A. Stotz All Weather Strategies – April 2023

The All Weather Strategy is available in Thailand through FINNOMENA. If you’re interested in our allocation strategy, you can also join the Become a Better Investor Community. Please note that this post is not investment advice and should not be seen as recommendations. Also, remember that backtested or past performance is not a reliable indicator of future performance.

What happened in world markets in April 2023

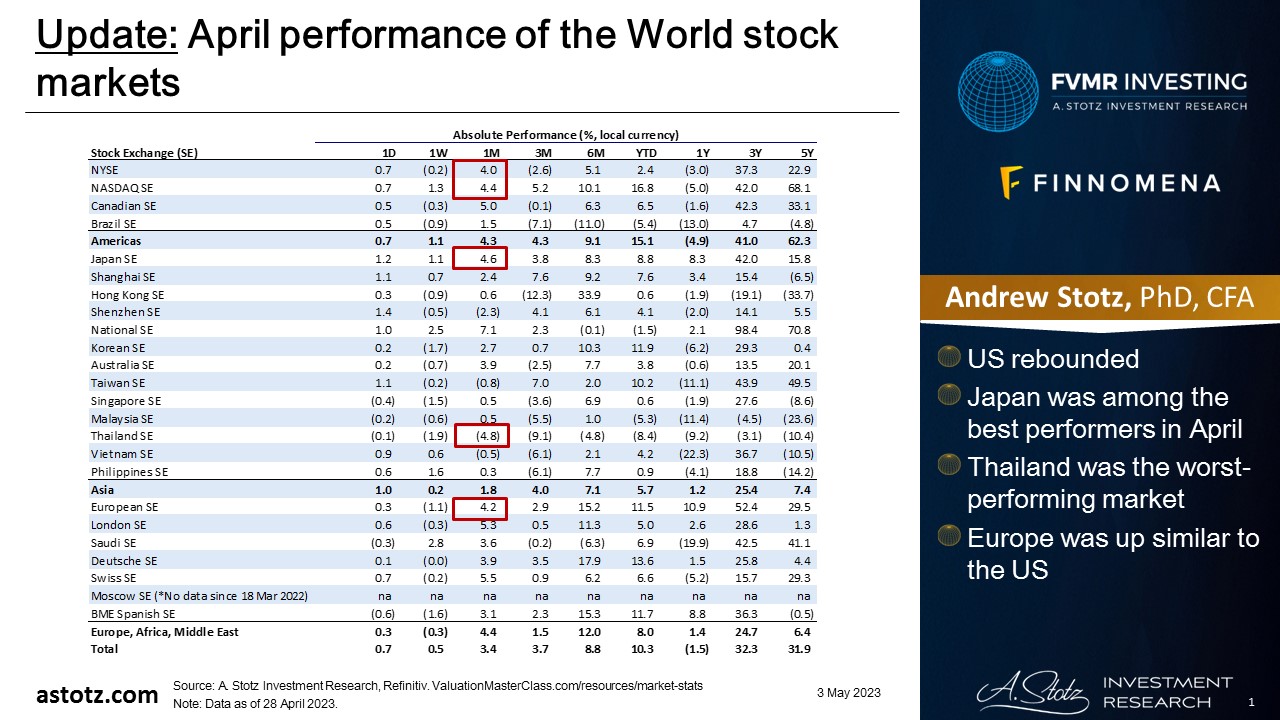

Performance of the World stock markets

- US rebounded

- Japan was among the best performers in April

- Thailand was the worst-performing market

- Europe was up similar to the US

Find the updated Performance of the World stock markets here.

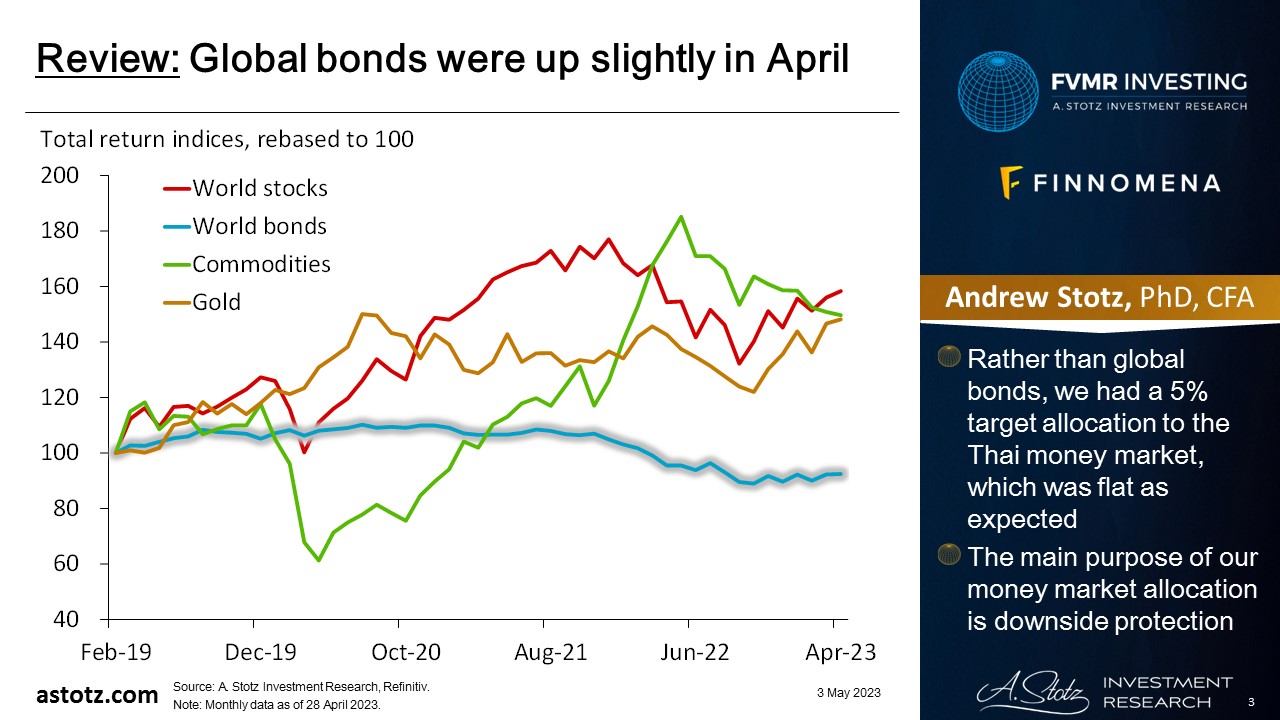

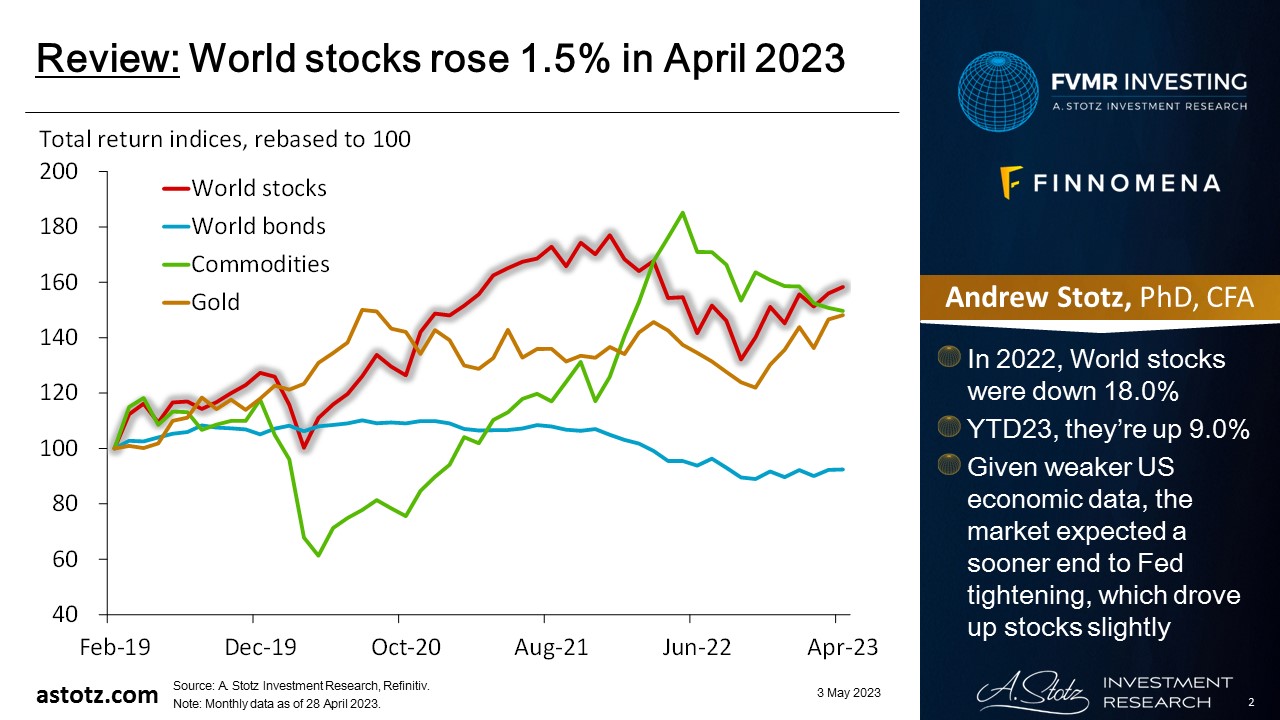

World stocks rose 1.5% in April 2023

- In 2022, World stocks were down 18.0%

- YTD23, they’re up 9.0%

- Given weaker US economic data, the market expected a sooner end to Fed tightening, which drove up stocks slightly

Global bonds were up slightly in April

- Rather than global bonds, we had a 5% target allocation to the Thai money market, which was flat as expected

