Can You Profit from Following Analysts in Thailand?

Introduction

A core function of sell-side analysts is to provide earnings estimates, target prices, and recommendations. Investors often rely on this information to make investment decisions. No one is always right but analysts as a group—consensus—should be quite smart.

Analysts should be more knowledgeable about industry and company than almost any other outsider. So it should make sense that an investor in Thailand could outperform with the help of sell-side analysts.

Our academic-style research format

- Ask a research question

- Summarize previous research

- Formulate a hypothesis to test

- Select a relevant data set, remove errors and outliers

- Formulate a methodology to test the hypothesis

- Present and analyze the results

- Advise on how to apply to improve investment decisions

Questions

Let’s test this research question

- Can investors outperform by relying on analyst recommendations, target prices, and earnings forecasts?

Hypothesis

- Following analysts’ earnings estimates, target prices, and recommendations should generate outperformance in Thailand

Data

Thai universe of non-financial companies

Started with all listed non-financial companies in Thailand. Excluded illiquid stocks, those with a 3MADTO less than U$0.4m in any period. Since the testing requires analyst input, we only included companies from any period that had at least three analyst recommendations. We also collected earnings estimates and target prices for those companies.

Method

Grouped in quarterly rebalanced quintiles

The time period tested was 2006-2018. We ranked stocks into 5 groups (quintiles) based upon the degree of analyst pessimism or optimism with regard to EPS growth forecasts, recommendations, and target prices. We then tracked the share price of each group for one quarter after which we re-ranked all stocks.

The quarterly time periods were based on when quarterly results from the majority of companies became known to the market. Each quintile was reselected and rebalanced to equal weight on a quarterly basis. To make it apples-to-apples we compared the performance of each quintile to the equal-weighted performance of all the stocks included in the study.

We tested three different factors based on consensus:

- EPS growth: 1-year forward EPS relative to prior rolling 4 quarters EPS

- Target price upside: Target price at current quarter relative to the closing price at the current quarter

