Two Types of Risk, but Only One Really Matters

The risk that really matters when investing is the risk of not having enough wealth to meet your future goal, so-called shortfall risk–may it be financial independence at the age of 40, a comfortable retirement at 65, or something else.

Your piggy bank won’t keep your money safe

In a previous post, we highlighted that while keeping cash may feel secure, you are actually losing wealth in real terms–your piggy bank turns out to be a robber. Investing in government bonds will earn you some return, but if you need your money to grow significantly over time, bond returns are likely not enough.

You need to get on the roller coaster

The asset classes that have historically generated higher returns than government bonds have not offered the same smooth ride. The ride is likely to be more like a roller coaster with ups and downs, and sometimes massive ups and downs.

Throughout a roller coaster ride, most riders will feel both fear and joy. And afterward, there’ll be many riders filled with joy and feeling better than before the ride. They’ve been through fear to end up being better off. But there’ll also be people getting off the roller coaster scared to death and maybe even throwing up. This is a good analogy to describe investors and their different levels of risk aversion.

The difference between riding a roller coaster and investing though is that you don’t have to learn to enjoy roller coasters to enjoy life. But when investing, you generally must accept a bit larger ups and downs—volatility—to enjoy higher long-term returns.

Two types of risk in investing

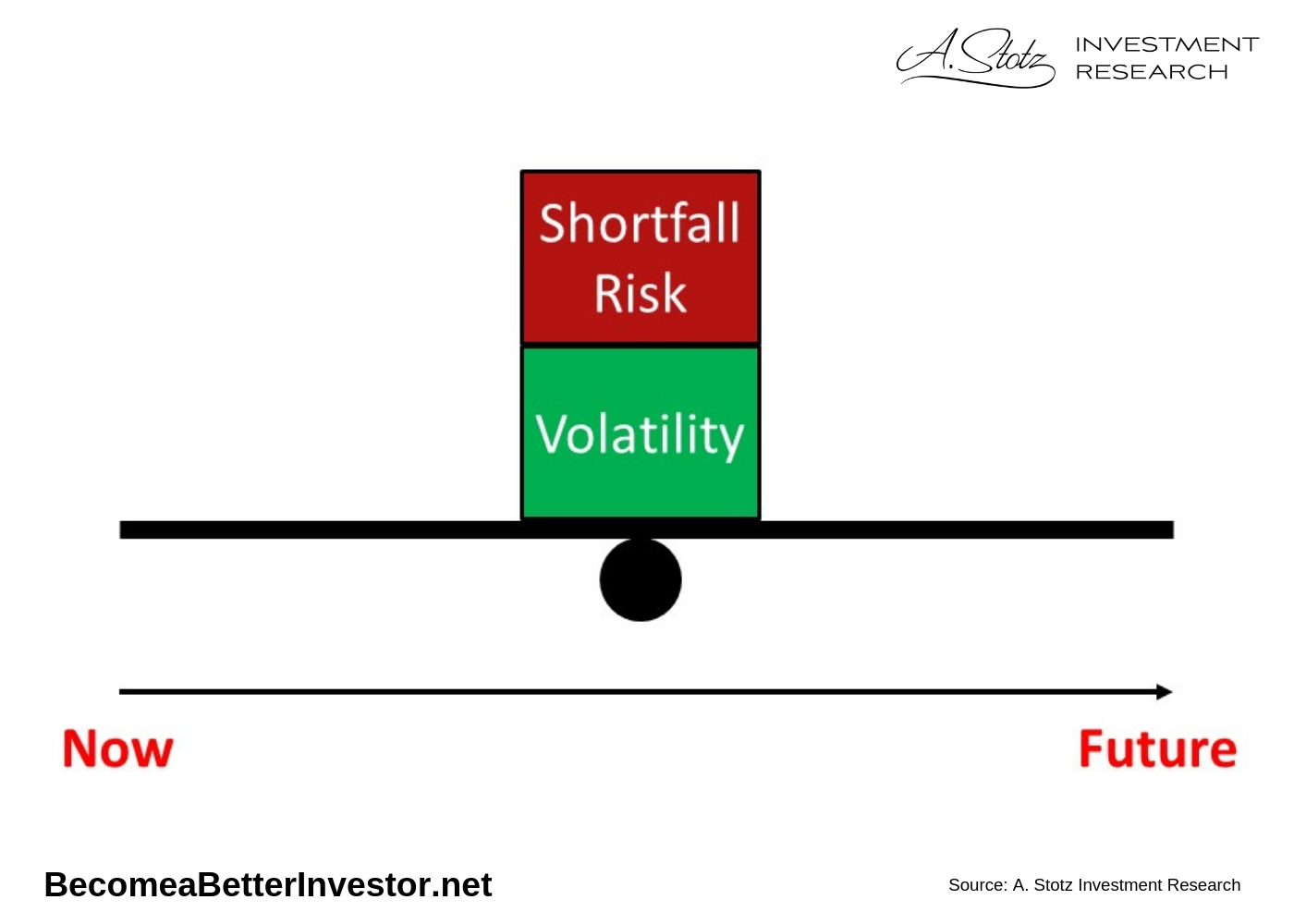

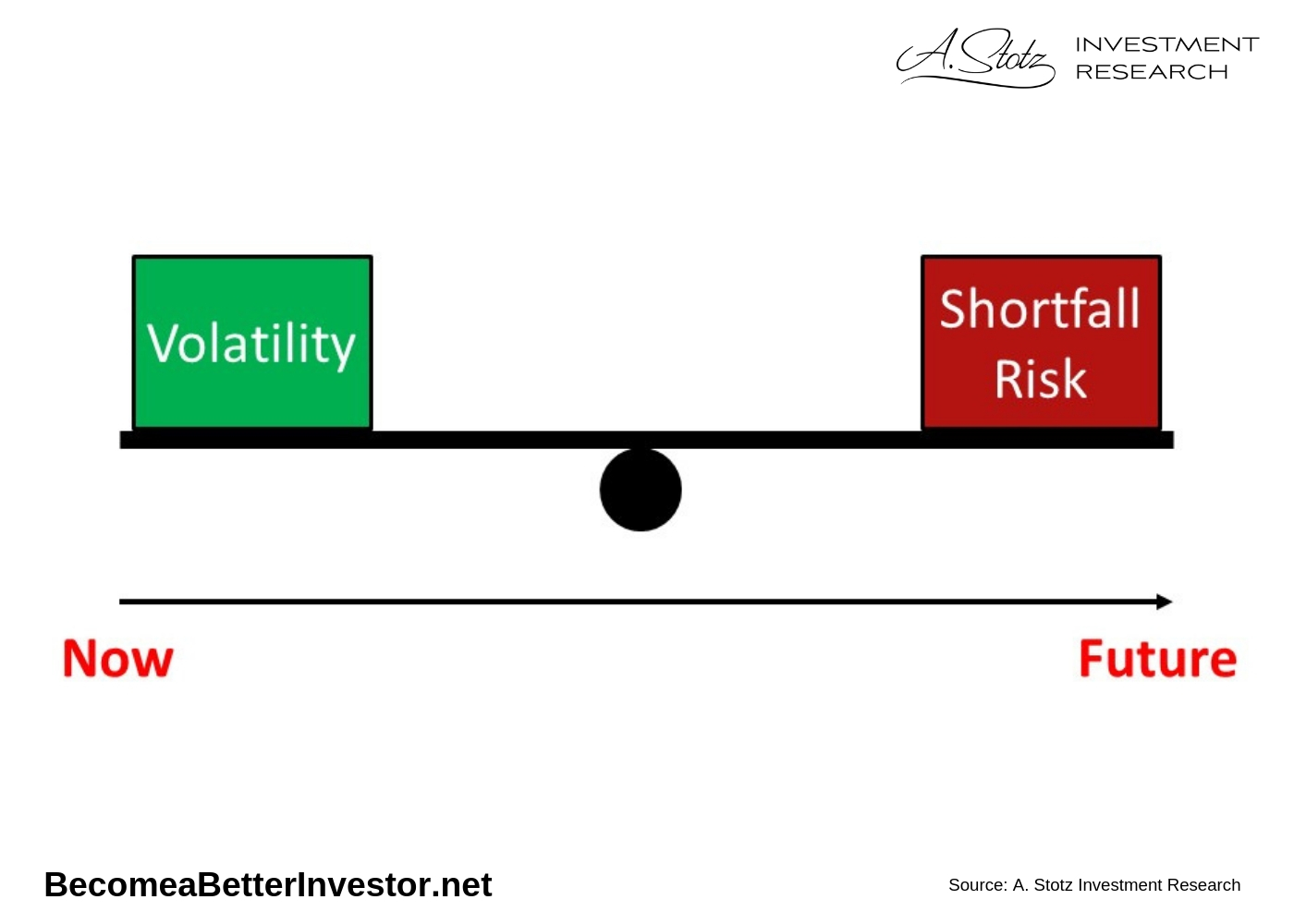

So, let’s talk about risk in investing, and two types of risk in particular–volatility and shortfall risk. Do you remember playing on a seesaw as a kid? Let’s think about a seesaw when we dig into these two risk concepts.

Volatility: The swings in asset prices. The price of assets traded on exchanges moves up and down every day. Volatility is a standard measure of risk in finance. High volatility can be emotionally painful. But for the long-term investor volatility is not really risk. We define risk as the permanent loss of capital.

Shortfall risk: The risk that you don’t reach your financial goal, e.g. you save all your life, but the day you want to retire you don’t have enough money. This risk is less often talked about, but this is the risk that matters most.

The seesaw of risk

In this seesaw of risk, the left side represents now, and the right side represents the future.

