5 Famous Investors and Their Portfolio Diversification

“Diversification covers up ignorance.” – Bill Ackman

“If you can identify six wonderful businesses, that is all the diversification you need. And you will make a lot of money.” – Warren Buffett

Some investors are big proponents of wide diversification, others hold very concentrated portfolios. In this post, we look into the portfolios of five well-known investors and how concentrated their portfolios are. The information of holdings comes from SEC filings, looks at long equity positions in the portfolios these investors manage, and are in most cases as of 31 December 2017.

Bill Ackman

Hedge fund manager, founder and CEO of Pershing Square Capital Management.

Carl Icahn

Businessman and investor, controlling shareholder of Icahn Enterprises.

Daniel Loeb

Hedge fund manager, founder, and CEO of Third Point.

David Einhorn

Hedge fund manager, founder, and president of Greenlight Capital.

Warren Buffett

Legendary value investor, chairman, and CEO of Berkshire Hathaway.

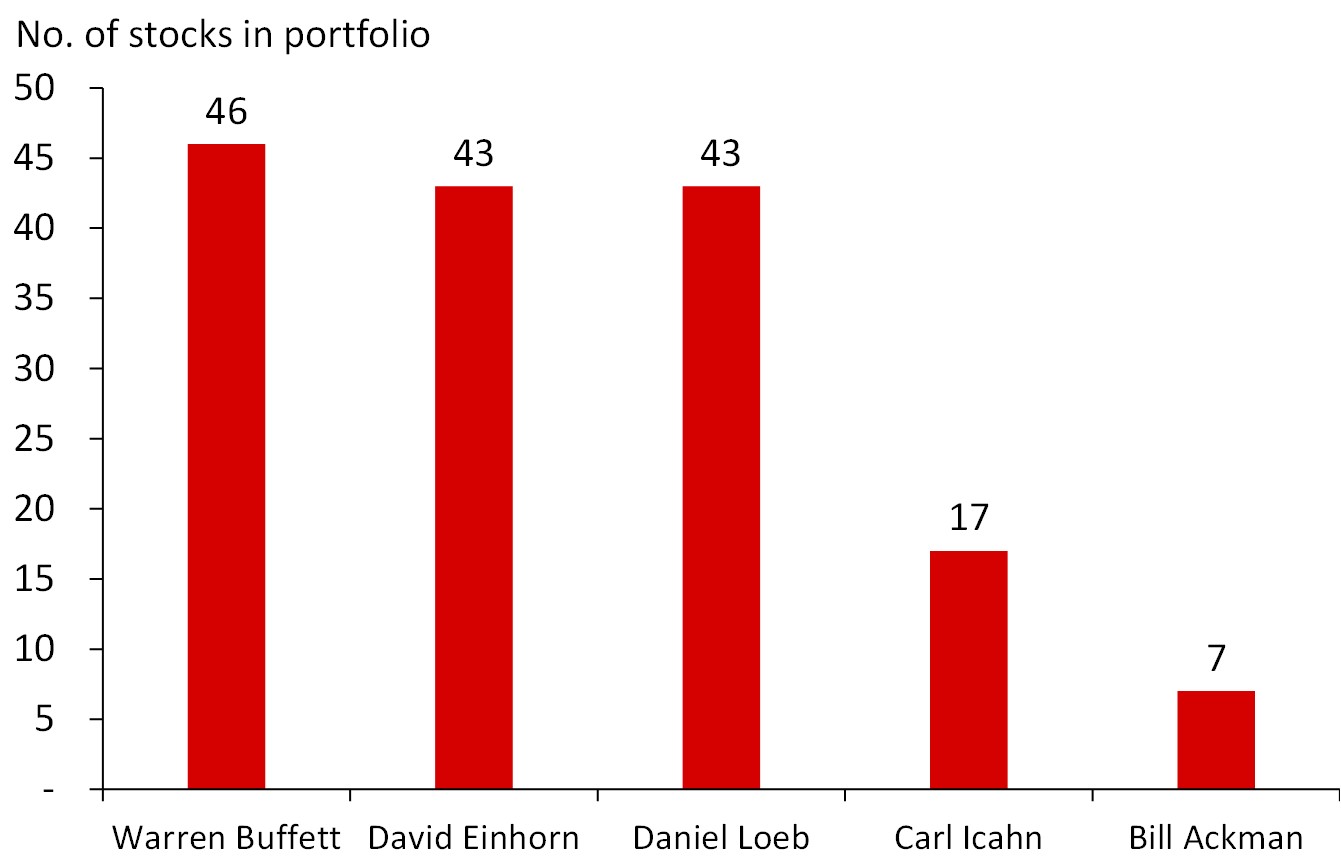

Buffett Has the Largest Number of Holdings

Buffett has the largest number of holdings in his portfolio, but he also has the largest portfolio in terms of AUM by far. Ackman only has 7 long equity positions in his portfolio.