- The main purpose of our money market allocation is downside protection

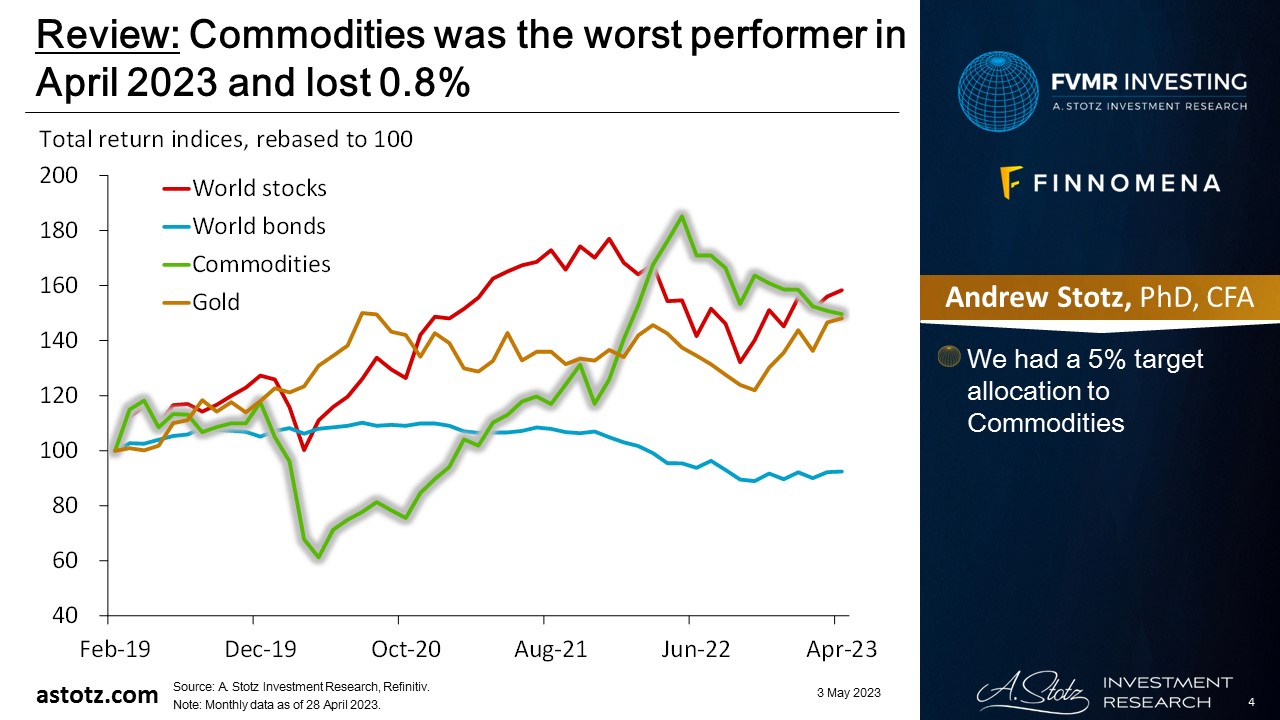

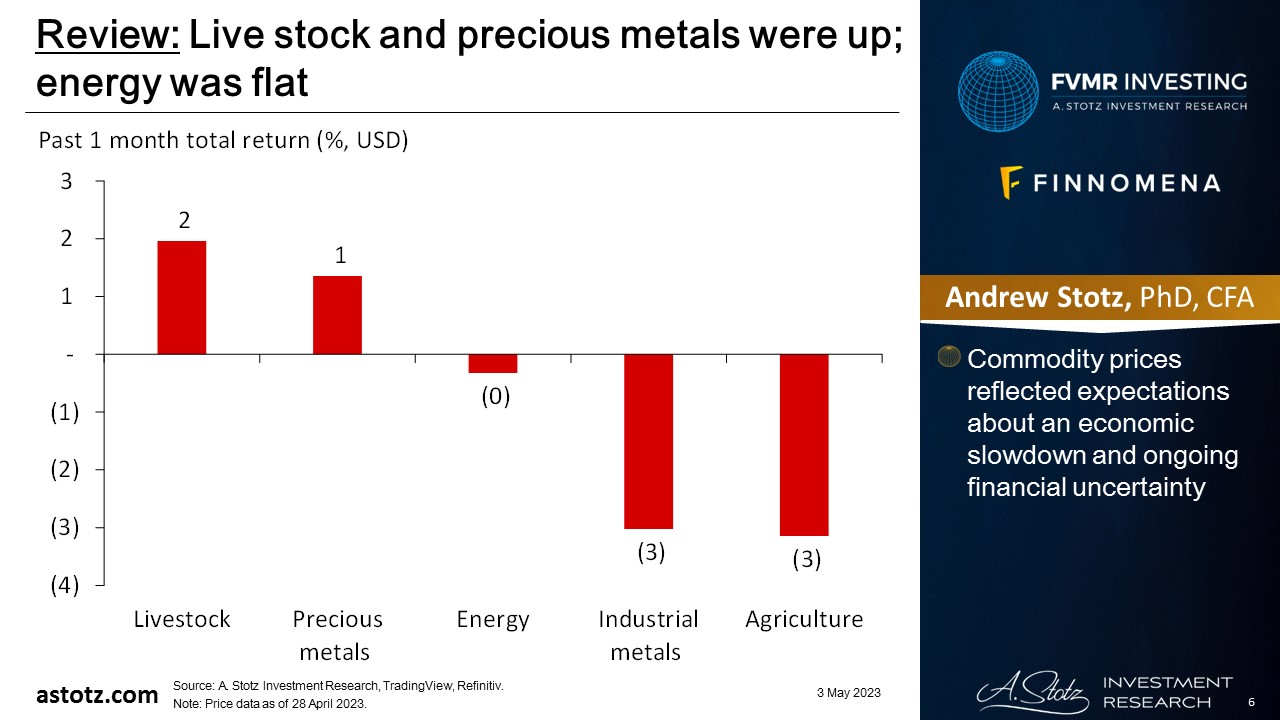

Commodities was the worst performer in April 2023 and lost 0.8%

- We had a 5% target allocation to Commodities

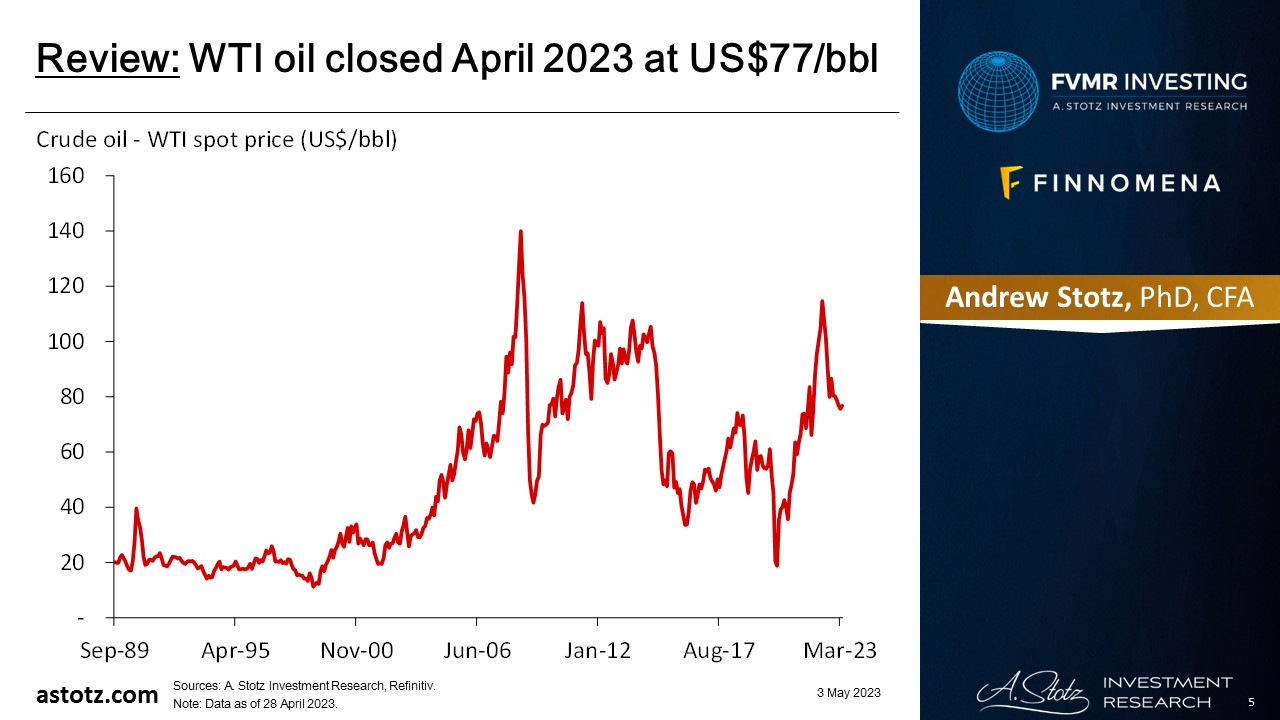

WTI oil closed April 2023 at US$77/bbl

Live stock and precious metals were up; energy was flat

- Commodity prices reflected expectations about an economic slowdown and ongoing financial uncertainty