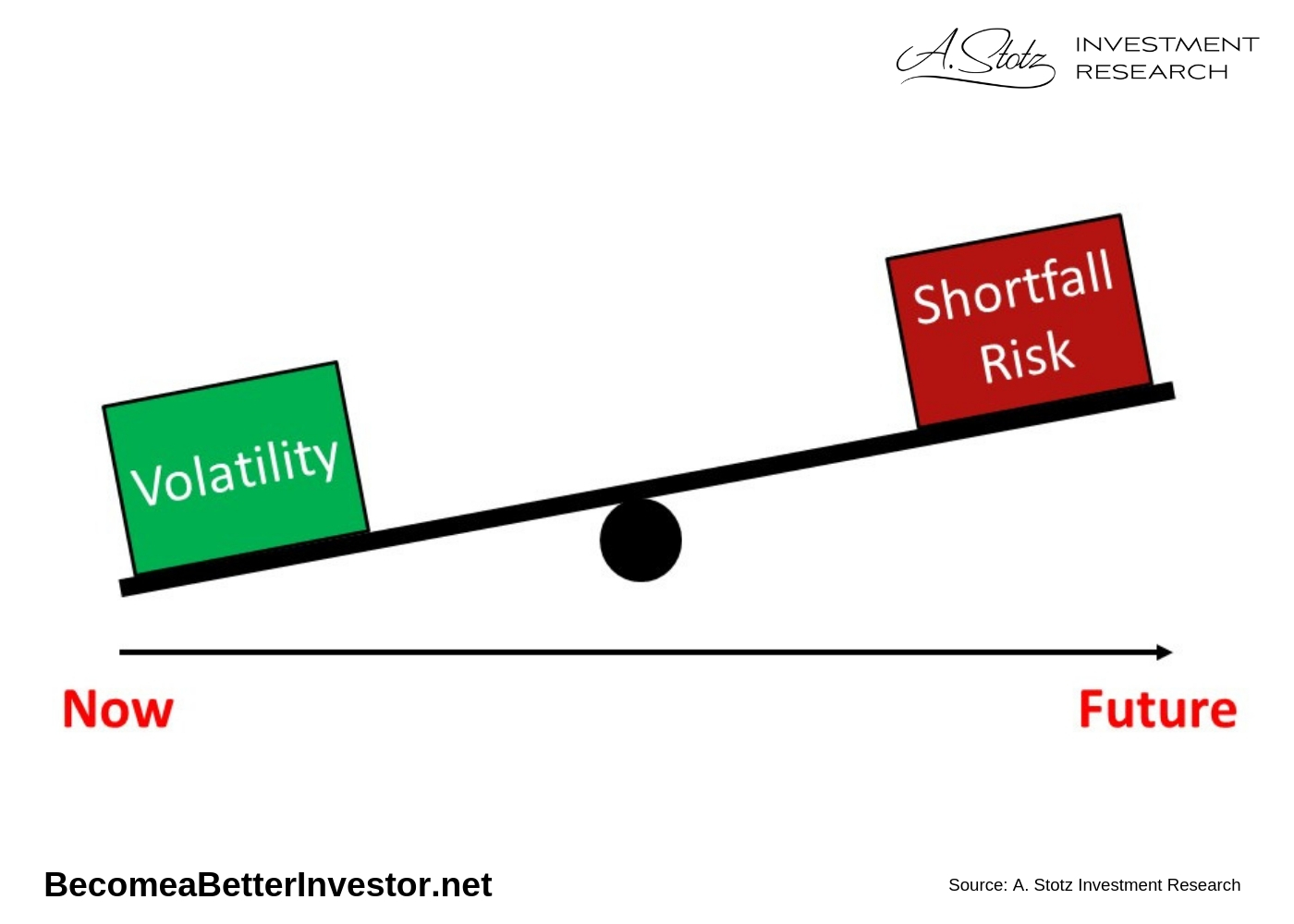

Low volatility today, means higher shortfall risk in the future. Investing in assets with very low volatility today can be comfortable.

When you invest in low yielding assets you get the benefit of your money growing stably; you won’t check your balance one day and see that it’s down by 30%. But the price of that safety is a low long-term return. The risk is that you may end up not having enough money in the future.

