A. Stotz All Weather Strategy – March 2021

The All Weather Strategy underperformed World equity in March as Asia Pacific ex Japan, Emerging markets, and commodities weakened due to a stronger US dollar. Western markets could remain strong on stimulus plans, and China drives the East. Our equity target allocation is at 65% and commodities at 25%.

The A. Stotz All Weather Strategy is Global, Long-term, and Diversified:

- Global – Invests globally, not only Thailand

- Long-term – Gains from long-term equity return, while trying to reduce a portion of losses during equity market downturns

- Diversified – Diversified globally across four asset classes

The All Weather Strategy is available in Thailand through FINNOMENA. Please note that this post is not investment advice and should not be seen as recommendations. Also, remember that backtested or past performance is not a reliable indicator of future performance.

Review

Developed markets dominated March

- Developed Europe performed the best, as investors are getting optimistic about a recovery in 2H21

- The US was the second-best performer, boosted by Biden’s trillion-dollar stimulus packages

Stronger US dollar meant weak Emerging markets

- Emerging markets underperformed Developed markets massively

- This could partly be explained by a stronger US dollar, which is generally bad for Emerging markets

- The rationale being US investments becoming relatively more attractive, and US$-denominated debt becomes more expensive

Much of Asia was performing poorly in March

- A stronger US dollar and weaker oil price were contributing factors to the poor performance of Asia Pacific ex Japan

- The outlook for when a recovery in, for example, tourism could happen remains uncertain

- Altogether, global investors seem to see a clearer recovery timeline in developed markets

Low bond target allocation at 5%

- We have a bond target allocation of 5% as they appeared less attractive relative to equity

- The strategy is to hold only Thai government bonds, rather than a mix of global government and corporate bonds

Commodities fell back after months of rising prices

- Commodities fell back in March, after months of strong performance

- A stronger US dollar generally is negative for the oil price, which has a large impact on commodities performance

- Many industrial metals fell back in March as steel supply increased from a deal between China and Indonesia and nickel demand from the EV sector weakened

Gold continued to be weak in March

- Gold continued its poor performance, based on a stronger US dollar and rising yields

- Besides, investors seem to have a continued strong appetite for risky assets, e.g., stocks

