How to Deal with Corporate Governance in Asia

In many stock markets around the world there are legislation and/or listing rules that ensure some level of shareholder protection and corporate governance. In Asia this is not always the case and the level of corporate governance varies considerably between countries. In this research we consider the state of corporate governance in Asia and give some thoughts on how to analyze the corporate governance of a company in a location where there are no corporate governance code or reports.

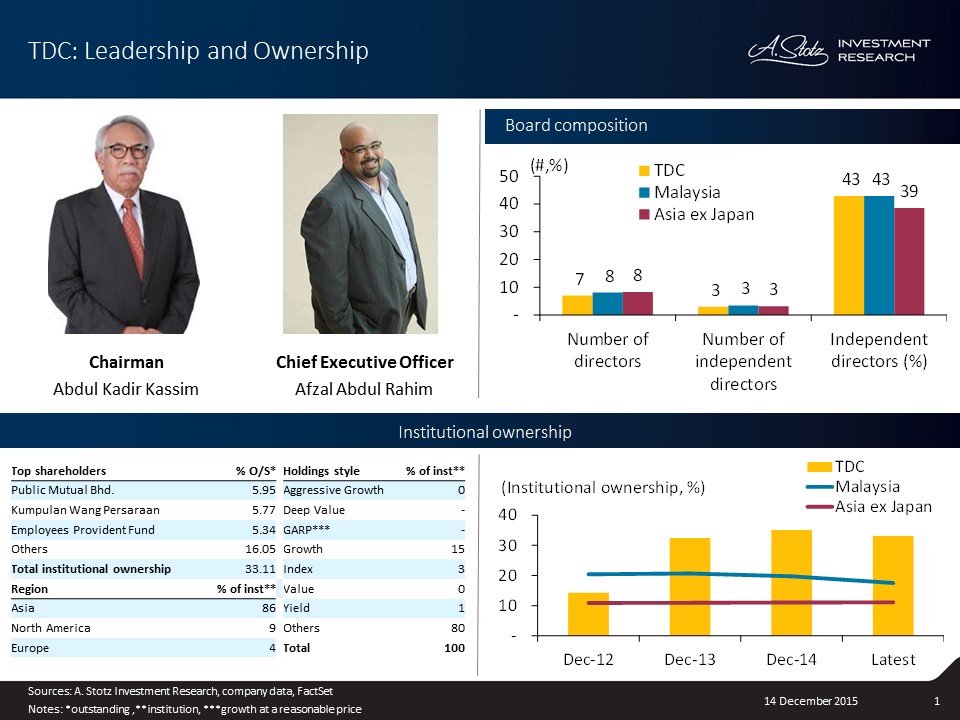

Part of our corporate governance analysis when we analyze a company at A. Stotz Investment Research is done in a page we call Leadership and Ownership. For illustrative purposes we’ll use the Malaysian IT company TIME dotCom Berhad (TDC) as an example to show the rationale behind our analysis.

Defining Corporate Governance

Corporate governance generally refers to the systems, processes and practices by which companies are controlled and directed. Corporate governance mechanisms should balance the interests of many stakeholders in a company which include its management, board, shareholders, customers, suppliers, financiers, government and the community. The corporate governance framework should help reaching the company’s objectives and also determining the ways of achieving those objectives as well as monitoring performance (Wikipedia, Investopedia, and OECD).

Previous Corporate Governance Research Highlights Three Main Areas

Huang and Ho (2011) did a bibliometric analysis that looked at keywords in 1,851 articles published on corporate governance from 1992-2008. Almost 60% of the articles were published in 2005 or later and the analysis underlined three main areas of importance: board of directors, ownership structure and agency theory.

Let’s take a further look into how board independence as well as the ownership structure affects corporate governance, and how the Asian markets may differ from Western markets.

The Level of Board Independence Varies A Lot in Asia

Evidence from Kumar and Singh (2012) showed that independent directors were less influenced by the owner or promoter of Indian companies and concluded that corporate boards with outside independent directors were considered as an important internal governing mechanism in the absence of external government mechanisms.

Liu et al. (2014) found that, in China, more independent directors on the board also led to better operating performance. This was especially prevalent in companies where information about the company was easily accessible, and mainly in government-controlled firms.