Icahn Is Heavily Concentrated in His Icahn Enterprises LP

The top holding for each investor is:

- Icahn: Icahn Enterprises (IEP US)

- Ackman: Restaurant Brands International (QSR US)

- Einhorn: General Motors (GM US)

- Loeb: Baxter International (BAX US)

- Buffett: Apple (AAPL US)

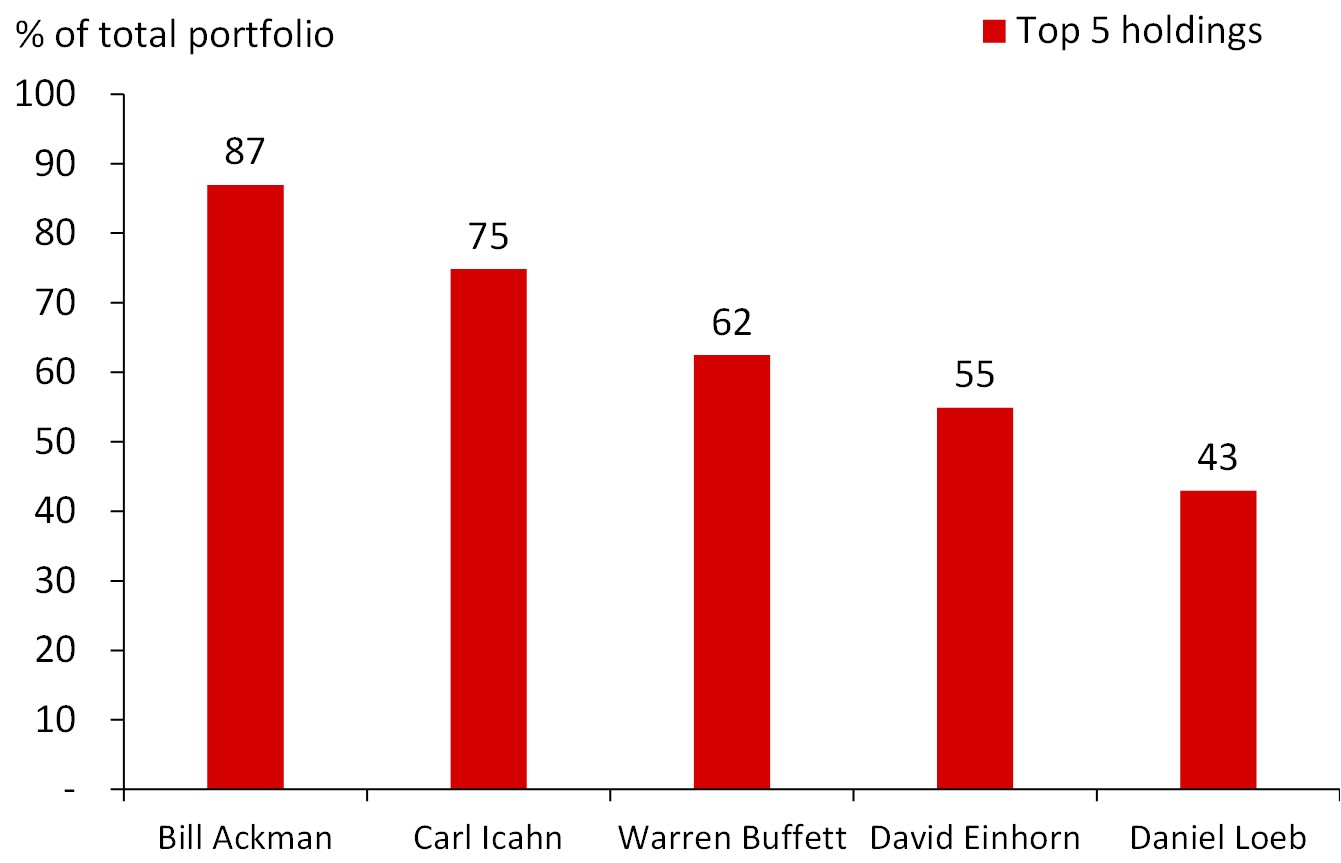

The Top 5 Holdings Almost Make Up 90% of Ackman’s Portfolio

Only Loeb has less than 50% in the top 5 stock holdings. As Ackman only holds 7 long equity positions, his top 5 holdings naturally account for a large part.