- Recommendation: Level of recommendation score at the current quarter

- Buy = 1

- Hold = 2

- Sell = 3

Results

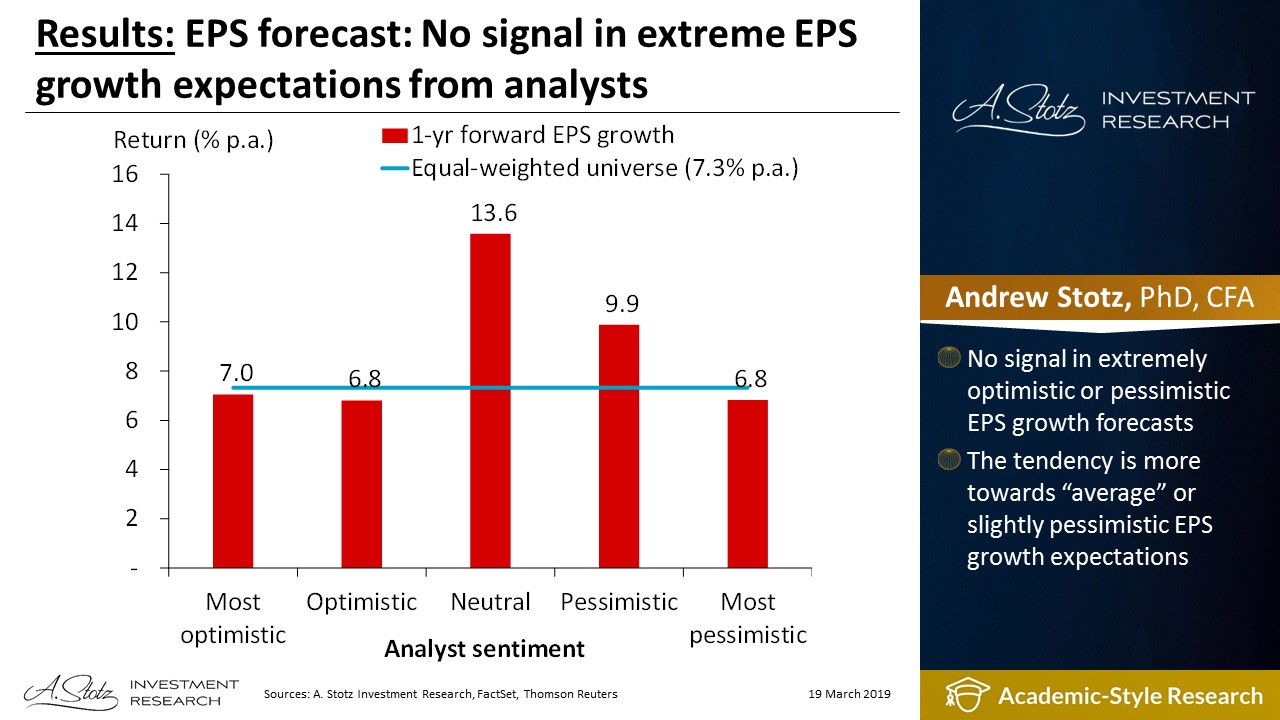

EPS forecast: No signal in extreme EPS growth expectations from analysts

No signal in extremely optimistic or pessimistic EPS