Claessens and Yurtoglu (2012) concluded that in emerging Asian countries, companies with a higher level of independent directors usually had a higher valuation and the probability of fraud decreased with greater board independence. Board independence played an important role, especially in countries in which other control mechanisms were weak.

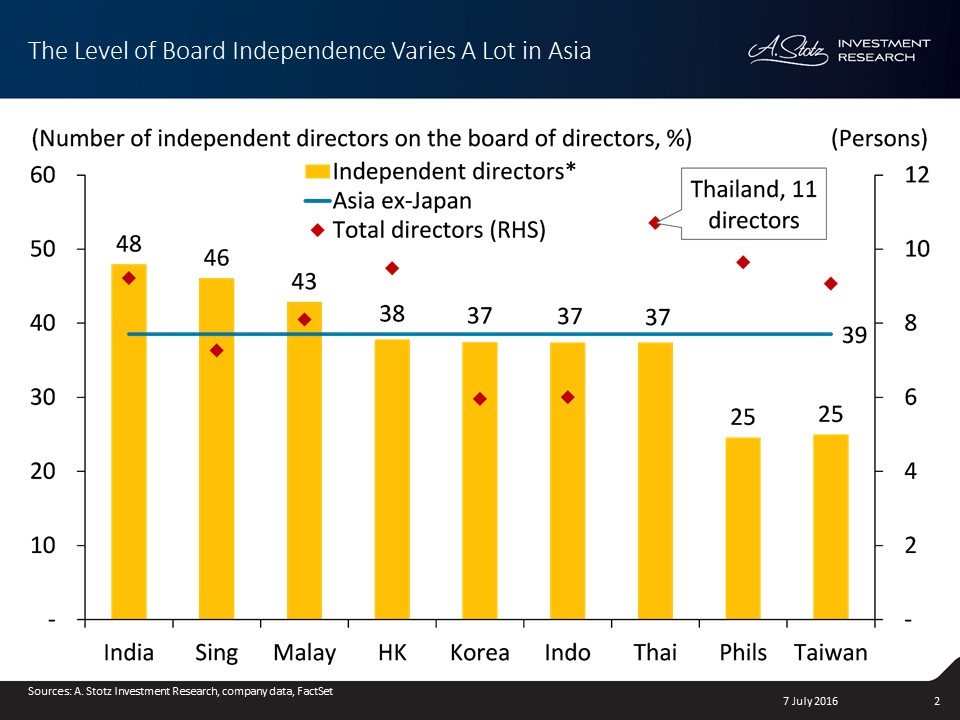

The rationale behind board independence as well as the evidence seem to be aligned and show that independent directors better protect the shareholders’ interests. When we analyze companies at A. Stotz Investment Research we therefore look at the proportion of independent directors on the company’s board relative to the country and regional average, as well as whether the chairman is independent or not. Looking across nine Asian markets and close to 7,000 companies we have found the following:

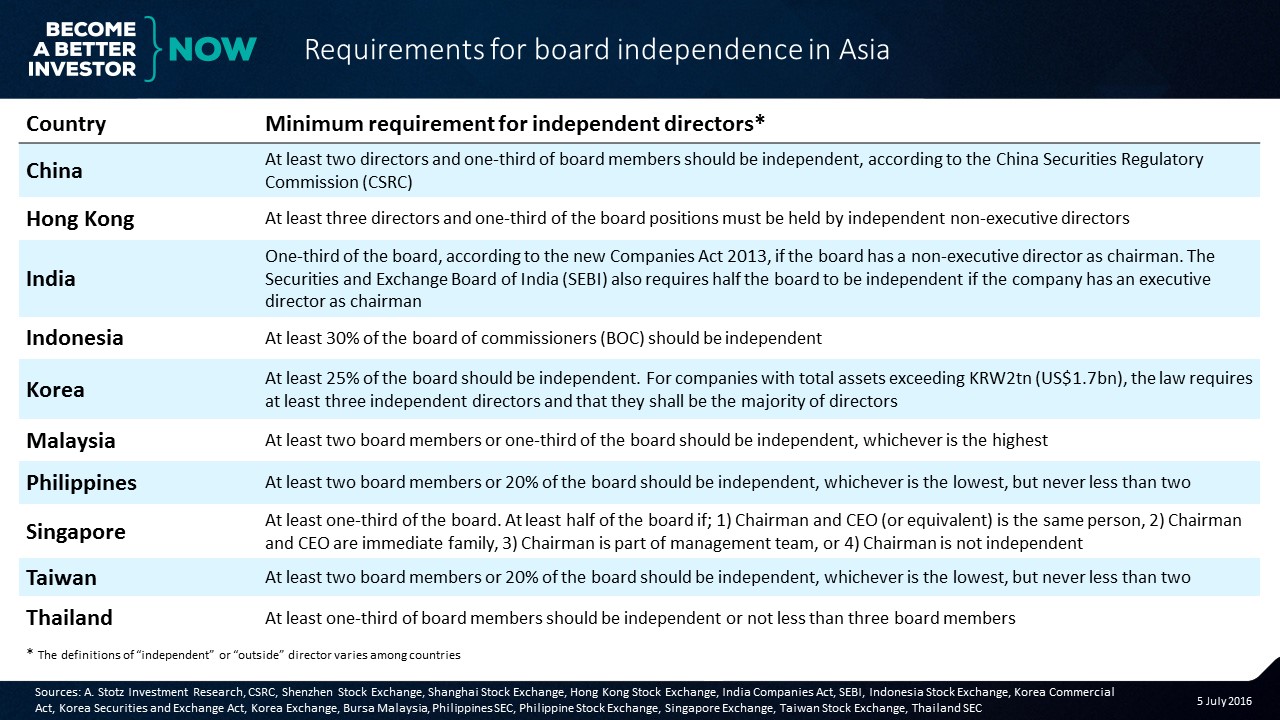

India has the highest board independence of 48% compared to the Asian average at 39%, followed by Singapore at 46% and Malaysia at 43% while Thailand has the largest average board of directors consisting of 11 directors. It is important to note that different countries also have different requirements in terms of board independence, as you can see in the table below; and it seems to correlate with what is seen in the above chart as the Philippines and Taiwan are also the markets with the weakest requirements. Note that the definitions of an independent director vary across these markets.

Identify Board and Management, Determine Their Level of Independence

Below is the leadership part of our Leadership and Ownership analysis of TDC. As you can see we identify the Chairman, Abdul Kadir Kassim and CEO, Afzal Abdul Rahim. We also consider whether the chairman is independent or not, in the case of TDC he is not. We then show the size and percentage of board independence for TDC relative to the Malaysian and Asian average. In the chart below we can see that three out of seven directors or 43% on TDC’s board are independent. The board of TDC has one director less than the average board size of eight in Malaysia and Asia ex Japan, while the percentage of independent directors is in line with the Malaysian average at 43% and above Asia ex Japan at 39%.

You might ask, “doesn’t every listed company in Asia have full information and pictures of its board and management available on their website or in their Annual Report?” the answer in Asia is a resounding “No”. From our experience that information is more easily accessible in ASEAN countries, while it is harder to find in China, Hong Kong and Taiwan, and hardest is Korea.

Family Ownership Swings Both Ways

Corporate governance in most of the East and Southeast Asian markets, e.g. China, Hong Kong, Malaysia, Indonesia, Korea, Malaysia, the Philippines, Singapore, and Thailand, is often influenced by family ownership. An example is Korea where there are a few so called chaebols; large family-run conglomerates such as Samsung, Hyundai and LG that historically not only have controlled most of the business environment, but also much of the country.

Hanazaki and Liu (2007) found that the main disadvantage with family-controlled firms was that the majority experienced difficulties in receiving financing from external capital markets. This may lead to serious internal financing constraints. Claessens and Yurtoglu (2012) also concluded that family-owned firms have problems related to liquidity as well as growth, and internal management issues; disagreements within the family.

Claessens and Yurtoglu also found that the main advantage of family-controlled firms was that there was generally no conflict of interest between managers and shareholders. However, minority shareholders’ rights may have been influenced negatively if their interests were not aligned with the controlling families. Minorities’ protection was critical when ownership was concentrated, to prevent unfair treatment.

Besides potential funding issues, the family ownership tradition can work in both ways for you as an investor. If the controlling family does a good job and its interests and actions are aligned with shareholders’ interest it can work to your benefit as the power to act is concentrated, and vice versa.