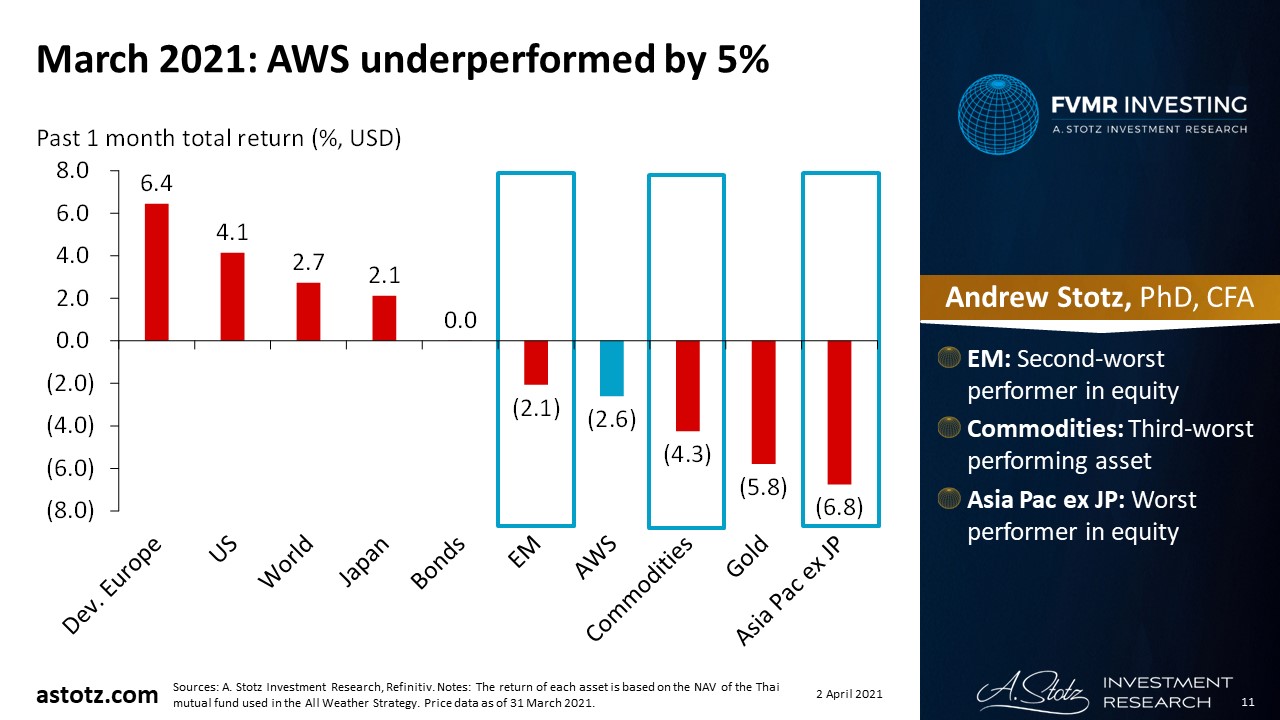

March 2021: All Weather Strategy underperformed by 5%

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- Emerging markets: Second-worst performer in equity