growth forecasts. The tendency is more towards “average” or slightly pessimistic EPS growth expectations.

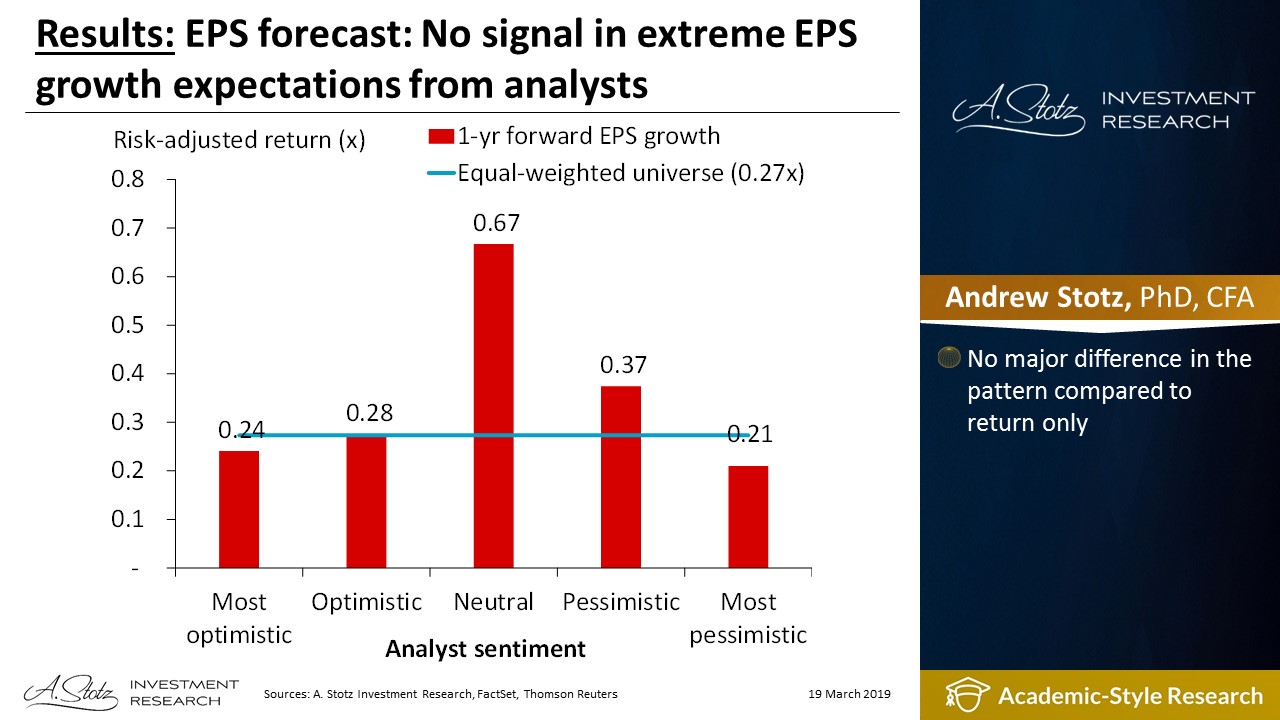

EPS forecast: No signal in extreme EPS growth expectations from analysts

No major difference in the pattern compared to return only.