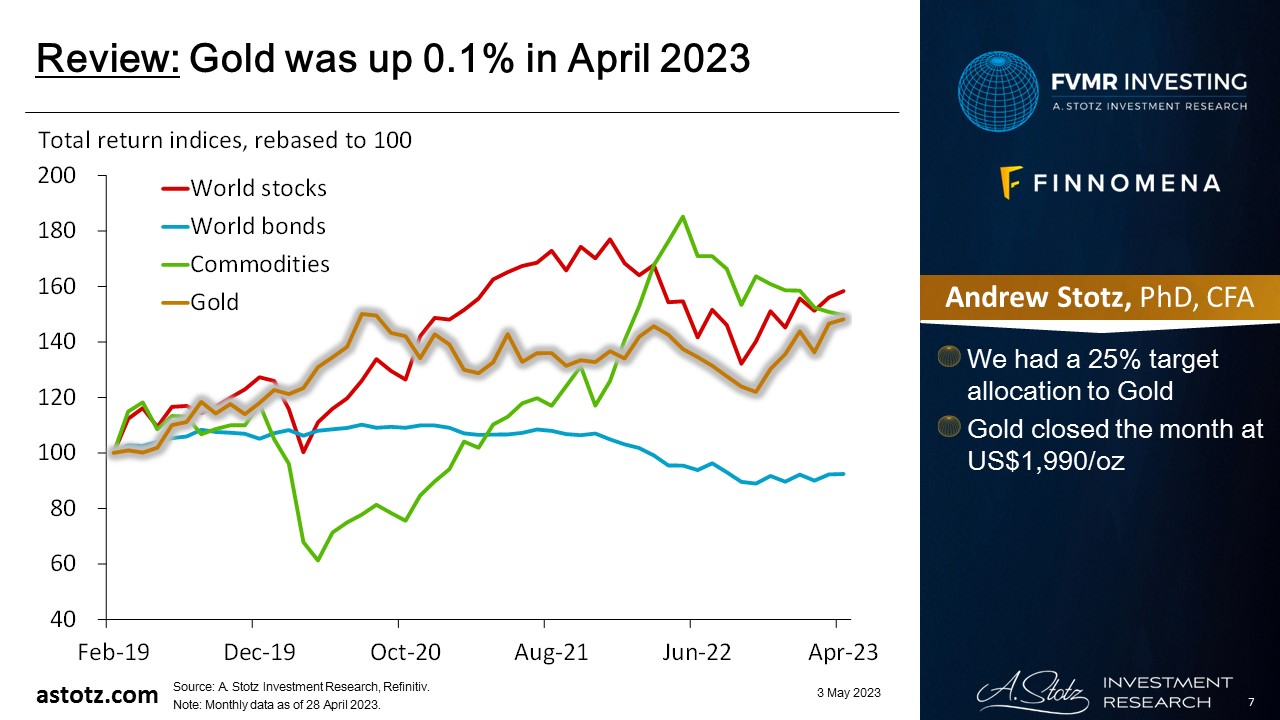

Gold was up 0.1% in April 2023

- We had a 25% target allocation to Gold

- Gold closed the month at US$1,990/oz

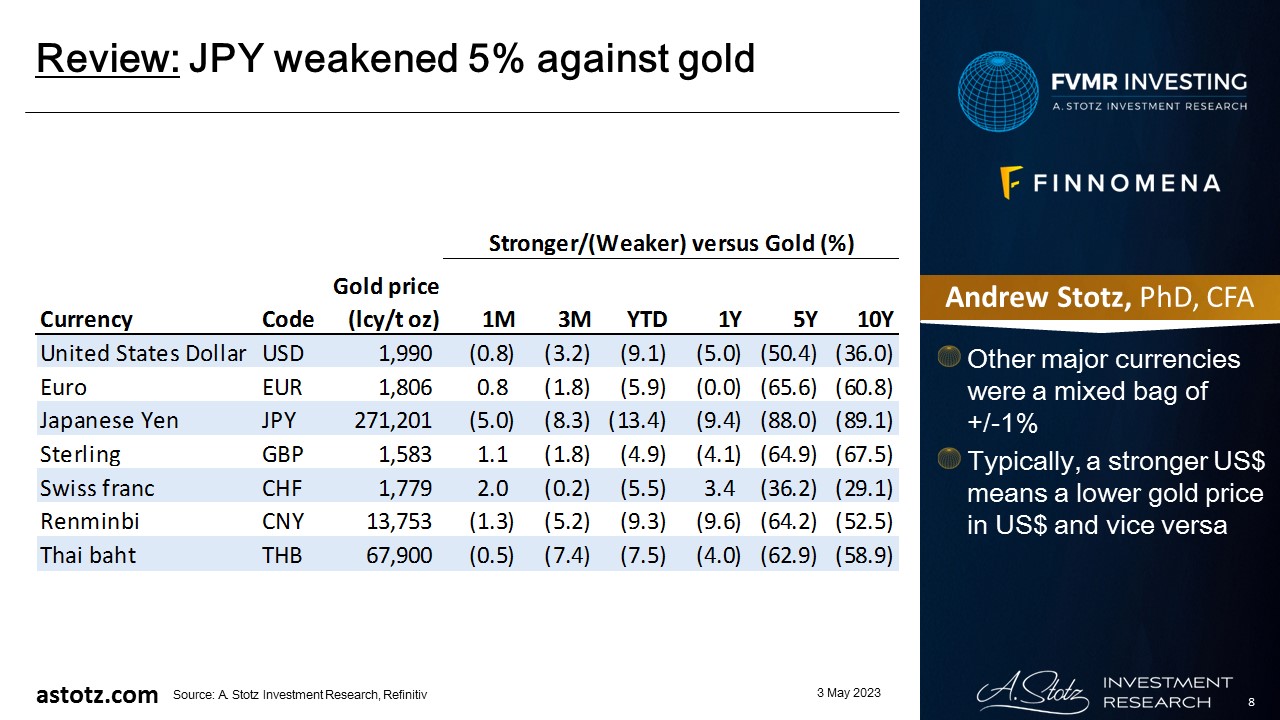

JPY weakened 5% against gold

- Other major currencies were a mixed bag of +/-1%

- Typically, a stronger US$ means a lower gold price in US$ and vice versa

The market doesn’t believe the Fed

The gap between what the #FederalReserve intends to do (at least a couple of weeks ago) and what markets expect the Fed to do is, again,

HUGE!! pic.twitter.com/AvwX2tCylK— jeroen blokland (@jsblokland) April 5, 2023

- Time will tell who is correct, but this mistrust is troublesome for the Fed either way

National Federation of Independent Business data shows start of US credit crunch

The US credit crunch has probably begun. The debacles of SVB and Signature Bank have made commercial banks cautious, as evidenced by the loan availability component of the NFIB small business survey falling sharply. This means businesses are having a tougher time getting a loan. pic.twitter.com/g1vVuIQp2q

— Gavekal (@Gavekal) April 17, 2023

- A credit crunch increases the likelihood of a recession

The big banks increase their dominance

1/2

Bank trading yesterday:

JPM +7.55%

Citi +4.78%

SP 500 Large Cap Banks +3.51%

SP 600 Small Cap Banks -2.10%The smaller the bank, the worse it did.

But this is not unique to yesterday, this has been the pattern since the banking crisis began in early March. pic.twitter.com/hn7fQnWQ3v

— Jim Bianco biancoresearch.eth (@biancoresearch) April 15, 2023

- Following the bank failures in the US, the larger banks benefit and see inflows at the cost of smaller banks.

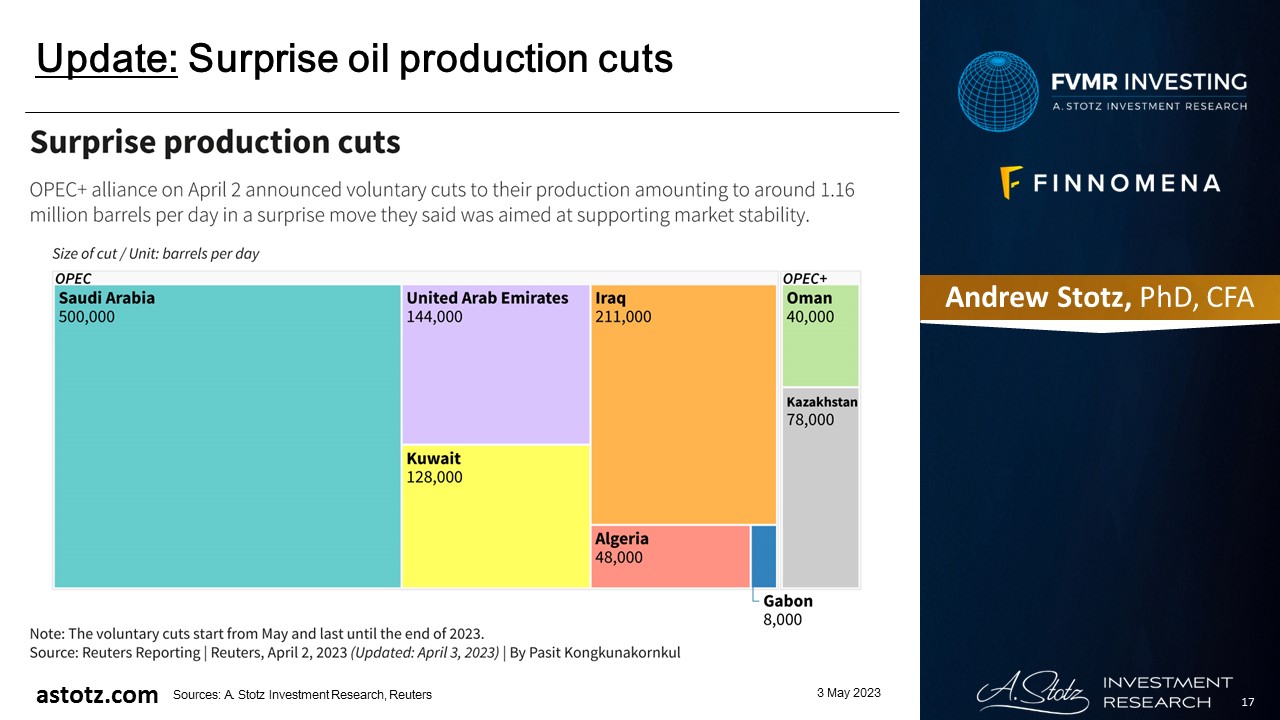

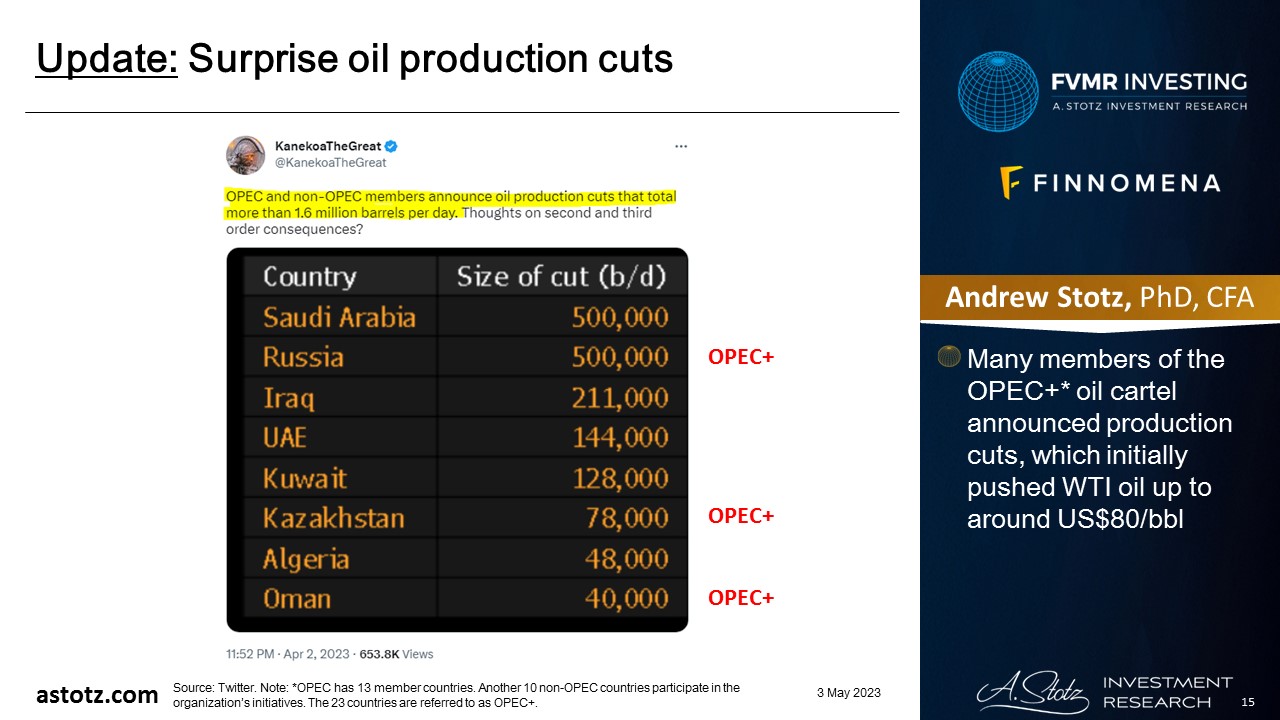

Surprise oil production cuts

- Many members of the OPEC+* oil cartel announced production cuts, which initially pushed WTI oil up to around US$80/bbl

OPEC countries and when they joined

- 1960 founding members: Iran, Iraq, Kuwait, Saudi Arabia and Venezuela

- 1960s: Added Libya, UAE, and Algeria

- 1970s: Added Nigeria and Gabon

- 2000s: Angola, Equatorial Guinea, and Congo

- Another 10 non-OPEC countries participate in the organization’s initiatives – the 23 countries are referred to as OPEC+

Gold broke the US$2,000 mark for the first time since August 2020

Gold has broken out above $2,000 👀

The all time high was $2,075 / oz in August 2020, ~18 months before global Central Bank balance sheets peaked.