- Commodities: Third-worst performing asset

- Asia Pac ex Japan: Worst performer in equity

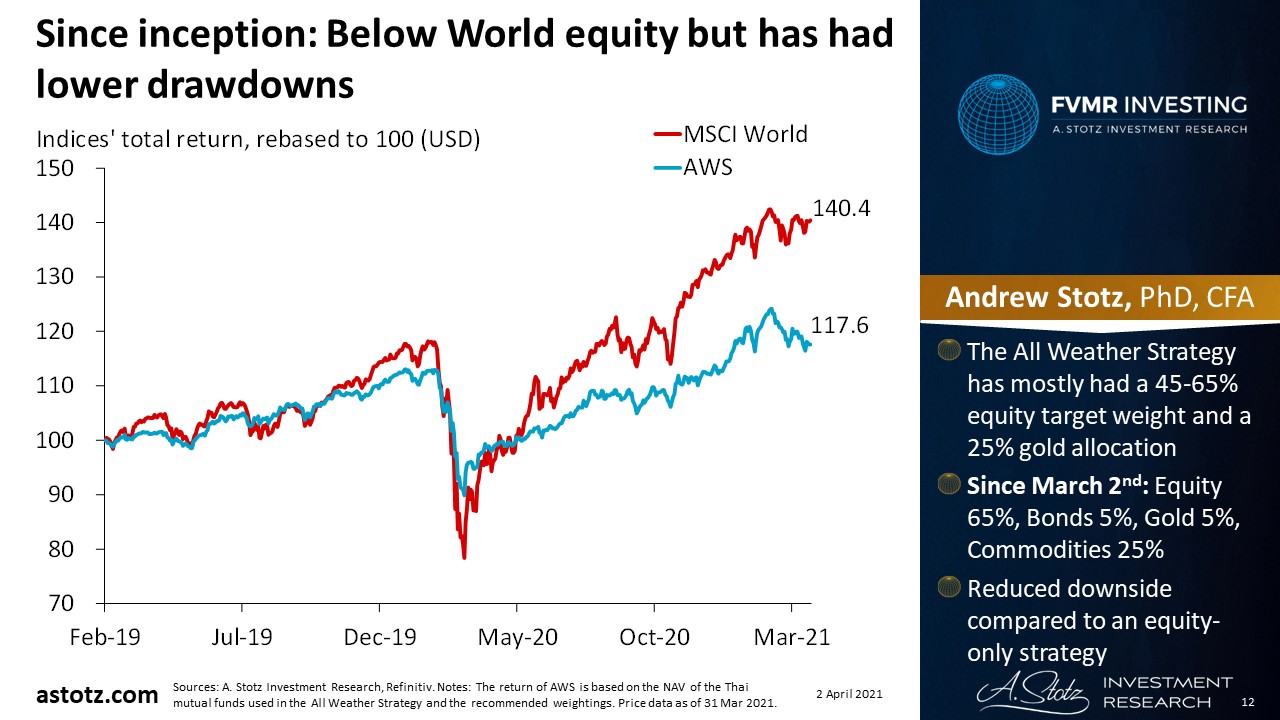

Since inception: Below World equity but has had lower drawdowns

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- The All Weather Strategy has mostly had a 45-65% equity target weight and a 25% gold allocation

- Since March 2nd: Equity 65%, Bonds 5%, Gold 5%, Commodities 25%

- Reduced downside compared to an equity-only strategy

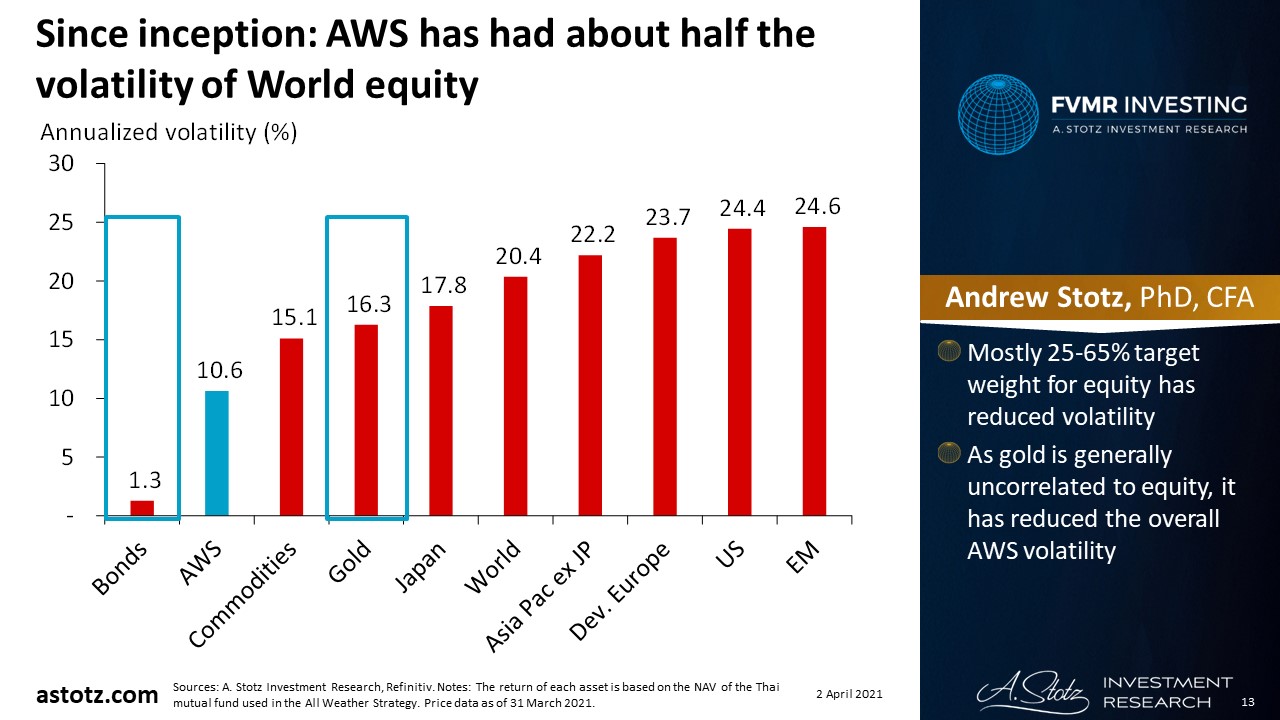

Since inception: All Weather Strategy has had about half the volatility of World equity

