Become a Better Investor’s Top 5 Bloggers 2018

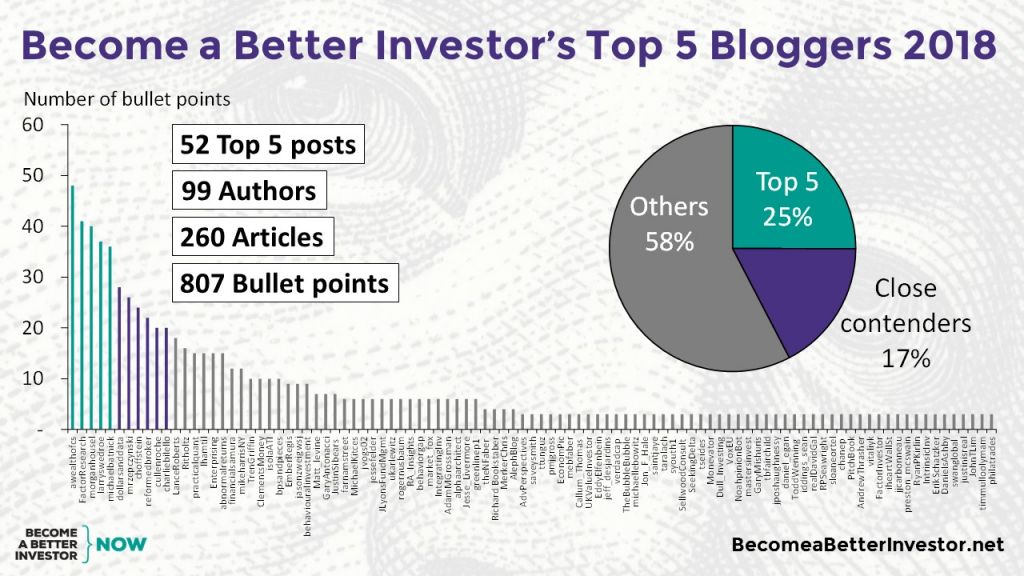

Yesterday, we shared the names of this year’s Close Contenders to our 2018 Top 5 of the Week Heavyweight Championship Bloggers. Today is the main event though and we can now reveal just who made it to the final medal-winning round. Before we check out the winners and their top takeaways from 2018, here’s a quick reminder of just how much all these brilliant authors have contributed to this year’s Top 5 of the Week blog.

As you can see, not only do we have some (very) familiar faces in the Top 5 of the Top 5, but we also have some new entries too! It perhaps won’t be a surprise for many to note that quite a few of the names in the higher end of the contribution scale work for Ritholtz Wealth Management. We have no affiliation, but the company obviously hire people that are great investment writers.

Most crucially though, all the authors we feature in our newsletter contribute significantly to the world of financial knowledge and investing, and we’re proud to share their great blog posts with you each week. In return, please spread some financial knowledge and happiness by congratulating these fine writers! Simply click on one of the share buttons within each of the blogger’s images below. ![]()

5. Michael Batnick

Blog: The Irrelevant Investor

Placed in 2017: 3rd

Share of total 2018 bullet points: 4.5%

Anything but an “Irrelevant Investor,” Michael Batnick, CFA the Director of Institutional Asset Management at Ritholtz Wealth Management, has placed on the podium for three years straight now. As well as being an avid investment blogger, 2018 also saw the release of Michael’s book, Big Mistakes: The Best Investors and Their Worst Investments. Follow him on Twitter here.

Our Top 5 Takeaways from Michael in 2018:

- Chart manufacturers have a long list of ways to fool investors by manipulating charts to present data in a favorable light (Read the full article here)

- Managers tend to focus on appearing overconfident to investors rather than circumspect and humble because this behavior is more appealing to investors (Read the full article here)

- Many of us put off saving till it’s affordable, but there’s a significant cost implication to waiting—don’t delay, the person you are tomorrow is no different to who you are today (Read the full article here)

- It’s logical to question the ideas that “the more you pay for stocks, the safer they are” and “credit spreads are safe when they’re low and risky when they’re high” (Read the full article here)

- Unfortunately, investors tend not to absorb hard lessons until they are “brought home with a hammer”—hard lessons must be lived before they are learned (Read the full article here)

4. Larry Swedroe

Blog: ETF.com

Placed in 2017: Close Contender

Share of total 2018 bullet points: 4.6%

Larry Swedroe is the Director of Research for Buckingham Strategic Wealth, an independent member of the BAM Alliance. We’re happy to see Larry has bumped up from the Close Contender’s circle to the medal-winner’s podium this year. He’s authored a number of books on investing, and he guest writes for a number of excellent blogs. Follow him on Twitter here.