Gold is sniffing out the next wave of fiat debasement. pic.twitter.com/UNkLCPHBEz

— Stack Hodler (@stackhodler) April 4, 2023

Key takeaways

- The market doesn’t believe the Fed

- US credit crunch has likely begun

- The big banks increase their dominance

- Surprise oil production cuts

- Gold broke the US$2,000 mark for the first time since August 2020

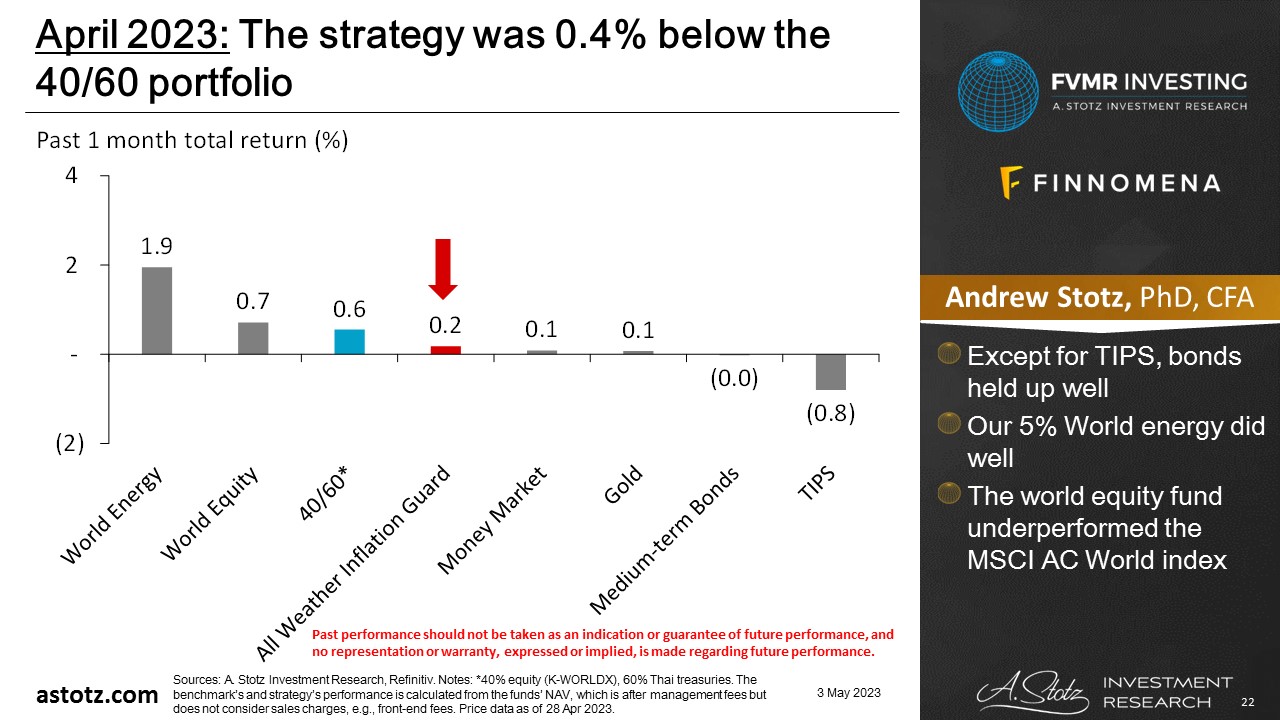

Performance review: All Weather Inflation Guard

- All Weather Inflation Guard was up 0.2%

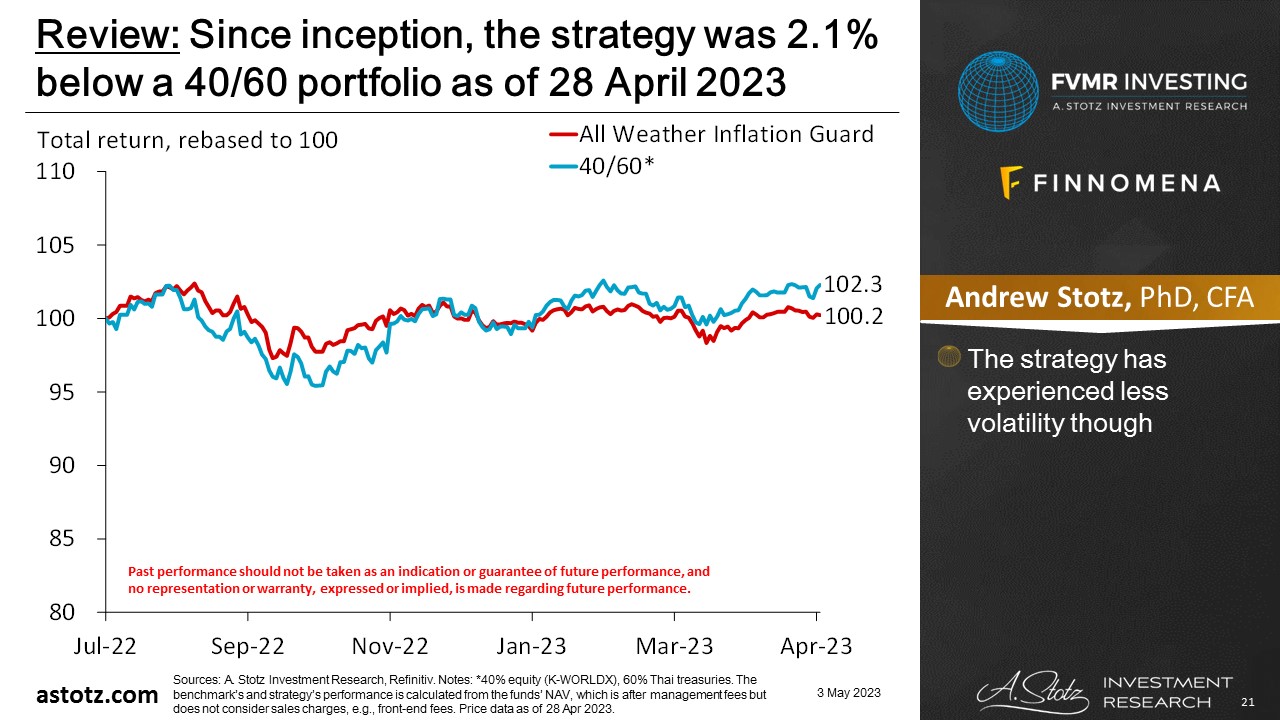

Since inception, the strategy was 2.1% below a 40/60 portfolio as of 28 April 2023

- The strategy has experienced less volatility though

The strategy was 0.4% below the 40/60 portfolio

- Except for TIPS, bonds held up well

- Our 5% World energy did well

- The world equity fund underperformed the MSCI AC World index

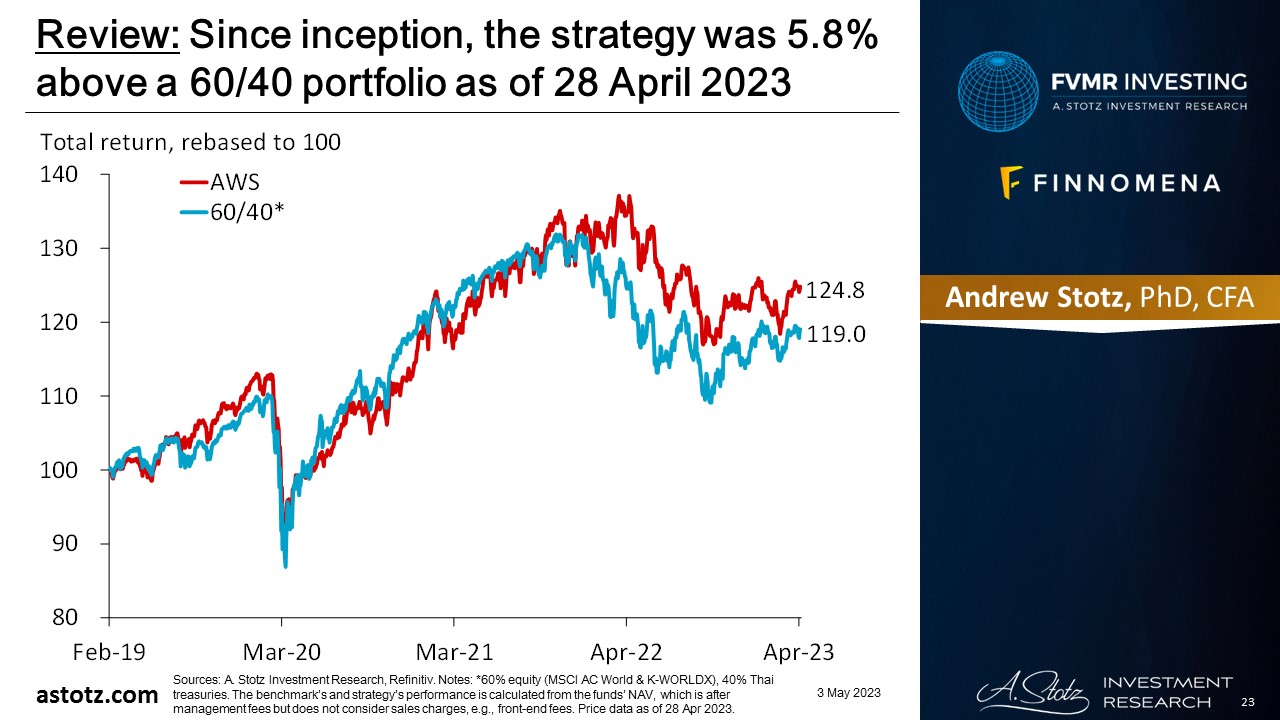

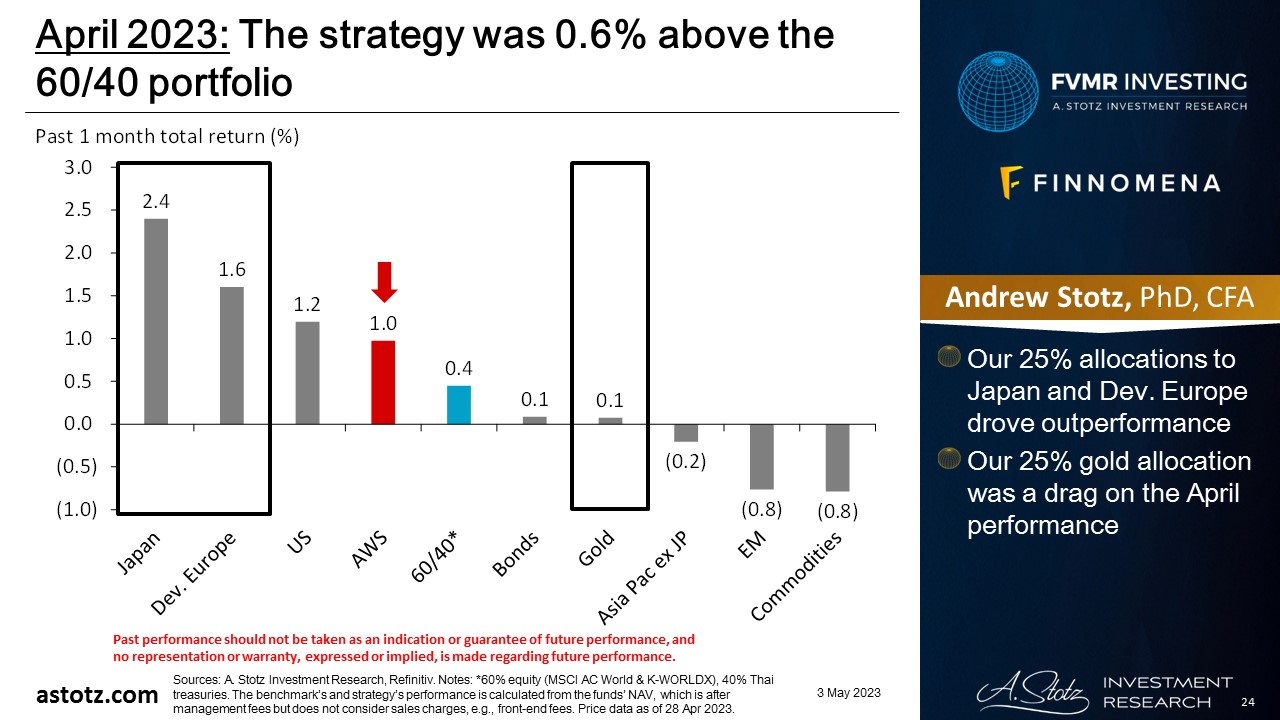

Performance review: All Weather Strategy

- All Weather Strategy was up 1.0%

Since inception, the strategy was 5.8% above a 60/40 portfolio as of 28 April 2023

