Thailand: Loved even with Low Expectations

Thailand Equity FVMR Snapshot

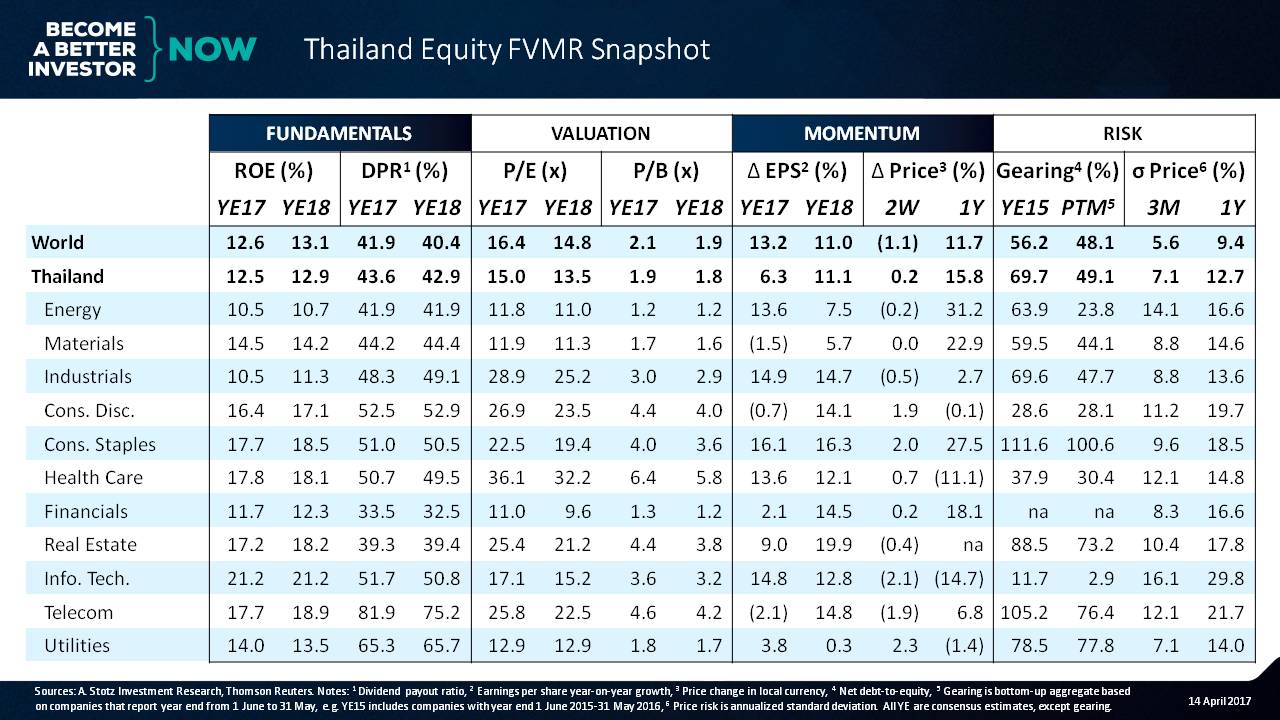

Fundamentals: Slightly cheaper, mostly average

The first thing we want to look at is the ROE and the fundamentals of the Thai market. We can see that they’re just about in line with the rest of the world ─ not bad.

If we look at dividend payout ratio, it’s also similar. And if we look at the valuation of the market, it’s slightly cheaper than the rest of the world.

Valuation: Earnings growth half of global average

The price-to-book value, once again, is slightly cheaper than the rest of the world. What we can see is that earnings growth expectations by analysts in 2017 is about 6%, only half of the world’s growth expectation. So possibly it will be a slow growth 2017, and then growth comes back in 2018.

Momentum: Share prices up despite slow growth

After that, let’s look at the price and see the momentum in price. The price is up by about 16% over the last year versus about 12% for the global market. So it’s done a little bit better there.

Risk: Higher than average

If we look at gearing, what we can see in fiscal 2015 is that Thailand’s 70% is much higher than the world average of 56%. Numbers for the prior 12 months show this chasm has come together at a lower level, but since we don’t have all the numbers for the prior 12 months, this may be slightly suspect.

But it’s a little bit higher than the rest of the world.

If we look at the volatility of the market, Thailand’s 1-year volatility of 12.7% is not unusually higher than the world’s 9%, because the latter is fully diversified. But we can use this volatility to look at the different sectors.

Thailand by sector

Let’s take a look at sectors to understand where the money is being made.

The ROE of the information technology sector is pretty massive at 21%. We can see that the energy sector and the industrial sector are pretty low in comparison.

If we want to look at the PE, the PE of the energy sector is very low. The PE of some of the other sectors, such as healthcare ─ massive! In fact, if we look at it on a price-to-book basis, we can see that it’s almost 6x price-to-book.

Of course, people are expecting steady growth in earnings, but that growth is probably not enough to support such a high level of valuation.

If we look at the financials, they’re in line with both the region and the world at 1.3x, which tends to be low.

But without a huge amount of nonperforming loans, the ROE of the financial sector is relatively good from what we can see.

If we look at EPS growth, we can see that analysts are most optimistic in the real estate and the consumer staples industries.

The sectors that have been hit most recently are information technology and healthcare. We’ve seen that the valuations are pretty high, so it makes sense that there’s been a bit of a hit there.

The biggest gainers, of course, are energy ─ due to a recovery in oil prices ─ and consumer staples.

If we look at the balance sheet of the companies, information technology is almost net cash with very low of debt. Consumer discretion and healthcare have very low levels of debt.

The highest volatility sector is information technology, and the lowest volatility sector is the industrial sector.

That gives you an idea of what’s going on in Thailand.

Basically, it’s in line with the rest of the world, except that the EPS expectations for Thailand are half of the world’s expectations for 2017.

If you want to look at your own country, just leave a comment below, and I’ll do it if I have it.

Get our Equity FVMR Snapshots for free to your inbox every Monday!

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.