Become a Better Investor’s Top 5 Bloggers 2017 – Close Contenders

It’s soon time to crown Become a Better Investor’s Top 5 Bloggers of 2017. This year, we start with our close contenders’ stats. We’ll reveal the full statistics with you tomorrow when we announce the medal-winning Become a Better Investor’s Top 5 Bloggers 2017, but here are some quick facts so you can see what it takes to make the close contenders list!

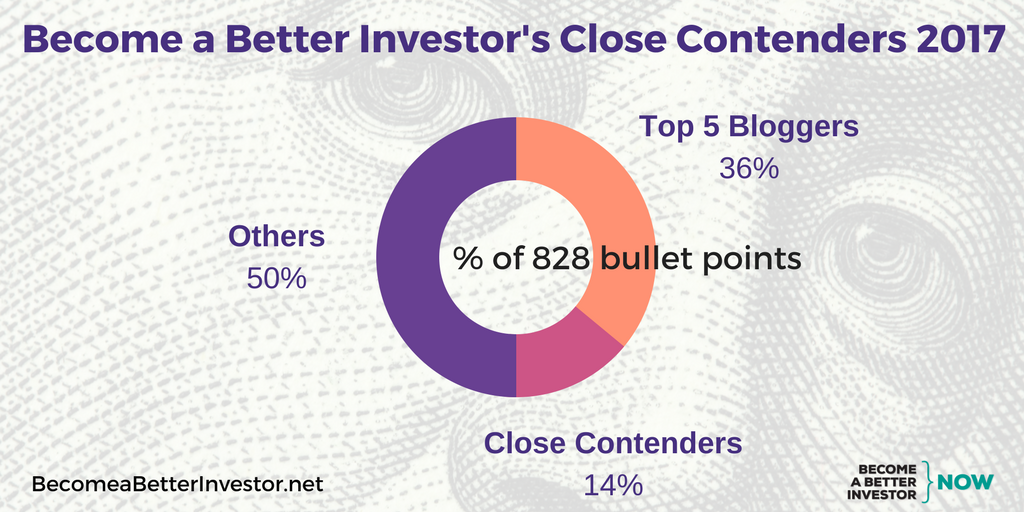

The Top 5 Bloggers and close contenders of 2017 have all been selected from the last 53 Top 5 of the Week posts. Over these weeks, we’ve summarized a massive 265 articles in 828 bullet points from 105 different authors. The medal-winners and close contenders of 2017 accounted for 50% of the total bullet points in our 53 Top 5 of the Week posts. So, the runners-up make up the top decile of our featured bloggers.

Having seen the statistics, you can see that the close contenders to the Top 5 are also among the best bloggers in the world, and we would like to share with you some of their investment wisdom that we think can help you become a better investor. Below you’ll find our Top 3 takeaways from our runners-up in 2017.

Larry Swedroe

Blog: ETF.com

Placed in 2016: New

Larry Swedroe is the Director of Research for Buckingham Strategic Wealth, an independent member of the BAM Alliance. Larry has authored a number of books on investing, and we usually read his blog articles on ETF.com.

Our Top 3 Takeaways from Larry in 2017:

- Studies show that of the many bad behavior traits investors are prone to, we have a weakness for gambling stocks; those with a small chance of massive returns (Read Full Article)

- Every investor wants to find the Holy Grail of an outperforming mutual fund—though just as with the myth, this quest is impossible (Read Full Article)

- Investors have been trend-following since the dawn of investing, so trends can be found in all stock, bond, commodity, and currency markets (Read Full Article)

David Merkel

Blog: The Aleph Blog

Placed in 2016: New

David Merkel, CFA, runs his own equity asset management firm, Aleph Investments. One of his blog objectives is: “To fight for what is right in money management, and encourage readers to pursue strategies that reduce risk and enhance returns.”

Our Top 3 Takeaways from David in 2017:

- Investors want to pay more for a “convenient package of stocks” than single assets, but that doesn’t indicate a connection between ETFs growth and a bull market (Read Full Article)

- Given the uncertain nature of the stock market future, it would be wise to reflect on your current asset allocation, and perhaps reevaluate your risk tolerance before it’s too late (Read Full Article)

- Taking a simple approach to investing can be incredibly beneficial, do this by choosing investments that you can understand—and explain—on a fundamental level (Read Full Article)

Cullen Roche

Blog: Pragmatic Capitalism

Placed in 2016: Close Contender

Cullen Roche founded his blog Pragmatic Capitalism following the Global Financial Crisis in 2008 to provide an alternative perspective to finance and economics. He is also the Founder of Orcam Financial Group, offering fee-only financial advisory services.

Our Top 3 Takeaways from Cullen in 2017:

- Positive returns on the price of gold have been a recent occurrence in the last 50 years only, before that its value has been despondent since 1791 (Read Full Article)

- Good portfolio construction is not about building a ‘perfect’ one—there’s no such thing—instead let diversification play its vital role keeping your portfolio sustainable (Read Full Article)

- The controversial idea that passive investing is a myth has become more accepted as more investors realize that “passive” indexing mirrors many different fund types (Read Full Article)

Wesley Gray

Blog: Alpha Architect

Placed in 2016: New

Wesley Grey, Ph.D., is a veteran of the United States Marine Corps who has since become an author and portfolio manager. His interest in entrepreneurship and behavioral finance led him to start the blog Alpha Architect, which is also where we read his articles.

Our Top 3 Takeaways from Wes in 2017:

- By identifying and mitigating potential risk factors, investors can create a truly diversified portfolio (Read Full Article)

- Market timing has a bad reputation because it’s mostly an unsuccessful endeavor for even the most seasoned investor (Read Full Article)

- Even though investors like Warren Buffett make it look easy, beating the market forever is nigh on impossible (Read Full Article)

Corey Hoffstein

Blog: Newfound Research

Placed in 2016: New

Corey Hoffstein is Co-founder and Chief Investment Officer at Newfound Research, a quantitative asset management firm. He was named a 2014 ETF All Star by ETF.com.

Our Top 3 Takeaways from Corey in 2017:

- Our behavior is the biggest influence on our investments; it decides the differences between our ideal theoretical portfolio and our real one (Read Full Article)

- In asset management, there is a gulf between research and individual investors; resulting in generic portfolios untailored to time horizons, spending requirements, and tax pressures (Read Full Article)

- Investors hoping to achieve long-term success may have to consider outside of the box thinking when it comes to portfolio construction (Read Full Article)

Anthony Isola

Blog: A Teachable Moment

Placed in 2016: Close Contender

Anthony Isola is a former forex trader and teacher of social studies (now you see where his blog name comes from). Nowadays, Tony heads the 403(b) division at Ritholtz Wealth Management.

Our Top 3 Takeaways from Tony in 2017:

- The power of compound interest can become a nightmare if it works in reverse for you as credit card debt, it can spiral quickly beyond our control (Read Full Article)

- Average and Return: There really is no such thing as an average market return that you can rely on, so don’t deceive yourself that it’s possible to achieve one (Read Full Article)

- One of the many difficulties new investors encounter is being preyed on by financial predators—this is especially true among our older generation (Read Full Article)

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article. The Become a Better Investor Team doesn’t necessarily endorse any stocks or shares mentioned in the articles or the author of such articles linked to and summarized in Top 5 of the Week and cannot guarantee the accuracy of its information.