My Worst Investment Ever: Scott and a consortium invested in distressed home loans in Chicago. The deal went south and legal proceedings dragged on. He bought out fellow investors and closed the deal, but lost US$250,000 in the process.

Read MoreFirst Gen Corporation (FGEN PM): Profitable Growth rank of 2 was up compared to the prior period’s 3rd rank. This is World Class performance compared to 300 large Utilities companies worldwide.

Read MoreSino-Thai Engineering & Construction Public Company Limited (STEC TB): Profitable Growth rank of 2 was same compared to the prior period’s 2nd rank. This is World Class performance compared to 1,480 large Industrials companies worldwide.

Read MorePTG Energy Public Company Limited (PTG TB): Profitable Growth rank of 5 was up compared to the prior period’s 7th rank. This is average performance compared to 350 large Energy companies worldwide.

Read MoreChart of the Day: Emerging markets’ net margin is still below peaks before the Asian and Global Financial Crises. Net margin in Developed markets is still at the highest it has been in over two decades–remains a risk.

Read MoreChart of the Day: Indonesia and the Philippines still appear attractive but has switched place, and joined by Singapore. China has moved to unattractive from attractive.

Read MoreFree cash flow to the firm (FCFF) is the cash flow that a company is ‘free’ to distribute to all providers of money (both, debt and equity) without damaging its growth opportunities.

Read MoreSince debt is cheaper than equity, in theory, this would mean that a company would prefer to be fully funded by debt to minimize its cost of capital. However, it’s not the case in reality that a company has a capital structure that is 100% debt.

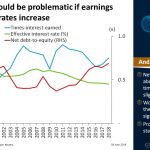

Read MoreChart of the Day: Net-debt to equity is well-above the 2008 level, while times-interest-earned is slightly lower. Worth pointing out is that the effective interest rate is significantly lower now. Problematic if earnings stagnate and rates increase.

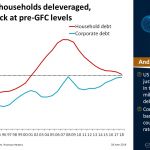

Read MoreChart of the Day: US household debt is back just above the levels seen at the start of the new millennium; big deleveraging since the Global Financial Crisis. Corporates, though, are back to 2008 levels which could constitute a risk if rates were to increase.

Read More