Institutional Owners May Safeguard Your Investment

A common assumption is that high institutional ownership should also mean good corporate governance. This assumption seems to be true based on the finding of Chung and Zhang (2009) that the larger proportion of institutional ownership of the firm the better quality of its governance structure.

Wahab et al. (2008) found that there was a positive relationship between institutional ownership and corporate governance in Malaysia. They also found that the correlation decreased when the external governance mechanisms improved, in this case Bursa Malaysia made a corporate governance code part of its listing rules. Hence as corporate governance improved across the board, the relationship weakened.

From the above findings our main takeaway is that institutional ownership seems to play an important role in improving corporate governance in absence of legislation, listing rules or other organizations that incentivize good corporate governance.

In Thailand as an example the Thai Institute of Directors provides a Corporate Governance Report on an annual basis where many of the listed companies are scored. This is however an exception rather than the rule in Asian markets, which is why we, in addition to investigating the board independence of a company, also analyze the institutional ownership over time relative to the country and regional average under the assumption that high institutional ownership also means better corporate governance. Below is the institutional ownership part of our Leadership and Ownership analysis of TDC.

In the table to the left we identify the three largest institutional shareholders in the most recent period, as well as considering what region the fund is registered in and its investment style. In the case of TDC, Public Mutual Berhad is the unit trust arm of Malaysia’s third largest bank Public Bank, and the second and third largest institutional shareholders are among the main provident funds in Malaysia.

In the chart to the right, we calculate the institutional ownership over time. The percentage of institutional ownership in TDC in 2012 was above the average in Asia ex Japan but below the Malaysian average. In the latest period showed in the chart above TDC was owned to one-third by institutions, which was significantly above the market average.

It’s Doubtful That Good Corporate Governance Generates Higher Return

Numerous studies have investigated the relationship between corporate governance and a firm’s performance and often concluded that there exists a positive one. For example, Kumar and Singh (2012) analyzed the relationship between outside directors and a firm’s performance by using leverage, profitability ratios and Tobin’s Q as variables and found a positive relationship. Liu et al. (2014) found that the better a corporate governance system, the higher profitability in terms of ROE and ROA for the firm.

Fewer studies have investigated the relationship between corporate governance and investor returns. Gompers et al. (2003) developed a governance index considering 24 governance rules on a data set of 1,500 large US firms during the 1990s. The authors then created an investment strategy where they bought the decile with the best corporate governance and shorted the decile with worst corporate governance and conclude the strategy earned abnormal returns of 8.5% per year. However, a few years later, Bhagat and Bolton (2008) cited and extended on Gompers’ et al. research and concluded “contrary to claims in the literature, none of the governance measures are correlated with future stock market performance.”

Good Corporate Governance is Still Preferred

Most studies show that good corporate governance is a positive for firm performance and investors, especially in the absence of legislation that protects shareholders’ rights.

Even though it’s less clear that good corporate governance also means higher investor returns, good corporate governance is still preferred. It’s hard for you to fairly evaluate and keep track of your investment, and be certain that the firm is acting in your interest, especially when the firm has low transparency and the board is comprised of major shareholders or executives.

When There is No Corporate Governance Code:

- See if you easily can identify the board of directors and management team, as well as determining their level of independence

- Consider the ownership structure and identify the major shareholders; if it’s controlled by one family beware of the pros and cons

- Look at the level of institutional ownership; in countries with weak corporate governance, high institutional ownership is often a signal that the company fulfills at least some internal corporate governance requirements of the institutional owner

Do you consider Corporate Governance when #investing in #stocks?

Please RT for more votes.#CorpGov

— Alexander Wetterling (@BkkBanker) July 8, 2016

Do you consider corporate governance when investing? Why/Why not? How do you analyze it?

We’d love to hear from you in a comment below.

Feel free to share this article with your friends.

DISCLAIMER: This content is for information purposes only. It is not intended to be investment advice. Readers should not consider statements made by the author(s) as formal recommendations and should consult their financial advisor before making any investment decisions. While the information provided is believed to be accurate, it may include errors or inaccuracies. The author(s) cannot be held liable for any actions taken as a result of reading this article.