- Gazprom has relatively low leverage

- Its net-debt to equity ratio stood at 0.3 in 2020

Ratios – Gazprom

- Given its capital-intensive nature, efficiency is very low

- Gross margin in 21E and 22E on a record level, but it might be difficult to maintain a gross margin above 60% over time

- The main driver constituted the inflated gas price

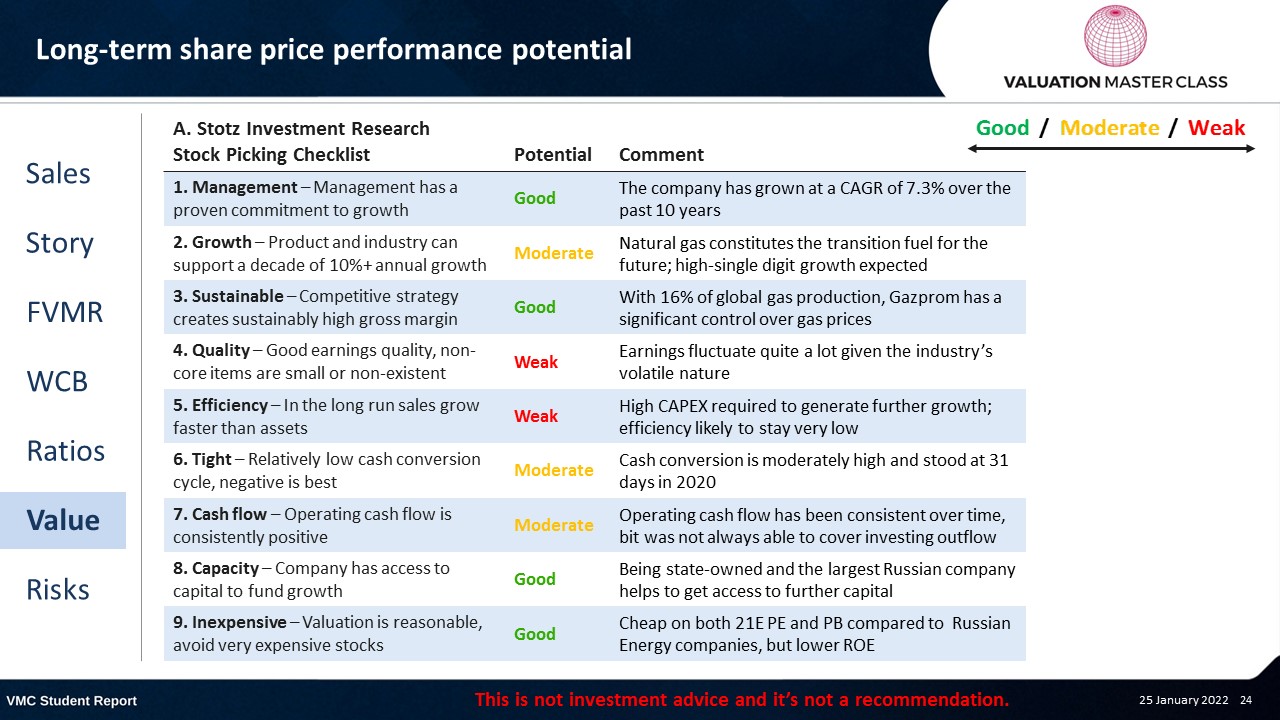

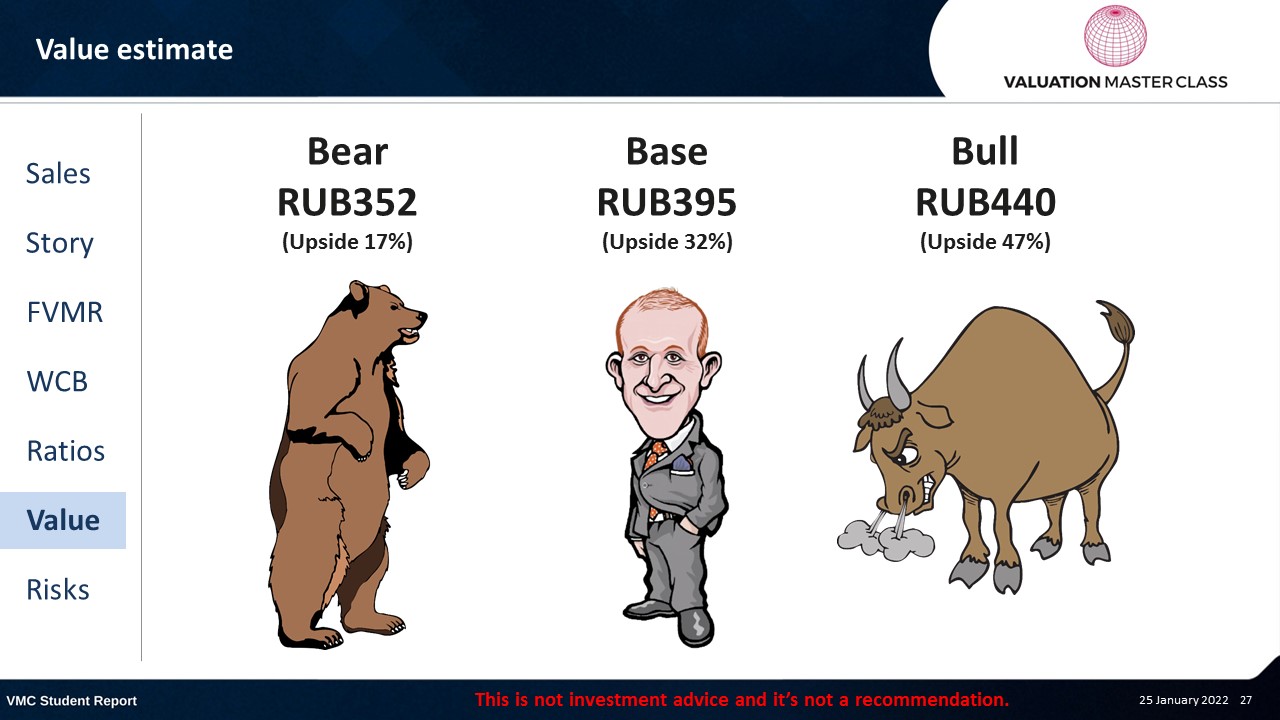

Long-term share price performance potential

Free cash flow – Gazprom

- FCFF likely to remain volatile given abrupt changes in working capital

Value estimate – Gazprom

- My revenue and margin forecast is roughly in line with analyst’s consensus

- Russia has a massively high risk-free rate of 10%

