Valuation

VMC: What to Expect on the CFA Level 2 Exam

With all that studying you’re no doubt doing in advance, ensure you also know exactly what to expect on the CFA Level 2 exam day, so there are no surprises!

Read MoreVMC: The Difference Between Stock Value and Stock Price

Discover why you need to know the difference between stock value and stock price with the Valuation Master Class. While there’s no 100% accurate way to find a stock’s true value, there are some figures and trends to watch out for as you’re trying to make a decision in the market.

Read MoreVMC: A Complete Guide to the CFA Equity Investments Topic

Equity calculation and valuation are inherent parts of all three CFA exams, review the full CFA equity investments topic across all three exams here.

Read MoreVMC: My #1 Study Tip for the CFA Exams

With this study tip, not only will you be able to improve your understanding of the comprehensive CFA material, but you’ll also be able to recall and apply it practically in the CFA exams.

Read MoreVMC: Equity Analysis: Art or Science?

As a financial analyst, your job is to enable someone to share your vision of the future. To give them a glimpse into a world that does not yet exist. This is a difficult task, and it takes your entire career to learn to do this effectively.

Read MoreVMC: If I Pass the CFA Exam Will I Get Higher Pay?

The CFA exams are favored as one of the top financial services qualifications to achieve—across the world. A common misconception is held though that simply passing the exams will help you get higher pay.

Read MoreVMC: What to Expect on the CFA Level 1 Exam

Becoming a Chartered Financial Analyst (CFA) is now one of the most popular career choices in the investment world. The advantages of joining the CFA program lie in acquiring specific investment-related experience for a reasonably low cost. On average though, the self-study course requires a commitment of around 4 years and 1,000 hours of study.

Read MoreVMC: Introducing the Valuation Master Class

When it comes to making crucial business and financial decisions, the savvy financial analyst wants the right tools on hand for performing equity valuations. Discover how the Valuation Master Class can work for you!

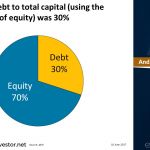

Read MoreThe Amount of Debt in the Long-Term Capital Structure

If the value of equity of a company is trading at a low 0.5x price-to-book value then the debt will appear as a large portion of capital. If the value of equity is trading at an expensive 4.0x then debt appears tiny. But debt never changed.

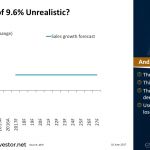

Read MoreForecasting Revenue Growth When Valuing a Company

How does an analyst forecast sales growth? What if a company is in a cyclical industry? What if the company has very volatile sales growth? Is it wrong to forecast a steady growth rate for each of the future years?

Read More