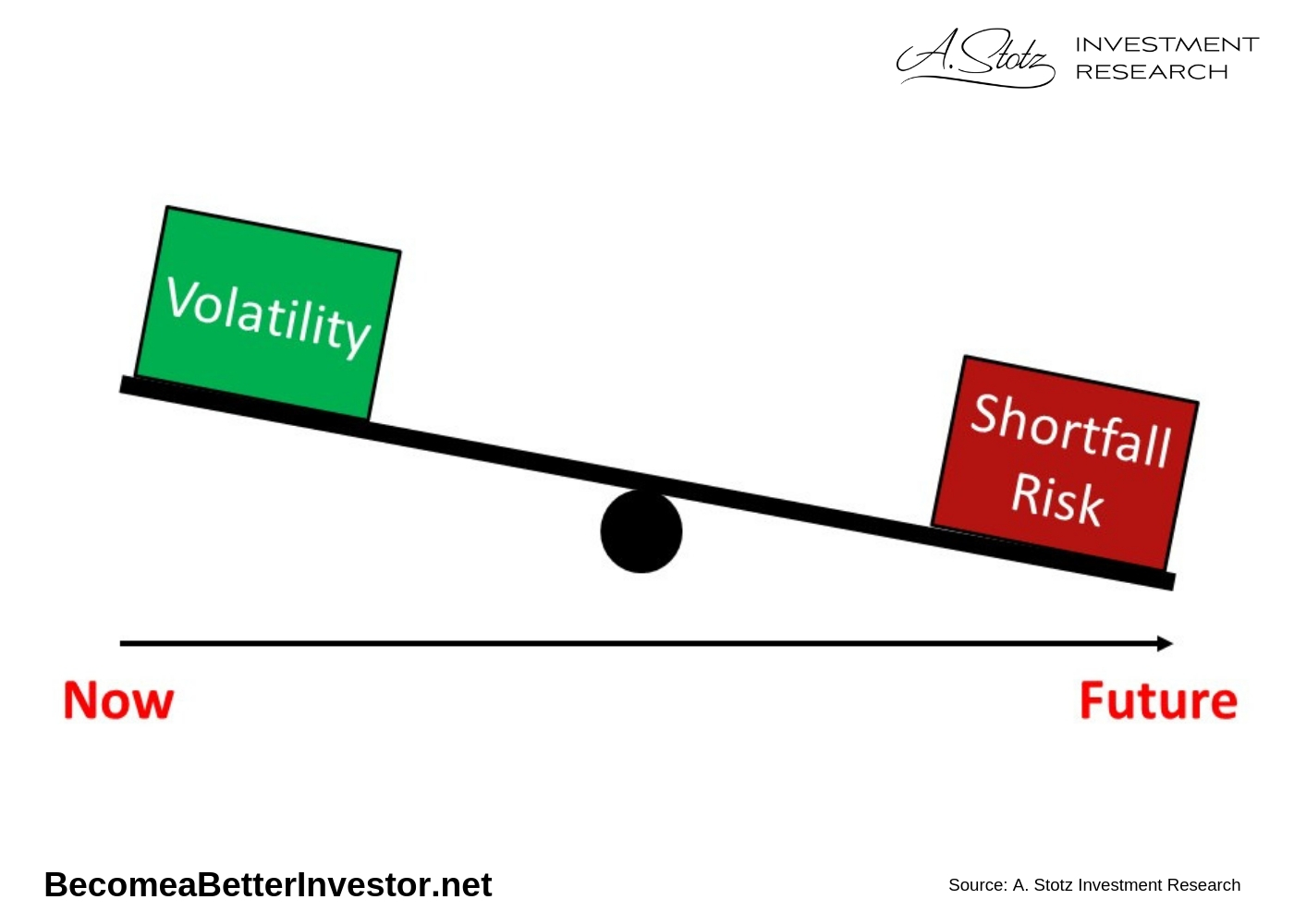

High volatility today, means lower shortfall risk in the future

Investing in volatile assets can be painful at times. You will face times when your investment account balance is down, sometimes down a lot.

But these volatile assets, generate a higher return in general and therefore reduce your risk of shortfall. Few financial advisors think about this tradeoff.

Many financial institutions will see volatility as risk and then ask the investor to confirm their level of risk tolerance. If the investor says they have “low” risk tolerance then the advisor will put that customer into low volatility, low return assets. They will have reduced volatility, but they will have increased shortfall risk.

The thing is that most financial advisors won’t be around years in the future when you suffer from shortfall risk. So the lesson is to remember that only you will look after your wealth best.

It’s a balancing act

The All Weather Strategy aims to find a balance. We know that even the biggest fans of roller coasters often feel fear during some part of the ride. Our primary target though is to reduce your shortfall risk, as reducing shortfall risk is what really matters.

As such, we must accept some level of volatility, certainly higher volatility than what a portfolio of only government bonds would exhibit. But we also know, that too much volatility can be so painful it leads to bad decisions.

Our emotions can easily result in bad decisions

It’s not uncommon to see investors getting into the stock market at close to peak levels and then experience a big downturn and sell close to the bottom–an experience that leads to pain and loss. Sometimes the experience can be so painful that the investor never returns to the stock market. To appeal to this kind of investor, we aim to find a balance between volatility and shortfall risk in our All Weather Strategy.

