Philippines: Strongest ‘Buy’ in Asia

Watch the video with Andrew Stotz or read Watching the Street: Philippines below.

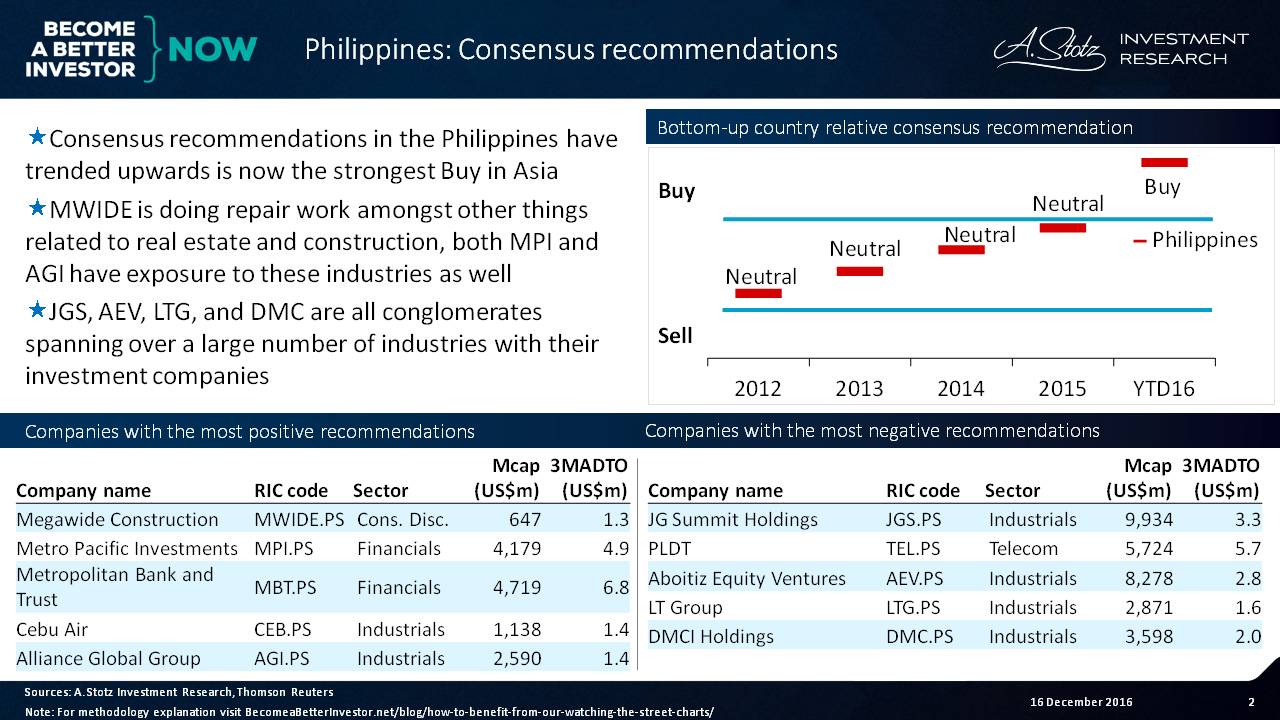

Consensus Recommendations: Philippines

Consensus recommendations in the Philippines have been trending upwards and the market now receives the strongest “buy” recommendation in Asia.

Learn more: How to Benefit from Our Watching the Street Charts

Among companies with the most positive recommendations, Megawide Construction is doing repair work among other things related to real estate and construction. Both Metro Pacific Investments and Alliance Global Group have exposure to these industries as well.

Among companies with the most negative ratings, JG Summit Holdings, Aboitiz Equity Venutures, LT Group and DMCI Holdings are all conglomerates spanning a large number of industries.