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- Mostly 25-65% target weight for equity has reduced volatility

- As gold is generally uncorrelated to equity, it has reduced the overall strategy’s volatility

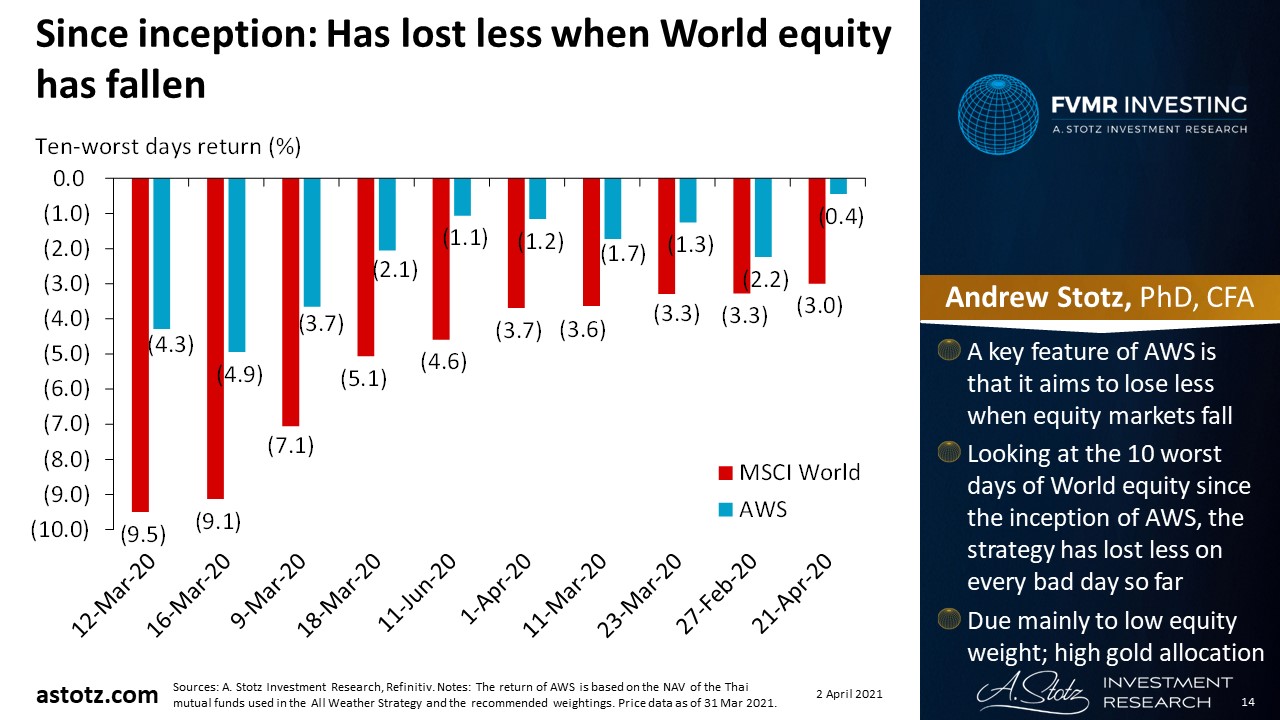

Since inception: Has lost less when World equity has fallen

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- A key feature of All Weather Strategy is that it aims to lose less when equity markets fall

- Looking at the 10 worst days of World equity since the inception of the All Weather Strategy, the strategy has lost less on every bad day so far