EPS forecast: Why not just flip a coin instead?

Relying on EPS forecasts seem to be pretty much as effective as flipping a coin. As with return, the tendency is more towards “average” or slightly pessimistic EPS growth expectations.

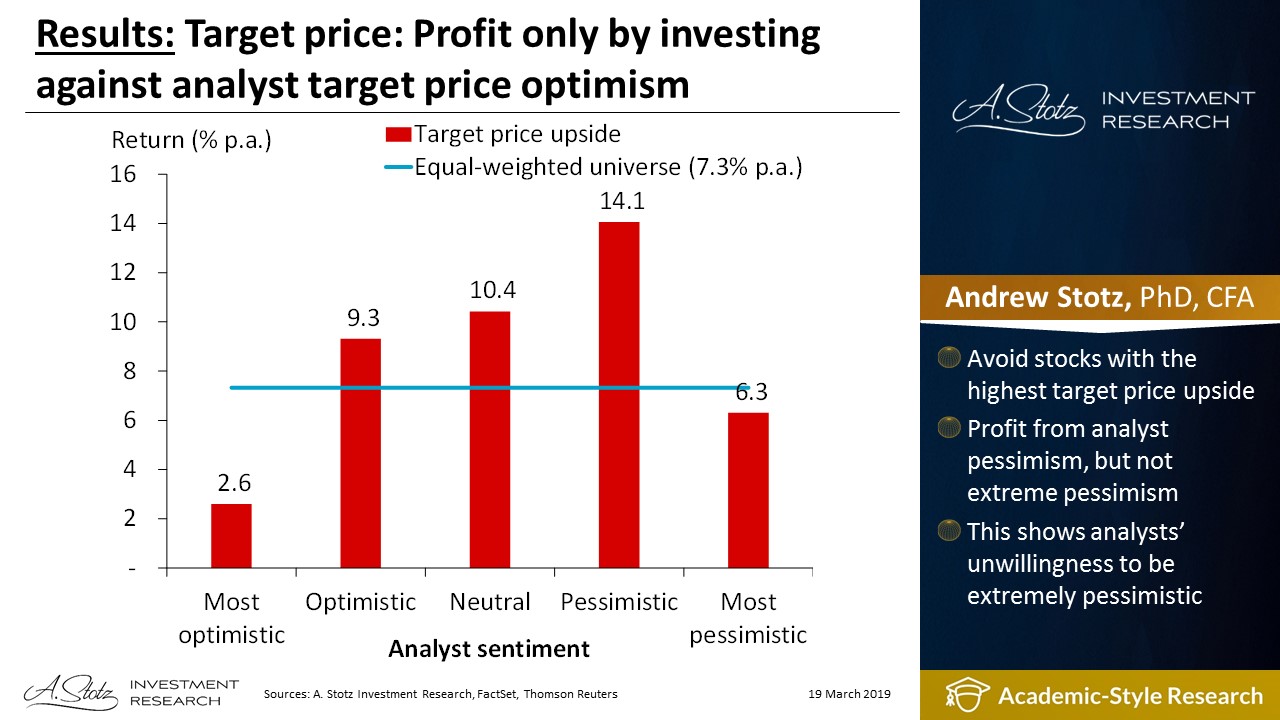

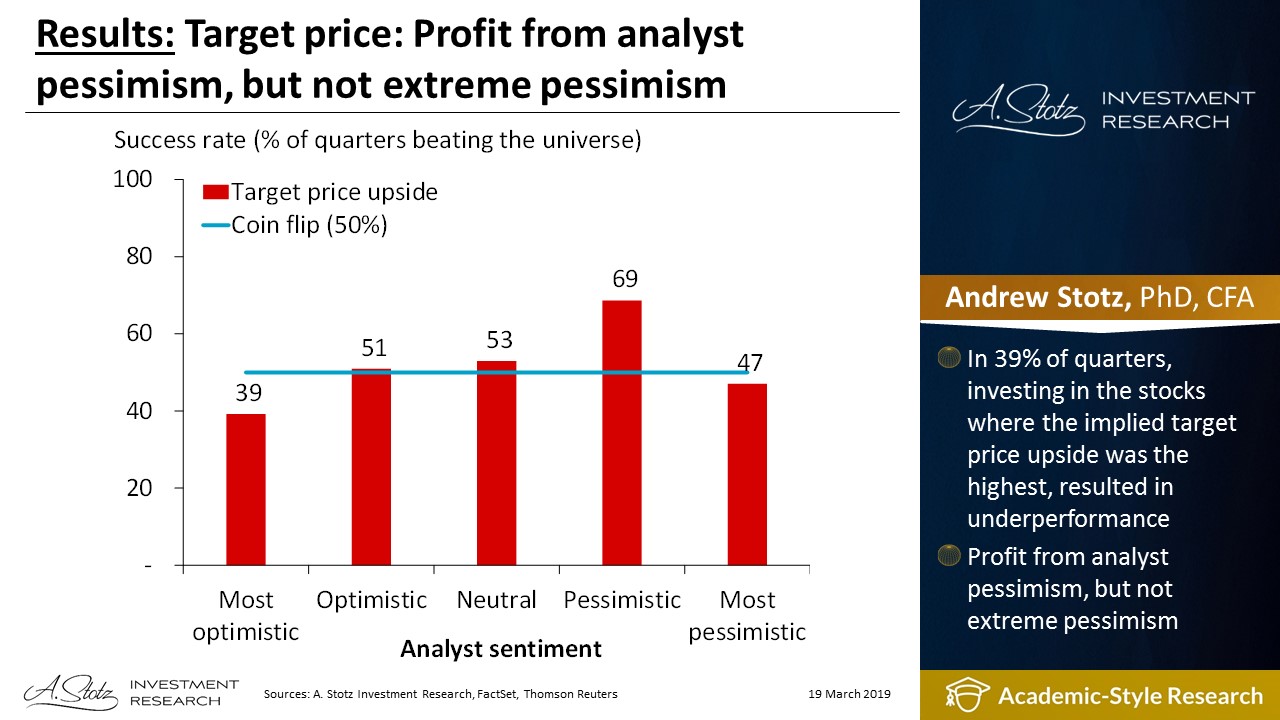

Target price: Profit only by investing against analyst target price optimism

Avoid stocks with the highest target price upside. Profit from analyst pessimism, but not extreme pessimism. This shows analysts’ unwillingness to be extremely pessimistic.