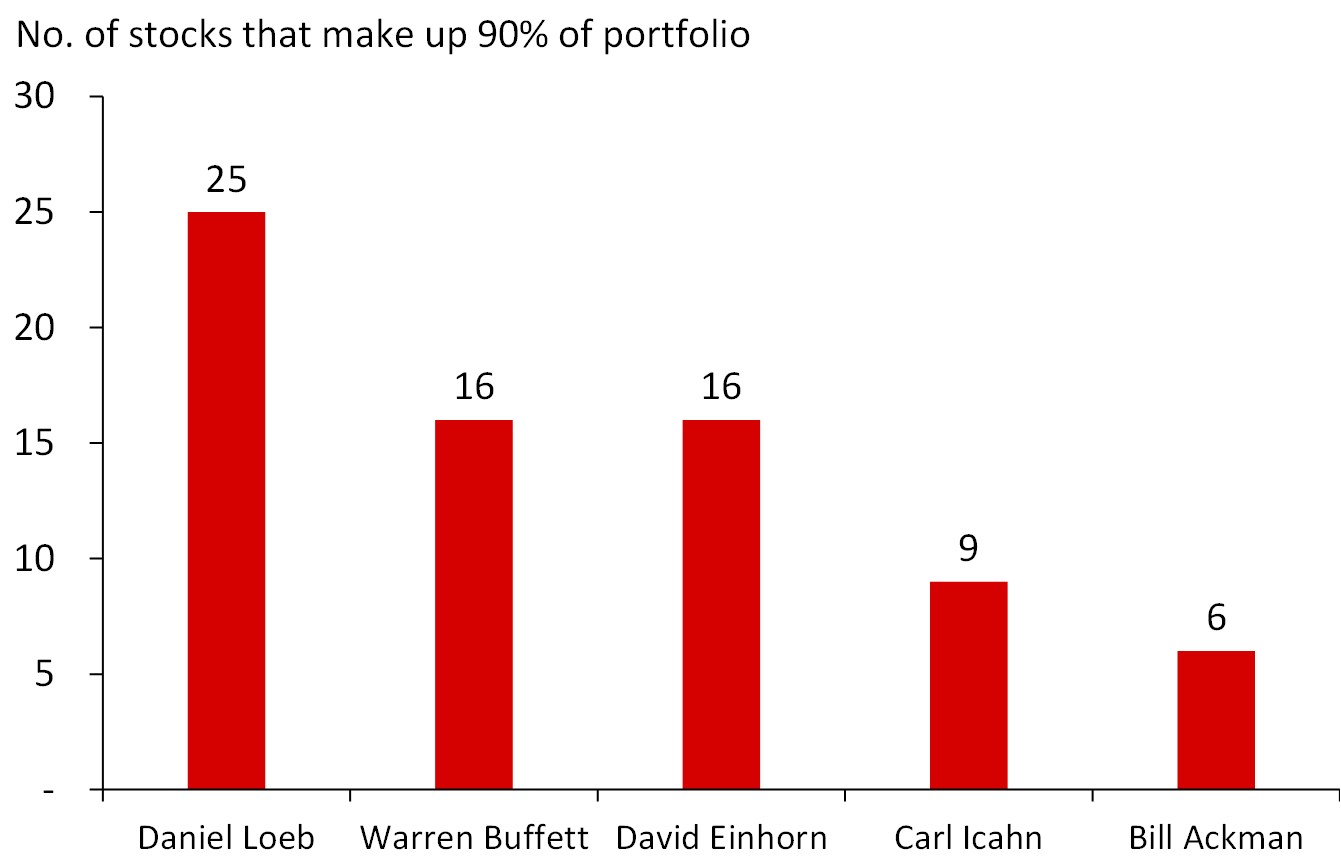

Fewer Than 10 Stocks Make Up 90% of Icahn’s and Ackman’s Portfolios

Loeb has spread out his capital the most, his top 10 holdings account for 61%. The other four investors are more concentrated, their top 10 holdings account for 77-100% of their total long equity portfolio.

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.