- Due mainly to low equity weight; high gold allocation

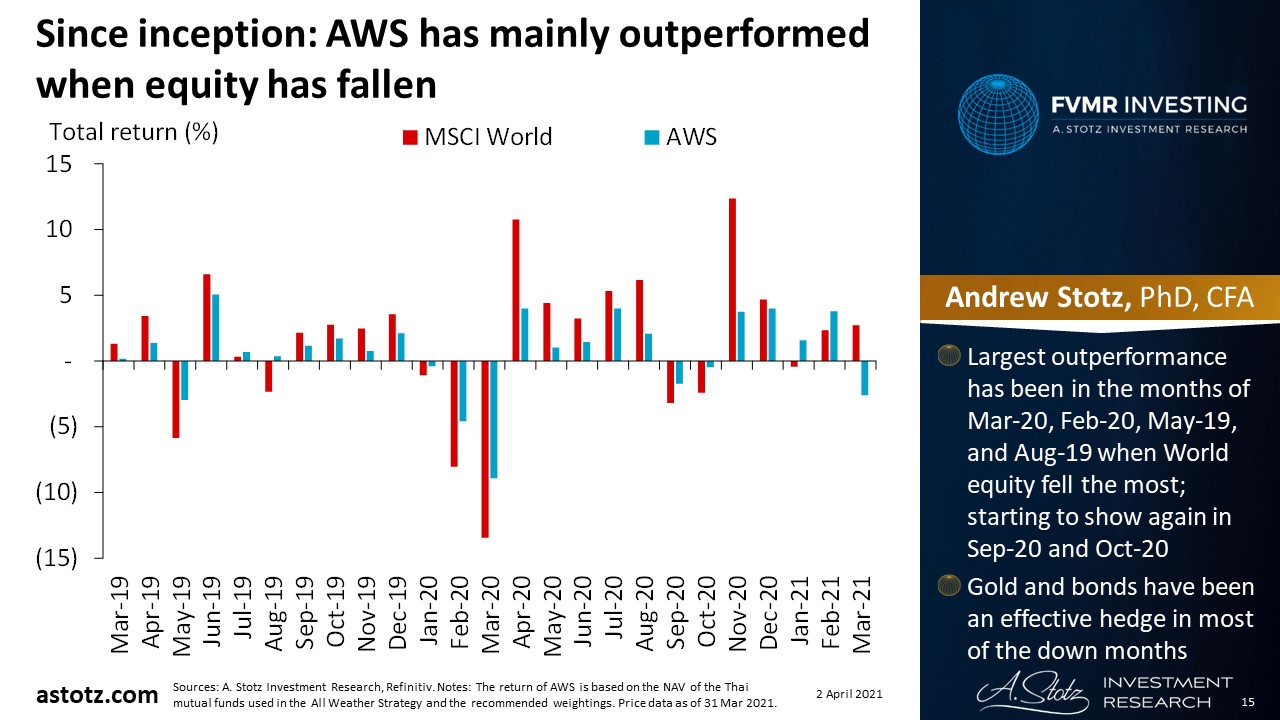

Since inception: All Weather Strategy has mainly outperformed when equity has fallen

Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, expressed or implied is made regarding future performance.

- Largest outperformance has been in the months of Mar-20, Feb-20, May-19, and Aug-19 when World equity fell the most; starting to show again in Sep-20 and Oct-20

- Gold and bonds have been an effective hedge in most of the down months

Outlook

Stimulus packages lead to recovery and inflation expectations in the US

- Vaccine and stimulus news can drive up inflation further

- Biden’s trillion-dollar stimulus plans have lead to strong recovery expectations in the US

- Rising yields on 10-year US Treasuries shows that the market expects inflation

European economic recovery expected in 2H21

- EU has seen a jump in inflation but doesn’t appear to be as close to overshooting as the US

- The European Commission’s recovery program is smaller than the US’

- European yields have started to move as well

- The market expects the vaccine rollout to result in an economic recovery in 2H21

Fed and ECB to allow excessive inflation

- Fed and the ECB are open to overshoot their inflation targets due to undershooting for a long time