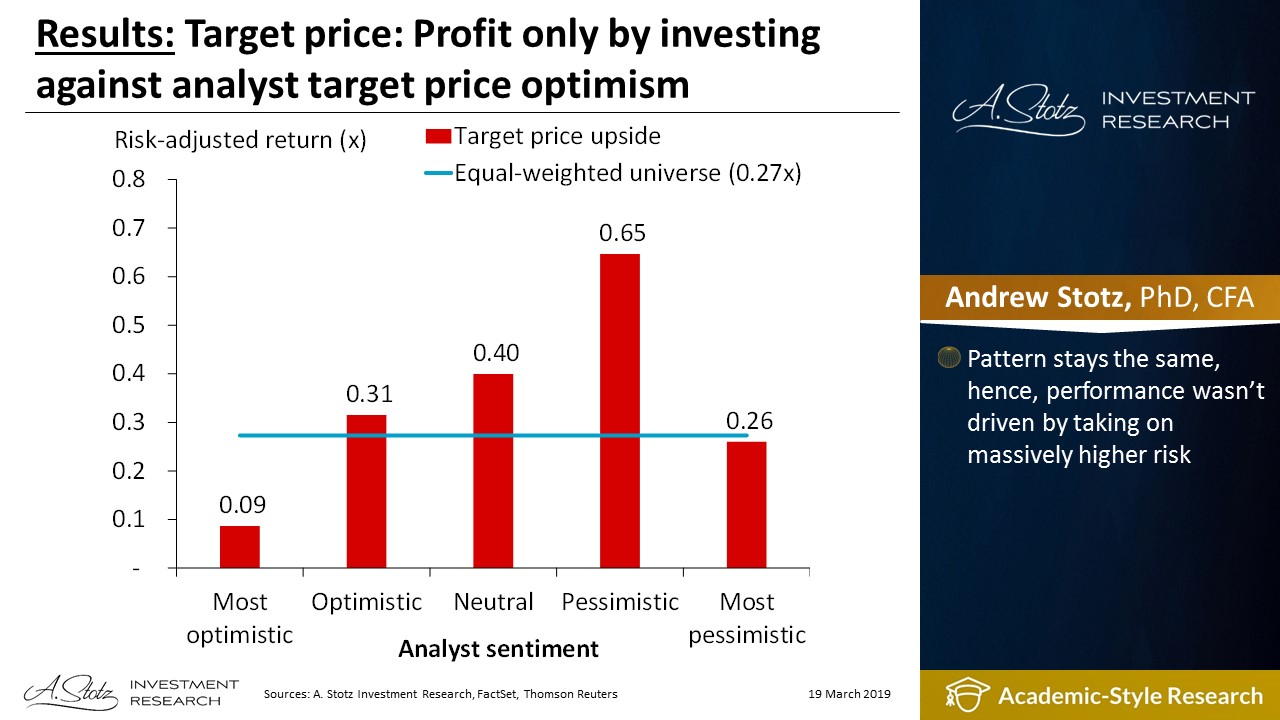

Target price: Profit only by investing against analyst target price optimism

The pattern stays the same, hence, the performance wasn’t driven by taking on massively higher risk.

Target price: Profit from analyst pessimism, but not extreme pessimism

In 39% of quarters, investing in the stocks where the implied target price upside was the highest, resulted in underperformance. Profit from analyst pessimism, but not extreme pessimism.