The strategy was 0.6% above the 60/40 portfolio

- Our 25% allocations to Japan and Dev. Europe drove outperformance

- Our 25% gold allocation was a drag on the April performance

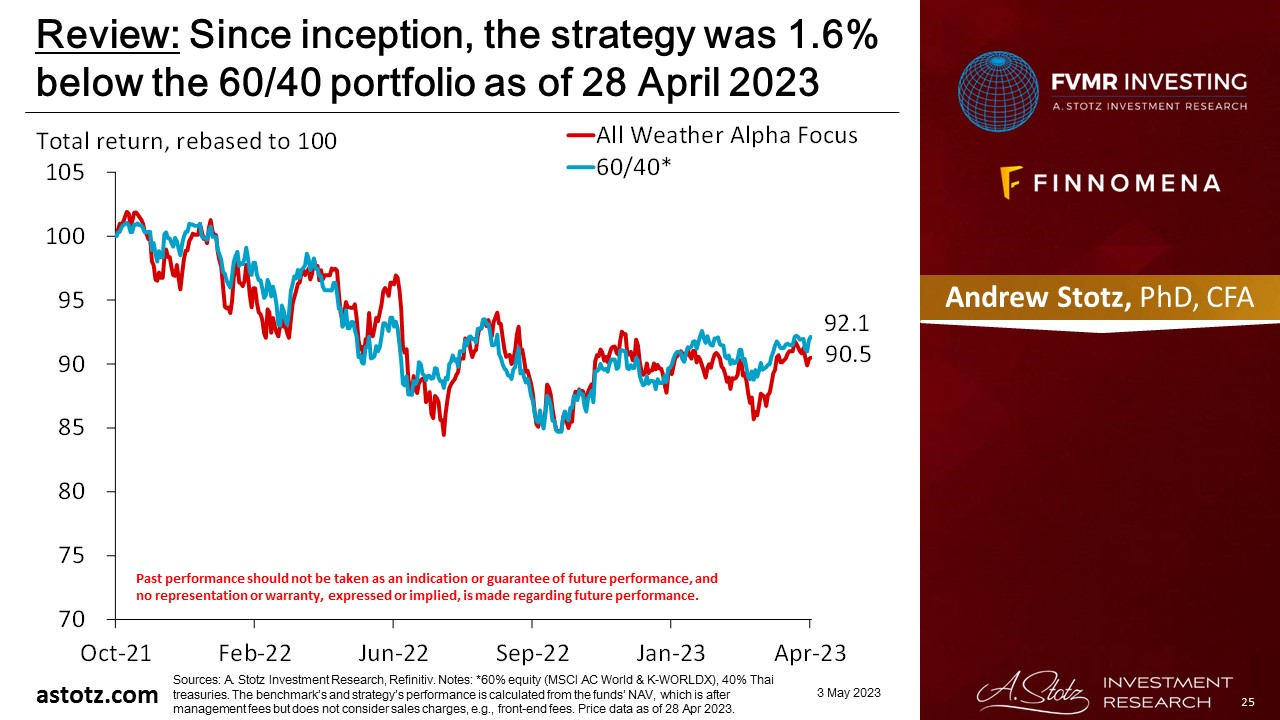

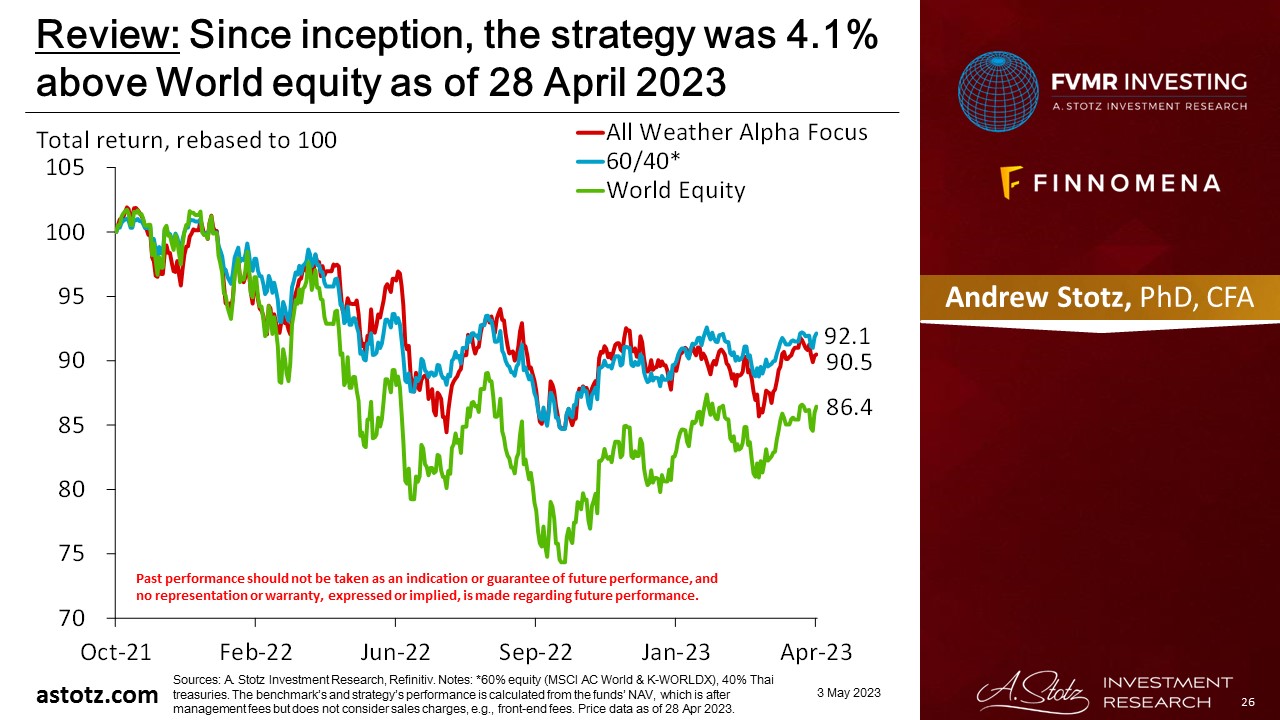

Performance review: All Weather Alpha Focus

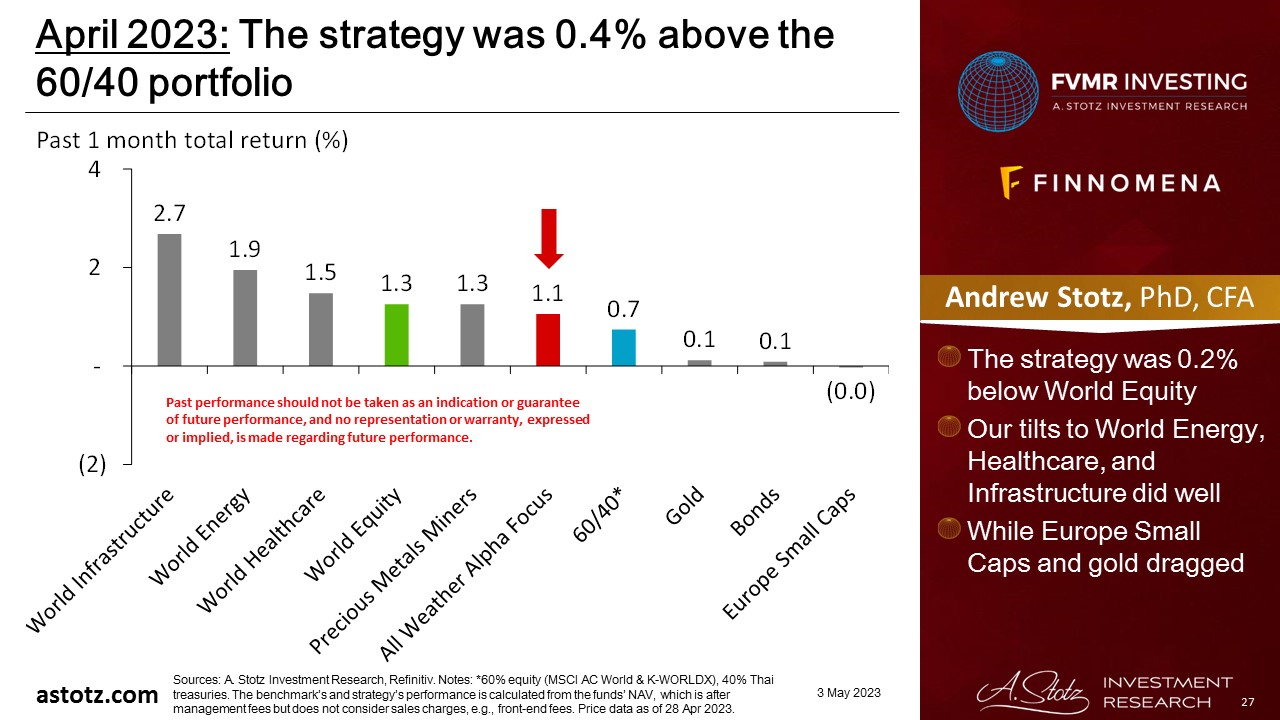

- All Weather Alpha Focus was up 1.1%

Since inception, the strategy was 1.6% below the 60/40 portfolio as of 28 April 2023