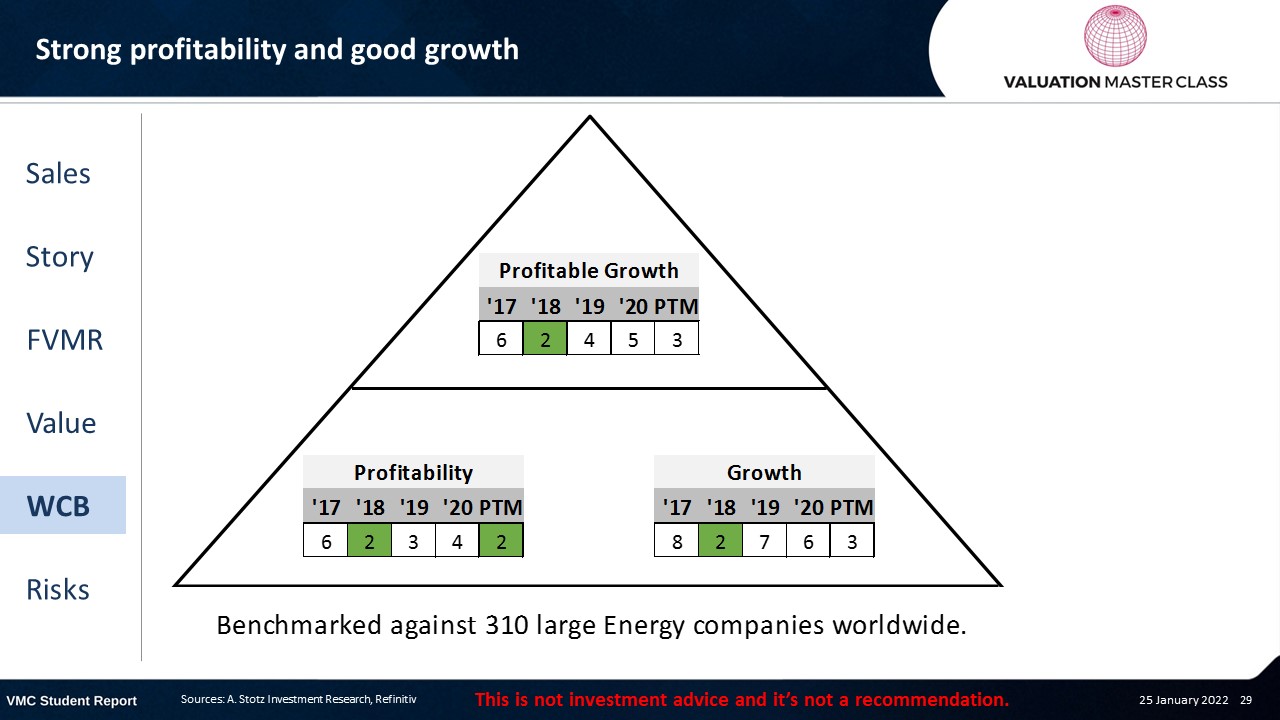

World Class Benchmarking Scorecard – Gazprom

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is fluctuations in oil price

- Increasing efforts of the European Union to reduce dependency on Russian gas

- Sanctions against Russia imposed by the US and EU (Russian-Ukrainian conflict)

- Slowing economy and fluctuations in gas prices

Conclusions

- Natural gas evolves as the most important fuel in energy transition

- Nordstream II became a political instrument; but in worst case, Gazprom could diversify to Asia

- Domestic market still provides further room to go

Download the full report as a PDF

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.