- This could drive inflation expectations further

- At least in the short-term, we think inflation is likely to rise

- Some will be from the COVID-19 base effect

China continues to drive demand in Asia and Emerging markets

- China’s strong demand recovery to continue, positive for Asia and Emerging markets

- This demand recovery could also drive commodities further

- Strong commodities are usually good for Emerging markets

- We prefer Asia Pacific ex Japan and Emerging markets within equity

- March is likely to be a temporary weakness

Gold could continue to be weak in the near term

- In the longer term, as the inflation narrative spreads, it could lead to expectations of negative real rates

- However, what we have just seen, is that real rates are up

- Rising real rates are the worst enemy of the gold price; hence, our low allocation in gold has been the right choice

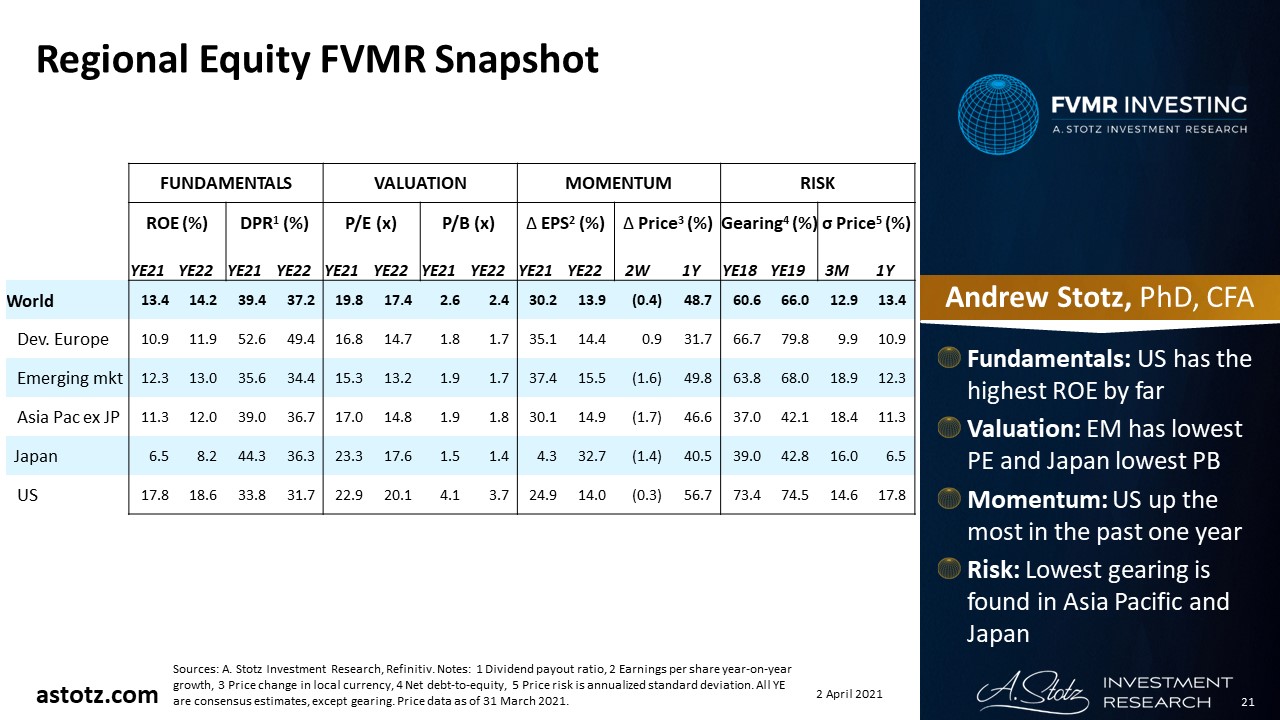

Regional Equity FVMR Snapshot

- Fundamentals: US has the highest ROE by far

- Valuation: Emerging markets has the lowest PE and Japan lowest PB

- Momentum: US up the most in the past year

- Risk: Lowest gearing is found in Asia Pacific and Japan

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.