Analysts Less Negative on China Heading into 2017

Watch the video with Andrew Stotz or read Watching the Street: China below.

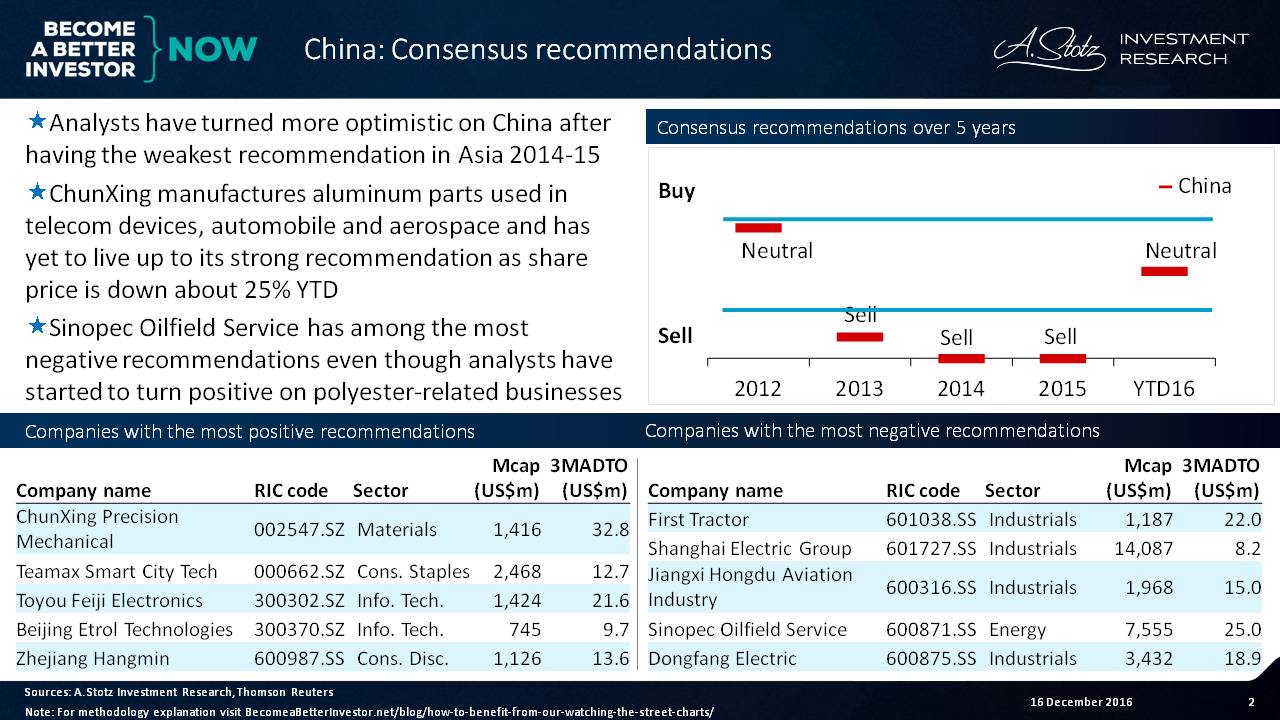

Consensus Recommendations: China

Analysts have turned more optimistic on China after having the weakest recommendation in Asia 2014-15. In the chart below, you can see that analysts covering the Chinese market have moved from being very negative in 2013, 2014 and 2015 to being neutral in 2016.

Learn more: How to Benefit from Our Watching the Street Charts

Among companies with the most positive recommendations, ChunXing Precision Mechanical manufactures aluminum parts used in telecom devices, automobile and aerospace but has yet to live up to its strong recommendation as its share price is down about 25% in 2016.

Sinopec Oilfield Service has among the most negative recommendations even though analysts have started to turn positive on polyester-related businesses.

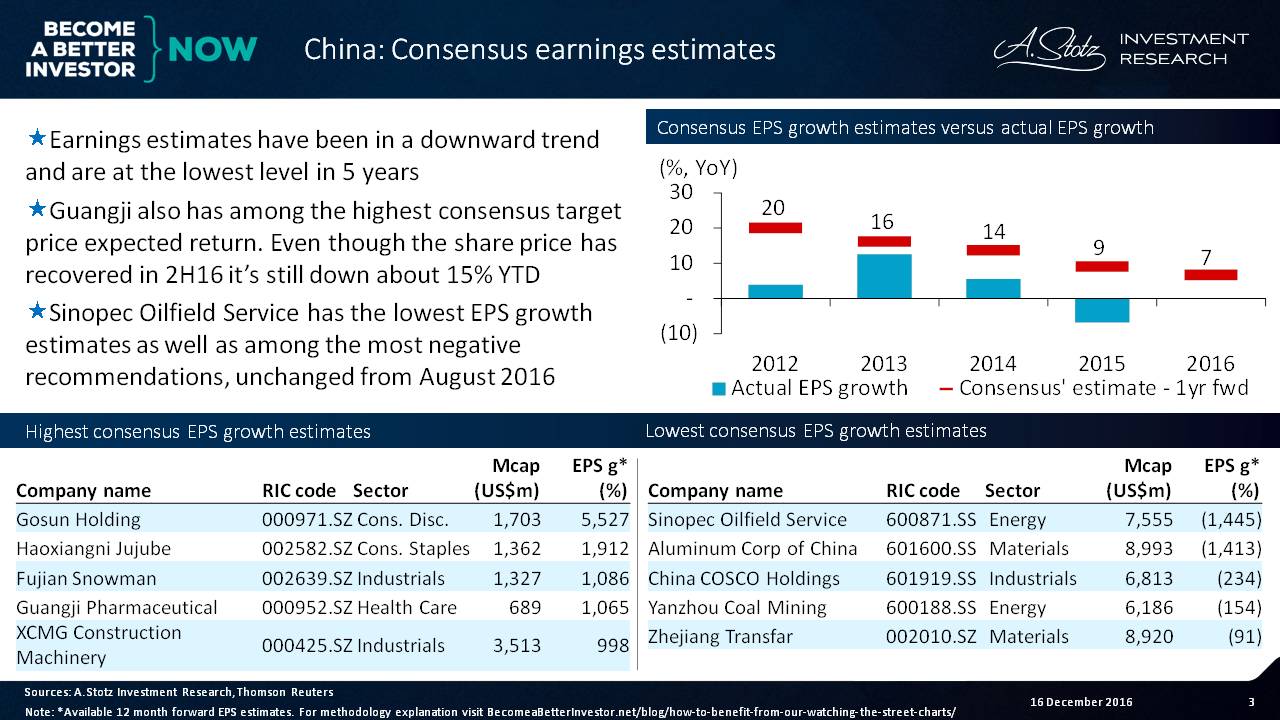

Consensus Earnings Estimates: China

Earnings estimates have been in a downward trend and are at their lowest level in 5 years.

Guangji has among the highest consensus target price expected return. Even though the share price has recovered in the second half of 2016, it’s still down about 15% YTD.

Sinopec Oilfield Service has the lowest EPS growth estimates, as well as among the most negative recommendations, unchanged from August 2016.

Consensus Target Prices: China

The 12-month forward target price expected return is slightly down compared to August 2016. It can partly be explained by Chinese shares on average trading at higher prices though.

JIULI Hi-tech Metals manufactures steel pipes and tubes. The share price has yet to live up to its expectations, as it has remained flat for the past 3 months.

Sinopec Oilfield Service is also found among the stocks with lowest target price expected return.

Do YOU use any kind of analyst estimate when considering an investment?

Let us know in a comment below.

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.