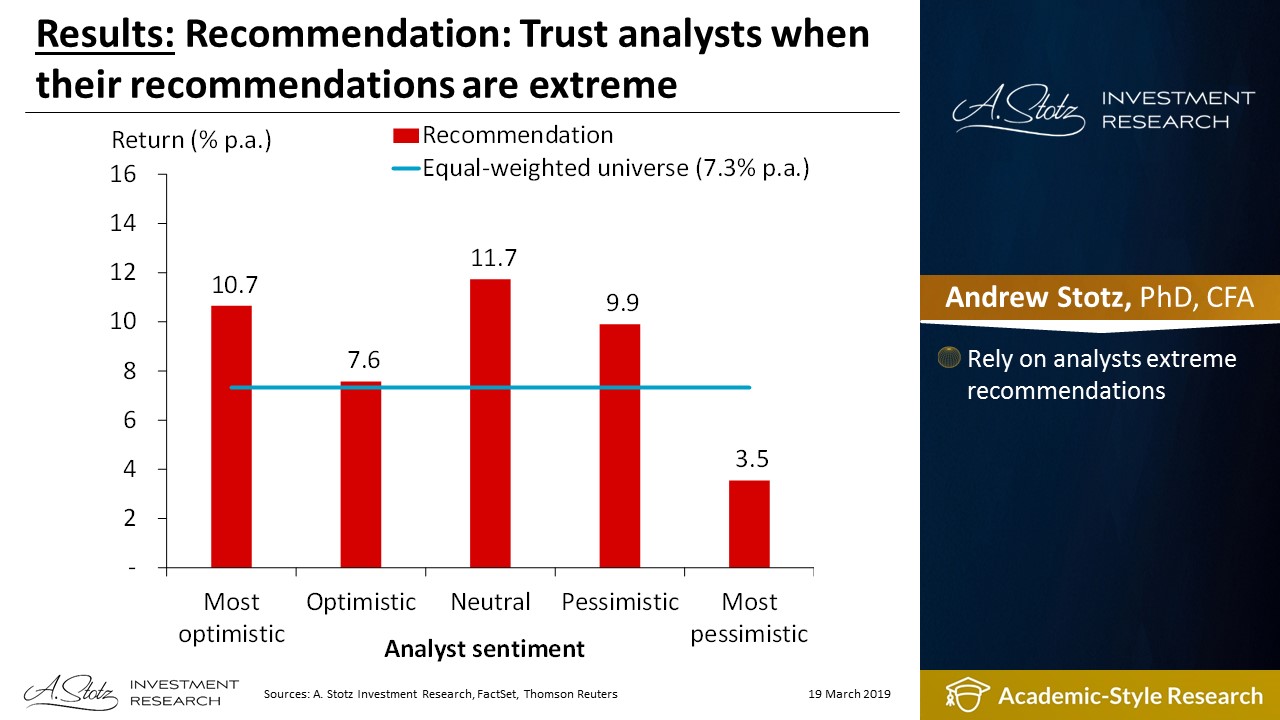

Recommendation: Trust analysts when their recommendations are extreme

Rely on analysts extreme recommendations.

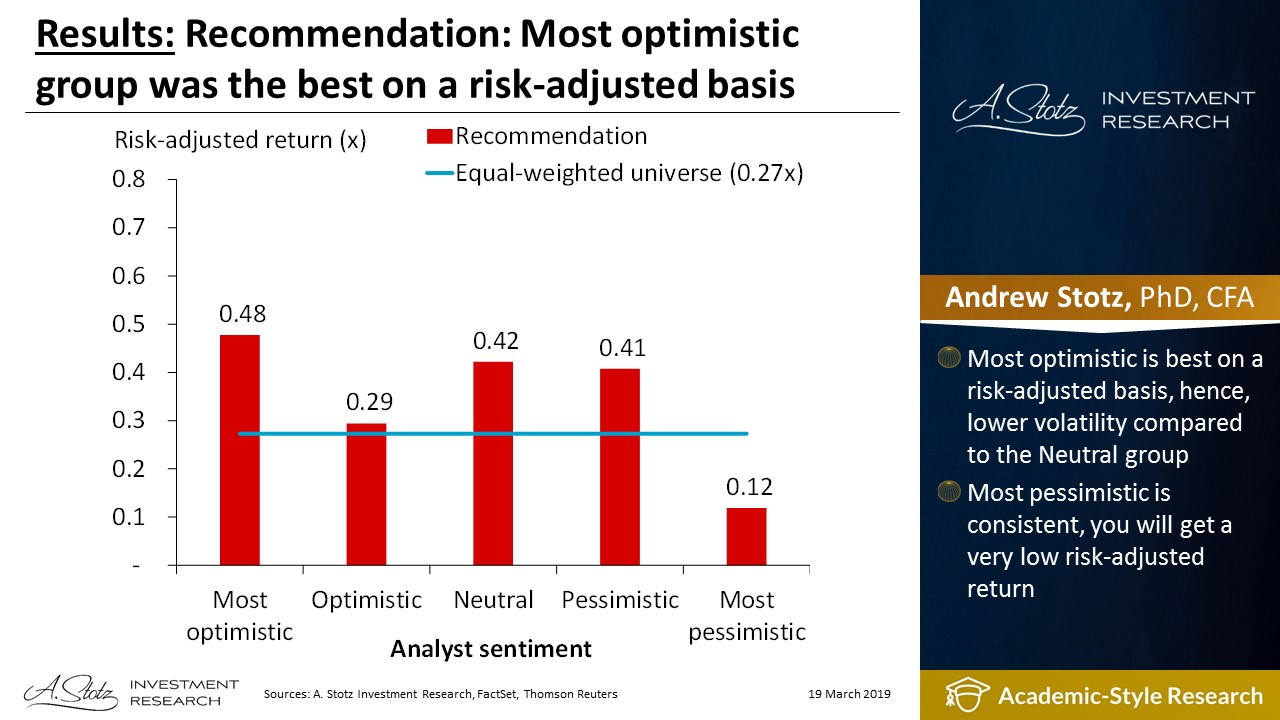

Recommendation: Most optimistic group was the best on a risk-adjusted basis

Most optimistic is best on a risk-adjusted basis, hence, lower volatility compared to the Neutral group. Most pessimistic is consistent, you will get a very low risk-adjusted return.