For those who want to build a long-term portfolio

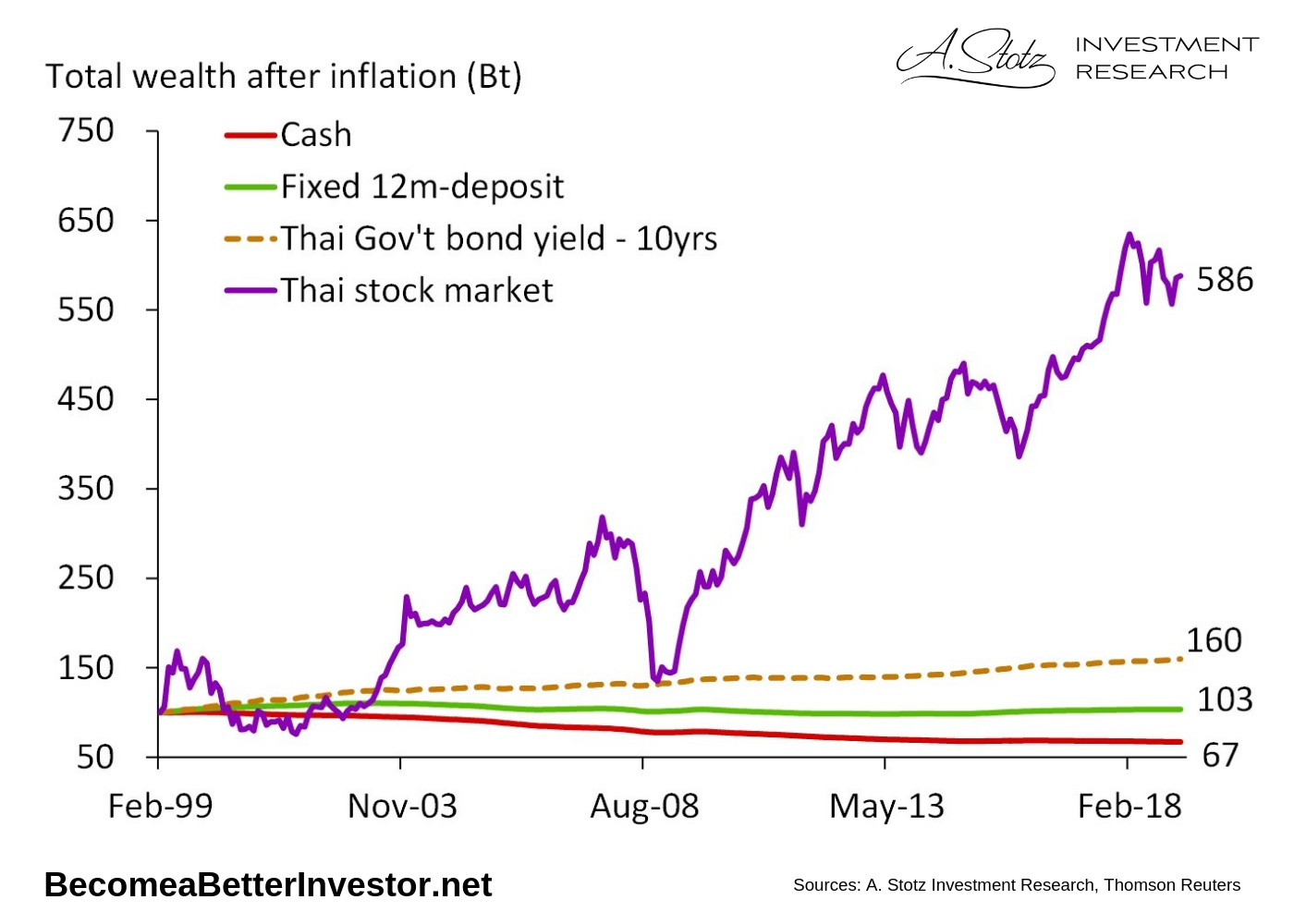

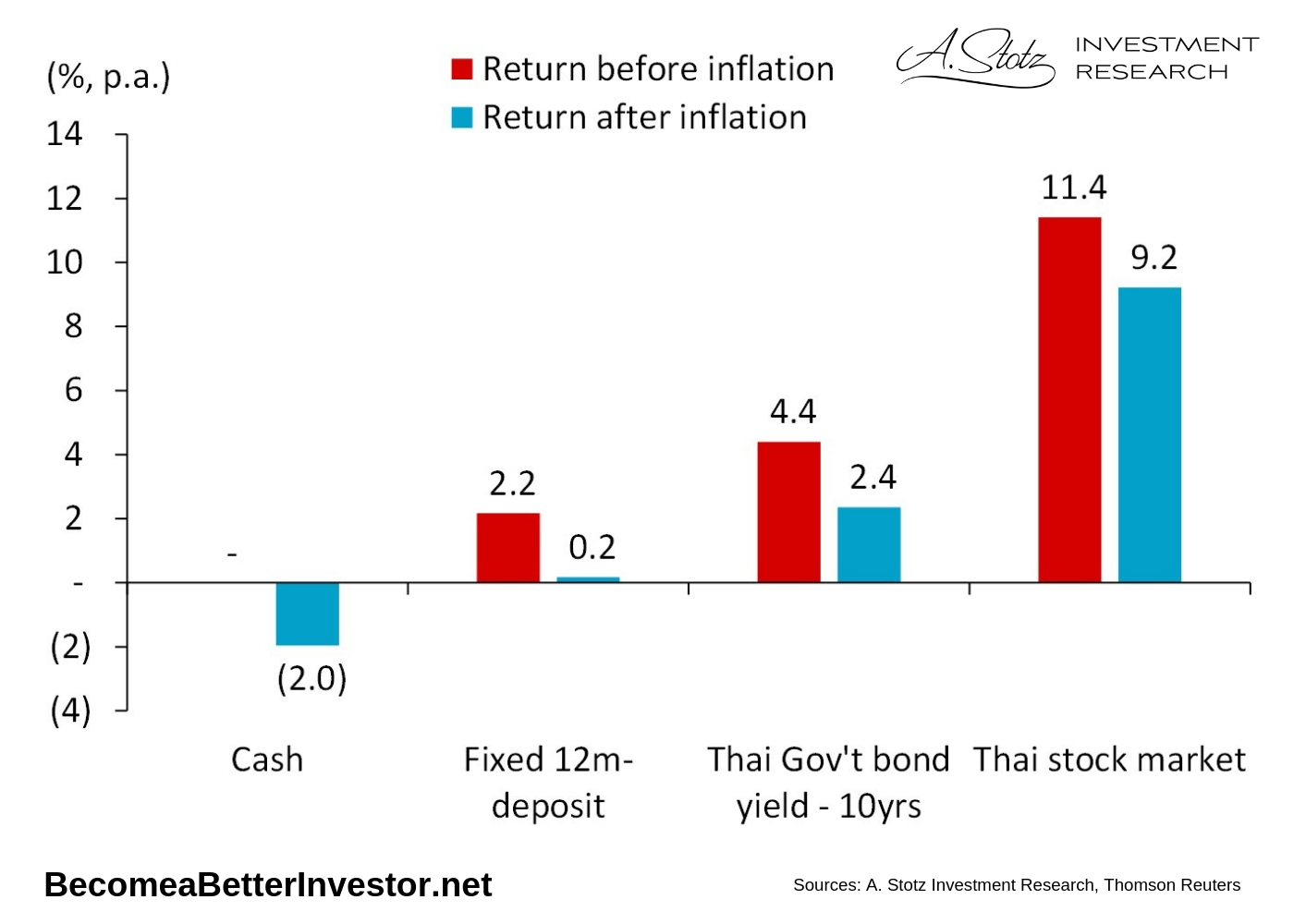

A strategy built around equities has historically been the best way to grow your wealth. No other asset class has outpaced inflation more than equities.

In Thailand since 1999, the equity market has generated an after-inflation terminal wealth almost four times higher than the second-best option, government bonds. But as you can see, investing in the stock market is not a smooth ride; it’s more like a roller coaster.

Let’s re-iterate that after inflation, no other asset class has outpaced inflation more than equities. So, if you want to grow your wealth significantly, you need to focus your strategy around stocks.

Regularly contribute to a long-term strategy

Regularly investing in a long-term portfolio is the best way to build your wealth over time. Long-term investing removes the trouble of watching the market every day and volatility becomes less of a concern. A long-term strategy can reduce your stress.

The All Weather Strategy gains from long-term equity return while trying to reduce a portion of losses during equity market downturns.

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.