Since inception, the strategy was 4.1% above World equity as of 28 April 2023

The strategy was 0.4% above the 60/40 portfolio

- The strategy was 0.2% below World Equity

- Our tilts to World Energy, Healthcare, and Infrastructure did well

- While Europe Small Caps and gold dragged

Global outlook that guides our asset allocation

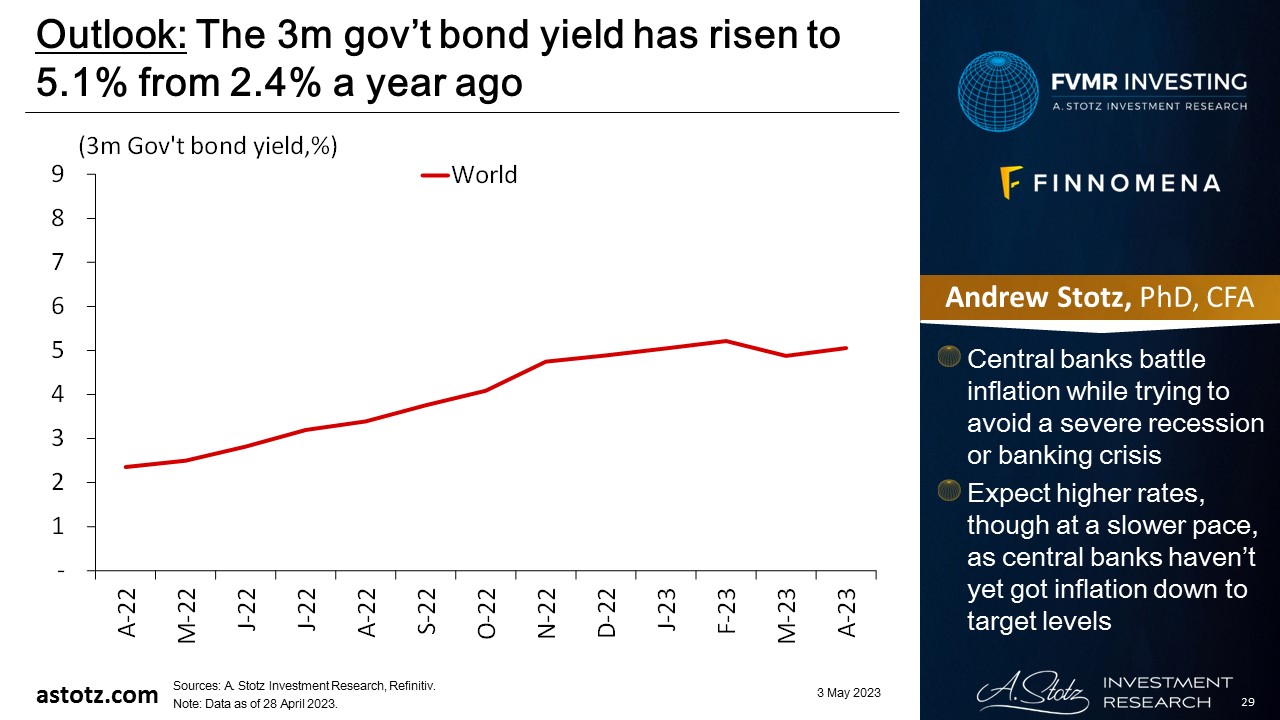

The 3m gov’t bond yield has risen to 5.1% from 2.4% a year ago

- Central banks battle inflation while trying to avoid a severe recession or banking crisis

- Expect higher rates, though at a slower pace, as central banks haven’t yet got inflation down to target levels

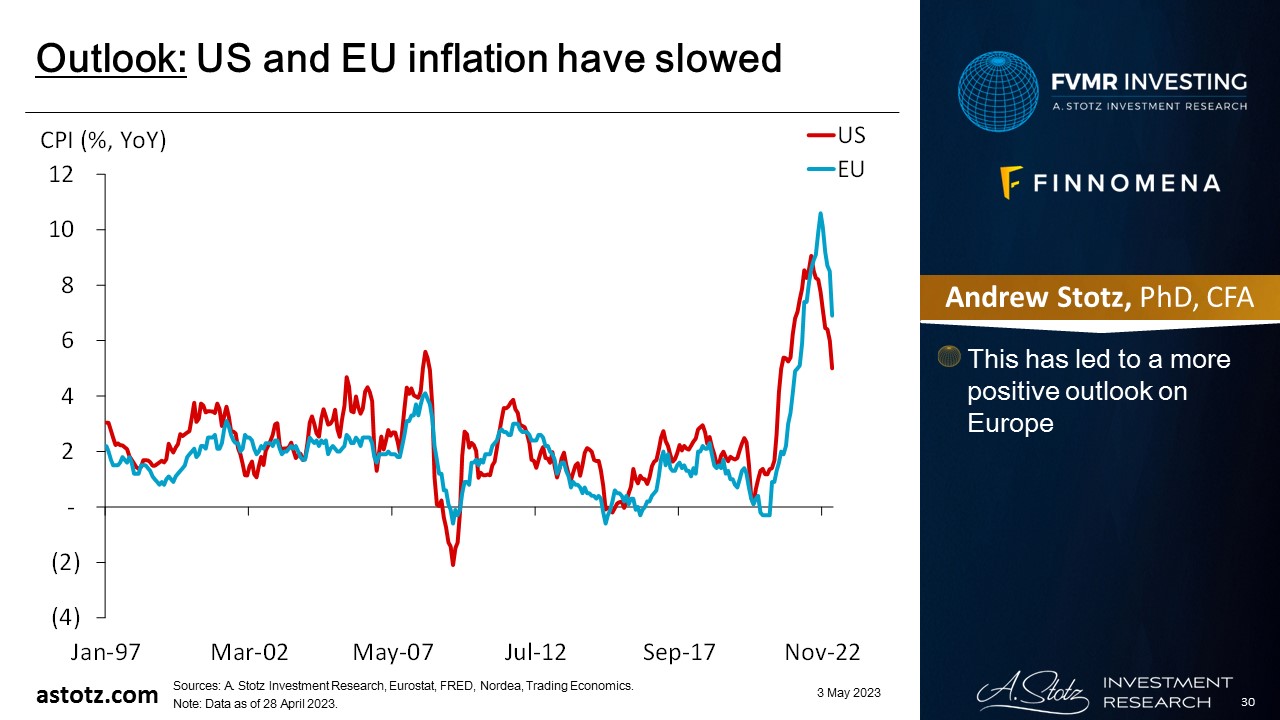

US and EU inflation have slowed

- This has led to a more positive outlook on Europe

The battle against inflation isn’t over

- Inflation is likely to be sticky

- If we don’t get a spike in oil, US YE23 inflation could be down to 3-4%, a new normal above the old days of 2% or less

- In the long run, equity is the best hedge against inflation, as companies have to adapt to survive

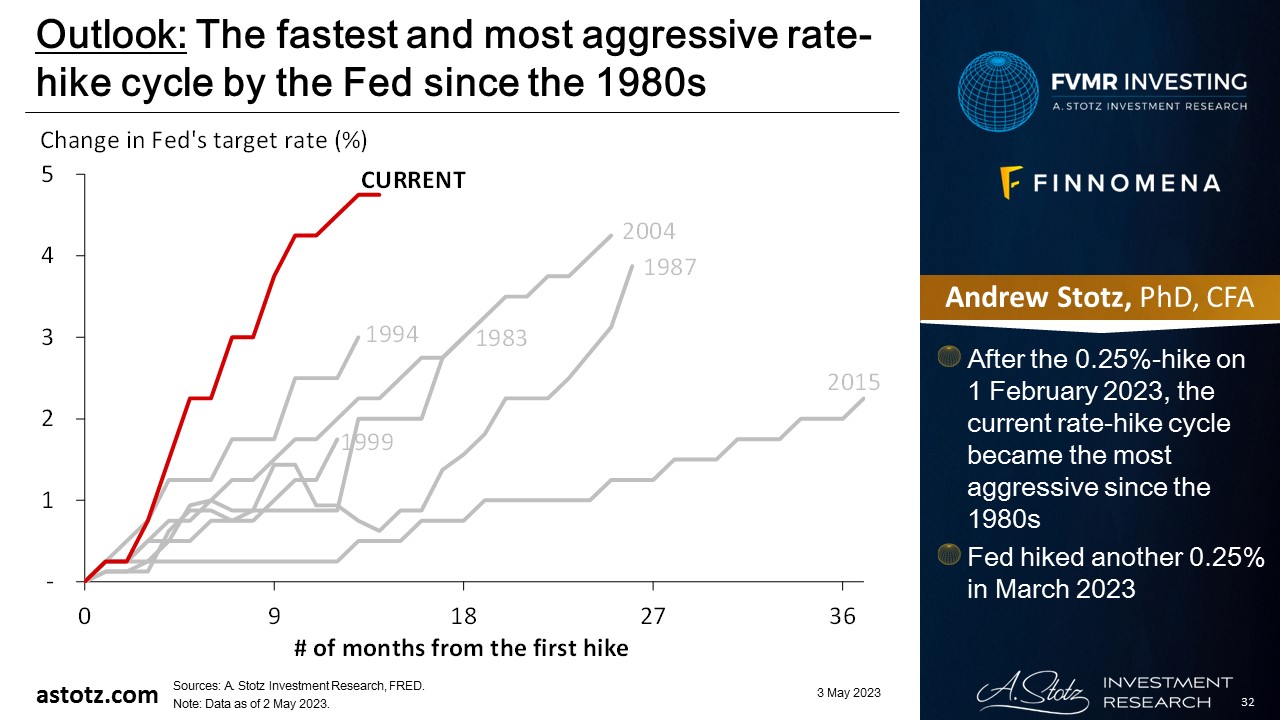

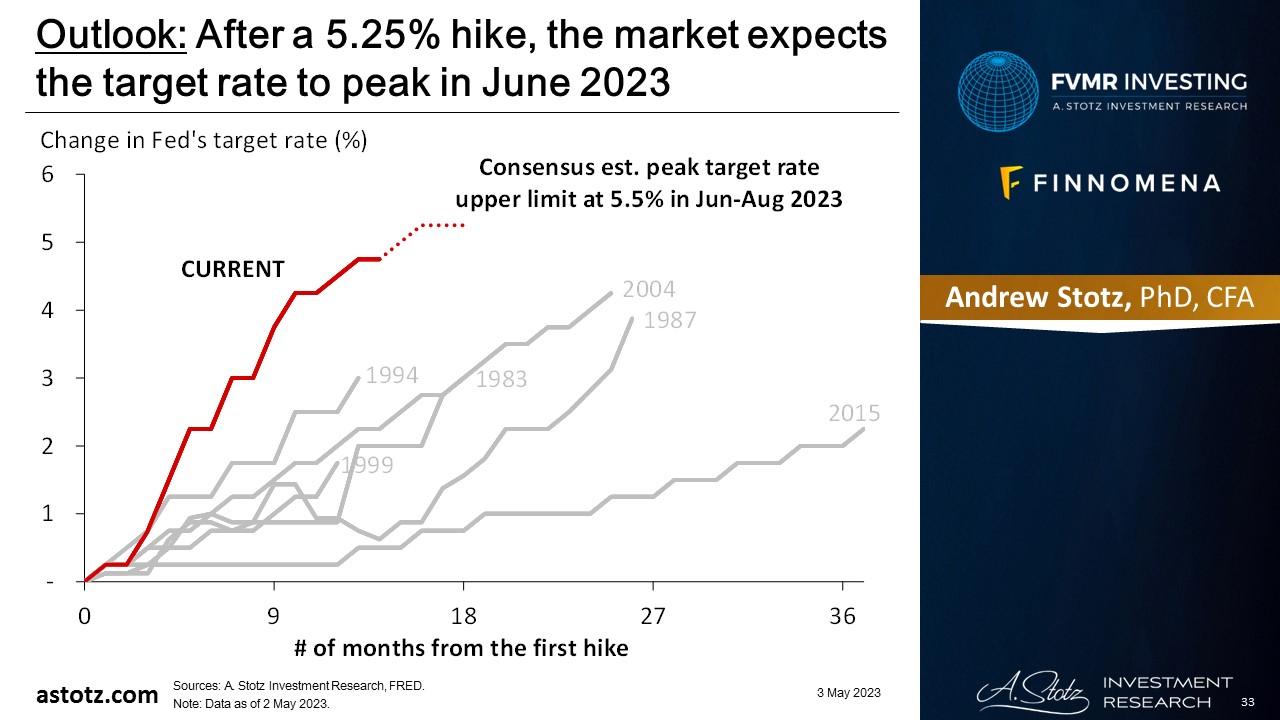

The fastest and most aggressive rate-hike cycle by the Fed since the 1980s

- After the 0.25%-hike on 1 February 2023, the current rate-hike cycle became the most aggressive since the 1980s

