“The S&P 500 will gain 20% in the first year of the new Millennium!” said the yuppie analyst to an impressed journalist while sipping champagne and chewing on a lobster tail. How could this, obviously well-paid, lobster-eating yuppie analyst be so wrong?

Read MoreFounded in 2002, Airports of Thailand’s core activities are management and development of international airports. AOT runs Suvarnabhumi, Don Mueang, Chiang Mai, Chiang Rai, Phuket and Hat Yai international airports. Profitable Growth has been excellent at top ranks since 2013.

Read MorePictures from CFA Society Malaysia ARX Speaker Series: Top 9 Valuation Mistakes and How to Avoid Them on 29 January 2018.

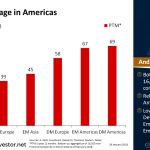

Read MoreChart of the Day: Bottom-up aggregation of 16,200 non-financial companies in the World. Relatively high gearing in Americas. Low balance sheet risk in Developed Pacific, Emerging Europe, and Emerging Asia.

Read MoreLive Event: On Saturday, February 3, Andrew Stotz will have four events in Bangkok. All events are free to attend and the venue is the CoffeeWORKS Experience Center.

Read MoreIn our Top 5 this week, we discuss the significance of asset allocation, when to make a move on cryptocurrencies, and what to expect from 2018. All this and more…

Read MoreChart of the Day: All regions have shown earnings recovery for the past 12 months. Seeing strong growth in all Emerging regions. Only Developed Americas showed single-digit growth at 7%, unlike other regions.

Read MoreLive Event: On Saturday, January 27, Andrew Stotz will have four events in Bangkok. All events are free to attend and the venue is the CoffeeWORKS Experience Center.

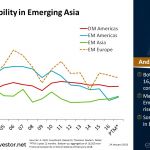

Read MoreChart of the Day: Bottom-up aggregation of 16,200 non-financial companies in the World. Margin recovery in Emerging Asia could still rise further. Some risk of falling margins in Emerging Europe.

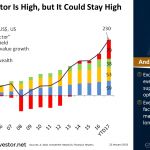

Read MoreChart of the Day: Excluding a major negative event, the fundamentals support a relatively optimistic market. Even though the Dream factor is high, the US market could stay high for longer.

Read More