Our Top 5 Takeaways from Larry in 2018:

- Furthermore, it also causes us to be overconfident and underperform in mutual funds—making recency bias the most common cause of many investing mistakes (Read the full article here)

- The traditional price-to-book no longer fits today’s business environment as it fails to incorporate the value of a company’s brand, intellectual property, and customer base onto a balance sheet (Read the full article here)

- In an ideal world, arbitrageurs would balance out such activity and push stocks to their “right” price—however, this doesn’t happen, and rational investors are unable to correct mispricing (Read the full article here)

- Always be skeptical about data-mining in research though, and ensure you believe strongly in your reasons for chosen factor premiums to help you stay disciplined during inevitable periods of low performance (Read the full article here)

- No other industry with above 90% failure rates would survive as active management has—given that in 20 years, the statistics for significant alpha generated has dropped from 20% to 2% (Read the full article here)

3. Morgan Housel

Blog: Collaborative Fund

Placed in 2017: 5th

Share of total 2018 bullet points: 5.0%

Now a Partner at Collaborative Fund, we’ve been a fan of Morgan Housel’s since the days when he used to write for The Motley Fool and The Wall Street Journal. As well as making the podium three years running as one of Become a Better Investor’s Top 5 Bloggers he is a two-time winner of the Best in Business award from the Society of American Business Editors and Writers. Follow him on Twitter here.

Our Top 5 Takeaways from Morgan in 2018:

- Risk, though, helps you accurately realize that stuff is beyond your control, luck can be deceptive in that it encourages the opposite in false feelings of power which should be ignored when it comes to investing (Read the full article here)

- The problem arises in forecasting when people, faced with proof that demonstrates they’re wrong, remain immovable anyway (Read the full article here)

- Like Warren Buffett, we may own between 4-500 stocks in our lifetimes, but we’ll generate the best returns from around 10 of them because “long tails drive everything” (Read the full article here)

- It doesn’t matter how intelligent you are if your emotions take over when making decisions about money (Read the full article here)

- We’ve forgotten that “normal, typical results” are what to expect most of the time (Read the full article here)

2. Nicolas Rabener

Blog: Factor Research

Placed in 2017: New to the podium!

Share of total 2018 bullet points: 5.1%

Coming in this year with a great entrance at #2, investor and entrepreneur Nicolas Rabener is the Managing Director—and main writer/researcher—at FactorResearch and Jackdaw Capital. Follow him on Twitter here.

Our Top 5 Takeaways from Nicolas in 2018:

- While Value is a common factor strategy—bargain-hunting being an appealing aspect of the factor—it can be challenging emotionally to hold these stocks long-term (Read the full article here)

- When it comes to why the global markets are doing so well, it’s simple; global earnings have been steadily improving since 2016 (Read the full article here)

- The theory behind factor investing is beautifully backed by substantial empirical evidence, plus it can be utilized by all investor types across markets and different asset classes (Read the full article here)

- Most professions, investing included, study and plan for the risks involved in common situations only, but it’s the crazy ones that can inflict the most damage (Read the full article here)

- Apply logical principles to cut through the randomness and noise of data, as factor strategies are at risk of being ineffective in the future (Read the full article here)

1. A Wealth of Common Sense from Ben Carlson

Blog: A Wealth of Common Sense

Placed in 2016 & 2017: Repeat winner!

Share of total 2018 bullet points: 5.9%

Ben Carlson, Director of Institutional Asset Management at Ritholtz Wealth Management, has been our consecutive Top 5 Blogger of the year for three years running now! As well as being a well-renowned blogger in the world of investment, Ben is also an accomplished author. Both his books, A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan and Organizational Alpha: How to Add Value in Institutional Asset Management, are a lot like his blog—they both feature a whole lot of common sense! Congratulations on winning for the third year in a row! Follow Ben on Twitter here.

Our Top 5 Takeaways from Ben in 2018:

- It’s always a good idea to look at the alternative side of an argument in the market, otherwise, we’re in danger of being prejudiced to our own perspectives (Read the full article here)

- We have no control over our politics, market returns, tax policies, economic growth, and other investor’s behavior, so invest in the one thing you can control; your savings rate (Read the full article here)

- Investment discussions rarely take into account the fact that investors are all very different people with very different goals and attitudes towards money and the future (Read the full article here)

- Anything that could have been avoided or identified as a mistake in advance counts as being a purposeful one—these are markedly different though to calculated bets with an unfavorable outcome (Read the full article here)

- Investors should be wary of ‘free’ though—when being promised by a for-profit company; it usually means hidden costs are actually being concealed in the fine print (Read the full article here)

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article. The Become a Better Investor Team doesn’t necessarily endorse any stocks or shares mentioned in the articles or the author of such articles linked to and summarized in Top 5 of the Week and cannot guarantee the accuracy of its information.