- Fed hiked another 0.25% in March 2023

After a 5.25% hike, the market expects the target rate to peak in June 2023

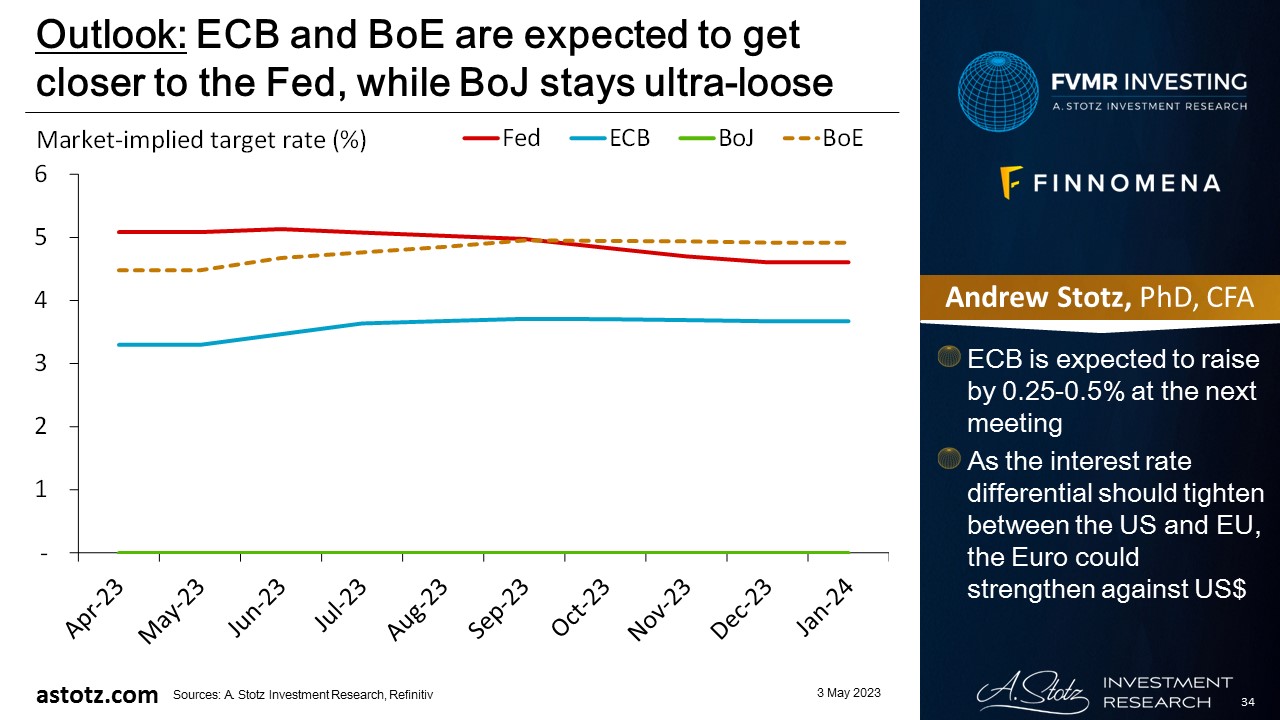

ECB and BoE are expected to get closer to the Fed, while BoJ stays ultra-loose

- ECB is expected to raise by 0.25-0.5% at the next meeting

- As the interest rate differential should tighten between the US and EU, the Euro could strengthen against US$

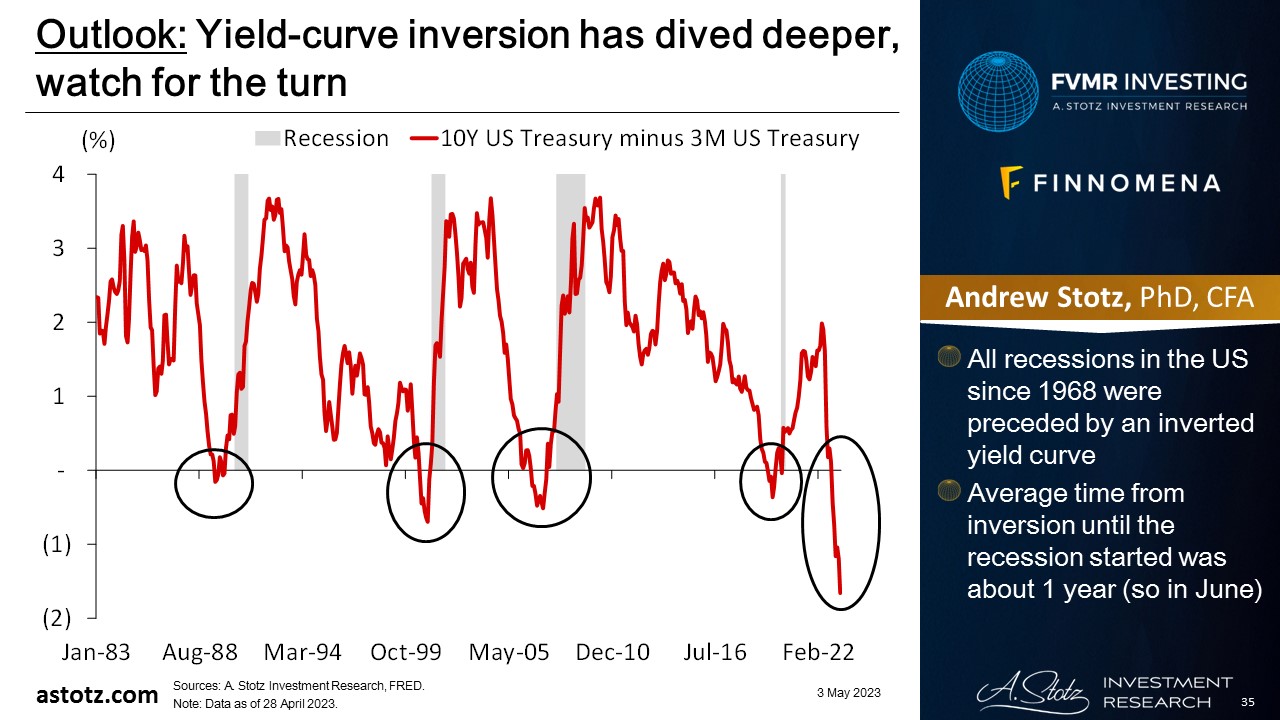

Yield-curve inversion has dived deeper, watch for the turn

- All recessions in the US since 1968 were preceded by an inverted yield curve

- Average time from inversion until the recession started was about 1 year (so in June)

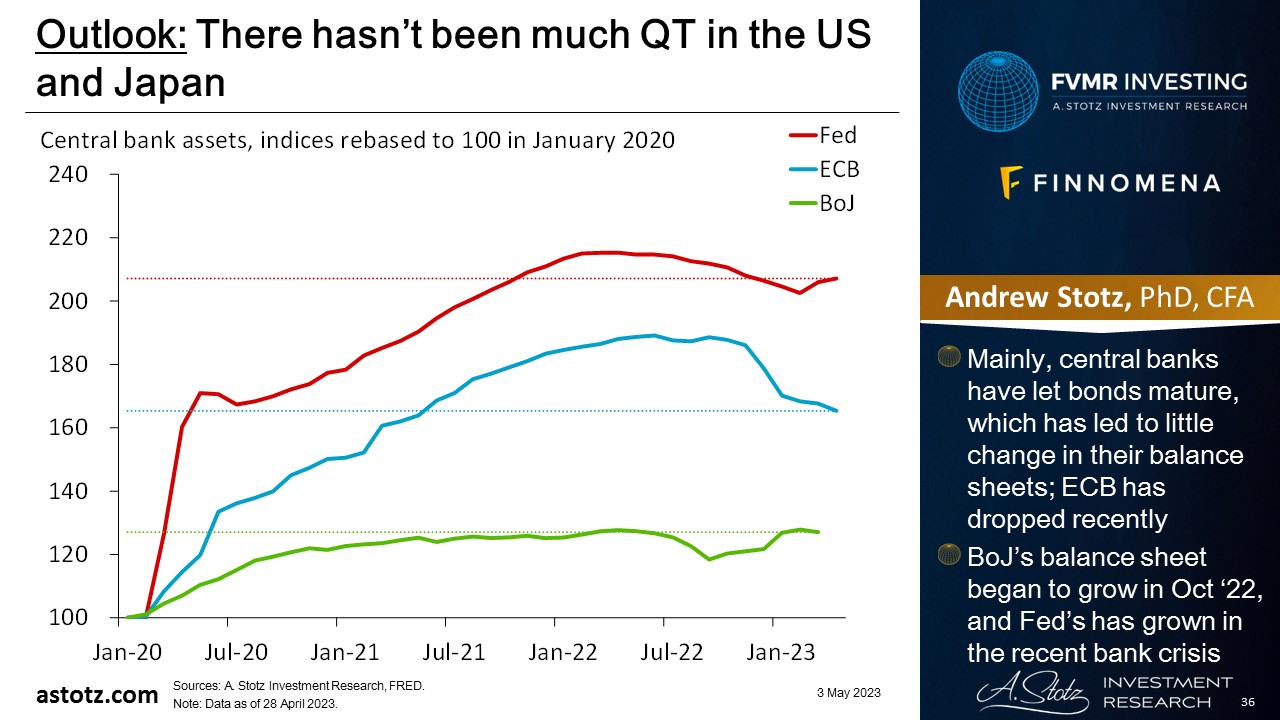

There hasn’t been much QT in the US and Japan

- Mainly, central banks have let bonds mature, which has led to little change in their balance sheets; ECB has dropped recently

- BoJ’s balance sheet began to grow in Oct ‘22, and Fed’s has grown in the recent bank crisis

Bonds are typically a safe place to be, even though 2022 was exceptionally bad

- In recessions, safer assets like government bonds typically have performed well

- Though with high inflation, low yields could still lead to negative real returns

- We generally don’t allocate to bonds to speculate on the upside but rather use it to protect capital over time