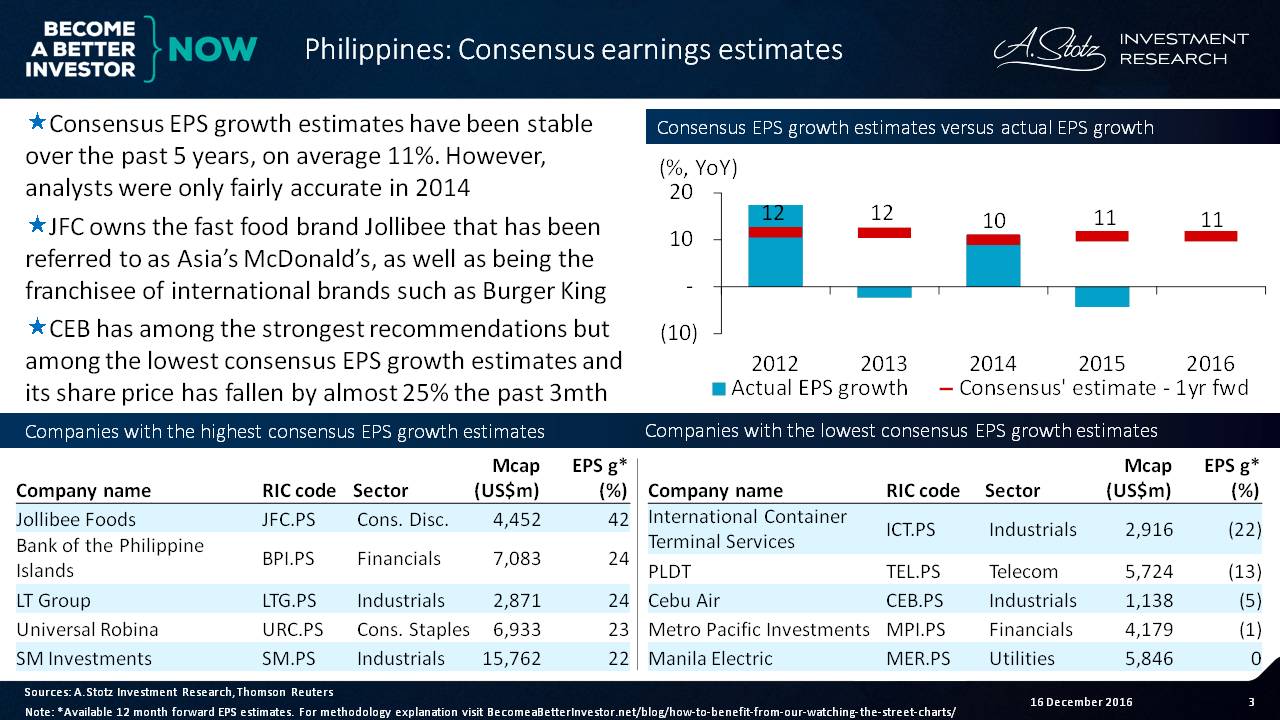

Consensus Earnings Estimates: Philippines

Consensus EPS growth estimates have been stable over the past five years, averaging about 11%. However, analysts were only fairly accurate in 2014.

Jollibee Foods owns the fast food brand Jollibee that has been referred to as Asia’s McDonald’s, as well as being the franchisee of international brands such as Burger King.

Cebu Air has among the strongest recommendations but among the lowest consensus EPS growth estimates, and its share price has fallen by almost 25% in the past 3 months.

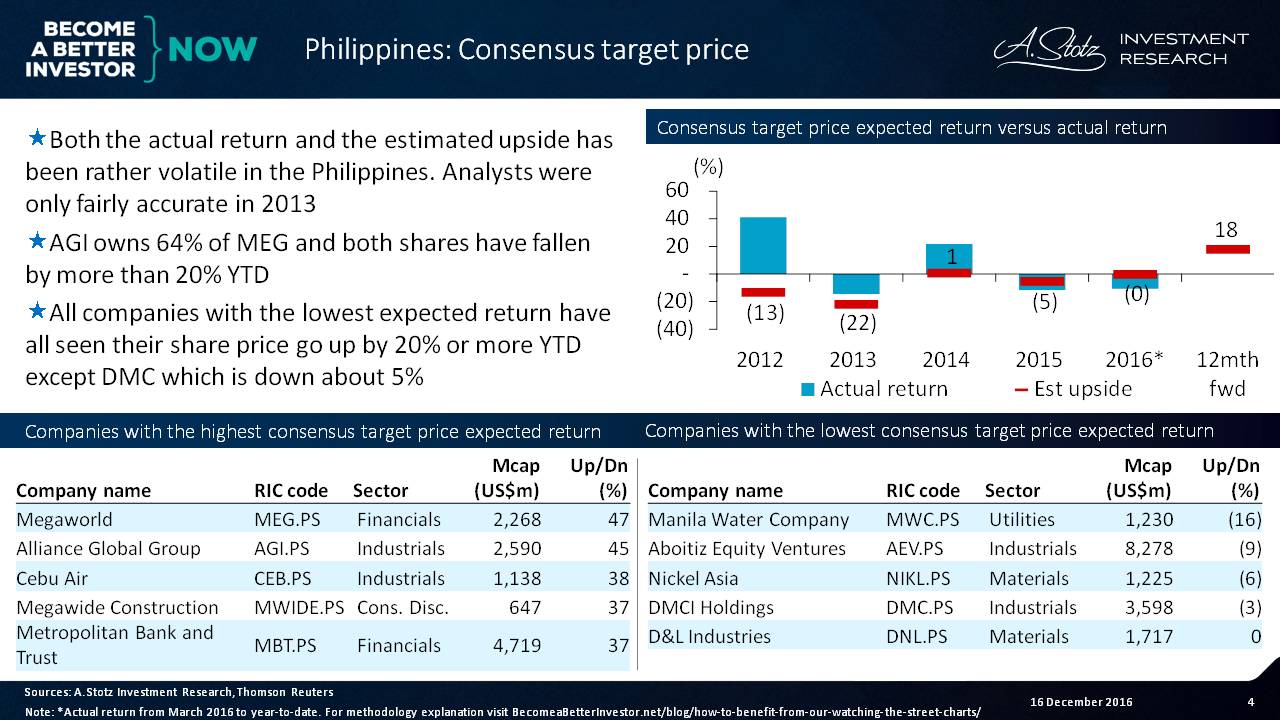

Consensus Target Prices: Philippines

Both the actual return and the estimated upside has been rather volatile in the Philippines. Analysts were only fairly accurate in 2013.

Among those with the highest estimated target price upside, Alliance Global Group owns 64% of Megaworld and both of their shares have fallen by more than 20% YTD.

Companies with the lowest expected return have all seen their share prices go up by 20% or more YTD, except DMCI Holdings, which is down about 5%.

Do YOU use any kind of analyst estimate when considering an investment?

Let us know in a comment below.

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.