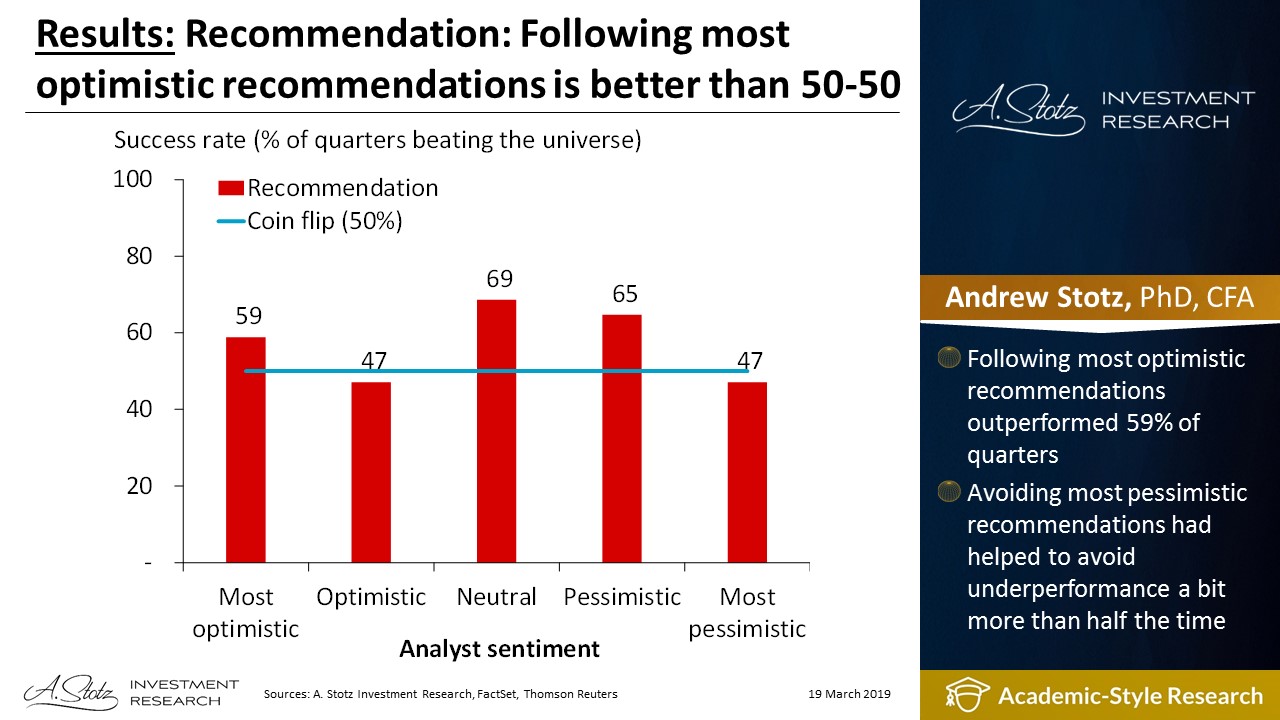

Recommendation: Following most optimistic recommendations is better than 50-50

Following most optimistic recommendations outperformed 59% of quarters. Avoiding most pessimistic recommendations had helped to avoid underperformance a bit more than half the time.

Action

- EPS Growth – No way to profit from analysts’ extreme EPS growth expectations

- Target price – Profit only by investing against analyst target price optimism

- Recommendation – Profit by following analysts’ most extreme recommendations