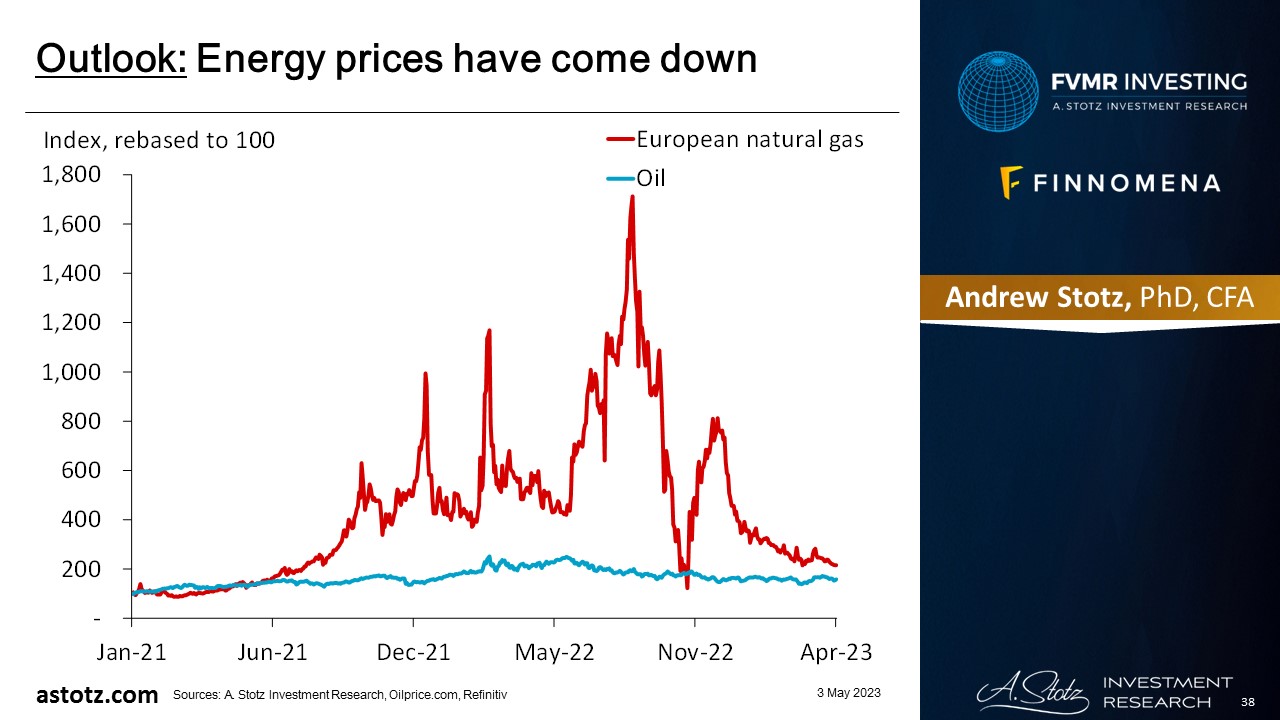

Energy prices have come down

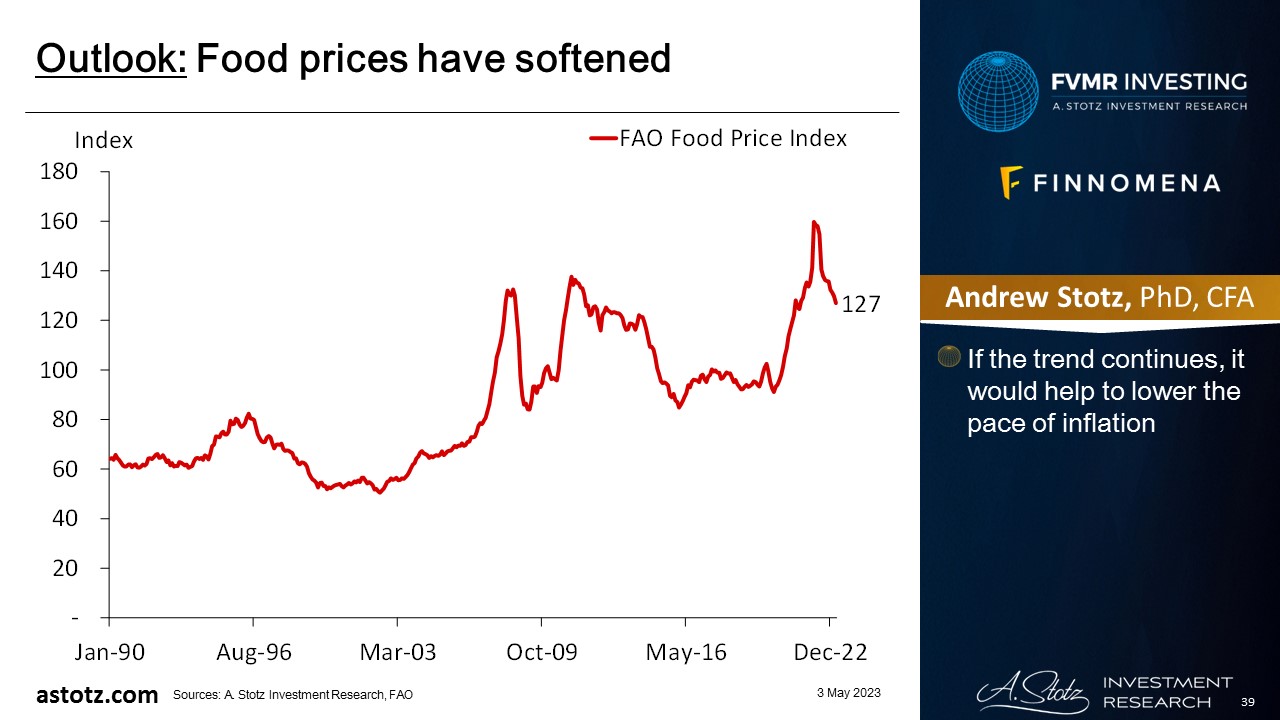

Food prices have softened

- If the trend continues, it would help to lower the pace of inflation

Commodities have lost momentum as energy prices eased due to a mild winter

- We currently don’t see a clear catalyst for energy prices to go significantly higher, but we think they can remain high, which supports profits for energy companies

- The main upside in commodities would come from a supply shock, adverse weather conditions, or significantly higher demand from, for example, the China reopening

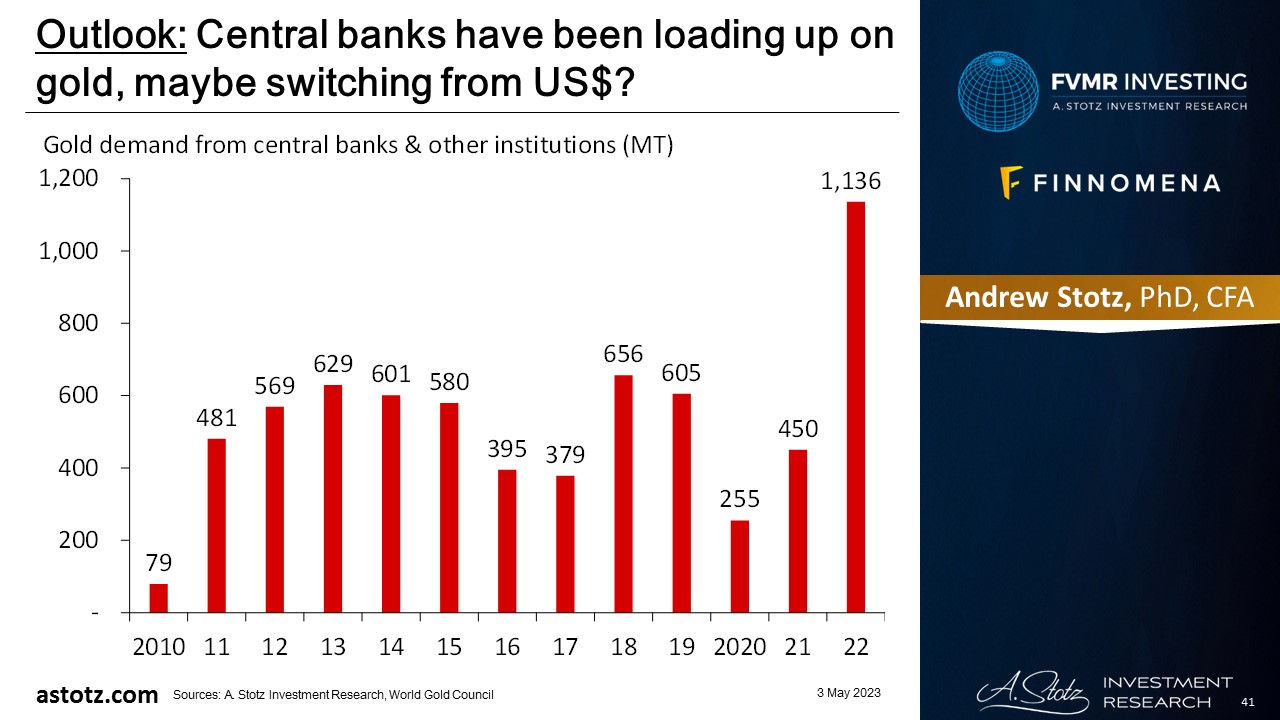

Central banks have been loading up on gold, maybe switching from US$?

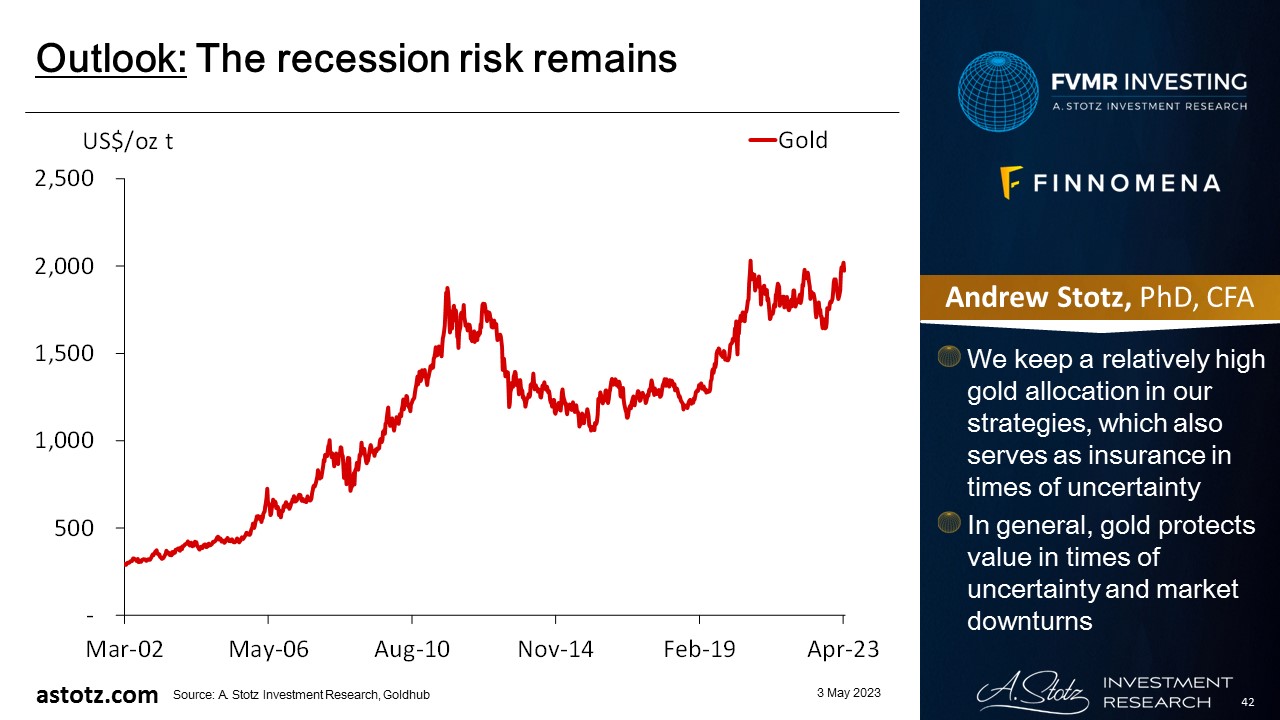

The recession risk remains

- We keep a relatively high gold allocation in our strategies, which also serves as insurance in times of uncertainty

- In general, gold protects value in times of uncertainty and market downturns

Risk: Inflation reaccelerates

- Central banks’ aggressive rate hikes and QT crash the stock markets

- Collapsing energy prices would be damaging to our tilts to World energy

- If inflation reaccelerates, we could miss out on rising commodities prices

- Our high gold allocation could get hit by higher rates or improved market sentiment

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.